Sembcorp and Pub Officially Open the Sembcorp Tengeh Floating Solar Farm

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Changing Hands Tracking Fund Flows in the Singapore Stock Market

Changing hands Tracking fund flows in the Singapore stock market Week of April 12, 2021 I Institutional investors net sell (-S$214.0m) vs (-S$82.9m) a week ago I Retail investors net buy (+S$95.1m) vs (+S$2.4m) a week ago Top 10 institution net buy Top 10 institution net sell STOCKS CODE (S$M) STOCKS CODE (S$M) Singtel Z74 23.4 SIA C6L (108.1) DBS D05 14.1 CapitaLand C31 (26.1) SPH T39 13.0 Genting Singapore G13 (22.9) SGX S68 9.9 Venture Corporation V03 (20.4) OCBC O39 5.2 Sembcorp Industries U96 (14.2) ComfortDelGro C52 5.2 Keppel Corporation BN4 (13.7) Top Glove Corporation BVA 5.1 UOB U11 (11.3) CapitaLand Integrated Comm Trust C38U 4.8 Dairy Farm International D01 (10.3) First Resources EB5 2.8 Thai Beverage Y92 (9.4) Jardine Matheson J36 2.7 Jardine Strategic J37 (8.2) Top 10 retail net buy Top 10 retail net sell STOCKS CODE (S$M) STOCKS CODE (S$M) SIA C6L 113.8 Singtel Z74 (37.6) Genting Singapore G13 17.9 SGX S68 (28.3) CapitaLand C31 14.0 DBS D05 (20.4) Sembcorp Marine S51 13.4 OCBC O39 (19.2) Keppel Corporation BN4 11.3 SPH T39 (13.8) Dairy Farm International D01 10.5 Yangzijiang Shipbuilding BS6 (6.4) Thai Beverage Y92 9.1 Mapletree Logistics Trust M44U (6.2) Keppel DC Reit AJBU 8.4 Ascendas Reit A17U (5.5) AEM Holdings AWX 7.8 ComfortDelGro C52 (5.1) Sats S58 7.4 CapitaLand Integrated Comm Trust C38U (4.3) Institutional investors’ net buy/sell by sector (S$m) OVERALL WEEK OF SGX SECTOR CLASSIFICATION CONSUMER CONSUMER ENERGY FINANCIAL HEALTH INDUSTRIALS MATERIALS REAL REITS TECH TELCOS UTILITIES CYCLICALS NON- OIL & SERVICES -

Board of Directors

13 SINGAPORE TELECOMMUNICATIONS LIMITED Board of Directors SIMON ISRAEL • Non-executive and non-independent Director • Member, Optus Advisory Committee • Chairman, Singtel Board • Date of Appointment: Director on 4 Jul • Chairman, Finance and Investment Committee 2003 and Chairman on 29 Jul 2011 • Member, Corporate Governance and • Last Re-elected: 26 Jul 2013 Nominations Committee • Number of directorships in listed • Member, Executive Resource and companies (including Singtel): 4 Compensation Committee Mr Simon Israel, 63, is the Chairman of Singapore Post Limited and a Director of CapitaLand Limited, Fonterra Co-operative Group Limited and Stewardship Asia Centre Pte. Ltd. He is also a member of the Governing Board of Lee Kuan Yew School of Public Policy and Westpac’s Asia Advisory Board. Simon is a former Chairman of Asia Pacifi c Breweries Limited. Simon was an Executive Director and President of Temasek Holdings (Private) Limited before retiring on 1 July 2011. Prior to that, he was Chairman, Asia Pacifi c of the Danone Group. Simon also held various positions in Sara Lee Corporation before becoming President (Household & Personal Care), Asia Pacifi c. Simon was conferred Knight in the Legion of Honour by the French government in 2007 and awarded the Public Service Medal at the Singapore National Day Awards 2011. He holds a Diploma in Business Studies from The University of the South Pacifi c. CHUA SOCK KOONG • Executive and non-independent Director • Last Re-elected: 21 Jul 2015 • Member, Optus Advisory Committee • Number of directorships in listed • Date of Appointment: Director on 12 Oct companies (including Singtel): 2 2006 and Group Chief Executive Officer (CEO) on 1 Apr 2007 Ms Chua Sock Koong, 58, was appointed Group CEO on 1 April 2007. -

How Has Trump Contracting Covid-19 Affected Markets?

SINGAPORE MARKET HOW HAS TRUMP CONTRACTING TRADING MATTERS SERIES: TRADING FLOWS COVID-19 AFFECTED MARKETS? An overview of the performance DIGITAL ENGAGEMENT TEAM of companies in the market 9 OCTOBER 2020 Straits Times Index Key Events Summary 200 Day MA 3,300 100 Day MA 2 Oct 50 Day MA 3,100 Stocks fall following Trump’s 2,900 positive virus test, but close off the 2,700 worst levels on stimulus hopes 5 Oct 2,500 Dow ends 465 09 Oct 2020: 2,300 points higher 2,532.96 after Trump cleared to leave 2,100 hospital after 3- Jan Feb Mar Apr May Jun Jul Aug Sep Oct 14 Oct night stay Singapore 3Q GDP Release Market Commentary 23 Oct • Straits Times Index current price caught between the 50 Day Moving Average (2,519.16) and 100 Day Singapore Sep Moving Average (2,573.17) CPI Release • Singapore’s GDP likely to contract at a slower pace in 3Q as stringent virus curbs were relaxed (09 Oct, Bloomberg) 30 Oct o Estimate -6.4% yoy for 3Q • CMT, CCT unit holders vote in favour of merger to SG Futures Roll form new REIT (30 Sep, The Straits Times) Date o Merger expected effective Oct 21. CCT's last day of trading expected Oct 16. • Wilmar's YKA listing to help fund 19 investment projects in China (07 Oct, The Business Times) 3 Nov o The IPO will raise 13.9b yuan (S$2.8b) US Presidential o Proposed listing slated to take place by mid- Elections Oct, subject to prevailing market conditions Data extractedfromBloomberg asof previous closing unlessotherwisestated Straits Times Index Components: Movers and Laggards TOP PERFORMING SINCE 05 OCTOBER 2020 LAST -

Stoxx® Singapore 75 Index

STOXX® SINGAPORE 75 INDEX Components1 Company Supersector Country Weight (%) Oversea-Chinese Banking Corp. Banks SG 10.52 DBS Group Holdings Ltd. Banks SG 8.74 Singapore Telecommunications L Telecommunications SG 8.24 United Overseas Bank Ltd. Banks SG 7.60 Jardine Matheson Holdings Ltd. Industrial Goods & Services SG 5.93 Wilmar International Ltd. Food & Beverage SG 3.38 Hongkong Land Holdings Ltd. Real Estate SG 3.04 Keppel Corp. Ltd. Oil & Gas SG 2.72 CapitaLand Ltd. Real Estate SG 2.47 Jardine Strategic Holdings Ltd Industrial Goods & Services SG 2.38 Thai Beverage PCL Food & Beverage SG 2.12 Singapore Exchange Ltd. Financial Services SG 2.00 Singapore Press Holdings Ltd. Media SG 1.99 ComfortDelGro Corp. Ltd. Travel & Leisure SG 1.97 Singapore Airlines Ltd. Travel & Leisure SG 1.92 GLOBAL LOGISTIC PROPS Real Estate SG 1.82 Jardine Cycle & Carriage Ltd. Retail SG 1.63 Ascendas Real Estate Investmen Real Estate SG 1.62 Singapore Technologies Enginee Industrial Goods & Services SG 1.52 CAPITALAND MALL TRUST MGMT Real Estate SG 1.51 Genting Singapore PLC Travel & Leisure SG 1.45 Suntec Real Estate Investment Real Estate SG 1.32 City Developments Ltd. Real Estate SG 1.13 UOL Group Ltd. Real Estate SG 0.99 CapitaLand Commercial Trust Real Estate SG 0.96 Golden Agri-Resources Ltd. Food & Beverage SG 0.91 SembCorp Industries Ltd. Oil & Gas SG 0.88 SINGAPORE POST Industrial Goods & Services SG 0.84 MAPLETREE CHINA COMMERCIAL TRU Real Estate SG 0.82 SATS Industrial Goods & Services SG 0.78 Dairy Farm International Holdi Retail SG 0.75 Noble Group Ltd. -

Sembcorp Industries Announces Inaugural S$400 Million Green Bond Offering to Support Its Growing Renewables Portfolio

PRESS RELEASE SEMBCORP INDUSTRIES ANNOUNCES INAUGURAL S$400 MILLION GREEN BOND OFFERING TO SUPPORT ITS GROWING RENEWABLES PORTFOLIO - First Certified green bond under the Climate Bonds Standard by a Singapore-based energy company - Competitive pricing achieved with a “Greenium” that reflects strong interest for Sembcorp’s Green Bonds Singapore, June 02, 2021 – Sembcorp Industries (Sembcorp) today announces the successful pricing of its inaugural S$400 million green bond offering (Green Bonds). Through its wholly-owned subsidiary Sembcorp Financial Services (SFS), Sembcorp has today priced the S$400,000,000 2.45 per cent. Green Bonds due 2031 comprising Series 001 under the S$3,000,000,000 Multicurrency Debt Issuance Programme established by Sembcorp and SFS. The payment obligations of SFS under the Green Bonds will be unconditionally and irrevocably guaranteed by Sembcorp. The Green Bonds are expected to be listed on the SGX-ST. The offering was competitively priced with more than 90% of the Green Bonds placed to institutional investors predominantly in the Asia-Pacific, and including some participation from Europe. With the completion of this offering, Sembcorp will have successfully issued the first Certified green bond under the Climate Bonds Standard by a Singapore-based energy company. Net proceeds arising from the issue of the Green Bonds (after deducting issue expenses) will be used to finance or refinance, in whole or in part, new or existing projects which fall in the list of Eligible Green Projects in the Sembcorp Green Financing Framework and that meet Climate Bonds Initiative (CBI) sector-specific technical criteria. Launched in May 2021, the Framework is aligned with the CBI’s Climate Bonds Standard v3.0. -

Singapore Strategy

Market Update Multi-Asset ▪ Global Singapore Strategy Navigating the trade war; stocks to accumulate Fund outflows from Asian markets The market has been spooked by many events recently, including US-China have caused a broad-based decline trade wars and OPEC’s tussle with expanding oil production. Alongside these over the past month. events are continued tightening by the Federal Reserve and a $37bn injection into the financial by the PBoC to calm markets after US tariffs. If we look at high We expect stocks that have yield spreads in Asia, they have been widening for the past 3 months, alongside underperformed the STI year-to-date a weakening of the CNH and a yield curve that is close to inversion. Spreads but continue to have positive between the 2 and 10 year treasuries are only trading around 35 bps now, a 5 earnings momentum to recover as year low. second quarter earnings season begins next month. Figure 1: Yield spread between 2-year and 10-year Treasuries We would accumulate stocks like Yangzijiang (+49% potential upside), ThaiBev (+28%), Venture Corp (+51%), Sembcorp Industries (+31%), Keppel Corp (+31%) and Singtel (+25%). Source: Bloomberg, KGI Research Figure 2: Asia high yield spread vs CNH Source: Bloomberg, KGI Research If the trend continues, there could be waves of default led by Chinese high yield, which can cause a domino effect on Asian high yield debt, as seen in the chart above. We recommend a defensive position in this kind of market environment. KGI Research Team 65 6202 1194 [email protected] See the last page for important disclosures. -

New Chairman Appointed to Sembcorp Industries Board

PRESS RELEASE NEW CHAIRMAN APPOINTED TO SEMBCORP INDUSTRIES BOARD SINGAPORE, March 24, 2010 – Sembcorp Industries announces that Mr Peter Seah Lim Huat will retire as Chairman and a director of the company with effect from May 1, 2010. Mr Seah will be succeeded by Mr Ang Kong Hua as non-executive Chairman of Sembcorp Industries. Mr Ang will also chair the Executive Committee, Nominating Committee and Executive Resource and Compensation Committee. Mr Ang is currently a director on Sembcorp’s board. The board and management of Sembcorp Industries would like to record their sincere appreciation to Mr Seah for his capable and astute leadership of the board, and his significant contribution to the success of the Sembcorp Group. As Sembcorp’s Chairman since 1999, Mr Seah presided over the board during a dramatic period of transformation and growth for Sembcorp, which saw it evolve from a multi-business conglomerate into an international energy, water and marine group. During this period, the Group restructured and focused on core businesses with profit after tax and minority interest before exceptional items increasing more than five-fold to S$683 million in 2009. In addition, Mr Seah’s tenure with Sembcorp was associated with the development of its energy and water businesses and also with emergence of Sembcorp Marine as one of the largest rig builders in the world. He led the push to globalise Sembcorp’s businesses and today, Sembcorp has energy and water operations in Singapore, the UK, China, Vietnam, the UAE and Oman, and operates in a total of 11 countries worldwide. -

Important Notice Not for Distribution in the United States Or to U.S

IMPORTANT NOTICE NOT FOR DISTRIBUTION IN THE UNITED STATES OR TO U.S. PERSONS IMPORTANT: You must read the following disclaimer before continuing. The following disclaimer applies to the attached preliminary pricing supplement. You are advised to read this disclaimer carefully before accessing, reading or making any other use of the attached preliminary pricing supplement. In accessing the attached preliminary pricing supplement, you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from us as a result of such access. Confirmation of Your Representation: In order to be eligible to view the attached preliminary pricing supplement or make an investment decision with respect to the securities, investors must not be a U.S. person (within the meaning of Regulation S under the Securities Act (as defined below)). The attached preliminary pricing supplement is being sent at your request and by accepting the email and accessing the attached preliminary pricing supplement, you shall be deemed to have represented to us (1) that you are not resident in the United States ("U.S.") nor a U.S. person, as defined in Regulation S under the U.S. Securities Act of 1933, as amended (the "Securities Act") nor are you acting on behalf of a U.S. person, the electronic mail address that you gave us and to which this email has been delivered is not located in the U.S. and, to the extent you purchase the securities described in the attached preliminary pricing supplement, you will be doing so pursuant to Regulation S under the Securities Act, and (2) that you consent to delivery of the attached preliminary pricing supplement and any amendments or supplements thereto by electronic transmission. -

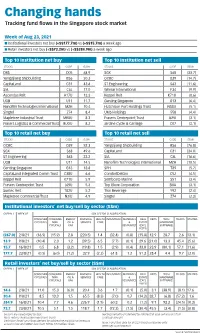

Changing Hands Tracking Fund Flows in the Singapore Stock Market

Changing hands Tracking fund flows in the Singapore stock market Week of Aug 23, 2021 I Institutional investors net buy (+S$177.7m) vs (+S$15.7m) a week ago I Retail investors net buy (+S$73.2m) vs (+S$384.9m) a week ago Top 10 institution net buy Top 10 institution net sell STOCKS CODE (S$M) STOCKS CODE (S$M) DBS D05 68.9 SGX S68 (33.7) Yangzijiang Shipbuilding BS6 50.3 OCBC O39 (14.7) CapitaLand C31 43.6 ST Engineering S63 (11.6) SIA C6L 17.0 Wilmar International F34 (9.9) Ascendas Reit A17U 13.3 Keppel Reit K71U (8.6) UOB U11 11.7 Genting Singapore G13 (6.4) Nanofilm Technologies International MZH 10.4 Hutchison Port Holdings Trust NS8U (5.1) Singtel Z74 8.4 UMS Holdings 558 (4.4) Mapletree Industrial Trust ME8U 8.3 Frasers Centrepoint Trust J69U (3.1) Frasers Logistics & Commercial Trust BUOU 8.2 Jardine Cycle & Carriage C07 (3.1) Top 10 retail net buy Top 10 retail net sell STOCKS CODE (S$M) STOCKS CODE (S$M) OCBC O39 52.3 Yangzijiang Shipbuilding BS6 (76.8) SGX S68 49.6 CapitaLand C31 (34.0) ST Engineering S63 22.2 SIA C6L (16.6) UOB U11 14.5 Nanofilm Technologies International MZH (10.5) Genting Singapore G13 13.8 SPH T39 (5.7) CapitaLand Integrated Comm Trust C38U 6.6 ComfortDelGro C52 (4.5) Keppel Reit K71U 5.9 Sembcorp Marine S51 (3.4) Frasers Centrepoint Trust J69U 5.3 Top Glove Corporation BVA (3.1) Suntec Reit T82U 5.2 Thai Beverage Y92 (2.4) Mapletree Commercial Trust N2IU 4.9 Singtel Z74 (2.3) Institutional investors’ net buy/sell by sector (S$m) OVERALL WEEK OF SGX SECTOR CLASSIFICATION CONSUMER CONSUMER ENERGY FINANCIAL -

Towards a Greener Future

Towards a Greener Future Sembcorp Industries Annual Report 2020 Sembcorp’s purpose and passion is to do good and play our part in building a sustainable future. Our vision is to be a leading provider of sustainable solutions – supporting development and creating value for our stakeholders and communities. Environmental, Social and Consolidated Overview Governance Review Financial Statements Group FY2020 Highlights 1 Sustainability Report 35 Directors’ Statement 74 Chairman and CEO’s Statement 2 y About this Report 35 Independent Auditors’ Report 84 Supporting a Renewables Future 6 y Managing Sustainability 38 Balance Sheets 90 – Our Sustainability Framework 38 Consolidated Income Statement 92 – Supporting the SDGs 39 Consolidated Statement Operating and Financial Review of Comprehensive Income 93 – Sustainability Governance 39 Consolidated Statement – Memberships and Associations 39 Group Financial Review 8 of Changes in Equity 94 y Our Material ESG Issues 40 y Financial Highlights 8 Consolidated Statement Enabling a Low-carbon of Cash Flows 98 y Five-year Financial Performance 10 and Circular Economy 40 Notes to the Financial Statements 101 y Value Added and Productivity Data 12 – Climate Change y Treasury Management 14 – Resource Management Energy Review 16 – Local Environmental Protection Other Information Urban Review 22 Empowering Our People and Communities 43 Additional Information on – Health and Safety Directors Seeking Re-election 222 Our Leadership – People Shareholding Statistics 226 – Community Corporate Information 228 Board -

Significant Events

SIGNIFICANT EVENTS FEBRUARY MARCH APRIL JUNE JULY SEPTEMBER Sembcorp strengthens its Sembcorp Marine's Sembawang Tan Sri Mohd Hassan Marican Sembcorp hosts China’s Sembcorp sponsors Singapore’s Sembcorp Marine announces a presence in India’s power market Shipyard secures a S$25 million succeeds Goh Geok Ling as Minister for Water Resources, Festival of Biodiversity to inspire S$222 million investment to set by acquiring 45% of NCC Power contract to revitalise the Chairman of Sembcorp Marine, Chen Lei, at its operations on greater awareness of nature up a state-of-the-art, automated Projects for Rs 848 crores 137,276-gross tonnage cruise with Mr Goh’s retirement from Jurong Island, Singapore. and conservation. steel fabrication facility at the (approximately S$175 million). ship Voyager of the Seas, the Sembcorp Marine board. Sembmarine Integrated Yard @ NCC Power Projects is as part of Royal Caribbean Sembcorp Marine signs a Sembcorp increases its stake in Tuas, Singapore. The 34.5-hectare developing a 1,320-megawatt International’s ongoing fleet US$4 million agreement to acquire Thermal Powertech Corporation second phase of the yard, which coal-fired supercritical power revitalisation programme. MAY 12% of GraviFloat, which designs India to 65%. has commenced construction in plant in Andhra Pradesh. and operates re-deployable, early 2014, will also include three Sembcorp commences Ajaib Haridass and gravity-based, modularised Sembcorp wins Best Managed new drydocks. Sembcorp announces a construction of its largest energy- Neil McGregor join the board liquefied natural gas (LNG) and Board and Best Annual Report RMB454.9 million (approximately from-waste facility in Singapore. -

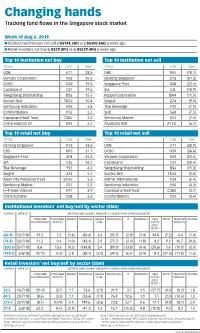

Changing Hands Tracking Fund Flows in the Singapore Stock Market

Changing hands Tracking fund flows in the Singapore stock market Week of Aug 6, 2018 I Institutional investors net sell (-S$148.3m) vs (-S$300.6m) a week ago I Retail investors net buy (+S$29.8m) vs (+S$229.4m) a week ago Top 10 institution net buy Top 10 institution net sell STOCKS CODE (S$M) STOCKS CODE (S$M) UOB U11 28.3 DBS D05 (78.1) Venture Corporation V03 20.5 Genting Singapore G13 (51.3) OCBC O39 19.9 Singapore Post S08 (22.0) CapitaLand C31 19.6 SIA C6L (18.9) Yangzijiang Shipbuilding BS6 15.5 Keppel Corporation BN4 (11.7) Suntec Reit T82U 10.8 Singtel Z74 (9.0) Sembcorp Industries U96 5.8 Thai Beverage Y92 (7.9) ComfortDelGro C52 3.2 SGX S68 (7.5) CapitaLand Mall Trust C38U 2.5 Sembcorp Marine S51 (7.0) China Aviation Oil G92 2.4 Ascendas Reit A17U (6.1) Top 10 retail net buy Top 10 retail net sell STOCKS CODE (S$M) STOCKS CODE (S$M) Genting Singapore G13 58.6 UOB U11 (38.9) DBS D05 31.7 OCBC O39 (38.6) Singapore Post S08 25.2 Venture Corporation V03 (20.5) SIA C6L 16.7 CapitaLand C31 (20.4) Thai Beverage Y92 6.3 Yangzijiang Shipbuilding BS6 (15.3) Singtel Z74 5.7 Suntec Reit T82U (5.6) Asian Pay Television Trust S7OU 5.6 Wilmar International F34 (5.4) Sembcorp Marine S51 5.5 Sembcorp Industries U96 (4.3) Hi-P International H17 3.9 CapitaLand Mall Trust C38U (3.7) China Sunsine CH8 3.6 ComfortDelGro C52 (3.4) Institutional investors’ net buy/sell by sector (S$m) OVERALL WEEK OF SECTORS: MSCI GLOBAL INDUSTRY CLASSIFICATION STANDARD (GICS®) CONSUMER CONSUMER ENERGY FINANCIALS HEALTH INDUSTRIALS IT MATERIALS REAL REITS* TELECOM