Bayer Annual Report 2013 Bayer Annual Report 2013 11 for a Better Life for a Better Life

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Active Bayer Companies with at Least a Share of 50% Last Update: 17.8.2020 Country Company

List of active Bayer companies with at least a share of 50% last update: 17.8.2020 Country Company Algeria Bayer Algerie S.P.A. Argentina Bayer S.A. Argentina Biagro S.A. Argentina Monsanto Argentina SRL Australia Bayer Australia Limited Australia Bayer CropScience Holdings Pty Ltd Australia Bayer CropScience Pty Limited Australia Cotton Growers Services Pty. Limited Australia Imaxeon Pty. Ltd. Australia Monsanto Australia Pty Ltd Bangladesh Bayer CropScience Ltd. Belgium Bayer Agriculture BVBA Belgium Bayer CropScience NV Belgium Bayer NV Bermuda MonSure Limited Bolivia Bayer Boliviana Ltda Bolivia Monsanto Bolivia S.A. Bosnia & Herzeg. Bayer d.o.o. Sarajevo Brazil Alkagro do Brasil Ltda Brazil Bayer S.A. Brazil D&PL Brasil Ltda Brazil Monsanto do Brasil Ltda. Brazil Rede Agro Fidelidade e Intermediacao S.A. Brazil Schering do Brasil Química e Farmacêutica Ltda. Brazil Stoneville Brasil Ltda. Bulgaria Bayer Bulgaria EOOD Burkina Faso Monsanto Burkina Faso SARL Chile Bayer Finance & Portfolio Management S.A. Chile Bayer Finance Ltda. Chile Bayer S.A. Chile Monsanto Chile, S.A. Costa Rica Bayer Business Services Costa Rica, SRL Costa Rica Bayer Medical S.R.L. Costa Rica Bayer S.A. Curacao Pianosa B.V. Germany Adverio Pharma GmbH - 1 - List of active Bayer companies with at least a share of 50% last update: 17.8.2020 Country Company Germany AgrEvo Verwaltungsgesellschaft mbH Germany Alcafleu Management GmbH & Co. KG Germany BGI Deutschland GmbH Germany Bayer 04 Immobilien GmbH Germany Bayer 04 Leverkusen Fußball GmbH Germany Bayer 04 Leverkusen -

Steven Sanders, Et Al. V. Bayer (AG) Aktiengesellschaft, Et Al. 03-CV-1546-Second Consolidated Amended Complaint

Q,^.IGiNAL &&,iN 2i 4- L UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK -_DOF x Consolidated Civil Action IN RE BAYER AG SECURITIES No. 03 CV 1546 (WHP) LITIGATION Class Action x 71 :n = SECOND CONSOLIDATED AMENDED COMPLAINT Jury Trial Demand MILBERG WEISS BERSHAD & SCHULMAN LLP Melvyn I. Weiss (MW-1392) Michael C . Spencer (MS-8874) Lee A. Weiss (LW-1130) Jennifer Sclar (JS-7313) One Pennsylvania Plaza New York, NY 10119 (212) 594-5300 Attorneys for Lead Plaintiff January 14, 2005 i • ' Table of Contents Page SUMMARY OF CLAIMS ...............................................................................................................2 JURISDICTION AND VENUE ...................................................................................................... 8 A. General Jurisdiction and Venue ............................................................................... 8 B. Subject Matter Jurisdiction Over Claims of Foreign Purchasers on Foreign Exchanges ................................................................................................................ 8 PARTIES .......................................................................................................................................12 RELEVANT EVENTS ..................................................................................................................14 A. Background of the Statin Market ...........................................................................14 B. FDA Approval and Introduction of Baycol; Early Safety Warnings -

Notes to the Consolidated Financial Statements of the Bayer Group

Five-Year Summary Bayer Annual Report 2018 Five-Year Summary 2014 2015 2016 2017 2018 Bayer Group (€ million) Sales 41,339 46,085 34,943 35,015 39,586 EBITDA1 8,315 9,573 8,801 8,563 10,266 1 EBITDA before special items 8,685 10,256 9,318 9,288 9,547 1 EBITDA margin before special items (in %) 21.0 22.3 26.7 26.5 24.1 EBIT1 5,395 6,241 5,738 5,903 3,914 1 EBIT before special items 5,833 7,060 6,826 7,130 6,480 Income before income taxes 4,414 5,236 4,773 4,577 2,318 Net income (from continuing and discontinued operations) 3,426 4,110 4,531 7,336 1,695 1 Earnings per share (from continuing and discontinued operations) (€) 4.14 4.97 5.44 8.29 1.80 1 Core earnings per share (from continuing operations) (€) 5.89 6.82 6.67 6.64 5.94 Net cash provided by operating activities (from continuing and discontinued operations) 5,810 6,890 9,089 8,134 7,917 Net financial debt 19,612 17,449 11,778 3,595 35,679 2 Capital expenditures (as per segment table) 2,484 2,554 2,627 2,418 2,564 Bayer AG Total dividend payment 1,861 2,067 2,233 2,402 2,611 Dividend per share (€) 2.25 2.50 2.70 2.80 2.80 Innovation Research and development expenses (€ million) 3,537 4,274 4,405 4,504 5,246 Ratio of R&D expenses to sales – Pharmaceuticals (%) 15.6 16.0 16.7 16.2 15.5 Ratio of R&D expenses to sales – Crop Science (%) 10.3 10.7 11.7 11.7 13.0 Employees in research and development3 13,900 14,753 14,213 14,041 17,275 Employees 3 Number of employees (Dec. -

Glaxosmithkline Aims to Divest Many OTC Brands

OTC11-02-11p1&28FIN.qxd 8/2/11 11:52 Page 1 11 February 2011 COMPANY NEWS 3 GlaxoSmithKline aims to Valeant expands in CEE 3 with PharmaSwiss deal J&J loses sales of US$1.1bn 4 Boots faces up to tough market 5 divest many OTC brands Key brands boost Novartis OTC sales 6 GSK consumer races ahead 7 laxoSmithKline intends to divest non- to divest the non-core brands as soon as pos- Taisho holds steady in weak market 8 Gcore OTC brands with combined an- sible – hopefully before the end of the year – Vicks shipments lift OTC at P&G 9 nual sales of £500 million (C593 million). depending on buyer interest. Perrigo plans spring Allegra launch 10 Chief executive officer Andrew Witty said The announcement came as GlaxoSmith- Consumer Care grows at Merck & Co 11 the move would enable the company’s Con- Kline reported a 7% rise – 5% at constant ex- Omega reports strong quarter 12 sumer Healthcare division to focus more effec- change rates – in 2010 sales at the Consumer Winter woes hit Boiron 13 tively on its “priority or global” brands as well Healthcare division to £5.01 billion. Sales in Pfizer wants Consumer 14 as its operations in emerging markets. Consumer Healthcare’s OTC Medicines busi- to prove worth A spokesperson for GlaxoSmithKline told ness grew by 5% – 3% at constant exchange OTC bulletin that the company was currently rates – to £2.46 billion. GENERAL NEWS 15 compiling the lists of priority and non-core OTC brands, and hoped to release more details Recent deals with Meda and Valeant Perrigo faces lawsuit over 15 in the second quarter of the year. -

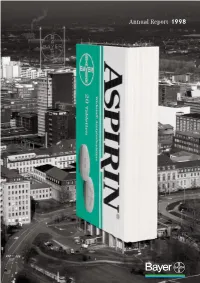

Annual Report 1998 Expertise with Responsibility

Annual Report 1998 Expertise with Responsibility Bayer is a diversified, international chemicals and health care group. We offer our customers a wide variety of products and services in areas ranging from pharmaceuticals and crop protection to plastics, specialty chemicals and imaging technologies. Bayer is research-based and aims for technological leadership in its core activities. Our goals are to steadily increase corporate value and generate a high value added for the benefit of our stockholders, our employees and the community in every country in which we operate. We believe that our technical and commercial expertise involves a responsibility to work for the common good and contribute to sustainable development. Bayer: Success through Expertise with Responsibility. Bayer Key Data Bayer Group 1998 1997 Change in % Sales DM million 54,884 55,005 – 0.2 Operating result DM million 6,151 6,018 + 2.2 Income before income taxes DM million 5,336 5,108 + 4.5 Net income DM million 3,157 2,941 + 7.3 Gross cash flow DM million 6,602 6,480 + 1.9 Stockholders’ equity DM million 24,991 23,923 + 4.5 Total assets DM million 57,216 54,170 + 5.6 Capital expenditures DM million 5,165 4,559 + 13.3 Employees at year end 145,100 144,600 + 0.3 Personnel expenses DM million 15,854 15,442 + 2.7 Research and development expenses DM million 3,920 3,878 + 1.1 Bayer AG 1998 1997 Change in % Total dividend payment DM million 1,461 1,388 + 5.3 Dividend per share DM 2.00 1.90 + 5.3 Tax credit DM 0.65 0.81 - 19.8 Published by Bayer AG, 51368 Leverkusen, This complete version of the Annual Report Germany is published in English and German. -

4:17-Cv-00865-AGF Doc

Case: 4:17-cv-00865-AGF Doc. #: 40 Filed: 07/14/17 Page: 1 of 10 PageID #: <pageID> UNITED STATES DISTRICT COURT EASTERN DISTRICT OF MISSOURI EASTERN DIVISION LAVETA JORDAN, et al., ) ) Plaintiffs, ) ) vs. ) Case No. 4:17-CV-865 (CEJ) ) BAYER CORP., et al., ) ) Defendants. ) MEMORANDUM AND ORDER This matter is before the Court on defendants’ motion to dismiss pursuant to Federal Rules of Civil Procedure 8, 9(b), 12(b)(2), and 12(b)(6), and defendants’ motion to sever. Also before the Court are plaintiffs’ motions to remand and stay this action. The issues are fully briefed. I. Background On January 19, 2017, the plaintiffs initiated this action in the Circuit Court for the City of St. Louis, Missouri to recover damages for injuries they allegedly sustained as a result of using Essure, a medical device manufactured and sold by the defendants. In the complaint, plaintiffs assert claims of (1) negligence, (2), negligence per se, (3) negligent misrepresentation, (4) strict liability for failure to warn and manufacturing defects, (5) fraud, (6) constructive fraud, (7) fraudulent concealment, (8) breach of express and implied warranties, (9) violations of assorted state consumer protection laws, (10) Missouri products liability under Mo. Rev. Stat. § 537.760, (11) violation of the Missouri Merchandising Practices Act under Mo. Rev. Stat. § 407.020, and (12) gross negligence. Case: 4:17-cv-00865-AGF Doc. #: 40 Filed: 07/14/17 Page: 2 of 10 PageID #: <pageID> Of the 94 plaintiffs, seven are citizens of Missouri. One plaintiff is an Illinois citizen who allegedly had the device implanted in Missouri. -

Disclosure Information

Disclosure of Financial Relationships with Commercial Interests Disclosure Policy Baylor College of Medicine (BCM) is accredited by the Accreditation Council for Continuing Medical Education (ACCME) to provide continuing medical education (CME) for physicians. BCM is committed to sponsoring CME activities that are scientifically based, accurate, current, and objectively presented. In accordance with the ACCME Standards for Commercial Support, BCM has implemented a mechanism requiring everyone in a position to control the content of an educational activity (i.e., directors, planning committee members, faculty) to disclose any relevant financial relationships with commercial interests (drug/device companies) and manage/resolve any conflicts of interest prior to the activity. Individuals must disclose to participants the existence or non-existence of financial relationships: 1) at the time of the activity or within 12 months prior; and 2) of their spouses/partners. In addition, BCM has requested activity faculty/presenters to disclose to participants any unlabeled use or investigational use of pharmaceutical/device products; to use scientific or generic names (not trade names) in referring to products; and, if necessary to use a trade name, to use the names of similar products or those within a class. Faculty/presenters have also been requested to adhere to the ACCME’s validation of clinical content statements. BCM does not view the existence of financial relationships with commercial interests as implying bias or decreasing the value of a presentation. It is up to participants to determine whether the relationships influence the activity faculty with regard to exposition or conclusions. If at any time during this activity you feel that there has been commercial/promotional bias, notify the Activity Director or Activity Coordinator. -

RESTRICTED Bayer Annual Report 2020 Five-Year Summary 2

Bayer-Geschäftsbericht 2018 A Zusammengefasster Lagebericht 1 Fehler! Kein Text mit angegebener Formatvorlage im Dokument. Annual Report RESTRICTED Bayer Annual Report 2020 Five-Year Summary 2 Five-Year Summary € million 2016 2017 2018 2019 2020 Bayer Group financial KPIs Sales 34,943 35,015 36,742 43,545 41,400 EBITDA1 8,801 8,563 9,695 9,529 (2,910) EBITDA before special items1 9,318 9,288 8,969 11,474 11,461 EBITDA margin before special items1 26.7% 26.5% 24.4% 26.3% 27.7% EBIT1 5,738 5,903 3,454 4,162 (16,169) EBIT before special items1 6,826 7,130 6,013 6,975 7,095 Income before income taxes 4,773 4,577 1,886 2,853 (17,250) Net income (from continuing and discontinued operations) 4,531 7,336 1,695 4,091 (10,495) Earnings per share (from continuing and discontinued operations) (€)1 5.44 8.29 1.80 4.17 (10.68) Core earnings per share (from continuing operations) (€)1 6.67 6.64 5.60 6.38 6.39 Free cash flow 5,806 5,202 4,652 4,214 1,343 Net financial debt 11,778 3,595 35,679 34,068 30,041 Capital expenditures (newly capitalized) 2,627 2,418 2,368 2,920 3,138 Return on Capital Employed (ROCE) (%) 10.3 10.8 4.0 3.7 – 16,5 Bayer AG Total dividend payment 2,233 2,402 2,611 2,751 1,965 Dividend per share (€) 2.70 2.80 2.80 2.80 2.00 Bayer Group nonfinancial KPIs2 Number of smallholder farmers in LMICs who have received support (million) – – – 42 45 Number of women in LMICs who have gained access to modern contraception (million) – – – 38 40 Number of people in underserved communities whose self-care needs have been supported by Bayer interventions -

American Innovation Proclamation

American Innovation Proclamation We, the leaders of American business and higher education, call on Congress to act quickly on an innovation agenda that will ensure continued U.S. competitiveness, enabling Americans to succeed in the global economy. Innovation leadership creates high-wage jobs and rising incomes for Americans. Innovation drives productivity and economic growth, giving American workers the tools to remain the most productive in the world and creating products, processes—and even new industries—that expand employment and boost living standards. The United States has remained the world’s innovation leader through a commitment to basic research, a world-class workforce and a climate that rewards innovation. But America cannot rest on past economic success. Our competitors are investing in innovation, improving their competitive position and, in some respects, surpassing us. Therefore, Congress must act to: Renew America’s commitment to discovery by doubling the basic research budgets at the National Science Foundation, the National Institute of Standards and Technology, the Department of Energy’s Office of Science and the Department of Defense; Improve student achievement in math and science through increased funding of proven programs and incentives for science and math teacher recruitment and professional development; Welcome highly educated foreign professionals, particularly those holding advanced science, technology, engineering, or mathematics degrees, especially from U.S. universities, by reforming U.S. visa policies; Make permanent a strengthened R&D Tax Credit to encourage continued private-sector innovation investment. We, the signatories, hereby proclaim our support for these initiatives and stand ready to do our part. Craig Barrett Arthur F. -

Case: 4:07-Cv-01796-CDP Doc. #: 14 Filed: 06/27/08 Page: 1 of 32 Pageid

Case: 4:07-cv-01796-CDP Doc. #: 14 Filed: 06/27/08 Page: 1 of 32 PageID #: <pageID> UNITED STATES DISTRICT COURT EASTERN DISTRICT OF MISSOURI EASTERN DIVISION IN RE GENETICALLY MODIFIED ) Case No. 4:06MD1811 CDP RICE LITIGATION ) ALL CASES MEMORANDUM AND ORDER Defendant Bayer AG has filed a motion to dismiss the claims against it for lack of personal jurisdiction. Having reviewed the briefs and extensive documentary evidence submitted by the parties, I conclude that plaintiffs have adequately shown a relationship between Bayer AG and its corporate subsidiaries, such that jurisdiction over Bayer AG in this case is proper. I will therefore deny Bayer AG’s motion to dismiss. I. Introduction In this multi-district litigation proceeding, plaintiffs allege that the defendants developed and mishandled a genetically-modified strain of rice that contaminated the U.S. rice supply. The majority of plaintiffs are U.S. long grain rice producers who reside in five U.S. states where rice is produced (Arkansas, Louisiana, Mississippi, Missouri and Texas). Most of the defendants are corporate entities affiliated with or owned directly or indirectly by Bayer AG, a German corporation headquartered in Leverkusen, Germany. Case: 4:07-cv-01796-CDP Doc. #: 14 Filed: 06/27/08 Page: 2 of 32 PageID #: <pageID> Three defendants in particular, Bayer AG, Bayer CropScience AG, and Bayer BioScience NV (“the foreign defendants”), filed a motion to dismiss plaintiffs’ claims against them for lack of personal jurisdiction. Bayer AG is the primary Bayer entity that owns and oversees the Bayer enterprise. Bayer CropScience AG is a corporate subsidiary and, like Bayer AG, is a German corporation. -

SUPREME COURT of MISSOURI En Banc

SUPREME COURT OF MISSOURI en banc STATE ex rel. BAYER CORPORATION, ) Opinion issued December 19, 2017 BAYER HEALTHCARE LLC, ) BAYER ESSURE INC., and ) BAYER HEALTHCARE ) PHARMACEUTICALS, INC., ) ) Relators, ) ) v. ) No. SC96189 ) HONORABLE JOAN L. MORIARTY, ) ) Respondent. ) ORIGINAL PROCEEDING IN PROHIBITION Bayer Corporation, Bayer Healthcare LLC, Bayer Essure Inc., and Bayer Healthcare Pharmaceuticals Inc., (collectively, “Bayer”), seek a writ of prohibition directing the circuit court to dismiss nonresident Plaintiffs’ claims in a petition alleging personal injuries from Essure, a female contraceptive device Bayer manufactures and distributes. Bayer alleges Missouri has no specific personal jurisdiction over 85 out of 92 Plaintiffs who are nonresidents of Missouri and who have not alleged their injury occurred in Missouri. Bayer further alleges Missouri does not have general jurisdiction as Bayer is neither incorporated in nor has its principal place of business here, and Bayer is not “at home” in Missouri. This Court agrees the petition did not assert any recognized basis for personal jurisdiction over Bayer with respect to nonresident Plaintiffs and vacates the circuit court’s order overruling Bayer’s motion to dismiss. Plaintiffs assert the claims of nonresident Plaintiffs should not be dismissed because nonresident Plaintiffs will seek leave to file an amended petition asserting an additional basis of specific jurisdiction over Bayer based on its conduct of clinical trials and marketing of Essure in Missouri. Plaintiffs allege they also will seek jurisdictional discovery on these issues. Bayer counters these allegations are equally without merit to those in the initial petition as the proposed amended allegations simply will seek to exercise general jurisdiction under another name and, therefore, ask the circuit court be directed to grant the motion to dismiss. -

NJ Passaic River Directive

Directive Number 2003-01 IN THE MATTER OF : THE LOWER PASSAIC RIVER : : AND : : 360 NORTH PASTORIA : ENVIRONMENTAL CORPORATION;: AMERADA HESS CORPORATION; : AMERICAN MODERN METALS : CORPORATION; : APOLLO DEVELOPMENT AND : LAND CORPORATION; : DIRECTIVE NO. 1 ASHLAND INC.; : AT&T CORPORATION; : NATURAL RESOURCE INJURY ATLANTIC RICHFIELD : ASSESSMENT COMPANY; : BAYER CORPORATION; : AND BENJAMIN MOORE & COMPANY; : BRISTOL MYERS-SQUIBB; : INTERIM COMPENSATORY CHEMICAL LAND HOLDINGS, INC.; : RESTORATION OF CHEVRON TEXACO CORPORATION;: NATURAL RESOURCE INJURIES DIAMOND ALKALI COMPANY; : DIAMOND SHAMROCK CHEMICALS : COMPANY; : DIAMOND SHAMROCK : CORPORATION; : DILORENZO PROPERTIES : COMPANY; : DILORENZO PROPERTIES, L.P.; : DRUM SERVICE OF NEWARK, INC.; : E.I. DUPONT DE NEMOURS AND : COMPANY; : EASTMAN KODAK COMPANY; : ELF SANOFI, S.A. : FINE ORGANICS CORPORATION; : FRANKLIN-BURLINGTON : PLASTICS, INC.; : FRANKLIN PLASTICS : CORPORATION; : FREEDOM CHEMICAL COMPANY; : GETTY PETROLEUM : CORPORATION; : GETTY REALTY GROUP; : H.D. ACQUISITION CORPORATION; : HEXCEL CORPORATION; : HILTON DAVIS CHEMICAL : COMPANY; : KEARNY INDUSTRIAL ASSOCIATES, : L.P.; : LUCENT TECHNOLOGIES, INC.; : MARSHALL CLARK : MANUFACTURING : CORPORATION; : MAXUS ENERGY CORPORATION; : MONSANTO COMPANY; : MOTOR CARRIER SERVICES : CORPORATION; : NAPPWOOD LAND CORPORATION; : NOVEON HILTON DAVIS INC.; : OCCIDENTAL CHEMICAL : CORPORATION; : OCCIDENTAL ELECTRO- : CHEMICALS CORPORATION; : OCCIDENTAL PETROLEUM : CORPORATION; : OXY-DIAMOND ALKALI : CORPORATION; : PITT-CONSOL CHEMICAL :