Restaurant Brands Target Company Statement CHAIRMAN’S LETTER

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Insights Restaurants Dealreader

Restaurants DealReader 2H 2018 Market Insights 2018 was a busy year for M&A in the restaurant sector and appetite for investments remains robust headed into 2019. Despite recent macro variability and the sector facing a number of challenges, primarily related to traffic and minimum wage hikes, strategic acquirers, private equity groups and family offices continue to be active. Investors with multi-brand portfolios are typically seeking investments that can either provide incremental growth (particularly if their current portfolio has experienced flat-to-negative comps), expand their competencies (especially related to digital technology) or provide meaningful synergies from day one (although buyers are not as forthcoming in pricing in such synergies to the valuations). In regards to growth equity, we expect strong activity to continue in 2019, especially for differentiated fast casual concepts. Investors will continue to be interested in concepts that are on-trend (e.g., healthy, better-for- you menu), have demonstrated strong consumer engagement, have a model that is proven across multiple geographies (without any store closures) and that have a well-defined growth story in terms of scaling up. Selected Upcoming Industry Events Restaurant Leadership Conference (April 7-10, 2019 – Phoenix, AZ) UCLA Annual Restaurant Industry Conference (April 25, 2019 - Los Angeles, CA) National Restaurant Association Show (May 18-21, 2019 – Chicago, IL) Commentary Restaurant Industry Trends .The restaurant industry experienced a more Monthly Same-Store -

Interim Report for Q3 2020 Amrest Holdings SE Capital Group 10 NOVEMBER 2020

(all figures in EUR millions unless stated otherwise) Interim Report for Q3 2020 AmRest Holdings SE capital group 10 NOVEMBER 2020 AmRest Group Interim Report for 9 months ended 30 September 2020 1 (all figures in EUR millions unless stated otherwise) AmRest Group Interim Report for 9 months ended 30 September 2020 2 (all figures in EUR millions unless stated otherwise) Contents FINANCIAL HIGHLIGHTS (CONSOLIDATED DATA) ........................................................................................................... 5 PART A. DIRECTORS’ REPORT FOR Q3 2020 ..................................................................................................................... 7 PART B. CONDENSED CONSOLIDATED INTERIM REPORT FOR Q3 2020 ................................................................ 18 PART C. SEPARATE INTERIM REPORT FOR Q3 2020 ..................................................................................................... 44 AmRest Group Interim Report for 9 months ended 30 September 2020 3 (all figures in EUR millions unless stated otherwise) ighlights H AmRest Group Interim Report for 9 months ended 30 September 2020 4 (all figures in EUR millions unless stated otherwise) Financial highlights (consolidated data) 9 months ended 30 September 30 September 2019 2020 Revenue 1 125.4 1 432.5 EBITDA* 154.8 266.4 Profit/(loss) from operations (113.6) 73.0 Profit/(loss) before tax (160.4) 37.9 Net profit/(loss) (159.8) 28.3 Net profit/(loss) attributable to non-controlling interests (1.2) 1.1 Net profit/(loss) attributable -

Amrest Acquires Starbucks Business in Germany

AmRest acquires Starbucks business in Germany Wroclaw, Poland, 20th April 2016, AmRest Holdings SE („AmRest”, “the Company”) (WSE: EAT), the largest publicly listed restaurant operator in Central Europe, announced today that on April 19th, 2016 the Company signed an agreement with Starbucks Coffee Company to acquire its equity stores in Germany. The transaction will come into effect as of May 23rd, 2016 and will result in AmRest having the license to operate and develop Starbucks brand in that country. Since entering Germany in 2002 with two stores in Berlin, Starbucks business has expanded to 158 stores across the country. The portfolio of 144 equity cafés together with 14 licensee stores makes Germany the largest market for Starbucks in the continental Europe. “We’ve built an impressive business in Germany over the past 14 years, employing nearly 2,000 partners across the market. But we know Germany could be a much bigger market for us and we have ambitious growth plans to be where our customers live, work and travel.” - said Kris Engskov, president of Starbucks, Europe, Middle East and Africa (EMEA). He continued: “We are proud to expand our partnership with AmRest, who are recognized across Europe as one of the most entrepreneurial, people-focused companies in food retail, and have been remarkably successful in bringing the Starbucks experience to these important markets.” AmRest has been a partner licensee for Starbucks since 2008, when it opened its first café in the Czech Republic. Since then, AmRest has developed Starbucks stores in Czech Republic, Poland, Hungary, Bulgaria, Romania and recently adding Slovakia, where the first Starbucks is planned to be opened by mid 2016. -

AMREST an Effective Recipe for Robust Global License Management

AMREST An Effective Recipe for Robust Global License Management COMPANY BACKGROUND AmRest operates restaurants such as Burger King, Pizza Hut and Starbucks in Central Europe, Eastern Europe and as far afield as China. It uses numerous retail and business software applications – from point-of-sale to engineering and business software – to support more than 25,000 staff. CHALLENGE Without strong controls in place, license management was extremely painstaking. Obtaining the right information regarding licenses and entitlement involved analyzing a mass of data. With multiple audits from major vendors to manage, accurate discovery for an IT estate across a global operation was a prerequisite for ensuring the company was correctly licensed. SNOW’S CONTRIBUTION The Snow Platform, comprising Snow License Manager, Snow Inventory and Software Recognition Service, is installed on-premiseSnow enables the company to identify license risks and provides a platform for effective Software Asset Management. BUSINESS BENEFITS • Accurate inventory and discovery giving full visibility and insight into actual license usage • Identification of more than €150,000 of unlicensed and unauthorized software • Optimization of licenses and significant cost reduction • Introduction of business unit charge backs for license costs • Creation of a white list of approved applications SAM HERO Pawel Szczepaniak, Software License Manager at AmRest, explains the benefits of devoting resource to strong license management. “In less than 12 months thanks to Snow, I have been able to transform how the company views license management. As a result, the need for a new role was created to focus specifically manage and optimize licenses across AmRest’s global operations.” SNOWSOFTWARE.COM MANAGING EXPENSIVE SOFTWARE APPLICATIONS “Using Snow, we have identified AmRest is the largest independent restaurant operator in more than €100,000 of unlicensed Central and Eastern Europe. -

Yum China Launches Pizza Hut Book Donation and Exchange Program Across China

Yum China Launches Pizza Hut Book Donation and Exchange Program across China 2 May, 2018 SHANGHAI, May 1, 2018 /PRNewswire/ -- Yum China Holdings, Inc. (the "Company" or "Yum China") (NYSE: YUMC) today launched the Pizza Hut Book Donation and Exchange Program at Pizza Hut restaurants across China. To mark World Book Day, Yum China also celebrated the grand opening of the "Pizza Hut Book Donation and Exchange Sub-Center" in Shenzhen. Joey Wat, CEO of Yum China commented, "By pioneering innovative CSR programs like this, we aim to make a positive difference to the lives of our customers and the communities in which we operate. Using our strong brand and scale, Yum China is in a privileged position to support government initiatives to encourage reading in the long term." Jeff Kuai, General Manager of Pizza Hut, said, "As a leading casual dining restaurant brand in China, Pizza Hut is well-positioned to help integrate reading into people's daily lives. We hope Pizza Hut's new book exchange center will ignite people's love for reading and learning, and provide a place for the community to connect and engage." In collaboration with the Shenzhen Book Donation and Exchange Center, Yum China initiated a pilot program in November 2017 to promote and advocate the importance of reading through the establishment of a community reading center – the Shenzhen Pizza Hut Book Donation and Exchange Sub-Center. This center, located in the Shenzhen Pizza Hut Oriental Garden Restaurant, currently has over 2,000 books and offers services similar to a library, including book exchange and sharing services. -

View/Download the Media

MEDIA [email protected] @PizzaMarktplace www.pizzamarketplace.comKIT2021 our mission // Be the premier online destination for C-level pizza executives seeking cutting-edge intelligence for their multiunit restaurant concepts. PizzaMarketplace.com’s coverage unearths trends before they manifest and keeps pizza executives informed about all the latest innovations in: • Food & beverage • Digital signage • Equipment & supplies • Franchising & growth • Health & nutrition • Risk management • Marketing • Branding & promotion • Operations management • Ingredients • Supply market dynamics • Staffing & training • Sustainability • Food safety • And much more [email protected] @PizzaMarktplace www.pizzamarketplace.com about the editor // SHELLY WHITEHEAD // editor [email protected] Award-winning veteran print and broadcast journalist, Shelly Whitehead, has spent most of the last 31 years reporting for TV and newspapers, including the former Kentucky and Cincinnati Post and a number of network news affiliates nationally. She brings her cumulative experience as a multimedia storyteller and video producer to the web-based pages of PizzaMarketplace.com and QSRweb.com, after a lifelong “love affair” with reporting the stories behind the businesses that make our world go ‘round. Ms. Whitehead is driven to find and share news of the many professional passions people take to work with them every day in the pizza and quick-service restaurant industry. She is particularly interested in the growing role of sustainable agriculture and nutrition in food service worldwide and is always ready to move on great story ideas and news tips. KATHY DOYLE // publisher [email protected] As the former group publisher of Purchasing, Semiconductor International, and Industrial Distribution magazines and websites at Reed Business Information, Kathy Doyle brings 20-plus years of print and online media experience to this position. -

Yum China Holdings, Inc. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents As filed with the Securities and Exchange Commission on February 27, 2018 Registration No. 333- UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 FORM S-3 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 Yum China Holdings, Inc. (Exact name of registrant as specified in its charter) Delaware 81-2421743 (State or other jurisdiction of incorporation or organization) (IRS Employer Identification No.) 7100 Corporate Drive Yum China Building Plano, Texas 75024 20 Tian Yao Qiao Road United States of America Shanghai 200030 People’s Republic of China (469) 980-2898 (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) Shella Ng Chief Legal Officer and Corporate Secretary Yum China Holdings, Inc. 7100 Corporate Drive Plano, Texas 75024 (469) 980-2898 (Name, address, including zip code, and telephone number, including area code, of agent for service) With copies to: Lindsey A. Smith Sidley Austin LLP One South Dearborn Street Chicago, Illinois 60603 (312) 853-7000 Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective. If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐ If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒ If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. -

Domino's Pizza

Domino’s Investor Day Presentation – October 10, 2019 AUSTRALIA NEW ZEALAND BELGIUM FRANCE NETHERLANDS JAPAN GERMANY LUXEMBOURG DENMARK Domino’s Presented by DON MEIJ AUSTRALIA NEW ZEALAND BELGIUM FRANCE NETHERLANDS JAPAN GERMANY LUXEMBOURG DENMARK The cornerstone of the Company’s success has been the ability to leverage a diversified Network of both Corporate and Franchised Stores backed by strong store level economic fundamentals and the power and proprietary systems of a global network. The Company plans to continue its expansion throughout Australia and New Zealand and expects that Domino’s Pizza and its Franchisees will continue to benefit from the economies of scale generated by operating the largest pizza Network in Australia. Future growth is expected from new store openings, growth in sales from existing stores and the potential for new store and menu formats. Domino’s pizza Australia new Zealand ltd share offer - 2004 Our view hasn’t changed, but our horizons have. This is a scale business You can’t have 20 or 30 stores. It’s like a 100 storey building, the first 50 or 60 storeys pay for the construction, IT’s When you have those foundations in place that you deliver the real returns. AUSTRALIA NEW ZEALAND BELGIUM FRANCE NETHERLANDS JAPAN GERMANY LUXEMBOURG DENMARK We are a pizza business and distance matters: customers are not going to drive across town to pick up a better deal – you have to be in the right suburb, on the right street, in fact, on the right side of the street. When delivering, time is temperature. Time is money. -

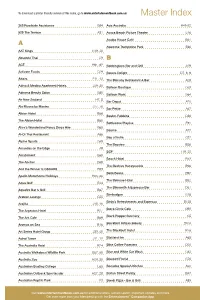

Master Index

To download a printer friendly version of this index, go to www.entertainmentbook.com.au Master Index 365 Roadside Assistance G84 Avis Australia H49-52 529 The Terrace A31 Avoca Beach Picture Theatre E46 Awaba House Café B61 A Awezone Trampoline Park E66 AAT Kings H19, 20 Absolute Thai C9 B ACE H61, 62 Babbingtons Bar and Grill A29 Activate Foods G29 Bakers Delight D7, 8, 9 Adairs F11, 12 The Balcony Restaurant & Bar A28 Adina & Medina Apartment Hotels J29, 30 Balloon Boutique G63 Adnama Beauty Salon G50 Balloon Worx G64 Air New Zealand H7, 8 Bar Depot A20 Ala Moana by Mantra J77, 78 Bar Petite A67 Albion Hotel B66 Baskin-Robbins D36 The Albion Hotel B60 Battlezone Playlive E91 Alice’s Wonderland Fancy Dress Hire G65 Baume A77 Al-Oi Thai Restaurant A66 Bay of India C37 Alpine Sports G69 The Bayview B56 Amandas on the Edge A9 BCF F19, 20 Amazement E69 Beach Hotel B13 The Anchor B68 The Beehive Honeysuckle B96 And the Winner Is OSCARS B53 Bella Beans B97 Apollo Motorhome Holidays H65, 66 The Belmore Hotel B52 Aqua Golf E24 The Bikesmith & Espresso Bar D61 Aqua re Bar & Grill B67 Bimbadgen G18 Arabian Lounge C25 Birdy’s Refreshments and Espresso B125 Arajilla J15, 16 Black Circle Cafe B95 The Argenton Hotel B27 Black Pepper Butchery G5 The Ark Cafe B69 Aromas on Sea B16 Blackbird Artisan Bakery B104 Art Series Hotel Group J39, 40 The Blackbutt Hotel B76 Astral Tower J11, 12 Blaxland Inn A65 The Australia Hotel B24 Bliss Coffee Roasters D66 Australia Walkabout Wildlife Park E87, 88 Blue and White Car Wash G82 Australia Zoo H29, 30 Bluebird Florist G76 Australian Boating College E65 Bocados Spanish Kitchen A50 Australian Outback Spectacular H27, 28 Bolton Street Pantry B47 Australian Reptile Park E3 Bondi Pizza - Bar & Grill A85 Visit www.entertainmentbook.com.au for additional offers, suburb search, important updates and more. -

EXCLUSIVE 2019 International Pizza Expo BUYERS LIST

EXCLUSIVE 2019 International Pizza Expo BUYERS LIST 1 COMPANY BUSINESS UNITS $1 SLICE NY PIZZA LAS VEGAS NV Independent (Less than 9 locations) 2-5 $5 PIZZA ANDOVER MN Not Yet in Business 6-9 $5 PIZZA MINNEAPOLIS MN Not Yet in Business 6-9 $5 PIZZA BLAINE MN Not Yet in Business 6-9 1000 Degrees Pizza MIDVALE UT Franchise 1 137 VENTURES SAN FRANCISCO CA OTHER 137 VENTURES SAN FRANCISCO, CA CA OTHER 161 STREET PIZZERIA LOS ANGELES CA Independent (Less than 9 locations) 1 2 BROS. PIZZA EASLEY SC Independent (Less than 9 locations) 1 2 Guys Pies YUCCA VALLEY CA Independent (Less than 9 locations) 1 203LOCAL FAIRFIELD CT Independent (Less than 9 locations) No response 247 MOBILE KITCHENS INC VISALIA CA Independent (Less than 9 locations) 1 25 DEGREES HB HUNTINGTON BEACH CA Independent (Less than 9 locations) 1 26TH STREET PIZZA AND MORE ERIE PA Independent (Less than 9 locations) 1 290 WINE CASTLE JOHNSON CITY TX Independent (Less than 9 locations) 1 3 BROTHERS PIZZA LOWELL MI Independent (Less than 9 locations) 2-5 3.99 Pizza Co 3 Inc. COVINA CA Independent (Less than 9 locations) 2-5 3010 HOSPITALITY SAN DIEGO CA Independent (Less than 9 locations) 2-5 307Pizza CODY WY Independent (Less than 9 locations) 1 32KJ6VGH MADISON HEIGHTS MI Franchise 2-5 360 PAYMENTS CAMPBELL CA OTHER 399 Pizza Co WEST COVINA CA Independent (Less than 9 locations) 2-5 399 Pizza Co MONTCLAIR CA Independent (Less than 9 locations) 2-5 3G CAPITAL INVESTMENTS, LLC. ENGLEWOOD NJ Not Yet in Business 3L LLC MORGANTOWN WV Independent (Less than 9 locations) 6-9 414 Pub -

Yum China Launches Family Care Program for Restaurant Management Team

Yum China Launches Family Care Program for Restaurant Management Team 5 February, 2020 SHANGHAI, Feb. 5, 2020 /PRNewswire/ -- Yum China Holdings, Inc. (the "Company" or "Yum China") (NYSE: YUMC) today announced the launch of a family care program, by establishing the "Restaurant Management Team (RMT) Family Care Fund". The program is designed to provide additional health protection for family members of restaurant management employees. The new scheme will start in July 2020 and cover an estimated 86,000 parents, spouses and children of more than 31,000 RMT employees. On top of the existing commercial insurance, RMT members will be entitled to additional coverage for critical illness for their parents as well as additional accident coverage for their children and spouse. The scheme also offers express medical treatment for their parents in selected hospitals. "In 2018, Yum China launched the Restaurant General Manager (RGM) Family Care Program, which was greatly appreciated by our RGMs and their families. Since then we have been exploring ways to offer a similar program for RMT members who are sometimes required to take on the extreme burden of caring for their families when faced with unfortunate events. The establishment of this plan further reinforces our commitment to being a supportive and caring employer," said Joey Wat, CEO of Yum China. RMT members can participate in the scheme on a voluntary basis with only a small contribution to the fund every year. The bulk of the remaining cost will be borne by the Company. This scheme goes beyond others in the market by increasing the age cap to 75 years for employees' parents and 22 years for their children. -

For Personal Use Only Use Personal for O Increased Leverage Covenant Ceiling to 2.50X (From 2.0X); and O Remaining Covenants (Interest Cover and Gearing) Unchanged

ASX/media release 26 March 2012 UPDATE: DEBT FACILITY & ORGANISATIONAL RESTRUCTURE Leading Australian retail food brand manager and franchisor, Retail Food Group Limited (RFG or the Company), today provided the following Update. Acquisition Opportunity During the 2011 AGM Presentation, the Company advised that: • a plethora of acquisition and other growth opportunities continue to present themselves; and • such opportunity, where meritorious, was being actively investigated. This opportunity has more recently resulted in acquisition of the Evolution Coffee Roasters Group in September 2011, and the conditional agreement to acquire the Pizza Capers Gourmet Kitchen franchise system (announced on the 28 th February 2012). While the Company continues to take a conservative and measured approach, acquisitions will continue to be a significant component of the RFG growth platform and ultimately will result in both increased outlets as well as the number of franchise systems under the Company’s stewardship. Such that RFG remains at the forefront of franchising best practice and is otherwise appropriately positioned to partake of ongoing acquisition opportunity, enhanced organic growth and development of its franchise systems, the Company has concluded the following initiatives: Reset of Banking Facility As a feature of its capital management platform, RFG announces that is has resolved terms to increase facility quantum and extend the present maturity date of the Company’s debt facilities with the National Australia Bank. The revised facility terms include: • increase in Senior Debt Revolving Facility from $95m to $135m; • extension of present maturity date from September 2013 to 30 September 2014; • increased flexibility, including: o voluntary debt retirement and redraw; For personal use only o increased leverage covenant ceiling to 2.50x (from 2.0x); and o remaining covenants (Interest Cover and Gearing) unchanged.