Enstar Group Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ecological Assessment

ECOLOGICAL ASSESSMENT Molonglo Stage 3 132KV Transmission Line Relocation FINAL March 2019 ECOLOGICAL ASSESSMENT Molonglo Stage 3 132KV Transmission Line Relocation FINAL Prepared by Umwelt (Australia) Pty Limited on behalf of Calibre Consulting (ACT) Project Director: Karina Carwardine Project Manager: Amanda Mulherin Technical Director: David Moore Report No. 8139B_R02_V2 Date: March 2019 Canberra PO Box 6135 2/99 Northbourne Avenue Turner ACT 2612 Ph. 1300 793 267 www.umwelt.com.au This report was prepared using Umwelt’s ISO 9001 certified Quality Management System. Disclaimer This document has been prepared for the sole use of the authorised recipient and this document may not be used, copied or reproduced in whole or part for any purpose other than that for which it was supplied by Umwelt (Australia) Pty Ltd (Umwelt). No other party should rely on this document without the prior written consent of Umwelt. Umwelt undertakes no duty, nor accepts any responsibility, to any third party who may rely upon or use this document. Umwelt assumes no liability to a third party for any inaccuracies in or omissions to that information. Where this document indicates that information has been provided by third parties, Umwelt has made no independent verification of this information except as expressly stated. ©Umwelt (Australia) Pty Ltd Document Status Rev No. Reviewer Approved for Issue Name Date Name Date FINAL Karina Carwardine 14 March 2019 Karina Carwardine 14 March 2019 ecological assessment Introduction 8139b_R02_V2.docx 4 Table of Contents -

Sydney Metro Martin Place Integrated Station Development South Tower Stage 2 DA Architectural Design Report

Sydney Metro Martin Place Integrated Station Development South Tower Stage 2 DA Architectural Design Report CSWSMP-MAC-SMA-AT-DRE-000110 [F] Prepared for Macquarie Corporate Holdings Pty Limited September 2018 2 View looking west along Martin Place. The proposed 39 Martin Place is on the left. Street trees, furniture and other public domain elements within the precinct are indicative only and are subject to relevant approvals and detailed coordination with new and existing underground utilities and infrastructure. Table of Contents 3 Contents Part 01 Project Overview 5 Part 02 Site Context 13 Part 03 Design Principles Summary 31 Part 04 Urban Design and Architecture 35 Part 05 Public Domain & Ground Plane 67 Part 06 Tower Functionality 73 Part 07 Appendices 79 Appendix A Architectural Drawings Appendix B Demarcation Drawings Appendix C Gross Floor Area Schedule Appendix D Consolidated Design Guidelines Project Overview 01 6 Project Overview South Site Introduction This report supports a State Significant Development (SSD) Development Application (DA) (SSD DA) submitted to the Minister for Planning (Minister) pursuant to Part 4 of the Environmental Planning and Assessment Act 1979 (EP&A Act) on behalf of Macquarie Corporate Holdings Pty Limited (Macquarie), who is seeking to create a world class transport and employment precinct at Martin Place, Sydney. The SSD DA seeks approval for the detailed design and construction of the South Site Over Station Development (OSD), located above and integrated with Metro Martin Place station (part of the NSW Government’s approved Sydney Metro project). The southern entrance to Metro Martin Place station and the South Site OSD above are located at 39-49 Martin Place. -

Impact Assessment Report

IMPACT ASSESSMENT REPORT Canberra Brickworks Access Road and Dudley Street Upgrade Area, Yarralumla, ACT FINAL May 2018 IMPACT ASSESSMENT REPORT Canberra Brickworks Access Road and Dudley Street Upgrade Area, Yarralumla, ACT FINAL Prepared by Umwelt (Australia) Pty Limited on behalf of Chief Minister, Treasury and Economic Development Directorate Project Director: Naomi Buchhorn Project Manager: Amanda Mulherin Report No. 8112_R02_Final Date: May 2018 Canberra PO Box 6135 56 Bluebell Street O’Connor ACT 2602 Ph. 02 6262 9484 www.umwelt.com.au This report was prepared using Umwelt’s ISO 9001 certified Quality Management System. Disclaimer This document has been prepared for the sole use of the authorised recipient and this document may not be used, copied or reproduced in whole or part for any purpose other than that for which it was supplied by Umwelt (Australia) Pty Ltd (Umwelt). No other party should rely on this document without the prior written consent of Umwelt. Umwelt undertakes no duty, nor accepts any responsibility, to any third party who may rely upon or use this document. Umwelt assumes no liability to a third party for any inaccuracies in or omissions to that information. Where this document indicates that information has been provided by third parties, Umwelt has made no independent verification of this information except as expressly stated. ©Umwelt (Australia) Pty Ltd Document Status Rev No. Reviewer Approved for Issue Name Date Name Date Final Naomi Buchhorn 19/09/2017 Naomi Buchhorn 19/09/2017 Final 2 Naomi Buchhorn -

AIA REGISTER Jan 2015

AUSTRALIAN INSTITUTE OF ARCHITECTS REGISTER OF SIGNIFICANT ARCHITECTURE IN NSW BY SUBURB Firm Design or Project Architect Circa or Start Date Finish Date major DEM Building [demolished items noted] No Address Suburb LGA Register Decade Date alterations Number [architect not identified] [architect not identified] circa 1910 Caledonia Hotel 110 Aberdare Street Aberdare Cessnock 4702398 [architect not identified] [architect not identified] circa 1905 Denman Hotel 143 Cessnock Road Abermain Cessnock 4702399 [architect not identified] [architect not identified] 1906 St Johns Anglican Church 13 Stoke Street Adaminaby Snowy River 4700508 [architect not identified] [architect not identified] undated Adaminaby Bowling Club Snowy Mountains Highway Adaminaby Snowy River 4700509 [architect not identified] [architect not identified] circa 1920 Royal Hotel Camplbell Street corner Tumut Street Adelong Tumut 4701604 [architect not identified] [architect not identified] 1936 Adelong Hotel (Town Group) 67 Tumut Street Adelong Tumut 4701605 [architect not identified] [architect not identified] undated Adelonia Theatre (Town Group) 84 Tumut Street Adelong Tumut 4701606 [architect not identified] [architect not identified] undated Adelong Post Office (Town Group) 80 Tumut Street Adelong Tumut 4701607 [architect not identified] [architect not identified] undated Golden Reef Motel Tumut Street Adelong Tumut 4701725 PHILIP COX RICHARDSON & TAYLOR PHILIP COX and DON HARRINGTON 1972 Akuna Bay Marina Liberator General San Martin Drive, Ku-ring-gai Akuna Bay Warringah -

Land Development Agency Flora and Fauna

LAND DEVELOPMENT AGENCY FLORA AND FAUNA ASSESSMENT Sections 10, 57, 58, 59, 65 and 66 Greenway, ACT LAND DEVELOPMENT AGENCY FLORA AND FAUNA ASSESSMENT Sections 10, 57, 58, 59, 65 and 66 Greenway ACT Submitted to: Project Officer Land Development Agency Level 6 TransACT House 470 Northbourne Avenue DICKSON ACT 2602 Attention: Lauren Kajewski Ph: 02 6205 2726 Fx: 02 6207 6110 Em: [email protected] Submitted by: Booth Associates Pty Ltd Agribusiness & Environmental Consultants PO Box 1458 Level 1 61 – 63 Yambil Street GRIFFITH NSW 2680 Ph: 02 6964 9911 Fx: 02 6964 5440 Em: [email protected] Web: www.boothassociates.com.au ABN: 79 095 414 065 July 2011 Privileged: The information herein is of a privileged and private nature and as such, all rights thereto are reserved. This document shall not, in part or whole, be lent, reproduced, stored in a retrieval system, or transmitted in any shape or form or by any means electronic, mechanical, photocopying, recording, verbal, left in an exposed and/or unattended position or otherwise used without the prior permission of Booth Associates or their duly qualified agents in writing. Document History: Date Issued Revision No. Author Reviewed By Approved Comments 16/06/2011 Draft KL Tyson/Dr S Hamilton Dr S Hamilton MG Ryan 20/07/20111 Final KL Tyson/Dr S Hamilton KL Tyson KL Tyson Distribution of Copies: Issue Date Revision No Issued To Quantity 16/06/2011 Draft Lauren Kajewski 1 by email 1 by email 20/07/2011 Final Lauren Kajewski 1 hardcopy i TABLE OF CONTENTS 1.0 INTRODUCTION...................................................................................................................1 1.1 Site Location and Existing Environment................................................................................ -

Commonwealth of Australia ASIC Gazette 24/01 Dated 1 November

= = `çããçåïÉ~äíÜ=çÑ=^ìëíê~äá~= = Commonwealth of Australia Gazette No. ASIC 24/01, Thursday 1 November 2001 (Special) Published by ASIC ^^ppff``==dd~~òòÉÉííííÉÉ== Contents Banking Act Unclaimed Money as at 31 December 2000 Specific disclaimer for Special Gazette relating to Banking Unclaimed Monies The information in this Gazette is provided by Authorised Deposit-taking Institutions to ASIC pursuant to the Banking Act (Commonwealth) 1959. The information is published by ASIC as supplied by the relevant Authorised Deposit-taking Institution and ASIC does not add to the information. ASIC does not verify or accept responsibility in respect of the accuracy, currency or completeness of the information, and, if there are any queries or enquiries, these should be made direct to the Authorised Deposit-taking Institution. ISSN 1445-6060 Available from www.asic.gov.au © Commonwealth of Australia, 2001 Email [email protected] This work is copyright. Apart from any use permitted under the Copyright Act 1968, all rights are reserved. Requests for authorisation to reproduce, publish or communicate this work should be made to: Gazette Publisher, Australian Securities and Investment Commission, GPO Box 5179AA, Melbourne Vic 3001 Commonwealth of Australia Gazette ASIC Gazette (Special) ASIC 24/01, Thursday 1 November 2001 Banking Act 1959 Unclaimed Money Page 2= = Banking Unclaimed Money as at 31 December 2000 Section 69 of Banking Act 1959 Statement of Unclaimed Money under the Banking Act General Information The publication contains details of amounts of $500.00 or more which Authorised Deposit-taking Institutions have paid to the Commonwealth Government as unclaimed moneys in accordance with Section 69 of the Banking Act 1959 for the year ended 31 December 2000. -

Sydney Local Environmental Plan 2012 Under the Environmental Planning and Assessment Act 1979

2012 No 628 New South Wales Sydney Local Environmental Plan 2012 under the Environmental Planning and Assessment Act 1979 I, the Minister for Planning and Infrastructure, pursuant to section 33A of the Environmental Planning and Assessment Act 1979, adopt the mandatory provisions of the Standard Instrument (Local Environmental Plans) Order 2006 and prescribe matters required or permitted by that Order so as to make a local environmental plan as follows. (S07/01049) SAM HADDAD As delegate for the Minister for Planning and Infrastructure Published LW 14 December 2012 Page 1 2012 No 628 Sydney Local Environmental Plan 2012 Contents Page Part 1 Preliminary 1.1 Name of Plan 6 1.1AA Commencement 6 1.2 Aims of Plan 6 1.3 Land to which Plan applies 7 1.4 Definitions 7 1.5 Notes 7 1.6 Consent authority 7 1.7 Maps 7 1.8 Repeal of planning instruments applying to land 8 1.8A Savings provision relating to development applications 8 1.9 Application of SEPPs 9 1.9A Suspension of covenants, agreements and instruments 9 Part 2 Permitted or prohibited development 2.1 Land use zones 11 2.2 Zoning of land to which Plan applies 11 2.3 Zone objectives and Land Use Table 11 2.4 Unzoned land 12 2.5 Additional permitted uses for particular land 13 2.6 Subdivision—consent requirements 13 2.7 Demolition requires development consent 13 2.8 Temporary use of land 13 Land Use Table 14 Part 3 Exempt and complying development 3.1 Exempt development 27 3.2 Complying development 28 3.3 Environmentally sensitive areas excluded 29 Part 4 Principal development standards -

EPBC Act Protected Matters Report

EPBC Act Protected Matters Report This report provides general guidance on matters of national environmental significance and other matters protected by the EPBC Act in the area you have selected. Information on the coverage of this report and qualifications on data supporting this report are contained in the caveat at the end of the report. Information is available about Environment Assessments and the EPBC Act including significance guidelines, forms and application process details. Report created: 30/06/16 17:02:59 Summary Details Matters of NES Other Matters Protected by the EPBC Act Extra Information Caveat Acknowledgements This map may contain data which are ©Commonwealth of Australia (Geoscience Australia), ©PSMA 2010 Coordinates Buffer: 5.0Km Summary Matters of National Environmental Significance This part of the report summarises the matters of national environmental significance that may occur in, or may relate to, the area you nominated. Further information is available in the detail part of the report, which can be accessed by scrolling or following the links below. If you are proposing to undertake an activity that may have a significant impact on one or more matters of national environmental significance then you should consider the Administrative Guidelines on Significance. World Heritage Properties: None National Heritage Places: 4 Wetlands of International Importance: 4 Great Barrier Reef Marine Park: None Commonwealth Marine Area: None Listed Threatened Ecological Communities: 2 Listed Threatened Species: 30 Listed Migratory Species: 9 Other Matters Protected by the EPBC Act This part of the report summarises other matters protected under the Act that may relate to the area you nominated. -

Sydney Metro and Martin Place Integrated Station Development

Sydney Metro and Martin Place Integrated Station Development State Significant Development Development Application — Stage 2 Statement of Heritage Impact South Tower CSWSMP-MAC-SMA-HE-REP-000110 Prepared for Macquarie Corporate Holdings Pty Ltd August 2018 • Issue C Project number 16 1035 _____________________________________________________________________________________________________________________________ Tanner Kibble Denton Architects Pty Ltd | ABN 77 001 209 392 | www.tkda.com.au Sydney Level 1, 19 Foster Street, Surry Hills NSW 2010 Australia | T+61 2 9281 4399 Brisbane Suite 9A, Level 7, 141 Queen Street, Brisbane QLD 4000 Australia | T+61 7 3087 0160 Principals Alex Kibble, Robert Denton, Megan Jones, John Rose | Practice Directors George Phillips, Jocelyn Jackson, Melanie Mackenzie Senior Associates Ian Burgher, Angelo Casado, David Earp, Emma Lee, Scott MacArthur, Renata Ratcliffe, Lachlan Rowe, Anna Harris Associates Paul Dyson, Sean Williams, Asta Chow NSW Nominated Architects Robert Denton Registration No 5782 | Alex Kibble Registration No 6015 Sydney Metro and Martin Place Integrated Station Development • SSD DA - Stage 2 - South Tower CONTENTS 1 Introduction 1 1.1 Purpose of the report 1 1.2 Background 2 1.3 Planning Approvals Strategy 5 1.4 Secretary’s Environmental Assessment Requirements 6 1.5 Site location and description 8 1.6 Context 10 1.7 Heritage management context 12 1.8 Report structure 14 1.9 Methodology and terminology 14 1.10 Author identification 14 1.11 Project Team 14 1.12 Documentation 15 2 Historical -

Ecological Assessment Report FEDERAL GOLF CLUB ILU PROJECT

Ecological Assessment Report FEDERAL GOLF CLUB ILU PROJECT JUNE 2018 Bega - ACT and South East NSW www.nghenvironmental.com.au e: [email protected] suite 1, 216 carp st (po box 470) bega nsw 2550 (t 02 6492 8333) Sydney Region Canberra - NSW SE & ACT Brisbane 18/21 mary st 8/27 yallourn st (po box 62) 8 trawalla st surry hills nsw 2010 (t 02 8202 8333) fyshwick act 2609 (t 02 6280 5053) the gap qld 4061 (t 07 3511 0238) Newcastle - Hunter and North Coast Wagga Wagga - Riverina and Western NSW Bathurst - Central West and Orana 7/11 union st suite 1, 39 fitzmaurice st (po box 5464) 35 morrisset st (po box 434) newcastle west nsw 2302 (t 02 4929 2301) wagga wagga nsw 2650 (t 02 6971 9696) bathurst nsw 2795 (t 02 6331 4541) Document Verification Project Title: Federal Golf Club ILU Project Project Number: 17-321 Project File Name: Ecological Assessment Report Revision Date Prepared by (name) Reviewed by (name) Approved by (name) Draft V1 13/02/18 Sam Patmore (NGH) Nick Graham-Higgs Final 25/06/18 Sam Patmore Nick Graham-Higgs NGH Environmental prints all documents on environmentally sustainable paper including paper made from bagasse (a by- product of sugar production) or recycled paper. NGH Environmental Pty Ltd (ACN: 124 444 622. ABN: 31 124 444 622) and NGH Environmental (Heritage) Pty Ltd (ACN: 603 938 549. ABN: 62 603 938 549) are part of the NGH Environmental Group of Companies. Bega - ACT and South East NSW www.nghenvironmental.com.au e: [email protected] suite 1, 216 carp st (po box 470) bega nsw 2550 (t 02 6492 -

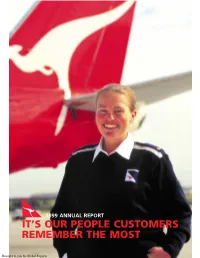

It's Our People Customers Remember the Most

1999 ANNUAL REPORT IT’S OUR PEOPLE CUSTOMERS REMEMBER THE MOST Brought to you by Global Reports CONTENTS Chairman’s Report . 3 Chief Executive’s Report . 4 Unbroken Record of Profit Improvement . 6 Growing the Network . 8 Fleet for the Future . 10 More Options through Alliances . 12 Australia’s Best Food, Wine and Service . 14 Technology into the Next Millennium . 16 Part of the Community . 18 Board of Directors . 22 Senior Management . 25 Corporate Governance . 26 Performance Summary . 28 Concise Report . 29 Five Year Summary . 46 Shareholder Information . 48 Directory . IBC REGISTERED OFFICE FINANCIAL CALENDAR Qantas Airways Limited 1999 ACN 009 661 901 30 June Year end Qantas Centre 19 August Preliminary final result announcement Level 9 Building A 3 November Record date for final dividend 203 Coward Street 17 November Annual General Meeting, Adelaide Mascot NSW 2020 1 December Final dividend payable Australia 31 December Half year end Telephone 61 2 9691 3636 2000 Facsimile 61 2 9691 3339 17 February Half year result announcement 1 March Record date for interim dividend Internet Address 29 March Interim dividend payable http://www.qantas.com.au 30 June Year end 17 August Preliminary final result announcement 1 November Record date for final dividend 16 November Annual General Meeting, Sydney 29 November Final dividend payable NOTICE OF MEETING The 1999 Annual General Meeting of Qantas Airways Limited will be held at 2:00pm on Wednesday 17 November 1999 in the Regency Ballroom at the Hyatt Regency Adelaide, North Terrace, Adelaide. COVER: Michelle Maude, Licensed Aircraft Maintenance All amounts are expressed in Australian dollars Engineer, Line Maintenance, Sydney. -

Briefing Note

Inspired People. Dedicated Team. Quality Outcomes. Briefing Note To: Matthew Priest, Department of Finance cc: Antoinette Perry, Department of Finance; Ben Ripley, Deloitte Real Estate From: Umwelt (Australia) Pty Limited Author: Amanda Mulherin Date: 24 August 2017 Subject: Impact Assessment to support an EPBC Act Referral for the proposed divestment of Blocks 3 and 15, Section 22, Barton ACT 2600 Purpose Umwelt (Australia) Pty Limited (Umwelt) is currently preparing a Referral under section 9 of the Environment Protection and Biodiversity Conservation Act 1999 (EPBC Act) for the proposed divestment of Blocks 3 and 15, Section 22, Barton, Australian Capital Territory (ACT) 2600 (the Project Area). This briefing note provides additional assessment information relating to matters of national environmental significance (MNES) protected under the EPBC Act that may occur within the Project Area; and to support the assessment on potential impacts to the ‘whole of the environment’. It is anticipated that this briefing note will be submitted with the EPBC Act Referral to further document the impact assessment process relevant to the proposed action. Key messages This assessment identifies two MNES as being likely to be impacted by the proposed Newcastle action. These are the following: 75 York Street Teralba NSW 2284 • critically endangered ecological community: natural temperate grassland of the Ph. 02 4950 5322 south eastern highlands (natural temperate grassland); and Perth PO Box 783 West Perth WA 6872 • critically endangered species: golden sun moth (Synemon plana). First Floor 9 Havelock Street West Perth WA 6005 These matters will require further discussion and assessment as part of the EPBC Act Ph.