Income Tax Ordinance [New Version] 5721-1961

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nahariyya 586

Nahariyya 586 Mckoroth Water Co Ltd Pumping Nahariya Meat Prdcts Ltd (Kasher Meat) Peter France 91 Herzl 92 07 64 Rosenfeld Klara Hotel & Pension MargM Station En Ziv Meona 92 01 93 45 Herzl 92 06 63 Pharmacy Merkaz Varjas Ladislav Kasher 71 Weizman 92 01 Jj Joel Gutwirth Mgr Res 92 05 27 Nairn Mamos Grocery & Vegs 22 Hameyasdim 92 01 31 Rosenhcimer M Real Estate Melamed Chaim 5 Hahagana.. .92 07 93 Kevish Nahariya-Meona 92 07 60 Pharmacy Nahariyya Fishman Meir Sederot Hagaaton 92 00 20 Meller Moses 5 Sokolov 92 06 18 Naknik Nahariyya Kasher 20 Sederot Hagaaton 92 00 70 Rosenthal Haim Melzer Mordechai & Ada Soglowek & Reinhold 92 00 16 Pharmacy Szabo Yaakov Szabo 5 David Hamelech 92 04 53a Herzl 92 08 1 5 Nakor Cold Storage Ltd 71 Herzl 92 04 54 Roth Moshe Elecn 54 Herzl 92 04 35 Meonot Hagalil Bldg Co Ltd Rehov Hanna Senesh 92 00 08 Philosoph Josef & Elisabeth Rothledcr Dr Julius Ear Nose & Throat 12 Balfour 92 08 10 Narco S Hotel 53 Arlosoroff 92 05 17 Kiryat He'assor 529/36 92 06 51 A Zohar Mgr Res 92 03 42 Rehov David Remez 92 01 34 Photo Nahariya Lazar Dr Dov Rozen Abraham Tasiat Mamtakim J Schwarz Mgr Res 92 06 00 Natansohn Haim Iron Sederot Hagaaton 92 02 57 106 Herzl 92 0255 Merkaz Habassar Nahariya Meat & 14 Hagaaton 92 07 00 Pincovici Dr Robert Phys Rozen Kalman 44a Ahad Ha'am92 08 00 Sausage Fcty Rehov Herzl 92 01 43 Navon Zeev (Nusscn) 4 Nordau 92 06 97 Rubin Mohr M North American Messer Malka & ltzhak Sport & Musical Instrmnts I'm inn Cafe & Rstnt Finance & Development Corp Weizman 67/69 92 0 0 82 Rassco Commercial Centre. -

The Humanitarian Monitor CAP Occupied Palestinian Territory Number 17 September 2007

The Humanitarian Monitor CAP occupied Palestinian territory Number 17 September 2007 Overview- Key Issues Table of Contents Update on Continued Closure of Gaza Key Issues 1 - 2 Crossings Regional Focus 3 Access and Crossings Rafah and Karni crossings remain closed after more than threemonths. Protection of Civilians 4 - 5 The movement of goods via Gaza border crossings significantly Child Protection 6-7 declined in September compared to previous months. The average Violence & Private 8-9 of 106 truckloads per day that was recorded between 19 June and Property 13 September has dropped to approximately 50 truckloads per day 10 - 11 since mid-September. Sufa crossing (usually opened 5 days a week) Access was closed for 16 days in September, including 8 days for Israeli Socio-economic 12 - 13 holidays, while Kerem Shalom was open only 14 days throughout Conditions the month. The Israeli Civil Liaison Administration reported that the Health 14 - 15 reduction of working hours was due to the Muslim holy month Food Security & 16 - 18 of Ramadan, Jewish holidays and more importantly attacks on the Agriculture crossings by Palestinian militants from inside Gaza. Water & Sanitation 19 Impact of Closure Education 20 As a result of the increased restrictions on Gaza border crossings, The Response 21 - 22 an increasing number of food items – including fruits, fresh meat and fish, frozen meat, frozen vegetables, chicken, powdered milk, dairy Sources & End Notes 23 - 26 products, beverages and cooking oil – are experiencing shortages on the local market. The World Food Programme (WFP) has also reported significant increases in the costs of these items, due to supply, paid for by deductions from overdue Palestinian tax increases in prices on the global market as well as due to restrictions revenues that Israel withholds. -

Lxstr. Genlxral

lxstr. GENlXRAL s/9790 11 l&y 1970 ORIGIXAL: ENGLISH lXTT73R T\A!ED 10 MAY 2.970 FRCIGTHE PERMANENTREPRl%ZNTATI~ OF ISRAEL TO THi;: UJ!?I~D NATIONS ADDRESSEDTC; THE PRESIDENT OF TEIE SECURITY CmJNCIL Cn instruction frcm my Government I have the honour to draw yowr npgent attention to the recent series of intensified acts of aggression carried out from Lebanon against Israel and particularly its civilian population- Cn the night of 22 April 1970 the villages of Zariit and Manara were shelled From Lebanon. The same night an Israeli border patrol encountered raiders frcm Lebanon in the area of Shetulah. In the ensuing clash two of the raiders were killed, sabotage equil;ment and arms were captured. On the night of 24 April the villages of Margalioth and Manara were shelled again from Lebanon. Cn the night of 29 April a band of saboteurs who had penetrated from Lebanon into Far Yuval was engaged by an Israeli force, which killed one of them and captured arms, ammunition and explosives. Cne Israeli soldier was killed and two were wounded. Cn the following night, 30 April, the same village came under heavy shelling f'rcm across the cease-fire line and two houses were damaged. r(far Yuval was shelled again on 2 May. Also on the night of 2 May gangs of raiders were encountered in the Nahal Hazoy area and Kerem Ben Zimra area. Gne Israeli soldier was killed and a second wounded. Five of the raiders were killed. Luring the night of 3 May Kfar Yuval and Maayan Earuch area were shelled from Lebanon. -

Strateg Ic a Ssessmen T

Strategic Assessment Assessment Strategic Volume 19 | No. 4 | January 2017 Volume 19 Volume The Prime Minister and “Smart Power”: The Role of the Israeli Prime Minister in the 21st Century Yair Lapid The Israeli-Palestinian Political Process: Back to the Process Approach | No. 4 No. Udi Dekel and Emma Petrack Who’s Afraid of BDS? Economic and Academic Boycotts and the Threat to Israel | January 2017 Amit Efrati Israel’s Warming Ties with Regional Powers: Is Turkey Next? Ari Heistein Hezbollah as an Army Yiftah S. Shapir The Modi Government’s Policy on Israel: The Rhetoric and Reality of De-hyphenation Vinay Kaura India-Israel Relations: Perceptions and Prospects Manoj Kumar The Trump Effect in Eastern Europe: Heightened Risks of NATO-Russia Miscalculations Sarah Fainberg Negotiating Global Nuclear Disarmament: Between “Fairness” and Strategic Realities Emily B. Landau and Ephraim Asculai Strategic ASSESSMENT Volume 19 | No. 4 | January 2017 Abstracts | 3 The Prime Minister and “Smart Power”: The Role of the Israeli Prime Minister in the 21st Century | 9 Yair Lapid The Israeli-Palestinian Political Process: Back to the Process Approach | 29 Udi Dekel and Emma Petrack Who’s Afraid of BDS? Economic and Academic Boycotts and the Threat to Israel | 43 Amit Efrati Israel’s Warming Ties with Regional Powers: Is Turkey Next? | 57 Ari Heistein Hezbollah as an Army | 67 Yiftah S. Shapir The Modi Government’s Policy on Israel: The Rhetoric and Reality of De-hyphenation | 79 Vinay Kaura India-Israel Relations: Perceptions and Prospects | 93 Manoj Kumar The Trump Effect in Eastern Europe: Heightened Risks of NATO-Russia Miscalculations | 103 Sarah Fainberg Negotiating Global Nuclear Disarmament: Between “Fairness” and Strategic Realities | 117 Emily B. -

The Land of Israel Symbolizes a Union Between the Most Modern Civilization and a Most Antique Culture. It Is the Place Where

The Land of Israel symbolizes a union between the most modern civilization and a most antique culture. It is the place where intellect and vision, matter and spirit meet. Erich Mendelsohn The Weizmann Institute of Science is one of Research by Institute scientists has led to the develop- the world’s leading multidisciplinary basic research ment and production of Israel’s first ethical (original) drug; institutions in the natural and exact sciences. The the solving of three-dimensional structures of a number of Institute’s five faculties – Mathematics and Computer biological molecules, including one that plays a key role in Science, Physics, Chemistry, Biochemistry and Biology Alzheimer’s disease; inventions in the field of optics that – are home to 2,600 scientists, graduate students, have become the basis of virtual head displays for pilots researchers and administrative staff. and surgeons; the discovery and identification of genes that are involved in various diseases; advanced techniques The Daniel Sieff Research Institute, as the Weizmann for transplanting tissues; and the creation of a nanobiologi- Institute was originally called, was founded in 1934 by cal computer that may, in the future, be able to act directly Israel and Rebecca Sieff of the U.K., in memory of their inside the body to identify disease and eliminate it. son. The driving force behind its establishment was the Institute’s first president, Dr. Chaim Weizmann, a Today, the Institute is a leading force in advancing sci- noted chemist who headed the Zionist movement for ence education in all parts of society. Programs offered years and later became the first president of Israel. -

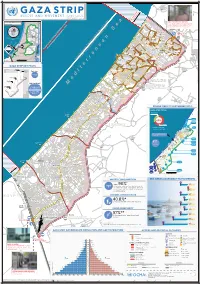

Gaza CRISIS)P H C S Ti P P I U

United Nations Office for the Coordination of Humanitarian Affairs occupied Palestinian territory Zikim e Karmiya s n e o il Z P m A g l in a AGCCESSA ANDZ AMOV EMENTSTRI (GAZA CRISIS)P h c s ti P P i u F a ¥ SEPTEMBER 2014 o nA P N .5 F 1 Yad Mordekhai EREZ CROSSING (BEIT HANOUN) occupied Palestinian territory: ID a As-Siafa OPEN, six days (daytime) a B?week4 for B?3the4 movement d Governorates e e of international workers and limited number of y h s a b R authorized Palestinians including aid workers, medical, P r 2 e A humanitarian cases, businessmen and aid workers. Jenin d 1 e 0 Netiv ha-Asara P c 2 P Tubas r Tulkarm r fo e S P Al Attarta Temporary Wastewater P n b Treatment Lagoons Qalqiliya Nablus Erez Crossing E Ghaboon m Hai Al Amal r Fado's 4 e B? (Beit Hanoun) Salfit t e P P v i Al Qaraya al Badawiya i v P! W e s t R n m (Umm An-Naser) n i o » B a n k a North Gaza º Al Jam'ia ¹¹ M E D I TER RAN EAN Hatabiyya Ramallah da Jericho d L N n r n r KJ S E A ee o Beit Lahia D P o o J g Wastewater Ed t Al Salateen Beit Lahiya h 5 Al Kur'a J a 9 P l D n Treatment Plant D D D D 9 ) D s As Sultan D 1 2 El Khamsa D " Sa D e J D D l i D 0 D s i D D 0 D D d D D m 2 9 Abedl Hamaid D D r D D l D D o s D D a t D D c Jerusalem D D c n P a D D c h D D i t D D s e P! D D A u P 0 D D D e D D D a l m d D D o i t D D l i " D D n . -

Exhibitors Catalogue

Exhibitors Catalogue ADAMA Makhteshim Agronet portal A CEO: Shlomi Nachum CEO: ayelet oron Marketing Manager: Danny Zahor Marketing Manager: ayelet oron A.B.Seed Sales Field of Activity: One of the world’s Field of Activity: agronet portal CEO: Yuval Ben Shushan (Sales leading agrochemical companies. Address: cfar saaba Manager) An importer and distributor of crop Tel: 504009974 Marketing Manager: Tali Edri protection products and agricultural Fax: +972 72-2128787 Field of Activity: Marketing and selling seeds. E-mail: [email protected] seeds in Israel Address: 1st. Golan st. Airport city Website: www.agronet.co.il Address: 2 Hanegev, Lod Tel: 3 6577577, Fax: +972 3 6032310 Tel: 3 9733661 E-mail: [email protected] AMIT SOLAR Fax: +972 3 9733663 Website: www.adama.com/mcw CEO: igal Reuveni E-mail: [email protected] Marketing Manager: Goldstein Amit Website: www.seminis.co.il Agam Ner / Greefa Field of Activity: A company that CEO: Nir Gilad manages and executes projects in the Aclartech Marketing Manager: Natan Gilad, fields of infrastructure, electricity, solar, CEO: Avi Schwartzer Agriculture Devision Manager wind and communications. Marketing Manager: Avi Schwartzer Field of Activity: Sele and service of Establishment of large, commercial, Field of Activity: AclarTech’s mobile sorting and packaging equipment and domestic net counter systems. application, AclaroMeter, monitors and for fruits and vegetablespalletizing Address: Betzet 87 analyzes fruit quality, ripeness and packages of vegetablesIndustrial Tel: 4-9875966 freshness.Address: Moshe Lerer 19 / 7 diesel enginesSpecial equipment Fax: +972 4-9875955 Nes Ziona Israel upon requestAddress: 19 Weizmann E-mail: [email protected] Tel: 545660850 Givatayim, Israel Website: http://www.amitsunsolar.co.il/ Fax: +972 545660850 Tel: 50-8485022 E-mail: [email protected] Fax: +972 3-6990160 Avihar /Nftali farm Website: www.aclartech.com E-mail: [email protected] hatzeva.arava Website: none CEO: Avihar Giora Agrolan Marketing Manager: Naftali Fraddy CEO: Yehuda Glikman AgriQuality Ltd. -

Three Conquests of Canaan

ÅA Wars in the Middle East are almost an every day part of Eero Junkkaala:of Three Canaan Conquests our lives, and undeniably the history of war in this area is very long indeed. This study examines three such wars, all of which were directed against the Land of Canaan. Two campaigns were conducted by Egyptian Pharaohs and one by the Israelites. The question considered being Eero Junkkaala whether or not these wars really took place. This study gives one methodological viewpoint to answer this ques- tion. The author studies the archaeology of all the geo- Three Conquests of Canaan graphical sites mentioned in the lists of Thutmosis III and A Comparative Study of Two Egyptian Military Campaigns and Shishak and compares them with the cities mentioned in Joshua 10-12 in the Light of Recent Archaeological Evidence the Conquest stories in the Book of Joshua. Altogether 116 sites were studied, and the com- parison between the texts and the archaeological results offered a possibility of establishing whether the cities mentioned, in the sources in question, were inhabited, and, furthermore, might have been destroyed during the time of the Pharaohs and the biblical settlement pe- riod. Despite the nature of the two written sources being so very different it was possible to make a comparative study. This study gives a fresh view on the fierce discus- sion concerning the emergence of the Israelites. It also challenges both Egyptological and biblical studies to use the written texts and the archaeological material togeth- er so that they are not so separated from each other, as is often the case. -

Memory Trace Fazal Sheikh

MEMORY TRACE FAZAL SHEIKH 2 3 Front and back cover image: ‚ ‚ 31°50 41”N / 35°13 47”E Israeli side of the Separation Wall on the outskirts of Neve Yaakov and Beit Ḥanīna. Just beyond the wall lies the neighborhood of al-Ram, now severed from East Jerusalem. Inside front and inside back cover image: ‚ ‚ 31°49 10”N / 35°15 59”E Palestinian side of the Separation Wall on the outskirts of the Palestinian town of ʿAnata. The Israeli settlement of Pisgat Ze’ev lies beyond in East Jerusalem. This publication takes its point of departure from Fazal Sheikh’s Memory Trace, the first of his three-volume photographic proj- ect on the Israeli–Palestinian conflict. Published in the spring of 2015, The Erasure Trilogy is divided into three separate vol- umes—Memory Trace, Desert Bloom, and Independence/Nakba. The project seeks to explore the legacies of the Arab–Israeli War of 1948, which resulted in the dispossession and displacement of three quarters of the Palestinian population, in the establishment of the State of Israel, and in the reconfiguration of territorial borders across the region. Elements of these volumes have been exhibited at the Slought Foundation in Philadelphia, Storefront for Art and Architecture, the Brooklyn Museum of Art, and the Pace/MacGill Gallery in New York, and will now be presented at the Al-Ma’mal Foundation for Contemporary Art in East Jerusalem, and the Khalil Sakakini Cultural Center in Ramallah. In addition, historical documents and materials related to the history of Al-’Araqīb, a Bedouin village that has been destroyed and rebuilt more than one hundred times in the ongoing “battle over the Negev,” first presented at the Slought Foundation, will be shown at Al-Ma’mal. -

The Tunnels in Gaza February 2015 the Tunnels in Gaza Testimony Before the UN Commission of Inquiry on the 2014 Gaza Conflict Dr

Dr. Eado Hecht 1 The Tunnels in Gaza February 2015 The Tunnels in Gaza Testimony before the UN Commission of Inquiry on the 2014 Gaza Conflict Dr. Eado Hecht The list of questions is a bit repetitive so I have decided to answer not directly to each question but in a comprehensive topical manner. After that I will answer specifically a few of the questions that deserve special emphasis. At the end of the text is an appendix of photographs, diagrams and maps. Sources of Information 1. Access to information on the tunnels is limited. 2. I am an independent academic researcher and I do not have access to information that is not in the public domain. All the information is based on what I have gleaned from unclassified sources that have appeared in the public media over the years – listing them is impossible. 3. The accurate details of the exact location and layout of all the tunnels are known only by the Hamas and partially by Israeli intelligence services and the Israeli commanders who fought in Gaza last summer. 4. Hamas, in order not to reveal its secrets to the Israelis, has not released almost any information on the tunnels themselves except in the form of psychological warfare intended to terrorize Israeli civilians or eulogize its "victory" for the Palestinians: the messages being – the Israelis did not get all the tunnels and we are digging more and see how sophisticated our tunnel- digging operation is. These are carefully sanitized so as not to reveal information on locations or numbers. -

4144R18E UNIFIL Sep07.Ai

700000E 710000E 720000E 730000E 740000E 750000E 760000E HQ East 0 1 2 3 4 5 km ni MALAYSIA ta 3700000N HQ SPAIN IRELAND i 7-4 0 1 2 3 mi 3700000N L 4-23 Harat al Hart Maritime Task Force POLAND FINLAND Hasbayya GERMANY - 5 vessels 7-3 4-2 HQ INDIA Shwayya (1 frigate, 2 patrol boats, 2 auxiliaries) CHINA 4-23 GREECE - 2 vessels Marjayoun 7-2 Hebbariye (1 frigate, 1 patrol boat) Ibil 4-1 4-7A NETHERLANDS - 1 vessel as Saqy Kafr Hammam 4-7 ( ) 1 frigate 4-14 Shaba 4-14 4-13 TURKEY - 3 vessels Zawtar 4-7C (1 frigate, 2 patrol boats) Kafr Shuba ash Al Qulayah 4-30 3690000N Sharqiyat Al Khiyam Halta 3690000N tan LEBANON KHIAM Tayr Li i (OGL) 4-31 Mediterranean 9-66 4-34 SYRIAN l Falsayh SECTOR a s Bastra s Arab Sea Shabriha Shhur QRF (+) Kafr A Tura HQ HQ INDONESIA EAST l- Mine Action a HQ KOREA Kila 4-28 i Republic Coordination d 2-5 Frun a Cell (MACC) Barish 7-1 9-15 Metulla Marrakah 9-10 Al Ghajar W Majdal Shams HQ ITALY-1 At Tayyabah 9-64 HQ UNIFIL Mughr Shaba Sur 2-1 9-1 Qabrikha (Tyre) Yahun Addaisseh Misgav Am LOG POLAND Tayr Tulin 9-63 Dan Jwayya Zibna 8-18 Khirbat Markaba Kefar Gil'adi Mas'adah 3680000N COMP FRANCE Ar Rashidiyah 3680000N Ayn Bal Kafr Silm Majdal MAR HaGosherim Dafna TURKEY SECTOR Dunin BELGIUM & Silm Margaliyyot MP TANZANIA Qana HQ LUXEMBURG 2-4 Dayr WEST HQ NEPAL 8-33 Qanun HQ West BELGIUM Qiryat Shemona INDIA Houla 8-32 Shaqra 8-31 Manara Al Qulaylah CHINA 6-43 Tibnin 8-32A ITALY HQ ITALY-2 Al Hinniyah 6-5 6-16 8-30 5-10 6-40 Brashit HQ OGL Kafra Haris Mays al Jabal Al Mansuri 2-2 1-26 Haddathah HQ FRANCE 8-34 2-31 -

Appendix 1(V) SEIZED DOCUMENTS: TARGETING POPULATION CENTERS in ISRAEL USING UPGRADED 122 MM GRAD ROCKET POSITIONS

Appendix 1(v) SEIZED DOCUMENTS: TARGETING POPULATION CENTERS IN ISRAEL USING UPGRADED 122 MM GRAD ROCKET POSITIONS 1. On August 11, 2006, during the second Lebanon war, three files were found in the village of Aita al-Shaab in the central sector of south Lebanon. They contained range cards for three 120 mm mortar and 122 mm upgraded Grad rocket fired from positions in the region of Shihin. The range cards were dated December 2005 and were for 122 mm upgraded Grad rockets (with a range of 20 km – 12.5 miles). The range cards belonged to the artillery department of the Nasr Unit, the unit responsible for the area south of the Litani River, and operating under the command of the Jihad Council.1 2. It should be noted that most of the rockets fired at Israel during the war were various types of 122 mm rockets (HE-frag rockets, cluster bombs, and upgraded rockets with extended range). The following data are for an upgraded Grad rocket: 1 The Jihad Council is a department within the Hezbollah headquarters, responsible for building up the organization’s military power and preparing it for emergencies. Hajj Imad Mughniyah, Hassan Nasrallah’s military deputy, heads it. He is wanted by the United States for the many terrorist attacks he has carried out against American targets. In addition, Argentina has issued an international warrant for his arrest because of his involvement in the 1994 bombing of the Jewish Community Center in Buenos Aires. 2 Upgraded 122 mm Grad rocket Diameter: 122 mm. Range: 20 km (12.5 miles)* Warhead weight: 66 kg (145 lbs) Manufacturer: China, Iran, Russia, Bulgaria * There are also upgraded Grad rockets with ranges of 30-40 kilometers (18- 25 miles), however, the seized range cards referred to rockets with a range of 20 kilometers Firing Position No.