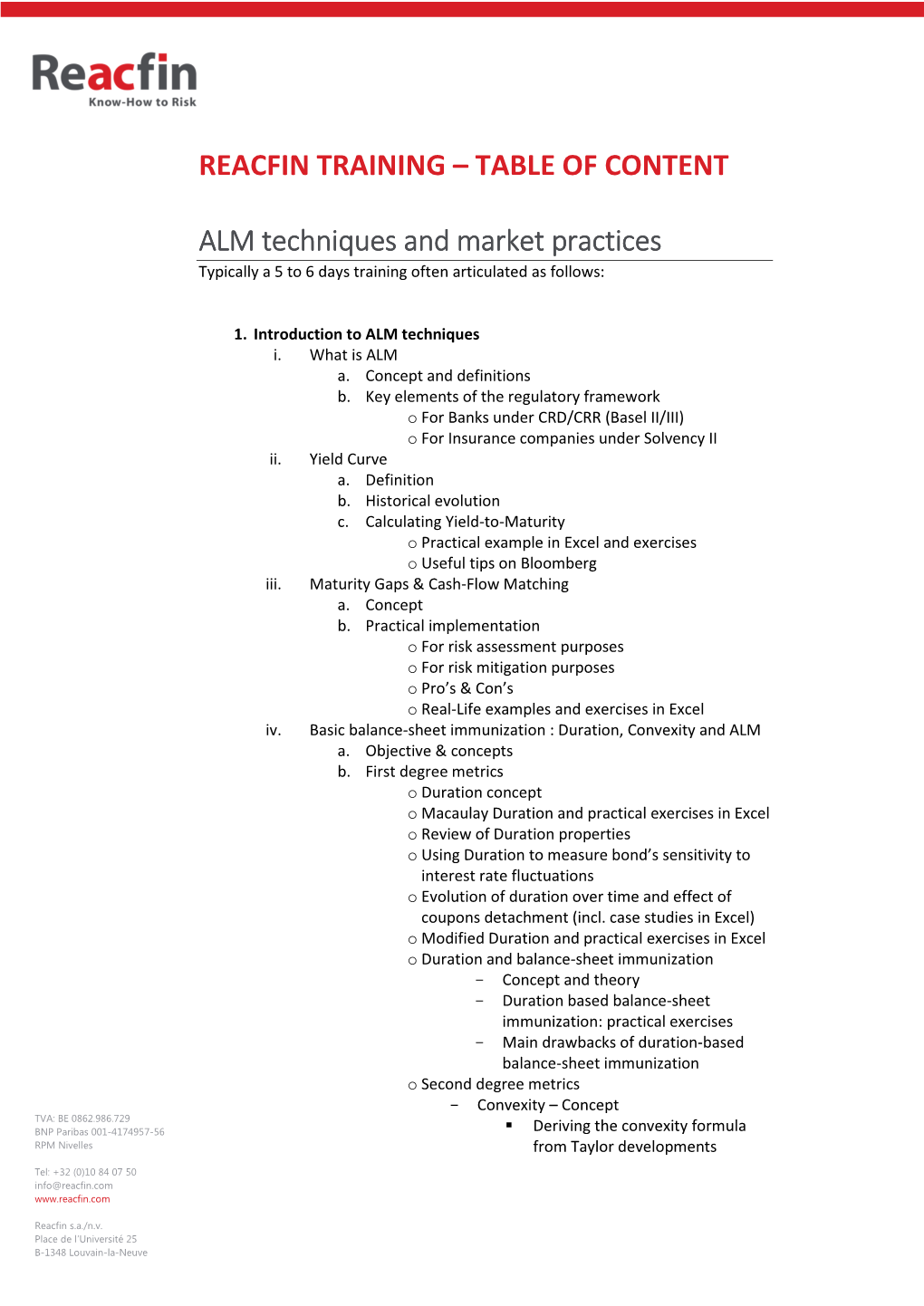

REACFIN TRAINING – TABLE of CONTENT ALM Techniques and Market Practices Typically a 5 to 6 Days Training Often Articulated As Follows

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Framework for Statistical Network Modeling

A FRAMEWORK FOR STATISTICAL NETWORK MODELING By Harry Crane and Walter Dempsey Rutgers University and University of Michigan Basic principles of statistical inference are commonly violated in network data analysis. Under the current approach, it is often impossi- ble to identify a model that accommodates known empirical behaviors, possesses crucial inferential properties, and accurately models the data generating process. In the absence of one or more of these properties, sensible inference from network data cannot be assured. Our proposed framework decomposes every network model into a (relatively) exchangeable data generating process and a sampling mecha- nism that relates observed data to the population network. This frame- work, which encompasses all models in current use as well as many new models, such as edge exchangeable and relationally exchangeable models, that lie outside the existing paradigm, offers a sound context within which to develop theory and methods for network analysis. 1. Introduction. A statistical model, traditionally defined [15, 40, 41], is a family of probability distributions on the sample space of all maps M S from the set of statistical units into the response space . Some other au- U R thors discuss statistical modeling from various perspectives [21, 28, 41], but none of these prior accounts directly addresses the specific challenges of network modeling, namely the effects of sampling on network data and its subsequent impact on inference. In fact, these issues are hardly even men- tioned in the statistical literature on networks, a notable exception being the recent analysis of sampling consistency for the exponential random graph model [46]. Below we address both logical and practical concerns of statisti- cal inference as well as clarify how specific attributes of network modeling fit within the usual statistical paradigm. -

An Empirical Comparison of Interest Rate Models for Pricing Zero Coupon Bond Options

AN EMPIRICAL COMPARISON OF INTEREST RATE MODELS FOR PRICING ZERO COUPON BOND OPTIONS HUSEYÄ IN_ S»ENTURKÄ AUGUST 2008 AN EMPIRICAL COMPARISON OF INTEREST RATE MODELS FOR PRICING ZERO COUPON BOND OPTIONS A THESIS SUBMITTED TO THE GRADUATE SCHOOL OF APPLIED MATHEMATICS OF THE MIDDLE EAST TECHNICAL UNIVERSITY BY HUSEYÄ IN_ S»ENTURKÄ IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF SCIENCE IN THE DEPARTMENT OF FINANCIAL MATHEMATICS AUGUST 2008 Approval of the Graduate School of Applied Mathematics Prof. Dr. Ersan AKYILDIZ Director I certify that this thesis satis¯es all the requirements as a thesis for the degree of Master of Science. Prof. Dr. Ersan AKYILDIZ Head of Department This is to certify that we have read this thesis and that in our opinion it is fully adequate, in scope and quality, as a thesis for the degree of Master of Science. Assist. Prof. Dr. Kas³rga Y³ld³rak Assist. Prof. Dr. OmÄurU¸gurÄ Co-advisor Supervisor Examining Committee Members Assist. Prof. Dr. OmÄurU¸gurÄ Assist. Prof. Dr. Kas³rga Y³ld³rak Prof. Dr. Gerhard Wilhelm Weber Assoc. Prof. Dr. Azize Hayfavi Dr. C. Co»skunKÄu»cÄukÄozmen I hereby declare that all information in this document has been obtained and presented in accordance with academic rules and ethical conduct. I also declare that, as required by these rules and conduct, I have fully cited and referenced all material and results that are not original to this work. Name, Last name: HÄuseyinS»ENTURKÄ Signature: iii abstract AN EMPIRICAL COMPARISON OF INTEREST RATE MODELS FOR PRICING ZERO COUPON BOND OPTIONS S»ENTURK,Ä HUSEYÄ IN_ M.Sc., Department of Financial Mathematics Supervisor: Assist. -

Essays on the Term Structure of Interest Rates Magnus Hyll

Essays on the Term Structure of Interest Rates Magnus Hyll AKADEMISK AVHANDLING Sam for avlaggande av filosofie doktorsexamen vid Handelshogskolan i Stockholm frarnlaggs for offentlig granskning fredagen den 2 februari 2001, kl. 13.15 i sal 550 Handelshogskolan, Sveavagen 65 t*\ STOCKHOLM SCHOOL OF ECONOMICS ,,,)' EFI, THE ECONOMIC RESEARCH INSTITUTE EFIMission EFI, the Economic Research Institute at the Stockholm School ofEconomics, is a scientific institution which works independently ofeconomic, political and sectional interests. It conducts theoretical and empirical r~search in management and economic sciences, including selected related disciplines. The Institute encourages and assists in the publication and distribution ofits research findings and is also involved in the doctoral education at the Stockholm School of Economics. EFI selects its projects based on the need for theoretical or practical development ofa research domain, on methodological interests, and on the generality ofa problem. Research Organization The research activities are organized in nineteen Research Centers within eight Research Areas. Center Directors are professors at the Stockholm School ofEconomics. ORGANIZATIONAND MANAGEMENT Management and Organisation; (A) ProfSven-Erik Sjostrand Center for Ethics and Economics; (CEE) Adj ProfHans de Geer Public Management; (F) ProfNils Brunsson Information Management; (I) ProfMats Lundeberg Center for People and Organization (PMO) Acting ProfJan Lowstedt Center for Innovation and Operations Management; (T) ProfChrister -

Volatility and the Treasury Yield Curve1

-228- Volatility and the Treasury yield curve1 Christian Gilles Introduction The topic for this year's autumn meeting is the measurement, causes and consequences of financial market volatility. For this paper, I limit the scope of analysis to the market for US Treasury securities, and I examine how the volatility of interest rates affects the shape of the yield curve. I consider explicitly two types of measurement issues: since yields of different maturities have different volatilities, which maturity to focus on; and how to detect a change in volatility. Although understanding what causes the volatility of financial markets to flare up or subside is perhaps the most important issue, I will have nothing to say about it; like much of contemporaneous finance theory, I treat interest rate volatility as exogenous. To provide context for the analysis, I discuss the reasons that led to work currently going on at the Federal Reserve Board, which is to estimate a particular three-factor model of the yield curve. That work is still preliminary, and I have no results to report. Current efforts are devoted to resolving tricky econometric and computational issues which are beyond the scope of this paper. What I want to do here is to explain the theoretical and empirical reasons for estimating a model in this particular class. This project's objective is to interpret the nominal yield curve to find out what market participants think will happen to future short-term nominal interest rates. It would be even better to obtain a market-based measure of expected inflation, but this goal would require data not merely on the value of nominal debt but also on the value of indexed debt, which the Treasury does not yet issue. -

Bond Trading Strategy Using Parsimonious Interest Rate Model

BOND TRADING STRATEGY USING PARSIMONIOUS INTEREST RATE MODEL CHARIYA PIMOLPAIBOON MASTER OF SCIENCE PROGRAM IN FINANCE (INTERNATIONAL PROGRAM) FACULTY OF COMMERCE AND ACCOUNTANCY THAMMASAT UNIVERSITY, BANGKOK, THAILAND MAY 2008 BOND TRADING STRATEGY USING PARSIMONIOUS INTEREST RATE MODEL CHARIYA PIMOLPAIBOON MASTER OF SCIENCE PROGRAM IN FINANCE (INTERNATIONAL PROGRAM) FACULTY OF COMMERCE AND ACCOUNTANCY THAMMASAT UNIVERSITY, BANGKOK, THAILAND MAY 2008 2 Bond Trading Strategy using Parsimonious Interest rate model Chariya Pimolpaiboon An Independent Study Submitted in Partial Fulfillment of the Requirements for the Degree of Master of Science (Finance) Master of Science Program in Finance (International Program) Faculty of Commerce and Accountancy Thammasat University, Bangkok, Thailand May 2008 3 Thammasat University Faculty of Commerce and Accountancy An Independent Study By Chariya Pimolpaiboon “Bond Trading Strategy using Parsimonious Interest rate Model” has been approved as a partial fulfillment of the requirements for the Degree of Master of Science (Finance) On May, 2008 Advisor: …………………………………… (Prof. Dr. Suluck Pattarathammas) 4 ACKNOWLEDGEMENTS I am forever indebted to Asst. Prof. Dr. Suluck Pattarathammas, my independent study advisor, for his invaluable guidance. This study would not have been possible without his thought provoking advice. It is also a pleasure to express my appreciation to my comprehensive examination committee members, Dr. Thanomsak Suwannoi and Aj. Anutchanat Jaroenjitrkam for their detailed comments and suggestions, which benefit me so much. Moreover, I would like also to express my sincere appreciation: - Dr. Supakorn Soontornkit, my boss and my lecturer in Fixed-Income security class at the MIF, for a consultation on interest rate modeling and fixed income markets. - Dr. Charnwut Roonsangmanoon for giving constructive and valuable suggestions. -

Some Optimal Control Problems in Mat Hematical Finance

Some Optimal Control Problems in Mat hematical Finance Chaoyang Guo A thesis submitted to the Faculty of Graduate Studies in partial fulfillment of the requirements for the degree of Doctor of Philosophy Graduate Programme in Mathematics and Statistics York University Toronto, Ontario April, 1999 National Library Bibliothlzque nationale du Canada Acquisitions and Acquisitions et 8ibliographc Services services bibliographiques 395 Wellington Street 395, rue Wellington Ottawa ON KIA ON4 Ottawa ON K1A ON4 Canada Canada The author has granted a non- L'auteur a accorde me licence non exclusive licence allowing the exclusive pennettant a la National Library of Canada to Bibliotheque nationale du Canada de reproduce, loan, distribute or sell reproduire, preter, distribuer ou copies of this thesis in microfom, vendre des copies de cette these sous paper or electronic formats. la forme de microfiche/film, de reproduction sur papier ou sur fonnat electronique. The author retains ownership of the L'auteur conserve la propriete du copyright in this thesis. Neither the droit d'auteur qui protege cette these. thesis nor substantial extracts fiom it Ni la these ni des extraits substantiels may be printed or otherwise de celle-ci ne doivent &re imprimes reproduced without the author's ou autrement reproduits sans son permission. autorisation. Some Optimal Control Problems in Mathematical Finance by Chaayang Guo a dissertation submitted to the Faculty of Graduate Studies of York University in partial fulfillment of the requirements for the degree of DOCTOR OF PHILOSOPHY 0 1999 Permission has been granted to the LIBRARY OF YORK UNIVERSITY to lend or sell copies of this dissertation, to the NATIONAL LIBRARY OF CANADA to microfilm this dissertation and to lend or sell copies of the film, and to UNIVERSITY MICROFILMS to publish an abstract of this dissertation. -

On Calibrating an Extension of the Chen Model

On Calibrating an Extension of the Chen Model MSc Degree Project in Mathematical Finance Martin Möllberg SF299X Degree Project in Mathematical Statistics, Second Cycle The Department of Mathematics at KTH March 4, 2015 Abstract There are many ways of modeling stochastic processes of short-term interest rates. One way is to use one-factor models which may be easy to use and easy to calibrate. Another way is to use a three-factor model in the strive for a higher degree of congruency with real world market data. Calibrating such models may however take much more effort. One of the main questions here is which models will be better fit to the data in question. Another question is if the use of a three-factor model can result in better fitting compared to one-factor models. This is investigated by using the Efficient Method of Moments to calibrate a three-factor model with a Lévy process. This model is an extension of the Chen Model. The calibration is done with Euribor 6-month interest rates and these rates are also used with the Vasicek and Cox-Ingersoll-Ross (CIR) models. These two models are calibrated by using Maximum Likelihood Estimation and they are one-factor models. Chi-square goodness-of-fit tests are also performed for all models. The findings indicate that the Vasicek and CIR models fail to describe the stochastic process of the Euribor 6-month rate. However, the result from the goodness-of-fit test of the three-factor model gives support for that model. 2 Acknowledgements First of all, the author of this report wants to thank Boualem Djehiche and Henrik Shahgholian who supervised the project. -

The Heston Model

Outline Introduction Stochastic Volatility Monte Carlo simulation of Heston Additional Exercise The Heston Model Hui Gong, UCL http://www.homepages.ucl.ac.uk/ ucahgon/ May 6, 2014 Hui Gong, UCL http://www.homepages.ucl.ac.uk/ ucahgon/ The Heston Model Outline Introduction Stochastic Volatility Monte Carlo simulation of Heston Additional Exercise Introduction Stochastic Volatility Generalized SV models The Heston Model Vanilla Call Option via Heston Monte Carlo simulation of Heston It^o'slemma for variance process Euler-Maruyama scheme Implement in Excel&VBA Additional Exercise Hui Gong, UCL http://www.homepages.ucl.ac.uk/ ucahgon/ The Heston Model Outline Introduction Stochastic Volatility Monte Carlo simulation of Heston Additional Exercise Introduction 1. Why the Black-Scholes model is not popular in the industry? 2. What is the stochastic volatility models? Stochastic volatility models are those in which the variance of a stochastic process is itself randomly distributed. Hui Gong, UCL http://www.homepages.ucl.ac.uk/ ucahgon/ The Heston Model Outline Introduction Generalized SV models Stochastic Volatility The Heston Model Monte Carlo simulation of Heston Vanilla Call Option via Heston Additional Exercise A general expression for non-dividend stock with stochastic volatility is as below: p 1 dSt = µt St dt + vt St dWt ; (1) 2 dvt = α(St ; vt ; t)dt + β(St ; vt ; t)dWt ; (2) with 1 2 dWt dWt = ρdt ; where St denotes the stock price and vt denotes its variance. Examples: I Heston model I SABR volatility model I GARCH model I 3/2 model I Chen model Hui Gong, UCL http://www.homepages.ucl.ac.uk/ ucahgon/ The Heston Model Outline Introduction Generalized SV models Stochastic Volatility The Heston Model Monte Carlo simulation of Heston Vanilla Call Option via Heston Additional Exercise The Heston model is a typical Stochastic Volatility model which p takes α(St ; vt ; t) = κ(θ − vt ) and β(St ; vt ; t) = σ vt , i.e. -

Pricing American Interest Rate Derivatives by Simulation

Pricing American Interest Rate Derivatives by Simulation Rami V. Tabri A Thesis in The Department of Mathematics and Statistics Presented in partial fulfillment of the requirements for the degree of Master of Science (Mathematics) at Concordia University Montreal, Quebec, Canada August 2008 ©Rami V. Tabri 2008 Library and Bibliotheque et 1*1 Archives Canada Archives Canada Published Heritage Direction du Branch Patrimoine de I'edition 395 Wellington Street 395, rue Wellington Ottawa ON K1A0N4 Ottawa ON K1A0N4 Canada Canada Your file Votre reference ISBN: 978-0-494-45530-2 Our file Notre reference ISBN: 978-0-494-45530-2 NOTICE: AVIS: The author has granted a non L'auteur a accorde une licence non exclusive exclusive license allowing Library permettant a la Bibliotheque et Archives and Archives Canada to reproduce, Canada de reproduire, publier, archiver, publish, archive, preserve, conserve, sauvegarder, conserver, transmettre au public communicate to the public by par telecommunication ou par Plntemet, prefer, telecommunication or on the Internet, distribuer et vendre des theses partout dans loan, distribute and sell theses le monde, a des fins commerciales ou autres, worldwide, for commercial or non sur support microforme, papier, electronique commercial purposes, in microform, et/ou autres formats. paper, electronic and/or any other formats. The author retains copyright L'auteur conserve la propriete du droit d'auteur ownership and moral rights in et des droits moraux qui protege cette these. this thesis. Neither the thesis Ni la these ni des extraits substantiels de nor substantial extracts from it celle-ci ne doivent etre imprimes ou autrement may be printed or otherwise reproduits sans son autorisation. -

Multi-Scale Simulation of Multiphase Multi-Component Flow in Porous

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Spiral - Imperial College Digital Repository Imperial College London Department of Chemical Engineering Multi-scale simulation of multiphase multi-component flow in porous media using the Lattice Boltzmann Method Jianhui Yang Supervised by Dr. Edo Boek Submitted in part fulfilment of the requirements for the degree of Doctor of Philosophy in Chemical Engineering of Imperial College London and the Diploma of Imperial College London 1 Declaration I hereby declare that this thesis titled Multi-scale simulation of multiphase multi-component flow in porous media using the Lattice Boltzmann Method is entirely my own work under the supervision of Dr. Edo Boek otherwise it is appropriately acknowledged. This work has not been previously sub- mitted in its entirety or in part to any other academic institute for a degree. Jianhui Yang Department of Chemical Engineering Imperial College London 2 The copyright of this thesis rests with the author and is made available under a Creative Commons Attribution Non-Commercial No Derivatives licence. Researchers are free to copy, distribute or transmit the thesis on the condition that they attribute it, that they do not use it for commercial purposes and that they do not alter, transform or build upon it. For any reuse or redistribution, researchers must make clear to others the licence terms of this work. 3 Abstract This thesis consists of work mainly performed within the Qatar Carbon- ates and Carbon Storage Research Centre (QCCSRC) project, focusing on the prediction of flow and transport properties in porous media. -

Feasibility Test Does It Serve Its Purpose?

Erasmus University Rotterdam MSc Quantitative Finance Thesis Feasibility Test Does it serve its purpose? Author: Supervisors: Sebastian van den Berg M. Jaskowski Student Number: B. Diris 324429 (Erasmus University) M. Blankevoort F. Hanlo D. Siewe (Kempen & Co) April 20, 2016 Preface This thesis is the final proof of competence for obtaining the Master of Science (MSc) degree in Econometrics and Management Science, with a specialization in Quantitative Finance, from the Erasmus University Rotterdam. The research was conducted in cooperation with Kempen Capital Management (KCM), a subsidiary of Kempen & Co. Kempen & Co is a Dutch merchant bank pro- viding financial services in Asset Management, Securities Broking and Corporate Finance. KCM is Kempen's Asset Management branch and manages portfolios for numerous large institutional in- vestors, financial institutions, (semi)public institutions, foundations and high net-worth individual clients. This thesis was specifically written in collaboration with KCM's Fiduciary Management Team. The Fiduciary Management team acts as the alternative investment arm for pension funds and insurance companies from around the world. The outsourcing of tasks by the pension fund board enables them to focus on policy-related issues such as payments, investments, premiums, benefits and indexation policies. I would like to take this opportunity to thank the following people for their help and support during the writing of my thesis. First of all, I would like to thank my supervisors Maarten Blankevoort, Florentine Hanlo, and Duncan Siewe at Kempen Capital Management for their constructive comments and guidance during this process. In addition, I want to thank Dr. Maya Beyhan (Fiduciary Manager at KCM) for her assistance on the quantitative part of my thesis. -

Stochastic Volatility Jump-Diffusion Models As Time-Changed Lévy Processes

University of Lisbon ISCTE Business School Faculty of Sciences University Institute of Lisbon Department of Mathematics Department of Finance Stochastic Volatility Jump-diffusion Models As Time-Changed Lévy Processes Ricardo Matos Dissertation Master’s Degree in Financial Mathematics 2014 University of Lisbon ISCTE Business School Faculty of Sciences University Institute of Lisbon Department of Mathematics Department of Finance Stochastic Volatility Jump-diffusion Models As Time-Changed Lévy Processes Ricardo Matos Dissertation supervised by Professor João Pedro Vidal Nunes Master’s Degree in Financial Mathematics 2014 Acknowledgments "Não sou nada. Nunca serei nada. Não posso querer ser nada. À parte isso, tenho em mim todos os sonhos do mundo." Álvaro de Campos "As nossas dúvidas são traidoras, e fazem-nos perder o que, com frequência, poderíamos ganhar, por simples medo de tentar." William Shakespeare "O carácter do homem é o seu destino." Heraclitus Gostaria de prestar os meus sinceros agradecimentos ao meu orientador, Professor Doutor João Pedro Nunes, por todo o apoio não só ao longo da tese mas também durante o mestrado. Pelo mentor e pessoa inspiradora que foi, estou sinceramente agradecido. Gostaria também de agradecer a todas as pessoas que me apoiaram durante o meu percurso académico e em especial durante a elaboração desta tese. Agradeço a toda a minha família pelo apoio incondicional: ao meu pai, à minha mãe, à minha irmã e à Céu, por nunca deixarem de acreditar em mim. Às minhas avós, porque sei que as deixei orgulhosas. E por fim, um agradecimento especial à Filipa por toda a compreensão, con- fiança e apoio durante esta etapa, por estar sempre ao meu lado e por fazer parte da minha vida.