Hb 975 Fiscal Memorandum Sb

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Racing Vacation RACING Connection Racing According to Plan June 2014 Vol

www.theracingconnection.comwww.theracingconnection.com June 2014 Vol. 18, No. 2 ARCAARCAARCAARCA &&&& MastersMastersMastersMasters PreviewPreviewPreviewPreview GoingGoing InIn CirclesCircles 1:11:1 WithWith GilomenGilomen June 2014 Page 2 Page 3 June 2014 The Midwest Publisher's Note The Racing Vacation RACING Connection Racing According to Plan June 2014 Vol. 18, No. 2 P.O. Box 22111 St. Paul MN, 55122 651-451-4036 [email protected] www.theracingconnection.com Publisher Dan Plan Contributing Writers Dan Plan photo Shane Carlson Dale P. Danielski one that I haven’t been to in a long time. This year’s trip Eric Huenefeld was to my neighboring state of Wisconsin over the Stan Meissner Memorial Day weekend. With the long weekend, I was able Jacklyn Daniels-Nuttleman Dan Plan to spend some time at a real campground (meaning Kris Peterson Throughout my life as a race fan, I’ve been lucky enough to something other than a race track parking lot) with my family Dean Reller go on several racing vacations. Actually, most of my before starting the journey into Wisconsin. Jason Searcy vacation days from my daytime job have been utilized for Charlie Spry racing related time off. I can’t think of a better way to use The agenda for this year had a visit to a couple of new my vacation days, but the rest of my family might not agree. tracks that I had never visited previously – Angell Park Photographers Speedway in Sun Prairie, WI and Columbus 151 Speedway Jim Ambruoso (815-623-3200) Many years ago, we would take family trips to mid-week in Columbus, WI. -

Music City 200 at Nashville Fairgrounds Speedway

MUSIC CITY 200 AT NASHVILLE FAIRGROUNDS SPEEDWAY NASHVILLE FAIRGROUNDS SPEEDWAY Nashville, TN Saturday, May 8, 2021 .596 Mile Paved Oval • 200 Laps • 119 Miles www.nashvillefairgroundsspeedway.racing LIVE - TRACKPass on NBCSports Gold / Delayed - NBCSports Network Live Timing and Scoring for all on track activities at arcaracing.com ARCA EVENT OPERATIONS PROTOCOL This event will be conducted under the most current version of the ARCA Event Operations Protocol document. All Posted Awards won by any team member (driver, crew chief etc.) shall be paid by ARCA (or Sponsoring Entity), to the registered/entered team owner. The team owner, and not ARCA, shall be solely responsible for the distribution of such Posted Awards to the respective team member. This shall also apply to Year-End and Point Fund awards unless otherwise specified. All awards paid by ACH Transfer only and team owner must have all ACH documents on file with ARCA prior to race. Racing Purse Breakdown: 1st-$5,000, 2nd-$2,500, 3rd-$2,250, 4th-$2,000, 5th-$1,900, 6th-$1,800, 7th-$1,700, 8th-$1,600, 9th-$1,550, 10th-$1,500, 11th-$1,400, 12th-$1,350, 13th-$1,250, 14th-$1,150, 15th-$1,100, 16th-$1,000, 17th-$1,000, 18th-$1,000, 19th-$1,000, 20th-$1,000, 21st-$1,000, 22nd-$1,000, 23rd-$1,000, 24th-$1,000. Additional provisional starting positions may be added for maximum starting field of 28. Bonus Plan: $7,500 ARCA Menards Series East Bonus Plan is to be paid at $500 to any of the Top 15 eligible car owners. -

2019 National Qualifier Dates

2019 National Qualifier Dates Asphalt Legend Qualifier Dates: Speedway (State) Date Tucson Speedway, AZ – March 9th East Carolina Motor Speedway, NC – March 23rd Texas Motor Speedway, TX – March 30th The Bullring at Las Vegas Motor Speedway, NV – April 20th Willow Springs Speedway, CA – May 4th Concord Speedway, NC – May 17th Hi-Way 92 Raceway, NE – May 24th Intermountain Speedway, WY – May 25th Star Speedway, NH – May 25th Evergreen Speedway, WA – May 25th Evergreen Speedway, WA – May 26th Colorado National Speedway, CO – May 26th Meridian Speedway, ID – May 27th Sportsdrome Speedway, IN – June 1st Hawkeye Downs Speedway, IA – June 7th Southeast Legends Tour (Tri-County Motor Speedway) – June 15th Wiscasset Speedway, ME – June 15th Elko Speedway, MN – June 22nd Seekonk Speedway, MA – June 28th Evergreen Speedway, WA – June 29th Kern County Raceway, CA – June 29th Peterborough Speedway, CAN Central – June 29th Sunny South Raceway, AL – July 6th Oyster Bed Speedway, CAN East – July 6th Sydney Speedway, CAN East – July 6th Sydney Speedway, CAN East – July 7th Eastbound International Speedway, CAN East – July 7th Edmonton International Raceway, CAN West – July 13th Irwindale Speedway, CA – July 13th I-25 Speedway, CO – July 13th Riverhead Raceway, NY – July 13th Fairgrounds Speedway Nashville, TN – July 13th Langley Speedway, VA – July 20th Wake County Speedway, NC – July 26th Dells Raceway Park, WI – July 27th Sydney Speedway, CAN East – July 27th Sydney Speedway, CAN East – July 28th Charlotte Motor -

USA Track Data Base (68) / As of 11/10/2020

Garmin Catalyst - USA Track Data Base (68) / as of 11/10/2020 Arizona Motorsports Park, Litchfield Park, AZ Arroyo Seco Raceway, Deming, NM Aspen Motorsports Park, Woody Creek, CO Atlanta Motor Speedway, Hampton, GA Atlanta Motorsports Park, Dawsonville, GA Auto Club Speedway, Fontana, CA Autobahn Country Club, Joliet, IL Barber Motorsports Park, Birmingham, AL Berlin Raceway, Marne, MI Blackhawk Farms Raceway, South Beloit, IL Brainerd International Raceway, Brainerd, MN Bristol Motor Speedway, Bristol, TN Brooklyn Street Circuit, Brooklyn, NY Buttonwillow Raceway Park, Buttonwillow, CA Canaan Motor Club, Canaan, NH Carolina Motorsports Park Inc, Kershaw, SC Charlotte Motor Speedway, South Concord, NC Chicagoland Speedway, Joliet, IL Chuckwalla Valley Raceway CCW, Desert Center, CA Circuit of the Americas (COTA), Austin, TX Club Motorsports, Tamworth, NH Darlington Raceway, Darlington, SC Daytona International Speedway, Daytona Beach, FL Detroit Belle Isle, Detroit, MI Dominion Raceway, Thornburg, VA Dover International Speedway, Dover, DE Driveway Austin, Austin, TX Eagles Canyon Raceway, Decatur, TX Exotics Racing Las Vegas, Las Vegas, NV Firestone Grand Prix of St. Petersburg, St. Petersburg, FL Gingerman Raceway, South Haven, MI Grand Prix Of Long Beach, Long Beach, CA Grattan Raceway, Belding, MI Hallett Motor Racing Circuit, Jennings, OK Harris Hill Raceway, San Marcos, TX Heartland Motorsports Park, Topeka, KS High Plans Raceway, Deer Tail, CO Homestead-Miami Speedway, Homestead, FL Hutchinson -

Event Track Location Date Box Number Collection Auto Races 16Th Street Speedway Indianapolis, in 1950 Sep 15 CR-2-D Box 2 F26 9

Programs by Venue Event Track Location Date Box Number Collection Auto Races 16th Street Speedway Indianapolis, IN 1950 Sep 15 CR-2-D Box 2 f26 99A104 Eastern States Midget Racing Assoc 1986 Official Program Various Tracks 1986 Annual Mezz Box 19A TQ Midgets/Carts-Baltimore Indoor Racing 1st Mariner Arena Baltimore, MD 2012 Dec 8 Mezz Box 33 98A13 Accord Speedway Souvenir Magazine Accord Speedway Accord, NY 1982 Mezz Box 19A The Buckeye Sports Car Races Akron Airport Akron, OH 1957 Sep 1 Mezz Box 84 19A27 The Buckeye Sports Car Races Akron Airport Akron, OH 1958 Aug 3 Mezz Box 1 Auto Races Akron Motor Speedway Akron, NY 1935 Jul 14 CR-2-E Box 4 f10 99A104 Auto and Motorcycle Races Akron Motor Speedway Akron, NY 1935 May 30 CR-2-E Box 4 f8 99A104 Auto Races Akron Motor Speedway Akron, NY 1935 Sep 22 CR-2-E Box 4 f12 99A104 Midget Auto Races Akron Motor Speedway Akron, NY 1936 Jul 26 CR-2-E Box 4 f19 99A104 Auto Races Akron Motor Speedway Akron, NY 1936 May 30 CR-2-E Box 4 f16 99A104 Auto Races Akron Motor Speedway Akron, NY 1937 May 30 CR-2-E Box 4 f21 99A104 Auto Races Akron Motor Speedway Akron, NY 1937 Sep 6 CR-2-E Box 4 f23 99A104 Talladega 500 Alabama International Motor Speedway Talladega, AL 1972 Aug 6 Mezz Box 28A Talladega 500 Alabama International Motor Speedway Talladega, AL 1973 Aug 12 Mezz Box 28A Winston 500 Alabama International Motor Speedway Talladega, AL 1973 May 6 Mezz Box 28A Talladega 500 Alabama International Motor Speedway Talladega, AL 1975 Aug 10 Mezz Box 28A Talladega 500 Alabama International Motor Speedway Talladega, -

The Highest Level of Grassroots Racing HERITAGE

2020 The Highest Level of Grassroots Racing HERITAGE On behalf of all of us at the Automobile Racing Club of America, welcome to the 2020 ARCA Menards Series racing season. There is a lot of excitement for the start of our 68th season, which will for the first time see ARCA sanction two regional tours, the ARCA Menards Series East and West, formerly known as the NASCAR K&N Pro Series. Just as we have since 1953, ARCA will continue to give racers a cost-effective and fair place to compete, fans an exciting at-track experience, and our partners a great platform to reach an enthusiastic and loyal customer base. The 2020 season will be one of the most memorable in ARCA’s history, with the blending of the ARCA Menards Series with the East and West to compete in the INNOVATION Sioux Chief Showdown, a ten-race challenge series that will bring together the best drivers and teams from across the country. Added to the ARCA Menards Series championship, along with the East and West series, the Showdown - a series within the overall ARCA Menards Series championship – will give drivers and teams four different championships to chase after. It’s the start of a new era, and we’re excited and grateful to have you on board. Let’s go racing, Ron Drager President, ARCA EXCITEMENT 2 1 HISTORY OF ARCA Founded in in 1953 as a Midwest-based stock car racing series, ARCA has grown to represent the most diverse national touring stock car series anywhere. Entering it’s 68th season, ARCA is the second-longest running championship racing series in the country (second only to NASCAR), and remains dedicated to fans, drivers, and sponsors at the grassroots level of the sport. -

2021 Marketing Information

2021 MARKETING INFORMATION WHAT IS THE CARS TOUR? The CARS Tour was formed out of the former USAR Hooters ProCup Series, long considered the premiere short track development series in the 2000s for drivers looking to advance their careers to the upper levels of NASCAR. Because so many CARS Tour competitors have dreams of competing in NASCAR, the cars raced in the CARS Tour closely resemble the racers seen in NASCAR except with less expensive technology and rules to control costs. The CARS Tour hosts two types of popular pavement short track racing divisions, thus making many of the seasons races dual division events. This allows fans to catch the action of both the Super Late Model and Late Model Stock divisions racing at the same track on the same night, for the price of just one ticket. Late model stock cars, a machine from which the NASCAR Xfinity Series cars originated in the 1980s and is still popular in the southeast today, weigh in at over 3100 lbs, teaching drivers car control and momentum as they advance their career. The super late model cars boast nearly 600 horsepower and weigh in at less than 2800 lbs, the true speed demons of short track racing where drivers learn to handle large amounts of horsepower. The CARS Tour has attracted teams from across the motorsports industry, including teams competing annually owned by NASCAR notables Dale Earnhardt Jr. and Kyle Busch. In addition the tour has grown on loyal veteran short track drivers that fans have grown accustom to. The CARS Tour races at nearly a dozen tracks over the course of 2021 with events running 2021 SCHEDULE between March and October; most are located within large southeastern markets. -

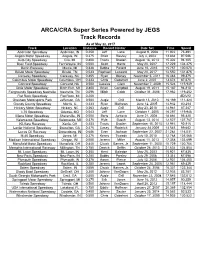

ARCA/CRA Super Series Powered by JEGS Track Records

ARCA/CRA Super Series Powered by JEGS Track Records As of May 22, 2017 Track Location Distance Record Holder Date Set Time Speed Anderson Speedway Anderson, IN 0.250 Jeff Lane August 9, 2008 11.922 75.491 Angola Motor Speedway Angola, IN 0.375 Brian Rievley July 4, 2003 13.834 97.586 Auto City Speedway Clio, MI 0.400 Travis Braden August 16, 2013 15.302 94.105 Baer Field Speedway Fort Wayne, IN 0.500 Scott Hantz May 20, 2007 17.229 104.475 Berlin Raceway Marne, MI 0.438 Bubba Pollard June 16, 2016 15.757 100.070 Bristol Motor Speedway Bristol, TN 0.533 Raphael Lessard May 20, 2017 14.550 131.876 Caraway Speedway Caraway, NC 0.455 Ryan Blaney November 5, 2011 16.483 99.375 Columbus Motor Speedway Columbus, OH 0.333 Chris Gabehart June 2, 2007 13.674 87.670 Concord Speedway Concord, NC 0.500 Cassius Clark November 7, 2009 15.524 115.949 Dixie Motor Speedway Birch Run, MI 0.400 Brian Campbell August 19, 2011 15.187 94.818 Fairgrounds Speedway Nashville Nashville, TN 0.596 Mitch Cobb October 31, 2008 17.962 119.452 Flat Rock Speedway Flat Rock, MI 0.250 #DIV/0! Gresham Motorsports Park Jefferson, GA 0.500 Augie Grill March 13, 2010 16.169 111.324 Grundy County Speedway Morris, IL 0.333 Ryan Mathews June 12, 2005 14.932 80.284 Hickory Motor Speedway Hickory, NC 0.363 Augie Grill May 23, 2010 14.961 87.347 I-70 Speedway Odessa, MO 0.543 Jeff Lane October 1, 2005 16.297 119.948 Illiana Motor Speedway Shererville, IN 0.500 Boris Jurkovic June 21, 2008 18.864 95.420 Kalamazoo Speedway Kalamazoo, MI 0.375 Kyle Busch August 13, 2014 12.527 107.767 Kil-Kare Raceway Xenia, OH 0.333 Travis Braden September 15, 2013 12.916 92.815 Lanier National Speedway Braselton, GA 0.375 Casey Roderick January 24,2009 13.543 99.682 Lucas Oil Raceway Brownsburg, IN 0.686 Evan Jackson September 22, 2007 21.284 116.031 M-40 Speedway Jones, MI 0.375 Kenny Tweedy July 10, 2010 12.788 105.568 Madison International Speedway Oregon, WI 0.500 Jeremy Miller August 11, 2013 17.358 103.699 Mansfield Motor Speedway Mansfield, OH 0.440 Chuck Barnes, Jr. -

Scopes of Service Sport Marketing Contract

Scopes of Service Sport Marketing Contract Regional Motorsports Contractor shall run a season long campaign utilizing 21 regional motorsports venues using signage and public address announcements. Provide on-site activation through a branded 10’ x 10’ display, provide a booth at each venue, and distribute 200 branded t-shirts at the booth for each track. Nightly public address announcements made during each event. The tent should be branded, provide table cloth, backdrop, and interactive game to engage the fans. Electronic surveys should be created and maintained by the contractor. The division will provide all questions used however, the contractor should run the system (s) and data management. o The 21 venues include: . 411 Motor Speedways – Friday, July 26, 2019 – Southern Nationals $10,00 to win . Bristol Dragway – June 14-16, 2019 – NHRA Thunder Valley Nationals . Buffalo Valley Dragway . Camden Speedway . Cherokee Raceway – May 10-12, 2019 $5,000/$2,500 - Weekend series . Clarksville Dragstrip – Friday, May 3, 2019 – Bracket Racing/No Box $800/22 Classes . Clarksville Speedway – Saturday, May 4, 2019 0 $2,000 to win pure mini . Crossville Dragway . Crosville Speedway . Fairgrounds Speedway – May 30 – June 1, 2019 – World of Outlaws . Highland Rim Speedway – Saturday, June 8, 2019 . Knoxville Dragway . Memphis Intl Raceway – October 3-6, 2019 0 IHRA Team Finals . Memphis Intl Speedway – Saturday, June 1, 2019 – NASCAR K&N Memphis 150 . Music City Raceway . Pickwick Dragway . Thunderhill Raceway . Tennessee National Raceway . Volunteer Speedway . Wartburg Speedway – Wednesday, July 3, 2019 - $3,000 to win Steelhead + Fireworks . Winchester Speedway Oil Recycling Rewards Contractor shall coordinate, activate, and manage a rewards program to encourage Tennesseans to recycle their oil. -

Racetrack Expansion Neighborhood Survey Intro

RACETRACK EXPANSION NEIGHBORHOOD SURVEY INTRO In March 2021, Metro Nashville and Bristol Motor Speedway What do the neighbors of the entered into a letter of intent to revamp the Nashville Nashville Fairgrounds Speedway Fairgrounds Speedway and see NASCAR racing return to the really think about the proposed track, located just south of the heart of the city in a racetrack expansion? residential neighborhood. The letter gave all parties until July 31 to finalize a deal. Nobody could answer that simple We surveyed more than 500 residents question, so Stand Up Nashville In May and June, respondents were found via in-person took things into our own hands. canvassing and online (615) 933-3407 PO Box 292583 standupnashville.org Nashville,TN 37229 METHODS We knocked over 1,000 doors in Vinehill, Bransford Avenue, Wedgewood Houston, Chestnut Hill, Rosedale/ Hurtwood Heights, Woodland in Waverly, and Woodycrest. All online respondents were filtered by location—only those from the area were counted in our results. Ready to find out what we learned? (615) 933-3407 PO Box 292583 standupnashville.org Nashville,TN 37229 TOPLINE: Majority of Residents Surveyed Do NOT Approve of the Racetrack Expansion As Is Q1: DO YOU SUPPORT THE CURRENT PLAN TO EXPAND THE RACETRACK? 55% of residents we spoke with do not support the plan, as it is currently proposed. (615) 933-3407 PO Box 292583 standupnashville.org Nashville,TN 37229 74% OF ALL RESIDENTS surveyed reported having “concerns” about the development Q2: DO YOU HAVE ANY CONCERNS ABOUT THE IMPACT OF DEVELOPMENT? An overwhelming majority of residents—even those that approve of the overall concept of track improvements—cited concerns with the proposed plan. -

ANDERSON, INDIANA (SP-M) Anderson Speedway Location: Located on Pendleton Avenue, 3 Miles North of Exit 22 from Interstate 69

ANDERSON, INDIANA (SP-M) Anderson Speedway www.andersonspeedway.com Location: Located on Pendleton Avenue, 3 miles north of Exit 22 from Interstate 69. Track Size: 1/4 Mile Surface: Paved Oval Track: 765-642-0206 Organizer: Rick Dawson Address: PO Box 2440, Anderson, IN 46018 Phone: 765-778-8168 Special Event Organizer: Don Kenyon Address: 2685 South 25 West, Lebanon, IN 46052 Phone: 765-482-4273 BAKERSFIELD, CALIFORNIA (M) Bakersfield Speedway www.bakersfieldspeedway.com Location: Track is located on north Chester Avenue, 1.5 miles north of Oildale. Track Size: 1/3 Mile Surface: Dirt Oval Track: 661-393-3373 Organizer: Scott & Randy Schweitzer Address: PO Box 82124, Bakersfield, CA 93380 Phone: 661-393-3373 BEAVER DAM, WISCONSIN (M) Dodge County Fairgrounds Speedway www.dodgecountyfairgrounds.com Location: Track is located on the south side of State Route 33, 3 miles east of U.S. 151, east of Beaver Dam. Track Size: 1/2 Mile Surface: Dirt Track Track Phone: Seasonal Organizer: Steve Sinclair Address: 706 North Green Street, McHenry, IL 60050 Phone: 815-759-9269 BELLEVILLE, KANSAS (M) Belleville High Banks www.highbanks.org Location: Track is located at “O” and 7th Streets, at the fairgrounds, north of Belleville. Track Size: 1/2 Mile Surface: Dirt Oval Track: 785-527-5691 Organizer: Belleville High Banks Race Committee Address: PO Box 349, Belleville, KS 66935 Phone: 785-527-2201 BECHTELSVILLE, PENNSYLVANIA (SP) Grandview Speedway www.grandvewspeedway.com Location: Track is located on Passmore Road, 1/2-mile east of State Road 100, about 3.5 miles north of State Route 73. -

Michael Klein Racing Sponsorship

Michael Klein Racing Sponsorship Michael Klein Introduction Dirt racing sponsorships are a great way to introduce your company and product to an audience of over 1.3 million drivers and fans. Thousands of fans attend races every week and many events are shown live on streaming services such as FloRacing and Lucas Oil Racing TV. Driver Bio I started my career racing karts at the age of 15, scoring three feature wins running a limited schedule each year of my karting career. In 2018 I began running dirt midgets with MWR Technology in the Badger Midget Series. In 2019 I made my USAC Midget debut at the BC39 at the Indianapolis Motor Speedway and made on more USAC appearance at the Jason Leffler Memorial at Wayne County Speedway. Sponsor Benefits When a company decides to sponsor a race team, this comes with many benefits to the company. Their product is being promoted to the entire audience of dirt racing fans, which exceeds one million. Race fans are known for being loyal to companies that support their favorites drivers. Sponsorship comes with exposure on the car, drivers firesuit, social media, and website. A good example of this is with NOS Energy, which sponsors both the USAC NOS Energy National Midget Series and World of Outlaws NOS Energy Sprint Car Series along with several midget and sprint car teams, and as a result they’re one of the most popular brands in the world of dirt track racing. Divisions Midgets Midget cars are characterized by their smaller size and very high power to weight ratio and are usually powered by four cylinder engines.