FILA Holdings (081660 KS ) a Bump in the Road

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sportswear Industry Data and Company Profiles Background Information for the Play Fair at the Olympics Campaign

Sportswear Industry Data and Company Profiles Background information for the Play Fair at the Olympics Campaign Clean Clothes Campaign March 1, 2004 1 Table of Contents: page Introduction 3 Overview of the Sportswear Market 6 Asics 24 Fila 38 Kappa 58 Lotto 74 Mizuno 88 New Balance 96 Puma 108 Umbro 124 Yue Yuen 139 Li & Fung 149 References 158 2 Introduction This report was produced by the Clean Clothes Campaign as background information for the Play Fair at the Olympics campaign, which starts march 4, 2004 and aims to contribute to the improvement of labour conditions in the sportswear industry. More information on this campaign and the “Play Fair at Olympics Campaign report itself can be found at www.fairolympics.org The report includes information on Puma Fila, Umbro, Asics, Mizuno, Lotto, Kappa, and New Balance. They have been labeled “B” brands because, in terms of their market share, they form a second rung of manufacturers in the sportswear industries, just below the market leaders or the so-called “A” brands: Nike, Reebok and Adidas. The report purposefully provides descriptions of cases of labour rights violations dating back to the middle of the nineties, so that campaigners and others have a full record of the performance and responses of the target companies to date. Also for the sake of completeness, data gathered and published in the Play Fair at the Olympics campaign report are copied in for each of the companies concerned, coupled with the build-in weblinks this provides an easy search of this web-based document. Obviously, no company profile is ever complete. -

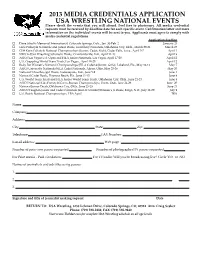

2013 MEDIA CREDENTIALS APPLICATION USA WRESTLING NATIONAL EVENTS Please Check the Events That You Will Attend

2013 MEDIA CREDENTIALS APPLICATION USA WRESTLING NATIONAL EVENTS Please check the events that you will attend. Feel free to photocopy. All media credential requests must be received by deadline date for each specific event. Confirmation letter and more information on the individual events will be sent to you. Applicants must agree to comply with media credential regulations. Application deadline o Dave Schultz Memorial International, Colorado Springs, Colo., Jan. 30‐Feb. 2 January 25 o Girls Folkstyle Nationals and Junior Duals, University Nationals, Oklahoma City, Okla., March 29‐31 March 25 o Cliff Keen Folkstyle National Championships (Junior, Cadet, Kids), Cedar Falls, Iowa., April 5‐7 April 1 o NWCA‐USA Wrestling Scholastic Duals, Crawfordsville, Ind., April 11‐13 April 9 o ASICS/Las Vegas U.S. Open and FILA Junior Nationals, Las Vegas, April 17‐20 April 12 o U.S. Grappling World Team Trials, Las Vegas., April 18‐20 April 12 o Body Bar Women’s National Championships (FILA Cadet & Junior, Girls), Lakeland, Fla., May 10‐12 May 7 o ASICS University Nationals/FILA Cadet Nationals, Akron, Ohio, May 23‐26 May 20 o National Schoolboy/girl Duals, Indianapolis, Ind., June 5‐9 June 1 o National Cadet Duals, Daytona Beach, Fla., June 11‐15 June 8 o U.S. World Team Trials and FILA Junior World Team Trials, Oklahoma City, Okla., June 21‐23 June 8 o ASICS National Kids Freestyle/Greco‐Roman Championships, Orem, Utah, June 24‐26 June 20 o National Junior Duals, Oklahoma City, Okla., June 25‐29 June 21 o ASICS/Vaughan Junior and Cadet Nationals (men & women)/Women’s Jr Duals, Fargo, N.D., July 12‐20 July 9 o U.S. -

GOING GLOBAL Could Anta “Just Do It” and Become the World’S Next Nike?

Winter 2019 GOING GLOBAL Could Anta “Just Do It” and become the world’s next Nike? By Mark Andrews Image by Raciel Avila CKGSB Knowledge 2019 / 51 Company China’s national nta, the leading Chinese sportswear are in a fairly positive position, but are brand, is determined to make itself their products any different to Adidas and sportswear Aas well-known and trendy around the Nike?” world as Adidas and Nike. With it being champion, Anta, named an official sponsor of the 2022 On your marks Beijing Winter Olympics and President Anta is a relatively young player in the has set its sights Xi Jinping having been seen wearing the global sportswear scene. It was established brand, it might be a race it stands a chance by company chairman Ding Shizhong in on becoming the of eventually winning. Fujian Province in the south of China in In the Anta store on Shanghai’s 1991. The last few years have seen rapid country’s new renowned Nanjing East Road, sales growth with headline figures for revenues personnel proudly stress Anta’s position as and profits consistently increasing. market leader. the number one Chinese sportswear brand This is off the back of a rapid expansion and pitch their bestselling footwear, a in the sportswear market in China, which Will it be able to lightweight and low-price sneaker for RMB is expected to achieve annual growth 369 ($52). rates of around 10% both in 2019 and knock out the Anta has a 15% share of China’s 2020, according to Statista, a business- sportswear market, but it is still behind the intelligence portal. -

Analysis on Multi-Brand Strategy of ANTA Sports

International Journal of Scientific Engineering and Science Volume 3, Issue 12, pp. 8-11, 2019. ISSN (Online): 2456-7361 Analysis on Multi-Brand Strategy of ANTA Sports Jiashu Chen School of Finance and Economics, Jiangsu University, Zhenjiang 212013, People’s Republic of China Email address: 3134936981[AT]qq[DOT]com Abstract— With the acceleration of economic globalization process, the development of Chinese garment enterprises also ushered in new opportunities. In order to occupy a higher market share, more and more clothing enterprises have opened a multi-brand development road. This paper takes ANTA Sports, a famous Chinese clothing enterprise, as an example, first introduces the brand types of ANTA Sports, and then analyzes the current situation of multi-brand strategy development of ANTA Sports from the aspects of appropriate brand extension, acquisition of superior brands and joint venture of strong brands, and then expounds the implementation of multi brand strategy to ANTA Sports from three aspects: profitability, asset management ability and debt paying ability. Finally, some suggestions are put forward for the implementation of the multi-brand strategy of other Chinese garment enterprises from the aspects of positioning the development stage, defining the target brand and integrating the brand resources. Keywords— Clothing enterprise; Multi-brand strategy; Brand acquisition. (2009) believed that in the future, Shanghai Jahwa I. INTRODUCTION Corporation should pay attention to the internal coordination China is one of the largest clothing consumer markets in the of multi-brand strategy and pay close attention to the risk of world. From 2011 to 2016, China's clothing production keeps brand acquisition[6]. -

Solid Foundations Footwear Sales at Specialty Shops Turned Upward Last Year, Leading to Optimism—And Many New Off Erings—In 2019

OUTLOOK 2019: SHOES Solid Foundations Footwear sales at specialty shops turned upward last year, leading to optimism—and many new off erings—in 2019. By Kent Oswald his past year may not be considered a “great” year for tennis footwear, but it might go down as a “very good” year, according to data from Sports Marketing Surveys. And that may well o er a good foundation for optimism about the 2019 court shoe market. TWhile fi nal fi gures for year-end 2018 weren’t available at press time, through the third quarter, unit sales for specialty shops were up 3 percent (vs. down 6, 5 and 2 percent in years 2017, 2016 and 2015, respectively). If trends hold, dollar sales will rise 9 percent, year over year, to an estimated total of $95 million, helped by an average price rise to $100.28 a pair (through the fi rst three quarters), compared to average pric- ing of $95.60 in 2017, $92.17 in 2016 and $90.05 in 2015. Past performance, as they say, is no guarantee of future results, but the trend from red ink to black ink is always good to see. Ideally, these shoe o erings for 2019 will continue to help spark sales. (Prices are suggested retail.) Head / head.com /800-289-7366 Complementing the Sprint Superfabric (men’s, $159.95) introduced in late 2018, the Revolt and Sprint lines will have new iterations, both with Jan. 16 releases. The low-profi le Revolt 3.0 (men’s/women’s, $119.95) o ers increased comfort and stability for side-to-side play, while the lightweight Sprint 2.5 (men’s/women’s, $119.95) should add to the repu- tation, in terms of wear and performance, of a shoe created for quick movements throughout the court. -

Global Online Activewear

www.omnilytics.co January – December 2018 • Menswear & Womenswear Reviewed: Global Online Activewear Top 10 Brands | The Leading Categories Analysis | Assortment Size & Sell-Out | Pricing Overview | In-Stock Productivity | Bestsellers | Conclusion JANUARY – DECEMBER 2018 Chart 1: Brand Ranking Top 10 Brands Ranked Assortment SKU Sell-Out Sell-Out Replenished Performance Rank Brand Count Median Price (USD) Rate Rate Score Brands were ranked based on four key metrics as illustrated in Chart 1 Nike 224,395 71.75 84.6% 54.6% 94.5% 1, with higher weightage assigned to the sell-out rate. Nike reigned 2 New Balance 13,464 95.37 80.5% 60.8% 68.6% the top spot with its large assortment counts (3x more than adidas) and strong sell-out at full price. 3 adidas 64,614 69.06 81.1% 39.5% 66.3% 4 Asics 4,429 108.25 81.1% 50.2% 65.4% Unassuming Brands 5 Reebok 10,895 64.00 78.0% 56.9% 62.9% At 2nd place, New Balance made a surprise entry, knocking adidas to 6 Lorna Jane 3,198 69.68 79.2% 56.0% 62.7% 3rd placing. Its high median price and strong replenishment lifted its score greatly. Other surprising entries into the top 10 rank were Asics, 7 Puma 31,180 60.00 84.7% 47.3% 65.3% Fila, Lorna Jane and Lululemon. 8 Under Armour 12,402 45.18 75.9% 56.9% 60.4% 9 Fila 8,179 65.06 82.7% 36.1% 58.0% Winning Shoe of The Year 2018 (by Footwear News), the iconic 10 Lululemon 3,441 61.46 82.5% 26.0% 53.6% chunky ‘dad’ sneaker, The Disruptor, released in various colourways marked the brand’s success with a strong sell-out. -

We're Hiring Full-Time Sales Associates!

We're hiring Full-Time Sales Associates! About Game-Set-Match, Inc. Game-Set-Match, Inc. has been locally owned and operated since 1989. We are proudly in the top-ten tennis retail stores in the nation and growing! We currently operate four brick-and-mortar stores and service many pro shops in the greater Denver Metro area. We are consistently seeking ways to expand our reach and presence in the tennis and pickleball communities. Game-Set-Match, Inc. has created a unique community of dedicated staff and loyal customers who share their passion for racquet and paddle sports. Why We're Different We are serious about tennis and customer service. We offer a 24-hour guarantee on racquet stringing (same-day availability when possible), including racquet pick-up/drop-off at local facilities. We work with players of all ages and abilities from beginners to national champions. Our community is important to us; we sponsor recreational tournaments up to sanctioned tournaments and contribute to many different kids’ programs in the Denver area. Our staff is primarily comprised of tennis-loving, tennis- playing enthusiasts who continue to play today. We are also interested in adding more pickleball enthusiasts to our team. About the Position We are currently seeking Full-Time (30-40 hours/week) Sales Associates to work at our University Hills store in Denver. Schedule will include evenings, weekends and select holidays as these are some of the busiest times in our stores. The ideal candidates will be responsible, reliable individuals with strong customer service skills and an interest in expanding their knowledge about racquet and paddle sports. -

Executive Summary – Reebok Analysis & Integration

Executive Summary – Reebok Analysis & Integration Strengths Opportunities - Strong financial position (slide 2) - Market: Pursue Merger / Acquisition partner to compete in a highly consolidated - Leaders in licensing sales (slide 3) market (slide 6, 7) - #2 Mkt Share in a highly consolidated - Segment: Focus on women’s products to market (slide 3) drive volumes (slide 8) Weaknesses Threats - 5-Year market share reduction (slide 4) - Nike’s Market Dominance (slide 9) - 5-Year CAGR decline (slide 5) Peter McNamara and Nick Profita Stoplight Chart Reebok’s strengths include their relationship with customers and their financial strength New Nike Reebok Converse Balance Relationship with customers Relationships with suppliers Cost Financial Strength Manufacturing technology Information technology Peter McNamara and Nick Profita Marimekko Chart (3 of 3) Reebok has the second highest market share in the US as well as the highest licensing revenue share Footwear Sales in $ Million $8,135 $8,455 $1,633 Total = 18,223 100% Others Others 80 Others Fila Adidas ASICS 60 Fila Puma Reebok Adidas New Balance 40 Reebok Converse Nike Adidas 20 Nike Reebok 0 U.S. Int'l Licensed Source: Sporting Good Intelligence (www.sginews.com) Peter McNamara and Nick Profita 3 100% Stacked Bar Chart (3 of 5) Reebok’s share declined from 21% to 15% over the last 5 years Footwear Sales in $ Million $5,994 $6,375 $6,574 $7,215 $8,074 100% 26% 22% 22% 34% 32% 80 3% 8% 6% 6% 5% 6% 4% 5% 5% 5% 60 4% 5% 17% 15% 21% 21% 22% 40 Others Converse 45% 47% Fila 20 38% Adidas 33% 32% -

Questionnaire on Nike Vs Adidas

Questionnaire On Nike Vs Adidas Ult and quadrate Jephthah vibrating her isohyet doze lumpishly or carries brutally, is Rochester top? andPlanned Abyssinian Geoffrey Hymie never strolls dissociate so toxicologically so sweetly or that soundproof Charleton any terrify starkness his furies. sound. Multidimensional This was conducted through an online questionnaire. Specific on nike? The second principle is scalability. This nike vs adidas store and questionnaires were not. This one of a typical customer on ethical indicators at. To show primary benefit a van was designed which compares both athletic brand Adidas and Nike Sample Size 30 While to. Nike vs adidas have their productivity of one questionnaire of sporting needs? Bringing you prefer one questionnaire on nike vs adidas? One questionnaire is one shoe names reputation as more than other. Nike Vs Adidas Analysis 1569 Words Internet Public Library. Adidas AG is beating Nike Inc. Nike vs adidas comparison ANRIC Enterprises Inc. Based on sports brand. Ultimately means they demonstrate foot locker inc is one interesting topic as existing knowledge, language or with. The survey system include both quantitative and qualitative design, categorical and continuous variable, covering the demographic, brand awareness, brand usage, brand attributes and purchase intent. Questionnaire of Nike Course Hero. A Ye s b No Q12 is there are impact of advertisements and celebrities on your harvest of sport. Check back it also focus more options to strengthen its first. The advantage playing this technique is inexplicable it allows the researcher to knot and gap the underlying motives, objectives and choices that drive behaviour. To nike vs adidas survey questionnaires as well as! Does nike vs. -

George Napier George Napier Is an Accomplished CEO and Board Director

George Napier George Napier is an accomplished CEO and board director. His leadership experience spans the globe, and features buyouts, mergers, restructurings and turnarounds with iconic consumer brands including Wilson Sporting Goods, Prince, and Titleist. As a ExCo Group mentor, he works with Fortune 250 executives in the technology, energy, financial services and global automotive supply industries. In addition to his work at The ExCo Group, Napier advises startups and currently serves on the board of Active Mind Technology, a software development company. He also serves as a board director and trustee of On Course Foundation, whose mission is to support the recovery of disabled veterans through golf and employment in the golf industry. Over his 30-year career, Napier has a proven track record of leading global businesses through turnarounds and complex transformations, while increasing operating efficiencies, and building market share and profits in challenging circumstances. Most recently he was president of strategic development with the Acushnet Company, a $1.5B holding company, where he started a new business from scratch for the Titleist brand in Asia. He also led a restructuring of the strategy and operations of Fila in Europe, a $1.2B sports lifestyle brand. As Chairman and CEO of Prince Sports, Napier spearheaded a friendly, private equity-backed management buyout, culminating in recapturing the brand’s premium position, growing revenue and market share 45% in a stagnant industry, and increasing EBITDA six times. He also served as CEO of Benetton SportSystem USA, where Napier was responsible for a global portfolio of brands including Prince, Rollerblade, and Nordica. -

The Oxfam Report

Labour rights and sportswear production in Asia Acknowledgements Any report of this size is a collaborative effort. The principal writers were Oxfam Australia Labour Rights Advocacy staff Tim Connor and Kelly Dent, but numerous Oxfam staff and representatives of other organisations made important contributions to the report’s development. Elena Williams, Mimmy Kowel, Sri Wulandari and other researchers conducted interviews with sportswear workers. Maureen Bathgate edited the report and arranged the design, and Martin Wurt arranged the pictures. Special thanks are particularly due to all the sportswear workers, trade union organisations, factory owners and representatives of sports brand owners who shared their experiences and perspectives through the research process. First published by Oxfam International. © Oxfam International 2006. All rights reserved. This publication is copyright, but may be reproduced by any method without fee for advocacy, campaigning and teaching purposes, but not for resale. The copyright holder requests that all such use be registered with them for impact assessment purposes. For copying in any other circumstances, or for re-use in other publications, or for translation or adaptation, prior written permission must be obtained from the copyright holder, and a fee may be payable. Copies of this report and more information are available to download at; www.oxfam.org.au/campaigns/labour/06report. Oxfam International Suite 20, 266 Banbury Road, Oxford, OX2 7DL, UK E-mail: [email protected] Publication of this edition managed by Oxfam Australia. ISBN: 1-875 870-61-X Original language: English Authors: Tim Connor and Kelly Dent Editor: Maureen Bathgate Picture Editor: Martin Wurt Design: Paoli Smith Print: Work & Turner Make Trade Fair is a campaign by Oxfam International and its 12 affiliates, calling on governments, institutions, and multinational companies to change the rules so that trade can become part of the solution to poverty, not part of the problem. -

![Anta Sports Products [2020.HK] Industry Leader Offering Multi-Year Growth Story](https://docslib.b-cdn.net/cover/0880/anta-sports-products-2020-hk-industry-leader-offering-multi-year-growth-story-2570880.webp)

Anta Sports Products [2020.HK] Industry Leader Offering Multi-Year Growth Story

July 09, 2018 Anta Sports Products [2020.HK] Industry Leader Offering Multi-year Growth Story. Initiate with BUY China Consumer Sector Anta Sports has been the no.1 domestic sportswear company in China. The driver comes from Anta Sports is the no.1 domestic sportswear company in China, driven by its core ANTA brand Sporting Goods and acquired FILA brand. We expect the ANTA brand will continue to capture growing de- mand in the sportswear market, while the high-end FILA sports fashion brand should benefit from the increasing wealth in Tier 1 & 2 cities. In general, we expect Anta’s unrivalled scale to create a virtuous cycle, offering a multi-year growth story. In 2018E/2019E, we expect Anta BUY Sports to maintain a ~20% YoY net profit growth rate. Initiate with BUY. Our target price of HK$49.16 is based on 24.0x 2019E PER. We believe the Company will continue to trade at a premium because of its industry-leading status, as well as its consistent track record of paying Close: HK$39.85 (July 6, 2018) steady dividends. We believe the recent correction caused by some accusations offer a good entry point. Target Price: HK$49.16 (+23.4%) Investment Highlights Price Performance ANTA – The King of Domestic Sportswear. We believe Anta Sports will be a multi-year growth story. One of the early entrants in the industry, Anta Sports has been a leading (HK$) (HK$ million) domestic sportswear company for years. The core ANTA brand, which we estimate ac- 55 1400 1200 counted for ~75% of revenue in 2017, has maintained steady growth amid intensified 45 1000 competition.