Annual Report 2017 DISCLAIMER

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Geschäftsbericht 2017

350 Geschäftsbericht 2017 1668 Auszug aus dem „Apotheken-Privileg“ des Landesherren für den Unternehmensgründer FRIEDRICH JACOB MERCK: „ [Er soll die Apotheke] der ordnung gemeess mit guten frischen, zu ein= und anderen Curen dienlichen heil- samen Medicamentis und wahren also genugsamlich versehen, und damit fort und fort würklich continuiren, daß kein Mangel erscheine.“ 2018 STEFAN OSCHMANN Vorsitzender der Geschäftsleitung und CEO von Merck „ Wissenschaftliche Neu- gierde treibt uns seit 350 Jahren an. Durch sie wurden wir Techno logie- Pioniere. Und jetzt gestalten wir die digi tale Revolution mit.“ DIE ZUKUNFT SPRICHT SIMON CLARK sechs Jungforscherinnen und -forscher promoviert im Bereich Atmosphä- rische Physik an der University of Exeter. Auch in seinen YouTube- Videos geht es vor allem um physi- kalische Themen. „ Die Dinge verbessern sich nur, wenn es Leute gibt, die ver- rückte Ideen haben und etwas Neues ausprobieren.“ Treibt Merck frische Ideen voran? Die Antwort finden Sie auf Seite 10. SAMUEL CUNHA ist ein brasilianischer Parasitologe, der seine Leidenschaft für Biologie mit vielen Fans auf YouTube teilt. „ Um leidenschaftlich zu bleiben, muss man immer an die Zukunft denken, an das mögliche Ergebnis seiner Arbeit.“ Wie hält es Merck mit diesem Grundsatz? Die Antwort lesen Sie auf Seite 11. EVA AMSEN ist promovierte Biochemikerin, Autorin und Wissenschaftsvermittlerin in London. „ Für Wissen- schaftler ist es wichtig, dass sie sich nicht nur mit ihren Kollegen austauschen, sondern auch mit Menschen aus völlig anderen Bereichen – zum Bei- spiel mit Künstlern.“ Wird interdisziplinärer Austausch bei Merck gelebt? Die Antwort lesen Sie auf Seite 13. INÉS DAWSON ist promovierte Biologin in Oxford und beliebte YouTuberin. „ Forschung und Kreativität sollten Hand in Hand gehen, da nicht alle Probleme eine eindeutige Lösung haben.“ Fördert Merck Kreativität? Die Antwort finden Sie auf Seite 14. -

Merck Annual Report 2009

More information inside the cover: Business development 2000 – 2009 Merck CONTENTS Annual Report 2009 Publication contributors Published on February 23, 2010 by Merck KGaA, Corporate Communications Frankfurter Strasse 250, 64293 Darmstadt, Germany Tel.: +49 (0) 6151-72 0, fax: +49 (0) 6151-72 5577 E-mail: [email protected] Website: www.merck.de Concept, design and typesetting: XEO GmbH, Düsseldorf, Germany Annual Report 2009 Photographs: Pages 6, 10 and 11: Catrin Moritz, Essen; Pages 1, 2, 4, 35, 51, 57, and 63: Reinhard Koslowski, Düsseldorf Printing: Franz Kuthal GmbH & Co. KG, Mainaschaff, Germany Paper: FSC-certified “heaven 42” by Scheufelen W 840 539 350210 www.merck.de Contents Contents COMPANY BUSINESS DEVELOPMENT 2000 – 2009 2 The history of Merck This overview may include historically adjusted values in order to ensure comparability with 2009. 3 Becoming a global, publicly listed company 4 Merck today 4 The future Change vs. 2008 € million 2000 2001 2002 2003 2004 2005 20061 20071 2008 2009 in % Total revenues 2 6,910 7,721 7,521 7,364 6,017 5,887 4,485 7,081 7,590 7,747 2.1 TO OUR SHAREHOLDERS Pharmaceuticals 3,047 3,484 3,265 3,458 3,601 3,905 2,338 4,900 5,456 5,812 6.5 6 Letter from Karl-Ludwig Kley Merck Serono 1,941 2,228 1,850 1,546 1,619 1,817 1,938 4,480 5,014 5,345 6.6 10 Executive Board Generics 3 790 936 1,096 1,585 1,625 1,712 – – – – – Consumer Health Care 299 320 319 327 357 376 400 420 442 467 5.7 3 MANAGEMENT REPORT Imaging 17 – – – – – – – – – – Chemicals 1,679 1,729 1,791 1,707 1,696 1,906 2,113 2,152 2,127 -

Merck Serono the Biopharma Division of Merck

Merck Serono The Biopharma Division of Merck September 16, 2014 Merck Our aspiration is to make great things happen Merck is the oldest pharmaceutical and chemical company in the world founded in 1668 in Darmstadt, Germany Merck is a publicly listed company on the DAX at the Frankfurt Stock exchange. The Merck family holds 70% of the shares Total Revenues : €11 billion in 2013 EBITDA Pre : €3.25 billion Around 38,000 employees in 66 countries 2 Our History Merck was founded by Friedrich Jacob Merck (1621-1678) when he acquired the Angel Pharmacy (Engel-Apotheke) in 1668 Heinrich Emanuel Merck (1794–1855) begins production on an industrial scale Merck and the US pharmaceutical company Merck, Sharp & Dohme have been two independent companies since 1917. Today, we are Merck worldwide (except for Canada and the US where we are known as EMD). 3 Our Corporate Structure Merck Group Merck Consumer Performance Merck Serono Health Materials Millipore • Oncology • Everyday health • Liquid Crystals • BioScience • ImmunoOncology protection • Pigments • Lab Solutions • Immunology/NDD • Women‘s and & Cosmetics • Process Solutions • Fertility children‘s health • Endocrinology & • Cough and cold General Medicine Biosimilars Allergopharma Pharma Business Merck Serono at a Glance We operate under the Group: Largest division of Merck name EMD Serono in Established: January 5, 2007 North America Business: Biopharmaceuticals Employees: ~15,000 Total Revenues: €6.3 billion in 2013 Headquarters: Darmstadt, Germany Global reach: Products commercialized in 150 -

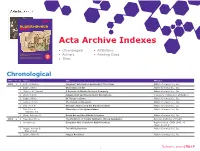

Acta Archive Indexes Directory

VOLUME 50, NO. 1 | 2017 ALDRICHIMICA ACTA Acta Archive Indexes • Chronological • Affiliations 4-Substituted Prolines: Useful Reagents in Enantioselective HIMICA IC R A Synthesis and Conformational Restraints in the Design of D C L T Bioactive Peptidomimetics A A • Authors • Painting Clues Recent Advances in Alkene Metathesis for Natural Product Synthesis—Striking Achievements Resulting from Increased 1 7 9 1 Sophistication in Catalyst Design and Synthesis Strategy 68 20 • Titles The life science business of Merck KGaA, Darmstadt, Germany operates as MilliporeSigma in the U.S. and Canada. Chronological YEAR Vol. No. Authors Title Affiliation 1968 1 1 Buth, William F. Fragment Information Retrieval of Structures Aldrich Chemical Co., Inc. 1 Bader, Alfred Chemistry and Art Aldrich Chemical Co., Inc. 1 Higbee, W. Edward A Portrait of Aldrich Chemical Company Aldrich Chemical Co., Inc. 2 West, Robert Squaric Acid and the Aromatic Oxocarbons University of Wisconsin at Madison 2 Bader, Alfred Of Things to Come Aldrich Chemical Co., Inc. 3 Koppel, Henry The Compleat Chemists Aldrich Chemical Co., Inc. 3 Biel, John H. Biogenic Amines and the Emotional State Aldrich Chemical Co., Inc. 4 Biel, John H. Chemistry of the Quinuclidines Aldrich Chemical Co., Inc. Warawa, E.J. 4 Clark, Anthony M. Dutch Art and the Aldrich Collection Aldrich Chemical Co., Inc. 1969 2 1 May, Everette L. The Evolution of Totally Synthetic, Strong Analgesics National Institutes of Health 1 Anonymous Computer Aids Search for R&D Chemicals Reprinted from C&EN 1968, 46 (Sept. 2), 26-27 2 Hopps, Harvey B. The Wittig Reaction Aldrich Chemical Co., Inc. Biel, John H. -

Annual Report 2017

350 Annual Report 2017 1668 Excerpt from the “Pharmacy Privilege” issued by the ruling court to the company founder FRIEDRICH JACOB MERCK: “ [He shall run the pharmacy] ensuring that it is properly stocked with good, freshly prepared medicinal products at all times so as to cure ailments and prevent ill health.” 2018 STEFAN OSCHMANN Chairman of the Executive Board and CEO of Merck “ Scientific curiosity has been a major driver of our success for 350 years. It has enabled us to pioneer new technologies. And now we are helping to shape the digital revolution.” THOUGHTS ON THE FUTURE SIMON CLARK Six young researchers is a PhD student in climate physics at the University of Exeter. His YouTube videos also mainly address topics in physics. “ Things only improve if there are people who have crazy ideas and try out something new.” Does Merck drive fresh ideas? Find the answer on page 10. SAMUEL CUNHA is a Brazilian parasitologist who shares his passion for biology with numerous followers on YouTube. “ To stay passionate, we always have to think of the future,of the poten- tial result of our work.” What does Merck think of this principle? Find the answer on page 11. EVA AMSEN is a biochemist, writer and science communicator based in London. “ For scientists it is important to exchange ideas not only with their colleagues, but also with people from totally different fields – for example, with artists.” Does Merck practice interdisciplinary exchange? Find the answer on page 13. INÉS DAWSON is a biologist, a PhD student at Oxford and a popular YouTube blogger. -

Merck Kgaa (Incorporated in Germany As a Corporation with General Partners)

http://www.oblible.com Prospectus dated September 7, 2020 Merck KGaA (incorporated in Germany as a corporation with general partners) EUR 1,000,000,000 Subordinated Fixed to Reset Rate Notes due September 2080 with a First Optional Redemption Date in June 2026 ISIN XS2218405772, Common Code 221840577, WKN A289QM Issue price: 100.00 per cent Merck KGaA, incorporated in the Federal Republic of Germany, (the "Issuer" and, together with its consolidated subsidiaries, the "Group" or "Merck" or "Merck Group") will issue on or about September 9, 2020 (the "Issue Date") EUR 1,000,000,000 in aggregate principal amount of subordinated notes subject to interest rate reset at 5 year intervals commencing on the first reset date on September 9, 2026 (the "Notes") in the denomination of EUR 100,000 (the "Specified Denomination") each. The Notes will be governed by the laws of the Federal Republic of Germany ("Germany"). The Notes shall bear interest on their principal amount (i) from and including the Issue Date to but excluding September 9, 2026 (the "First Reset Date") at a rate of 1.625 % per annum (the "Fixed Interest Rate"); (ii) from and including the First Reset Date to but excluding September 9, 2031 at the relevant 5 year swap rate for the relevant reset period plus a margin of 199.8 basis points per annum (the "Initial Margin"); (iii) from and including September 9, 2031 to but excluding September 9, 2046 at the relevant 5 year swap rate for the relevant reset period plus a first step-up margin (being equal to the Initial Margin plus 25 basis points per annum); and (iv) from and including September 9, 2046 to but excluding September 9, 2080 (the "Maturity Date") at the relevant 5 year swap rate for the relevant reset period plus a second step-up margin (being equal to the Initial Margin plus 100 basis points per annum). -

Annual Report 2017 DISCLAIMER

350 Annual Report 2017 DISCLAIMER Publication of Merck KGaA, Darmstadt, Germany. In the United States and Canada the subsidiaries of Merck KGaA, Darmstadt, Germany, operate as EMD Serono in Healthcare, MilliporeSigma in Life Science and EMD Performance Materials. To reflect such fact and to avoid any misconception of the reader of the publication certain logos, terms and names of businesses of the publication have been substituted or additional descriptions have been added. This version of the publication, therefore, slightly deviates from the otherwise identical version of the publication provided outside the United States and Canada. 1668 Excerpt from the “Pharmacy Privilege” issued by the ruling court to the company founder FRIEDRICH JACOB MERCK: “ [He shall run the pharmacy] ensuring that it is properly stocked with good, freshly prepared medicinal products at all times so as to cure ailments and prevent ill health.” 2018 STEFAN OSCHMANN Chairman of the Executive Board and CEO of Merck KGaA, Darmstadt, Germany “ Scientific curiosity has been a major driver of our success for 350 years. It has enabled us to pioneer new technologies. And now we are helping to shape the digital revolution.” THOUGHTS ON THE FUTURE SIMON CLARK Six young researchers is a PhD student in climate physics at the University of Exeter. His YouTube videos also mainly address topics in physics. “ Things only improve if there are people who have crazy ideas and try out something new.” Do we drive fresh ideas? Find the answer on page 10. SAMUEL CUNHA is a Brazilian parasitologist who shares his passion for biology with numerous followers on YouTube.