Bengaluru- Industrial H2 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 to 20 Bedded Hospital List

1 TO 20 BEDDED HOSPITALS LIST (BANGALORE) NO. OF TOTAL NO. OF NO. OF ICU NO. OF OXYGENATED BEDS BEDS VENTILATORS SL NO. NAME OF THE ESTABLISHMENT ADDRESS OF THE FACILITY Beds BEDS AVAILABLE IN AVAILABLE IN AVAILABLE IN AVAILABLE IN THE FACILITY THE FACILITY THE FACILITY THE FACILITY 76-93, Kalkere Main Road, Opposite More 1 Sri Arogya Hospital Super Market, Kodenahalli, Ramamurthy Nagar, 1 to 50 beds 20 Centralized 2 0 Bangalore 560016 No.1943, 1st A Main 6th Cross, Near Andhra 2 Adarsh Multi Speciality Hospital 1 to 50 beds 20 Centralized 1 2 Bank Kengeri Satellite town, Bangalore-560060. No.27/A Cross Opp Vani Villas Hospital K R 3 Asian Hospital 1 to 50 beds 20 Centralized 1 1 Road, Near City Market Bangalore-560002 No.1/8E Cross, 3rd Main, Bismillanagar, 4 BSA Nursing Home 1 to 50 beds 20 Centralized 1 1 Bannerghatta Road Cross, Bangalore-560029 # 80, 117, P and T Colony, RT Nagar, Bangalore- 5 Chaitanya Hospital 1 to 50 beds 20 Centralized 0 1 560032 #18, doddalalasandra Industrial area 6 Cura Hospitals kanakapura main road, uttarahalli Bangalore- 1 to 50 beds 20 Centralized 1 1 560062 #387/347, Next to post office, B.B Road, 7 Deeksha Hospital Nehrunagar, Yelahanka old town, Bangalore- 1 to 50 beds 20 Centralized 1 1 560064. #86, 2nd Main, 16th D Cross, Malagala Near 8 Deepashri Hospitals inner Ring Road under Pass, Nagarabhavi 2nd 1 to 50 beds 20 Centralized 1 2 Stage, Bangalore-560091. Genesis Hospital-Unit of 9 No.10/2, Queens Road, Bangalore-560052. -

Summary of Family Membership and Gender by Club MBR0018 As of May, 2009

Summary of Family Membership and Gender by Club MBR0018 as of May, 2009 Club Fam. Unit Fam. Unit Club Ttl. Club Ttl. District Number Club Name HH's 1/2 Dues Females Male TOTAL District 324D6 26591 CHIKBALLAPUR 6 7 2 24 26 District 324D6 26593 BANGALORE CITY ANAND 0 0 0 27 27 District 324D6 26595 BANGALORE INDIRANAGAR 7 0 0 32 32 District 324D6 26596 BANGALORE NORTH 6 7 7 47 54 District 324D6 26597 BANGALORE JAYAMAHAL 0 0 1 54 55 District 324D6 26601 BANGALORE SOMESHWARAP 9 10 10 26 36 District 324D6 26616 DODDABALLAPUR 4 5 5 84 89 District 324D6 26639 KOLAR 9 13 9 14 23 District 324D6 26676 TIRUPATI 8 2 8 47 55 District 324D6 29716 HOSKOTE 0 0 4 17 21 District 324D6 30532 CHITTOOR 0 0 3 24 27 District 324D6 31640 GOWRIBIDANUR 0 0 0 35 35 District 324D6 32275 CHINTAMANI 2 2 4 25 29 District 324D6 32992 NELAMANGALA 5 6 5 25 30 District 324D6 33157 BANGALORE VIJAYANAGAR 0 0 1 55 56 District 324D6 33158 DEVANAHALLI 1 1 0 35 35 District 324D6 33193 BANGARAPET 1 0 1 63 64 District 324D6 33610 PEENYA-YESHWANTHPUR L C 9 10 9 36 45 District 324D6 33980 BANGALORE SADASHIVANAGAR 0 0 11 8 19 District 324D6 35008 BANGALORE CENTRAL 2 0 0 25 25 District 324D6 36536 YELAHANKA 6 0 5 41 46 District 324D6 37295 BANGALORE KUMARAPARK 0 0 0 24 24 District 324D6 38758 MADANAPALLE 6 8 7 29 36 District 324D6 39004 PILER 30 31 27 48 75 District 324D6 39101 BANGALORE EAST 1 0 1 82 83 District 324D6 39776 HEBBAL 0 0 5 37 42 District 324D6 39832 PALAMANER 0 0 0 42 42 District 324D6 40576 BANGALORE SESHADRIPURAM 0 0 1 28 29 District 324D6 45754 VIJANAPURA 0 0 1 12 -

Strictly Confidential for Addressee Only Valuation Study of Property

Strictly Confidential For Addressee Only Valuation study of property located along Varthur Road, Whitefield, Bangalore Report for Elbit Plaza India Management Services Private Limited & Plaza Centers N.V. Report Date 18 March 2020 Aayas Trade Services Private Limited Valuation Study, Whitefield, Bangalore March 2020 Executive Summary Property located on Varthur Main Road, Whitefield, Bangalore Valuation 31 December, 2019 Date: Valuation Financial Statements Reporting (IFRS) Purpose: The land parcel admeasuring 54.38 acres, located on Varthur Road, Whitefield (hereafter refer as ‘the subject property’). The subject property is a part of Whitefield micro market. Carmel Incor Heights, Location / Myhna Maple, Brigade Woods, Brigade Utopia are some of the Situation: prominent residential developments in the vicinity of the subject property. The subject micro market is self-sufficient in nature with a Internal view of the subject property good mix of commercial, residential and hospitality developments and quality social infrastructure. The subject property is currently at land stage admeasuring 54.38 acres. It is irregular in shape and has presence of drain and vegetation within the premises. The subject property currently has access through Varthur Main Road which lies towards west of the subject property. Description: Internal View of the subject property Varthur Lake also lies in the west of the subject property. The subject property enjoys good frontage (~1,100 ft.) as informed by the client. The permissible Building height is 72 m. as per area statement shared by the client. Land Area: 54.38 acres Tenure: Freehold Land Sale Comparison Method: INR 2,061 Million Access to the subject property Market Value Discounted Cash Flow Method: INR 1,979 Million Mantri Deal Value: INR 2,421 Million (As of Valuation Date) This summary is strictly confidential to the addressee. -

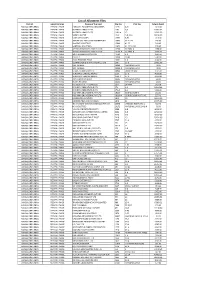

List of Allotment Files District Industrial Area Name of the Unit File No

List of Allotment Files District Industrial Area Name of the Unit File No. Plot No. Extent (Sqm) BANGALORE URBAN PEENYA I PHASE CARNATIC ENGINEERING INDUSTRIES 11271 6-F1 1012.00 BANGALORE URBAN PEENYA I PHASE INGERSOLL-RAND P LTD 1161 7,8 42864.04 BANGALORE URBAN PEENYA I PHASE INGERSOLL-RAND P LTD 1161-A 12 16262.00 BANGALORE URBAN PEENYA I PHASE WIPRO LIMITED 1243 9-B,10-A 38240.00 BANGALORE URBAN PEENYA I PHASE VIVEK ASSOCIATES 12670 6-F2 1012.00 BANGALORE URBAN PEENYA I PHASE AARVEE CNC PRECISION ENGINEERING 13658 SY.41-P4 208.00 BANGALORE URBAN PEENYA I PHASE JAYATHE INDUSTRIES 13666 41-P3 240.00 BANGALORE URBAN PEENYA I PHASE SANTOSH INDUSTRIES 13673 41-P2 SY.NO 278.00 BANGALORE URBAN PEENYA I PHASE APPOLO POWER SYSTEMS PVT LTD 13708 28-PART A 1768.00 BANGALORE URBAN PEENYA I PHASE APPOLO POWER SYSTEMS PVT LTD 13708-A 28-PART B 2596.04 BANGALORE URBAN PEENYA I PHASE AOTS ALUMNI ASSOCIATION 13748 6-G 3501.00 BANGALORE URBAN PEENYA I PHASE K S R T C 13830 20-A1 5702.00 BANGALORE URBAN PEENYA I PHASE GOVT PRINTING PRESS 13831 6-E 2722.00 BANGALORE URBAN PEENYA I PHASE GEMINI DYEING & PRINTING MILLS LTD 1397 16-B 18466.00 BANGALORE URBAN PEENYA I PHASE SMT.KAMALA 14949 MARGINAL LAND 70.00 BANGALORE URBAN PEENYA I PHASE SMT.KAMALA 14949-A MARGINAL LAND 70.00 BANGALORE URBAN PEENYA I PHASE LT.COL. SHASHIDHAR V S 14952 Under HT Line 3717.47 BANGALORE URBAN PEENYA I PHASE SUNDAR CHEMICALS WORKS 1530 27-B 4030.00 BANGALORE URBAN PEENYA I PHASE SUNDAR CHEMICALS WORKS 1530-A 27-A 4355.00 BANGALORE URBAN PEENYA I PHASE AJAY KUMAR BHOTIKA 16215 -

District Census Handbook, Bangalore, Part XII-B, Series-11

CENSUS OF IN,DIA 1991 Series· 11 KARNATAKA DISTRICT CENSUS HANDBOOK ~ . - - - - BANGALORE DISTRICT PART XII· R VILLAGE AND TOWN WISE PRIMARY CENSUS ABSTRACT SORHA NAMBISAN Director or Census Operntlons, Karnatuka CONTENTS Page No. FOREWORD v-vi PREFACE vii-viii IMPORTANT STATISTICS lX-Xli ANALYTICAL NOTE xv-liii PRIMARY CENSUS ABSTRACT Explanatory Notes 1-4 A. District Primary Census Abstract 6-72 (i) Villagcrrown Primary Census Abstract Alphabetical List of Villages - Andal CD.Block 75-80 Primary Census Abstract - Anekal CD.Bloek 82-109 Alphabetical List of Villages - Bangalore North CD.Block 113-118 Primary Census Abstract - Bangalorc North CD.Block 120-159 Alphabetica( List of Villages - Bangalore South CD.Block 163-169 Primary Census Abstract - Bangalon.: SmIth CD.Block 170-209 (ii) Town Primary Census Abstractn (Wan.lwise) Alphabetical List of Towns in the District 212-213 Anekal (TMC) 214-217 Dommasandra (NMCT) 214-217 Katigodi (NMCTT 214-217 Bangalore U A 214-261 B. District Primary Censu::. Abstract for Scheduled Castes 264-323 C. District. Primary Census Abstract for Scheduled Tribes 326-385 Appendix-I - District Primary Census Abstract Talukwise 388-429 Appendix-II - List of Schedukd Castes and Scheduled Tribes 431-432 Appl.:ndix-llI - Publication Plan 433-435 ILLUSTRATIONS Map of Karnataka showing the Administrative Divisons (xiii) Map of Bangalore District (xiv) (iii) FOREWORD Publication of the District Census Handbooks (DCHs) was initiated after the 1951 Census and is continuing since then with some innovations/ modifications after each decennial Census. This is the most valuable distriCsJevcl publication brought out by the Census Organisation on behalf of each State Govt./Union Territory administration. -

GREEN LINE Metro Time Schedule & Line Route

GREEN LINE metro time schedule & line map GREEN LINE GREEN LINE View In Website Mode The GREEN LINE metro line (GREEN LINE) has 2 routes. For regular weekdays, their operation hours are: (1) Nagasandra: 6:00 AM - 9:30 PM (2) Yelachenahalli: 6:00 AM - 9:30 PM Use the Moovit App to ƒnd the closest GREEN LINE metro station near you and ƒnd out when is the next GREEN LINE metro arriving. Direction: Nagasandra GREEN LINE metro Time Schedule 29 stops Nagasandra Route Timetable: VIEW LINE SCHEDULE Sunday 6:00 AM - 9:30 PM Monday 6:00 AM - 9:30 PM Silk Institute Tuesday 6:00 AM - 9:30 PM Talaghattapura Wednesday 6:00 AM - 9:30 PM Vajarahalli Thursday 6:00 AM - 9:30 PM Doddakallasandra Friday 6:00 AM - 9:30 PM Konanakunte Cross Saturday 6:00 AM - 9:30 PM Yelachenahalli Jayaprakash Nagara GREEN LINE metro Info Banashankari Direction: Nagasandra Stops: 29 Trip Duration: 70 min Rashtreeya Vidyalaya Road Line Summary: Silk Institute, Talaghattapura, Vajarahalli, Doddakallasandra, Konanakunte Cross, Jayanagara Yelachenahalli, Jayaprakash Nagara, Banashankari, Rashtreeya Vidyalaya Road, Jayanagara, South End South End Circle Circle, Lalbagh, National College, Krishnarajendra Market, Chickpet, Nadaprabhu Kempegowda Lalbagh Interchange, Majestic, Mantri Square Sampige Road, Srirampura, Mahakavi Kuvempu Road, Rajajinagar, National College Mahalakshmi, Sandal Soap Factory, Yeshwanthpur, Goraguntepalya, Peenya, Peenya Industry, Jalahalli, Krishnarajendra Market Dasarahalli, Nagasandra Chickpet Nadaprabhu Kempegowda Interchange, Majestic Mantri Square Sampige -

Bangalore Urban Ward Details

Ward Name District Taluka Hobli Ward Number Ward Name in English Area Comes Under Concern Ward in Kannada Govindapura, Kulappa Layout, Vasudevapura, Kendriya Vihar, Manchenahalli, Yelahanka (P), Yelhanka Airport Area, Maheshwari Nagar, Sai spring field colony, Gandhi Nagar, Lake view residency, Nehru Nagar, Venkatala, Surabhi Layout, Venkatappa Layout, Shobha Ultima villas, Bangalore Bangalore North Addl Yelahanka-1 Ward-1 Kempegowda ಂಡ Venkatala Layout, Mantri township, Vikas layout, Yelahanka Kere, Shankaranna Layout, Sathyappa Anjanappa Kempamma Layout, Shivanahalli (P), Maruthi Nagar, Sapthagiri Layout (P), Jayanna Layout, Basaveshwara Nagar (P), Bhadranna Layout Harohalli, Harohalli kere, Kanchenahalli, ISRO Layout, Naganahalli, Naganahalli new layout, KEB Layout Phase I, Balaji Layout, Vinayaka Layout, Ramanashree Califonia East Garden layout, Deo Marvel Layout, Mahalaxmi Bangalore Bangalore North Addl Yelahanka-1 Ward-2 Chowdeshwari ಶ Layout, Nisarga Layout, CRPF Quarters, Puttanahalli, Puttanahalli kere, Monte Carlo apartment, DG staff quarters, Central excise quarters, Wheel and Axle plant, FM Goetze plant, Chowdeswari Layout, Kamakshiamma Layout, East Colony, Yelahanka (P), KHB Colony Ananthapura, Chikka Bettahalli, Dodda Bettahalli, Bharat Nagar (MS Palya), Chandrappa Layout, Hill side meadows layout, Sai Nagar Phase I and II, Basavalingappa Layout, Netravathi Layout (P), Sai orchards, Best country 3, G Ramaiah Layout, Jyothi Nagar, GPF Layout, Muneshwara Layout 1st and 2nd Bangalore Bangalore North Addl Yelahanka-3 Ward-3 -

District: Benga

Details of Respective area engineers of BESCOM (Row 2 - District name) (Column 10 - Alphabetical order of Areas) District: Bengaluru uban Sl No Zone Circle Division Sub Division O&M Unit Areas 1 2 3 4 5 6 7 8 9 10 11 12 13 Service Superintending Executive Assistant Executive Assistant Engineer / Junior Name Chief Engineer Name Name Name Name Station Engineer Engineer Engineer Engineer Number Sri.T.S Chandran AE Sri. Venkatesh 9449864538 Abbigere F-2:- Raghavendra L/o, Old KG Halli, Abbigere F-3:-Lakshmi Pura, Vaderahalli (V), Sri. B.G Umesh Sri. Lakshmish Assistant Executive 94498 44988 JE Sri. Lingaraju 9449631101 Abbigere F-5:- Lakshmi Pura Main Rd, Singa Pura, Lakappa L/o, Singa Pura L/o, Abbigere Indl Area, BMAZ 8277892599 82778 93904 Engineer Sri. Mylarappa 1 North 080-22350436 Jalahalli C3 ABBIGERE JE Sri. Somashekar Reddy 94484 32824 9448365156 Abbigere F-7:- Abbigere (V), Pipe Line Rd, Venkateshwara l/o, Suraj L/o, NORTH [email protected] [email protected] senorthcircle.work@gmail A 9449844643 JE Sri. Yacob 9900723350 Abbigere F-8:- Kala Nagar, KG Halli,Abbigere F-9:- Vishweshwaraiah l/o, [email protected] n .com [email protected] JE Sri. Sunkaiah 9342892872 HVVY Vally, Kuvempu Nagar, Abbigere F-10:- KashVaderahalli L/o, Muneshwara l/o, Renuka L/o, Sri. M Sri.Thippesamy, Chennakeshava Assistant Executive Sri.Sriramegowda 9449877444 Adugodi, Koramangala 7th Block, 8th Block, Koramangala Village, KR Garden Village, Balappa L/o, 94498 44613 Engineer Sri. Manoj BMAZ 9449045888 sesouthcircle.work Koramangal AE 9449868075 Munikrishnappa L/o, AK Colony, Rajendra Nagar, Ambedkar Nagar, LR Nagar, Devegowda Block, 2 South eeadnlsouth.work@ S4 Kumar 9449844664 ADUGODI JE Sri. -

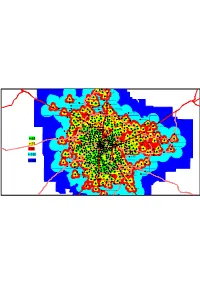

Coverage Plot of 3G Service in Bangalore City

KHB Colony - Yelahanka Attur L/O Yelahanka TE Yelehanka-1 Tumkur Road Vidyaranyaoura TE Chickbanavara MS Palya - Vidyaranyapura Allalasandra Judges L/O Bagalaguntai Abbigere thindlu Amuruthhalli Chikkasandra - Hesaraghatta Main Road Indian Express LO Madanayakanahalli Doddabommasandra KodigehalliGate,BellaryRoad Tumk_Rd_Jindal2 (BIEC) Hessaraghatta Main Road Jalhalli(Gangamma Circle) Bhuvaneswari Nagar Dasarahalli_TUMK_Rd (MS Ramaiah Nagar) Jindal Nagar Peenya Dasrahalli Bhadrappa L/O Hennur Main Road 2 Ayyappan Temple, Jalahalli Gokul Sanjaynagar TE Cholanayakanahalli Nagawara Junction HMT Colony, Neelagaddana halli Hebbal (Airtel Tower Building) Whitefield Road AG'S L/O RMV Hennur Cross Anand Nagar-II Nagavara Kelkere Village Peenya - SRS Hennur LIC Colony Anand Nagar Mallappa L/O Peenya I Stage Subedar Palya HBR L/O RSU Ganga Nagar - II Anand nagar, KR Puram M.S.Ramaiah Road Akshay Nagar PIE Goraguntapalya Ambedakar Medical College 2 Kalyan Nagar Thambu Chettipalya - KR Puram Nandini Layout Kavalbyrasandra-II Hoysala nagar BHEL, opp to IISc Ganapathi nagar Nandini L/O TE DJ Halli Banaswadi Malleshwaram 8th Main Lingarajapuram-II K.R Puram Market Hegganahalli-II Laggere-2 kurubarahalli-II Chowdaiah Memorial Hall Kasturinagar II Rajajinagar R Block CACT Tel exge Hegganahalli Kurubarahalli GuttaHalli Jayamahal Banasawadi Rly Stn Rd Ayyappanagar Basaveshwaranagar, Modi Hospital Kadugodi Cox Town Palace Road Benson Town Benniganahalli K R Puram RSU Basaveshwaranagar RSU Hoodi Frazer Town - III Basaveshwaranagar - III Block Seshadripuram -

Sl.No Name of the Office Landline Phone Number Address of the Help

Sl.No Name of the Office Landline phone number Address of the help desk office Vanijya Therige Karyalaya, Kalidasa Road, Groundfloor, Gandhinagar, 1 CCT OFFICE 18004256300 (Toll Free) BANGALORE-560009 DGSTO-1 Joint Commissioner of Commercial Taxes(Admn) DGSTO1 TTMC 2 DGSTO-1 Helpdesk 080-23570264 BMTC Building Yeshwanthpura Bangalore 560022 Assistant Commissioner Of Commercial Taxes(LGSTO-10) DGSTO-1 3 LGSTO 010 - Bengaluru 080-22208556 Vanijya Therige Karyalaya, Kalidasa Road, Groundfloor, Gandhinagar, BANGALORE-560009 Assistant Commissioner Of Commercial Taxes(LGSTO-10-A) DGSTO-1 4 LGSTO 010 A - Bengaluru 080-22342691 Vanijya Therige Karyalaya, Kalidasa Road, Groundfloor, Gandhinagar, BANGALORE-560009 Assistant Commissioner Of Commercial Taxes(LGSTO-20) 3rd floor 5 LGSTO 020 - Bengaluru 080-22860622 Vishwaraiah Tower BANGALORE. 560001 Assistant Commissioner Of Commercial Taxes(LGSTO-30) DGSTO-1 6 LGSTO 030 - Bengaluru 080-22208557 Vanijya Therige Karyalaya, Kalidasa Road, Groundfloor, Gandhinagar, BANGALORE-560009 Assistant Commissioner Of Commercial Taxes(LGSTO-30A) DGSTO-1 7 LGSTO 030 A - Bengaluru 080-22342687 Vanijya Therige Karyalaya, Kalidasa Road, Groundfloor, Gandhinagar, BANGALORE-560009 Assistant Commissioner of Commercial Taxes(LGSTO-130 ) T.T.M.C. 8 LGSTO 130 - Bengaluru 080-23470478 B.M.T.C. BuildingYeshwathapura BANGALORE 560022 Assistant Commissioner of Commercial Taxes(LGSTO-130 ) T.T.M.C. 9 LGSTO 130A-Bengaluru 080-23378647 B.M.T.C. BuildingYeshwathapura BANGALORE 560022 DGSTO-2 Deputy Commissioner of Commercial Taxes(Int.Audit -

Map Title Proposed Bangalore City License Area

Legend N a t io Railway n Industrial Area a lH w KIADB INDUSTRIAL AREA JIGANI CityMain y Plantation 4 CityMajor River/Waterbody ExpressHwy Hillocks <Double-click here to enter title> MajorRoad Building MinorRoad City Boundary 7 0 2 NationalHwy Neatline y w H l StateHwy Buffer a n o i t a N 5 3 y Surrounding_Area w H Anekal HOODY-WHITEFIELD ROAD e t Banguluru HOSUR MAIN ROAD a t S Bangaluru South HOSUR MAIN ROAD, SITE NO.2 B. M. SHANKARAPPA ESTATE INDL AREA DODDABALLAP BANGALORE (BRIGADE ROAD) INDUSTRIAL SUBURB YESHWANTH BANGALORE (TUMK ROAD) JP NAGAR BANNERGHATTA KANAKAPURA ROAD BATTAHALLI KASTURBA NAGAR INDL AREA DODDABALLAP BEGUR CROSS ROAD KIADB INDUSTRIAL AREA JIGANI Yelahanka Satelite Town Yelahanka BEGUR HOBLI M G ROAD BEGUR ROAD MADIWALA POST BIDADI MAGADI ROAD BIDARHALLI MAHADEVAPURA 7 BIOCON PARK MISSION ROAD y BOMANAHALLI MUNESHWARA BLOCK w H BOMMANAHALLI MYSORE ROAD y 48 Kuvempu Nagar l alHw a BOMMASANDRA INDUSTRIALAREA NEW THIPPASANDRA POST ation n N o CAMPUS WHITEFIELD Peenya II Stage Indl Est i t Byatarayanapura a D. KRISHNA REDDY LAYOUT RICHMOND ROAD 3 N DEEPANJALI NAGAR TELUGARAHALLI ROAD, ANEKAL y BIDARHALLI DODDA BEGUR TUMKUR ROAD w HMT INDUSTRIAL ESTATE H DODDANEKUNDI INDUSTRIAL AREA VIRGONAGAR e t VIRGONAGAR a ELECTRONIC CITY VITTAL NAGAR t Jalahalli S GANDHI NAGAR VIVESWARAIAH INDUSTRIAL AREA Peenya Industrial Area I Phase Rmv II Stage 4 Hebbal y Gubbanna Industrial Estate WHITEFIELD w lH HMT INDUSTRIAL ESTATE WHITEFIELD ROAD Kelkere na BANGALORE (TUMK ROAD) tio Na TUMKUR ROAD Hormavu INDUSTRIAL SUBURB YESHWANTHHOSUR MAIN ROAD, SITE NO.2 Kadugondanahalli Peenya II Stage Indl Est Yesvantpur Industrial Subrub Kacharakanahalli Handrihalli Hegganahalli BOMMANAHALLIBOMANAHALLI Basavanapura Mallesvaram Jayamahal Rajaji Nagar Maruti Nagar Banasvadi Duravani Nagar Belatur Kamala Nagar Srirampuram Benson Town VIVESWARAIAH INDUSTRIAL AREA d a Kadugodi o B. -

Jurisdiction of Income Tax Officers, Bengaluru with Telephone Directory

JURISDICTION OF INCOME TAX OFFICERS, BENGALURU WITH TELEPHONE DIRECTORY CONTENT PAGE NO. SPAN OF CONTROL 1-5 PINCODE JURISDICTION 6-8 RANGE 1 (1) TO RANGE 7 (2) RANGE 1, 1(1), 1(2), 1(3) 9-14 RANGE 2, 2(1), 2(2), 2(3) 15-19 RANGE 3, 3(1), 3(2), 3(3) 20-26 RANGE 4, 4(1), 4(2), 4(3) 27-33 RANGE 5, 5(1), 5(2), 5(3) 34-38 RANGE 6, 6(1), 6(2), 6(3) 39-45 RANGE 7, 7(1), 7(2) 46-49 TRANSFER PRICING 50-52 INTERNATIONAL TAXATION 53-54 AUDIT 55-56 TDS 57-59 DGIT - CENTRAL CIRCLE - I & II 60-61 INVESTIGATION - UNIT I, II, III 62 CIB (INTELLIGIENCE) 63 EXEMPTIONS 64 SPAN OF CONTROL Pr. CCIT, Bengaluru CCIT, Bengaluru - 1 CCIT, Bengaluru - 2 Pr. CIT, Bengaluru - 1 Pr. CIT, Bengaluru - 2 Pr. CIT, Bengaluru - 5 Range - 1(1), Bengaluru Range - 2(1), Bengaluru Range - 5(1), Bengaluru Range - 1(2), Bengaluru Range - 2(2), Bengaluru Range - 5(2), Bengaluru Range - 1(3), Bengaluru Range - 2(3), Bengaluru Range - 5(3), Bengaluru CIT (ADMN & CO), Bengaluru Pr. CIT, Bengaluru - 3 Pr. CIT, Bengaluru - 6 CIT (DR), ITAT, Bengaluru - 1 Range - 3(1), Bengaluru Range - 6(1), Bengaluru CIT (DR), ITAT, Bengaluru - 2 Range - 3(2), Bengaluru Range - 6(2), Bengaluru CIT (DR), ITAT, Bengaluru - 3 Range - 3(3), Bengaluru Range - 6(3), Bengaluru CIT (Judicial), Bengaluru Pr. CIT, Bengaluru - 4 Pr. CIT, Bengaluru - 7 Range - 4(1), Bengaluru Range - 7(1), Bengaluru CIT (Audit), Bengaluru Range - 4(2), Bengaluru Range - 7(2), Bengaluru Range - 4(3), Bengaluru CIT (A)-1, Bengaluru Pr.