Hong Leong Assurance Sibu Branch

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Flooding Projections from Elevation and Subsidence Models for Oil Palm Plantations in the Rajang Delta Peatlands, Sarawak, Malaysia

Flooding projections from elevation and subsidence models for oil palm plantations in the Rajang Delta peatlands, Sarawak, Malaysia Flooding projections from elevation and subsidence models for oil palm plantations in the Rajang Delta peatlands, Sarawak, Malaysia Report 1207384 Commissioned by Wetlands International under the project: Sustainable Peatlands for People and Climate funded by Norad May 2015 Flooding projections for the Rajang Delta peatlands, Sarawak Table of Contents 1 Introduction .................................................................................................................... 8 1.1 Land subsidence in peatlands ................................................................................. 8 1.2 Assessing land subsidence and flood risk in tropical peatlands ............................... 8 1.3 This report............................................................................................................. 10 2 The Rajang Delta - peat soils, plantations and subsidence .......................................... 11 2.1 Past assessments of agricultural suitability of peatland in Sarawak ...................... 12 2.2 Current flooding along the Sarawak coast ............................................................. 16 2.3 Land cover developments and status .................................................................... 17 2.4 Subsidence rates in tropical peatlands .................................................................. 23 3 Digitial Terrain Model of the Rajang Delta and coastal -

Hong Leong Bank Berhad

March 6, 2018 Global Markets Research Fixed Income Fixed Income Daily Market Snapshot US Treasuries UST T enure C lo sing (%) C hg (bps) US Treasuries ended slightly weaker over a muted session with 2-yr UST 2.24 0 overall yields a mere 1-2 bps higher amid decent economic data 5-yr UST 2.65 2 by ISM. The curve bear-steepened slightly with the front end 2Y 10-yr UST 2.88 2 30-yr UST 3.15 1 (which is sensitive to Fed policy interest rate expectations) unchanged at 2.24% whilst the much-watched 10Y weakened MGS GII* pushing yields higher by 2bps at 2.88%. Meanwhile market T enure C lo sing (%) C hg (bps) C lo sing (%) C hg (bps) players will be following trade-related news as US President 3-yr 3.39 -1 3.55 0 Trump faces growing pressure following the imposition of tariffs 5-yr 3.59 0 3.85 0 7-yr 3.89 -1 4.05 0 on steel and aluminium products. Upcoming data includes the all- th 10-yr 4.01 1 4.19 0 important NFP figures out on 9 this Friday. 15-yr 4.44 0 4.58 0 20-yr 4.55 -3 4.78 0 30-yr 4.76 -1 4.96 0 MGS/GII * M arket indicative levels Local Govvies reversed the strong volume seen in recent M YR IRS Levels sessions with secondary market volume down at RM1.03b. IR S C lo sing (%) C hg (bps) Interest was mainly seen in the shorter off-the-run 21’s and 24’s; 1-yr 3.76 -1 Despite lower traded volume; benchmark yields were generally 3-yr 3.83 0 0-3bps lower. -

SARAWAK GOVERNMENT GAZETTE PART II Published by Authority

For Reference Only T H E SARAWAK GOVERNMENT GAZETTE PART II Published by Authority Vol. LXXI 25th July, 2016 No. 50 Swk. L. N. 204 THE ADMINISTRATIVE AREAS ORDINANCE THE ADMINISTRATIVE AREAS ORDER, 2016 (Made under section 3) In exercise of the powers conferred upon the Majlis Mesyuarat Kerajaan Negeri by section 3 of the Administrative Areas Ordinance [Cap. 34], the following Order has been made: Citation and commencement 1. This Order may be cited as the Administrative Areas Order, 2016, and shall be deemed to have come into force on the 1st day of August, 2015. Administrative Areas 2. Sarawak is divided into the divisions, districts and sub-districts specified and described in the Schedule. Revocation 3. The Administrative Areas Order, 2015 [Swk. L.N. 366/2015] is hereby revokedSarawak. Lawnet For Reference Only 26 SCHEDULE ADMINISTRATIVE AREAS KUCHING DIVISION (1) Kuching Division Area (Area=4,195 km² approximately) Commencing from a point on the coast approximately midway between Sungai Tambir Hulu and Sungai Tambir Haji Untong; thence bearing approximately 260º 00′ distance approximately 5.45 kilometres; thence bearing approximately 180º 00′ distance approximately 1.1 kilometres to the junction of Sungai Tanju and Loba Tanju; thence in southeasterly direction along Loba Tanju to its estuary with Batang Samarahan; thence upstream along mid Batang Samarahan for a distance approximately 5.0 kilometres; thence bearing approximately 180º 00′ distance approximately 1.8 kilometres to the midstream of Loba Batu Belat; thence in westerly direction along midstream of Loba Batu Belat to the mouth of Loba Gong; thence in southwesterly direction along the midstream of Loba Gong to a point on its confluence with Sungai Bayor; thence along the midstream of Sungai Bayor going downstream to a point at its confluence with Sungai Kuap; thence upstream along mid Sungai Kuap to a point at its confluence with Sungai Semengoh; thence upstream following the mid Sungai Semengoh to a point at the midstream of Sungai Semengoh and between the middle of survey peg nos. -

12 June 2018

June 12, 2018 Global Markets Research Fixed Income Fixed Income Daily Market Snapshot US Treasuries US Treasuries ended range-bound within 0-2bps higher as UST market was able to digest the double-auction of UST$32b T enure C lo sing (%) C hg (bps) of UST3Y; averaging 2.664% and also $22b of UST10Y 2-yr UST 2.52 2 which averaged at 2.962%. The front-end was weaker 5-yr UST 2.80 1 ahead of the all-important FOMC meeting schedule for this 10-yr UST 2.95 1 Wednesday. Focus will also be on Trump-Kim meeting in 30-yr UST 3.09 0 Singapore today. Meanwhile UST Futures is reputed to spike on rumors of the sudden illness of Trump’s top MGS GII* economic adviser; Larry Kudlow. Even though another T enure C lo sing (%) C hg (bps) C lo sing (%) C hg (bps) 3-yr 3.70 -3 3.72 0 25bps rate hike in the upcoming FOMC meeting this week 5-yr 3.85 0 4.04 2 is a done deal in our view, markets are looking for more th 7-yr 4.03 0 4.18 0 clues if the Fed will deliver a 4 rate hike for the year. 10-yr 4.23 0 4.35 0 15-yr 4.62 0 4.72 0 MGS/GII 20-yr 4.90 1 4.84 0 30-yr 4.95 7 5.01 0 Trading momentum in local govvies maintained as total * M arket indicative levels volume of RM1.66b was largely due to some interest on the short-end 18-19’s mainly by offshore flows. -

Hong Leong Bank Berhad

June 8, 2021 Global Markets Research Fixed Income Fixed Income Dail y Market Snapshot US Treasuries • US Treasuries ended slightly weaker on Monday, a departure from last Friday’s rally following weaker-than-expected jobs data for UST May. Bond movements were seen lacking catalysts with limited Tenure Closing (%) Chg (bps) price action with the new auction cycle starting on Tuesday. Overall 2-yr UST 0.16 1 5-yr UST 0.79 1 benchmark yields edged between 1-2bps with the UST 2Y yield 10-yr UST 1.57 2 closing at 0.16% whilst the much-watched 10Y bond at 1.57%. 30-yr UST 2.25 2 Nevertheless, there was little to suggest that there were major fears over Fed tapering or even additional stimulus for now. The Treasury MGS GII* auction cycle this week comprises $58b 3Y new issue on Tuesday Tenure Closing (%) Chg (bps) Closing (%) Chg (bps) followed by $38b 10Y and $24b 30Y reopenings on Wednesday 3-yr 2.24 0 2.01 0 and Thursday. Elsewhere, the flood of cash continues to 5-yr 2.52 0 2.65 0 7-yr 2.98 3 2.94 0 overwhelm US dollar funding markets despite the mere offering of 10-yr 3.24 -3 3.30 0 0% rate on the Fed facility. Meanwhile, expect attention to shift to 15-yr 3.94 6 4.02 1 the US inflation data and ECB meeting outcome on Thursday. 20-yr 4.15 2 4.27 0 MGS/GIIl 30-yr 4.28 0 4.49 -1 * Market indicative levels • Financial markets were closed Monday due to the public holiday However last Friday, local govvies were slightly pressured going MYR IRS Levels into the long weekend; breaking the recent upward trend for the IRS Closing (%) Chg (bps) past several sessions with overall benchmark yields closing 1-yr 1.95 0 between 0-6bps higher save for the 10Y MGS and 30Y GII. -

Language Use and Attitudes As Indicators of Subjective Vitality: the Iban of Sarawak, Malaysia

Vol. 15 (2021), pp. 190–218 http://nflrc.hawaii.edu/ldc http://hdl.handle.net/10125/24973 Revised Version Received: 1 Dec 2020 Language use and attitudes as indicators of subjective vitality: The Iban of Sarawak, Malaysia Su-Hie Ting Universiti Malaysia Sarawak Andyson Tinggang Universiti Malaysia Sarawak Lilly Metom Universiti Teknologi of MARA The study examined the subjective ethnolinguistic vitality of an Iban community in Sarawak, Malaysia based on their language use and attitudes. A survey of 200 respondents in the Song district was conducted. To determine the objective eth- nolinguistic vitality, a structural analysis was performed on their sociolinguistic backgrounds. The results show the Iban language dominates in family, friend- ship, transactions, religious, employment, and education domains. The language use patterns show functional differentiation into the Iban language as the “low language” and Malay as the “high language”. The respondents have positive at- titudes towards the Iban language. The dimensions of language attitudes that are strongly positive are use of the Iban language, Iban identity, and intergenera- tional transmission of the Iban language. The marginally positive dimensions are instrumental use of the Iban language, social status of Iban speakers, and prestige value of the Iban language. Inferential statistical tests show that language atti- tudes are influenced by education level. However, language attitudes and useof the Iban language are not significantly correlated. By viewing language use and attitudes from the perspective of ethnolinguistic vitality, this study has revealed that a numerically dominant group assumed to be safe from language shift has only medium vitality, based on both objective and subjective evaluation. -

The North Kalimantan Communist Party and the People's Republic Of

The Developing Economies, XLIII-4 (December 2005): 489–513 THE NORTH KALIMANTAN COMMUNIST PARTY AND THE PEOPLE’S REPUBLIC OF CHINA FUJIO HARA First version received January 2005; final version accepted July 2005 In this article, the author offers a detailed analysis of the history of the North Kalimantan Communist Party (NKCP), a political organization whose foundation date itself has been thus far ambiguous, relying mainly on the party’s own documents. The relation- ships between the Brunei Uprising and the armed struggle in Sarawak are also referred to. Though the Brunei Uprising of 1962 waged by the Partai Rakyat Brunei (People’s Party of Brunei) was soon followed by armed struggle in Sarawak, their relations have so far not been adequately analyzed. The author also examines the decisive roles played by Wen Ming Chyuan, Chairman of the NKCP, and the People’s Republic of China, which supported the NKCP for the entire period following its inauguration. INTRODUCTION PRELIMINARY study of the North Kalimantan Communist Party (NKCP, here- after referred to as “the Party”), an illegal leftist political party based in A Sarawak, was published by this author in 2000 (Hara 2000). However, the study did not rely on the official documents of the Party itself, but instead relied mainly on information provided by third parties such as the Renmin ribao of China and the Zhen xian bao, the newspaper that was the weekly organ of the now defunct Barisan Sosialis of Singapore. Though these were closely connected with the NKCP, many problems still remained unresolved. In this study the author attempts to construct a more precise party history relying mainly on the party’s own information and docu- ments provided by former members during the author’s visit to Sibu in August 2001.1 –––––––––––––––––––––––––– This paper is an outcome of research funded by the Pache Research Subsidy I-A of Nanzan University for the academic year 2000. -

A Study on Trend of Logs Production and Export in the State of Sarawak, Malaysia

International Journal of Marketing Studies www.ccsenet.org/ijms A Study on Trend of Logs Production and Export in the State of Sarawak, Malaysia Pakhriazad, H.Z. (Corresponding author) & Mohd Hasmadi, I Department of Forest Management, Faculty of Forestry, Universiti Putra Malaysia 43400 Serdang, Selangor, Malaysia Tel: 60-3-8946-7225 E-mail: [email protected] Abstract This study was conducted to determine the trend of logs production and export in the state of Sarawak, Malaysia. The trend of logs production in this study referred only to hill and peat swamp forest logs production with their species detailed production. The trend of logs export was divided into selected species and destinations. The study covers the analysis of logs production and export for a period of ten years from 1997 to 2006. Data on logs production and export were collected from statistics published by the Sarawak Timber Industry Development Corporation (Statistic of Sarawak Timber and Timber Product), Sarawak Timber Association (Sarawak Timber Association Review), Hardwood Timber Sdn. Bhd (Warta) and Malaysia Timber Industry Board (MTIB). The trend of logs production and export were analyzed using regression model and times series. In addition, the relation between hill and peat swamp forest logs production with their species and trend of logs export by selected species and destinations were conducted using simple regression model and descriptive statistical analysis. The results depicted that volume of logs production and export by four major logs producer (Sibu division, Bintulu division, Miri division and Kuching division) for hill and peat swamp forest showed a declining trend. Result showed that Sibu division is the major logs producer for hill forest while Bintulu division is the major producer of logs produced for the peat swamp forest. -

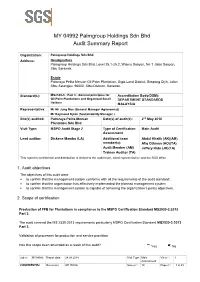

Management System Certification Be: Granted / Continued / Withheld / Suspended Until Satisfactory Corrective Action Is Completed

MY 04992 Palmgroup Holdings Sdn Bhd Audit Summary Report Organization: Palmgroup Holdings Sdn Bhd Address: Headquarters Palmgroup Holdings Sdn Bhd, Level 25.1-25.2, Wisma Sanyan, No 1 Jalan Sanyan, Sibu Sarawak. Estate Palmraya Pelita Meruan Oil Palm Plantation, Gigis Land District, Simpang Dijih, Jalan Sibu-Selangau, 96000, Sibu Division, Sarawak. Standard(s): MS2530-3 : Part 3 : General principles for Accreditation Body(DSM): Oil Palm Plantations and Organized Small DEPARTMENT STANDARDS Holders MALAYSIA Representative: Mr Hii Jung Mee (General Manager Agronomist) Mr Raymond Nyian (Sustainability Manager ) Site(s) audited: Palmraya Pelita Meruan Date(s) of audit(s): 2nd May 2018 Plantation Sdn Bhd Visit Type: MSPO Audit Stage 2 Type of Certification Main Audit Assessment Lead auditor: Dickens Mambu (LA) Additional team Abdul Khalik (AK)(AM) member(s): Afiq Othman (AO)(TA) Audit Member (AM) Jeffery Ridu (JR)(TA) Trainee Auditor (TA) This report is confidential and distribution is limited to the audit team, client representative and the SGS office. 1. Audit objectives The objectives of this audit were: ▪ to confirm that the management system conforms with all the requirements of the audit standard; ▪ to confirm that the organization has effectively implemented the planned management system; ▪ to confirm that the management system is capable of achieving the organization’s policy objectives. 2. Scope of certification Production of FFB for Plantations in compliance to the MSPO Certification Standard MS2530-3:2013 Part 3. The audit covered the MS 2530:2013 requirements particularly MSPO Certification Standard MS2530-3:2013 Part 3. Validation of processes for production and service provision Has this scope been amended as a result of this audit? Yes No Job n°: MY04992 Report date: 24.08.2018 Visit Type: Main Visit n°: 1 Assessment CONFIDENTIAL Document: GP 7003A Issue n°: 10 Page n°: 1 of 23 This is a multi-site audit and an Appendix listing all relevant sites and/or remote Yes No locations has been established (attached) and agreed with the client 3. -

General Sop for Movement Control Order (Mco)

Updated as of 4 February 2021 GENERAL SOP FOR MOVEMENT CONTROL ORDER (MCO) Allowed Activities Operation hours 24 hours Allowed Activity As per rules set in Brief Residents Conditional Hours Description Movement • Essential Services & chains • Purchase / obtain essential ACTIVITIES & PROTOCOLS goods or services Action Brief Description • Obtain health treatment & medicine Involved Areas THE WHOLE OF PENINSULA MALAYSIA, FEDERAL TERRITORY OF LABUAN, SABAH - Please Refer to Sabah • Conducting official State Movement Control Order (MCO) SOP AND SARAWAK (SIBU DIVISION, KAPIT DISTRICT AND SONG DISTRICT) - Please Government and judicial duties Refer to Sibu Division Movement Control Order (MCO) SOP and Kapit District and Song District Movement Control Order (MCO) SOP) Prohibited Activities Enforcement Period 5 February 2021 (starts at 12:01 a.m.) until 18 February 2021 (11:59 p.m.) • Cross district movement within MCO *For Sarawak (Sibu Division) starting from 30 January 2021 (starts at 12.01 am) until 14 February 2021 (11.59pm) areas and crossing state movement *For Sarawak (Kapit District and Song District) starting from 2 February (starts at 12 a.m.) until 15 February 2021 (11:59 p.m.) without the permission of PDRM • Movement in and out of MCO areas Controlled Movement • PDRM is responsible in enforcing control over local infection areas with the assistance of Malaysian Armed Forces, Malaysian without PDRM permission Civil Defense & RELA. The entry and exit routes of MCO areas are closed and controlledby PDRM. • All residents in the MCO areas are NOT ALLOWED to leave their homes / residences except: ➢ Only two (2) household representatives are allowed to go out just to get food supplies, medicine, dietary supplement and Fixed Instructions basic necessities within a radius not exceeding 10 kilometers from their residence or to the nearest place from their residence • Regulation 15 P.U. -

A-306 Peat and Organic Soils Challenges in Road

15TH INTERNATIONAL PEAT CONGRESS 2016 Abstract No: A-306 PEAT AND ORGANIC SOILS CHALLENGES IN ROAD CONSTRUCTION IN SARAWAK: JKR SARAWAK EXPERIENCE Vincent Tang Chok Khing Public Works Department Sarawak *Corresponding author: [email protected] SUMMARY Road construction on peat/organic soils has always posed challenges to Engineers, Contractors and policy-makers, be it a technical, contractual obligation, or cost implication. The success of road construction on soft soils relies on various important factors such as proper planning, analysis, design, construction, control and supervision. For Engineers, the primary boundary conditions are the stability and allowable settlement in terms of serviceability limits both as a function of time. Our current observation reveals that many of the road embankments and culvert foundation failures are associated with geotechnical factors. Majority of these failures are still repeating and quite identical / similar in nature that they are caused by failure to comply with one or a combination of the above factors. This paper presents some of the case histories of the road embankment construction closely related to the geotechnical factors investigated by the Author. Lastly, some simple guidelines on Method of Treatment, Cost and Design Principle to prevent future embankment failures related to geotechnical factors on soft ground are presented. INTRODUCTION Sarawak has approximately 1.7 million ha of tropical peat that covers 13% of the total land area (12.4 million ha.). It is the largest area of peatland in Malaysia. It constitutes nearly 63% of the total peatland of the country. More than 80% of the peats are more than 2.5 m depth. -

FTSE Publications

2 FTSE Russell Publications 28 October 2020 FTSE Malaysia USD Net Tax Index Indicative Index Weight Data as at Closing on 27 October 2020 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country AirAsia Group Berhad 0.16 MALAYSIA Hong Leong Bank 1.83 MALAYSIA Press Metal Aluminium Holdings 2.07 MALAYSIA Alliance Bank Malaysia 0.48 MALAYSIA Hong Leong Financial 0.66 MALAYSIA Public Bank BHD 9.5 MALAYSIA AMMB Holdings 1.1 MALAYSIA IHH Healthcare 2.99 MALAYSIA QL Resources 1.31 MALAYSIA Astro Malaysia Holdings 0.22 MALAYSIA IJM 0.87 MALAYSIA RHB Bank 1.3 MALAYSIA Axiata Group Bhd 2.49 MALAYSIA IOI 2.73 MALAYSIA Sime Darby 1.65 MALAYSIA British American Tobacco (Malaysia) 0.27 MALAYSIA IOI Properties Group 0.31 MALAYSIA Sime Darby Plantation 3.39 MALAYSIA CIMB Group Holdings 4.14 MALAYSIA Kuala Lumpur Kepong 2.05 MALAYSIA Sime Darby Property 0.38 MALAYSIA Dialog Group 3.3 MALAYSIA Malayan Banking 8.28 MALAYSIA Telekom Malaysia 0.93 MALAYSIA Digi.com 2.8 MALAYSIA Malaysia Airports 0.74 MALAYSIA Tenaga Nasional 7.53 MALAYSIA FGV Holdings 0.41 MALAYSIA Maxis Bhd 2.65 MALAYSIA Top Glove Corp 8.82 MALAYSIA Fraser & Neave Holdings 0.64 MALAYSIA MISC 1.9 MALAYSIA Westports Holdings 0.8 MALAYSIA Gamuda 1.48 MALAYSIA Nestle (Malaysia) 1.69 MALAYSIA YTL Corp 0.72 MALAYSIA Genting 1.34 MALAYSIA PETRONAS Chemicals Group Bhd 3.28 MALAYSIA Genting Malaysia BHD 1.11 MALAYSIA Petronas Dagangan 1.18 MALAYSIA Hap Seng Consolidated 0.93 MALAYSIA Petronas Gas 1.79 MALAYSIA Hartalega Holdings Bhd 5.25 MALAYSIA PPB Group 2.49 MALAYSIA Source: FTSE Russell 1 of 2 28 October 2020 Data Explanation Weights Weights data is indicative, as values have been rounded up or down to two decimal points.