Ncsoft (036570 KS) Power of Role-Playing Games

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Plenty of Positive Momentum Remains

NCSOFT (036570.KS) Plenty of positive momentum remains Company Note │Jul 6, 2020 Despite the recent sharp rise in NCSOFT’s share price, we believe that plenty ※ Refer to page 2 for of additional upward momentum remains in play, considering expectations ESG index/event tables for new games, global growth, and platform expansion. Buy (maintain) TP W1,270,000 (raise) Several attractive points on offer CP (’20/07/03) W944,000 Sector Game Adhering to a Buy rating on NCSOFT, our sector top pick, we raise our TP from Kospi/Kosdaq 2,152.41 / 752.18 W1,000,000 to W1,270,000. Given expectations for new title releases, including Market cap (common) US$17,270.50mn Blade & Soul 2 (2H20), Lineage 2M (2H20, Japan & Taiwan), Aion 2 (2021), Outstanding shares (common) 22.0mn and Project TL (2021, PC/console/mobile), the company’s new game 52W high (’20/07/02) W964,000 low (’19/07/03) W468,500 momentum looks to be entering full swing. Believing that it still boasts Average trading value (60D) US$75.08mn significant drivers of positive momentum, including: 1) the entering of a high Dividend yield (2020E) 0.64% OP growth cycle, with OP rising from W479bn in 2019 to W998.1bn (+108.4% Foreign ownership 52.0% y-y) in 2020E and W1.51tn (+51.2% y-y) in 2021F; 2) PC/mobile/console Major shareholders platform expansion; and 3) Korea/global business growth, we expect NCSOFT’s TJ Kim & 9 others 12.0% share price to continue climbing despite its recent sharp increase. -

NCSOFT (036570 KS) Blade & Soul Gaining Renewed Momentum

NCSOFT (036570 KS) Blade & Soul gaining renewed momentum Game 4Q15 review: In-line results NCSOFT reported 4Q15 revenue and operating profit that were broadly in line with our Results Comment expectations. Revenue expanded 21% QoQ to W236.9bn, with balanced growth across February 12, 2016 existing titles, while operating profit increased 48% QoQ to W74.9bn, backed by strong top-line growth. Existing titles, including Lineage I, Lineage II , Aion, and Blade & Soul, recorded strong (Maintain) Buy revenue growth QoQ. In particular, revenue from Blade & Soul jumped 30% QoQ to W32.4bn thanks to rollouts of new classes and items, which were positively received. Target Price (12M, W) 400,000 4Q15 net profit, however, fell below our estimate to W42.2bn, hurt by a goodwill impairment charge (W18.4bn) related to Ntreev Soft Share Price (2/11/16, W) 240,000 1Q16 catalysts: Blade & Soul US revenue recognition and China mobile launch Expected Return 67% Blade & Soul US , the company’s first new release in 2016, is doing much better than th initially expected. Launched on January 19 , the title has attracted more than 2mn players and currently has a total of 34 servers, after originally starting with 22. We are OP (15P, Wbn) 237 conservatively modeling quarterly revenue of W10bn for Blade & Soul US (beginning Consensus OP (15F, Wbn) 238 1Q16). Since the title is free to play, user metrics are critical in predicting revenue . With EPS Growth (15P, %) -26.9 the title still in its very early stages, we could see changes in user metric trends, which Market EPS Growth (15F, %) 19.9 would prompt revisions to our estimates. -

Battle for the Crown

Game Battle for the crown Initiate coverage on game sector at Overweight Overweight (Initiate) We initiate our coverage on the game sector with an Overweight recommendation. The game industry is undergoing consolidation, spurred by the increasing scale of Initiation Report individual mobile titles and a wave of M&A deals. We believe rising entry barriers to May 2, 2017 game development will set the stage for a “battle for the crown,” with competition between new titles and M&As becoming concentrated among top-tier firms. Mirae Asset Daewoo Co., Ltd. We see strong potential for a re-rating in the sector. As industry consolidation unfolds, we think the market will assign valuation premiums to leading gaming [Internet/Game/Advertising] companies. We also expect multiple expansions to extend into small/mid-cap stocks Jee-hyun Moon as the proliferation of development studio systems and rise in M&A deals reveal +822-3774-1640 their development capabilities and intellectual property. [email protected] 2017: More mobile releases and increased market concentration Global gaming companies are expected to release an increased number of new mobile titles in 2017. NCsoft, which was previously geared towards domestic PC games, has continued to roll out new mobile titles since late 2016, sending a number of them to the top of the charts. The company’s next new title is expected to be Lineage M. In the mobile space, we are seeing a clear shift away from casual trends to those that are more sophisticated in genre (MMORPG) and larger in scale. Looking at some of the key trends among major gaming companies, we note that larger companies are currently piling up cash, while smaller companies are focusing on new releases and entry into augmented reality (AR) and virtual reality (VR). -

Platforms Have a New Role to Play Pan-Asia Mobile Games Sector

Information Technology / Pan Asia 24 October 2014 Platforms have a new role to play Pan-Asia Mobile Games Sector • Smart devices are fast becoming the primary “screens” through which entertainment content is consumed • After casual games, we highlight “mid-core” RPGs as the next driver of growth in the region’s mobile-game industry • We favour integrated platforms over pure developers; our top picks are Daum Communications, Tencent and Square Enix How do we justify our view? See important disclosures, including any required research certifications, beginning on page 70 Information Technology / Pan Asia 24 October 2014 Platforms have a new role to play Pan-Asia Mobile Games Sector • Smart devices are fast becoming the primary “screens” through which entertainment content is consumed • After casual games, we highlight “mid-core” RPGs as the next driver of growth in the region’s mobile-game industry • We favour integrated platforms over pure developers; our top picks are Daum Communications, Tencent and Square Enix How do we justify our view? the big 3 markets to account for 38% games and other services. We also like of the global game market (including Japan’s Square Enix (Outperform mobile and other games) in 2015. [2]), which should lead the way in meeting the region’s rising demand Mid- to hard-core role-playing for quality RPGs. Thomas Y. Kwon games (RPGs) should spur (82) 2 787 9181 ARPU and extend service cycles. We rate Nexon a Buy (1), as it is [email protected] We forecast user demand for mid- to focusing on global publishing of hard-core games to rise strongly over blockbuster mobile games, while Satoshi Tanaka 4Q14-2016, driven by improving Bandai Namco (Outperform [2]) is (81) 3 5555 7049 [email protected] service infrastructure, more advanced seeing solid growth from internally devices, and growth in the number of developed IP. -

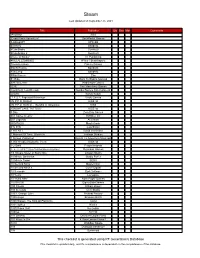

This Checklist Is Generated Using RF Generation's Database This Checklist Is Updated Daily, and It's Completeness Is Dependent on the Completeness of the Database

Steam Last Updated on September 25, 2021 Title Publisher Qty Box Man Comments !AnyWay! SGS !Dead Pixels Adventure! DackPostal Games !LABrpgUP! UPandQ #Archery Bandello #CuteSnake Sunrise9 #CuteSnake 2 Sunrise9 #Have A Sticker VT Publishing #KILLALLZOMBIES 8Floor / Beatshapers #monstercakes Paleno Games #SelfieTennis Bandello #SkiJump Bandello #WarGames Eko $1 Ride Back To Basics Gaming √Letter Kadokawa Games .EXE Two Man Army Games .hack//G.U. Last Recode Bandai Namco Entertainment .projekt Kyrylo Kuzyk .T.E.S.T: Expected Behaviour Veslo Games //N.P.P.D. RUSH// KISS ltd //N.P.P.D. RUSH// - The Milk of Ultraviolet KISS //SNOWFLAKE TATTOO// KISS ltd 0 Day Zero Day Games 001 Game Creator SoftWeir Inc 007 Legends Activision 0RBITALIS Mastertronic 0°N 0°W Colorfiction 1 HIT KILL David Vecchione 1 Moment Of Time: Silentville Jetdogs Studios 1 Screen Platformer Return To Adventure Mountain 1,000 Heads Among the Trees KISS ltd 1-2-Swift Pitaya Network 1... 2... 3... KICK IT! (Drop That Beat Like an Ugly Baby) Dejobaan Games 1/4 Square Meter of Starry Sky Lingtan Studio 10 Minute Barbarian Studio Puffer 10 Minute Tower SEGA 10 Second Ninja Mastertronic 10 Second Ninja X Curve Digital 10 Seconds Zynk Software 10 Years Lionsgate 10 Years After Rock Paper Games 10,000,000 EightyEightGames 100 Chests William Brown 100 Seconds Cien Studio 100% Orange Juice Fruitbat Factory 1000 Amps Brandon Brizzi 1000 Stages: The King Of Platforms ltaoist 1001 Spikes Nicalis 100ft Robot Golf No Goblin 100nya .M.Y.W. 101 Secrets Devolver Digital Films 101 Ways to Die 4 Door Lemon Vision 1 1010 WalkBoy Studio 103 Dystopia Interactive 10k Dynamoid This checklist is generated using RF Generation's Database This checklist is updated daily, and it's completeness is dependent on the completeness of the database. -

Korea's Online

People & Culture FEBRUARY 2011 KOREA‘S ONLINE GAME THRILLS WITH MULTIPLAYERS KOREA WORKS OUT KOREANS DASH TOWarD BETTer HeaLTH UPO WETLAND A FOUNTAIN of LIfe www.korea.net ISSN: 2005-2162 Contentsfebruary 2011 VOL.7 NO.02 02 COVER STORY As one of the world’s most wired nations, Korea’s vibrant gaming industry is booming. This is the story to look forward to in 2011. 14 PEN & BRUSH Bae Su-ah’s delicate and sensitive prose reflects a novelist of extraordinary versatility. 18 PEOPLE Carpenter Lee Jeong-seob is fond of tradition, but certainly isn’t afraid of modernity. 22 GREAT KOREAN Joseon-era artist Shin Saimdang left behind a legacy for women that has endured the ages. 24 02 MY KOREA February’s Lunar New Year holiday, or seollal, is a meaningful time for Koreans as they gather with family to welcome a new year. 28 PUBLISHER Seo Kang-soo, SEOUL Korean Culture and Information Service Seoul’s long history as a city embraces majestic architecture that includes many royal palaces. EDITING HEM KOREA Co., Ltd 30 E-MAIL [email protected] TRAVEL PRINTING Samsung Moonhwa Printing Co. Upo Wetland is Korea’s largest inland swamp and a well-known ecological reserve. All right reserved. No part of this 18 publication may be reproduced in any form without permission from 36 KOREA and the Korean Culture and NOW IN KOREA Information Service. Koreans are now turning en masse toward a healthier lifestyle – and it’s about far more The articles published in KOREA do not necessarily represent the views of than just a slim figure. -

Complete List of ALL File Extensions and Information - Botcrawl

Complete List of ALL File Extensions and Information - Botcrawl Extension Information A Image Alchemy File (Handmade Software, Inc.) A Unknown Apple II File (found on Golden Orchard Apple II CD Rom) A ADA Program A Free Pascal Archive File for Linux or DOS Version (FPC Development Team) a UNIX Static Object Code Library A Assembly Source Code (Macintosh) A00 Archive Section A01 ARJ Multi-volume Compressed Archive (can be 01 to 99) (also see .000) (can be 01 to 99) (also see .000) A01 OzWin CompuServe E-mail/Forum Access SYSOP File A01 Archive Section A02 Archive Section A02 OzWin CompuServe E-mail/Forum Access SYSOP File A03 Archive Section A03 annotare ava 04 Project File (annotare.net) A03 OzWin CompuServe E-mail/Forum Access SYSOP File A04 OzWin CompuServe E-mail/Forum Access SYSOP File A04 Archive Section A05 OzWin CompuServe E-mail/Forum Access SYSOP File A05 Archive Section A06 OzWin CompuServe E-mail/Forum Access SYSOP File A06 Archive Section A06 Lotto Pro 2002 Smart Number Ticket A07 OzWin CompuServe E-mail/Forum Access SYSOP File A07 Archive Section A07 TaxCalc Tax File (Acorah Software Products Ltd.) A08 OzWin CompuServe E-mail/Forum Access SYSOP File A08 Archive Section A09 OzWin CompuServe E-mail/Forum Access SYSOP File A09 Archive Section A1 Free Pascal Archive File for GO321v1 Platform (FPC Development Team) A1 Unknown Apple II File (found on Golden Orchard Apple II CD Rom) A10 OzWin CompuServe E-mail/Forum Access SYSOP File A11 AOL Instant Messenger (AIM) Graphic (America Online, Inc.) A2 Unknown Apple II File (found on