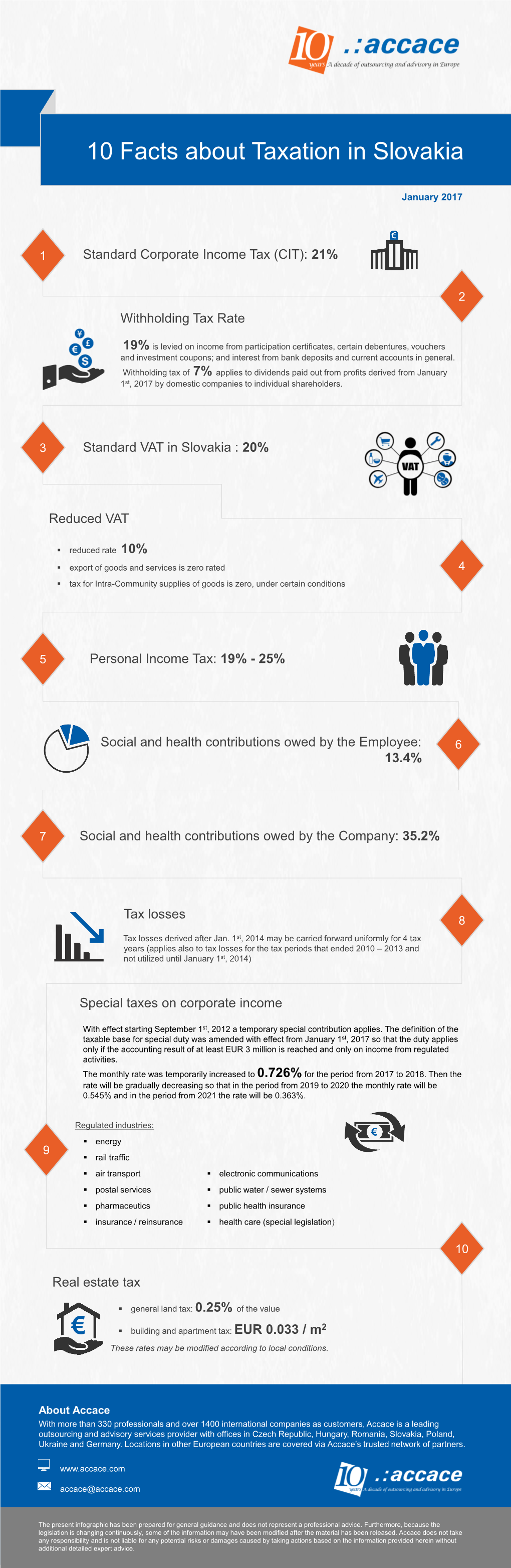

10 Facts About Taxation in Slovakia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Slovak Republic Slovak Republic

guidelines to taxation 2019 slovak republic slovak republic I TAX FRAMEWORK FOR DOING BUSINESS II SPECIAL AREAS OF TAXATION OF BUSINESS-RELATED IN THE SLOVAK REPUBLIC 382 ACTIVITIES 412 A LEGAL FORMS 382 A HOLDING STRUCTURES 412 1 Participation exemption 412 B INCOME TAX ASPECTS 383 2 Dividends 413 1 Sole entrepreneurs 383 3 Interest deduction and thin capitalization 414 2 Corporations including partnerships 390 4 Non-resident shareholders 415 3 Tax relief 392 5 Tax group 415 4 Reorganizations 393 5 Specific aspects for foreign investors 394 B REAL ESTATE INVESTMENTS 416 1 Resident investors 416 C INTERNATIONAL BUSINESS-RELATED ISSUES 398 2 Non-resident investors 417 1 Tax treaties 398 3 Real estate taxes 418 2 Transfer pricing 398 4 VAT on real estate 418 3 Controlled foreign companies 399 5 Real estate investment funds 418 4 Exit taxation 399 6 Structuring of real estate investments 419 D VALUE ADDED TAX 400 III EMPLOYEES AND BOARD MEMBERS 420 1 Taxable persons 400 A EMPLOYEES 420 2 Taxable transactions 401 1 Resident employees 420 3 Place of supply 403 2 Non-resident employees 422 4 Taxable amount 405 5 Tax rates 405 B BOARD MEMBERS 422 6 Exemptions 405 1 Executives 422 7 Input VAT deduction 406 2 Non-executives 423 8 VAT liability 407 3 Non-resident board members 423 9 Tax assessment 408 C MUNICIPAL TAX 423 E OTHER BUSINESS-RELATED TAXES 410 D SPECIFIC PROVISIONS FOR CROSS-BORDER EMPLOYMENTS 424 1 Capital duty 410 1 General provisions 424 2 Stamp duties 410 3 Customs duties 410 IV TAX ASPECTS FOR PRIVATE INVESTORS 425 4 Other excise -

International Assignment Services Taxation of International Assignees Country – Slovak Republic

www.pwc.com International Assignment Services Taxation of International Assignees Country – Slovak Republic Human Resources Services International Assignment Taxation Folio Table of Contents Introduction – International assignees working in the Slovak Republic ......................................................................... 3 Step 1 – Understanding basic principles ............................................................................................................................ 4 Step 2 – Understanding the Slovak tax system ................................................................................................................. 6 Step 3 – What to do before you arrive in the Slovak Republic ....................................................................................... 10 Step 4 – What to do when you arrive in the Slovak Republic ......................................................................................... 13 Step 5 – What to do at the end of the year ....................................................................................................................... 14 Step 6 – What to do when you leave the Slovak Republic .............................................................................................. 17 Step 7 – Health and social security contributions ........................................................................................................... 18 Step 8 – Other matters requiring consideration ............................................................................................................ -

Living and Working in Slovakia

Living and Working in Slovakia Central Offi ce of Labour, Social Affairs and Family Living and Working European Employment Services in Slovakia SLOVAKIA SLOVAKIA Basic data ____Offi cial name: Slovak Republic ____Date of inception of the Republic: 1.1.1993 ____Form of statehood: Republic ____Political system: Parliamentary democracy ____Regional cities: Bratislava, Trnava, Nitra, Trenčín, Žilina, Banská Bystrica, Prešov, Košice ____Offi cial language: Slovak ____Capital: Bratislava (population 428 672) ____Neighbouring countries: Czech Republic, Republic of Poland, Ukraine, Republic of Hungary, Austria ____Area: 49 035 km2 ____Population: 5 379 455 ____Density: 109/km2 ____Nationalities: Slovak (85.8 %), Hungarian (9.7 %), Romany (1.7 %), Czech (0.8 %), Ruthenian, Ukrainian, Russian, German, Polish and others (2 %) ____Currency: Slovak crown (koruna), 1 SKK = 100 hellers (halier) ____Membership of international organizations: EU, NATO, OSN UNESCO, OECD, OBSE, CERN, WHO, INTERPOL, etc. ______3 WORKING IN SLOVAKIA Working in Slovakia Who can work in Slovakia? Registration procedures Free movement of workers in the EU/EEC member states is one Citizens of EU/EEC member states are entitled to have their of the fundamental rights, enabling nationals of a EU/EEC member permanent residences on the territory of the Slovak Republic. When state to work in another EU/EEC member state under the same they wish to permanently reside on the SR territory, they are obliged conditions as the citizens of that member state. to register as permanent residents, present a valid travel document and a document confi rming accommodation. Similarly, the relatives By its accession to the EU Slovakia did not introduce restrictions of of citizens of EU/EEC member states are also entitled to have their access to its labour market of any other member of the European permanent residences on the SR territory. -

An Interpretation of Equity with Special Reference to Individual Tax Rates

An interpretation of equity with special reference to individual tax rates S Kalideen orcid.org/0000-0002-4268-6042 Thesis submitted in fulfilment of the requirements for the degree Doctor of Philosophy in Taxation at the North-West University Promoter: Prof K Coetzee Graduation ceremony: October 2019 Student number: 25947494 ABSTRACT The primary aim of taxes is to collect enough revenue to finance public administration and affect redistribution of income especially in developing countries. Ideal tax reform strategies should include tax base broadening, rationalization of tax rates and an overhaul of the tax laws to address the issues of equity, efficiency and simplicity. Historically, taxation has enjoyed much favour with economists either analysing equity principles or searching for the optimal tax structure. Depending on the affiliations of the economists of the era, tax systems were either progressive or proportional and levied on income or consumption. Early economists raised the issue of equity while efficiency concerns were introduced later and the trade-off between these two principals were analysed to ascertain an acceptable compromise. The South African tax system has been frequently amended on a piecemeal basis resulting in individual taxpayers contributing proportionally more every year. When equity and efficiency requirements are seen to be lacking, taxpayers may feel aggrieved resulting in non-compliance. Recently personal income tax reform, particularly in the developing world has favoured proportional rather than progressive tax systems. In an effort to simplify their tax systems numerous countries, particularly those situated in Eastern Europe have adopted a version of the Hall-Rabushka flat tax. The adoptive jurisdictions have deviated from the recommended pure consumption based flat rate tax with a basic exemption to a fixed flat rate income tax to satisfy vertical equity principles. -

Investment in Slovakia 2017

Investment in Slovakia KPMG in Slovakia May 2017 kpmg.sk Investment in Slovakia KPMG in Slovakia May 2017 SARIO SLOVAK INVESTMENT AND TRADE DEVELOPMENT AGENCY Chapters 2 and 3 were prepared in cooperation with Slovak Investment and Trade Development Agency. kpmg.sk Contents 1. Why Slovakia? 8 2. Facts about Slovakia 12 3. Labour Market 20 4. Investment Aid 28 5. Business Law 38 6. Accounting, Financial Statements and Audit Requirements 48 7. Taxation of Businesses 56 8. Taxation of Individuals 78 9. Labour Law 86 10. Living and Working in Slovakia 92 11. How KPMG Can Help 100 Investing in a new country always opens up many options, nuances and opportunities. Even the most experienced of us will need a solid foundation to feel truly confi dent every step of the way. Choosing a new country could be a puzzle in itself with many things to consider. Of course, we could talk for hours about the benefi ts of Slovakia’s geographical location, country’s welcoming tax environment or just broader business establishment conditions. What I would like to highlight, however, is the people. The pool of talent in this country is truly impressive. The desire to learn new things and acquire new skills is limitless. I am convinced that here, in Slovakia, you will be able to build a true team. We prepared this booklet with one goal in mind: to provide essential background information, which would serve as a guide for your preliminary planning efforts. We hope that it will serve as a solid starting point for your additional research when it comes to areas particularly relevant for you and your business. -

European Holding Company Analysis 2017 (Extended)

European Holding Company Analysis 2017 (Extended) Dear Nexia member, We are pleased to present an updated version of the (Extended) European Holding Company Analysis, as per January 1, 2017. We gratefully acknowledge the contributions made by the following Nexia members (in alphabetical order per country): Austria: K&E Wirtschaftstreuhand GmbH in Graz, [email protected] Belgium: VGD in Antwerpen, [email protected] Cyprus: Nexia Poyiadjis in Nicosia, [email protected] Czech Republic: VGD s.r.o. in Prague, magda.vecerova@@vgd.eu Denmark: Christensen Kjaerulff in Copenhagen, [email protected] Finland: Nexia Fiscales Ltd in Helsinki, [email protected] France: Cabinet Sevestre in Paris, [email protected] Germany: DHPG Dr. Harzem & Partner mbB in Bonn, [email protected] Greece: Nexia Eurostatus Certified Auditors S.A. in Athens, [email protected] Guernsey: Saffery Champness in St. Sampson, [email protected] Hungary: VGD Ferencz & Partner Kft. in Budapest, [email protected] Italie: TCFCT – Studio Associato Consulenza Societaria e Tributaria in Milano, [email protected] Malta: Nexia BT in San Gwann, [email protected] Netherlands, The: Koenen en Co in Maastricht, [email protected] Norway: BHL DA in Billingstad, [email protected] Poland: Advicero Tax Sp. z o.o. in Warsaw, [email protected] Slovak Republic: VGD SLOVAKIA s.r.o. in Bratislava, [email protected] Slovenia: Cautela Pros d.o.o. in Ljubljana, [email protected] Spain: LAUDIS Consultor in Barcelona, [email protected] Sweden: Nexia Revision in Stockholm, [email protected] Switzerland: ABT Treuhandgesellschaft AG in Adliswil, [email protected] United Kingdom: Saffery Champness in London, [email protected] Extended with: Hong Kong: Nexia Charles Mar Fan & Co in Kong Kong, [email protected] Singapore: Nexia TS Tax Services Pte.Ltd. -

Freedom in the World 1982 Complete Book — Download

Freedom in the World Political Rights and Civil Liberties 1982 A FREEDOM HOUSE BOOK Greenwood Press issues the Freedom House series "Studies in Freedom" in addition to the Freedom House yearbook Freedom in the World. Strategies for the 1980s: Lessons of Cuba, Vietnam, and Afghanistan by Philip van Slyck. Studies in Freedom, Number 1 Freedom in the World Political Rights and Civil Liberties 1982 Raymond D. Gastil With Essays by Charles R. Beitz Jeffrey M. Riedinger Grace Goodell Leonard R. Sussman Stephen J. Morris George Weigel John P. Powelson Lindsay M. Wright Roy L. Prosterman GREENWOOD PRESS Westport, Connecticut • London, England Copyright © 1982 by Freedom House, Inc. Freedom House, 20 West 40th Street, New York, New York 10018 All rights reserved. No portion of this book may be reproduced, by any process or technique, without the express written consent of the publisher. ISBN: 0-313-23178-8 First published in 1982 Greenwood Press A division of Congressional Information Service, Inc. 88 Post Road West Westport, Connecticut 06881 Printed in the United States of America 10 987654321 Contents MAP AND TABLES vii PREFACE ix PART I. THE SURVEY IN 1982 Freedom in the Comparative Survey 3 Survey Ratings and Tables for 1982 9 PART II. ANALYZING SPECIFIC CIVIL LIBERTIES A Comparative Survey of Economic Freedoms Lindsay M. Wright 51 Worker Freedoms in Latin America 91 The Continuing Struggle for Freedom of Information Leonard R. Sussman 101 A Preliminary Examination of Religious Freedom George Weigel 121 PART III. DEMOCRACY AND DEVELOPMENT Democracy in Developing Societies Charles R. Beitz 145 The Democratic Prerequisites of Development Grace Goodell and John P. -

Holding Regimes New EU Countries 2013

Holding Regimes New EU Countries 2013 Comparison of Selected Countries Share the Expertise © Loyens & Loeff N.V. 2013 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or in an automated database or disclosed in any form or by any means (electronic, mechanical, photocopy, recording or otherwise) without the prior written permission of Loyens & Loeff N.V. Insofar as it is permitted, pursuant to Section 16b of the Dutch Copyright Act 1912 (Auteurswet 1912) in conjunction with the Decree of 20 June 1974, Dutch Bulletin of Acts and Decrees 351, as most recently amended by the Decree of 22 December 1997, Dutch Bulletin of Acts and Decrees 764 and Section 17 of the Dutch Copyright Act 1912, to make copies of parts of this publication, the compensation stipulated by law must be remitted to Stichting Reprorecht (the Dutch Reprographic Reproduction Rights Foundation, PO Box 3060, 2130 KB Hoofddorp, the Netherlands). For reproductions of one or more parts of this publication in anthologies, readers or other compilations (Section 16 of the Dutch Copyright Act 1912), please contact the publisher. This publication does not constitute tax or legal advice and the contents thereof may not be relied upon. Each person should seek advice based on his or her particular circumstances. Although this publication was composed with the greatest possible diligence, Loyens & Loeff N.V., the contributing firms and any individuals involved cannot accept liability or responsibility for the results of any actions taken on the basis of this publication without their cooperation, including any errors or omissions. -

Slovakia – Tax Considerations on Short-Term Lettings

This guide has been prepared by an independent third-party accounting firm January 2019 SLOVAKIA – TAX CONSIDERATIONS ON SHORT-TERM LETTINGS The following information is a guide to help you get started in learning about some of the tax requirements that might apply to you when providing short-term accommodation in Slovakia. Tax can be tricky and it is important to ensure that you keep up to date with your tax obligations and remain tax compliant. The timely preparation, filing and payment of taxes are your responsibility. If you are supplying short-term accommodation in Slovakia, you should make sure that you understand each of the following types of taxes, and pay the ones that apply to you; ! Income taxes ! Value added tax (VAT) Please understand that this information is not comprehensive, and is not intended to be legal or tax advice. If you are unsure about your local tax obligations, we encourage you to check this with official local sources, or to seek advice from qualified professionals. Please note that we do not update this information in real time, so you should confirm that the laws or procedures have not changed recently. INCOME TAX Where you earn income in Slovakia, it is likely that you will be required to pay a percentage of the tax on this income to the Slovak tax authorities. Below is a brief outline of tax that may arise on income earned from short-term lettings in Slovakia and some information on how this tax can be paid over to the Slovak tax authority. Slovakia’s tax year runs from 1 January to 31 December. -

Administrative Costs of Taxation in Slovakia Juraj Nemec – Ladislav Pompura – Vladimír Šagát

Administrative Costs of Taxation in Slovakia Juraj Nemec – Ladislav Pompura – Vladimír Šagát Abstract: This article reports an investigation into the administrative costs of the Slovak tax system. By applying methodology used in the Czech Republic, it analyses the administrative costs of taxation in Slovakia between 2004 and 2011. The results show that Slovakia has relatively high costs of tax administration compared to other developed countries, including its neighbours - the V4 countries. We argue that most of the higher relative cost is caused by subjective – speculative factors that will be addressed by ongoing tax system reforms. Key Words: Administrative costs of taxation; Tax administration; Slovakia. JEL Classification: H20. 1 Introduction In the theory and practice of Slovak taxation, administrative costs have been considered mostly in connection with questions of efficiency, and with the process of tax harmonization and coordination that is connected with ongoing integration processes. The issue of their measurability and the effort to create a unified methodology, in order to eliminate existing bureaucratic barriers, and the necessity of building a new institutional base for the tax system, did not arise until an OECD study highlighted the higher rate of administrative costs of taxation in transition economies. That study motivated our own study of these issues for the Slovak Republic. It is prefaced by a short summary of current theory and empirical research, and uses a methodology first employed in the Czech Republic. 2 Theoretical basis and existing investigations The first integrated concept of taxation expenses was presented by Smith (2005), whose principles of taxation involved in the Canons of Taxation formed the starting point for the study of the theory and practice of the administrative costs of taxation. -

AN ESTIMATION of the COMPLIANCE COSTS of SLOVAK TAXATION Juraj Nemec, Pavol Čižmárik, Vladimír Šagát

Economics AN ESTIMATION OF THE COMPLIANCE COSTS OF SLOVAK TAXATION Juraj Nemec, Pavol Čižmárik, Vladimír Šagát Introduction “administrative costs of taxation” as a subset The fi rst integrated concept of taxation of the public sector’s expenses, in which he expenses was presented by Smith (2005), also includes so-called other or sundry costs. whose Canons of Taxation formed the starting A second group of authors divide the costs point for the study of the theory and practice of taxation into two subsets. The fi rst subset of taxation. Equity, certainty, convenience and “direct administrative costs” are the direct effi ciency represent the principles that inform costs of the public sector. The second subset the development of contemporary taxation the “compliance costs of taxation” are the theory and infl uence the development of indirect expenses of the private sector. Our opinion on the additional expenses of taxation, understanding of the term “costs of taxation” is both in the public and private sectors, which set out in Fig. 1 and will be used in the analytical will be the main object of our interest. What part. is most signifi cantly connected to our theme Investigations into the costs of taxation, is the effi ciency of taxation, which appears to which began before the Second World War (for be a chronic problem, and hence has been the example Haig (1935)), grew rapidly in the 1950’s focus of both theoretical and empirical work in and 1960’s (Oster & Lynn, 1955; Matthews, recent decades. The productivity of tax offi cials 1957; Bryden, 1961; Johnston, 1963) and peaked with seminal works by Sandford and and the compliance costs of taxpayers have his group (1989; 1995), Slemrod and Sorum been the focus of researchers for many years (1984) and Vaillancourt (1987). -

Doing Business in Slovakia

Doing business in Slovakia 2019 2 Content Page Content 3 Foreword 4 Country profile 6 Regulatory environment 12 Finance 15 Imports 20 Business entities 23 Labour 29 Financial reporting and audit 34 Contact details 51 “Our team of highly ambitious and experienced people are prepared to serve the demands of our clients. Being part of an international organization allows us to understand the needs of our international clients. We always deliver a professional service with a personal touch and a smile”. Wilfried Serles, Managing Partner Grant Thornton Slovakia 3 Foreword Grant Thornton Audit, s.r.o. in Slovakia Grant Thornton Consulting, k. s. in Slovakia Valid as of January 2019 Member of Grant Thornton International Our services: Grant Thornton Consulting, k. s. and Grant Thornton Audit, s.r.o. offer you: AUDIT Obligatory and voluntary audits of annual financial statements and group financial statements Audits of non-profit organisations and foundations Due diligence Audits under capital market law as reviews of prospects and reviews of management reports High Level Reviews Agreed upon procedures Special reviews (in case of change, merger, reviews under securities law, etc.) Implementation and audit of financial analyses Analysis of risk of misappropriation and fraud TAX National and international tax planning, tax optimization Preparation of tax returns, review of adjustment notices Support for the preparation of transfer pricing documentation Representation in dealings with financial authorities, including tax audits and