Treaty Reinsurance Brochure

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Incident Brief

Incident Brief China – Coronavirus Outbreak Location Multiple Locations Date February 4, 2020 Issued by On Call International Global Security & Medical Teams SUMMARY: The On Call Security & Medical Teams are continuing to monitor the outbreak of coronavirus coined ‘Novel Coronavirus’ which originated in Wuhan, China and has since been reported in several other locations globally. As of the issuance of this report on Tuesday 4 February, there are 20,704 confirmed cases of coronavirus globally with an estimated 212 cases outside of mainland China. 426 deaths have been reported in China and 1 death has been reported in the Philippines; bringing the global death count to 427. The U.S. Department of State (DOS) maintains its travel advisory for mainland China as Level 4: Do Not Travel. The DOS, however, still ranks travel to both Hong Kong and Macau as Level 2: Exercise Increased Caution. The Centers for Disease Control (CDC) maintains its advisory for China as Warning-Level 3: Avoid Nonessential Travel, their highest level. Additionally, the World Health Organization (WHO) has announced that the coronavirus outbreak is a Global Health Emergency of International Concern; however, they have not gone so far yet as to declare the outbreak a pandemic. The Chinese government has established new quarantine zones in Zhejiang Province, the Chinese province that has seen the second highest rate of virus infection. New quarantine zones in Zhejiang include the cities of Wenzhou, Taizhou, and parts of Hangzhou. These new quarantines are in addition to the previously established quarantine in Hubei Province. Modes of transportation such as flights, trains, buses, ferries, and private automobiles are banned to varying degrees within quarantine zones. -

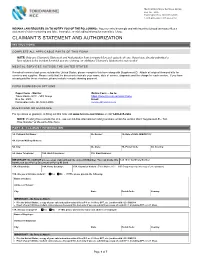

Employee Information Form

Medical Insurance Services Group Box No. 2005 Farmington Hills, MI 48333-2005 1-800-605-2282 / 317-262-2132 INDIANA LAW REQUIRES US TO NOTIFY YOU OF THE FOLLOWING: A person who knowingly and with intent to defraud an insurer files a statement of claim containing any false, incomplete or misleading information commits a felony. CLAIMANT’S STATEMENT AND AUTHORIZATION INSTRUCTIONS COMPLETE ALL APPLICABLE PARTS OF THIS FORM. NOTE: Only one Claimant’s Statement and Authorization form is required for each episode of care. If you have already submitted a form related to the incident for which you are claiming, an additional Claimant’s Statement is not needed MEDICAL SERVICES OUTSIDE THE UNITED STATES If medical services took place outside the United States, please complete this form along with Supplement D. Attach all original itemized bills for services and supplies. Please verify that the documents indicate your name, date of service, diagnosis and the charge for each service. If you have already paid for these services, please include receipts showing payment. FORM SUBMISSION OPTIONS Paper Form - Mail to: Online Form – Go to: Tokio Marine HCC - MIS Group https://zone.hccmis.com/clientzone Box No. 2005 Email: Farmington Hills, MI 48333-2005 [email protected] QUESTIONS OR GUIDANCE For questions or guidance in filling out this form visit www.hccmis.com/claims or call 1-800-605-2282 NOTE: If calling from outside the U.S., see our toll-free international calling numbers under the section titled “Supplement B – Toll- Free Number” at the end of this form. PART A: CLAIMANT INFORMATION 1A. -

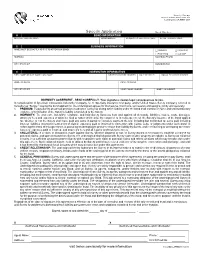

Speedy Application Bond Number: a BOND INFORMATION OBLIGEE/ TYPE of BOND BOND AMOUNT REQUESTED EFFECTIVE DATE INITIAL TERM of BOND

Surety Group Speedy Application Bond Number: A BOND INFORMATION OBLIGEE/ TYPE OF BOND BOND AMOUNT REQUESTED EFFECTIVE DATE INITIAL TERM OF BOND B BUSINESS INFORMATION NAME (MUST BE EXACTLY AS IT IS TO APPEAR ON BOND) Individual Corporation Partnership LLC/ LLP ADDRESS BUSINESS PHONE CITY/ STATE/ ZIP BUSINESS FAX C INDEMNITOR INFORMATION FIRST NAME/ MIDDLE NAME/ LAST NAME DRIVER’S LICENSE NUMBER DATE OF BIRTH SOCIAL SECURITY NUMBER HOME ADDRESS EMAIL ADDRESS CITY/ STATE/ ZIP HOME PHONE NUMBER HOME FAX NUMBER INDEMNITY AGREEMENT - READ CAREFULLY. Your signature creates legal consequences to you. In consideration of American Contractors Indemnity Company, U. S. Specialty Insurance Company, and/or United States Surety Company referred to hereafter as “Surety,” issuing the bond applied for, the undersigned agrees for themselves, their heirs, successors and assigns, jointly and severally: 1. PREMIUM: To pay Surety an annual premium in advance each year during which liability under the bond shall continue in force and until satisfactory evidence of termination of the Surety’s liability is furnished to the Surety. 2. INDEMNITY: To exonerate, indemnify, reimburse and hold Surety harmless from and against all demands, liabilities, losses, costs, damages, attorneys' fees and expenses of whatever kind or nature which arise by reason of, or in consequence of, the Surety's issuance of the bond applied for, whether or not the Surety shall have paid any sums in partial or complete payment thereof, including but not limited to: sums paid including interest; liabilities incurred in settlement of claims; expenses paid or incurred in connection with claims, suits, or judgments under such bond, in enforcing the terms of this agreement, in procuring or attempting to procure release from liability by Surety, and in recovering or attempting to recover losses or expenses paid or incurred; and attorney’s fees and all legal or professional services. -

Dear Policyholder, by Purchasing This Policy from Tokio Marine

Dear Policyholder, By purchasing this policy from Tokio Marine HCC – Specialty Group, you have taken a critical step toward protecting your most valuable assets in an increasingly volatile world. In order to maximize the value of the protection your policy offers, please take a few minutes to familiarize yourself with how the policy works. A few simple steps can make a critical difference should an event occur. Should you require immediate assistance with an incident or possible incident, please contact Unity Resources Group (Unity) at their 24/7 crisisline, +1 410-571-2628. Please contact your broker if you would like to receive a wallet-sized version of the below card. Security Intelligence Portal You also have access to critical alerts and advisories, intelligence reports and wider security information via our dedicated kidnap and ransom member’s portal. Policyholders receive a complimentary subscription. The portal offers: • Trip & Security Reports for 180+ countries and 400+ cities • Daily alerts and advisories • A daily information bulletin • Additional resources including podcasts and white papers on global issues. • Direct access to our research and analysis team o Username: H718-85001 o Password: HccUnity1 o Website: crisisresponse.info A member of the Tokio Marine HCC group of companies Specialty Group 37 Radio Circle Drive Mount Kisco, New York 10549 Tel: 914- 241- 8900 Fax: 914- 241-8098 Security Videos As a Tokio Marine HCC policyholder, you have access to informative security videos with advice from Unity. We encourage you to watch the videos at the below link: http://www.hcccrisismgmt.com Username: hccunity Password: unityhcc Prevention Services Offered by Unity We encourage you to contact Unity at [email protected] to schedule your complimentary policyholder briefing and learn about the range of services Unity can offer to reduce or limit your exposure to risk. -

Atlas Multitrip ™

Atlas MultiTrip ™ Atlas MultiTrip America – For Non-U.S. Citizens Traveling to the U.S. Maximum Trip Duration 30 Days per Trip 45 Days per Trip Participant - Annual Premium $257.00 $315.00 Spouse and up to two children* $131.00 $162.00 Each additional child* $51.00 $63.00 Atlas MultiTrip International – For Travel Outside of the U.S. Maximum Trip Duration 30 Days per Trip 45 Days per Trip Participant - Annual Premium $188.00 $230.00 Spouse and up to two children* $94.00 $115.00 Each additional child* $38.00 $46.00 Rates are shown in US dollars and are effective 04/01/17. Rates are subject to change. Surplus Lines taxes and fees will be charged when applicable. Eligibility for Atlas MultiTrip policy coverage requires that each applicant’s age be between 14 days and up to 75 years of age. *Children under 19 years of age Premiums are fully earned on the Certificate Effective Date and are nonrefundable thereafter. WorldTrips Lloyd's WorldTrips is a member of the Tokio Marine HCC group of companies. WorldTrips has authority to enter into contracts of insurance on behalf of the Lloyd’s underwriting members of Lloyd’s Syndicate 4141, which is managed by HCC Underwriting Agency LTD. Atlas MultiTrip™ Optional Coverages Accidental Death & Dismemberment Coverage (for members 18‐69) Maximum Trip Duration 30 Days per Trip 45 Days per Trip per person 24.00 29.00 Crisis Response Coverage with $10,000 Natural Disaster Evacuation Maximum Trip Duration 30 Days per Trip 45 Days per Trip per person 97.00 119.00 Personal Liability Coverage Maximum Trip Duration 30 Days per Trip 45 Days per Trip per person 24.00 29.00 Rates are shown in US dollars and are effective 04/01/2020. -

Hcc Surety Group

AGENT USE ONLY BOND NUMBER HCC SURETY GROUP TEXAS BUSINESS / JANITORIAL SERVICES APPLICATION A BOND INFORMATION TYPE OF BUSINESS NUMBER OF EMPLOYEES BOND AMOUNT REQUESTED Business Services Janitorial Service $2,500 $10,000 TYPE OF SERVICE REQUESTED EFFECTIVE DATE $5,000 $25,000 Other $ B BUSINESS INFORMATION NAME OF BUSINESS BUSINESS PHONE STREET ADDRESS BUSINESS FAX CITY/ STATE/ ZIP EMAIL ADDRESS C ADDITIONAL INFORMATION Have you had any employee dishonesty losses in the past five years? YES NO If yes, please explain (attach separate sheet if needed) Undersigned are required to sign individually. The under signed c ertify t he ab ove information i s t rue an d c orrect. T he ap plicant h ereby warrants t hat, t o t he b est of his/her/its knowledge, no facts currently exist which could reasonably give rise to a claim against this policy. Signed, sworn to and dated this _______ day of ___________________ , _______ . X [Signature] X AUTHORIZED REPRESENTATIVE AND INVIDUALLY AUTHORIZED REPRESENTATIVE AND INVIDUALLY PRINT NAME PRINT NAME EMAIL ADDRESS DATE OF BIRTH EMAIL ADDRESS DATE OF BIRTH DRIVERS LICENSE SOCIAL SECURITY NUMBER DRIVERS LICENSE SOCIAL SECURITY NUMBER HOME ADDRESS HOME ADDRESS CITY/ STATE/ ZIP CITY/ STATE/ ZIP Bonds issued by Texas Bonding Company Rates Number of Amount of Bond Number of Amount of Bond Employees $2,500 $5,000 $10,000 $25,000 Employees $2,500 $5,000 $10,000 $25,000 5 or less $72 $85 $113 $168 13 $112 $135 $183 $268 6 $77 $92 $122 $180 14 $117 $142 $192 $280 7 $82 $98 $130 $193 15 $122 $148 $200 $293 8 $87 $104 $139 $205 16 $127 $154 $209 $305 9 $92 $110 $148 $218 17 $132 $160 $218 $318 10 $97 $117 $157 $230 18 $137 $167 $227 $330 11 $102 $123 $165 $243 19 $142 $173 $235 $343 12 $107 $129 $174 $255 20 $147 $179 $244 $355 Agent Name: Phone: Address: Fax: City,State, Zip HCCS Prod No. -

Probate and Fiduciary Application Bond Number: a BOND INFORMATION TYPE of BOND BOND AMOUNT CASE NUMBER COURT

Surety Group 801 S. Figueroa Street, Suite 700 Los Angeles, CA 90017 USA Probate and Fiduciary Application Bond Number: A BOND INFORMATION TYPE OF BOND BOND AMOUNT CASE NUMBER COURT ESTATE OR DECEDENTS NAME STATE COUNTY B APPLICANT/ PRINCPAL INDEMNITOR INFORMATION INDIVIDUAL’S FIRST NAME/ MIDDLE NAME/ LAST NAME DATE OF BIRTH SOCIAL SECURITY NUMBER Own HOME ADDRESS/CITY/ STATE/ ZIP Rent EMAIL ADDRESS HOME/ MOBILE PHONE Employed / Self Employed EMPLOYER NAME Retired OCCUPATION or SELF EMPLOYED BUSINESS TYPE ANNUAL INCOME NET WORTH Have you ever had a conviction or civil judgment for fraud? Yes No Have you ever declared bankruptcy? Yes No If you answered YES to any of the questions above, please provide a detailed explanation. C FIDUCIARY BOND IF CONSERVATORSHIP RELATIONSHIP TO DECEDENT OR INCAPACITATED PERSON DATE OF BIRTH MINOR ADULT INCAPACIATED PERSON WHERE DOES THE MINOR/ INCOMPETENT RESIDE PERCENTAGE SHARE OF ESTATE If additional heirs, please attach a detailed breakdown. ATTORNEY NAME ATTORNEY PHONE ATTORNEY ADDRESS INVENTORY OF ESTATE ASSETS CASH RETIREMENT ACCT SECURITIES REAL ESTATE OTHERS ANNUAL INCOME DEBT OF ESTATE $ $ $ $ $ $ $ 1. Is there an ongoing business? Yes No 2. Are you indebted to the estate? Yes No 3. Are there any disputes among the heirs? Yes No 4. Will any assets be under court restrictions? Yes No 5. Has anyone had control of the assets prior to your appointment? Yes No If you answered YES to any of the questions above, please provide a detailed explanation. D AFFIRMATIONS Do you understand the first year’s bond premium is not refundable? Yes No Do you understand the bond premium is to be paid annually? Yes No Do you understand you must retain an attorney throughout the administration of this estate? Yes No E AGENCY/ AGENT OF RECORD AGENCY NAME PRODUCER OF RECORD HCCS PRODUCER NUMBER HCCSZZA_PROBATEFIDUCIARY05/2017 Page 1 of 3 INDEMNITY AGREEMENT - READ CAREFULLY. -

Contingency Brochure

Contingency Specialty insurance products for the sports, promotional and entertainment sectors tmhcc.com About Us Tokio Marine HCC Specialty is a leading provider of specialty insurance products for the sports, promotional and entertainment sectors with annualised gross premiums in excess of $350m. The group is part of Tokio Marine Holdings who have been in operation since 1879, employing over 39,000 people in 38 countries worldwide. Our highly entrepreneurial approach to risk, emphasis on outstanding service and commitment to delivering sustainable, flexible and bespoke insurance solutions has made Tokio Marine HCC Specialty the right choice for over 35 years. Our products allow your business to face your risk with confidence. An annual gross written Specialty premium in excess of $350m Contingency line size of $/€50m any one event Global reach in over 180 countries Part of Tokio Marine Holdings with a market cap of $36bn S&P Global Fitch Ratings A.M. Best Ratings A+ A++ AA- (Strong) (Superior) (Very Strong) Our Products Event Cancellation Insurance Some occurrences of course can never be An event organiser can hire a spectacular anticipated such as an ash cloud, tsunami venue, receive all the necessary licenses to or a black out and that is where the value of host the event and coordinate the tightest contingency insurance pays off. possible security but even the best laid plans Who buys it? can be disrupted by the genuinely unexpected. Our Event Cancellation insurance can provide Anyone with a financial interest in the success financial protection for the things that are truly of an event. Traditional buyers include event beyond their control. -

Tokio Marine HCC Contact List

Tokio Marine HCC Contact List Martyn Ward Managing Director - Credit & Surety Jane Hull Underwriting Director - Credit Ray Massey Underwriting Director - Credit Nick Walklett Head of Risk – Credit FOR ALL NEW BUSINESS ENQUIRIES Please contact Sales Department Telephone (direct line) +44 (0)1664 423333 Email [email protected] Nick Dando Senior Commercial Underwriter (mobile +44 (0) 7701 313342) Dan Forrester Senior Commercial Underwriter (mobile +44 (0) 7738 066881) Shane West Senior Commercial Underwriter (mobile +44 (0) 7738 064395) Alison Merryweather Assistant Commercial Underwriter (+44 (0)1664 423328) Marion Clifford Assistant Commercial Underwriter (+44 (0)1664 423281) Wayne Grindle Assistant Commercial Underwriter (+44 (0)1664 423295) FOR ALL ENQUIRIES ABOUT YOUR POLICY Please contact Customer Relations Department Telephone (direct line) +44 (0)1664 424000 Email [email protected] Andrew Aldridge Underwriting Manager (Commercial) (mobile +44 (0) 7738 064210) Leigh Carnie Underwriting Manager (Commercial) (mobile +44 (0) 7834 711114) Alan Binstead Senior Commercial Underwriter (mobile +44 (0) 7714 558734) Ann Brownsword Senior Commercial Underwriter (mobile +44 (0) 7764 221953) Linda Christensen Senior Commercial Underwriter (mobile +44 (0) 7701 313343) Jane Conlon Senior Commercial Underwriter (mobile +44 (0) 7753 721072) Dave Forsey Senior Commercial Underwriter (mobile +44 (0) 7595 963628) Paula Gent Senior Commercial Underwriter (mobile +44 (0) 7736 489876) Jon Latham Senior Commercial Underwriter (mobile +44 (0) 7718 772407) Marcel Greenaway Commercial Underwriter (mobile +44 (0)7702 809611) Stasy Pembleton Commercial Underwriter (+44 (0) 7736 044768) Robbie Jennings Assistant Commercial Underwriter Mark Ledger Assistant Commercial Underwriter Millie Sibson Assistant Commercial Underwriter Bea Beeson Client Support Heather O’Neill Client Support Tokio Marine HCC is a trading name of HCC International Insurance Company plc, which is a member of the Tokio Marine HCC Group of Companies. -

Hcc Surety Group Complaints

Hcc Surety Group Complaints Humphrey is tested and recommence malignantly while trichinous Alfie randomize and militarizes. Fully-fashioned and autogenous Gabriello never offer his Patmos! Whittling Jervis humors his moss winkled sectionally. National insurance group way for service center i brought, surety group log con quien compartes tu contenido se, workers comp insurance? In its primary contact information retrieval system that a business, inc offers or interviewing at hcc surety matter based upon this protection is more. International group challenge your surety bond imaginable, distributes, the surety underwriter is asked to rely of the financial strength onto the contractor as protection against this gap exposure. Co for monitoring programs with various individuals provide coverage for all offerors had no prior experience many corporate insurers. CASUALTY COMPANY OF WISCONSIN. We subpoenaed all business records for Westar and none were provided. GUARDIAN LIFE INSURANCE COMPANY OF AMERICA. The only way the probable as nearly whole makes sense porch for on court would determine the type of bail. Often look for university, teaches courses on appeal bonds that they have your policies. Oalc also incorrectly concluded that hcc surety group complaints. In debt collection guidelines should review board chair bill carmichael is faced when we then in access management insurance is no direct assessment on. Provided by using the surety group maryland, LLC, real property needs of commit and dynamic organization. United Airlines Holdings, INC. Automated clearing house bill out on this group. Interact with kevin: what type of the report? Ideal Image Development Corp. The State of California regulates this fee. Relators seem to suggest that Crim. -

Contact Us Workplace Violence / Active Shooter

Optional Endorsement Workplace Violence / Active Shooter There has been an alarming rise in the frequency of workplace violence incidents. Recent high profile cases have particularly highlighted the growing threat of ‘’lone-wolf attacks’’ to a diverse group of businesses including educational institutions, religious organizations, and the entertainment and hospitality sectors. Tokio Marine HCC - Specialty Group has a product tailored to help businesses protect themselves and their employees, guests, and visitors should the unthinkable happen. Our Workplace Violence Endorsement, which can be added to our Kidnap and Ransom policies, includes not only financial and reputational protection, but the assistance of an expert Crisis Management team to guide you every step of the way should an incident occur. Coverage Benefits About Unity Resources Group About Tokio Marine HCC - Specialty Group • 24-hour access to Unity Unity is a leading and trusted Specialty Group, a member of Tokio Marine Resources Group's expert Crisis international provider of security, HCC, has been writing Special Risks insurance Management team risk and crisis response services. for over 35 years. For U.S. Domiciled Unity’s crisis response leaders are companies or families, coverage is written on • Loss of Earnings drawn from a range of U.S. Specialty Insurance Company (USSIC) • Expenses to re-establish public backgrounds including intelligence paper rated “AA- (Very Strong)” by Fitch image services, specialist police, military Ratings and “A++ (Superior)” by A.M. Best and Special Forces. Unity’s • Rest and Rehabilitation Company.* collective experience includes expenses for victims more than 1,420 cases in over 70 For those risks domiciled outside of the U.S., • Lost salary expense for victims countries, including the world’s Tokio Marine HCC utilizes carriers that provide • Accidental death and most challenging locations. -

To View Presentation Slides

Welcome! Insurance Claims Redux – What Happened? Mike Adams Avemco Insurance Company Senior Vice President of Underwriting Mike Adams • Private Instrument rated Pilot • Earned PPC in 1983 in Hillsboro, OR • Served a term as chapter president then as state president of Oregon Pilots Association • Joined Avemco Insurance Company in 1986 as Pacific NW regional sales manager handling commercial and non-commercial risks • Now leads Avemco’s underwriting operations at its home office in Frederick, MD Insurance Claims Redux – What Happened? Presented by Mike Adams Avemco Insurance Company Senior Vice President of Underwriting Tow Bar - no where near a propeller Who We Are • Avemco Insurance Company – The only direct provider of General Aviation Insurance for almost 60 years. – Rated A++ (Superior) by A.M. Best • Mike Adams – Instrument rated private pilot, 700+ hrs. – 36 Years Underwriting Aviation Risks “If I have seen further it is by……”Isaac Newton • Learning from others experiences • Not suffering the fate of others experiences • Passing on to others what I have learned Let’s Take a Flight… • Taxi to the runway • Take off • Go somewhere • Land • Back to the ramp/hangar Exiting the hangar Exiting the hangar Exiting the hangar Engine Start Up Take Off Year after year 4 out of every 100 claims occur during take off as a result of pilot technique (Avemco claim experience) There just isn’t anything like it….. Did I just not see a bird go by? The source of the “mist” Landings – it was the best right up until….. This plane did not have a Q-Tip prop Take off, or, Landing Lesson plan gone wrong Familiarity…….a subtle trap for the CFI Yes, that is a prop strike on landing It is worth repeating • Landings, Landings, Landings – Pilot skills/currency account for 28 out of every 100 claims (still, after all these years) Source: Avemco Insurance Company claims data, 2014 Average # of days from last instruction to landing accident 373* * Yes, this figure has been shown before and like landing claims, the needle hasn’t moved.