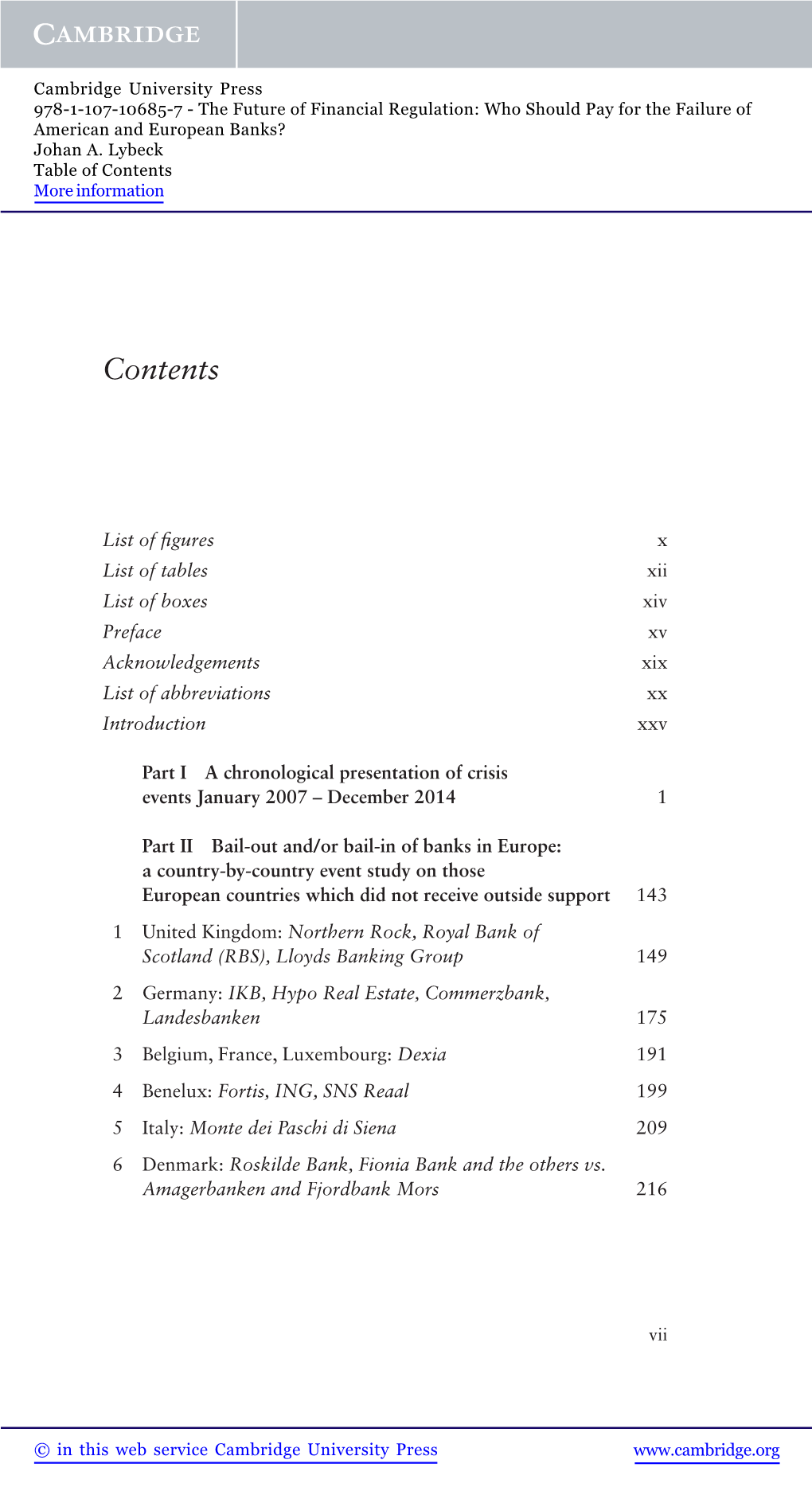

Contents More Information

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Bad Bank Resolutions and Bank Lending by Michael Brei, Leonardo Gambacorta, Marcella Lucchetta and Bruno Maria Parigi

BIS Working Papers No 837 Bad bank resolutions and bank lending by Michael Brei, Leonardo Gambacorta, Marcella Lucchetta and Bruno Maria Parigi Monetary and Economic Department January 2020 JEL classification: E44, G01, G21 Keywords: bad banks, resolutions, lending, non-performing loans, rescue packages, recapitalisations BIS Working Papers are written by members of the Monetary and Economic Department of the Bank for International Settlements, and from time to time by other economists, and are published by the Bank. The papers are on subjects of topical interest and are technical in character. The views expressed in them are those of their authors and not necessarily the views of the BIS. This publication is available on the BIS website (www.bis.org). © Bank for International Settlements 2020. All rights reserved. Brief excerpts may be reproduced or translated provided the source is stated. ISSN 1020-0959 (print) ISSN 1682-7678 (online) Bad bank resolutions and bank lending Michael Brei∗, Leonardo Gambacorta♦, Marcella Lucchetta♠ and Bruno Maria Parigi♣ Abstract The paper investigates whether impaired asset segregation tools, otherwise known as bad banks, and recapitalisation lead to a recovery in the originating banks’ lending and a reduction in non-performing loans (NPLs). Results are based on a novel data set covering 135 banks from 15 European banking systems over the period 2000–16. The main finding is that bad bank segregations are effective in cleaning up balance sheets and promoting bank lending only if they combine recapitalisation with asset segregation. Used in isolation, neither tool will suffice to spur lending and reduce future NPLs. Exploiting the heterogeneity in asset segregation events, we find that asset segregation is more effective when: (i) asset purchases are funded privately; (ii) smaller shares of the originating bank’s assets are segregated; and (iii) asset segregation occurs in countries with more efficient legal systems. -

Summary of Government Interventions in Financial Markets Denmark

8 September 2009 Summary of Government Interventions in Financial Markets Denmark Overview and which is wholly owned by the Kingdom of Denmark. The Winding-Up Company is responsible for In response to effect of the crisis on Danish financial covering the unsecured claims and has a power to wind markets, Denmark, similar to the US, the UK, up a bank which fails to meet the statutory capital Germany, Ireland and the Netherlands, has established adequacy requirements and for which no sustainable a state guarantee scheme and a bailout package to private sector solution can be found. The Winding-Up ensure financial stability in the country. Company will contribute to a new subsidiary in order to take over the distressed bank and wind it up in a State guarantee scheme controlled way to safeguard unsecured creditors against losses. On 5 October 2008, the Danish Government and the Private Contingency Association (the “PCA”, in Danish: The scheme covers all Danish banks which were Det Private Beredskab, which was established in 2007 members of the PCA prior to 13 October 2008 and may and comprises nearly all Danish banks), agreed to cover their foreign branches, provided they are in a establish a safety scheme to ensure that depositors and country with a corresponding guarantee scheme. (in respect of Danish banks only) other unsubordinated Danish branches of foreign banks can also access the and unsecured creditors are protected. scheme but will only receive coverage for a limited type of claim (i.e. deposits of a type covered by the Danish The guarantee scheme provides that the Kingdom of Deposit Guarantee Scheme). -

Back to the 'Domestic' Future: Pricewaterhousecoopers M&A

Financial Services Back to the ‘domestic’ future* From strategic expansion to rapid contraction in financial services M&A in EMEA March 2009 *connectedthinking Contents Welcome 3 Annus horribilis 6 2008: year zero for Financial Services M&A 9 Valuations: fundamental value or hope, fear and greed? 12 UK large cap: the government steps in 15 UK mid-market: balance sheet restructuring driving non-core disposals 17 Western & Northern Europe: crisis leads to increased government involvement 19 Central, Eastern and South Eastern Europe and the CIS: the tide turns 22 Middle East and North Africa: shifting sands 25 Sub-Saharan Africa: feeling the heat? 28 The buyout market: down but not out 30 Speciality finance: coming in from the cold? 34 Infrastructure: the next big thing? 36 Investment management: at a crossroads 38 Distressed assets return to prominence 40 Does the industry need a new mindset? 42 The day after tomorrow 44 Greater domestic focus, lower valuations and restructuring 46 PricewaterhouseCoopers Back to the ‘domestic’ future 3 Welcome This 6th annual review of European Financial Services M&A has been written by a broader range of authors than previously. It comprises a series of articles covering specific issues and geographical areas. Notwithstanding this change, we continue to deliver in-depth deal analysis and still provide a consistent and continuous means to compare and contrast activity. We have also chosen to expand the scope of our report to embrace the Middle East and African markets. As a result, we now offer a comprehensive Europe, Middle East and Africa (EMEA) perspective. 2008 will be remembered as the year in which the developed economies entered recession and economists downgraded economic growth expectations (Figure 1). -

EU State Aid Rules and the Lender of Last Resort: Challenges to the Notion of State Aid in the Wake of the Financial Crisis

Department of Law EU State Aid Rules and the Lender of Last Resort: Challenges to the Notion of State Aid in the Wake of the Financial Crisis Kira Krissinel Thesis submitted for assessment with a view to obtaining the degree of Master in Comparative, European and International Laws (LL.M.) of the European University Institute Florence, October 2010 EUROPEAN UNIVERSITY INSTITUTE Department of Law EU State Aid Rules and the Lender of Last Resort: Challenges to the Notion of State Aid in the Wake of the Financial Crisis Kira Krissinel Thesis submitted for assessment with a view to obtaining the degree of Master in Comparative, European and International Law (LL.M.) of the European University Institute. Supervisor: Prof. Heike Schweitzer, University of Mannheim © 2010, Kira Krissinel No part of this thesis may be copied, reproduced or transmitted without prior permission of the author INTRODUCTION 4 PART I - OVERVIEW OF THE LEGAL FRAMEWORKS 6 THE ‘NO CRISIS’ LEGAL FRAMEWORK 6 CASE STUDY 1: NORTHERN ROCK 8 CASE STUDY 2: ROSKILDE BANK 9 THE ‘IN CRISIS’ FRAMEWORK 11 The Banking Communication and the new legal framework 12 The Recapitalisation Communication 13 Impaired Assets Communication 13 Restructuring Communication 14 CASE STUDY 3: CARNEGIE BANK 14 PART II - THE THEORY ON THE LENDER OF LAST RESORT 16 (1) The Central Bank’s Role as a Lender of Last Resort and its Justifications 16 Banks are special 17 Interbank market 18 (2) Academic Debate on LOLR and current practice 19 (i) The question of solvency 20 (ii) The question of good collateral -

Remuneration for Bank Executives

Remuneration for bank execu- tives A study on the impacts of corporate governance codes on executive re- muneration in Sweden, Denmark and the United Kingdom between 2004 and 2010 Degree Project within Business Administration Author: Andreas Klang and Niclas Kristoferson Tutor: Assoc. Prof. Dr. Dr. Petra Inwinkl Jönköping May 2011 Acknowledgements The process of this degree project, would not have been what it is without a number of people whom have contributed and played a part in shaping it to what it is today We would like to thank our tutor Assoc. Prof. Dr. Dr. Petra Inwinkl for herr advice and guidance throughout the process of the whole thesis. This thesis would not have been the same without her influential ideas and constructive criticism. We would also like to thank our seminare partners for their constructive feedback dur- ing all seminars. At last we would like to thank our families and girlfriends whom have endure us during the past six months with constant support and love. Andreas Klang Niclas Kristoferson Division of work The authors of the Remuneration for bank executives, a study on the impacts of corporate go- vernance codes on executive remuneration in Sweden, Denmark and the United Kingdom be- tween 2004 and 2010 are Andreas Klang and Niclas Kristoferson. Andreas Klang have done fif- ty per cent and Niclas Kristoferson have done fifty per cent. Degree Project within Business Administration Title: Remuneration for Bank Executive- A study on the impacts of corporate governance on executive remuneration Author: Andreas Klang and Niclas Kristoferson Tutor: Assoc. Prof. Dr. Dr. -

Governmental Assistance to the Financial Sector: an Overview of the Global Responses (V9)

Economic Stabilization Advisory Group | October 2, 2009 Governmental Assistance to the Financial Sector: an Overview of the Global Responses (v9) The measures that Governments have taken to protect the financial sector have settled down to a large extent. We have, however, decided to publish a further update on the measures following a renewed interest in developments and the recent G20 Summit. This memorandum summarizes the measures Governments across the world have taken to protect the financial sector and prevent a recession. The measures fall into the following categories: guarantees of bank liabilities; retail deposit guarantees; central bank assistance measures; bank recapitalization through equity investments by private investors and Governments; and open-market or negotiated acquisitions of illiquid or otherwise undesirable assets from weakened financial institutions. The purpose of this publication is to provide an overview of the principal measures that have been taken in the major financial jurisdictions to support the financial system. The first version of this note was published on November 12, 2008. Since then, Governments in some jurisdictions have adopted further measures or amended measures previously adopted. The current version of the note takes into account those measures and is based on information available to us on September 30, 2009. Table of Contents Page AUSTRALIA.......................................................................................................................................................................................................................... -

State Aid: Overview of Decisions and On-Going In-Depth Investigations of Financial Institutions in Difficulty

European Commission - Fact Sheet State aid: Overview of decisions and on-going in-depth investigations of Financial Institutions in Difficulty Brussels, 10 February 2016 In 2008/2009, the Commission adopted a temporary state aid framework to enable Member States to deal with financial problems in systemic banks, as well as support access to finance for real economy firms. The crisis rules for banks, which were tightened in July and December 2010, were extended on 1 December 2011. The Temporary Framework for state aid measures to support access to finance in the current financial and economic crisis expired in December 2011. Situation as of 10 February 2016 Communications from the Commission to provide guidance to Member States Communication from the Commission — The application of State aid rules to measures taken in relation to financial institutions in the context of the current global financial crisis, 13 October 2008 (see IP/08/1495) Communication from the Commission — The recapitalisation of financial institutions in the current financial crisis: limitation of aid to the minimum necessary and safeguards against undue distortions of competition, 5 December 2008 (see IP/08/1901) Communication from the Commission on the Treatment of Impaired Assets in the Community Banking Sector, 25 February 2009 (see IP/09/322) Communication from the Commission - Temporary framework for State aid measures to support access to finance in the current financial and economic crisis, adopted on 17 December 2008 (see IP/08/1993), as amended on 25 February -

2008Annual Report 2008 Contents

2008Annual Report 2008 Contents The Nordea Business Solid result and strong position Summary 2 despite financial turmoil and economic re- CEO letter 6 Vision, values and strategy 8 cession. Nordea sticks to its organic growth Business development 2008 12 strategy, but adjusts the speed of execution. People forming Great Nordea 22 Cost, risk and capital management receives Corporate Social Responsibility 24 higher priority. Nordea will continue to focus The Nordea share 26 Events 2008 30 ’’on supporting existing core customers and to Board of Directors’ Report attract new relationship customers with solid Financial Review 2008 31 credit profiles. Our ambitious vision of Great Customer area results 37 Nordea remains. Risk, Liquidity and Capital management 44 Christian Clausen, Corporate Governance 70 President and Group CEO Financial statements 5-year overview 78 Quarterly development 81 Income statement 82 Balance sheet 83 Statement of recognised income and expense 84 Cash flow statement 85 Notes to the financial statements 87 Proposed distribution of earnings 145 Audit report 146 Organisation Legal structure 147 Board of Directors 148 CEO letter Page Group Executive Management 150 6 Group Organisation 151 Others Ratings 151 Business definitions 152 Annual General Meeting 153 Financial calendar 153 Corporate Governance Report This Annual Report contains forward-looking statements that reflect management’s current views with respect to certain future events and potential financial performance. Although Nordea believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ materially from those set out in the forward-looking statements as a result of various factors. -

Annual Report 2018

Translation Front page Annual Report 2018 Contents CONTENTS ▪ HIGHLIGHTS ▪ REVIEW AND RESULTS ▪ CORPORATE GOVERNANCE ▪ CORPORATE SOCIAL RESPONSIBILITY FINANCIAL STATEMENTS ▪ STATEMENTS ▪ BOARD OF DIRECTORS AND MANAGEMENT BOARD ▪ COMPANY DETAILS Contents Management’s review Highlights 3 Review and results 4 Corporate governance 20 Corporate social responsibility 24 Financial statements Income statement 27 Comprehensive income statement 27 Balance sheet 28 Statement of changes in equity 30 Cash flow statement 31 Notes to the parent company and consolidated financial statements 32 Statement by Management 74 Independent auditor’s report 75 Board of Directors 77 Management Board 78 Company details 79 Highlights CONTENTS ▪ HIGHLIGHTS ▪ REVIEW AND RESULTS ▪ CORPORATE GOVERNANCE ▪ CORPORATE SOCIAL RESPONSIBILITY FINANCIAL STATEMENTS ▪ STATEMENTS ▪ BOARD OF DIRECTORS AND MANAGEMENT BOARD ▪ COMPANY DETAILS Highlights Finansiel Stabilitet Group: Guarantee Fund: ▪ Surplus of DKK 756 million, mainly attributable to contri- ▪ Surplus of DKK 36 million. The surplus for 2018 was butions to the Resolution Fund of DKK 618 million mainly attributable to the overall surplus of FS Finans ▪ Total assets of DKK 21.9 billion I-IV, in which the Guarantee Fund has financial interests. ▪ Loans and guarantees of DKK 1.0 billion ▪ Total assets of DKK 13.3 billion ▪ Equity of DKK 20.6 billion. ▪ The assets of the Guarantee Fund amounted to DKK 13.3 billion, of which DKK 8.8 billion was attributable to Bank Package I-V activities: the Banking Department. ▪ Surplus of DKK 103 million in 2018. The result reflects Resolution Fund: the continued resolution of the remaining activities. Reversal of impairment losses on loans, advances and ▪ Surplus of DKK 617 million. -

European Commission

EUROPEAN COMMISSION Joaquín Almunia Vice President of the European Commission responsible for Competition Policy Restructuring the banking sector in the EU: A State aid perspective Conference on State Aid in the Banking Market – Legal and Economic Perspectives - Frankfurt am Main 21 June 2012 SPEECH/12/481 I wish to thank the House of Finance policy platform and the Institute for Monetary and Financial Stability of the Goethe University for inviting me to this conference. Frankfurt is the perfect place for a debate on the banking sector; this city is not only home to the European Central Bank but also one of the continent’s financial hubs. These days almost everybody is paying attention to the European banking sector. Today the Eurogroup is meeting in Brussels, and finance ministers will discuss – among other important topics – the possibility to advance towards a ‘banking union’. Next week, it will be the turn of the Heads of State and Government to show their political commitment for the future of the Economic and Monetary Union and to come up with a common strategy to overcome the present difficulties. Against this backdrop, I would like to share with you my views on Europe’s banks on the basis of the experience gathered by the Commission since the introduction of the special State Aid rules for the financial sector adopted at the start of the crisis. Upon reflecting on this experience, I would say that the banks that have been involved in some form of public support fall under four categories. • The first includes the banks that were -

Pwc Euro M&A

Financial Services Back to the ‘domestic’ future* From strategic expansion to rapid contraction in financial services M&A in EMEA March 2009 *connectedthinking Contents Welcome 3 Annus horribilis 6 2008: year zero for Financial Services M&A 9 Valuations: fundamental value or hope, fear and greed? 12 UK large cap: the government steps in 15 UK mid-market: balance sheet restructuring driving non-core disposals 17 Western & Northern Europe: crisis leads to increased government involvement 19 Central, Eastern and South Eastern Europe and the CIS: the tide turns 22 Middle East and North Africa: shifting sands 25 Sub-Saharan Africa: feeling the heat? 28 The buyout market: down but not out 30 Speciality finance: coming in from the cold? 34 Infrastructure: the next big thing? 36 Investment management: at a crossroads 38 Distressed assets return to prominence 40 Does the industry need a new mindset? 42 The day after tomorrow 44 Greater domestic focus, lower valuations and restructuring 46 PricewaterhouseCoopers Back to the ‘domestic’ future 3 Welcome This 6th annual review of European Financial Services M&A has been written by a broader range of authors than previously. It comprises a series of articles covering specific issues and geographical areas. Notwithstanding this change, we continue to deliver in-depth deal analysis and still provide a consistent and continuous means to compare and contrast activity. We have also chosen to expand the scope of our report to embrace the Middle East and African markets. As a result, we now offer a comprehensive Europe, Middle East and Africa (EMEA) perspective. 2008 will be remembered as the year in which the developed economies entered recession and economists downgraded economic growth expectations (Figure 1).