Gross Domestic Product—An Index of Economic Welfare Or a Meaningless Metric?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Off to a Good Start: the Nber and the Measurement of National Income

NBER WORKING PAPER SERIES OFF TO A GOOD START: THE NBER AND THE MEASUREMENT OF NATIONAL INCOME Hugh Rockoff Working Paper 26895 http://www.nber.org/papers/w26895 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 March 2020 Many thanks are due to Katharine Abraham who discussed a previous draft when it was presented at the 2020 annual meeting of the American Economic Association in a session celebrating the 100th anniversary of the Bureau, and to Claudia Goldin for many helpful comments. The remaining errors are mine. The views expressed herein are those of the author and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer-reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2020 by Hugh Rockoff. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. Off to a Good Start: The NBER and the Measurement of National Income Hugh Rockoff NBER Working Paper No. 26895 March 2020 JEL No. B0,N12 ABSTRACT The creation of the National Bureau of Economic Research was a response to the bitter controversies over the distribution of income that roiled the United States during the Progressive Era. Thanks to Malcolm Rorty, a business economist, and Nahum I. Stone, an independent socialist economist, a “Committee on the Distribution of Income” was created; what might be considered the first name of the Bureau. -

Speech--Chairman Ben S. Bernanke

For release on delivery 9:30 a.m. EDT May 8, 2010 Commencement Address: The Economics of Happiness Remarks by Ben S. Bernanke Chairman Board of Governors of the Federal Reserve System at the University of South Carolina Columbia, South Carolina May 8, 2010 I want to begin by thanking the Board of Trustees of the University of South Carolina, President Pastides, and this year’s graduates for the great honor of addressing this commencement ceremony. Although I was born just across the border in Augusta, Georgia, I considered South Carolina my home from early childhood until I married and took my first academic job after graduate school. During most of that time, my family lived in Dillon, a couple of hours’ drive from here. I have had several occasions to visit Dillon and other places in the Carolinas since I got into government work, and I am both amazed and proud about the remarkable economic and social progress that has occurred since I grew up here. South Carolina, like America, is always reinventing itself, despite new and, it sometimes seems, ever more difficult challenges. I always find it difficult to choose a topic for a commencement talk. I am an economist, but my experience has been that people in a celebratory frame of mind are usually not that interested in an economics lecture. (I can’t quite understand why not.) Instead, they are generally looking for something more personal and inspirational. So I thought I would split the difference between an economics lecture and inspirational remarks and speak briefly about what economics and social science more generally have to say about personal happiness, and what those ideas imply both for economic policymaking and the choices each of you will make as you leave college for other pursuits. -

The Great Depression As a Historical Problem

Upjohn Institute Press The Great Depression as a Historical Problem Michael A. Bernstein University of California, San Diego Chapter 3 (pp. 63-94) in: The Economics of the Great Depression Mark Wheeler, ed. Kalamazoo, MI: W.E. Upjohn Institute for Employment Research, 1998 DOI: 10.17848/9780585322049.ch3 Copyright ©1998. W.E. Upjohn Institute for Employment Research. All rights reserved. 3 The Great Depression as a Historical Problem Michael A. Bernstein University of California, San Diego It is now over a half-century since the Great Depression of the 1930s, the most severe and protracted economic crisis in American his tory. To this day, there exists no general agreement about its causes, although there tends to be a consensus about its consequences. Those who at the time argued that the Depression was symptomatic of a pro found weakness in the mechanisms of capitalism were only briefly heard. After World War II, their views appeared hysterical and exag gerated, as the industrialized nations (the United States most prominent among them) sustained dramatic rates of growth and as the economics profession became increasingly preoccupied with the development of Keynesian theory and the management of the mixed economy. As a consequence, the economic slump of the inter-war period came to be viewed as a policy problem rather than as an outgrowth of fundamental tendencies in capitalist development. Within that new context, a debate persisted for a few years, but it too eventually subsided. The presump tion was that the Great Depression could never be repeated owing to the increasing sophistication of economic analysis and policy formula tion. -

Front Matter In" Wesley Clair Mitchell: the Economic Scientist"

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: Wesley Clair Mitchell: The Economic Scientist Volume Author/Editor: Arthur F. Burns, ed. Volume Publisher: NBER Volume ISBN: 0-87014-052-3 Volume URL: http://www.nber.org/books/burn52-1 Publication Date: 1952 Chapter Title: Front matter in "Wesley Clair Mitchell: The Economic Scientist" Chapter Author: Arthur F. Burns Chapter URL: http://www.nber.org/chapters/c3093 Chapter pages in book: (p. -14 - 0) We Clair Mitchell The Economic'Scientist.' Edited by ARTHUR F. BURNS NATIONAL BUREAU OF ECONOMIC RESEARCH, INC. NEW YORK 1952 S Copyright,1952, by Bureau of Economic Research, Inc. 1819 Broadway, New York 23 All Rights Reserved Typography by Oscar Leventhal, Inc. Presswork and binding by H. Wolff Library of Congress Catalog Card Number: 52-6013 PUBLICATIONS OF THE NATIONAL BUREAU OF ECONOMIC RESEARCH, INC. NUMBER 53 WESLEY CLAIR MITCHELL THE ECONOMIC SCIENTIST '•1 OFFICERS 1952 Harry Scherman, Chairman C. C. Balderston, President Percival F. Brundage, Vice-President George B. Roberts, Treasurer W. J. Carson, Executive Director DIRECTORS AT LARGE Donald R. Beicher, American Telephone and Telegraph Company Oswald W. Knauth, Beau fort, South Carolina Simon Kuznets, University of Pennsylvania H. W. Laidler, Executive Director, League for Industrial Democracy Shepard Morgan, New York City C. Reinold Noyes, Princeton, New Jersey George B. Roberts, Vice-President, National City Bank Beardsley Rumi, New York City Harry Scherman, Chairman, Book-of-the-Month Club George Soule, Bennington College N. I. Stone, Consulting Economist J. Raymond Walsh, New York City Leo Wolman, Columbia University Theodore 0. -

Institutional Economics

INSTITUTIONAL ECONOMICS AT COLUMBIA UNIVERSITY Malcolm Rutherford University of Victoria (This Draft: March 2001) This paper draws on archival work using the James Bonbright Papers, J. M. Clark Papers, Joseph Dorfman Papers, Carter Goodrich Papers, Robert Hale Papers, and Wesley Mitchell Papers, all at the Rare Book and Manuscript Library, Columbia University, the Arthur F. Burns Papers at the Eisenhower Library, Abilene, Kansas, and the John R. Commons Papers at the State Historical Society of Wisconsin. My thanks to Lowell Harriss, Aaron Warner, Eli Ginzberg, Donald Dewey, Mark Perlman, Daniel Fusfeld, Mark Blaug, and Walter Neale for sharing their recollections of Columbia. Thanks also to my research assistant Cristobal Young. Any errors are my responsibility. This research has been supported by a Social Science and Humanities Research Council of Canada research grant (project # 410-99-0465). 1 1. Introduction In a number of recent papers I have attempted to outline the nature of the institutionalist movement in American economics in the interwar period (Rutherford 2000a, 2000b, 2000c). At that time institutionalism was a very significant part of American economics. In terms of research output and the production of graduate students, the main centers for institutionalism were the university of Chicago (until 1926 and the departure of J. M. Clark), the University of Wisconsin, the Robert Brookings Graduate School (which existed only briefly between 1923 and 1928), and, after the arrival of Wesley Mitchell in 1913, and J. M. Clark in 1926, Columbia University. Columbia University became the academic home of a large concentration of economists of institutionalist leaning, and other Schools and Departments in the University, particularly Business, Law, Sociology, and Philosophy, also contained many people of similar or related persuasion. -

Milton Friedman: a Bibliography

__________________________________________________________________ MILTON FRIEDMAN: A BIBLIOGRAPHY Compiled by Julio H. Cole1 Milton Friedman (1912-2006), the world-famous author of Capitalism and Freedom (1962) and Free to Choose (1980), was one of the most influential economists of the 20th century, and his memory will live long in the lore of economics. To mark the centenary of his birth, Laissez-Faire is pleased to publish this bibliography, the most complete listing to date of his scholarly writings. It provides both an indication of the breadth of his interests, and a measure of the magnitude of his contribution to economic scholarship. A. Books by Milton Friedman .…………………………………………… 98 B. Other Publications by Milton Friedman .……………………………… 100 C. Published Correspondence ……………………………………………. 120 D. Published Interviews ...………………………………………………... 121 1Professor of Economics, Universidad Francisco Marroquín (Guatemala). This bibliography is based upon three earlier bibliographical orientations to Friedman‘s writings: Niels Thygesen, ―The Scientific Contributions of Milton Friedman,‖ Scandinavian Journal of Economics, 79 (1977): 84-98, Kurt Leube (ed.), The Essence of Friedman (Stanford, CA: Hoover Institution Press, 1987), pp. 526-51 (compiled by Gloria Valentine), and Marc Lavoie and Mario Seccareccia (eds.), Milton Friedman et son oeuvre (Montreal: Presses de l‘Université de Montréal, 1993), pp. 191-24 (compiled by Gilles Dostaler). It includes books authored, co-authored or edited by Milton Friedman, introductions and forewords to books by other authors, articles in scholarly and professional journals, comments and replies, chapters in edited volumes, articles in encyclopedias and general interest magazines, book reviews, and published interviews. It does not include articles published in newspapers or in news magazines, speeches, or testimonies to congressional committees. -

Front Matter, EVIDENCES OP LONG SWINGS in AGGREGATE

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: Evidences of Long Swings in Aggregate Construction Since the Civil War Volume Author/Editor: Moses Abramovitz Volume Publisher: NBER Volume ISBN: 0-87014-404-9 Volume URL: http://www.nber.org/books/abra64-1 Publication Date: 1964 Chapter Title: Front matter, Evidences of Long Swings in Aggregate Construction since the Civil War Chapter Author: Moses Abramovitz Chapter URL: http://www.nber.org/chapters/c1799 Chapter pages in book: (p. -14 - 0) OCCASIONAL PAPER EVIDENCESOP LONG SWINGS IN AGGREGATE CONSTRUCTION SINCE THE CIVILWAR MOSESABRAMOVITZ StanfordUniversity Published by NATIONAL BUREAU OF ECONOMIC RESEARCH NEW YORK Distributed by COLUMBIA UNIVERSITYPRESS NEW YORK and LONDON Copyright0 1964 by NATIONAL BUREAU OF ECONOMIC RESEARCH, INC. 261 Madison Avenue, New York 16, N. Y. All Rights Reserved LIBRARY OF CONGRESS CATALOG CARD NUMBER: 64-7747 PRICE: $4.00 Printed in the United States of America NATIONAL BUREAU OF ECONOMIC RESEARCH 1964 OFFICERS Albert J. Hettinger, Jr., Chairman Arthur F. Burns, President Frank W. Fetter, Vice-President Donald B. Woodward, Treasurer Solomon Fabricant, Director of Research Geoffrey H. Moore, Associate Director of Research Hal B. Lary, Associate Director of Research William J. Carson, Executive Director DJRECTORS AT LARGE Robert B. Anderson, New York City Wallace J. Campbell, Foundation for Cooperative Housing Erwin D. Canham, Christian Science Monitor Solomon Fabricant, New York University Marion B. Folsom, Eastman Kodak Company Crawford H. Greenewalt, E. I. du Pont de Nemours & Company Gabriel Hauge, Manufacturers Hanover Trust Company A. J. Hayes, International Association of Machinists Albert J. -

A Macroeconomics Reader

A Macroeconomics Reader Edited by Brian Snowdon and Howard R. Vane London and New York Contents Preface xi 1 The development of modern macroeconomics: a rough guide Brian Snowdon and Howard R. Vane 1 Part I Keynesian economics and the Keynesian revolution 27 Introduction 29 2 Keynesian economics: the search for first principles Alan Coddington Journal of Economic Literature (1976) 14, December, pp. 1258-73 36 3 On different interpretations of the General Theory Don Patinkin Journal of Monetary Economics (1990) 26, October, pp. 205-43 55 4 Keynes's General Theory: interpreting the interpretations Bill Gerrard Economic Journal (1991) 101, March, pp. 276-87 95 5 The fall and rise of Keynesian economics Alan S. Blinder Economic Record (1988) December, pp. 278-94 109 6 Price flexibility and output stability: an old Keynesian view James Tobin Journal of Economic Perspectives (1993) 7, Winter, pp. 45-65 135 Part II The monetarist counter-revolution 157 Introduction 159 7 The role of monetary policy Milton Friedman American Economic Review (1968) 58, March, pp. 1-17 164 viii Contents 8 The structure of monetarism Thomas Mayer Kredit und Kapital (1975) 8, pp. 191-215, 292-313 180 9 Monetarism: an interpretation and an assessment David Laidler Economic Journal (1981) 91, March, pp. 1-28 216 10 The monetarist controversy revisited Franco Modigliani Contemporary Policy Issues (1988) 6, October, pp. 3-18 247 Part III The challenge of rational expectations and new classical macroeconomics 263 Introduction 265 11 After Keynesian macroeconomics Robert E. Lucas and Thomas J. Sargent After the Phillips Curve: Persistence of High Inflation and High Unemployment (1978) Boston, MA: Federal Reserve Bank of Boston, pp. -

The Use of Mathematics in Economics and Its Effect on a Scholar's

Munich Personal RePEc Archive The use of mathematics in economics and its effect on a scholar’s academic career Espinosa, Miguel and Rondon, Carlos and Romero, Mauricio London School of Economics, International Monetary Fund, University of California San Diego September 2012 Online at https://mpra.ub.uni-muenchen.de/41341/ MPRA Paper No. 41341, posted 15 Sep 2012 00:30 UTC The use of Mathematics in Economics and its Effect on a Scholar’s Academic Career∗ (Preliminary version. Comments are welcome.) Miguel Espinosa† Carlos Rondon,‡ and Mauricio Romero§ September 14, 2012 Abstract There has been so much debate on the increasing use of formal methods in Economics. Although there are some studies tackling these issues, those use either a little amount of papers, a small amount of scholars or a short period of time. We try to overcome these challenges constructing a database characterizing the main socio-demographic and academic output of a survey of 438 scholars divided into three groups: Economics Nobel Prize winners; scholars awarded with at least one of six worldwide prestigious economics recognitions; and academic faculty randomly selected from the top twenty economics departments. We give statistical evidence on the increasing trend of number of equations and econometric outputs per article, showing that for each of these variables there have been four structural breaks and three of them have been increasing ones. Therefore, we provide concrete measures of mathematization in Economics. Furthermore, we found that the use and training in mathematics has a positive correlation with the probability of winning a Nobel Prize in certain cases. -

WEAI Program 2010-FINAL.Pub

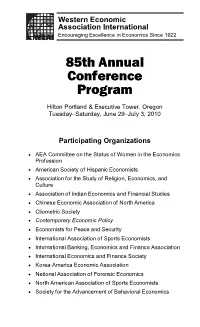

Western Economic Association International Encouraging Excellence in Economics Since 1922 85th Annual Conference Program Hilton Portland & Executive Tower, Oregon Tuesday–Saturday, June 29–July 3, 2010 Participating Organizations • AEA Committee on the Status of Women in the Economics Profession • American Society of Hispanic Economists • Association for the Study of Religion, Economics, and Culture • Association of Indian Economics and Financial Studies • Chinese Economic Association of North America • Cliometric Society • Contemporary Economic Policy • Economists for Peace and Security • International Association of Sports Economists • International Banking, Economics and Finance Association • International Economics and Finance Society • Korea-America Economic Association • National Association of Forensic Economics • North American Association of Sports Economists • Society for the Advancement of Behavioral Economics START OR RENEW YOUR MEMBERSHIP TODAY! Western Economic Association International membership offers all of these great benefits... • Individual subscriptions to both • Reduced submission fee for your quarterly journals, Economic Inquiry individual paper submitted for and Contemporary Economic Policy presentation at either conference if (includes full collection online). you choose not to organize a • Reduced registration fees for the session. Annual Conference and for the • Manuscript submission fee is Biennial Pacific Rim Conference. waived for submitting your • Opportunity to organize your own conference paper to EI or CEP if sessions for both conferences with you do so within six months after the submission fees waived for all conference. included papers. • Reduced EI and CEP manuscript • Complimentary conference regis- submission fees for non- tration for either or both conference manuscripts. conferences if you are an • Discount on International Atlantic Institutional Member affiliate and Economic Society membership. organize a session. -

BURNS, ARTHUR F.: Papers, 1928-1969

DWIGHT D. EISENHOWER LIBRARY ABILENE, KANSAS BURNS, ARTHUR F.: Papers, 1928-1969 Accessions A66-6, 82-7, 83-6 Processed by: JRB, JAW, HLP Date Completed: May 1986 The papers of Arthur F. Burns, economist, educator, and chairman of the council of Economic Advisers, were deposited in the Eisenhower Library in January 1966, December 1981, and December 1982, by Mr. Burns. Linear feet shelf space occupied: 85 Approximate number of pages: 169,600 Approximate number of items: 50,000 In January 1965, Mr. Burns executed an instrument of gift for these papers. Literary property rights in the unpublished writings of Arthur F. Burns in these papers and in other collections of papers in the Eisenhower Library are reserved to Mr. Burns during his lifetime and thereafter pass to the people of the United States. By agreement with the donor the following classes of documents will be withheld from research use: 1. Papers relating to private business affairs of individuals and to family and personal affairs. 2. Papers relating to investigations of individuals or to appointments and personnel matters. 3. Papers containing statements made by or to the donor in confidence unless in the judgement of the Director of the Dwight D. Eisenhower Library the reason for the confidentiality no longer exists. 4. All other papers which contain information or statements that might be used to injure, harass, or damage any living person. SCOPE AND CONTENT NOTE The papers of Arthur F. Burns span the years 1928 through 1969. Although the bulk of the materials tend to be concentrated in the 1950's and 1960's, a significant exception is the file of drafts to several manuscripts which Burns worked on in the 1930's and 1940's. -

Front Matter, Table of Contents

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: The Transition in Eastern Europe, Volume 1 Volume Author/Editor: Olivier Jean Blanchard, Kenneth A. Froot, and Jeffrey D. Sachs, editors Volume Publisher: University of Chicago Press Volume ISBN: 0-226-05660-0 Volume URL: http://www.nber.org/books/blan94-2 Conference Date: February 26-29, 1992 Publication Date: January 1994 Chapter Title: Front matter, table of contents Chapter Author: Olivier Jean Blanchard, Kenneth A. Froot, Jeffrey D. Sachs Chapter URL: http://www.nber.org/chapters/c6013 Chapter pages in book: (p. -11 - 0) This Page Intentionally Left Blank The Transition in Eastern Europe A National Bureau of Economic Research Project Report The Transition in Eastern Europe Volume Country Studies 1 Edited by Olivier Jean Blanchard, Kenneth A. Froot, and Jeffrey D. Sachs The University of Chicago Press Chicago and London OLIVIERJEAN BLANCHARD is professor of economics at the Massachu- setts Institute of Technology. KENNETHA. FROOTis professor of business administration at the Graduate School of Business, Harvard University. JEFFREYD. SACHSis the Galen L. Stone Professor of International Trade at Harvard University. All are research associates of the National Bureau of Economic Research. The University of Chicago Press, Chicago 60637 The University of Chicago Press, Ltd., London 0 1994 by the National Bureau of Economic Research All rights reserved. Published 1994 Printed in the United States of America 03020100999897969594 12345 ISBN: 0-226-05660-0 (cloth) Library of Congress Cataloging-in-Publication Data The Transition in Eastern Europe / edited by Olivier Jean Blanchard, Kenneth A.