United States Soccer Federation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020 UNC Women's Soccer Record Book

2020 UNC Women’s Soccer Record Book 1 2020 UNC Women’s Soccer Record Book Carolina Quick Facts Location: Chapel Hill, N.C. 2020 UNC Soccer Media Guide Table of Contents Table of Contents, Quick Facts........................................................................ 2 Established: December 11, 1789 (UNC is the oldest public university in the United States) 2019 Roster, Pronunciation Guide................................................................... 3 2020 Schedule................................................................................................. 4 Enrollment: 18,814 undergraduates, 11,097 graduate and professional 2019 Team Statistics & Results ....................................................................5-7 students, 29,911 total enrollment Misc. Statistics ................................................................................................. 8 Dr. Kevin Guskiewicz Chancellor: Losses, Ties, and Comeback Wins ................................................................. 9 Bubba Cunningham Director of Athletics: All-Time Honor Roll ..................................................................................10-19 Larry Gallo (primary), Korie Sawyer Women’s Soccer Administrators: Year-By-Year Results ...............................................................................18-21 Rich (secondary) Series History ...........................................................................................23-27 Senior Woman Administrator: Marielle vanGelder Single Game Superlatives ........................................................................28-29 -

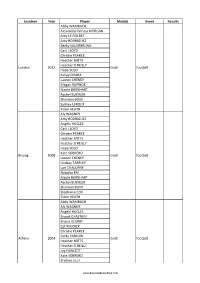

List of All Olympics Prize Winners in Football in U.S.A

Location Year Player Medals Event Results Abby WAMBACH Alexandra Patricia MORGAN Amy LE PEILBET Amy RODRIGUEZ Becky SAUERBRUNN Carli LLOYD Christie PEARCE Heather MITTS Heather O REILLY London 2012 Gold football Hope SOLO Kelley OHARA Lauren CHENEY Megan RAPINOE Nicole BARNHART Rachel BUEHLER Shannon BOXX Sydney LEROUX Tobin HEATH Aly WAGNER Amy RODRIGUEZ Angela HUCLES Carli LLOYD Christie PEARCE Heather MITTS Heather O REILLY Hope SOLO Kate SOBRERO Beijing 2008 Gold football Lauren CHENEY Lindsay TARPLEY Lori CHALUPNY Natasha KAI Nicole BARNHART Rachel BUEHLER Shannon BOXX Stephanie COX Tobin HEATH Abby WAMBACH Aly WAGNER Angela HUCLES Brandi CHASTAIN Briana SCURRY Cat REDDICK Christie PEARCE Cindy PARLOW Athens 2004 Gold football Heather MITTS Heather O REILLY Joy FAWCETT Kate SOBRERO Kristine LILLY www.downloadexcelfiles.com Lindsay TARPLEY Mia HAMM Shannon BOXX Brandi CHASTAIN Briana SCURRY Carla OVERBECK Christie PEARCE Cindy PARLOW Danielle SLATON Joy FAWCETT Julie FOUDY Kate SOBRERO Sydney 2000 Silver football Kristine LILLY Lorrie FAIR Mia HAMM Michelle FRENCH Nikki SERLENGA Sara WHALEN Shannon MACMILLAN Siri MULLINIX Tiffeny MILBRETT Brandi CHASTAIN Briana SCURRY Carin GABARRA Carla OVERBECK Cindy PARLOW Joy FAWCETT Julie FOUDY Kristine LILLY Atlanta 1996 Gold football 5 (4 1 0) 13 Mary HARVEY Mia HAMM Michelle AKERS Shannon MACMILLAN Staci WILSON Tiffany ROBERTS Tiffeny MILBRETT Tisha VENTURINI Alexander CUDMORE Charles Albert BARTLIFF Charles James JANUARY John Hartnett JANUARY Joseph LYDON St Louis 1904 Louis John MENGES Silver football 3 pts Oscar B. BROCKMEYER Peter Joseph RATICAN Raymond E. LAWLER Thomas Thurston JANUARY Warren G. BRITTINGHAM - JOHNSON Claude Stanley JAMESON www.downloadexcelfiles.com Cormic F. COSTGROVE DIERKES Frank FROST George Edwin COOKE St Louis 1904 Bronze football 1 pts Harry TATE Henry Wood JAMESON Joseph J. -

Women's Soccer Awards

WOMEN’S SOCCER AWARDS All-America Teams 2 National Award Winners 15 ALL-AMERICA TEAMS NOTE: From 1980-85, the National D–Karen Gollwitzer, SUNY Cortland D–Karen Nance, UC Santa Barbara M–Amanda Cromwell, Virginia Soccer Coaches Association of D–Lori Stukes, Massachusetts D–Kim Prutting, Connecticut M–Linda Dorn, UC Santa Barbara America (NSCAA) selected one F–Pam Baughman, George Mason D–Shelley Separovich, Colorado Col. M–Jill Rutten, NC State All-America team that combined all F–Bettina Bernardi, Texas A&M D–Carla Werden, North Carolina F–Brandi Chastain, Santa Clara three divisions. Starting in 1986, Division III selected its own team, F–Moira Buckley, Connecticut F–Michelle Akers, UCF F–Lisa Cole, SMU but Divisions I and II continued to F–Stacey Flionis, Massachusetts F–Joy Biefeld, California F–Mia Hamm, North Carolina select one team. Starting in 1988, F–Lisa Gmitter, George Mason F–Shannon Higgins, North Carolina F–Kristine Lilly, North Carolina all three divisions selected their 1984 F–April Kater, Massachusetts F–April Kater, Massachusetts own teams. Soccer America started F–Jennifer Smith, Cornell NSCAA 1991 selecting a team in 1988, which SOCCER AMERICA included all divisions. Beginning in G–Monica Hall, UC Santa Barbara NSCAA 1990, the team was selected from D–Suzy Cobb, North Carolina D–Lisa Bray, William Smith G–Heather Taggart, Wisconsin only Division I schools. NSCAA and D–Leslie Gallimore, California D–Linda Hamilton, NC State D–Holly Hellmuth, Massachusetts was rebranded as United Soccer D–Liza Grant, Colorado Col. D–Lori Henry, North Carolina M–Cathleen Cambria, Connecticut Coaches in 2017. -

2011 Boston Breakers Media Guide Alyssa Naeher

BOSbreakers_programAd.pdf 1 4/7/11 3:46 PM C M Y CM MY CY CMY K 2011 BOSTON BREAKERS Schedule Breakers B1 2011 Boston Breakers Contents Team Information: WPS Info: Team History ..........................................4 2009 Statistics....................................43 Front Office........................... ..................6 2010 Statistics....................................45 Breakers Head Coach Bio.....................................7 League Info ........................................47 Assistant Coach Bios............................8 Timeline ..............................................48 Stadium History....................................9 WPS Playoffs ......................................50 Stadium Directions............................10 Tickets & Seating Chart.....................11 Ticket Packages .................................. 12 Kristine Lilly Feature..........................14 Player Info: Roster......................................................16 Jordan Angeli.......................................18 Leah Blayney....................................... 19 Liz Bogus .............................................. 20 Rachel Buehler.....................................21 Lauren Cheney ................................... 22 Stephanie Cox ..................................... 23 Niki Cross...............................................24 Kelsey Davis ......................................... 25 Ifeoma Dieke........................................26 Taryn Hemmings ............................... 27 Amy LePeilbet -

Korea DPR 2:2 (0:0) Match Date Venue / Stadium / Country Time Att

FIFA Women's World Cup China 2007 Match Report Group B USA - Korea DPR 2:2 (0:0) Match Date Venue / Stadium / Country Time Att. 3 11 SEP 2007 Chengdu / Chengdu Sports Center Stadium / CHN 17:00 35,100 Match Officials: Referee: Nicole PETIGNAT (SUI) Assistant Referee 1: Corinne LAGRANGE (FRA) 4th Official: Dagmar DAMKOVA (CZE) Assistant Referee 2: Karine VIVES SOLANA (FRA) Match Commissioner: Sombo WESLEY (LBR) General Coordinator: Tjienta VAN PELT (NED) Goals Scored: Abby WAMBACH (USA) 50' , KIL Son Hui (PRK) 58' , KIM Yong Ae (PRK) 62' , Heather O REILLY (USA) 69' USA (USA) Korea DPR (PRK) [ 18] Hope SOLO (GK) [ 21] JON Myong Hui (GK) [ 3] Christie RAMPONE [ 2] KIM Kyong Hwa [ 4] Cat WHITEHILL [ 3] OM Jong Ran [ 7] Shannon BOXX [ 5] SONG Jong Sun [ 9] Heather O REILLY (-92') [ 7] HO Sun Hui (-22') [ 11] Carli LLOYD [ 8] KIL Son Hui [ 13] Kristine LILLY (C) [ 9] RI Un Suk [ 14] Stephanie LOPEZ [ 10] RI Kum Suk (C) [ 15] Kate MARKGRAF [ 12] RI Un Gyong [ 17] Lori CHALUPNY [ 15] SONU Kyong Sun [ 20] Abby WAMBACH [ 16] KONG Hye Ok Substitutes: Substitutes: [ 1] Briana SCURRY (GK) [ 1] PHI Un Hui (GK) [ 2] Marian DALMY [ 4] YUN Song Mi [ 5] Lindsay TARPLEY [ 6] KIM Ok Sim [ 6] Natasha KAI (+92') [ 11] HO Un Byol [ 8] Tina ELLERTSON [ 14] JANG Yong Ok [ 10] Aly WAGNER [ 17] KIM Yong Ae (+22', -90') [ 12] Leslie OSBORNE [ 18] YUN Hyon Hi (GK) [ 16] Angela HUCLES [ 19] JONG Pok Sim (+90') [ 19] Marci JOBSON [ 20] HONG Myong Gum [ 21] Nicole BARNHART (GK) Coach: KIM Kwang Min (PRK) Coach: Greg RYAN (USA) Cautions: Christie RAMPONE (USA) 45' , JONG Pok Sim (PRK) 91' Expulsions: Additional Time: First half: 2 min., second half: 4 min. -

2005 Women's Soccer Brochure

All-Time Letter Winners A E J Moraca, Mandy 2005-06 1998-99 Acquavella, Kristin 1989- Eames, Jenn 1991-94 Jacobs, Cassie 1983 Morrell, Anne 2001-04 Sherow, Anne 1985-88 91, 1993 Egan, Danielle 1991-94 Jakowich, Jill 1990 Morrison, Mandy 1997- Simmons, Katie 2000-01 Allan, Senga 1982-85 Eller. Karli 2003-05 Jennings, Melissa 1996-97 2000 Slocum, Nancy 1983-85 Altherr, Jenny 1987 (M) Ellis, Julie 1984 Johnson, Betsy 1982-85 Mount, Chaille 1990 (M) Smith, J. Douglas 1983-86 Arab, Alex 1981 (M) Ellis, Susan 1980-81, 83- Johnson, Marianne 1981- Mullinix, Siri 1995-98 (M) Averbuch, Yael 2005-06 84 82 Munden, Paula 1991 Smith, Jane 2000-02 Azzu, Renee 1990 Engen, Whitney 2006 Johnson, Rye 1994-95 Murphy, Leea 2002-05 Smith, Julie 2000 Enos, Stacey 1982-85 Jones, Kasey 1985-86 Murphy, Tina 1997-2000 Smith, Mary 1984 B Esposito, Kelly 2005-06 Jordan, Eleanor 1979-81 Smith, Sterling 2006 Ball, Elizabeth 1999, 2001- Eubanks, Mary 1989 Judd, Kerry 1980 N Soares, Sasha 1989-92 02 Eveland, Kristi 2006 Nelson, Stacey 1984-85 Springer, Carolyn 1990-93 Ball, Susie 2000-01 Everton, Erin 1990 K Noel, Margie 1988 (M) Steadman, Amy 2003-04 Ballinger, Anne 1979-80 Everton, Holly 1983 Kalinoski, Pam 1987-89, Nogueira, Casey 2006 Steelman, Amy 1995-96 Barnes, Brandy 1987 1991 Noonan, Tracy 1992-95 Stoecker, Lindsay 1997- Bates, Tracey 1985-87, F Kamholz, Kalli 1999-2000 2000 1989 Fair, Lorrie 1996-99 Karvelsson, Rakel 1995-98 O Stollmeyer, Suzie 1982 Baucom, Eva 2006 Falk, Aubrey 1994-97 Keller, Debbie 1993-96 O’Dell, Kathleen 1983-86 Stumpf, Andrea 1980 Beatty, -

2005 Media Guide

F L O R I D A S T A T E U N I V E R S I T Y 1 TABLE OF CONTENTS MEDIA INFORMATION Seminole Soccer Complex................ 55 SUPPORTING OUR ATHLETES Team Photo ....................................... 1 This Is ACC Soccer .......................... 56 Support Staff ................................... 91 Table of Contents .............................. 2 Endowed Scholarships ..................... 57 Training Room ................................. 92 Quick Facts ....................................... 3 Nations Premiere Program ............... 58 Strength & Conditioning .................. 93 Media Information.............................. 4 This Is Florida State......................... 62 Academics....................................... 94 Roster/Breakdown ............................ 6 This Is Tallahassee .......................... 66 Support Staff ................................... 95 Photo Roster ..................................... 7 This Is The ACC ............................... 68 Student Services ............................. 96 Season Outlook ................................. 8 Community Service .......................... 97 OPPONENT INFORMATION Compliance ..................................... 98 COACHING STAFF Opponents ....................................... 69 Coaching Staff ................................. 11 Opponent Summary .......................... 70 Mark Krikorian ................................. 12 ACC Opponents ............................... 71 MEDIA GUIDE CREDITS The 2005 Seminole Soccer Krikorian Q&A ................................. -

NCAA Box Score

Soccer Box Score (Final) 2005 Florida State Soccer #7 Florida State vs #2 North Carolina (Nov 25, 2005 at Chapel Hill, N.C.) Florida State (20-3-1) vs. Goals by period 1 2 OT O2 Tot North Carolina (23-1-1) ------------------------------------- Date: Nov 25, 2005 Attendance: 2518 Florida State....... 1 0 0 0 - 1 Weather: Crisp, clear, temps in 50s North Carolina...... 0 1 0 0 - 1 Florida State North Carolina Pos ## Player Sh SOG G A Pos ## Player Sh SOG G A ------------------------------------------ ------------------------------------------ GK 0 Ali Mims............ - - - - GK 00 Anna Rodenbough..... - - - - F 2 India Trotter....... 4 2 1 - D 4 Kendall Fletcher.... 2 2 1 - D 3 Teresa Rivera....... - - - - MF 5 Jaime Gilbert....... 1 - - - D 5 Sarah Wagenfuhr..... - - - - MF 9 Kacey White......... 1 1 - - F 6 Sel Kuralay......... 1 1 - - D 10 Ariel Harris........ - - - - MF 7 Viola Odebrecht..... 1 - - - D 11 Robyn Gayle......... 1 1 - - MF 9 Melissa Samokishyn.. - - - - MF 17 Lori Chalupny....... 1 1 - - D 10 Kelly Rowland....... - - - - F 20 Heather O'Reilly.... 4 3 - 1 MF 12 Libby Gianeskis..... - - - - F 25 Lindsay Tarpley..... 8 5 - 1 D 14 Katrin Schmidt...... - - - - F 30 Elizabeth Guess..... 8 3 - - MF 20 Mami Yamaguchi...... 1 - - - MF 32 Yael Averbuch....... 5 3 - - ---------- Substitutes ---------- ---------- Substitutes ---------- 25 Colette Swensen..... - - - - 1 Leea Murphy......... - - - - Totals.............. 7 3 1 0 6 Katie Brooks........ - - - - 23 Corinne Black....... - - - - Totals.............. 31 19 1 2 Florida State North Carolina ## Player MIN GA Saves ## Player MIN GA Saves --------------------------------------- --------------------------------------- 0 Ali Mims............ 110:00 1 13 00 Anna Rodenbough..... 110:00 1 2 TM Team................ 0:00 0 5 Shots by period 1 2 OT O2 Tot Saves by period 1 2 OT O2 Tot ------------------------------------- ------------------------------------- Florida State...... -

2009 UNC Soccer Media Guide Table of Contents Carolina Quick Facts 2009 Senior Class

Carolina Women’s Soccer • General Information 2009 UNC Soccer Media Guide Table of Contents Carolina Quick Facts 2009 Senior Class .............................FrontCover Location: Chapel Hill, N.C. Celebrating UNC’s 2008 NCAA Championship . .Inside Front Cover Established: December 11, 1789 Table of Contents, Quick Facts, Credits, Website Info, Nike Info . .1 Enrollment: 28,136 (17,895 undergraduate, 8,275 postgraduates) 2009 Roster ...........................................2 Chancellor: Dr. Holden Thorp 2009 Schedule ........................................3 Director of Athletics: Dick Baddour 2009 Outlook ..........................................4 Senior Women’s Administrator: Beth Miller WinForeverFund......................................7 National Affiliation: NCAA Division I 2008 National Championship Season Review ................8 Conference: Atlantic Coast Conference 2009 Player Biographies ................................12 Nickname: Tar Heels Head Coach Anson Dorrance ............................36 Mascot: Rameses the Ram (both live and costumed) Chief Assistant Coach Bill Palladino .......................40 School Colors: Carolina Blue and White Assistant Coach Chris Ducar ............................41 Athletic Department Website: www.TarHeelBlue.com Carolina Women’s Soccer Staff ..........................42 Carolina Women’s Soccer Information Carolina Women’s Soccer History ........................43 Head Coach: Anson Dorrance (North Carolina, ‘74) Tar Heel Historical Honor Roll of Awards ...................50 Record -

Women's Award Winners

Women’s Award Winners Division I First-Team All-America (1980-2012) ................................................ 2 Division I First-Team All-Americans by School ..................................................... 4 Division II First-Team All-America (1988-2012) ................................................ 5 Division II First-Team All-Americans by School ..................................................... 6 Division III First-Team All-America (1986-2012) ................................................ 7 Division III First-Team All Americans by School ..................................................... 8 National Award Winners ........................... 10 2 2013 NCAA WOMEN'S SOccER AwaRDS THROUGH 2012 All-America Teams NOTE: From 1980-85, the National D–Lori Stukes, Massachusetts F–Kristine Lilly, North Carolina SOCCER AMERICA Soccer Coaches Association of D–Harriet Tatro, Vermont F–Kerri Tashiro, Colorado Col. G–Saskia Webber, Rutgers America (NSCAA) selected one All- F–Michelle Akers, UCF F–Gina Vasallo, Boston College D–Holly Hellmuth, Massachusetts F–Lori Bessmer, SUNY Cortland D–Jennifer Lewis, Duke America team that combined all F–April Heinrichs, North Carolina SOCCER AMERICA M–Karen Ferguson, Connecticut three divisions. Starting in 1986, Di- F–Donna MacDougall, Connecticut G–Karen Richter, UCF M–Julie Foudy, Stanford vision III selected its own team, but F–Catherine Shankweiler, Connecticut D–Tamie Batista, Santa Clara M–Tisha Venturini, North Carolina D–Kyllene Carter, Barry M–Sue Wall, Santa Clara Divisions I and II continued to select D–Kim Prutting, Connecticut one team. Starting in 1988, all three 1985 F–Mia Hamm, North Carolina M–Joy Biefeld, California F–Kim LeMere, Hartford divisions selected their own teams. NSCAA M–Shannon Higgins, North Carolina G–Janine Szpara, Colorado Col. F–Kristine Lilly, North Carolina Soccer America started selecting a M–April Kater, Massachusetts F–Tiffeny Milbrett, Portland D–Debbie Belkin, Massachusetts M–Robin Lotze, William & Mary team in 1988, which included all di- D–Sharon Hoag, Colorado Col. -

2016+U.S.+Soccer+Annual+General

2016 Annual General Meeting Table of Contents I. 2016 National Council Meeting Agenda II. Transcript of the 2015 National Council Meeting III. The Book of Reports IV. Proposed Budget – FY ‘17 V. Proposed Amendments to Federation Bylaws VI. Affirmation of Policies Adopted since 2015 AGM U.S. Soccer Federation 2016 Annual General Meeting Section I 2016 National Council Meeting Agenda U.S. Soccer Federation 100th National Council Meeting February 27, 2016 San Antonio, Texas 9:00 a.m. CT I. Opening Remarks and Introduction – President Sunil Gulati II. Moment of Silence III. Pledge of Allegiance IV. Roll Call V. 2016 Credentials Committee Report VI. Approval of AGM 2015 National Council Meeting Minutes VII. Reports of Officers and Committees A. President’s Report B. Vice President’s Report C. Secretary General’s Report D. Appeals Committee Report E. Athlete’s Council Report F. Budget Committee Report G. Credentials Committee Report (2015) H. Disability Soccer Committee Report I. Open Cup Committee Report J. Physical Fitness, Sports Medicine Committee Report K. Referee Committee Report L. Rules Committee Report VIII. New Business A. Proposed Budget Fiscal Year 2017 IX. Proposed Amendments to the Federation Bylaws A. Bylaw 213 (USASA) B. Bylaw 802 (Stephen Flamhaft) X. Affirmation of Federation Policies adopted since 2015 AGM A. Policy 601-6—International Clearances B. Policy 102(4)-1—Lamar Hunt U.S. Open Cup XI. Election of Vice President XII. Election of Independent Director XIII. For the Good of the Game XIV. Adjournment U.S. Soccer Federation 2016 Annual General Meeting – NCM Agenda Section II Transcript of the 2015 National Council Meeting Page 1 1 PROCEEDINGS 2 3 4 5 6 7 UNITED STATES SOCCER FEDERATION 8 NATIONAL COUNCIL MEETING 9 99TH ANNUAL GENERAL MEETING 10 11 12 13 14 San Francisco Marriott Marquis 15 San Francisco, California 16 17 18 February 14, 2015 19 8:00 a.m. -

2010Womensoccermg.Pdf

2010 Women’s Soccer Year Book Carolina Quick Facts Table of Contents Location: Chapel Hill, N.C. 2010 Senior Class Recognition ...................................... Front Cover Established: December 11, 1789 Celebrating UNC’s 2009 NCAA Championship ....Inside Front Cover Enrollment: 17,981 undergraduates Table of Contents, Quick Facts, Credits, Website Info, Nike Info .... 1 Chancellor: Dr. Holden Thorp 2010 Roster, 2010 Schedule, Pronunciation Guide ........................ 2 Director of Athletics: Dick Baddour 2010 Outlook ................................................................................... 3 Senior Women’s Administrator: Beth Miller 2009 National Championship Season Review ................................ 5 National Affiliation: NCAA Division I 2009 Notes & Honors ...................................................................... 6 Conference: Atlantic Coast Conference 2009 Statistics ................................................................................. 7 2009 Results.................................................................................... 8 Nickname: Tar Heels 2010 Player Biographies ................................................................. 9 Rameses the Ram (both live and costumed) Mascot: Head Coach Anson Dorrance ........................................................ 26 School Colors: Carolina Blue and White Carolina Women’s Soccer Staff ..................................................... 30 Athletic Department Website: www.TarHeelBlue.com Carolina Women’s Soccer History ................................................