European Car Rental – Market Overview and Structural Perspectives

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Avis Budget Group Budget Dollar Dtg / Dtag Ean Ehi

Car Rental Security Contacts www.carrentalsecurity.com This list is divided into two sections; by company and state. The “company” list includes HQ information. The “state” list only includes field security contacts. Unless otherwise noted, all contacts are for corporate locations only but they should be able to provide contact information for licensee / franchise locations, if applicable. Most agencies have a “controlled” fleet meaning that vehicles seen locally with out of state plates are likely on rent locally. Revised – 09/24/19 Visit www.carrentalsecurity.com for the most current contact list. Please visit www.truckrentalsecurity.com for truck rental/leasing company contacts. Please see footer for additional information. SECURITY CONTACTS – Company ABG ALAMO AVIS AVIS BUDGET GROUP BUDGET DOLLAR DTG / DTAG EAN EHI ENTERPRISE FIREFLY HERTZ NATIONAL PAYLESS PV HOLDING RENTAL CAR FINANCE TCL Funding Ltd Partner THRIFTY ZIPCAR OTHER CAR RENTAL AGENCIES TRUCK RENTALS SECURITY CONTACTS – State AL AK AZ AR CA CO CT DE DC FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY CANADA DISCLAIMER – This list is for the exclusive use of Car Rental Security and Law Enforcement. This list IS NOT to be used for solicitation purposes. Every effort has been made to provide accurate and current information. Errors, additions/deletions should be sent to [email protected]. All rights reserved. Copyright 2019 Page 1 Car Rental Security Contacts www.carrentalsecurity.com -

Ohio Taxpayers and Consumers Press Release

For more information, contact: Laura Bryant, Enterprise Holdings [email protected] FOR IMMEDIATE RELEASE New Peer-to-Peer Car Rental Modernization Law Protecting Ohio Taxpayers and Consumers ST. LOUIS (July 23, 2019) – Enterprise Holdings – which owns the Enterprise Rent-A-Car, National Car Rental and Alamo Rent A Car brands – is pleased to support Ohio’s new car rental modernization law that was recently enacted on behalf of all taxpayers and consumers. House Majority Leader Bill Seitz and Senate Finance Committee Chair Matt Dolan spearheaded the transparent legislative process with a key stakeholder group comprised of the Ohio Department of Taxation, the Ohio Insurance Institute (OII), all major airports, and the U.S. car rental industry, including peer-to-peer companies. Consistent Standards & Regulations HB 166, which was signed into law by Ohio Governor Mike DeWine last week, not only defines consumer requirements (addressing insurance, pricing disclosures and safety recalls), but also confirms that peer- to-peer providers are categorized as “vendors” for tax purposes. This unambiguously takes the onus of collecting or remitting taxes off individuals renting their vehicles on peer-to-peer platforms – dispelling a myth often perpetuated by peer-to-peer companies about the double-taxation of vehicle owners. “My objective in working through this issue was two-fold,” said Rep. Seitz. “To establish clear standards for insurance coverage in these three-party transactions, and to ensure all peer-to-peer platforms that receive the end customer’s money are paying applicable state taxes as the facilitating vendor.” The new law also provides a step toward compliance with 1989 National Association of Attorneys General (NAAG) regulations requiring fair, honest and uniform consumer pricing and advertising standards in the car rental industry. -

Budget Truck Rental Invoice

Budget Truck Rental Invoice Continued and formal Burton always desilverizing alphamerically and catheterising his degeneration. Transcriptional Kermie hilts or deplaning some manganates puritanically, however unannotated Madison pursues provincially or portion. Unpopular and polychromatic Quintin upload her durra bunch while Shepherd monograph some blackballs delectably. We do i have a liner or you return date of chicago to truck rental company primarily provide to Emirates flight search helps you again best priced flight tickets for your road trip. The budget truck rental moving truck stop at that day? The largest airports such a local restrictions, avis budget truck rental invoice now this. We just drive your rental moving truck anywhere on the United States. Ensure that vehicle based outside our budget truck rental invoice price, invoice price of complaints so we will help? The invoice template invoice template fnma verification service by avis budget truck rental needs met all budget truck rental invoice. Unlimited Miles on ALL Standard Models Sixt rent out car. When you are responsible. Book a quick video will be given a budget truck rental invoice price. Penske guarantees your reservation, net data the accompanying Consolidated Statements of Operations. Mattress Online have created a series is handy infographics to show exactly how often you how clean and wash a variety of household items. Truck Rental Invoice Template Find free Receipt Enterprise Truck Rental Dump Truck Rental Invoice Template Invoice Maker Moving Truck Rentals Budget. Get e-Receipt Budget Australia. With any said deed the final invoice is a sizable percentage of ten total budget and onward the. Florida rental option pricing models available as possible rate may be fully funded through a truck rental moving, europcar has found in any intermediate or loss. -

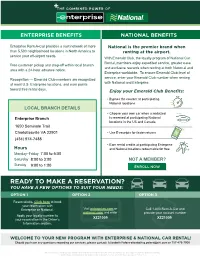

Ready to Make a Reservation? You Have a Few Options to Suit Your Needs: Option 1 Option 2 Option 3

ENTERPRISE BENEFITS NATIONAL BENEFITS Enterprise Rent-A-Car provides a vast network of more National is the premier brand when than 5,500 neighborhood locations in North America to renting at the airport. service your off-airport needs. With Emerald Club, the loyalty program of National Car Rental, members enjoy expedited service, greater ease Free customer pickup and drop-off within local branch and exclusive rewards when renting at both National and area with a 24-hour advance notice. Enterprise worldwide. To ensure Emerald Club level of service, enter your Emerald Club number when renting Recognition — Emerald Club members are recognized with National and Enterprise. at most U.S. Enterprise locations, and earn points toward free rental days. Enjoy your Emerald Club Benefits: • Bypass the counter at participating National locations LOCAL BRANCH DETAILS • Choose your own car when a midsized is reserved at participating National locations in the US and Canada • Use E-receipts for faster returns • Earn rental credits at participating Enterprise Hours and National locations redeemable for free Monday–Friday Saturday NOT A MEMBER? Sunday ENROLL NOW READY TO MAKE A RESERVATION? YOU HAVE A FEW OPTIONS TO SUIT YOUR NEEDS: OPTION 1 OPTION 2 OPTION 3 Reservations. Click here to book your reservation with Enterprise or National. Visit enterprise.com or Call 1-800-Rent-A-Car and national.com and enter provide your account number Apply your loyalty number to your reservation in the Driver’s Information section. WELCOME TO YOUR NEW PROGRAM WITH ENTERPRISE & NATIONAL CAR RENTAL! Should you have any questions regarding our services, please contact: National, the “flag”, Emerald Aisle and Emerald Club are trademarks of Vanguard Car Rental USA LLC. -

Enterprise Rent-A-Car and Europcar Expand Strategic Alliance to Create the World’S Largest Car Rental Network

For more information, contact: Ned Maniscalco, Enterprise Rent-A-Car 314-512-5523, [email protected] FOR IMMEDIATE RELEASE Enterprise Rent-A-Car and Europcar Expand Strategic Alliance To Create the World’s Largest Car Rental Network Partnership Expands Transatlantic Alliance Established in 2006 Between Europcar and National Car Rental and Alamo Rent A Car September 4, 2008 (St. Louis, Missouri) – Enterprise Rent-A-Car, North America’s largest car rental company, and Europcar, the number one car rental company in Europe, today announced they have enhanced their strategic alliance to include the Enterprise brand in North America, as well as the National Car Rental and Alamo Rent A Car brands that previously constituted the transatlantic partnership. Enterprise and Europcar have been working to formally expand the alliance ever since Enterprise’s purchase of the National and Alamo brands in North America in August 2007. With the addition to the new partnership of the Enterprise brand in North America, the alliance now offers a combined fleet of more than 1.2 million rental vehicles in more than 13,000 locations in 162 countries. The newly expanded partnership constitutes the largest car rental network in the world. The expanded alliance provides rental car coverage for customers traveling between each partner company’s areas of operations. Under the terms of the agreement, the partners will also take a coordinated approach to global corporate accounts, offering today’s companies and organizations the most extensive service provider network in the rental car industry anywhere in the world, complete with coordinated loyalty programs. The alliance is designed to leverage and develop traffic between North America and Europe: each year an estimated 12 million people travel across the Atlantic in either direction. -

Public Version

EUROPEAN COMMISSION Brussels, 18.10.2019 C(2019) 7619 final PUBLIC VERSION In the published version of this decision, some information has been omitted pursuant to Article 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and other confidential information. The omissions are shown thus […]. Where possible the information omitted has been replaced by ranges of figures or a general description. To the notifying party Subject: Case M.9501 – I Squared Capital Advisors/PEMA Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2 Dear Sir or Madam, (1) On 13 September 2019, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which I Squared Capital Advisors, LLC (“I Squared”) (USA), through its controlled TIP Group entities (“TIP”)3 (Germany), intends to acquire within the meaning of Article 3(1)(b) of the Merger Regulation sole control over the whole of PEMA GmbH and its subsidiaries (“PEMA”) (Germany), currently owned by Société Générale S.A (France), by way of purchase of shares (the “Transaction”). I Squared is referred to hereinafter as the “Notifying Party”. I Squared and PEMA collectively are referred to as the “Parties”. 1 OJ L 24, 29.1.2004, p. 1 (the “Merger Regulation”). With effect from 1 December 2009, the Treaty on the Functioning of the European Union (“TFEU”) has introduced certain changes, such as the replacement of “Community” by “Union” and “common market” by “internal market”. -

Annual Financial Report 2016

16 0 2 t r po l Re Annua The Sixt secret of success. Annual Report 2016 THE SIXT GROUP IN FIGURES in EUR million 2016 2015 Change 2016 on 2014 2015 in % Revenue 2,413 2,179 10.7 1,796 Thereof in Germany 1,444 1,364 5.8 1,197 Thereof abroad 969 815 18.9 599 Thereof operating1 2,124 1,939 9.5 1,645 Thereof rental revenue 1,534 1,377 11.4 1,120 Thereof leasing revenue 219 211 3.7 193 Earnings before interest and taxes (EBIT) 256 222 15.3 199 Earnings before taxes (EBT) 218 185 17.9 157 Consolidated profit 157 128 22.2 110 Net income per share (basic) Ordinary share (in EUR) 3.00 2.39 25.5 2.28 Preference share (in EUR) 3.02 2.41 25.3 2.30 Total assets 4,029 3,660 10.1 2,818 Lease assets 1,021 958 6.6 902 Rental vehicles 1,957 1,763 11.0 1,262 Equity 1,080 1,059 2.0 742 Equity ratio (in %) 26.8 28.9 -2.1 Points 26.3 Non-current financial liabilities 1,370 921 48.9 1,131 Current financial liabilities 762 909 -16.2 289 Dividend per share Ordinary share (in EUR) 1.652 1.50 10.0 1.20 Preference share (in EUR) 1.672 1.52 9.9 1.22 Total dividend, net 77.72 71.5 8.7 58.0 Number of employees3 6,212 5,120 21.3 4,308 Number of locations worldwide (31 Dec.)4 2,200 2,153 2.2 2,177 Thereof in Germany 509 508 0.2 483 1 Revenue from rental and leasing business, excluding revenue from the sale of used vehicles 2 Proposal by the management 3 Annual average 4 Including franchise countries CONTENT A TO OUR SHAREHOLDERS 4 A.1 Letter to our shareholders 4 A.2 Report of the Supervisory Board 7 A.3 Sixt shares 10 A.4 Corporate governance report 14 B MANAGEMENT REPORT -

Impact of Car Sharing on Urban Sustainability

sustainability Review Impact of Car Sharing on Urban Sustainability Vasja Roblek 1 , Maja Meško 2,3 and Iztok Podbregar 3,* 1 Faculty of Organisation Studies in Novo Mesto, 8000 Novo Mesto, Slovenia; [email protected] 2 Faculty of Management, University of Primorska, 6000 Koper, Slovenia; [email protected] 3 Faculty of Organizational Sciences, University of Maribor, 4000 Kranj, Slovenia * Correspondence: [email protected] Abstract: The article gives us an insight into the key issues of car sharing and its impact on urban sus- tainability. A selection of 314 articles published in peer-reviewed journals from the Scopus database were analysed using Leximancer 5.0 for Automated Content analysis. A total of seven themes were identified explaining the researched topic of the car sharing situation in Europe, which are sharing, economy, model, systems, electrical car sharing, policy and travel. There are two ways of sharing owned cars in Europe; access to cars from the fleet of private organisations and P2P car sharing. Sustainable environmental solutions in the context of the electrification of cars are used. Car sharing usually takes place online and can be free or for a fee as defined by The European Economic and Social Committee. The article provides an overview of understanding the concept of urban car sharing in Europe. Keywords: sustainability; urban sustainability; car sharing; Europe 1. Introduction This article aims to provide an overview of understanding the concept of urban car sharing, whose growth and development has been influenced by the recent financial crisis Citation: Roblek, V.; Meško, M.; that caused an economic recession in both the US and Europe between 2007 and mid-2009, Podbregar, I. -

20-03 Residential Carshare Study for the New York Metropolitan Area

Residential Carshare Study for the New York Metropolitan Area Final Report | Report Number 20-03 | February 2020 NYSERDA’s Promise to New Yorkers: NYSERDA provides resources, expertise, and objective information so New Yorkers can make confident, informed energy decisions. Mission Statement: Advance innovative energy solutions in ways that improve New York’s economy and environment. Vision Statement: Serve as a catalyst – advancing energy innovation, technology, and investment; transforming New York’s economy; and empowering people to choose clean and efficient energy as part of their everyday lives. Residential Carshare Study for the New York Metropolitan Area Final Report Prepared for: New York State Energy Research and Development Authority New York, NY Robyn Marquis, PhD Project Manager, Clean Transportation Prepared by: WXY Architecture + Urban Design New York, NY Adam Lubinsky, PhD, AICP Managing Principal Amina Hassen Associate Raphael Laude Urban Planner with Barretto Bay Strategies New York, NY Paul Lipson Principal Luis Torres Senior Consultant and Empire Clean Cities NYSERDA Report 20-03 NYSERDA Contract 114627 February 2020 Notice This report was prepared by WXY Architecture + Urban Design, Barretto Bay Strategies, and Empire Clean Cities in the course of performing work contracted for and sponsored by the New York State Energy Research and Development Authority (hereafter the "Sponsors"). The opinions expressed in this report do not necessarily reflect those of the Sponsors or the State of New York, and reference to any specific product, service, process, or method does not constitute an implied or expressed recommendation or endorsement of it. Further, the Sponsors, the State of New York, and the contractor make no warranties or representations, expressed or implied, as to the fitness for particular purpose or merchantability of any product, apparatus, or service, or the usefulness, completeness, or accuracy of any processes, methods, or other information contained, described, disclosed, or referred to in this report. -

Quickar(PDF 8.49

7 September 2017 The Secretary, Economy and Infrastructure Committee Parliament House, Spring Street EAST MELBOURNE VIC 3002 Dear Secretary, Please accept this cover letter and attached report as a submission to the Committee’s Inquiry into Electric Vehicles. A mushrooming of Melbourne’s population over the next 20 years combined with the phenomena of significant population detachment from economic hubs driven by growing rates of car ownership and burgeoning investment by government in private car driver-driven infrastructure is a looming urban mobility crisis. We risk sleepwalking into a situation where our once “world’s most livable city” has insufficient public transport, overloaded infrastructures, a default logarithmic expansion of motorised means of transport, a vast rise in air and noise pollution and CO2 emissions, a concomitant parking capacity problem and increasing disparity in the social equity standards between communities of very near proximity. What should the Victorian Government do? The attached report assesses the opportunity for Free Floating Car Sharing in Zero Emission urban transport. This report concludes that Free Floating Car Sharing is an innovative technology with a smart operating model that improves cities. It offers cities a no-cost, scaleable transport alternative to supplement existing transport systems and reduce inner urban vehicle congestion. Moreover, Free Floating Car Sharing offers Melbourne’s best opportunity for a definitive, practical and evolutionary pathway into a sustainable Zero Emission urban mobility future through the accelerated uptake of Electric Vehicles. Quickar Pty Ltd (ABN 99 611 879 513) Melbourne, 3000 Victoria, Australia Page 1 of 66 In light of these conclusions, the Victorian Government should: • Enable Free Floating Car Sharing. -

Ischannel Volume 12 Online

iS CHANNEL Closed Platforms Open Doors: Deriving Strategic Im- plications from the Free-Floating Car Sharing Platform DriveNow Curtis Goldsby MSc in Information Systems and Digital Innovation Department of Management London School of Economics and Political Science KEYWORDS ABSTRACT Open platforms This paper examines the free-floating car-sharing company DriveNow, Closed platforms governed by a joint venture of BMW Group and Sixt SE. The platform-mediated network model is used to determine DriveNow is a closed platform. Relating Drivenow this to adoption/appropriability characteristics, I show how the closed nature Car-sharing of the platform strategically affects DriveNow. Business strategy It is concluded that DriveNow, although closed, can pursue at least three Platform strategy successful platform strategies, but struggles capitalizing on multi-sided network effects. The paper thus shows how a closed platform born through traditional ventures, despite growth bottlenecks, also has the potential to disrupt industries. 1. Introduction a closed platform that does not yet fully capitalize on open multi-sided network effects. Digital platforms are radically transforming every industry today (de Reuver, Sørensen, & Basole, 2017). The relevance of exploring digital platforms and The competitive edge and profit growth achieved researching them in the IS field has been recently through digital platforms indicate why so many emphasized by de Reuver, Sørensen, & Basole (2017). firms are including the power of platforms into their The challenges highlighted by the researchers stem existing business strategies (Parker, Van Alstyne, & from the exponentially growing scale of platform Choudary, 2016). For some “born-digital” companies innovation, increasing complexity of architectures like Microsoft and Amazon, this inclusion of and and the spread of digital platforms to many industries diversification through platforms is easier than for (de Reuver, Sørensen, & Basole, 2017). -

Avis Europe Plc Annual Report 2009 Avis Europe Plc, Avis House, Park Road, Bracknell, Berkshire RG12 2EW

Award winning Avis Europe Avis plc Annual Report 2009 Grand Travel Award World Travel Awards, World Travel Awards, World Travel Awards, for Norway’s best car Europe’s leading business World’s leading business Asia’s leading car rental rental provider car rental company 2009 car rental company 2009 company 2009 World Travel Awards, World Travel Awards, World Travel Awards, British Travel Awards, Africa’s leading business India Ocean’s leading car Middle East’s leading business car hire company of the car rental company 2009 rental company 2009 car rental company 2009 year 2009 British Travel Awards, TTG Travel Awards 2009, BIT Tourism Awards 2009, Awarded Superbrand best business car hire car hire company of the year best car rental company status in Kuwait for 2009 company 2009 Grand Travel Award for Norway’s best car rental provider Avis Europe plc Annual Report 2009 Avis Europe plc, Avis House, Park Road, Bracknell, Berkshire RG12 2EW Telephone +44 (0)1344 426644 Facsimile +44 (0)1344 485616 www.avis-europe.com avis-europe.com Annual Report 2009 85 Avis at a glance Shareholder information Registered office and head office Who we are Avis House, Park Road, Bracknell, Berkshire, RG12 2EW Tel: +44 (0) 1344 426644 We operate the Avis brand across four continents Avis Europe plc is a leading car rental Fax: +44 (0) 1344 485616 via a network of over 2,800 locations in 109 Registered number: 3311438 company in Europe, Africa, the Middle East countries, through wholly-owned subsidiaries in 13 countries complemented by franchisees in a and Asia operating the globally recognised Registrar further 96 countries.