Press Release NLC India Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Detailed Advertisement

NLC India Limited (Formerly Neyveli Lignite Corporation Limited) - Government of India Enterprise) (‘Navratna’ RECRUITMENT CELL / HR DEPARTMENT / CORPORATE OFFICE Advt.No. 07 /2017 NLC India Limited (Formerly Neyveli Lignite Corporation Limited), a premier ‘NAVRATNA’ Public Sector Enterprise with a present annual turnover of INR.8673 Crore (approx.) is spreading its wings in the frontiers of Mining and Power generation. The Corporate plan of the company has many ambitious expansion schemes for massive capacity augmentation in the years to come. The company is looking for Specialist Doctors in the following specialties for its 369 bed Hospital:- A SPECIALTIES; NUMBER OF VACNCIES AND QUALIFICATION REQUIREMENT No. of Speciality Qualification requirement posts General Surgery 04 MBBS and MS / DNB in General Surgery, preferably with skill to perform Laparoscopy Surgeries. Medicine 03 MBBS and MD / DNB in General Medicine Ophthalmology 01 MBBS and Diploma / MS / DNB in Ophthalmology Orthopedics 01 MBBS and Diploma / MS / DNB in Orthopedics All Degree / PG Degree / DNB should have been registered with Medical Council of India / State Medical Council. B. LEVEL OF INDUCTION Depending upon qualification; Upper age limit; length of experience and performance in the Interview, the selected candidates will be inducted either in E-4 Grade or E-5 Grade, as indicated below: - UPPER AGE LIMIT MINIMUM LENGTH OF POST QUALIFICTION POST / GRADE (As on 01/10/2017) AREA OF EXPERIENCE REQUIRED (As on 01/10/2017) SCALE OF PAY / CTC * EXPERIENCE FOR CANDIDATES WITH FOR CANDIDATES WITH UR OBC SC/ST PG DIPLOMA MD / MS / DNB Medical Officer Post qualification experience E-4 Grade 36 39 41 (experience after passing PG 04 Years ** Not required Rs.29100-3%-54500 Diploma / MD / MS / DNB as Rs.13.96 Lacs. -

PRSI National Awards-2020 Winners

PRSI NATIONAL AWARDS- 2020 Results Public Relations Society of India www. prsi.org.in PRSI NATIONAL AWARDS - 2020 No of S No Category Name of Organization entries 1 First Prize HP Samachar Hindustan Petroleum Corporation Ltd – Mumbai House Journal (Hindi) Second Petroleum Swar Prize Bharat Petroleum Corporation Ltd – Mumbai Third Prize Prayas Numaligarh Refinery Limited – Guwahati 2 First Prize Sail News House Journal (English) Steel Authority of India - New Delhi First Prize Varta Garden Reach Shipbuilders & Engineers Ltd. Second HP News Prize Hindustan Petroleum Corporation Ltd – Mumbai Second Kribhco News Prize Kribhco, Noida Third Prize IndianOil News Indian Oil Corporation - Marketing Division HO,Mumbai 3 Newsletter (English) First Prize Heritage Institute of Technology / Kalyan Bharti Trust, kolkata Second Ordnance Factory Board (OFB), Prize Kolkata Third Prize Aditya Birla Fashion & Retail Limited - Bengaluru, Karnataka / Mumbai 4 Third Prize Indian Oil Corporation Ltd - Barauni Newsletter (Hindi) Refinery ,Barauni 5 First Prize NTPC Ltd - New Delhi Special/Prestige Publication Second Steel Authority of India - New Delhi Prize Third Prize Indian Oil Corporation - Marketing Division (HO), Mumbai 6 Coffee Table Book First Prize Indian Oil Corporation - Marketing Division (HO) Second Garden Reach Shipbuilders & Prize Engineers Ltd. Kolkata Third Prize AIRADS Ltd. Third Prize Ordnance Factory Board (OFB) Kolkata 7 Sustainable Development Report First Prize ITC Ltd – Kolkata Second Indian Oil Corporation Ltd - Prize Corporate Office, New -

Organisational Structure and Functions

CHAPTER 1 44th Foundation Day of CIL ORGANISATIONAL STRUCTURE AND FUNCTIONS ANNUAL REPORT 2018-19 Ministry OF Coal ORGANISATIONAL STRUCTURE AND FUNCTIONS Introduction Allocating coal blocks in a transparent manner. The Ministry of Coal has the overall responsibility of determining Functions of the Ministry of Coal policies and strategies in respect of exploration and development The Ministry of Coal is concerned with exploration, development of coal and lignite reserves, sanctioning of important projects of and exploitation of coal and lignite reserves in India. The subjects high value and for deciding all related issues. These key functions allocated to the Ministry of Coal (includes Subordinate or other are exercised through its public sector undertakings, namely Coal organizations including PSUs concerned with their subjects) India Limited (CIL) and NLC India Limited (NLCIL) and Singareni under the Government of India (Allocation of Business) Rules, Collieries Company Limited (SCCL), a joint sector undertaking of 1961, as amended from time to time as follows :- Government of Telangana and Government of India with equity capital in the ratio of 51:49. (i) Exploration and development of coking and non-coking coal and lignite deposits in India. Vision (ii) All matters relating to production, supply, distribution The core objectives of MoC are linked to its vision of securing and prices of coal. the availability of coal to meet the demand of different sector of the economy in an eco-friendly and sustainable manner and the (iii) Development and operation of coal washeries other than overall mission of augmenting production through Government those for which the Department of Steel is responsible. -

Nlc India Limited Mine-Ii

NLC INDIA LIMITED ('Navratna' - A Government of India Enterprise) MINE-II PRE-FEASIBILTY REPORT FOR MINING OF LIGNITE & ASSOCIATED MINERALS (Silica sand & Ball clay) PRE-FEASIBILITY REPORT FOR MINING OF LIGNITE & ASSOCIATED MATERIALS AT MINE-II 1. INTRODUCTION: NLC India Limited, (NLCIL) formerly (Neyveli Lignite Corporation limited) is Navaratna, a Government of India Enterprise registered under Indian Companies Act, 1956, engaged in commercial exploitation of the Lignite deposit available at Neyveli region. NLCIL is engaged in commercial mining of the Lignite deposit available at Neyveli region in Tamil Nadu as well as in Rajasthan. Four lignite mines having a combined production capacity of 30.6 MTPA feeding lignite to thermal power stations having a combined generating capacity of 3240 MW. NLCIL is operating 1000 MW Coal based Thermal Power Station as joint venture project with NLC Tamilnadu Power Limited. The total power generating capacity of NLCIL is 4240 MW. In addition, NLCIL is also supplying lignite (1.9 MT/Y) to an Independent Power Plant (TAQA) of 250 MW generation capacity. A New Neyveli Thermal Power Station (NNTPS) of 1,000 MW generation capacity at Neyveli is under commissioning as a replacement for the existing TPS-I of 600 MW. In the Non-Conventional Energy Sector, 51 MW wind power project and 640 MW Solar Power Project has been commissioned in Tamilnadu while another 709 MW at Neyveli is under implementation stage. NLCIL has signed a JV agreement with UP Government to establish a 1980 MW Power Station (3 x 660MW) at Ghatampur, Uttar Pradesh and the project is at the execution phase. -

3 Committee on Welfare Of

COMMITTEE ON WELFARE OF OTHER BACKWARD CLASSES 3 (2019-20) (SEVENTEENTH LOK SABHA) MINISTRY OF COAL “Measures undertaken to secure representation of OBCs in employment and for their welfare in Coal India Ltd. (CIL), Northern Coalfields Limited (NCL) and South Eastern Coalfields Limited (SECL)” THIRD REPORT LOK SABHA SECRETARIAT NEW DELHI March, 2020/Chaitra, 1942 (Saka) THIRD REPORT COMMITTEE ON WELFARE OF OTHER BACKWARD CLASSES (2019-20) (SEVENTEENTH LOK SABHA) MINISTRY OF COAL “Measures undertaken to secure representation of OBCs in employment and for their welfare in Coal India Ltd. (CIL), Northern Coalfields Limited (NCL) and South Eastern Coalfields Limited (SECL)”. Presented to Hon’ble Speaker on 13th June, 2020 LOK SABHA SECRETARIAT NEW DELHI March, 2020/Chaitra, 1942 (Saka) C.O.OBC No. 35 Price : Rs @2014 BY LOK SABHA SECRETARIAT Published under Rule 382 of the Rules of Procedure and Conduct of Business in Lok Sabha (Fifteenth Edition) and printed by the General Manager, Government of India Press, Minto Road, New Delhi-110002. CONTENTS PAGE COMPOSITION OF THE COMMITTEE (2019-20)........................................................... (iii) INTRODUCTION…………………………………………................................................... (v) PART-I Narration Analysis CHAPTER I Introductory.........................................................................................................1 CHAPTER II Representation of OBCs in CIL, NCL and SECL...............................................5 CHAPTER III Implementation of Reservation Policy -

NLC India Limited Corporate Presentation August 2021 1 Disclaimer

NLC India Limited A “Navratna” – Government of India Enterprise Corporate Presentation August- 2021 NLC India Limited Corporate Presentation August 2021 1 Disclaimer This presentation is for distribution only under such circumstances as may be permitted by applicable law. It is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments of NLC India Limited (the “Company” or “NLCIL“) in any jurisdiction. No representation or warranty, either express or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the future proposals , strategies and projections referred to in the report. This presentation does not constitute a prospectus, offering circular or offering memorandum or an offer, or a solicitation of any offer, to purchase or sell, any shares and should not be considered as a recommendation that any investor should subscribe for or purchase any of the Company’s equity shares. Securities of the Company may not be offered or sold in the United States absent registration under the U.S. Securities Act of 1933, as amended, or an exemption from the registration requirements of that Act. Any public offering or sale of securities of the Company to be made in the United States will be made by means of a prospectus that may be obtained from the Company or the selling security holder and that will contain detailed information about the Company and its management, as well as financial statements. -

Chapter Iii: Ministry of Coal

Report No. 11 of 2018 CHAPTER III: MINISTRY OF COAL Bharat Coking Coal Limited 3.1 Blending of precious steel grade coal with inferior washery grade coal Steel grade coal is precious, fetches higher revenue and can be used directly by consumers in the steel sector. Due to relatively low ash content, it does not require washing. However, Bharat Coking Coal Limited (BCCL) blended steel grade coal with inferior washery grade coal in its four washeries, instead of supplying the steel grade coal directly to customers and earning higher revenue. This has resulted in loss of `95.09 crore to the Company during 2013-14 to 2015-16, worked out on a conservative basis. Bharat Coking Coal Limited (BCCL), one of the coal producing subsidiaries of Coal India Limited (CIL) is engaged in mining, washing and distribution of coal to meet the energy requirement of its consumers. BCCL produces both coking and non-coking coal. Coking coal having less than 18 per cent ash is termed steel grade coal which can be used directly by consumers in the steel sector. Coal having higher ash content (18 per cent to 35 per cent ) is termed washery grade coal and requires washing to make it suitable for use in production of steel. During 2013-14 to 2015-16, BCCL fed 26.33 lakh tonne of coking coal into its four washeries (Sudamdih & Dugda-II for entire period and Mahuda & Bhojudih only in 2015-16) by blending 13.91 lakh tonne steel grade coal 1 with 12.42 lakh tonne washery grade coal, which finally yielded only 6.64 lakh tonne of washed coal (25 per cent ) along with middling, slurry and rejects. -

Annual Report 2016 (Full) 16-08-2016.Cdr

th Annual Report 2015-16 NLC India Limited Navratna - Govt. of India Enterprise CHAIRMAN AND MANAGING DIRECTOR PRINCIPAL BANKERS Shri. Sarat Kumar Acharya State Bank of India DIRECTORS Canara Bank Shri. Rakesh Kumar AXIS Bank Shri. Subir Das HDFC Bank Shri. V. Thangapandian ICICI Bank Shri. P. Selvakumar TRUSTEES TO THE NEYVELI BONDS 2009 Shri. Chandra Prakash Singh Shri. Azad Singh Toor M/s. IDBI Trusteeship Services Ltd., Shri. K. Madhavan Nair Vishawastha Bhavan, 1st Floor, CHIEF FINANCIAL OFFICER 218, Pratapganj Peth, Satara - 415 002. Shri. Rakesh Kumar Telefax : 02162 - 280075. COMPANY SECRETARY REGISTERED OFFICE Shri. K. Viswanath First Floor, No.8, Mayor Sathyamurthy Road, STATUTORY AUDITORS FSD, Egmore Complex of Food Corporation of India, M/s. P.B. Vijayaraghavan & Co., Chetpet, Chartered Accountants, Chennai - 600 031. 14/27, Cathedral Garden Road, DEPOSITORY REGISTRAR & Nungambakkam, SHARE TRANSFER AGENT Chennai - 600 034. M/s. Integrated Enterprises (India) Ltd., M/s. Chandran & Raman, Chartered Accountants, II Floor, 'Kences Towers', Paragon No.2, Dr. Radhakrishnan Salai, No.1, Ramakrishna Street, 2nd Street, Mylapore, North Usman Road, T. Nagar, Chennai - 600 004. Chennai - 600 017. BRANCH AUDITOR M/s. Surender K Goyal & Co., CONTENTS Chartered Accountants, Performance Highlights 9 Nukul Niwas, Behind Roadways Depot, Sardar Shahar - 331 403. Directors' Report 11 COST AUDITOR C&AG's Comments 68 M/s. M. Krishnaswamy & Associates, Auditors' Report 69 Cost Accountants, Significant Accounting Policies 78 Flat 1K, Ramaniyam Ganga, Balance Sheet 84 Door No. 27-30, First Avenue, Ashok Nagar, Chennai - 600 083. Profit & Loss Statement 85 SECRETARIAL AUDITOR Cash Flow Statement 86 Shri. R. Balasubramaniam, Notes to the Financial Statement 88 Practising Company Secretary, Information on Subsidiary Companies 108 J Block, Second Street, "Newry Suprit", Consolidated Financial Statements 111 Door: 27, Flat A2, Anna Nagar East, Social Overhead 148 Chennai - 600 102. -

Metering Scheme

For SOUTHERN REGIONAL POWER COMMITTEE BENGALURU Minutes of the 42ndMeeting of Commercial Sub-Committee of SRPC held at Bengaluru on 22.10.2019. 1. Introduction 1.1 The 42nd Meeting of the Commercial Sub-Committee of SRPC was held on 22nd October 2019 in the Conference Hall of SRPC. There was no representation from APTRANSCO and TSTRANSCO. The list of participants is at ANNEXURE-I. 1.2 Member Secretary, SRPC welcomed all the members and participants to the 42ndmeeting of Commercial Sub-Committee. He mentioned the following: i. CERC had invited comments from the stakeholders on the provisions of Draft Central Electricity Regulatory Commission (Sharing of Revenue Derived from Utilization of Transmission Assets for Other business) Regulations, 2019. The constituents may furnish their comment to CERC. ii. CERC had extended the Security Constrained Economic Despatch (SCED) pilot for the period up to the March 2020. The revised procedure for pilot on SCED for Inter State Generating Stations came into effect from 1st October 2019. iii. SRPC Secretariat had submitted suggestion on the proposed framework for Real- Time Market for Electricity to CERC. Then same is put up for information of the Members. iv. CEA had published “Marketing Monitoring Report” for the month of April 2019 and the same is available on CEA web site. v. In the Special meeting held on 29th September 2019, possible solutions for Reserve Shut Down issues were finalized and the same would be furnished to CERC for consideration. He observed that lot of correspondence between NPCIL/KKNPP and beneficiaries with a copy to MS.SRPC were being taking place on the issue of long pending payments. -

Annual Report 2019-20

NEYVELI UTTAR PRADESH POWER LIMITED CHAIRMAN SECRETARIAL AUDITOR Shri. Rakesh Kumar CS Gunjan Goel, Practicing Company Secretary, C-4/152, Vikas Khand, DIRECTORS Gomti Nagar, Lucknow – 226 010. Shri. Rajnish Kwatra Shri. Shaji John PRINCIPAL BANKERS & Shri. Jaikumar Srinivasan FINANCIAL INSTITUTIONS Power Finance Corporation Ltd. Shri. Ajit Kumar Tewary REC Ltd. State Bank of India. Shri. Bibhu Prasad Mahapatra REGISTERED OFFICE CHIEF EXECUTIVE OFFICER 6/42, Vipul Khand, Shri. Mohan Reddy K. Gomti Nagar, Lucknow – 226 010, Uttar Pradesh. CHIEF FINANCIAL OFFICER Shri. Ashok Kumar Mali 02 COMPANY SECRETARY 31 Shri. Nikhil Kumar 35 44 STATUTORY AUDITOR 45 Seth & Associates, Chartered Accountants, 47 90- Pirpur Square, Lucknow – 226 001. 48 1 8th Annual Report 2019-20 NEYVELI UTTAR PRADESH POWER LIMITED DIRECTORS’ REPORT FOR THE FINANCIAL YEAR 2019-20 To The Members, Neyveli Uttar Pradesh Power Limited. Your Directors have great pleasure in presenting the Eighth Annual Report of your Company together with the Audited Statements of Accounts, Auditors’ Report and the Report of the Comptroller & Auditor General of India on the Accounts for the Financial Year ended on 31st March, 2020. Project Profile As members may be aware that your Company is setting up 1980 MW (3 X 660 MW) Coal based Ghatampur Thermal Power Plant (GTPP) at Ghatampur Tehsil, Kanpur Nagar District in the State of Uttar Pradesh. The Government of India (GOI) had accorded sanction for the project on 27.07.2016 at the revised Capital Expenditure of `17,237.80 crore with base date of Dec-2015 and the schedule for completion of the project is 52 months, 58 months and 64 months from the date of GOI sanction for the 1st, 2nd and 3rd unit of 660 MW each, respectively. -

NLC India Limited (The “Company”) As on the Record Date in Accordance with Securities and Exchange Board of India (Buy-Back of Securities) Regulations, 2018

DRAFT LETTER OF OFFER THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION This Letter of Offer is being sent to you, being an Eligible Shareholder of NLC India Limited (the “Company”) as on the Record Date in accordance with Securities and Exchange Board of India (Buy-Back of Securities) Regulations, 2018. If you require any clarifications about the action to be taken, you may consult your stockbroker or investment consultant or the Manager to the Buyback Offer i.e. IDBI Capital Markets & Securities Limited or the Registrar to the Buyback Offer i.e. Integrated Registry Management Services Private Limited. Please refer to the section on ‘Definitions’ for the definition of the capitalized terms used herein. NLC India Limited (Formerly Neyveli Lignite Corporation Limited) (‘Navratna’ – A Government of India Enterprise) Registered Office: First Floor, No. 8, Mayor Sathyamurthy Road, FSD, Egmore Complex of Food Corporation of India, Chetpet, Chennai – 600 031 Corporate Office: Block-1, Neyveli – 607 801, Cuddalore District, Tamil Nadu CIN: L93090TN1956GOI003507 Contact Person: Shri K. Viswanath, Company Secretary Tel: 044 – 28364613/14 04142-252205 | Fax: 04142-252645/6 | Email: [email protected] | Website: www.nlcindia.com CASH OFFER FOR BUYBACK OF NOT EXCEEDING 14,19,31,818 (FOURTEEN CRORE NINETEEN LAKH THIRTY ONE THOUSAND EIGHT HUNDRED EIGHTEEN) FULLY PAID-UP EQUITY SHARES OF FACE VALUE `10 EACH, REPRESENTING 9.29% OF THE TOTAL NUMBER OF EQUITY SHARES IN THE ISSUED, SUBSCRIBED AND PAID-UP EQUITY SHARE CAPITAL OF THE COMPANY, FROM ALL THE EXISTING SHAREHOLDERS/ BENEFICIAL OWNERS OF EQUITY SHARES OF THE COMPANY AS ON THE RECORD DATE i.e. -

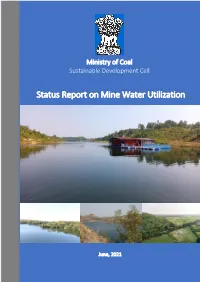

Mine Water Utilization Status Report – Format Circulated to Coal Companies by Moc

Ministry of Coal Sustainable Development Cell Status Report on Mine Water Utilization June, 2021 PREFACE Coal plays a crucial role in India’s energy consumption matrix and is expected to remain the bedrock of the energy supply for the country till 2030 and beyond. Coal India Limited (CIL), NLC India Limited (NLCIL) and Singareni Collieries Company Limited (SCCL) are key contributors towards coal production in India and have set ambitious targets to push up coal production in the coming years. Apart from coal production, emphasis is also placed on facilitating improvement in social and environmental scenario of coal mining areas through various forums / mechanisms; utilization of mine water is a stepping stone towards fulfilling this agenda. Mine water generation occurs where aquifers surrounding the coal seams get exposed during the mining operation – the result is an accumulation of groundwater in a sump within the mine. In order to continue safe mining operations, the accumulated mine water is dewatered to a separate sump within the mine lease area. Generally, these mine water sumps / pit lakes are retained even post closure of the mines and provide an excellent opportunity for storage of freshwater. Such accumulated mine water lakes are usually free from pollutants and can be utilized as a source of water with an aim towards enhancing environmental responsibility by coal producing companies. Mine water can be utilized for the following broad purposes: for industrial and domestic purposes within the mining project, for community uses