Milford-Crossing-Press-Release.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MINUTES Guilford Planning and Zoning Commission Regular Meeting and Public Hearing, August 17, 2016 Nathanael B

DRAFT ‐ MINUTES Guilford Planning and Zoning Commission Regular Meeting and Public Hearing, August 17, 2016 Nathanael B. Greene Community Center 32 Church Street, Guilford CT 7:30 P.M. Menunkatuck Room (2nd floor) Members Present: Tom Cost (Chairman), Richard Meier & Joshua Hershman Members Absent: Ray Bower, Frank D’Andrea, Richard Wallace Alternates Present: Phil Johnson & George Underhill Staff Present: Regina Reid, Zoning Enforcement Officer –– Lisa Brewer, Recording Secretary. Video: Peter Schulze Audio Recording: Digital Approximate number of people in attendance: 30 Chairman Tom Cost called the meeting to order at 7:31 PM and explained the meeting procedure to those in attendance. He then introduced the members of the Commission and Staff: Chairman Tom Cost (V), Joshua Hershman (V) & Richard Meier (V). Alternates: George Underhill & Phil Johnson. Staff: Zoning Enforcement Officer Regina Reid and Recording Secretary Lisa Brewer. Decisions of this meeting are available the day after the meeting by calling the Planning & Zoning office at (203‐453‐8039) after 9:00 AM. Cmsr Richard Meier read the call of the meeting. Upon a motion by Cmsr Meier it was unanimously voted to open this meeting of the Guilford Planning and Zoning Commission. ~~~~~~~~~~~~~~~~~~~~~~~~~~ Page | 1 August 22, 2016 PUBLIC HEARING CONTINUED ‐ Town of Guilford, Map 49 & 43, Zone R/3 & TS; Coastal Area Management Site Plan; Creation of paved Shoreline Greenway Trail from the Madison Town Line to the intersection of Route 146 & Boston Post Road. §273‐91 Continued to 9/7/16 for Mandatory Second Public Hearing Assistant Town Engineer presented the plans to create of paved Shoreline Greenway Trail the trail which will have an asphalt surface with a stone chip seal on top. -

Town of Darien Planning and Zoning Commission Application Form

TOWN OF DARIEN PLANNING AND ZONING COMMISSION APPLICATION FORM Application is hereby submitted for approval in accordance with the following Sections of the Darien Zoning Regulations (check all that apply). Section 810 Coastal Site Plan Review Section 1000 Special Permit Requirements Section 820 Flood Damage Prevention Section 1020 Site Plan Requirements Section 850 Land Filling, Excavation Section 1051 Protected Town Landmarks and Earth Removal Subdivision Application Section 1110 Change of Zoning Regulations and/or Zoning Map Other (specify)_______________________________________________ Property Location: Street Address: _____________________________________________________ Assessor’s Map(s) # ___________________ as Lot(s) # ___________________ Subject property is situated on the __________ side of________________________(street) approximately __________ feet __________ from the corner formed by the intersection of _______________________________and __________________________ (streets). Zoning District(s): ________________ Size of Site: ________________ square feet, _________ acres The subject property is is not as a result of this project will become tied into the Town sanitary sewer system. The subject property is is not as a result of this project will become tied into the public water system (Aquarion Water Co.). The subject property is is not within 500 feet of an adjoining municipality. Applicant: Property Owner: Name: _______________________ Name: ______________________________ Address: Address: ______________________________ -

Figure 9. Digital Map Depicting the Locations of Previously

Figure 9. Digital map depicting the locations of previously National Register of Historic Places properties in the vicinity of the proposed tower location in East Lyme, Connecticut. Project Area 5 1 4 2 3 6 7 8 9 10 11 20 0 20 I Meters Figure 10 . Aerial view of the location of the proposed telecommunications tower in East Lyme , Connecticut depicting the location and direction of each the following photographs. CO SUBMISSION PACKET – FCC FORM 620 0.5-mile Project Site Visual APE Ë 2 Ë 3 Ë 1 Figure 11: Photograph Directions Map #2. Applicant: New Cingular Wireless PCS, LLC Project Number: CT1931401 Project Location: 351A Boston Post Road, East Lyme, CT, 06333 CO SUBMISSION PACKET – FCC FORM 620 Figure 12: Bird’s Eye View Aerial Photograph. Applicant: New Cingular Wireless PCS, LLC Project Number: CT1931401 Project Location: 351A Boston Post Road, East Lyme, CT, 06333 CO SUBMISSION PACKET – FCC FORM 620 Attachment 4 – Site Information – Additional Site Information Additional Site Information and Recommendations: Describe any additional structures, access roads, utility lines, fences, easements, or other construction planned for the site in conjunction with the proposed collocation and related facilities. Use this attachment to provide additional details needed to provide a full and accurate description of any structural alterations, additions, or other construction activities that will take place to complete the collocation. The Subject Property is located at 351A Boston Post Road in East Lyme, Connecticut, and is situated on the north side of Boston Post Road (CT Route 1) opposite Naomi Lane . The proposed site is approximately 0.38-mile southwest of Pattagansett Lake; 1.52-miles west of Boston Post Road ’s intersection with Flanders Road (Ct Route 161), also known as Flanders Four Corners; and 1.26-miles northwest of Interstate 84. -

Bloomingdale: Colonial Times and After the Revolutionary War by Pam Tice, Member of the Bloomingdale Neighborhood History Group Planning Committee

===================================================================== RNA House History Club May 2021 ===================================================================== [The following post is the first of three documenting life in the Bloomingdale neighborhood in the colonial and revolutionary times. It can be seen on the Bloomingdale Neighborhood History Group blog site at: https://www.upperwestsidehistory.org/blog/march-30th-2021] Part 1: Bloomingdale: Colonial Times and after the Revolutionary War by Pam Tice, Member of the Bloomingdale Neighborhood History Group planning committee Introduction A few months ago, a new website developed by John Jay College caught my attention. Like many institutions of higher education, the College was exploring the link between slavery and the famous man whose name adorns it. One of the resources used was the 1790 federal Census. I looked up Charles Ward Apthorp, whom I had written about previously, one of the colonial property owners in our Bloomingdale neighborhood. He owned eight slaves. That got me thinking: who were the other people in this census? How was the Bloomingdale neighborhood settled in the era before the Revolution? What was Bloomingdale like after the Revolution and in the early 1800s? I started to dig a bit deeper into the Bloomingdale history, beyond the work of numerous local historians who write about a particular property owner and the history of a mansion house, as I myself had done in writing about Apthorp’s mansion that became Elm Park. The Bloomingdale Road, authorized in 1703, and laid out in 1707, was key to the area’s development; Bloomingdale became more like a suburb of the city than what we call a neighborhood today. -

BOARD of TRUSTEES January 14, 2019

BOARD OF TRUSTEES January 14, 2019 PRESENT: Mayor Monachino Lapey Trustee Annunziata Trustee McLaughlin Trustee Senerchia Attorney Cornachio Manager Pierpont ABSENT: Trustee Bennett PLEDGE OF ALLEGIANCE AND FIRE SAFETY ANNOUNCEMENT Mayor Monachino Lapey led those assembled in the Pledge of Allegiance and notified those in attendance where the fire exits were located. The Mayor announced that Trustee Bennett was recovering with a medical matter and sends her regrets. She said that the website will be complete in the upcoming weeks and said that the upgrade is coming shortly. The Mayor also announced that Deputy Mayor Annunziata has two new grandchildren. He has four daughters and five granddaughters. Mayor Monachino Lapey said that Pelham High School graduates P.J. Shiels from the Village of Pelham and Andrew Spana from Pelham Manor were both honored for receiving the rank of Eagle Scout on January 11th. She spoke at the Eagle Scout Court of Honor. She said that Andrew Spana made several structural improvements at OLPH church, The Mayor highlighted in her remarks that the Village’s houses of worship are not only religious institutions but are community resources for the underserved and those struggling with addiction. The community benefits from them. She especially thanked Andrew Spana for his work in the community. The Mayor also noted that she had a very productive meeting with Alessandra Biaggi, the new senator representing the Village. She and Mr. Pierpont met with Senator Biaggi and her staff assistant Maura Curtin who lives in the Village of Pelham. She is happy to have a communicative and collaborative relationship with Senator Biaggi. -

William & Bette Krygier Boston Post Road

Notes: Thomas A. Stevens 1. This survey and map have been prepared in accordance with Sections 20-300b-1 thru & 20-300b-20 of the Regulations of Connecticut State Agencies - "Minimum Standards for Surveys and Maps in the State of Connecticut" as endorsed by the Connecticut Association Associates, Inc. of Land Surveyors, Inc. It is an "Improvement Location Survey - Record" based on a "Dependent Resurvey" conforming to Horizontal Accuracy Class "A-2" and Vertical Civil Engineers ● Land Surveyors Accuracy Class "V-2". The intent of this map is to depict the improvements and their relationship to the property lines. 141 Durham Road, Unit 24 P.O. Box 568 2. Reference map(s): Madison, Connecticut S 04° 41' 15" W a.) "MAP AND SURVEY SHOWING PROPOSED DIVISION OF LANDS OF WILLIAM W. & 06443-0568 MARILYN N. MATTHIES, #109 BOSTON POST ROAD - TWON MAP 44, LOT 33, phone: MADISON, CONNECTICUT, SCALE: 1 INCH =40 FEET, DATE: JULY 1, 1992" by Arthur E. 90.00' (203) 245-0149 Barden. or (860) 373-0260 b.) "MAP OF PROPERTY OWNED BY WILLIAM PAUL KRYGIER AND BETTE BOSCO fax: KRYGIER, MADISON, CONN., SCALE: 1"=20', MAY 14, 1985 REVISED TO 09-13-88", by (203) 245-0731 Robert C. Hart. email: [email protected] 3. Zone: R-2. N 75° 03'160.64' 18" E NAD 83 - North - 83 NAD web: 4. Area: 69,398.5 sq.ft., 1.5932 acres. www.civilsurvey.org 345 15 30 330 N NE 5. Offsets shown to the foundation located 10-21-19. NW 60 300 75 285 5.00' E 6. -

484 Boston Post Road, Orange, Connecticut

484 Boston Post Road, Orange, Connecticut Center Highlights: Attractive investment opportunity in the nucleus of Orange’s retail district! Potential high rate of return, lots of exposure off Boston Post Road, convenient access to I-95, easy access to public transportation, great sight line! Tons of traffic as you are near restaurants and shopping centers. 144 feet of frontage and ample parking! For further information, please contact: Randy Vidal 203-226-7101 ext. 3 [email protected] Individual Members 719 Post Road East, Westport, CT 06880 Society of Industrial and Office Realtors www.vidalwettenstein.com INVESTMENT OPPORTUNITY Orange, Connecticut We are pleased to exclusively offer for sale, offered at $1,490,000 this free standing retail building located on Boston Post Road. It is situated on the main Orange/Milford retail artery in an area with outstanding demographics. This prime retail building, consisting of 9,880 square feet is five minutes from exit 41 of I-95 and has 144± feet of frontage on the Boston Post Road (Route 1). 484 Boston Post Road All information from sources deemed reliable and is submitted subject to errors, omissions, change of price, rental, and property sale and withdrawal notice. Contact : Randy Vidal 719 Post Road East, Westport, CT 06880 203-226-7101 ext. 3, [email protected] www.vidalwettenstein.com 484 Boston Post Road, Orange, Connecticut Southbound -Post Rd Northbound -Post Rd Rear View Lower Rear Parking Individual Members 719 Post Road East, Westport, CT 06880 Society of Industrial and Office Realtors www.vidalwettenstein.com 484 Boston Post Road, Orange, Connecticut Individual Members 719 Post Road East, Westport, CT 06880 Society of Industrial and Office Realtors www.vidalwettenstein.com 484 Boston Post Road, Orange, Connecticut Rear View The building had been fully leased since it was built and for the first time available for sale. -

City of Rye 1051 Boston Post Road Rye, Ny 10580 Agenda

CITY OF RYE 1051 BOSTON POST ROAD RYE, NY 10580 AGENDA REGULAR MEETING OF THE CITY COUNCIL Wednesday, June 5, 2019 7:30 p.m. Please Note: The Council will convene at 6:30 p.m. and it is expected they will adjourn into Executive Session at 6:31 p.m. to discuss attorney-client privileged matters, personnel matters and labor negotiations. 1. Pledge of Allegiance. 2. Roll Call 3. General Announcements. 4. Draft unapproved minutes of the Regular Meeting of the City Council held May 22, 2019. 5. Residents may be heard on matters for Council consideration that do not appear on the Agenda. 6. Consideration of a request from Universal Content Productions to film an episode of “Mr. Robot” on Purchase Street on Monday, July 15, 2019 with the following accommodations in exchange for a fee to be negotiated: • Waive parking restrictions on the Snow Lot July 12, 15 and 16, 2019 • Occupy spots #22-#71 of Car Park 1 on July 15th, 7 am – 8:30 pm • Permission to close Haviland St. on July 15th from 8am – 12 pm • Occupy up to 10 parking spots on Purchase Street from Boston Post Road to Locust Street on July 15th, from 12:30 pm – 3:30 pm • Occupy up to 30 parking spots on Purchase Street from Purdy to Smith Street on July 15th, from 3:30 – 8:30 pm • Occupy 10-15 municipal spots on July 12 and 16, 2019from 7 am – 8:30 pm 7. Authorize the preparation and execution of two quitclaim deeds to transfer parcels No. -

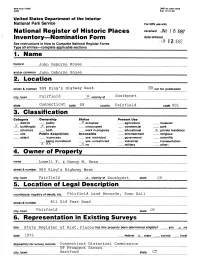

National Register of Historic Places Inventory Nomination Form 1

NPS Form 10-900 OMB No. 1024-0018 (3-82) Exp. 10-31-84 United States Department of the Interior National Park Service For NPS use only National Register of Historic Places received JAN I 6 1987 Inventory Nomination Form date entered See instructions in How to Complete National Register Forms 12 Type all entries complete applicable sections_______________ 1. Name historic John Osborne House and/or common John Osborne House 2. Location street & number 909 King's Highway West NA not for publication city, town Fairfield x vicinity of Southport state Connecticut code 09 county Fairfield code 001 3. Classification Category Ownership Status Present Use district public x occupied agriculture museum ^ building(s) x private unoccupied commercial park structure both work in progress educational x private residence site Public Acquisition Accessible entertainment religious object in process yes: restricted government scientific being considered yes: unrestricted industrial transportation x no military other: 4. Owner of Property name Lowell F. & Nancy W. Hess street & number 909 King's Highway West city, town Fairfield vicinity of Southport state 5. Location of Legal Description courthouse, registry of deeds, etc. Fairfield Land Records, Town Hall street & number 611 Old Post Road city, town Fairfield state CT 6. Representation in Existing Surveys title State Register of Hist. Places has this property been determined eligible? yes no date 1975 federal state county local depository for survey records Connecticut Historical Commission 59 Prospect Street city, town Hartford state CT 7. Description Condition Check one Check one excellent deteriorated unaltered x original site -4£ good ruins _x- altered moved date fair unexposed Describe the present and original (if known) physical appearance The John Osborne House faces north on King's Highway West, one block south west of its intersection with Route 1, the Boston Post Road. -

Boston Post Road

FORM B - BUILDING Assessor's number USGS Quad Area(s) Form Number Massachusetts Historical Commission I 62-3 I I Sudbury 11~__ 15__ 80 Boylston Street Boston, Massachusetts 02116 Town M'arlboTOugb 982 Boston post Road istoric Name Amos and Jouas Darling House Present Dwelling Original DweIling ate of Construction ca] 760 Maps; style; Bigelow le/Form Georgian vernacular Cape Cod cottage rchitect/Builder unknown erior Material: Sketch Map Foundation granite Draw a map of the area indicating properties within it. Number each property for which individual Wa]l!frim wood clapboard inventory[arms have been completed. Label streets, including rowe numbers, if any. Attach a separate Roof slate sheet if space it; not sufficient here. Indicate north: Outbuildings/Secondary Structures _ barn; cottagetgarage Major Alterations (with dates) _ one-story addition on east--20tb C Condition good Moved [X] no [ ] yes Date __ N....••.•../A _ Acreage 247 acres Recorded by Anne Forbes Setting On remnant of early £ann overlooking Organization for Marlboro Hist Camm Hager's pond across Rte 10 Spacious front Date 4n S/Q4, lawn with stone retaining wal] along road BUILDING FORM ARCHITECIURAL DESCRIPTION [ ] see continuation sheet Describe architectural features. Evaluate the characteristics of this building in terms of other buildings within the community. This house is extremely rare in Marlborough as an example of a 1 lI2-story Cape Cod cottage of the Colonial era. Although it has acquired at least three additions over the years, the form of the main house remains as a five-by-two-bay, center-chimney structure. Most of the windows, which appear to retain their original narrow, projecting enframements, are primarily 8-over-12-sash; a pair of 6- over-S-sash windows appear under the roof gables. -

D&M Plan for Singer Substation to Fairfield/Westport Town

Connecticut Siting Council Docket No. 272 Development & Management Plan for the Middletown-Norwalk 345-kV Transmission Line Project Segment 4a – Singer Substation to Fairfield/Westport Town Line Volume 1 of 3 December 2005 Development & Management Plan for the Middletown-Norwalk 345-kV Transmission Line Project Segment 4a - Singer Substation to Fairfield/Westport Town Line Volume 1 of 3 Connecticut Siting Council Docket No. 272 Submitted By: The Connecticut Light and Power Company December 2005 Prepared by: Burns & McDonnell Engineering Company, Inc TABLE OF CONTENTS 1.0 INTRODUCTION........................................................................................................... 1-1 1.1 Project Description............................................................................................. 1-2 1.1.1 Duct Bank Installation........................................................................... 1-2 1.1.1.1 Saw Cutting Pavement ............................................................. 1-2 1.1.1.2 Trench Excavation....................................................................1-3 1.1.1.3 Duct Placement........................................................................ 1-3 1.1.1.4 Backfilling................................................................................ 1-3 1.1.1.5 Temporary Pavement Restoration............................................ 1-3 1.1.2 Splice Vault Installation ........................................................................ 1-3 1.1.3 Cable Pulling........................................................................................ -

Tom Marshall's Weekly News, June 27, 2016 Major Highway Routes

Tom Marshall’s Weekly News, June 27, 2016 Major Highway Routes through Our Area: The Weekly News of April 30, 2007, explained how the numbering of U.S. highways took place in the late 1920s. Especially local to us were U.S. Route 1 that passed through Kennett Square en route from Maine to Florida and U.S Routes 30 and 40 that went west from Atlantic City. U.S. Route 1 (this had nothing to do with the present Delaware Route 1), from Port Kent, Maine, to Key West, Florida, passed through all the major cities en route, such as Boston, New York, Philadelphia, Baltimore, and Washington. As originally laid out, it went near the center of each city. Following the Boston Post Road from New Haven into New York City, it crossed Manhattan to the new Holland Tunnel under the Hudson, and then across the Jersey marshes to Newark. In Philadelphia it followed the road closest to the Delaware River, then past City Hall and west toward Baltimore Pike. As traffic increased, many of these old routes with increasing stop lights became slow and tedious ways to travel, so faster routes were sought around the center of big cities. In 1930, our favorite route south was to go to Elkton and pick up the new U.S. Route 40 (now Maryland Route 7), which had crossed the Pennsville-New Castle Ferry en route from Atlantic City. Southwest of Elkton it passed through the center of North East, Charlestown, and Principia Furnace before reaching the Susquehanna at Perryville. Here the river was crossed on the old railroad bridge with a single lane in each direction, one above the other.