Is It Time to Go Paperless? Records Management

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Preserving Organizational Knowledge with Proper Document Management Oksana Kornilova Opsomer Iowa State University

Iowa State University Capstones, Theses and Retrospective Theses and Dissertations Dissertations 2006 Preserving organizational knowledge with proper document management Oksana Kornilova Opsomer Iowa State University Follow this and additional works at: https://lib.dr.iastate.edu/rtd Part of the English Language and Literature Commons, and the Rhetoric and Composition Commons Recommended Citation Opsomer, Oksana Kornilova, "Preserving organizational knowledge with proper document management " (2006). Retrospective Theses and Dissertations. 7113. https://lib.dr.iastate.edu/rtd/7113 This Thesis is brought to you for free and open access by the Iowa State University Capstones, Theses and Dissertations at Iowa State University Digital Repository. It has been accepted for inclusion in Retrospective Theses and Dissertations by an authorized administrator of Iowa State University Digital Repository. For more information, please contact [email protected]. Preserving organizational knowledge with proper document management by Oksana Kornilova Opsomer A thesis submitted to the graduate faculty in partial fulfillment of the requirements for the degree of MASTER OF ART Major: Rhetoric, Composition, and Professional Communication Program of Study Committee: Lee Honeycutt, Major Professor Donald Payne Hilary Seo Iowa State University Ames, Iowa 2006 Copyright © Oksana Kornilova Opsomer, 2006. All rights reserved. 11 Graduate College Iowa State University This is to certify that the master's thesis of Oksana Komilova Opsomer has met the thesis requirements of Iowa State University Signatures have been redacted for privacy Ill Table of Contents List of Figures iv List ofTables v Chapter 1. Introduction 1 Technical Communicators' Role in Knowledge Management 3 Chapter 2. Knowledge Management or Document Management 7 Knowledge Management 7 Document Management 11 Chapter 3. -

Funding Your Records Management Project by Diane R

Funding Your Records Management Project By Diane R. Gladwell, MMC IIMC ReCoRds ManageMentteChnICal BulletIn seRIes • 2012 Records Management Technical Bulletins This publication, one of sixteen bulletins in the 2012 Local Government Records Management Technical Publica- tion Series, is a joint effort of the Municipal Clerks Education Foundation (MCEF), the International Institute of Municipal Clerks (IIMC), and the National Association of Government Archives and Records Administrators (NAGARA). Funding for this project was made available, in part, by a grant from the National Historical Publi- cations and Records Commission. The Municipal Clerks Education Foundation (MCEF), established in 1984, is a tax- exempt, nonprofit foundation under Section 501 (C)(3) created to raise funds for its part- ner, the International Institute of Municipal Clerks. IIMC uses these funds to promote, train and educate Municipal Clerks, making them proficient in the services they provide for the citizens of their community. MCEF is a diverse team of volunteers who are passionately committed to helping IIMC pursue its educational objectives. The International Institute of Municipal Clerks (IIMC) is devoted to advancing the professionalization of the Office of Municipal Clerk and improving the efficiency of munici- pal government. The IIMC provides its members with educational, conference, reference, research, and informational services designed to keep them informed of changes in the professional community. The National Association of Government Archives and -

Crown Records Management Press Kit

Crown Records Management Press Kit The power of memory www.crownrms.com next page About Crown Records Management Crown Records Management is the corporate information management business of Crown Worldwide, serving large and small corporations around the world. Companies know that managing information effectively is valuable, but it can also be a costly headache. Fueled by the exponential growth of data, advances in technology, changes in regulation, cost efficiency drives, risk management and the need for competitive advantage, staying in control of ever-growing information is impossible without help. Similarly, while the knowledge and experience locked in company archives is an asset that can underpin core business, extracting the value from this asset can appear complex and daunting. As an established global player, Crown Records Management is well positioned to help organizations meet the challenges of good information management in a fast changing world. Its combination of facilities, knowledge and insight into the opportunities of effective records management can bring order to a complex environment and create advantage. The company manages nearly 30,000,000 cubic feet of business records and has grown to become the number one private company in this field. previous page next page About the Crown Group 2012 Fast Facts Founder & Chairman: Type: Privately owned Revenue: US $766 million James E. Thompson Founded: 1965 Assets: US $656 million Group CFO & CEO Asia-Pacific (APAC): Employees: Over 5,200 Properties: US $398 million Ken -

Records Management Supervisor

Records Management Supervisor Under direction, supervises, assigns, and reviews the work of staff responsible for services and activities within the citywide Records Purpose of the Management Program; ensures work quality and adherence to established role: policies and procedures; performs the more technical and complex tasks relative to assigned area of responsibility; and performs related duties as assigned. The Records Management Supervisor assumes responsibility for supervising and overseeing the work of the Records Management section within the City Clerk’s Office. Incumbents in this class supervise, assign work to, and evaluate the performance of three or more positions within the assigned unit. In addition, at least 50 percent of the Records Management Supervisor’s work time is spent performing supervisory functions. Assignments are varied and carried out with considerable judgment and independence. Distinguishing Characteristics: The Records Management Supervisor is responsible for the ongoing development, implementation and enhancement of the citywide records management program both to ensure compliance with all legal requirements and to provide departments with an effective, easy-to-use process for maintaining and accessing information on City operations. Responsibilities include updating and interpreting the records management system; supervising the storage, retrieval and destruction of City records; and overseeing the maintenance, preservation and security of vital and archival records. The incumbent exercises considerable independent judgment and problem-solving skills and must be highly skilled in records management concepts and practices. The following duties are typical for this classification. Incumbents may not perform all of the listed duties and/or may be required to perform additional or different duties from those set forth below to address business needs and changing business practices. -

Collaborative Electronic Records Project: an Introduction and Overview.” Sleepy Hollow, NY and Washington DC: the Collaborative Electronic Records Project

COLLABORATIVE ELECTRONIC RECORDS PROJECT: AN INTRODUCTION AND OVERVIEW December 2008 Rockefeller Archive Center TABLE OF CONTENTS Page Executive Summary . 3 Planning, Funding, Staffing . 5 Phase I: Surveying the Situation . 6 Developing Guidelines . 7 Phase II: Transferring, Testing, Processing . 8 Phase III: Preserving, Storing, and Retrieving . 12 Wish List . 15 Sharing our Experiences . 15 Presentations and Publications . 15 Lessons Learned . 17 What Can an Archivist do Now? . 19 Glossary . 20 This documentation is released by the Collaborative Electronic Records Project under a Creative Commons Attribution-Noncommercial-Share Alike 3.0 United States License, 2008 and 2009. This license can be viewed at http://creativecommons.org/licenses/by-nc-sa/3.0/us/ Citation 2 Adgent, Nancy. (2008). “Collaborative Electronic Records Project: An Introduction and Overview.” Sleepy Hollow, NY and Washington DC: The Collaborative Electronic Records Project. EXECUTIVE SUMMARY In August 2005, the Rockefeller Archive Center (RAC) and the Smithsonian Institution Archives (SIA) launched the three-year Collaborative Electronic Records Project (CERP) to de- velop the methodology and technology for managing and preserving the born-digital mate- rials in archival collections. The project’s primary objectives were to produce management guidelines and technical preservation capability that would enable archives and manuscript repositories to make electronic information accessible and usable for future researchers, and to share findings and products with depositors, peer institutions, and other interested non- profit groups. Differences between the SIA and RAC contributed to the CERP’s applicability to a wide range of institutions. The SIA is both the institutional archives and the Smith- sonian’s records manager, serving all of the contributing units. -

Guidance for Planning an Enterprise-Wide Electronic Records

National Archives and Records Administration E-Gov Electronic Records Management Initiative Recommended Practice: Developing and Implementing an Enterprise-wide Electronic Records Management (ERM) Proof of Concept Pilot March 2006 1 Recommended Practice: Developing and Implementing an Enterprise-wide Electronic Records Management (ERM) Proof of Concept Pilot A proof of concept pilot project is an opportunity to demonstrate the capabilities of Electronic Records Management (ERM) software on a small area and in a controlled manner. A pilot project is an excellent risk mitigation strategy for an agency planning to implement a ERM system. It can also serve to inform or resolve an alternatives analysis for an agency during the investment planning phase. The pilot helps determine whether the software is appropriate for use by the agency and how easily it can be configured, providing hands-on experience for records managers, information technology (IT) personnel, and users. This document applies the principles and “best practices” of IT project management to a proof of concept demonstration pilot for ERM whose purpose is to assess whether the solution should be deployed agency-wide. Based on the experiences of ERM pilot projects at the state and federal level, this document can be used by agencies as a reference when they assemble pilot project teams, develop work plans, and solicit participants for an ERM pilot project. It is composed of six sections, followed by an Appendix of Resources for Conducting a Pilot Project: 1. Introduction 2. Application of this Guidance Document 3. Planning the Successful Pilot 3.1 Preliminary Activities 3.1.1 Defining the Purpose, Goals, and Objectives of the Pilot 3.1.2 Establishing Success Criteria 3.1.3 Outlining the Benefits of a Pilot Project 3.1.4 Defining the Scope and Duration 3.1.5 Setting up Administrative Infrastructure and Writing the Work Plan 3.1.6 Minimizing Risks Associated with Pilot Projects 3.2 Conducting the Pilot 3.3 Evaluating the Pilot 4. -

Air Logistics Body Copy

Code of Ethics <DEPARTMENT: HEADING> Code of Ethics 2 Table of Contents INTRODUCTION .......................................................................................................................................... 3 PROTECTION OF INFORMATION ASSETS, PERSONAL DATA AND COMPANY PROPERTY .......................... 3 CONFLICT OF INTEREST POLICY ................................................................................................................ 5 RECORDS MANAGEMENT AND RETENTION POLICY .................................................................................. 7 ELECTRONIC DATA AND COMMUNICATIONS POLICY ................................................................................. 8 NON-DISCRIMINATION AND ANTI-HARASSMENT POLICY ......................................................................... 11 COMPLIANCE WITH LAWS ......................................................................................................................... 13 CORPORATE AND WORLDWIDE ANTI-CORRUPTION POLICY ................................................................... 13 ACCURATE BOOKS AND RECORDS POLICY ............................................................................................. 15 COMPLIANCE WITH U.S. SANCTIONS & EMBARGOES (TRANSACTIONS IN SANCTIONED AND EMBARGOED COUNTRIES) & THE PROHIBITION ON DOING BUSINESS WITH RESTRICTED OR DENIED PERSONS/ENTITIES ................. 17 POLICY ON DEALING WITH GOVERNMENT .............................................................................................. -

Comparing Records Management Systems, Enterprise Content Management Systems, and Enterprise Information Portals

Understanding and selecting the right tool for the job: Comparing Records Management Systems, Enterprise Content Management Systems, and Enterprise Information Portals The urgency around capturing, managing and protecting corporate and public records has become serious business. New laws, tightening industry regulations and increased scrutiny has resulted in a stream of software products and tools entering the market to manage various problems. So how do you choose the right records management system for your organization? This whitepaper is designed to help you do that. We’ll look at: • The difference between content and records and how they differ • The differences in handling content vs. records • Core competencies: Enterprise Content Management (ECM) systems • Core competencies: Records Management Systems (RMS) • The role of enterprise information portals • Selecting the right system for your environment • Required functionality in an RMS Finding the right product for your records management needs can be simplified once you have this basic understanding of the records management software landscape, the various options available to you, as well as how this might fit your records management environment. www.tab.com Understanding and selecting the right tool for the job: Comparing Records Management Systems, Enterprise Content Management Systems, and Enterprise Information Portals 2 Content vs. Records: How they differ It’s important to first understand the fundamental difference between content and records. They are frequently and erroneously lumped into the same bucket with the assumption that they serve the same purpose and should be managed the same way. Defined: Content is simply information or data— structured or unstructured information that can be accessed and used in a variety of ways by a variety of people throughout an organization. -

Subchapter B—Records Management

SUBCHAPTER B—RECORDS MANAGEMENT PART 1220—FEDERAL RECORDS; § 1220.3 What standards are used as GENERAL guidelines for Subchapter B? These regulations are in conformance Subpart A—General Provisions of with ISO 15489–1:2001, Information and Subchapter B documentation—Records management. Other standards relating to specific Sec. sections of the regulations are cited 1220.1 What is the scope of Subchapter B? where appropriate. 1220.2 What are the authorities for Sub- chapter B? § 1220.10 Who is responsible for 1220.3 What standards are used as guidelines records management? for Subchapter B? (a) The National Archives and 1220.10 Who is responsible for records man- Records Administration (NARA) is re- agement? sponsible for overseeing agencies’ ade- 1220.12 What are NARA’s records manage- quacy of documentation and records ment responsibilities? disposition programs and practices, 1220.14 Who must follow the regulations in and the General Services Administra- Subchapter B? tion (GSA) is responsible for overseeing 1220.16 What recorded information must be economy and efficiency in records managed in accordance with the regula- tions in Subchapter B? management. The Archivist of the 1220.18 What definitions apply to the regula- United States and the Administrator of tions in Subchapter B? GSA issue regulations and provide 1220.20 What NARA acronyms are used guidance and assistance to Federal throughout Subchapter B? agencies on records management pro- grams. NARA regulations are in this Subpart B—Agency Records Management subchapter. GSA regulations are in 41 Program Responsibilities CFR parts 102–193. (b) Federal agencies are responsible 1220.30 What are an agency’s records man- for establishing and maintaining a agement responsibilities? records management program that 1220.32 What records management principles complies with NARA and GSA regula- must agencies implement? tions and guidance. -

Project Management System Description (PMSD) Revision 1 June 2011

Managed by Princeton University for the U.S. Department of Energy PPPL Project Management System Page 1 of 111 Project Management System Description (PMSD) Revision 1 June 2011 Prepared by: ____________________________________ Date: ________________ Thomas Egebo Planning & Control Division Approved by: ___________________________________ Date: ________________ Tim Stevenson Head, Project Management Office Approved by: ___________________________________ Date: ________________ Edward Winkler Head, Business Operations and CFO Approved by: ___________________________________ Date: ________________ Mike Williams Engineering & Infrastructure Associate Director PPPL Project Management System Description Rev-01 PPPL Project Management System Page 2 of 111 NOTE: Throughout this description document, cross reference is made to the ANSI/EIA-748-B (2007) standard EVMS guidelines by both the reference section and the guideline number as indicated in the National Defense Industrial Association (NDIA) Program Management Systems Committee (PMSC) ANSI/EIA-748-A Intent Guide Revision 9a. For Example, Intent Guideline 12 corresponds to ANSI/EIA-748-A section 2.2g. This will be referred to in this description as Guide 12 {2.2g}. PPPL Project Management System Description Rev-01 PPPL Project Management System Page 3 of 111 RECORD OF REVISIONS Revision Date Description of Changes 0 July 2009 Initial issue. 1 June 2011 Deleted “Program” from document title “Project Management System Program Description”. Revised to incorporate corrective actions to resolve findings in Audit #1004, Project Management July 13, 2010 (pages 5, 6 and 9). Revised to incorporate suggestions from PPPL Project Management Advisory Committee Report September 30, 2010 (pages 9, 16 and 31). Update references from DOE O 413.3A to DOE O 413.3B. Added new requirement of DOE 413.3B to perform monthly cost performance uploads (including earned value) to the DOE’s Project and Assessment and Reporting System (PARS II). -

STATEMENT of WORK Records Management Project 1

Records Management IAEA Statement of Work Project RFP 46268-SIS Dated 2017-11-24 STATEMENT OF WORK Records Management Project 1. Background The International Atomic Energy Agency (hereinafter referred to as the “IAEA”) operates its records management services through the Archives and Records Management Section (ARMS). Both, internal and external audits conducted in 2016, have noted significant inefficiencies inherent to the paper workflows, and pointed to the challenges encountered by ARMS to meet new and ever-growing requirements for the proper handling of digital information and its carriers. Both audit reports pointed to the necessity of revising the current Records Management Programme which consists of the Record Keeping Policy, the Records Retention Schedule, the IAEA File Plan, the ARM Handbook, and other guidelines. The IAEA’S Record Keeping Policy defines the ARMS mandate as “to guarantee the management and preservation of authentic and reliable records”. However, this policy lacks detail and consistency and ignores the existence of hybrid documentation such as hard copies, digital documents, databases or datasets which are functionally linked in and to business processes. The current policy framework and its implementation bear the signs of the 1990s when digital information was considered to be an exception, or a simple set of copies of the records’ paper version. The IAEA operates six (6) departments with over 2.500 staff members who generate and distribute documents and records as part of their daily routine. Page 1 of 7 Records Management IAEA Statement of Work Project RFP 46268-SIS Dated 2017-11-24 2. Scope This Request for Proposal (RFP) describes the requirements for the Agency wide Records Management Project to revise the IAEA Records Management Programme. -

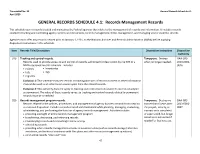

GRS 4.1: Records Management Records

Transmittal No. 31 General Records Schedule 4.1 April 2020 GENERAL RECORDS SCHEDULE 4.1: Records Management Records This schedule covers records created and maintained by Federal agencies that relate to the management of records and information. It includes records related to tracking and controlling agency records and documents, records management, forms management, and managing vital or essential records. Agencies must offer any records created prior to January 1, 1921, to the National Archives and Records Administration (NARA) before applying disposition instructions in this schedule. Item Records Title/Description Disposition Instruction Disposition Authority 010 Tracking and control records. Temporary. Destroy DAA-GRS- Records used to provide access to and control of records authorized for destruction by the GRS or a when no longer needed. 2013-0002- NARA-approved records schedule. Includes: 0016 • indexes • inventories • lists • logs • registers Exclusion 1: This schedule excludes records containing abstracts of records content or other information that can be used as an information source apart from the related records. Exclusion 2: This authority does not apply to tracking and control records related to records scheduled as permanent. The value of these records varies, so tracking and control records related to permanent records must be scheduled. 020 Records management program records. Temporary. Destroy no DAA-GRS- Records related to the policies, procedures, and management of agency business records from creation sooner than 6 years after 2013-0002- to eventual disposition. Includes records created and maintained while planning, managing, evaluating, the project, activity, or 0007 administering, and performing the function of agency records management. Activities include: transaction is completed • providing oversight of entire records management program or superseded, but longer • transferring, destroying, and retrieving records retention is authorized if • inventorying records and conducting records surveys needed for business use.