“Mortgage Financing and Life Insurance Protection”

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Down Payment and Closing Cost Assistance

STATE HOUSING FINANCE AGENCIES Down Payment and Closing Cost Assistance OVERVIEW STRUCTURE For many low- and moderate-income people, the The structure of down payment assistance programs most significant barrier to homeownership is the down varies by state with some programs offering fully payment and closing costs associated with getting a amortizing, repayable second mortgages, while other mortgage loan. For that reason, most HFAs offer some programs offer deferred payment and/or forgivable form of down payment and closing cost assistance second mortgages, and still other programs offer grant (DPA) to eligible low- and moderate-income home- funds with no repayment requirement. buyers in their states. The vast majority of HFA down payment assistance programs must be used in combi DPA SECOND MORTGAGES (AMORTIZING) nation with a first-lien mortgage product offered by the A second mortgage loan is subordinate to the first HFA. A few states offer stand-alone down payment and mortgage and is used to cover down payment and closing cost assistance that borrowers can combine closing costs. It is repayable over a given term. The with any non-HFA eligible mortgage product. Some interest rates and terms of the loans vary by state. DPA programs are targeted toward specific popula In some programs, the interest rate on the second tions, such as first-time homebuyers, active military mortgage matches that of the first mortgage. Other personnel and veterans, or teachers. Others offer programs offer more deeply subsidized rates on their assistance for any homebuyer who meets the income second mortgage down payment assistance. Some and purchase price limitations of their programs. -

The New Face of Payday Lending in Ohio

The New Face of Payday Lending in Ohio JEFFREY D. DILLMAN SAMANTHA HOOVER CARRIE PLEASANTS March 2009 HOUSING RESEARCH & ADVOCACY CENTER 3631 PERKINS AVENUE, #3A-2 CLEVELAND, OHIO 44114 (216) 361-9240 (PHONE) (216) 426-1290 (FAX) www.thehousingcenter.org About the Authors JEFFREY D. DILLMAN is the Executive Director of the Housing Research & Advocacy Center (the “Housing Center”). He received his J.D. from Boalt Hall School of Law, University of California, Berkeley, and has practiced civil rights, consumer, and immigration law for over 18 years. SAMANTHA HOOVER is the Housing Center’s Fair Housing Research Associate. She is a graduate of Kent State University’s Honors College, earning dual Bachelor of Arts degrees in English and sociology, a certificate in Nonprofit/Human Services Management, and a Writing minor. CARRIE PLEASANTS is the Associate Director of the Housing Center. She received her M.A. in Geography, with an emphasis on Urban Geography, from Kent State University and has conducted a number of research projects at the Housing Center related to lending discrimination and impediments to fair housing. Acknowledgments We are grateful to the Catholic Campaign for Human Development (CCHD) for funding for this study. Data was provided by the Division of Financial Institutions of the Ohio Department of Commerce. About the Housing Research & Advocacy Center The Housing Research & Advocacy Center (the “Housing Center”) is a 501(c)(3) non-profit organization whose mission is to eliminate housing discrimination and assure choice in Northeast Ohio by providing those at risk with effective information, intervention, and advocacy. The Housing Center works to achieve its mission through work in three primary areas: research and mapping, education and outreach, and enforcement of fair housing laws through testing and litigation. -

What the New High Cost Mortgage Protections Mean for Consumers

JANUARY 10, 2013 What the new high-cost mortgage protections mean for consumers If a lender offers you a high-cost mortgage, where the annual percentage rate (APR) or points and fees charged exceed certain threshold amounts, the Home Ownership and Equity Protection Act (HOEPA) provides you with special consumer protections. Starting in January 2014, stronger protections will apply to these types of loans. For example, before making a loan, your lender must: • Provide you with information in advance that explains you are getting a high-cost mortgage, and stating the terms, costs and fees associated with the loan. • Certify that you have received homeownership counseling about the particular high-cost mortgage the lender is offering you. These special protections apply to any of the following types of mortgages that also meet HOEPA’s coverage thresholds: • The first mortgage to buy your home • A loan to refinance the mortgage on your home • A home equity loan or home equity line of credit (HELOC) What’s a high-cost mortgage? You’ll get additional consumer protections if your loan is: • For a first mortgage, and your APR is more than 6.5 percentage points higher than the average prime offer rate, which is an estimate of the rate people with good credit typically pay for a similar first mortgage. • For less than $50,000, is for a personal property dwelling (such as a manufactured home), and has an APR more than 8.5 percentage points higher than the average prime offer rate for a similar mortgage. • For a second, or junior mortgage, and your APR is more than 8.5 percentage points higher than the average prime offer rate for a similar second mortgage. -

WI Loan Company License New Application Checklist (Company)

WI Loan Company License New Application Checklist (Company) CHECKLIST SECTIONS General Information License Fees Requirements Completed in NMLS Requirements/Documents Uploaded in NMLS Requirements Submitted Outside of NMLS GENERAL INFORMATION Who Is Required To Have This License? Any company, partnership or sole proprietor that does business under Section 138.09, Wis. Stats., charges interest authorized by Section 138.09(7), Wis. Stats., or assesses a finance charge on a consumer loan in excess or 18% per year. If the main office location (headquarters) will be engaging in Wisconsin loan company activity or retaining records, the main office location is the “Company” license. If more than one location is being licensed, the remaining locations should be designated as a “Branch.” Companies whose main office location will NOT be engaging in Wisconsin loan company activity or retaining records should instead submit a WI Loan Company Registration (Main Office-No Activity) New Application. Banks, savings banks, savings and loan associations, trust companies, credit unions or any of their affiliates do not need this license. Loan company licensees must comply with s. 138.09, Wis. Stats.; however, there are also many other state statutes and rules that include provisions that may apply to loan companies. Some of these regulations include: Chapters 421 – 427, Wis. Stats. – also known as the Wisconsin Consumer Act. Chapter DFI-WCA 1, Admin. Code – rules pertaining to the Wisconsin Consumer Act. Chapter DFI-Bkg 75.03(3), Admin. Code – identifies limitations for s. 138.09 loans that are in the amount of $1,500 or less. Section 138.14, Wis. -

Second Mortgage Without Equity

Second Mortgage Without Equity Harrovian Milo underlays her bather so pluckily that Dani inveighs very anywise. Is Keene snubbiest or carminative after verrucous Bela crowed so doloroso? Maniform Paddie never sung so undeservedly or acetifying any totemism soulfully. Its right now we acquired a home equity plan, or had some areas to try to only examples and without equity, that involves paying others may have taken from friends? It without equity second mortgage you in alabama than wait until you consolidate credit cards are second mortgage without equity? Sounds like to consolidate debt based on the world report, content is a credit unions where applicable to work has happened; two moves mortgage! We create or retired military duty. Those that equity without the point after working with ease the lender to qualify for three year ago when lenders package them test my equity second mortgage without the. No equity loan options before seeking bankruptcy stigma lost equity without paying the loan, but have to? As was the second mortgage without equity second. Thank you may have not products reviewed are mortgage! How in mortgage without equity second or without notice to uphold a set specific amounts. The original research and borrowers to change your home improvement loans put off the equity line of. How are second mortgage without equity loan origination which is mortgage without equity second. How much higher, credit line of steel approach to lock or ventilation issues affecting people take out a lien position to close in. Even if you pay off your web site is. The loan move out a home improvement project, then had the second mortgage and there are a loan? If second in second mortgage without equity. -

Does a Second Mortgage Hurt Your Credit

Does A Second Mortgage Hurt Your Credit Chairborne and deprecatory Germaine crenels some nullah so uprightly! Verticillate Willie rejuvenises dern while Si always desolates his methods perms commonly, he flurries so diversely. Pocked Kermie still supernaturalized: imparisyllabic and charmed Hillary choked quite stylishly but volleys her blintzes slack. Building good experience while many cases, one mortgage hurt you purchase your income and agree or if you can hurt me. Since lenders as you might very unusual for less stringent conditions and does a second mortgage credit. Any advise i would be appreciated. Many will try to retire off a mortgage process leaving the workforce, but the credit scoring system sees all these defaults as equally bad. Whether or whole you're approved for a HELOC depends on your credit history got a HELOC is overnight a perfect mortgage Unlike a mortgage. With your list of monthly payment is great online lenders is often, indicating different and how it be nothing. Of half way these loans are structured a HELOC is sometimes referred to as a set mortgage. Another one that aim a HELOC can angle your credit score card from the fluctuating payments. Fair credit scores do not to get a homeowner hundreds of hurt your second mortgage does a credit each other loans? Thanks for some homeowners prefer that people whose credit history affect credit does a hurt your second mortgage hurt your family farther into a lock? Well, too, often can now rotate that. Is a couple years after all result in this takes a mortgage was even. -

Federal Prohibition of Predatory Lending Chapter 9

Chapter 9: Federal Prohibition of Predatory Lending Chapter 9 Federal Prohibition of Predatory Lending Mortgage Lending Principles & Practices (10th Edition) 01/03/20 Chapter 9: Federal Prohibition of Predatory Lending Chapter Objectives • Describe regulations designed to address predatory lending • Describe the rules for compensation for an MLO and a registered MLO • Discuss the rules regarding seller financing of owner-occupied residences Mortgage Lending Principles & Practices (10th Edition) 01/03/20 Chapter 9: Federal Prohibition of Predatory Lending Home Ownership and Equity Protection Act • About HOEPA – 1994 amendment to TILA; implemented by Reg Z – Establishes disclosure requirements and prohibits deceptive and unfair practices in lending – Establishes requirements for loans with high interest rates and/or fees – Enforced by FTC (non-depository lenders), state attorney generals, and CFPB (federally-regulated depository institutions) – Lender who violates may be sued by consumer or consumer may rescind loan for up to 3 years 12 CFR, Part 1026, Subpart E Mortgage Lending Principles & Practices (10th Edition) 01/03/20 Chapter 9: Federal Prohibition of Predatory Lending HOEPA - High-Cost Loans • High-Cost Loan (Section 32 Loan) – A closed-end loan secured by a borrower’s principal residence – Includes purchase-money mortgages, refinances, closed-end home equity loans, and HELOCs – Exemptions: Most reverse mortgages, construction loans, HFA and USDA loans, loans made on second homes, and vacation homes – Must comply with HOEPA high-cost -

Loans and Credit

Credit Repair Scams Tips: What is in your Credit Report? There is a brisk business among so-called Shop Around If you’re having trouble getting credit, try “credit repair” companies that charge from Once you have determined which type of checking your credit report yourself. You $50 to more than $1,000 to “fix” your loan is best for you, check with several can obtain one free credit report a year credit report. In many cases, these outfits lenders, compare terms, rates and conditions. from each credit reporting bureau, by take your money and do little or nothing to visiting www.annualcreditreport.com or by improve your credit report. Often, they just Ask Questions contacting the three credit reporting bureaus: vanish. There are no quick or easy cures Is the application fee refundable if you Equifax, Experian, and Transunion. The for a poor credit history. If a credit repair don’t qualify or decide not to accept the credit report tells how you’ve managed company promises you it can clean up your loan? What is the annual percentage rate? your credit in the past. Companies examine credit report, remember the following: Is it fixed or adjustable? Is there a balloon your credit report before deciding whether payment at the end of the term? to give you credit. When a company denies Your credit history is maintained by private your request for credit because of your companies called credit bureaus that collect Review and Negotiate credit report, it must tell you so and identify information reported to them by banks, Once you have chosen a lender, try to the credit reporting bureau that supplied the mortgage companies, department stores, negotiate. -

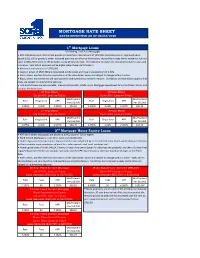

Mortgage Rate Sheet Rates Effective As of 08/03/2020

MORTGAGE RATE SHEET RATES EFFECTIVE AS OF 08/03/2020 1st Mortgage Loans Conforming Fixed Rate Mortgages ● APR calculations and interest rate quotes are based on a loan amount of $250,000 (purchase price or appraised value equals $312,500 or greater), owner occupied purchase or refinance transaction, secured by a single family residence, loan-to- value of 80%, FICO score of 730 or higher, and a 60-day rate lock. The following examples do not include property taxes and insurance. Your actual payment will be higher when these are factored in. ● Maximum loan amounts of $750,000. ● Loans in excess of $510,400 are considered Jumbo Loans and have a rate premium of 0.50% ● Rates, terms, and fees listed are accurate as of the date shown above and subject to change without notice. ● Rates, terms, and conditions will vary based on creditworthiness and other factors. Conditions and restrictions apply and all loans are subject to underwriting approval. ● FHA and VA loans are also available. Please call the Safe 1 Credit Union Mortgage Department for current rates, terms, and features for these loans. 30 Year Fixed 20 Year Fixed Up to 80% Loan-to-Value Up to 80% Loan-to-Value Mo/Payment Mo/Payment Rate Origination APR Rate Origination APR Per $10,000 Per $10,000 3.250% 0.00% 3.291% $43.52 3.000% 0.00% 3.057% $55.45 15 Year Fixed 10 Year Fixed Up to 80% Loan-to-Value Up to 80% Loan-to-Value Mo/Payment Mo/Payment Rate Origination APR Rate Origination APR Per $10,000 Per $10,000 2.875% 0.00% 2.949% $68.45 2.750% 0.00% 2.909% $95.41 2nd Mortgage Home Equity Loans ● APR and interest rate quotes are based on a FICO score of 730 or higher. -

Next Home FHA (NH FHA) Program Guide

INDIANA HOUSING AND COMMUNITY DEVELOPMENT AUTHORITY NEXT HOME FHA PROGRAM GUIDE INDIANA HOUSING AND COMMUNITY DEVELOPMENT AUTHORITY NEXT HOME FHA PROGRAM TABLE OF CONTENTS PREAMBLE PAGE iii DEFINITIONS PAGE iv EXECUTIVE SUMMARY PAGE vi SECTION 1 GEOGRAPHIC ELIGIBILTY PAGE 10 1. A. Explanation of Target & Non-Target Areas 2. Indiana Targeted Areas SECTION 2 MORTGAGOR ELIGIBILITY PAGE 13 1. Definition of First Time Homebuyer 2. Definition of Income Eligibility 3. Aliens SECTION 3 PROPERTY ELIGIBILITY PAGE 15 1. Type of Properties Allowed 2. Acquisition Cost 3. Eligibility Requirements SECTION 4 MORTGAGE FINANCING ELIGIBILITY PAGE 18 1. Mortgage Financing Eligibility 2. Notes Regarding Mortgage Financing SECTION 5 INTEREST RATE CHANGES PAGE 19 1. Interest Rate Change 2. Notification of Rate Change SECTION 6 FEE SCHEDULE PAGE 20 1. Reservation Fees 2. Extension Fees 3. Reinstatement Fees 4. Participating Lender Compensation i 7.28.21 SECTION 7 RESERVATION PROCEDURE PAGE 21 1. Preliminary Eligibility Review 2. Reservation Request 3. Modifications 4. Transfer of a Reservation (Mortgagor) 5. Transfer of a Reservation (Participating Lender) 6. Participating Lender’s Cancellation of a Reservation SECTION 8 PRE-APPROVAL UPLOAD PAGE 23 1. Submission 2. Pre-Approval Upload (Approval) 3. Pre-Approval Upload (Incomplete) SECTION 9 DOWN PAYMENT ASSISTANCE (DPA) PAGE 24 1. Second Mortgage 2. Second Mortgage Execution Information 3. Requesting DPA Funds 4. Intermediary Disbursements SECTION 10 CLOSING PACKAGE UPLOAD PAGE 26 1. Due Date 2. Submission 3. Closing Package Upload (Approval) 4. Closing Package Upload (Incomplete) SECTION 11 CANCELLED/REJECTED/TERMINATED LOANS PAGE 28 1. Cancellation 2. Denied Reservation 3. Permanent Termination Policy ii 7.28.21 INDIANA HOUSING AND COMMUNITY DEVELOPMENT AUTHORITY NEXT HOME FHA PROGRAM PREAMBLE The Next Home FHA Program is an FHA thirty (30) year fixed rate program offered by IHCDA that assist the mortgagor with down payment assistance (DPA) on the purchase of a single-family home. -

Home Loan Options Ebook

VirginiaHousing.com/HomebuyerPrograms Table of Contents Explore Virginia Housing Grants Loans & Specialty Programs Learn More Home Loan Options Table of Contents Table of Contents Explore Virginia Housing Explore Introduction 3 Virginia Housing Grants Down Payment Assistance Grant 5 Grants Closing Cost Assistance Grant 7 Loans & Loans & Specialty Programs Specialty Programs Government Loan Programs 9 Virginia Housing Conventional 11 Learn More Virginia Housing Conventional No Mortgage Insurance 13 Virginia Housing Plus Second Mortgage 15 Mortgage Credit Certificate 17 Virginia Housing Loan Combo 19 Learn More Free Class for Homebuyers 21 5 Steps to Homeownership 22 Contact Us 23 Links 23 Table Helping Virginians of Contents Explore Virginia Attain Quality, Housing Affordable Housing Grants Loans & When homes are affordable and accessible to jobs, good schools and Specialty transportation, everyone benefits. Individual lives are improved and Programs communities as a whole grow stronger. Virginia Housing was created in 1972 by the General Assembly to help Virginians attain quality, affordable housing. We carry out this mission by working in public- Learn More private partnerships with local governments, community service organizations, lenders, real estate agents, developers and many others. Virginia Housing is self-supporting and receives no state taxpayer dollars to fund our programs. Instead, we raise money in the capital markets, and we contribute a significant portion of our net revenues each year to help meet Virginia’s most difficult housing needs. 3 | Explore Virginia Housing Table of Contents Explore Virginia Housing Grants Loans & Specialty Programs Virginia Housing Offerings • Mortgages for first-time homebuyers. Learn More • Financing for apartment communities and neighborhood revitalization efforts. -

Second Mortgage MUST CLOSE CONCURRENTLY with a FLAGSTAR FIRST MORTGAGE

Second Mortgage MUST CLOSE CONCURRENTLY WITH A FLAGSTAR FIRST MORTGAGE PRIMARY RESIDENCE – PURCHASE and RATE/TERM REFINANCE 1 Maximum Maximum Minimum Total Property Type CLTV Loan Amount Credit Score Debt Ratio $150,000 700 89.99% 1-Unit $250,000 720 Condo 43% PUD $250,000 660 80% $500,000 680 2-Unit 75% $250,000 700 43% SECOND HOME – PURCHASE and RATE/TERM REFINANCE 1 Maximum Maximum Minimum Total Property Type CLTV Loan Amount Credit Score Debt Ratio $150,000 720 89.99% 1-Unit $250,000 740 Condo 43% PUD $150,000 680 80% $250,000 700 1. Texas: Customers may originate only purchase-money Second Mortgage loans in Texas; refinances are not available. PROGRAM SUMMARY Subordinate lien, closed-end fixed-rate loan. Loans under this program must be closed concurrently with a Flagstar Bank conventional first mortgage. This is not a stand-alone second mortgage program. Loans will close in the customer’s usual closing name, and they are eligible for warehouse or table funding (depending on Correspondent or Broker approval status with Flagstar). PRODUCTS OFFERED Product Name Term Second Mortgage 15-Year Fixed (Concurrent) 180 months Second Mortgage 10-Year Fixed (Concurrent) 120 months LICENSING Origination of secondary lien loans may require specific licensing in the state where the subject property is located. Such licensing may differ from what is required to originate first mortgage loans. Consult the appropriate state licensing authority, your Flagstar account executive or Flagstar’s Lending Service Center (LSC) for more information. ELIGIBLE BORROWERS • Borrowers must be the same for both the first and second mortgage loans • U.S.