The Applied Research on the Loss Distribution in Reinsurance And

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Qingdao City Shandong Province Zip Code >>> DOWNLOAD (Mirror #1)

Qingdao City Shandong Province Zip Code >>> DOWNLOAD (Mirror #1) 1 / 3 Area Code & Zip Code; . hence its name 'Spring City'. Shandong Province is also considered the birthplace of China's . the shell-carving and beer of Qingdao. .Shandong china zip code . of Shandong Province,Shouguang 262700,Shandong,China;2Ruifeng Seed Industry Co.,Ltd,of Shouguang City,Shouguang 262700,Shandong .China Woodworking Machinery supplier, Woodworking Machine, Edge Banding Machine Manufacturers/ Suppliers - Qingdao Schnell Woodworking Machinery Co., Ltd.Qingdao Lizhong Rubber Co., Ltd. Telephone 13583252201. Zip code 266000 . Address: Liaoyang province Qingdao city Shandong District Road No.what is the zip code for Qingdao City, Shandong Prov China? . The postal code of Qingdao is 266000. i cant find the area code for gaomi city, shandong province.Province City Add Zip Email * Content * Code * Product Category Bamboo floor press Heavy bamboo press . No.111,Jing'Er Road,Pingdu, Qingdao >> .Shandong Gulun Rubber Co., Ltd. is a comprehensive . Zhongshan Street,Dezhou City, China, Zip Code . No.182,Haier Road,Qingdao City,Shandong Province E .. Qingdao City, Shandong Province, Qingdao, Shandong, China Telephone: Zip Code: Fax: Please sign in to . Qingdao Lifeng Rubber Co., Ltd., .Shandong Mcrfee Import and Export Co., Ltd. No. 139 Liuquan North Road, High-Tech Zone, Zibo City, Shandong Province Telephone: Zip Code: Fax: . Zip Code: Fax .Qingdao Dayu Paper Co., Ltd. Mr. Ike. .Qianlou Rubber Industrial Park, Mingcun Town, Pingdu, Qingdao City, Shandong Province.Postal code: 266000: . is a city in eastern Shandong Province on the east . the CCP-led Red Army entered Qingdao and the city and province have been under PRC .QingDao Meilleur Railway Co.,LTD AddressJinLing Industrial Park, JiHongTan Street, ChengYang District, Qingdao City, ShanDong Province, CHINA. -

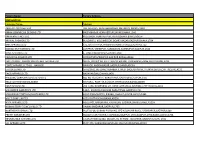

ATTACHMENT 1 Barcode:3800584-02 C-570-107 INV - Investigation

ATTACHMENT 1 Barcode:3800584-02 C-570-107 INV - Investigation - Chinese Producers of Wooden Cabinets and Vanities Company Name Company Information Company Name: A Shipping A Shipping Street Address: Room 1102, No. 288 Building No 4., Wuhua Road, Hongkou City: Shanghai Company Name: AA Cabinetry AA Cabinetry Street Address: Fanzhong Road Minzhong Town City: Zhongshan Company Name: Achiever Import and Export Co., Ltd. Street Address: No. 103 Taihe Road Gaoming Achiever Import And Export Co., City: Foshan Ltd. Country: PRC Phone: 0757-88828138 Company Name: Adornus Cabinetry Street Address: No.1 Man Xing Road Adornus Cabinetry City: Manshan Town, Lingang District Country: PRC Company Name: Aershin Cabinet Street Address: No.88 Xingyuan Avenue City: Rugao Aershin Cabinet Province/State: Jiangsu Country: PRC Phone: 13801858741 Website: http://www.aershin.com/i14470-m28456.htmIS Company Name: Air Sea Transport Street Address: 10F No. 71, Sung Chiang Road Air Sea Transport City: Taipei Country: Taiwan Company Name: All Ways Forwarding (PRe) Co., Ltd. Street Address: No. 268 South Zhongshan Rd. All Ways Forwarding (China) Co., City: Huangpu Ltd. Zip Code: 200010 Country: PRC Company Name: All Ways Logistics International (Asia Pacific) LLC. Street Address: Room 1106, No. 969 South, Zhongshan Road All Ways Logisitcs Asia City: Shanghai Country: PRC Company Name: Allan Street Address: No.188, Fengtai Road City: Hefei Allan Province/State: Anhui Zip Code: 23041 Country: PRC Company Name: Alliance Asia Co Lim Street Address: 2176 Rm100710 F Ho King Ctr No 2 6 Fa Yuen Street Alliance Asia Co Li City: Mongkok Country: PRC Company Name: ALMI Shipping and Logistics Street Address: Room 601 No. -

Cereal Series/Protein Series Jiangxi Cowin Food Co., Ltd. Huangjindui

产品总称 委托方名称(英) 申请地址(英) Huangjindui Industrial Park, Shanggao County, Yichun City, Jiangxi Province, Cereal Series/Protein Series Jiangxi Cowin Food Co., Ltd. China Folic acid/D-calcium Pantothenate/Thiamine Mononitrate/Thiamine East of Huangdian Village (West of Tongxingfengan), Kenli Town, Kenli County, Hydrochloride/Riboflavin/Beta Alanine/Pyridoxine Xinfa Pharmaceutical Co., Ltd. Dongying City, Shandong Province, 257500, China Hydrochloride/Sucralose/Dexpanthenol LMZ Herbal Toothpaste Liuzhou LMZ Co.,Ltd. No.282 Donghuan Road,Liuzhou City,Guangxi,China Flavor/Seasoning Hubei Handyware Food Biotech Co.,Ltd. 6 Dongdi Road, Xiantao City, Hubei Province, China SODIUM CARBOXYMETHYL CELLULOSE(CMC) ANQIU EAGLE CELLULOSE CO., LTD Xinbingmaying Village, Linghe Town, Anqiu City, Weifang City, Shandong Province No. 569, Yingerle Road, Economic Development Zone, Qingyun County, Dezhou, biscuit Shandong Yingerle Hwa Tai Food Industry Co., Ltd Shandong, China (Mainland) Maltose, Malt Extract, Dry Malt Extract, Barley Extract Guangzhou Heliyuan Foodstuff Co.,LTD Mache Village, Shitan Town, Zengcheng, Guangzhou,Guangdong,China No.3, Xinxing Road, Wuqing Development Area, Tianjin Hi-tech Industrial Park, Non-Dairy Whip Topping\PREMIX Rich Bakery Products(Tianjin)Co.,Ltd. Tianjin, China. Edible oils and fats / Filling of foods/Milk Beverages TIANJIN YOSHIYOSHI FOOD CO., LTD. No. 52 Bohai Road, TEDA, Tianjin, China Solid beverage/Milk tea mate(Non dairy creamer)/Flavored 2nd phase of Diqiuhuanpo, Economic Development Zone, Deqing County, Huzhou Zhejiang Qiyiniao Biological Technology Co., Ltd. concentrated beverage/ Fruit jam/Bubble jam City, Zhejiang Province, P.R. China Solid beverage/Flavored concentrated beverage/Concentrated juice/ Hangzhou Jiahe Food Co.,Ltd No.5 Yaojia Road Gouzhuang Liangzhu Street Yuhang District Hangzhou Fruit Jam Production of Hydrolyzed Vegetable Protein Powder/Caramel Color/Red Fermented Rice Powder/Monascus Red Color/Monascus Yellow Shandong Zhonghui Biotechnology Co., Ltd. -

Qingdao Facts

QINGDAO CHINA EXPAT GUIDE Qingdao Facts Geographic Location & Climate Qingdao is located in the middle of Shandong Peninsula (120°22′E, 36°4′N), with the Yellow Sea to the east and south, and the mainland to the west and north. Qingdao covers an area of 10,654sq km. Located in the temperate semi-humid continental climate zone, it is a well-known summer resort. The average summer and winter temperatures are 25 and 1.3 respectively with an annual average temperature of 12.2 . Average annual rainfall is 775.6 mm. ℃ ℃ ℃ Districts, Counties, and Population Qingdao is comprised of 7 districts: Shinan, Shibei, Sifang, Licang, Chengyang, Huangdao, and Laoshan, and 5 county-level cities: Jiaozhou, Jiaonan, Jimo, Pingdu, and L a i x i. The total population of approximately 8.2 million comes under the jurisdiction of Qingdao Local Government. The urban population is 2.3 million which includes 60,000 Koreans working and/or residing in Qingdao. Getting Here and Away Liuting International Airport: Qingdao currently offers 19 international & interregional passenger and freight air routes, with over 300 flights per week. Qingdao's International Airport (TAO) offers direct flights to Tokyo, Osaka, Fukuoka, Seoul, Busan, Taegu, Paris, Singapore, Bangkok, Hong Kong, and Macao with a new route to Frankfurt currently underway. Qingdao's airport also provides over 800 domestic flights per week, directly linking Qingdao with 47 cities including Beijing, Shanghai, Guangzhou. Flight Times to Adjacent Cities: Seoul: 1 hour Busan: 1 hour 30 min. Fukuoka: 1 hour 30 min. Tokyo: 2 hours 40 min. Osaka: 2 hours Beijing: 1 hour Shanghai: 1 hour Guangzhou: 2.5 Railway, Highway Networks, Bus & Ferry Terminals The Qingdao Railway Station provides frequent connections to regions throughout China with direct routes to Beijing, Shanghai, Jinan, Weihai, and Yantai (just to name a few). -

Factory Name

Factory Name Factory Address BANGLADESH Company Name Address AKH ECO APPARELS LTD 495, BALITHA, SHAH BELISHWER, DHAMRAI, DHAKA-1800 AMAN GRAPHICS & DESIGNS LTD NAZIMNAGAR HEMAYETPUR,SAVAR,DHAKA,1340 AMAN KNITTINGS LTD KULASHUR, HEMAYETPUR,SAVAR,DHAKA,BANGLADESH ARRIVAL FASHION LTD BUILDING 1, KOLOMESSOR, BOARD BAZAR,GAZIPUR,DHAKA,1704 BHIS APPARELS LTD 671, DATTA PARA, HOSSAIN MARKET,TONGI,GAZIPUR,1712 BONIAN KNIT FASHION LTD LATIFPUR, SHREEPUR, SARDAGONI,KASHIMPUR,GAZIPUR,1346 BOVS APPARELS LTD BORKAN,1, JAMUR MONIPURMUCHIPARA,DHAKA,1340 HOTAPARA, MIRZAPUR UNION, PS : CASSIOPEA FASHION LTD JOYDEVPUR,MIRZAPUR,GAZIPUR,BANGLADESH CHITTAGONG FASHION SPECIALISED TEXTILES LTD NO 26, ROAD # 04, CHITTAGONG EXPORT PROCESSING ZONE,CHITTAGONG,4223 CORTZ APPARELS LTD (1) - NAWJOR NAWJOR, KADDA BAZAR,GAZIPUR,BANGLADESH ETTADE JEANS LTD A-127-131,135-138,142-145,B-501-503,1670/2091, BUILDING NUMBER 3, WEST BSCIC SHOLASHAHAR, HOSIERY IND. ATURAR ESTATE, DEPOT,CHITTAGONG,4211 SHASAN,FATULLAH, FAKIR APPARELS LTD NARAYANGANJ,DHAKA,1400 HAESONG CORPORATION LTD. UNIT-2 NO, NO HIZAL HATI, BAROI PARA, KALIAKOIR,GAZIPUR,1705 HELA CLOTHING BANGLADESH SECTOR:1, PLOT: 53,54,66,67,CHITTAGONG,BANGLADESH KDS FASHION LTD 253 / 254, NASIRABAD I/A, AMIN JUTE MILLS, BAYEZID, CHITTAGONG,4211 MAJUMDER GARMENTS LTD. 113/1, MUDAFA PASCHIM PARA,TONGI,GAZIPUR,1711 MILLENNIUM TEXTILES (SOUTHERN) LTD PLOTBARA #RANGAMATIA, 29-32, SECTOR ZIRABO, # 3, EXPORT ASHULIA,SAVAR,DHAKA,1341 PROCESSING ZONE, CHITTAGONG- MULTI SHAF LIMITED 4223,CHITTAGONG,BANGLADESH NAFA APPARELS LTD HIJOLHATI, -

Epidemiological Characteristics and Spatial-Temporal Clusters of Mumps in Shandong Province, China, 2005–2014

Epidemiological Characteristics and Spatial-Temporal Clusters of Mumps in Shandong Province, China, 2005-2014 Author Li, Runzi, Cheng, Shenghui, Luo, Cheng, Rutherford, Shannon, Cao, Jin, Xu, Qinqin, Liu, Xiaodong, Liu, Yanxun, Xue, Fuzhong, Xu, Qing, Li, Xiujun Published 2017 Journal Title Scientific Reports Version Version of Record (VoR) DOI https://doi.org/10.1038/srep46328 Copyright Statement © The Author(s) 2017. This work is licensed under a Creative Commons Attribution 4.0 International License. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in the credit line; if the material is not included under the Creative Commons license, users will need to obtain permission from the license holder to reproduce the material. To view a copy of this license, visit http:// creativecommons.org/licenses/by/4.0/ Downloaded from http://hdl.handle.net/10072/343865 Griffith Research Online https://research-repository.griffith.edu.au www.nature.com/scientificreports OPEN Epidemiological Characteristics and Spatial-Temporal Clusters of Mumps in Shandong Province, Received: 02 September 2016 Accepted: 15 March 2017 China, 2005–2014 Published: 11 April 2017 Runzi Li1, Shenghui Cheng2, Cheng Luo1, Shannon Rutherford3, Jin Cao1, Qinqin Xu1, Xiaodong Liu4, Yanxun Liu1, Fuzhong Xue1, Qing Xu4 & Xiujun Li1 Mumps presents a serious threat to public health in China. We conducted a descriptive analysis to identify the epidemiological characteristics of mumps in Shandong Province. Spatial autocorrelation and space-time scan analyses were utilized to detect spatial-temporal clusters. From 2005 to 2014, 115745 mumps cases were reported in Shandong, with an average male-to-female ratio of 1.94. -

2012 Annual Report 2017-10-17

www.cs.ecitic.com (a joint stock limited company incorporated in the People’s Republic of China with limited liability) (STOCK CODE : 6030) 2012 ANNUAL REPORT This annual report is printed on environmental paper. IMPORTANT NOTICE The Board and the supervisory committee of the Company and the Directors, Supervisors and Senior Management warrant the truthfulness, accuracy and completeness of the report and that there is no false representation, misleading statement contained herein or material omission from this report, and for which they will assume joint and several liabilities. This report was considered and approved at the 11th Meeting of the 5th Session of the Board of the Company. All Directors of the Company attended the meeting. No Director or Supervisor submitted any objection to this report. The Company’s 2012 profi t distribution proposal considered by the Board is a cash dividend of RMB3.00 for every 10 shares (tax inclusive), and is subject to the approval of the general meeting of the Company. The domestic and international annual fi nancial reports of the Company were audited by Ernst & Young Hua Ming LLP and Ernst & Young respectively, and auditor’s reports with standard unqualifi ed audit opinions were issued accordingly. Mr. WANG Dongming, Chairman of the Company, and Mr. GE Xiaobo, the person-in-charge of accounting affairs and the head of the Company’s fi nancial department, warrant that the fi nancial statements set out in this annual report are true, accurate and complete. There was no appropriation of funds of the Company by connected parties for non-operating purposes. -

Minimum Wage Standards in China August 11, 2020

Minimum Wage Standards in China August 11, 2020 Contents Heilongjiang ................................................................................................................................................. 3 Jilin ............................................................................................................................................................... 3 Liaoning ........................................................................................................................................................ 4 Inner Mongolia Autonomous Region ........................................................................................................... 7 Beijing......................................................................................................................................................... 10 Hebei ........................................................................................................................................................... 11 Henan .......................................................................................................................................................... 13 Shandong .................................................................................................................................................... 14 Shanxi ......................................................................................................................................................... 16 Shaanxi ...................................................................................................................................................... -

1 Latest Project on 13 July, the Group Acquired Zhong Cun Project in Qingdao. the Plot Is Located in Northeast Chengyang

HKSE Stock Code: 960 Latest Project On 13 July, the Group acquired Zhong Cun project in Qingdao. The plot is located in northeast Chengyang District, which is 30 km from the core downtown area of Qingdao and only 5 km from the Government of Chengyang District. The plot, with a total consideration of RMB475 million, has a site area of 210,500 sq.m., offers a GFA of 302,700 sq.m. and has an accommodation value of RMB1,569 per sq.m.. The plot will be developed into an integrated community incorporating townhouses, villas, high-rises apartment and shops. On 26 July, the Group acquired Dong Gang project in Dalian. The plot is located in the center of the CBD of Donggang District, Dalian. Close Chongqing Chunsen Starry Street to a metro station and it is the only residential project in the region that has a magnificent sea view. The plot, with a total consideration of RMB1,652 million, has a site area of 62,800 sq.m., offers a GFA of 188,400 sq.m. and has an accommodation value of RMB8,767 per sq.m.. The plot will be developed into a high-end integrated community incorporating low-rises apartments, high-rises apartment and commercial centers. On 8 August, the Group acquired Li Jia project in Chongqing at reserve Chongqing Times Paradise Walk price. The plot is in the core area of the Lijia business district in the north area of Chongqing New Distric, with a total consideration of RMB4,220 million, has a site area of 879,000 sq.m, offers a GFA of 1,985,000 sq.m. -

Bestseller Factory List

BESTSELLER FACTORY LIST LAST UPDATED: 21.05.2021 It is imperative for us to work with our partners in an open and honest way. We continuously seek to create more transparency in our supply chain to address risks and promote positive change. In light of this, and to provide increased transparency, we are making supplier factory information publicly available. The factory list includes the name, address, product type and number of workers of all tier 1 manufacturing factories (cut-make-trim) of apparel, footwear and accessories. The list will be updated twice a year. As changes occur in our supply chain with new partners, new factories onboarded, or factories being phased out, such alterations will be collected and published in the next supplier factory list update. FACTORY NAME ADDRESS MALE FEMALE NO. OF POSTAL CITY REGION COUNTRY PRODUCT EMPLOYEE EMPLOYEE EMPLOYEES CODE TYPES % % Almeg Shoes No. 14 Rruga Albania 5 95 <500 2000 Durres Durres ALBANIA Footwear Aba Fashions Ltd. No. 521/1 Gacha, Gazipur City Corporation 35 65 1001-5000 1704 Gazipur Dhaka BANGLADESH Apparel ABM Fashions Ltd. No.1143 &1145 Kashimpur Road, Konabari, Gazipur 30 70 1001-5000 1700 Dhaka Dhaka BANGLADESH Apparel Agami Apparels Ltd. Nayapara, Kathgara, Ashulia 40 60 5001-10000 1344 Savar Dhaka BANGLADESH Apparel Agami Fashions Ltd. Abdus Sattar Road, Pallibiduyt, Holding No. 79/1 30 70 1001-5000 1751 Gazipur Dhaka BANGLADESH Apparel AKM Knit Wear Ltd. No. 14 Gedda Karnapara, Ulail, Savar 35 65 >10000 1340 Dhaka Dhaka BANGLADESH Apparel Al-Muslim Apparels Ltd. No. 12 Nischintapur 25 75 <500 1341 Ashulia Dhaka BANGLADESH Apparel Aman Tex Ltd. -

International Registration Designating India Trade Marks Journal No: 1797 , 15/05/2017 Class 1

International Registration designating India Trade Marks Journal No: 1797 , 15/05/2017 Class 1 Priority claimed from 27/05/2014; Application No. : 14 4 093 910 ;France 2927807 20/11/2014 [International Registration No. : 1234019] S.P.C.M. SA ZAC de Milieux F-42160 ANDREZIEUX-BOUTHEON France Proposed to be Used IR DIVISION Industrial chemicals; chemical products for use in the petroleum and gas industry; chemical products used for assisted recovery of petroleum and gas. 6665 Trade Marks Journal No: 1797 , 15/05/2017 Class 1 Priority claimed from 25/06/2014; Application No. : 013032875 ;European Union 2931338 17/11/2014 [International Registration No. : 1221666] BASF SE Carl-Bosch-Strasse 38 67056 Ludwigshafen am Rhein Germany Proposed to be Used IR DIVISION Unprocessed plastics in the form of powders, dispersions, granules, pastes or liquids, especially polymeric compounds having absorbent properties. 6666 Trade Marks Journal No: 1797 , 15/05/2017 Class 1 2935602 17/07/2014 [International Registration No. : 1234347] New England Biolabs, Inc. Attn: Harriet Strimpel, 240 County Road Ipswich MA 01938 United States of America Address for service in India/Attorney address: K & S PARTNERS NEW DOOR NO.15 (OLD NO.3), POSTAL COLONY 4TH STREET, WEST MAMBALAM, CHENNAI-600033, TAMILNADU, INDIA. Proposed to be Used IR DIVISION Assays and reagents for use in genetic research; biochemical catalysts; biochemical reagents commonly known as probes, for detecting and analyzing molecules in protein or nucleotide arrays; biochemical reagents used for non-medical -

Qingdao Hospitals, Medical & Dental Care

QINGDAO CHINA EXPAT GUIDE Qingdao Hospitals, Medical Care, & Dental Clinics This is a list of the best Ho s p it a ls and Dental Clinics in Qingdao. If you are a foreigner seeking emergency medical attention you should go to the International Clinic of Qingdao Municipal Hospital. Advanced stem cell therapy from Beike Biotechnology is available at ChengYang People's Hospital. Hospitals International Clinic of Qingdao Municipal Hospital 5 DongHai Middle Road Telephone: +86 (532) 8890-5062; 8593-7690 Ext.2266 ShiNan District > Fushan Bay Area (Central Qingdao) Qingdao, Shandong Province. P.R. China 青岛市立医院东院区, 东海中路 5 号 ChengYang People's Hospital 600 ChangCheng Road Telephone: (+86) 1680-6222 (toll free) Chengyang District > Near Qingdao International Airport Qingdao, Shandong Province. P.R. China 青岛市城阳区长城路 600 号 Jian Lian Chinese Medicine Clinic & Pharmacy 19 Yan’erDao Road Telephone: +86 (532) 8589-4483 ShiNan District > Fushan Bay Area (Central Qingdao) Qingdao, Shandong Province. P.R. China 燕儿岛路 19 号, 检联药店 健联诊所(中医) The Affiliated Hospital of Qingdao University Medical College 16 JiangSu Road Telephone: +86 (532) 8291-1847 ShiNan District > Old Town Qingdao, Shandong Province. P.R. China 青岛大学医学院附属医院, 江苏路 16 号 Qingdao Municipal Hospital (Old Town) 1 JiaoZhou Road Telephone: +86 (532) 8278-9030 ShiBei District > ZhongShan Lu Shopping Area Qingdao, Shandong Province. P.R. China 青岛市立医院, 胶州路 1 号 Traditional Chinese Medicine Hospital of Qingdao 4 Remin Road Telephone: +86 (532) 8377-7066 ShiNan District > Fushan Bay Area (Central Qingdao) Qingdao, Shandong Province. P.R. China 青岛市中医院, 人民路 4 号 Qingdao 401 Navy Hospital 22 MinJiang Road Telephone: +86 (532) 8582-4460 ShiNan District > Fushan Bay Area (Central Qingdao) Qingdao, Shandong Province.