Siblinksept 17.Pmd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Accused Persons Arrested in Thrissur Rural District from 13.01.2019To19.01.2019

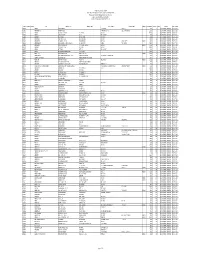

Accused Persons arrested in Thrissur Rural district from 13.01.2019to19.01.2019 Name of Name of the Name of the Place at Date & Arresting Court at Sl. Name of the Age & Cr. No & Sec Police father of Address of Accused which Time of Officer, which No. Accused Sex of Law Station Accused Arrested Arrest Rank & accused Designation produced 1 2 3 4 5 6 7 8 9 10 11 Anthikkad P S Cr 14/19 u/s 143, 147, 283 R/W 149 IPC, 1 SEC 4(1)6KP ERATT House, ACT(R OF CHEMMAPPILLY, A&P)ACT SEC MANOJKUMAR PRABHAKARA MALE VADAKKUMURI 117(e) of KP , INSPECTOR JFCM No: II, HARISH N 43 Village ANTHIKKAD 14-01-2019 atAct 11.00 ANTHIKKAD OF POLICE Thrissur Anthikkad P S Cr 14/19 u/s 143, 147, 283 R/W 149 IPC, 2 THAIVALAPPIL SEC 4(1)6KP HOUSE, ACT(R OF PERINGOTTUKARA, A&P)ACT SEC MANOJKUMAR MALE VADAKKUMURI 117(e) of KP , INSPECTOR JFCM No: II, RATHEESH GOPINATH 33 VILLAGE ANTHIKKAD 14-01-2019 atAct 11.00 ANTHIKKAD OF POLICE Thrissur Anthikkad P S Cr 14/19 u/s 143, 147, 283 R/W 149 IPC, 3 THAIVALAPPIL SEC 4(1)6KP HOUSE, ACT(R OF PERINGOTTUKARA, A&P)ACT SEC MANOJKUMAR MALE VADAKKUMURI 117(e) of KP , INSPECTOR JFCM No: II, VALSAN VELAYUDHAN 52 VILLAGE ANTHIKKAD 14-01-2019 atAct 11.00 ANTHIKKAD OF POLICE Thrissur Anthikkad P S Cr 14/19 u/s 143, 147, 283 R/W 149 IPC, 4 SEC 4(1)6KP ACT(R OF AMALATH HOUSE, A&P)ACT SEC MANOJKUMAR SREEKESH SATHEESH MALE PERINGOTTUKARA, 117(e) of KP , INSPECTOR JFCM No: II, CHANDRAN CHANDRAN 28 THANYAM VILLAGE ANTHIKKAD 14-01-2019 atAct 11.00 ANTHIKKAD OF POLICE Thrissur Anthikkad P S Cr 14/19 u/s 143, 147, 283 R/W 149 IPC, 5 ATHAKUDATH SEC -

List of Offices Under the Department of Registration

1 List of Offices under the Department of Registration District in Name& Location of Telephone Sl No which Office Address for Communication Designated Officer Office Number located 0471- O/o Inspector General of Registration, 1 IGR office Trivandrum Administrative officer 2472110/247211 Vanchiyoor, Tvpm 8/2474782 District Registrar Transport Bhavan,Fort P.O District Registrar 2 (GL)Office, Trivandrum 0471-2471868 Thiruvananthapuram-695023 General Thiruvananthapuram District Registrar Transport Bhavan,Fort P.O District Registrar 3 (Audit) Office, Trivandrum 0471-2471869 Thiruvananthapuram-695024 Audit Thiruvananthapuram Amaravila P.O , Thiruvananthapuram 4 Amaravila Trivandrum Sub Registrar 0471-2234399 Pin -695122 Near Post Office, Aryanad P.O., 5 Aryanadu Trivandrum Sub Registrar 0472-2851940 Thiruvananthapuram Kacherry Jn., Attingal P.O. , 6 Attingal Trivandrum Sub Registrar 0470-2623320 Thiruvananthapuram- 695101 Thenpamuttam,BalaramapuramP.O., 7 Balaramapuram Trivandrum Sub Registrar 0471-2403022 Thiruvananthapuram Near Killippalam Bridge, Karamana 8 Chalai Trivandrum Sub Registrar 0471-2345473 P.O. Thiruvananthapuram -695002 Chirayinkil P.O., Thiruvananthapuram - 9 Chirayinkeezhu Trivandrum Sub Registrar 0470-2645060 695304 Kadakkavoor, Thiruvananthapuram - 10 Kadakkavoor Trivandrum Sub Registrar 0470-2658570 695306 11 Kallara Trivandrum Kallara, Thiruvananthapuram -695608 Sub Registrar 0472-2860140 Kanjiramkulam P.O., 12 Kanjiramkulam Trivandrum Sub Registrar 0471-2264143 Thiruvananthapuram- 695524 Kanyakulangara,Vembayam P.O. 13 -

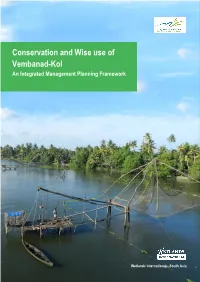

Conservation and Wise Use of Vembanad-Kol an Integrated Management Planning Framework

Conservation and Wise use of Vembanad-Kol An Integrated Management Planning Framework Wetlands International - South Asia Wetlands International – South Asia Mangroves for the Future WISA is the South Asia Programme of MFF is a unique partner- led initiative to Wetlands International, a global organization promote investment in coastal ecosystem dedicated to conservation and wise use of conservation for sustainable wetlands. Its mission is to sustain and development. It provides a collaborative restore wetlands, their resources and platform among the many different biodiversity. WISA provides scientific and agencies, sectors and countries who are technical support to national governments, addressing challenges to coastal wetland authorities, non government ecosystem and livelihood issues, to work organizations, and the private sector for towards a common goal. wetland management planning and implementation in South Asia region. It is MFF is led by IUCN and UNDP, with registered as a non government organization institutional partners : CARE, FAO, UNEP, under Societies Registration Act and steered and Wetlands International and financial by eminent conservation planners and support from Norad and SIDA wetland experts. Wetlands International-South Asia A-25, (Second Floor), Defence Colony New Delhi – 110024, India Telefax: +91-11-24338906 Email: [email protected] URL: http://south-asia.wetlands.org Conservation and Wise Use of Vembanad-Kol An Integrated Management Planning Framework Wetlands International – South Asia December 2013 Wetlands International - South Asia Project Team Acknowledgements Dr. Ritesh Kumar (Project Leader) Wetlands International – South Asia thanks the following individuals and organizations for support extended to management planning of Prof. E.J.James (Project Advisor) Vembanad-Kol wetlands Dr. -

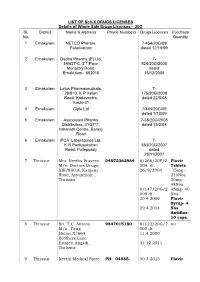

20G Sl. No. District Name & Address Phone Numbers Drug

LIST OF Sch-X DRUGS LICENSES Details of Whole Sale Drugs Licenses – 20G Sl. District Name & Address Phone Numbers Drugs Licences Purchase No. Quantity 1 Ernakulam NETCO Pharam, 7-454/20G/09 Palarivattom dated 12/10/99 2 Ernakulam Dadha Pharma (P) Ltd, 7- 39/627-C, 2nd Floor, 528/20G/2008 Monastry Road, dated Ernakulam- 682016 15/12/2008 3 Ernakulam Lotus Pharmaceuticals, 7- 28/810, K P Vallon 175/20G/2008 Road, Kadavantra, dated 22/5/08 Kochi-31 4 Ernakulam Cipla Ltd 7/445/20G/09 dated 1/10/09 5 Ernakulam Associated Pharma 7-38/20G/2008 Distributors, 41/2711, dated 15/2/08 Vallanath Centre, Banerji Road 6 Ernakulam IPCA Laboratories Ltd., 7- K R Pankajakshan 583/20G/2007 Road, Pulleppady dated 28/11/2007 7 Thrissur Mrs. Reetha Praveen 04872362984 8/268/20F/2 Fluvir M/s. Doctors Drugs, 004 dt. Tablets XIII/800 A, Kanjany 26/9/2004 75mg - Road, Ayyanthole , 210Nos. Thrissur 30mg - 48Nos. 8/147/20G/2 45mg- 40 009 dt. Nos. 30.4.2009 Fluvir Syrup- 4 29.4.2014 Nos. Antiflue- 10 caps. 8 Thrissur Sri. T.C. Antony 9847015180 8/122/20G/2 nil M/s . Drug 000 dt. House,X/664 11.4.2000 Brothers Lane Erinjeri Angadi, 31.12.2011 Thrissur 9 Thrissur Neethi Medical Store, PH: 04885- 30.3.2015 Fluvir Kunnamkulam 227234 Tablets 75mg - 30Nos. 10 Thrissur Mrs Reetha Praveen, 8/147/20G/2009 M/s Doctors Drugs, dated XIII/800A, Kanjany 30/4/2009 Road, Ayyanthole 11 Thrissur Sri T C Antony, M/s Drug 8/122/20G/2000 House, X/664, Brothers dated 11/4/2000 Lane, Erinjeri Angadi, Thrissur 12 Kozhikode C J Drugs, Palayam, 20G Sabha School Road, Thali 13 Kozhikode Medi -

Souvenir Lazer.Pmd

IDRBT AWARD Dr. Y.V. Reddy, RBI Governor Presents IDRBT Award. 100 per cent Core Banking Mr. N.R. Narayana Moorthy, Chief Mentor, Infosys Technologies declares SIB as 100 per cent CBS enabled 500th Branch Ms. Sheila Dikshit, Chief Minister of Delhi inaugurating 500th Branch Dear Patrons & Well Wishers, Someone once said “If you add a little to a little and do this often, soon the little will become great”. South Indian Bank as it ushers in its 80th year of service to the community is the very epitome of this quotation. From its humble beginnings in 1929, the bank has grown from strength to strength in delivering outstanding value to its customers and creating a name for itself in the banking arena. With an initial paid up capital of Rs 22000, the bank has now grown into an organization with a business of Rs 27000 crores, presence in 23 states and 520 branches, truly making it a force to reckon with amongst the banks in the country. “ ... little will become great ” The journey over the last 80 years has not been without its fair share of difficulties, but our bank has always endeavoured to ensure that the basic epithet of customer service was never compromised. Our achievements are a glowing testimonial of the confidence and the trust which we enjoy with our customers. We have been pioneers right from being the first private sector bank to open a NRI branch as well as being the first to start an Industrial Finance branch in 1993. We have been ahead of the curve in taking cognisance of the importance of technology and achieved 100% implementation of the Core Banking Solution in 2007. -

Alumni Directory 2018

Alumni Directory 2018 Amala Cancer Research Centre Amala Nagar P O Thrissur - 680 555, Kerala, India Phone : 0487 2307968 E-mail: [email protected] [email protected] www.amalaims.org Preface Amala Cancer Research Centre established in 1982 is a recognized Centre for Ph.D. studies in Biochemistry, Immunology, Microbiology and Radiation Biology by Mahatma Gandhi University of Calicut and Kerala University of Health Sciences. Hundred students have completed their Degree from this centre and presently they are working at various scientific institutions or Universities all around the world. Although most of the students communicate to our Centre and the number of students passing out increase every year, it becomes difficult to know each other. With these ideas in mind, we had our first, second and third Alumni Meeting in 2003, 2008 and 2013 at our Centre, respectively. It was suggested that Alumni should meet every five years. Latest Directory of the Alumni has been published in our website also and we hope this will be an easy access for communication. Padmabhooshan Fr. Gabriel CMI (Founder Director) Many things have changed over the years , but you are still the same great parson you have always been. Our founding director, guiding light and visionary par excellence.......... Flowers may fade, but fragrant memory lingers…. In loving memory of Dr. K K Soudamini Fr. Francis Kurissery CMI Managing Director Dr. Ramadasan Kuttan Research Director 5 Faculties Dr. Girija Kuttan Dr. K K Janardhanan Professor, Dept. of Immunology Professor, Dept. of Microbiology Dr. T D Babu Associate Professor, Dept. of Biochemistry Dr. Achuthan C Raghavamenon Dr. -

Accused Persons Arrested in Thrissur Rural District from 26.11.2017 to 02.12.2017

Accused Persons arrested in Thrissur Rural district from 26.11.2017 to 02.12.2017 Name of Name of the Name of the Place at Date & Arresting Court at Sl. Name of the Age & Cr. No & Sec Police father of Address of Accused which Time of Officer, which No. Accused Sex of Law Station Accused Arrested Arrest Rank & accused Designation produced 1 2 3 4 5 6 7 8 9 10 11 KOCHEDATH HOUSE CR.1012/17 26.11.201 20/17 THOTTAPPU U/S 341, 323, M.K REMESH JFCM 1 MINEESH NARAYANAN CHAVAKAD 7 AT 11.30 CHAVAKAD MALE MADUKADAPPURA 324, R/W 34 SI OF POLICE CHAVAKAD HRS M THRISSUR IPC KUTTALI HOUSE CR.1012/17 KADAPPURAM 26.11.201 21/17 U/S 341, 323, M.K REMESH JFCM 2 NADHIRSHA ASHARAF THOTTAPPU MADU CHAVAKAD 7 AT 11.30 CHAVAKAD MALE 324, R/W 34 SI OF POLICE CHAVAKAD KADAPPURAM HRS IPC THRISSUR THOTTAPPIL CR.1012/17 26.11.201 21/17 REMALAM HOUSE U/S 341, 323, M.K REMESH JFCM 3 THESLIH ALIKUNJU CHAVAKAD 7 AT 11.30 CHAVAKAD MALE THOTTAPPU MADU 324, R/W 34 SI OF POLICE CHAVAKAD HRS KADAPPURAM IPC VATTAPARAMBIL CR.1933/17 HOUSE, MARTHOMA 26.11.201 JFCM 26/17 U/S 118 (a ) KODUNGALL JINESH 4 SHAFAN ALAVUDHIN MENONBAZAR, AZHEEKODE 7 AT 22.35 KODUNGALL MALE KP ACT & 160 UR SI OF POLICE AZHIKODE VILLAGE. BEACH HRS UR IPC THRISSUR VATTAPARAMBIL CR.1933/17 HOUSE, MARTHOMA 26.11.201 JFCM 28/17 U/S 118 (a ) KODUNGALL JINESH 5 ANSHIQ ALAVUDHIN MENONBAZAR, AZHEEKODE 7 AT 22.35 KODUNGALL MALE KP ACT & 160 UR SI OF POLICE AZHIKODE VILLAGE. -

CSBL Unpaid Dividend, Refund Consolidated As on 22.09.2015.Xlsx

The Catholic Syrian Bank Limited Regd. Office, "CSB Bhavan", St. Mary's College Road, Thrissur 680020 Phone: 0487 -2333020, 6451640, eMail: [email protected] List of Unpaid Dividend as on 22.09.2015 (Dividend for the periods 2007-08 to 2013-14) FOLIO / DEMAT ID INITLS NAME ADDRESS LINE 1 ADDRESS LINE 2 ADDRESS LINE 3 ADDRESS LINE 4 PINCOD DIV.AMOUNT DWNO MICR PERIOD IEPF. TR. DATE A00350 ANTONY PALLANS HOUSE KURIACHARA TRICHUR, 30.00 0 2007-08 UNPAID DIVIDEND 25-OCT-2015 A00385 ANNAMMA P X AKKARA HOUSE PANAMKUTTICHIRA OLLUR, TRICHUR DIST 150.00 5 2007-08 UNPAID DIVIDEND 25-OCT-2015 A00398 ANTONY KUTTENCHERY HOUSE HIGH ROAD TRICHUR 1020.00 0 2007-08 UNPAID DIVIDEND 25-OCT-2015 A00406 ANTONY KALLIATH HOUSE OLLUR TRICHUR DIST 27.00 9 2007-08 UNPAID DIVIDEND 25-OCT-2015 A00409 ANTHONY PLOT NO 143 NEHRU NAGAR TRICHUR-6 120.00 0 2007-08 UNPAID DIVIDEND 25-OCT-2015 A00643 ANTHAPPAN PADIKKALA HOUSE EAST FORT GATE TRICHUR 540.00 12 2007-08 UNPAID DIVIDEND 25-OCT-2015 A00647 ANTHONY O K OLAKKENGAL HOUSE LOURDEPURAM TRICHUR - KERALA STATE. 680005 180.00 13 2007-08 UNPAID DIVIDEND 25-OCT-2015 A00668 ANTHONISWAMI C/O INASIMUTHU MUDALIAR SONS 55 NEW STREET KARUR TAMILNADU 2100.00 14 2007-08 UNPAID DIVIDEND 25-OCT-2015 A00822 ANNA JACOB C/O J S MANAVALAN 5 V R NAGAR ADAYAR MADRAS - 600020 210.00 18 2007-08 UNPAID DIVIDEND 25-OCT-2015 A01072 ANTHONY VI/62 PALACE VIEW EAST FORT TRICHUR 4200.00 0 2007-08 UNPAID DIVIDEND 25-OCT-2015 A01077 ANTONY KOTTEKAD KUTTUR TRICHUR DIST 30.00 0 2007-08 UNPAID DIVIDEND 25-OCT-2015 A01103 ANTONY ELUVATHINGAL CHERUVATHERI -

Ecology of Wetland Birds in the Kole Lands of Kerala

KFRI Research Report No. 244 ISSN 0970-8103 ECOLOGY OF WETLAND BIRDS IN THE KOLE LANDS OF KERALA E. A. Jayson Kerala Forest Research Institute Peechi- 680 653, Kerala, India October 2002 KFRI Research Report No. 244 ECOLOGY OF WETLAND BIRDS IN THE KOLE LANDS OF KERALA (FINAL REPORT OF THE RESEARCH PROJECT KFRI/303/98) E. A. Jayson Division of Wildlife Biology Kerala Forest Research Institute Peechi- 680 653, Kerala, India October 2002 1. INTRODUCTION Wetlands are complex ecosystems with many interacting organisms. Wetlands are defined as areas of marsh, ponds, swamps, whether natural or artificial, permanent or temporary, with water that is static or flowing, fresh, brackish or salt, including that of marine water the depth of which at low tide does not exceed six meters (IUCN, 1971). Wetlands are extremely important throughout the world for wildlife protection, recreation, pollution and sediment control, flood prevention and food production. Cowardin et al. (1979) define wetlands as ‘the lands transitional between terrestrial and aquatic system where the water table is usually at or near the surface or the land is covered by shallow water. Wetlands must have one or more of the three attributes: 1) at least periodically, the land supports predominantly hydrophytes, 2) the substrate is predominantly undrained hydric soil and 3) the substrate is nonsoil and is saturated with water or covered by shallow water at some time during the growing season of each year. Although considerable amount of research on wetlands has been done in India, most of the information has come from Keoladio, Point Calimere, Chilka Lake and the Sunderbans or from specific regions such as Gujarat and Ladakh (Wolstencroft et al., 1989). -

Snji$ Mcru4 Ojledao*...A

BEFORE TK£ HP.V3 LE COURT OF E>'0 [ ]RY COMMl-SMONER a >D>P ( i \L .n IX,E. |V1G!UV( R Form No.l KERALA POLICE- 3n-DeJlmJ FIRST INFORMATION REPORT fcjLoa niloi® Under Section 154 Cr.PC ct>s«js1 mica®* 154-0* oia^J 1.* District.. Thrissur ‘Police Station VACB * Year 2017 * FIR No. 06/17/TSR * Date.25/02/2017 ........ 11. ‘ Inquest Report/U.D Case No. if any........................................................... SSlgJ On-OeJImJ m J a g n liri Cu it& o n4)n5 l.SVi5).«15i4 cncnj4 (dJIcUKuil 3<gj <o nilaiXBcm r f l m^ojIa ®®«rr>o oAcnJ maud £e<rB®>l<d 2. (i) A ct PC Act 1988 ‘ Sections. U/s 13(2) r/w 13(l)(d) * A |. IPC ‘ Sections. 4 2 0 ,120(B) r/w 34 IPC 12. F.I.R. contents (Attach separate sheets if necessary) rrilofflo njAr^Atii cntooo njA<^Aui (iii) Act...................... ‘ Sections................ (iv) ‘Other Acts ahd Sections............................................................ That A-l Sri.K.P.Mohanan, while holding the post of Minister for Agriculture, Government of Kerala, nritoaio o j a ^ a o # roloasrogsoo j a ^ a ^ o Thiruvananthapuram, and A-2 Dr.lCPrathapan, while holding the post of Managing Director, Kerala 3. *(a) Occurrence of Offence ‘ During 2016* Date from* Date to ‘ Time period .............. AQ$cn^o rruoSoiljj gIojctuo roiloasl e^ai><d (bJIcq <b>) mo® rruiaoBo Feeds Limited, Irinjalakuda, Thrissur District, abused their official position as public servants, •Time from...‘Time to....... (b)Information received at Police Station......Date 25/02/2017....Time 15.00 Hrs. -

Ac Name Ac Addr1 Ac Addr2 Ac Addr3 Chandy Joseph

AC_NAME AC_ADDR1 AC_ADDR2 AC_ADDR3 CHANDY JOSEPH MOONJATTUPARAMBIL HOUSE MOONJATTUPARAMBIL HOUSEPONGA,KAINAKARY SHARON FELLOWSHIP CHURCH ASOKAPURAM ALUVA OPERATION BY ANY TWO JOINTLY ANTO M L AMBALLUR P O ALAGAPPANAGAR BABY DAVIS C/O P A DAVIS P0AYYAPPILLY HOUSE PO PUDUKKAD JOMON K JOSEPH KANJIRATHINGAL HOUSE P O PUDUKAD SHANTY C L CHUKKIRI HOUSE PUDUKAD SREEKUTTY T S D/O SUNDARAN T B THOTTIPARAMBIL HOUSE CHITTISSERY P O OMANA P C W/O KUNJAPPAN PALIYAMPARAMBIL HOUSE KUMBIDY POOVATHUSSERY R RAMESH FUTURE ELECTRONIC SYSTEM MADATHIL P O MALA KOTTAMURY FRANCIS JACOB THARAYIL HOUSE ANNALLUR P O JOFFY K J S/O.JOHNY KALAPURAKKAL HOUSE MALAPALLIPPURAM.P.O. K S SUJILKUMAR KIZHAKKANOTE HOUSE ASHTAMICHIRA ABDUL KHADER P K S/O ABDUL MUSALIAR POKKOKKATH HOUSE ATTUPURAM. PUNNAYURKULAM.P.O. LAMESH T M S/O MADHAVAN THAIPARAMBIL HOUSE VELIYANCODE P O MALAPPURAM DT SALJU W/O DHANAKESWARAN CHALIL HOUSE PURANGU PO SANJAYAN T S THOTTAPATTUNJALIL HOUSE S VAZHAKUALM SOORAJ K S/O K PADMANABHAN ARATHI, THERU, AZHIKODE KANNUR T V RAFEEK THAHIRA MANZIL POOTHAPPARA,AZHIKODE P OKANNUR ANIL KUMAR.G. NO.13,11TH CROSS ANEPALAYA MAIN ROAD,ADUGODIBANGALORE PO 560030. B.CLUB C/O KRISTU JYOTHI COLLEGE BIJU 10 th CROSS MAGADI ROAD BANGALORE -23 CHRISTOPHER DSOUZA 148/1,GOKUL SUDHA,M M ROAD, FRAZER TOWN,BANGLORE 5. K A FRANCIS NO 120/2, KULANTHAPPA GARDENADUGODI ANEPALAYAM BANGALORE KARTEEK SHARMA S-3,CRYSTAL VIEW APTS,62 ST JOHNS ROAD, BANGALORE-560042 MARY FRANCINA GOOD SHEPHERD HOME MUSEUM ROAD BANGALORE 25 RIZWAN AMEER 481,5TH MAIN 11 STAGE,RAJ MAHA-L VILAS EXTN,DOLLARS COLONYBANGALORE-94 SHRUTI C SEBASTIAN ASHRAY, NO.110, II CROSS, BYAPPANAHALLI NEW EXT. -

Kallettumkara Heronry, an Ideal Breeding Site for Waterbirds in Kerala, South India

International Journal of Science and Research (IJSR) ISSN (Online): 2319-7064 Index Copernicus Value (2013): 6.14 | Impact Factor (2013): 4.438 Kallettumkara Heronry, An Ideal Breeding Site For Waterbirds in Kerala, South India Ajitha K. V.1, Boby Jose2 PG and Research Department of Zoology, St. Joseph‟s College, Devagiri, Calicut, Kerala, India Abstract: The study was focused on the colonial breeding waterbirds and their preference in the nesting tree species of Kallettumkara heronry (10o 21 N, 76 o 26 E) in Kerala, South India during the period May to November 2011. The heronry accommodates five species of waterbirds belonging to the various families like Anhingidae, Phalacrocoracidae and Ardeidae. The most abundant species recorded in the study area was Little cormorant (Phalacrocorax niger) and the least one was Pond heron (Ardeola grayii).Apart from these species Indian cormorant, Near threatened species Oriental darter (Anhinga melanogaster), and Little egret (Egretta garzetta) were also breed here in good number. This site also provides breeding and roosting area for numerous resident birds as well as waterbirds, including globally near threatened species Oriental darter. As the heronry is situated very close to human inhabitation, it needs better care and adequate protection. The government should take initiation for protecting this area. Keywords: Heronry, Kallettumkara, Thommana, Muriyad 1. Introduction into two divisions namely the Thrissur Kole and the Ponnani Kol. The heronry is located at Kallettumkara village near Breeding places of wetland birds are called heronry. Usually Thommana kole wetland, in south kole of Thrissur District, o o all heronries are spectacular aggregation of waterbirds during Kerala.