Your DAP/401(K) Portfolio Dr

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Should U.S. Investors Invest Overseas?

Should U.S. Investors Invest Overseas? nterest in foreign investment has been high among U.S. investors in recent years. The unprecedented growth of 401k pension plans has Igreatly increased the number of people who must make their own investment decisions in planning for their retirement. Many investors know that geographic diversification can improve investment returns without increasing risk. However, whether or not to invest abroad and, if so, how much weight to give to foreign investment, are questions often subject to heated debate. Some investment advisors recommend that U.S. investors put as much as one-third of their stock portfolio in foreign stocks to take advantage of the benefits of diversification. Others believe that foreign investment should play only a small role, if any, in a U.S. investor’s stock portfolio. They argue that political uncertainties and currency fluctuations make the value of foreign investments far more volatile for the investor without the offsetting benefits of higher returns, and that diversification benefits are not enough to offset this disadvan- tage.1 Moreover, U.S. investors can get overseas exposure by investing in the stocks of domestic companies. Many U.S. multinationals that are part of the Dow Jones Industrial Average, such as IBM and Coca-Cola, derive a substantial portion of their revenue from overseas operations. The question of whether or not to invest abroad is part of the larger question of how to assemble a portfolio that is appropriate for the investor’s circumstances and degree of risk tolerance. Modern portfolio theory, introduced by Markowitz in the 1950s, uses optimization tech- Katerina Simons niques and historical data on the returns, risks, and correlations of available securities to construct a portfolio with the lowest possible risk for a given level of return. -

Roth IRA Vantagepoint Funds

Vantagepoint IRA Funds Stable Value/CashManagement Funds Code U.S. Stock Funds Code Dreyfus Cash Management Fund, Class Participant DPCXX MX Legg Mason Capital Management Value Trust, Class Financial Intermediary LMVFX G6 Bond Funds Code Vantagepoint Growth Fund VPGRX MG Vantagepoint Low Duration Bond Fund VPIPX MB Janus Fund, Class S JGORX 6C Vantagepoint Core Bond Index Fund, Class I VPCIX WM T Rowe Price® Growth Stock Fund, Class Advisor TRSAX PX PIMCO Total Return Fund, Class Administrative PTRAX XM T Rowe Price® Blue Chip Growth Fund, Class Advisor PABGX TC Vantagepoint Ination Protected Securities Fund VPTSX MT Legg Mason Capital Management Growth Trust, Class Financial Intermediary LMGFX ES PIMCO Real Return Fund, Class Administrative PARRX HK Janus Forty Fund, Class S JARTX AG PIMCO High Yield Fund, Class Administrative PHYAX XT Vantagepoint Select Value Fund VPSVX M2 Balanced/Asset Allocation Funds Code Fidelity Advisor Value Fund, Class A FAVFX 5F Vantagepoint Milestone Retirement Income Fund VPRRX 4E Vantagepoint Mid/Small Company Index Fund, Class I WDVPSIX Vantagepoint Milestone 2010Fund VPRQX CA Legg Mason Capital Management Special Investment Trust, Class Financial Intermediary LGASX 3V Vantagepoint Milestone 2015Fund VPRPX CH Fidelity Advisor Leveraged Company Stock Fund, Class A FLSAX VV Vantagepoint Milestone 2020Fund VPROX CJ Vantagepoint Aggressive Opportunities Fund VPAOX MA Vantagepoint Milestone 2025Fund VPRNX CN Janus Enterprise Fund, Class S JGRTX N4 Vantagepoint Milestone 2030Fund VPRMX CR American Century® Vista -

Vanguard Fund Fact Sheet

Fact sheet | June 30, 2021 Vanguard® Vanguard Dividend Growth Fund Domestic stock fund Fund facts Risk level Total net Expense ratio Ticker Turnover Inception Fund Low High assets as of 05/28/21 symbol rate date number 1 2 3 4 5 $51,232 MM 0.26% VDIGX 15.4% 05/15/92 0057 Investment objective Benchmark Vanguard Dividend Growth Fund seeks to Dividend Growth Spliced Index provide, primarily, a growing stream of income over time and, secondarily, long-term capital Growth of a $10,000 investment : January 31, 2011—D ecember 31, 2020 appreciation and current income. $33,696 Investment strategy Fund as of 12/31/20 The fund invests primarily in stocks that tend to $32,878 offer current dividends. The fund focuses on Benchmark high-quality companies that have prospects for as of 12/31/20 long-term total returns as a result of their ability 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 to grow earnings and their willingness to increase dividends over time. These stocks typically—but not always—will be undervalued Annual returns relative to the market and will show potential for increasing dividends. The fund will be diversified across industry sectors. For the most up-to-date fund data, please scan the QR code below. Annual returns 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Fund 9.43 10.39 31.53 11.85 2.62 7.53 19.33 0.18 30.95 12.06 Benchmark 6.32 11.73 29.03 10.12 -1.88 11.93 22.29 -1.98 29.75 15.62 Total returns Periods ended June 30, 2021 Total returns Quarter Year to date One year Three years Five years Ten years Fund 6.56% 11.10% 33.04% 17.04% 14.69% 13.45% Benchmark 5.79% 10.46% 34.52% 17.30% 15.48% 13.09% The performance data shown represent past performance, which is not a guarantee of future results. -

ICMA-RC Fund Sheet

COBB COUNTY FUND CODES SHEET Stable Value Fund Fund Code PLUS Fund ................................................................................................71 Vantagepoint Model Portfolio Funds Bond Funds Savings Oriented (Code SF) VP Core Bond Index Fund ..................................................................... WN VP US Government Securities Fund ....................................................... MT 5% International Fund VT PIMCO Total Return Fund (Administrative shares) ............................. I8 10% Growth & Income Fund VT PIMCO High Yield Fund (Administrative shares) .............................. L2 Balanced Funds 10% Equity Income Fund 35% Short-Term VP Asset Allocation Fund ........................................................................ MP VT Fidelity Puritan® Fund ......................................................................... 24 Bond Fund VP Savings Oriented Model Portfolio Fund .............................................. SF VP Conservative Growth Model Portfolio Fund ........................................ SG 30% Core Bond VP Traditional Growth Model Portfolio Fund ........................................... SL Index Fund 10% US Government VP Long-Term Growth Model Portfolio Fund ......................................... SM VP All-Equity Growth Model Portfolio Fund ........................................... SP Securities Fund VP Milestone Retirement Income Fund .................................................... 4E VP Milestone 2010 Fund ........................................................................ -

Modern Portfolio Theory: Dynamic Diversification for Today’S Investor

Modern Portfolio Theory: DYNAMIC DIVERSIFICATION FOR TODAY’S INVESTOR Contact: Mitch Fee Alternative Investments Three Lakes Advisors (949) 533-2136 [email protected] Modern Portfolio Theory: Dynamic Diversification for Today’s Investor A Personal Message from Three Lakes Advisors ____________________________________________1 Modern Portfolio Theory _______________________________________________________________3 Growth of Managed Futures ____________________________________________________________4 Studies on Managed Futures Portfolio Impact and Performance ________________________________5 Hypothetical Examples of Adding Managed Futures to a Stock and Bond Portfolio __________________10 Are Managed Futures Riskier Than Stocks? ________________________________________________11 Academic Studies on Managed Futures ___________________________________________________11 What Are Professional Commodity Trading Advisors? ________________________________________14 The Professional Versus The Amateur Trader ______________________________________________15 Dynamic Diversification at an Affordable Cost ______________________________________________16 Our CTA Selection Process ____________________________________________________________17 Doubly Diversified CTA Portfolios ________________________________________________________17 The Investment Process _______________________________________________________________18 Questions & Answers _________________________________________________________________19 Trading futures and options involves -

Semi-Annual Report

SEMIANNUAL REPORT August 31, 2020 T. ROWE PRICE New York Tax-Free Funds For more insights from T. Rowe Price investment professionals, go to troweprice.com. Beginning on January 1, 2021, as permitted by SEC regulations, paper copies of the T. Rowe Price funds’ annual and semiannual shareholder reports will no longer be mailed, unless you specifically request them. Instead, shareholder reports will be made available on the funds’ website (troweprice.com/prospectus), and you will be notified by mail with a website link to access the reports each time a report is posted to the site. If you already elected to receive reports electronically, you will not be affected by this change and need not take any action. At any time, shareholders who invest directly in T. Rowe Price funds may generally elect to receive reports or other communications electronically by enrolling at troweprice.com/paperless or, if you are a retirement plan sponsor or invest in the funds through a financial intermediary (such as an investment advisor, broker-dealer, insurance company, or bank), by contacting your representative or your financial intermediary. You may elect to continue receiving paper copies of future shareholder reports free of charge. To do so, if you invest directly with T. Rowe Price, please call T. Rowe Price as follows: IRA, nonretirement account holders, and institutional investors, 1-800-225-5132; small business retirement accounts, 1-800-492-7670. If you are a retirement plan sponsor or invest in the T. Rowe Price funds through a financial intermediary, please contact your representative or financial intermediary or follow additional instructions if included with this document. -

FRS Investment Plan Excessive Fund Trading Policy November 2003 (Revised July 2014)

FRS Investment Plan Excessive Fund Trading Policy November 2003 (revised July 2014) 1. Foreign and global investment funds are subject to a minimum holding period of 7-calendar days following any non-exempt transfers into such funds. For example, if a member transfers $5,000 into one of the funds listed below on November 4, the member will not be able to transfer the $5,000 out of that fund until November 12, except for distributions out of the plan. Foreign and global funds include: a. FRS Foreign Stock Index Fund (200) b. American Funds EuroPacific Growth Fund (220) c. American Funds New Perspective Fund (210) 2. All investment funds (except for money market funds and funds within the Self-Directed Brokerage Account1) are subject to the following controls in order to mitigate excessive fund trading: a. Members that engage in one or more Market Timing Trades (as defined in the Definitions section below) in authorized funds will receive a warning letter sent by U.S. mail. The warning letter will notify the member that Market Timing trades have been identified in his/her account and any additional violations will result in a direction letter. b. Members engaging in one or more Market Timing Trades and who have previously received a warning letter will be sent a direction letter by courier (i.e. UPS, FedEx, etc.). The SBA may require non-automated trade instructions for at least one full calendar month following the date of the direction letter for all trades involving the Investment Plan primary funds. Subsequent violations may require members to conduct trades via paper trading forms mailed certified/return- receipt to the SBA for all trades involving the Investment Plan primary funds. -

Chapter 11 Return and Risk the Capital Asset Pricing Model.Pdf

University of Science and Technology Beijing Dongling School of Economics and management ChapterChapter 1111 ReturnReturn andand RiskRisk TheThe CapitalCapital AssetAsset PricingPricing ModelModel Nov. 2012 Dr. Xiao Ming USTB 1 Key Concepts and Skills • Know how to calculate the return on an investment • Know how to calculate the standard deviation of an investment’s returns • Understand the historical returns and risks on various types of investments • Understand the importance of the normal distribution • Understand the difference between arithmetic and geometric average returns Dr. Xiao Ming USTB 2 Key Concepts and Skills • Know how to calculate expected returns • Know how to calculate covariances, correlations, and betas • Understand the impact of diversification • Understand the systematic risk principle • Understand the security market line • Understand the risk-return tradeoff • Be able to use the Capital Asset Pricing Model Dr. Xiao Ming USTB 3 Chapter Outline 11.1 Individual Securities 11.2 Expected Return, Variance, and Covariance 11.3 The Return and Risk for Portfolios 11.4 The Efficient Set for Two Assets 11.5 The Efficient Set for Many Assets 11.6 Diversification 11.7 Riskless Borrowing and Lending 11.8 Market Equilibrium 11.9 Relationship between Risk and Expected Return (CAPM) Dr. Xiao Ming USTB 4 11.1 Individual Securities • The characteristics of individual securities that are of interest are the: – Expected Return – Variance and Standard Deviation – Covariance and Correlation (to another security or index) Dr. Xiao Ming USTB 5 11.2 Expected Return, Variance, and Covariance Consider the following two risky asset world. There is a 1/3 chance of each state of the economy, and the only assets are a stock fund and a bond fund. -

Dodge & Cox Funds 2020 Estimated Year-End Distributions

2020 Estimated Year-End Distributions Estimates as of October 31, 2020 Year-End Distribution Dates December 2020 income and capital gain distributions will occur according to the following schedule: Record Date: December 17, 2020 Ex-Dividend and Reinvestment Date: December 18, 2020 Payable Date: December 21, 2020 Estimated Year-End Income and Capital Gain Distributions The table below lists estimated year-end income and capital gain distributions for the Dodge & Cox Funds. Please note that these distribution estimates are based on shares outstanding on October 31, 2020 and are subject to change. Actual distributions will be based on shares outstanding on the Record Date and are subject to approval by the Funds’ Board of Trustees. Estimated Estimated Short-Term Estimated Long-Term Income Distribution Capital Gain Distribution Capital Gain Distribution Amount per % of Amount per % of Amount per % of Fund Share NAV Share NAV Share NAV Stock Fund (DODGX) $0.40* 0.2% None None $7.92 4.9% Global Stock Fund (DODWX) $0.17 1.6% None None None None International Stock Fund $0.78 2.2% None None None None (DODFX) Balanced Fund (DODBX) $0.41* 0.5% $0.14 0.2% $3.66 4.0% Income Fund (DODIX) $0.08* 0.6% $0.19 1.3% $0.11 0.8% Global Bond Fund (DODLX) $0.19* 1.6% $0.06 0.5% None None *Fund normally distributes income (if any) on a quarterly basis Timing of Capital Gain Distributions If a Fund has net capital gains through October 31st, they are normally distributed to shareholders in December. -

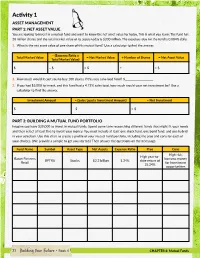

Activity 1 ASSET MANAGEMENT PART 1: NET ASSET VALUE You Are Looking to Invest in a Mutual Fund and Want to Know the Net Asset Value for Today

Activity 1 ASSET MANAGEMENT PART 1: NET ASSET VALUE You are looking to invest in a mutual fund and want to know the net asset value for today. This is what you learn: The fund has 20 million shares and the total market value of its assets today is $300 million. The expense ratio for the fund is 0.004% daily. 1. What is the net asset value of one share of this mutual fund? Use a calculator to find the answer. – (Expense Ratio x Total Market Value = Net Market Value ÷ Number of Shares = Net Asset Value Total Market Value) $ – $ = $ ÷ = $ 2. How much would it cost you to buy 100 shares if this was a no-load fund? $________________________ 3. If you had $5,000 to invest, and this fund had a 4.75% sales load, how much would your net investment be? Use a calculator to find the answer. Investment Amount – (Sales Load x Investment Amount) = Net Investment $ – $ = $ PART 2: BUILDING A MUTUAL FUND PORTFOLIO Imagine you have $20,000 to invest in mutual funds. Spend some time researching different funds that might fit your dsnee and then select at least five to invest your money. You must include at least one stock fund, one bond fund, and one hybrid in your selection. Use this chart to create a profile of your mutual fund portfolio, including the pros and cons for each of your choices. (We provide a sample to get you started.) Then answer the questions on the next page. Fund Name Symbol Asset Type Net Assets Expense Ratio Pros Cons High risk, High year-to- Baron Partners borrows money BPTRX Stocks $2.2 billion 1.34% date return of Retail for investment 15.34% opportunities 31 Building Your Future • Book 4 CHAPTER 4: Mutual Funds 1. -

PERA International Stock Fund

International Stock Fund Benchmark MSCI ACWI Ex-USA Index Volatility and Risk High 2Q Performance as of 6/30/2021 Fund Inception Date 10/1/2011 50% Total Fund Assets ($M) $559.9 42.4% Admin. Fee* 0.03% 40% 35.7% Inv. Mgmt. Fee* 0.26% 30% Total Fee* 0.29% 20% 12.5% 13.4% 10.2% 11.1% Investment Objective & Strategy 9.2% 9.4% 10% 5.4% 5.5% The fund seeks to provide long-term capital appreciation and dividend income primarily by investing in the common stock 0% of companies located outside the United States. This fund QTR YTD 1 Year 3 Year 5 Year 2021 invests in a wide array of international stocks similar to those found in the MSCI All Country World Index (ACWI) ex-USA Index. International Stock Fund MSCI ACWI Ex-USA Index Principal Risks Loss of Money, Not FDIC Insured, Active Management, Index Annual Returns 2020 2019 2018 2017 2016 Correlation/Tracking Error, Suitability, Multimanager, Equity Securities, Foreign Securities International Stock Fund 19.5% 24.5% (16.1)% 27.4% 6.5% MSCI ACWI Ex-USA Index 10.7% 21.5% (14.2)% 27.2% 4.5% Subadvisors Market Cap % of Fund Regional Allocation % of Fund Mega 15.1% World Ex-USA 70.7% Large 54.3% Europe Developed 49.1% 40% Medium 14.8% Asia Pacific Developed 17.3% 60% Small 15.5% North America 3.1% Micro 0.4% Other 1.2% Emerging Markets 25.6% Schroders International Alpha PERA International Multi-Factor United States 3.6% Sector Allocation % of Fund % of Benchmark Top Holdings % of Fund Consumer Discretionary 19.0% 13.8% Taiwan Semiconductor Manufacturing 3.3% Information Technology 15.4% 12.9% Samsung -

Conquering the Seven Faces of Risk

CONQUERING THE SEVEN FACES OF RISK This book intends to shake the very foundation of the sleepy momentum monoculture that seems happily mired in decades-old simplistic models that not only fail to treat momentum as the multi- faceted problem it is, but also fail to consider fundamental signal processing methods (older than Modern Portfolio Theory) that reduce the “random walk” part of the signal and improve the probability of making a better investment choice. The good news is two-fold: (1) The book’s principles and methods are described in a manner most ordinary investors will easily grasp, and (2) While it is truly complicated under the hood (like my car), software tools make it easy to drive. So, buckle up, turn the page, and let’s go for a ride! Scott M. Juds CONQUERING THE SEVEN FACES OF RISK Copyright © 2017, 2018 Scott M. Juds All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except as follows: Brief quotations embedded in critical reviews and technical publications, which may include graphical material, provided that quotations and graphical material include a proper citation (i.e. “Fair Use Doctrine.”) Other noncommercial uses permitted by copyright law. Please visit www.FinTechPress.pub for more information about: Other related papers, books, or Updates or Revisions to this Book. How to get the Author’s Personal Autograph on your hardcover copy. Requesting Permission for other re-uses of this copyrighted material.