Statement of Preliminary Issues H. J. Heinz Company (New Zealand

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Case Study Cerebos Australia – 2016 Outstanding Achievement in Design

Case Study Cerebos Australia - 2016 Outstanding Achievement in Design Case Study Cerebos Australia – 2016 Outstanding Achievement in Design Overview In 2016, Cerebos Australia won the Australian Packaging Covenant award for Outstanding Achievement in Design. This award recognises the organisation’s success in integrating the Sustainable Packaging Guidelines (SPGs) into their design and procurement processes, and implementing the opportunities identified. Taking advantage of an extensive factory modernisation, the Cerebos design team has been able to use the outcomes of the SPG reviews to redesign and rethink packaging as production lines were upgraded. A consistently high performing signatory, Cerebos also works actively with its supply chain to identify and implement design changes. Background Cerebos Australia Cerebos is a successful and innovative sauce, spice and coffee manufacturing organisation that develop and manufacture their own products across both Australia and New Zealand. They have a wide range of well- known brands including Fountain, Gravox, Saxa and Gregg’s. Cerebos Australia and New Zealand is a trans- Tasman integration of two companies. The parent company, Cerebos Pacific Limited, is based in Singapore and is wholly owned by Suntory Limited, a Japanese global food and beverage group. Commitment to Sustainable Design Since joining the Covenant in mid-2000, Cerebos has progressively improved its packaging decision-making processes in order to reduce environmental impacts and create business efficiencies. Cerebos has an ongoing commitment to minimise the environmental impact arising from packaging by continuing to pursue their specific performance goals of Design, Recycling and Product Stewardship. Environmental issues are considered in the product development process through a packaging decision checklist based on the SPGs. -

Chicken Essence for Cognitive Function Improvement: a Systematic Review and Meta-Analysis

nutrients Review Chicken Essence for Cognitive Function Improvement: A Systematic Review and Meta-Analysis Siew Li Teoh 1, Suthinee Sudfangsai 2, Pisake Lumbiganon 3, Malinee Laopaiboon 4, Nai Ming Lai 5 and Nathorn Chaiyakunapruk 1,6,7,8,* Received: 3 November 2015; Accepted: 11 January 2016; Published: 20 January 2016 1 School of Pharmacy, Monash University Malaysia, Selangor 47500, Malaysia; [email protected] 2 Faculty of Pharmaceutical Sciences, Naresuan University, Phitsanulok 65000, Thailand; [email protected] 3 Department of Obstetrics and Gynaecology, Faculty of Medicine, Khon Kaen University, Khon Kaen 40002, Thailand; [email protected] 4 Department of Biostatistics and Demography, Faculty of Public Health, Khon Kaen University, Khon Kaen 40002, Thailand; [email protected] 5 School of Medicine, Taylor’s University Malaysia, Selangor 47500, Malaysia; [email protected] 6 Center of Pharmaceutical Outcomes Research (CPOR), Department of Pharmacy Practice, Faculty of Pharmaceutical Sciences, Naresuan University, Phitsanulok 65000, Thailand 7 School of Pharmacy, University of Wisconsin, Madison, WI 53705-2222, USA 8 School of Population Health, University of Queensland, Brisbane, Herston QLD 4006, Australia * Correspondence: [email protected]; Tel.: +603-5514-4413; Fax: +603-5514-6326 Abstract: Chicken essence (CE) is a popular traditional remedy in Asia, which is believed to improve cognitive functions. CE company claimed that the health benefits were proven with research studies. A systematic review was conducted to determine the cognitive-enhancing effects of CE. We systematically searched a number of databases for randomized controlled trials with human subjects consuming CE and cognitive tests involved. Cochrane’s Risk of Bias (ROB) tool was used to assess the quality of trials and meta-analysis was performed. -

Comvita Limited 2011 Independent Adviser's Report

Comvita Limited Independent Adviser’s Report On the Full Takeover Offer from Cerebos New Zealand Limited November 2011 COMVITA LIMITED TARGET COMPANY STATEMENT 2011 29 Table of Contents Glossary..........................................................................................................................................................................................3 1. Terms of the Cerebos Offer .................................................................................................................................................4 1.1 Background..................................................................................................................................................................4 1.2 Details of the Cerebos Offer..........................................................................................................................................4 1.3 Requirements of the Takeovers Code ...........................................................................................................................5 1.4 Overview of Cerebos ....................................................................................................................................................6 2. Scope of the Report..............................................................................................................................................................7 2.1 Purpose of the Report ..................................................................................................................................................7 -

Teachers' Retirement System of Louisiana: Comprehensive Annual Financial Report--A Component Unit of the State of Louisiana for the Fiscal Year Ended June 30, 1996

DOCUMENT RESUME ED 405 307 SP 037 185 TITLE Teachers' Retirement System of Louisiana: Comprehensive Annual Financial Report--A Component Unit of the State of Louisiana for the Fiscal Year Ended June 30, 1996. INSTITUTION Teachers Retirement System of Louisiana, Baton Rouge. PUB DATE Oct 96 NOTE 138p. PUB TYPE Reports Descriptive (141) EDRS PRICE MF01/PC06 Plus Postage. DESCRIPTORS Elementary Secondary Education; Fringe Benefits; Higher Education; *Investment; Personnel Policy; *Retirement Benefits; *Teacher Employment Benefits; *Teacher Retirement IDENTIFIERS Financial Planning; Financial Reports; *Louisiana; *Retirement Planning ABSTRACT The annual Financial Report of the Teachers' Retirement System of Louisiana is divided into six main sections. The Introductory Section includes the letter of transmittal, names of the Board of Trustees, staff, and consultants; the organization chart; copy of certificate of achievement for excellence in financial reporting for 1995 financial report; summary of 1995-96 legislative acts; and a plan summary. The Financial Section includes the Independent Auditor's Report, General Purpose Finance Statements, Required Supplementary Information, and Supporting Schedules. The Investment Section includes reports on investment activity and policy, an Investment Summary, a list of investments, net earnings on investments and performance measures, annual rates of return, and Summary Schedule of Commissions Paid to Brokers. The Actuarial Section includes a summary of assumptions; Actuarial Valuation Balance Sheet; summary, reconciliation, and amortization of unfunded actuarial liabilities; and membership data. The Statistical Section provides data on vested and nonvested members, retirees, benefit recipients, benefit expenses, revenues, expenses, and participating employers. The final section outlines the Optional Retirement Plan, the Deferred Retirement Option Plan, and Option 5. -

Government Pension Fund – Global Holding of Equities at 31 December 2007

NORGES BA N K IN VESTME N T MA N AGEME N T ANNU A L REPO R T 2007 1 Government Pension Fund – Global Holding of equities at 31 December 2007 Europe Market value (NOK 1000) Ownership stake (per cent) Voting (per cent) Market value (NOK 1000) Ownership stake (per cent) Voting (per cent) AUSTRIA CROATIA Agrana Beteiligungs AG 7 370 0,092 0,092 Hrvatski Telekom dd 9 366 0,031 0,031 Andritz AG 44 606 0,261 0,261 A-TEC Industries AG 8 731 0,183 0,183 CYPRUS Austriamicrosystems AG 14 733 0,545 0,544 Bank of Cyprus Public Co Ltd 258 088 0,462 0,462 Austrian Airlines AG 4 904 0,115 0,115 Marfin Popular Bank Public Co Ltd 112 322 0,195 0,195 Boehler-Uddeholm AG 21 637 0,077 0,077 bwin Interactive Entertainment AG 23 914 0,346 0,346 CZECH REPUBLIC BWT AG 7 777 0,151 0,151 Philip Morris CR AS 23 736 0,364 0,364 CA Immo International AG 6 034 0,151 0,151 CA Immobilien Anlagen AG 34 729 0,328 0,328 DENMARK CAT Oil AG 4 798 0,082 0,082 A P Moller - Maersk A/S 921 847 0,363 0,433 Conwert Immobilien Invest SE 26 735 0,328 0,328 ALK-Abello A/S 13 504 0,209 0,230 Erste Bank der Oesterreichischen Sparkassen AG 729 685 0,599 0,599 Alm Brand A/S 7 943 0,125 0,125 EVN AG 62 871 0,219 0,219 Amagerbanken A/S 5 234 0,176 0,176 Flughafen Wien AG 19 884 0,151 0,151 Auriga Industries 3 080 0,123 0,175 Immoeast AG 173 045 0,355 0,355 Bang & Olufsen A/S 21 199 0,342 0,377 IMMOFINANZ AG 179 658 0,709 0,709 Bavarian Nordic A/S 3 610 0,148 0,148 Intercell AG 15 019 0,157 0,157 Biomar Holding A/S 2 573 0,112 0,112 Lenzing AG 3 475 0,033 0,033 Carlsberg A/S 97 282 0,199 -

Energy Efficiency National Partnership

ENERGY EFFICIENCY NATIONAL PARTNERSHIP Company Name: 1) 3M INNOVATION SINGAPORE PTE LTD 2) 3M SINGAPORE PTE LTD 3) ABB PTE LTD 4) ABBOTT MANUFACTURING SINGAPORE PRIVATE LIMITED 5) ACP METAL FINISHING PTE LTD 6) ADM COCOA PTE LTD 7) ADVANCED MICRO DEVICES (S) PTE LTD 8) AFPD PTE LTD 9) AGILENT TECHNOLOGIES SINGAPORE PTE LTD 10) AIR PRODUCTS SINGAPORE PTE LTD 11) AIRFOIL TECHNOLOGIES INTERNATIONAL SINGAPORE PTE LTD 12) ALTUS LOGISTICS PTE LTD 13) ASAHI KASEI PLASTICS SINGAPORE PTE LTD 14) ASCENDAS FUNDS MANAGEMENT (S) LTD 15) ASCENDAS LAND (SINGAPORE) PTE LTD 16) ASE SINGAPORE PTE LTD 17) ASIA PACIFIC BREWERIES (S) PTE LTD 18) ASM TECHNOLOGY SINGAPORE PTE LTD 19) AVITRON PRIVATE LIMITED 20) AZEN MANUFACTURING PTE LTD 21) BAN CHOON MARKETING PTE LTD 22) BAXTER HEALTHCARE SA, SINGAPORE BRANCH 23) BAYER (SOUTH EAST ASIA) PTE LTD 24) BECTON DICKINSON MEDICAL (S) PTE LTD 25) BEECHAM PHARMACEUTICALS PTE LTD 26) BODYNITS INTERNATIONAL PTE LTD 27) BROADCOM SINGAPORE PTE LTD 28) BRUDERER PRESSES (FAR EAST) PTE LTD 29) CADBURY ENTERPRISES PTE LTD Page 1 of 8 Updated as of 01 December 2015 ENERGY EFFICIENCY NATIONAL PARTNERSHIP 30) CEL COATINGS INDUSTRIES PTE LTD 31) CEREBOS PACIFIC LIMITED 32) CEVA ASIA PACIFIC HOLDINGS COMPANY PTE LTD 33) CHEMICAL INDUSTRIES (FE) LIMITED 34) CHEMICAL SPECIALTIES (S) PTE LTD 35) CHEVRON ORONITE PTE LTD 36) CHEVRON PHILLIPS SINGAPORE CHEMICALS (PRIVATE) LIMITED 37) CIBAVISION ASIAN MANUFACTURING AND LOGISTICS PTE LTD 38) CITY DEVELOPMENTS LIMITED 39) CITY GAS PTE LTD 40) COCA COLA SINGAPORE BEVERAGES PTE LTD 41) COHERENT -

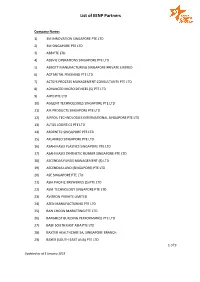

List of EENP Partners

List of EENP Partners Company Name: 1) 3M INNOVATION SINGAPORE PTE LTD 2) 3M SINGAPORE PTE LTD 3) ABB PTE LTD 4) ABBVIE OPERATIONS SINGAPORE PTE LTD 5) ABBOTT MANUFACTURING SINGAPORE PRIVATE LIMITED 6) ACP METAL FINISHING PTE LTD 7) ACTSYS PROCESS MANAGEMENT CONSULTANTS PTE LTD 8) ADVANCED MICRO DEVICES (S) PTE LTD 9) AFPD PTE LTD 10) AGILENT TECHNOLOGIES SINGAPORE PTE LTD 11) AIR PRODUCTS SINGAPORE PTE LTD 12) AIRFOIL TECHNOLOGIES INTERNATIONAL SINGAPORE PTE LTD 13) ALTUS LOGISTICS PTE LTD 14) ARDENTEC SINGAPORE PTE LTD 15) ARLANXEO SINGAPORE PTE LTD 16) ASAHI KASEI PLASTICS SINGAPORE PTE LTD 17) ASAHI KASEI SYNTHETIC RUBBER SINGAPORE PTE LTD 18) ASCENDAS FUNDS MANAGEMENT (S) LTD 19) ASCENDAS LAND (SINGAPORE) PTE LTD 20) ASE SINGAPORE PTE LTD 21) ASIA PACIFIC BREWERIES (S) PTE LTD 22) ASM TECHNOLOGY SINGAPORE PTE LTD 23) AVITRON PRIVATE LIMITED 24) AZEN MANUFACTURING PTE LTD 25) BAN CHOON MARKETING PTE LTD 26) BARGHEST BUILDING PERFORMANCE PTE LTD 27) BASF SOUTH EAST ASIA PTE LTD 28) BAXTER HEALTHCARE SA, SINGAPORE BRANCH 29) BAYER (SOUTH EAST ASIA) PTE LTD 1 of 9 Updated as of 5 January 2018 List of EENP Partners 30) BECTON DICKINSON MEDICAL (S) PTE LTD 31) BEECHAM PHARMACEUTICALS PTE LTD 32) BODYNITS INTERNATIONAL PTE LTD 33) BROADCOM SINGAPORE PTE LTD 34) BRUDERER PRESSES (FAR EAST) PTE LTD 35) CADBURY ENTERPRISES PTE LTD 36) CCD (SINGAPORE) PTE LTD 37) CEL COATINGS INDUSTRIES PTE LTD 38) CEREBOS PACIFIC LIMITED 39) CEVA ASIA PACIFIC HOLDINGS COMPANY PTE LTD 40) CHEMICAL INDUSTRIES (FE) LIMITED 41) CHEMICAL SPECIALTIES (S) PTE LTD -

Suntory Beverage & Food (2587)

09 December 2014 Asia Pacific/Japan Equity Research Beverage (Food (Japan)) / MARKET WEIGHT Suntory Beverage & Food (2587) Rating NEUTRAL* Price (08 Dec 14, ¥) 4,385 INITIATION Target price (¥) 4,600¹ Chg to TP (%) 4.9 Stable earnings supported by sustained cost- Market cap. (¥ bn) 1,354.96 (US$ 11.15) Enterprise value (¥ bn) 1,585.96 cutting effects Number of shares (mn) 309.00 Free float (%) 35.0 Initiating coverage: We initiate coverage of Suntory Beverage & Food (SBF) 52-week price range 4,385 - 3,215 with a NEUTRAL rating and a ¥4,600 target price (potential return 4.9%). SBF, *Stock ratings are relative to the coverage universe in each which has the second-largest domestic soft drinks market share, appears analyst's or each team's respective sector. committed to building a strong business base. We see little risk of a slowdown in ¹Target price is for 12 months. sales momentum other than due to weather and other unavoidable externals. Research Analysts SBF’s international operations mainly consist of: (1) European business, where it is boosting margins by focusing on brands with high market shares, and Masashi Mori 81 3 4550 9695 (2) Southeast Asian business, where we see substantial growth potential, [email protected] especially in Vietnam. Amid intense competition in the global soft drinks market, Suntory is relatively strong in its focus regions, but we see little potential upside over our TP. Investment theme: We see prospects for a double-digit CAGR in OP over the next three years. The company has stepped up mainstay brand consolidation in all regions. -

Contributions to Communities

CSR Activities of Group Companies Contributions to Communities As a company rooted in related communities, the Suntory Group contributes to the growth of culture and lifestyle in communities in a global level. Château Lagrange S.A.S. Suncafé Ltd. Thirtieth Year of Our Participating in Management Trainings and Social Assistance Program in Coffee Country Hosting la Fête de la Fleur, the Prestigious Flower Festival Suncafé Ltd., a company roasting coffee beans and manufacturing various coffee and tea extracts has on-site training program for the harvesting and selection of Château Lagrange, located in a particularly superior red wine region of Medoc in Bordeaux, coffee beans with local farmers in Guatemala, a key supplier country of the main France, is classified as Troisème Crus (Third Growths) in the Bordeaux wine official ingredient for our BOSS brand of canned coffee. With ITOCHU Corporation's classification of 1855. In its impressive history, the name of chateau was found in a local subsidiary, UNEX (GUATEMALA), S.A., the company is working on to document dating back to 1631. We began participating in the management of the chateau provide various assistance programs to support the local communities. In 2013, in 1983. This was the source of much talk, as the French government had never before 11 participants from our group companies, including Suntory Beverage & Food allowed a non-Western business to participate in chateau ownership. Ltd. and Pronto Corp., visited Guatemala. Back then, everything, from the buildings and equipment to even the vineyards themselves, In addition to experiencing the differences that climate and terroir can have on Practicing harvesting the coffee cherries was in a desolate state. -

The Protective Effect of BRAND's

Journal of Health Science, 52(1) 17–23 (2006) 17 The Protective Effect of BRAND’S Essence of Chicken (BEC) on Energy Metabolic Disorder in Mice Loaded with Restraint Stress Hiroshi Kurihara,a Xin-Sheng Yao,a Hajime Nagai,b Nobuo Tsuruoka,c Hiroshi Shibata,c Yoshinobu Kiso,c and Harukazu Fukami*, c aInstitute of Traditional Chinese Medicine and Natural Products, Jinan University, 601, Huangpu Avenue West, Guangzhou, 510632, China, bBRAND’S Center for Health and Nutritional Sciences, Cerebos Pacific Ltd., 18 Cross Street #12-01/08, China Square Cen- tral, Singapore 048423, Singapore, and cInstitute for Health Care Science, Technological Development Center, Suntory Ltd., 5–2–5, Yamazaki, Shimamoto-cho, Mishima-gun, Osaka 618–0001, Japan (Received August 16, 2005; Accepted November 1, 2005) We investigated the effects of BRAND’S Essence of Chicken (BEC) on the basic metabolism of plasma lipids in mice loaded with restraint stress. When a lipid emulsion was intravenously injected into mice, 20 hr restraint stress prolonged the elimination of plasma triglyceride (TG). The results indicated that lipid metabolism was defi- nitely disrupted by stress, and that the use of TG as an energy source decreased. The plasma TG level was 320 ± 27 mg/dl 35 min after Intralipid® administration in restrained mice, while it was 253 ± 23 mg/dl in the restrained mice that were given 5 ml/kg of BEC. The improved plasma lipid metabolism was well explained by the finding that lipoprotein lipase in omental adipose tissue was remarkably improved by BEC. Our study shows that BEC improves metabolic dysfunction possibly by utilizing plasma lipids as energy sources and elevating lipoprotein lipase activity reduced by stress. -

Prepared by SIAS, IIAS and SKBI Content

Prepared by SIAS, IIAS and SKBI Content Message from Organisers Securities Investors Association (Singapore) (SIAS) 2 The Institute of Internal Auditors Singapore (IIAS) Sim Kee Boon Institute for Financial Economics (SKBI) Message from Sponsor RSM Ethos Pte Ltd 3 The Importance of Internal Audit 4 The Selection Process 5 The Winning Companies Winner : DBS Group Holdings Ltd 7 Runner Up : Singapore Airlines Limited 8 : Cerebos Pacific Limited 9 Merit : Oversea-Chinese Banking Corporation Ltd 10 Photo Gallery 11 2013 Internal Audit Excellence Award FAQ 12 Message from Organisers ointillism is a style of painting where the artist carefully places thousands of tiny Pdots of different colors come together. Each single dot on its own is meaningless. But seen together, the dots form a larger picture that captures the artist’s vision. Like the pointillist, the internal auditor produces a slew of recommendations and insights from his work across the organization. Each one may seem insignificant. But seen as a whole, the internal auditor’s work comes together to help the organization achieve its objectives and realize its vision. The board and the management receive assurance that the organization’s processes and controls are sound and robust through the internal auditor’s testing and evaluation. Stakeholders’ concerns about strategic, financial, operational and compliance risks are alleviated by up-to-date information gathered and communicated by the internal auditor. Constantly working on the ground, the internal auditor acts as the eyes and ears of the shareholders. While internal audit may be viewed as costly, the larger picture that emerges is that the function adds value to the organization through its independent, objective assurance and consulting activities, governed by the International Professional Practices Framework (IPPF) comprising standards promulgated by The Institute of Internal Auditors (IIA). -

NZ Processed 2017 New Zealand Processed Foods Overview

THE INVESTOR’S GUIDE TO THE NEW ZEALAND PROCESSED FOOD INDUSTRY 2017 Part of the New Zealand Food & Beverage Information Project FINAL REPORT; v1.02; June 2017 STEERING & GUIDANCE Projected market information, analyses and conclusions contained herein are Unless otherwise noted, all photos used in this discussion document were based (unless sourced otherwise) on the information described above and on provided by the New Zealand Story resource (www.nzstory.govt.nz), This project would not have been possible without the strong guidance of our Coriolis’ judgment, and should not be construed as definitive forecasts or purchased by Coriolis from a range of stock photography providers as Steering Committee. In particular, we would like to thank Andrew McCallum guarantees of future performance or results. Neither Coriolis nor its officers, documented, or are low resolution, complete product/brand for illustrative of MBIE for his tireless energy in keeping this project on track, while at the directors, shareholders, employees or agents accept any responsibility or purposes used under fair dealing/fair use for both “research and study” and same time pushing us forward. liability with respect to this document. “review and criticism”. Our usage of them complies with New Zealand law or their various license agreements. Draft versions of parts of this document were distributed to key firms for Coriolis wishes to draw your attention to the following limitations of the comment, addition or correction. This was done in the form of emails and Coriolis report “New Zealand Meat Industry 2017“ (the Coriolis Report) Cover image: Under license from Shutterstock phone calls. We thank those who helped us in this process for their time and including any accompanying presentation, appendices and commentary (the effort.