Latest Annual Accounts

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Heartlands of Fife Visitor Guide

Visitor Guide Heartlands of Fife Heartlands of Fife 1 The Heartlands of Fife stretches from the award-winning beaches of the Firth of Forth to the panoramic Lomond Hills. Its captivating mix of bustling modern towns, peaceful villages and quiet countryside combine with a proud history, exciting events and a lively community spirit to make the Heartlands of Fife unique, appealing and authentically Scottish. Within easy reach of the home of golf at St Andrews, the fishing villages of the East Neuk and Edinburgh, Scotland’s capital city, the Heartlands of Fife has great connections and is an ideal base for a short break or a relaxing holiday. Come and explore our stunning coastline, rolling hills and pretty villages. Surprise yourself with our fascinating wildlife and adrenalin-packed outdoor activities. Relax in our theatres, art galleries and music venues. Also don’t forget to savour our rich natural larder. In the Heartlands of Fife you’ll find a warm welcome and all you could want for a memorable visit that will leave you eager to come back and enjoy more. And you never know, you may even lose your heart! Contents Our Towns & Villages 3 The Great Outdoors 7 Golf Excellence 18 Sporting Fun 19 History & Heritage 21 Culture 24 Innovation & Enlightenment 26 Family Days Out 27 Shopping2 Kirkcaldy & Mid Fife 28 Food & Drink 29 Events & Festivals 30 Travel & Accommodation 32 Visitor Information 33 Discovering Fife 34 welcometofife.com Burntisland Set on a wide, sweeping bay, Burntisland is noted for its Regency terraces and A-listed buildings which can be explored on a Burntisland Heritage Trust guided tour. -

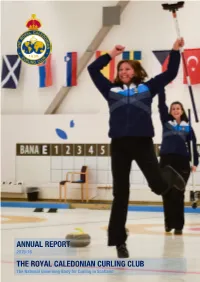

2015-2016 Annual Report

ANNUAL REPORT 2015-16 THE ROYAL CALEDONIAN CURLING CLUB The National Governing Body for Curling in Scotland RCCC Annual Report 2015-16 vFinalSW1 1 CONTENTS RCCC OFFICIALS ............................................................................................................................ 3 HEADQUARTERS STAFF ................................................................................................................ 4 CURLING DEVELOPMENT OFFICERS ........................................................................................... 4 IN MEMORIAM ................................................................................................................................. 5 MEMBERSHIP .................................................................................................................................. 6 Current Membership ...................................................................................................................... 6 New Clubs ..................................................................................................................................... 6 Resigned Clubs ............................................................................................................................. 6 AWARDS & MEDALS ....................................................................................................................... 6 Clubs that have completed 150 years continuous affiliation ........................................................... 6 Members who have been awarded -

Arun District Council Initial Feasibility Study

Arun District Council Civic Centre Maltravers Road Littlehampton West Sussex BN17 5LF Tel: (01903) 737611 Fax: (01903) 730442 DX: 57406 Littlehampton Members are reminded to bring Minicom: 01903 732765 their Agendas from the Cabinet e-mail: [email protected] Meeting held on 23 July 2018 with them to the meeting 28 August 2018 COUNCIL MEETING To all Members of the Council You are summoned to attend a meeting of the ARUN DISTRICT COUNCIL to be held on Wednesday, 12 September 2018 at 6.00 pm in the Council Chamber at the Arun Civic Centre, Maltravers Road, Littlehampton, to transact the business set out below. Nigel Lynn Chief Executive AGENDA 1. Apologies for Absence 2. Declarations of Interest Members and Officers are invited to make any declarations of pecuniary, personal and/or prejudicial interests that they may have in relation to items on this agenda, and are reminded that they should re-declare their interest before consideration of the item or as soon as the interest becomes apparent. Members and Officers should make their declaration by stating: a) the item they have the interest in b) whether it is a pecuniary, personal and/or prejudicial interest c) the nature of the interest d) if it is a pecuniary or prejudicial interest, whether they will be exercising their right to speak under Question Time 1 3. Public Question Time To receive questions from the public (for a period of up to 15 minutes) 4. Questions from Members with Pecuniary/Prejudicial Interests To receive questions from Members with pecuniary/prejudicial interests (for a period of up to 15 minutes) 5. -

Minutes of the Annual General Meeting of the West of Fife Curling Province on 29 March 2012 in the Lounge, Fife Ice Arena at 7.30 P.M

Minutes of the Annual General Meeting of the West of Fife Curling Province on 29 March 2012 in the Lounge, Fife Ice Arena at 7.30 p.m. Present: Bob Smith Inverkeithing Bill Linton Bank of Scotland Colin Campbell Inverkeithing Mike Hudspeth Dalgety Bay Robin Park, Boreland/Dunfermline Karen McDonald Dalgety Bay Ian Borland Dunfermline Lizy Mills Dunfermline Ladies Brian Duncan Boreland Liz Smith Dunfermline Ladies Mike Caffyn Boreland Kevin Thomson Kirkcaldy Ice Rink Harry Mitchell Raith & Abbotshall/ Ann Mitchell Raith & Abbotshall Ladies Aberdour Iain Brown Raith & Abbotshall Anne Buchan Raith & Abbotshall Ladies Bill Creevy Kirkcaldy Curling School Bill Arnott Area 7 President Willie Nicoll Bank of Scotland Alan Muirhead Area 7 Vice President Margo Nicoll Bank of Scotland Hector Snoddy Area 7 Secretary Neil Anderson Bank of Scotland (23) President Robin welcomed the representatives of the Clubs in attendance and called for any apologies for absence to be intimated. 1. Apologies: Elinor Ritchie, Wendy Smith, Bank of Scotland, Bob Tait, Inverkeithing/ Boreland, Drew Gordon, Helen Gordon, Aberdour, David Jones, Area Development Officer Kinross; 2. Minutes of last AGM The President asked if the Minute of the previous year’s AGM could be taken as read, asking for it to be approved and seconded. Adoption proposed by Bill Linton and seconded by Ian Boreland. The minutes were duly approved. Thereafter the President and Secretary signed the Minute. 3. Matters Arising a. Badges The purchase of badges from Image Printers, Edinburgh, approved at the 2011 AGM had duly been ordered and received by the secretary. The cost was £120.00 for the origination and £175.00 for 100 badges plus VAT. -

Gogar Park Young Curlers), David Henderson (RCCC President/New Abbey), Frances Henderson (New Abbey), Naomi Brown (Stoneykirk)

Minutes of the 55th Annual General Meeting of the Ladies’ Branch of the Royal Caledonian Curling Club held on Tuesday, 12th May 2015 a North West Castle Hotel, Stranraer, Dumfries & Galloway DG9 8EH at 2pm. Present Office Bearers: Mary Anne McWilliam (President), Marion Fraser (Vice President), Jan Howard (Junior Vice President), Gail Munro (Treasurer), Kate Caithness (Honorary President & Past President 1997/98) Past Presidents: Sheila Watson (1993/94), Ena Stevenson (1999/00), Kathleen Scott (2001/02), Marion Murdoch (2002/03), Anne Malcolm (2005/06), Kay Gibb (2009/10), Brenda Macintyre (2010/11), Claire McLaren (2011/12), Jenny Bain (2012/13), Fiona Hardie (2013/14) Centre Representatives: Judith Carr (Aberdeen), Margaret White (Ayr), Nina Clancy (Border), Elaine Semple (Braehead), Carolyn Nicoll (Forfar), Elaine Telfer (Greenacres), Ann Gibb (Inverness), Jane Drysdale (Kinross), Helen Gordon (Kirkcaldy), Mhairi Baird (Lanarkshire), Helen Hally (Lockerbie), Cath McIntosh (Perth), Jeanette Kerr (Stirling), Maureen Parker (Stranraer), Shirley Morton (Waterfront), Ruth Addinall (SIAE) New Centre Representatives: Fiona McFarlane (Braehead), Brenda Sillars (Dumfries), Shirley Jeans (Forfar), Ann Mitchell (Kirkcaldy), Rhona Johnston (Stirling), Annette Blair (Waterfront) Invited Guests: Sue Howat (Ayr), Billy Howat (RCCC Vice President/Cumnock & District), Gina Aitken (Gogar Park Young Curlers), David Henderson (RCCC President/New Abbey), Frances Henderson (New Abbey), Naomi Brown (Stoneykirk) Individual Members (in alphabetically order -

Kirkcaldy Walking Guide

LSTTON 2020 Jan HEEL ON D Chapel Moss ITC RRIIVE MMI R Begg Moss O DDUD S guide. this of versions B UD Plantation DDINGINGS S R TON DRRII P P VVEE A GULLANE LLYN O future any in this update can we that so know us let please E O Y PLACE W H W N E F F A information, incorrect any across come you If guide. this in R R T IDDEE PITREAVIE O OOT BRRAIDA SSTREE A ROAD C D IDS SST O O L ROA D O N T A E AD R E A H PLACE T C O A N PL R D O CHC N Y D TTO G ASHLUDIE contained information the verify to effort every made have We THE A R IL M AAD DOWNNF D E R A S FIIEELLD LLEE N G G S CROSS PPI O I U I D C E WWA PLACE C E LINN G L PLA H RROVO T O A CE AR V A k N E R T C I N RRE GARDENS D E E B R D E E D OOTT KKIN A S RATHO Dunnikier r HA D T G EEL O BBE C C N H PLACE PANMURE L A RO LLD Y C AD L M Y T AD P A ROOA E E O C E K PLACE A I A Y CRAIGIE R IISS CRAIGIE A R ARRR LLEE R Golf Course R PLACE L S B OOAADPLACE R A L N BROAD a S D R I WWA P W P E SST N OOL TCT WYND D C A E I AAD E Y N SSC N RO Capshard T N O M C N N T B E RNNT HHI C E M R R RA R S BBARA H C P A O P O I O D W W E D A R N CCE DUKE B SCO41412 No. -

In This Month's Issue

Issue 53 | JANUARY 2018 | WWW.SCOTTISHCURLING.ORG Yo u r keepingCurler you connected with Scottish Curling In this month’s issue... COMPETITIONS FEATURES Canada Takes lead in Scotland’s WJCC Strathcona Cup representatives now decided CLUBS & RINKS Lanarkshire Ice Rink Celebrates its 50th Anniversary www.scottishcurling.org I ssue 53 | January 2018 | www.scottishcurling.org | FEATURES FEATURESFEATURES A WORD FROM OUR CEO Our latest edition of Your Curler in 2018 is at the start of the peak period when national and international curling championships take the limelight. The British Olympic Curlers left on 1 Feb for their training camp in Japan prior to the start of the Games on 8 February. TeamGB play their first curling games on 14 February playing at (UK times) midnight, 5am and 11am, full schedule is on our website in the competitions calendar. The Scottish Government has declared 2018 the Year of Young People, in the year that we are hosting the World Junior Curling Championships 3rd- 10th March 2018. Following the Johnston Carmichael Scottish Curling Junior Championships in Curl Aberdeen in January we are now looking forward to getting behind Team Morrison and Team Whyte when they don their Scotland kit next month. Look out for other ways that young people will be involved in playing and planning for the future of Scottish Curling. We have also said farewell to the Canadian tourists who won the Strathcona Cup after 53 games of curling, the result was resoundingly in the visitors favour as they finished 325 shots ahead of the Scottish club curlers who they played and with whom they enjoyed a memorable time on and off the ice. -

Minutes of the Annual General Meeting of the West of Fife Curling Province Held Within the Brucefield Manor Hotel, Dunfermline

Minutes of the Annual General Meeting of the West of Fife Curling Province on 28 April 2011 in the Lounge, Fife Ice Arena at 7.30 p.m. Present : Bob Smith, Colin Campbell, Inverkeithing; Robin Park, Boreland/Dunfermline; Donald Whyte, Dunfermline; Brian Duncan, Bob Anderson, Inverkeithing; Harry Mitchell, Raith & Abbotshall/Aberdour; Iain Brown, Raith & Abbotshall; Bill Creevy, Kirkcaldy Curling School; Willie Nicoll, Wendy Smith, Elinor Ritchie, Bank of Scotland; Mike Hudspeth, Stuart Carnegie, Karen McDonald, Dalgety Bay; Aileen Preistley, Susan Cupar, Joy Bowie, Dunfermline Ladies; Bob Tait, Inverkeithing/Boreland; Alice Mairs, George Swan, Ronnie Herd, Kirkcaldy Ice Rink; David Jones, Area Development Officer Kinross; Bill Arnot, Area 7 President (24) President Bob welcomed the representatives of the Clubs in attendance and called for any apologies for absence to be intimated. Apologies: Ross Muir, Broomhall CC; Ian Borland, Dunfermline CC; Lynne Stevenson, Liz Smith, Dunfermline Ladies Minutes of last AGM The President asked if the Minute of the previous year’s AGM could be taken as read, asking for it to be approved and seconded. Adoption proposed by Mike Hudspeth and seconded by Willie Nicoll. The minutes were duly approved. Thereafter the President and Secretary signed the Minute. Matters Arising Bill Arnott apologised for no apologies last year. He understood these would be passed on!! President's Remarks Bob again welcomed everyone to the meeting and thanked the clubs for attending ‘League consisted of 10 teams out of 12 in Province (Tulliallan and Dunf Ladies missing) That was disappointing as Kirkcaldy ice is generally accepted as being better than recent years and we need support to keep it going.