Market Perspectives

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2Nd Quarter 2021 SWMG Newsletter

June 2021 MAIN OFFICE Market Summary FLINT, MICHIGAN 5206 Gateway Centre, Suite 300 Flint, MI 48507 The economic recovery is on very solid ground and stronger than Phone: 810-732-7411 many expected. For the first quarter, our economy grew 6.4% as Fax: 810-732-8190 measured by GDP*. Second quarter growth could very well be in FLORIDA OFFICE 712 S. Oregon Ave. double digits and would put us back to where we were in the fourth Tampa, FL 33606 quarter of 2019 before the pandemic began. The market returns Phone: 813-251-1879 Fax: 813-251-1716 reflect a strong economic recovery and continued stimulus as the PEARL PLANNING S&P 500 now sits at or near all-time highs. Last year, the number of 8031 Main Street, Suite 302 stocks that had positive returns were dominated by very few. This Dexter, MI 48130 Phone: 734-274-6744 year, they are much more broadly reflected, especially given the Fax: 734-274-6754 recovery of the energy, hospitality and travel sectors. StephensWMG.com Interest rates rose slightly for a period before the Federal Reserve FINANCIAL MARKET clarified their position and comments from earlier in June. The fear UPDATE* Year-to-date change as of 06/30/21 is that rising inflation will lead to rising interest rates. Recent comments from the Federal Reserve Open Market Committee • S&P 500 Index…………………15.25% indicate they are expecting future inflation to be in the 3.4% range. • Bloomberg Commodity Index….....21.15% The Fed Reserve Chair, Jerome Powell, subsequently reassured that • MSCI EAFE $$ (International)…....…8.83% there is no plan to raise rates in the short-term. -

Raymond James Strengthens Its Leadership with Montreal Branch Manager Appointment Micol Haimson Joins the Firm

Raymond James strengthens its leadership with Montreal Branch Manager Appointment Micol Haimson Joins the Firm MONTREAL and TORONTO, April 30, 2019 /CNW/ - Raymond James Ltd., the Canadian arm of North American investment dealer Raymond James Financial, Inc., today announced that Micol Haimson has been appointed Senior Vice President and Branch Manager of the firm's Montreal Private Client Group flagship branch. "Micol is widely respected throughout the industry for her breadth of wealth experience and business development acumen," said Richard Rousseau, Executive Vice-President – Head of Wealth Management. "She will play a key role in supporting our Montreal advisors as they grow their businesses and she will help expand the Raymond James presence as we continue to attract high calibre professionals to the firm." Ms Haimson joins Raymond James after a 20 year career of senior executive roles in wealth management at a major Canadian bank. She will be focusing on growing the Private Client Group footprint in Montreal, supporting advisors and attracting top wealth management professionals to the firm. "I am excited to join Raymond James as I believe its platform uniquely serves the wealth management needs of Quebec investors and their families," says Ms Haimson. "As the nation's leading independent investment dealer and a global leader in wealth management, Raymond James provides its clients with the best of both worlds to meet their total wealth management needs." Ms Haimson earned her Bachelor of Science in Computer Science from McGill University. She is an active volunteer serving or having served as: Board member and President, Investment Committee, of the McGill University Health Centre Foundation; Vice-Chairman, The Trafalgar Ross Foundation; past Director of Membership of the Treasury Management Association of Canada; and past Committee Member, MS Society of Quebec. -

Form 10-K Raymond James Financial, Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended September 30, 2017 Or TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-9109 RAYMOND JAMES FINANCIAL, INC. (Exact name of registrant as specified in its charter) Florida No. 59-1517485 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 880 Carillon Parkway, St. Petersburg, Florida 33716 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code (727) 567-1000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, $.01 par value New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

GFMA Member Brochure

overview 2013 www.gfma.org ABOUT e Global Financial Markets Association (GFMA) serves as a forum that brings together its existing regional trade association members to address issues with global implications. GFMA represents the common interests of the world’s leading nancial and capital market participants, and speaks for the industry on the most important global market issues. GFMA’s mission is to provide a forum for global systemically important banks to develop policies and strategies on issues of global concern within the regulatory environment. GFMA brings together three of the world’s leading nancial trade associations to address the increasingly important global regulatory agenda and to promote coordinated advocacy e orts. e Association for Financial Markets in Europe (AFME) in London and Brussels, the Asia Securities Industry & Financial Markets Association (ASIFMA) in Hong Kong and the Securities Industry and Financial Markets Association (SIFMA) in New York and Washington are, respectively, the European, Asian and North American members of GFMA. MEMBERS OF THE ALLIANCE GLOBAL MODEL GFMA operates with a unique model—leveraging the deep policy, technical, and market expertise of over 200 employees in ve cities worldwide EUROPE ASIA NORTH AMERICA Advocate stable, competitive, Promote the growth and Develop policies and practices sustainable European development of Asia’s capital which strengthen nancial nancial markets that support markets and facilitate their markets and which encourage economic growth and bene t orderly integration into the capital availability, job creation society global nancial system and economic growth while building trust and con dence in the nancial industry GFMA’S BOARD OF DIRECTORS GFMA’s Board of Directors manage the business and a airs of the association. -

EMS Counterparty Spreadsheet Master

1 ECHO MONITORING SOLUTIONS COUNTERPARTY RATINGS REPORT Updated as of October 24, 2012 S&P Moody's Fitch DBRS Counterparty LT Local Sr. Unsecured Sr. Unsecured Sr. Unsecured ABN AMRO Bank N.V. A+ A2 A+ Agfirst Farm Credit Bank AA- AIG Financial Products Corp A- WR Aig-fp Matched Funding A- Baa1 Allied Irish Banks PLC BB Ba3 BBB BBBL AMBAC Assurance Corporation NR WR NR American International Group Inc. (AIG) A- Baa1 BBB American National Bank and Trust Co. of Chicago (see JP Morgan Chase Bank) Assured Guaranty Ltd. (U.S.) A- Assured Guaranty Municipal Corp. AA- Aa3 *- NR Australia and New Zealand Banking Group Limited AA- Aa2 AA- AA Banco Bilbao Vizcaya Argentaria, S.A. BBB- Baa3 *- BBB+ A Banco de Chile A+ NR NR Banco Santander SA (Spain) BBB (P)Baa2 *- BBB+ A Banco Santander Chile A Aa3 *- A+ Bank of America Corporation A- Baa2 A A Bank of America, NA AA3AAH Bank of New York Mellon Trust Co NA/The AA- AA Bank of North Dakota/The AA- A1 Bank of Scotland PLC (London) A A2 A AAL Bank of the West/San Francisco CA A Bank Millennium SA BBpi Bank of Montreal A+ Aa2 AA- AA Bank of New York Mellon/The (U.S.) AA- Aa1 AA- AA Bank of Nova Scotia (Canada) AA- Aa1 AA- AA Bank of Tokyo-Mitsubish UFJ Ltd A+ Aa3 A- A Bank One( See JP Morgan Chase Bank) Bankers Trust Company (see Deutsche Bank AG) Banknorth, NA (See TD Bank NA) Barclays Bank PLC A+ A2 A AA BASF SE A+ A1 A+ Bayerische Hypo- und Vereinsbank AG (See UniCredit Bank AG) Bayerische Landesbank (parent) NR Baa1 A+ Bear Stearns Capital Markets Inc (See JP Morgan Chase Bank) NR NR NR Bear Stearns Companies, Inc. -

'To Raise, Perchance to Tarry, There's the Rub'

www.berkcap.com NEWSLETTER | 2nd-Quarter 2015 NEW YORK | SAN FRANCISCO | DENVER | LONDON | SYDNEY ‘To raise, perchance to tarry, Berkshire Capital Securities LLC is an independent there’s the rub’ employee-owned global boutique investment bank that provides merger, acquisition, valuation To raise or not to raise? That is the question the Federal Reserve and strategic advisory services to clients focused pondered in the first half. In a March news conference that followed in the investment management and securities a policy committee meeting in which the Fed dismissed its promise to industries. Since 1983, Berkshire Capital has be “patient,” Fed Chair Janet Yellen nevertheless underlined the Fed’s completed over 305 transactions (with AUM intention to let the data drive decisions. “Just because we removed the transfer of nearly $960 billion and an aggregate value of $13.4 billion) and over 275 valuations, word ‘patient’ from the statement doesn’t mean we are going to be strategic reviews and fairness opinions. ‘impatient,” she told reporters, displaying dexterity as a wordsmith that the Bard himself might have applauded. Headquartered in New York City, Berkshire As the Fed considered the timing for tightening — opting to stand pat Capital has partners in San Francisco, Denver, at its latest mid-June meeting — central banks elsewhere were heading Philadelphia, London and Sydney. The team in the opposite direction. Key among them was the European Central consists of over 35 professionals and support staff dedicated to our mandate with more than Bank, which kicked off its own version of quantitative easing to the 30 years’ experience focused in the investment tune of €60 billion ($68 billion) in monthly purchases of government management and securities industries. -

Raymond James, Bank of America, HSBC, Barclays, Socgen Reuters Staff

Reuters 27 September 2017 MOVES-Raymond James, Bank of America, HSBC, Barclays, SocGen Reuters Staff (Adds HSBC Global Asset Management, Bank of America, Raymond James) Sept 27 (Reuters) - The following financial services industry appointments were announced on Wednesday. To inform us of other Job changes, email [email protected]. BARCLAYS Barclays has hired Jean-Christophe Gerard from HSBC as head of investments for its private banking and overseas services. CASH PROCESSING SOLUTIONS CPS appointed Adam Lawrence as its chief executive officer, effective Oct. 16. GRAVIS CAPITAL MANAGEMENT LTD The specialist investment advisory firm said it appointed ex-Fidelity director Charles Payne as an investment consultant. CUSHMAN & WAKEFIELD The real estate services firm appointed Nicholas West to an analytics and research role in its healthcare advisory team. ALPHA FMC The wealth and asset management consulting firm appointed Kevin O‘Shaughnessy as its director and head of digital. HSBC HSBC said it appointed Philip Kunz as head of global private banking for South East Asia. MADISON INTERNATIONAL REALTY The real estate private equity firm said ex-Goldman Sachs executive Kyle Torpey has Joined the firm as director of investments. SOCIETE GENERALE Jose Enrique Concejo has been appointed global head of the financial institution group at Societe Generale. UBS UBS has hired Bruce MacKenzie as a managing director in EMEA leveraged capital markets (LCM), reporting to David Slade, the bank’s global co-head of leveraged finance. HAMILTON LANE The investment management firm appointed Nick Kavanagh as vice president to its co-investment and secondary teams in London. BANK OF AMERICA The bank named former CFO Bruce Thompson as the new leader of its European global banking and markets operations to be based in Dublin, according to a memo from Chief Operating Officer Tom Montag. -

And the Winner Is… Raymond James & Associates: Good Times Roll

The 20th Annual Broker Report Card Survey Two years after the financial markets tanked and giant mergers declared it the best firm to work for, up from 36 percent in 2009. and acquisitions dramatically reshaped the landscape of Wall Bob McCann, who was tapped in 2009 to lead UBS’ Wealth Street, many wealth management firms are still pulling the Management Americas unit, gets some credit for improving pieces back together. Some have so far been more successful morale and support for advisors. “I like the vision of who we than others, at least as far as the financial advisors who work are and what we are to become. McCann is doing a good job there are concerned: The country’s five national full service making UBS a great wealth management culture,” one survey brokerage firms got very mixed grades in Registered Rep.’s 20th respondent wrote. It certainly doesn’t hurt that the firm’s Swiss Annual Broker Report Card, with once-tarnished UBS pulling headquarters has managed to put to bed its tussle with the IRS. ahead, while Edward Jones and Morgan Stanley Smith Barney This year, the firm with the weakest grade was Morgan each took a significant hit in their ratings. And yet, despite Stanley Smith Barney, which has been going through a difficult diminished enthusiasm in some camps, most advisors are plan- merger process that won’t be complete until the first quarter of ning to stay put rather than switch firms. Of the 887 advisors next year. Smith Barney advisors are particularly rankled, with who responded to the survey in October, 89 percent said they only 12 percent calling the merger with Morgan Stanley positive, were “very” or “somewhat likely” to be working for their current and 72 percent calling the merger a negative. -

Raymond James Announces Early Tender Results of Cash Tender Offers and Consent Solicitations for Any and All of Its 5.625% Senio

March 31, 2021 FOR IMMEDIATE RELEASE Media Contact: Steve Hollister, 727.567.2824 Investor Contact: Kristina Waugh, 727.567.7654 raymondjames.com/news-and-media/press-releases RAYMOND JAMES ANNOUNCES EARLY TENDER RESULTS OF CASH TENDER OFFERS AND CONSENT SOLICITATIONS FOR ANY AND ALL OF ITS 5.625% SENIOR NOTES DUE 2024 AND 3.625% SENIOR NOTES DUE 2026 ST. PETERSBURG, Fla. ‒ Raymond James Financial, Inc. (NYSE-RJF) (“Raymond James”) today announced the early tender results as of 5:00 p.m., New York City time, on March 31, 2021 (the "Early Tender Deadline") of its previously announced tender offers (the "Tender Offers") to purchase for cash any and all of its outstanding 5.625% senior notes due 2024 (the “2024 Notes”) and its 3.625% senior notes due 2026 (the “2026 Notes” and, together with the 2024 Notes, the “Notes”). In connection with the Tender Offers, Raymond James also announced the results as of the Early Tender Deadline of its previously announced solicitation of consents (the “Consents”) from holders of the Notes (the “Consent Solicitations”) to proposed amendments to the indentures governing the Notes providing for the shortening of the minimum notice periods for the optional redemption of the Notes by Raymond James (the “Proposed Amendments”). The terms and conditions of the Tender Offers and Consent Solicitations are described in an Offer to Purchase and Consent Solicitation Statement, dated March 18, 2021 (the “Offer to Purchase and Consent Solicitation Statement”). The aggregate principal amount of each series of Notes validly tendered and not validly withdrawn at or prior to the Early Tender Deadline (the "Early Tender Notes"), as well as the percent of the aggregate principal amount of each series of Notes outstanding constituting Early Tender Notes, is set forth in the columns entitled "Aggregate Principal Amount of Early Tender Notes" and "Percent of Outstanding Principal Amount Tendered," respectively, in the table below. -

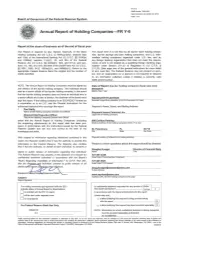

Raymond James Fncl 381

FR Y-6 OMS Number 7100-0297 Approval expires November 30, 2019 Page 1 of 2 Board of Governors of the Federal Reserve System .•·of·c·oJ··. ~: Annual Report of Holding Companies-FR Y-6 ·· ... !~ --- · Report at the close of business as of the end of fiscal year This Report is required by law: Section 5(c)(1 )(A) of the Bank This report form is to be filed by all top-tier bank holding compa Holding Company Act (12 U.S.C. § 1844(c)(1)(A)); sections 8(a) nies, top-tier savings and loan holding companies, and U.S. inter and 13(a) of the International Banking Act (12 U.S.C. §§ 3106(a) mediate holding companies organized under U.S. law, and by and 3108(a)); sections 11(a)(1), 25, and 25A of the Federal any foreign banking organization that does not meet the require Reserve Act (12 U.S.C. §§ 248(a)(1), 602, and 611a); and sec ments of and is not treated as a qualifying foreign banking orga tions 113, 165,312, 618, and 809 of the Dodd-Frank Act (12 U.S.C. nization under Section 211 .23 of Regulation K (12 C.F.R. § §§ 5361 , 5365, 5412, 1850a(c)(1), and 5468(b)(1)). Return to the 211.23). (See page one of the general instructions for more detail appropriate Federal Reserve Bank the original and the number of of who must file.) The Federal Reserve may not conduct or spon copies specified. sor, and an organization (or a person) is not required to respond to, an information collection unless it displays a currently valid 0MB control number. -

2020 Annual Report on Form 10-K, William R

ANNUAL REPORT 2020 OBSTACLE AND OPPORTUNITY ANNUAL REPORT 2020 Challenging. Tumultuous. Transformative. Defining. 2020 was a year that will stay with us. CONTENTS 4 10 22 24 26 MESSAGE FROM OBSTACLE AND PRIVATE CLIENT CAPITAL MARKETS ASSET MANAGEMENT THE CHAIRMAN OPPORTUNITY: GROUP AND CEO THE STORY OF 2020 It took directions we’d planned for and turns we couldn’t have anticipated. But through all of its unique upheaval – maybe because of it – we found ways to stay connected and stay the course. We also found ways forward – building on the long-term planning and everyday ingenuity that has kept us steady throughout our history to give us even more clarity in our vision for the firm’s future. The path wasn’t easy or clear. But we walked it together. And we’re walking it still, supporting clients, colleagues and communities, putting people first – always. 27 28 32 34 35 RAYMOND JAMES CORPORATE 10-YEAR CORPORATE AND ANNUAL REPORT BANK LEADERSHIP FINANCIAL SHAREHOLDER ON FORM 10-K SUMMARY INFORMATION MESSAGE FROM THE CHAIRMAN AND CEO Fiscal year 2020 brought incredible challenges, including the COVID-19 pandemic, economic uncertainty and social unrest across the nation. While the year was one of the most difficult years in my career, in many ways it was also the most rewarding, as the response of our associates and advisors during this time of crisis truly reinforced our unique culture at Raymond James. Our associates and advisors remained steadfast in their Despite temporarily suspending share repurchases in focus on our core values, including long-term thinking mid-March due to the significant economic uncertainty and always putting clients first, in order to continue surrounding the COVID-19 pandemic, we repurchased providing excellent service during these difficult times. -

Form 10-K Raymond James Financial, Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended September 30, 2019 Or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-9109 RAYMOND JAMES FINANCIAL, INC. (Exact name of registrant as specified in its charter) Florida 59-1517485 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 880 Carillon Parkway St. Petersburg Florida 33716 (Address of principal executive offices) (Zip Code) (727) 567-1000 Registrant’s telephone number, including area code Securities registered pursuant to Section 12(b) of the Exchange Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, $.01 par value RJF New York Stock Exchange Securities registered pursuant to Section 12(g) of the Exchange Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.