Some Holiday Shopping and Browsing Page 2 Model Portfolio Changes

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

An Embedded Linux Based Navigation System for an Autonomous Underwater Vehicle

An Embedded Linux Based Navigation System for an Autonomous Underwater Vehicle Sonia Thakur James M. Conrad University of North Carolina at Charlotte University of North Carolina at Charlotte [email protected] [email protected] Abstract The purpose of a data acquisition system is to provide reliable and timely information. The received information can be then analyzed in real-time or remotely to assess the state of the measured environment. Similarly, for an autonomous underwater navigation system it is critical to analyze the data received from the inertial measurement unit and other acoustic sensors to calculate its position and direct the vehicle. This work is an effort toward the development of a data logging system based on an embedded Linux platform for an unmanned underwater vehicle. An embedded Linux based board has been chosen Fig. 1. A Hydroid Remus AUV [2] as the core data processing unit of the Autonomous Underwater Vehicle (AUV). This work implements device drivers required for interfacing the inertial sensors and 1.1. Motivation GPS unit to the core-processing unit. This system is intended to provide a development base for implementing The motivation of this work is to design an underwater various navigation algorithms, like Kalman Filter, to navigation system composed of a low cost Embedded calculate the direction of the vehicle. Linux platform and small sized sensors. For air or ground vehicles, a Global Positioning System (GPS) receiver with differential corrections (DGPS) can provide very precise 1. Introduction and inexpensive measurements of geodetic coordinates. Unfortunately these GPS radio signals cannot penetrate Autonomous Underwater Vehicles (AUVs) are beneath the ocean’s surface, and this poses a considerable unmanned and untethered submarines. -

M-Learning Tools and Applications

2342-2 Scientific m-Learning 4 - 7 June 2012 m-Learning Tools and Applications TRIVEDI Kirankumar Rajnikant Shantilal Shah Engineering College New Sidsar Campu, PO Vartej Bhavnagar 364001 Gujarat INDIA m-Learning Tools and Applications Scientific m-learning @ ICTP , Italy Kiran Trivedi Associate Professor Dept of Electronics & Communication Engineering. S.S.Engineering College, Bhavnagar, Gujarat Technological University Gujarat, India [email protected] Mobile & Wireless Learning • Mobile = Wireless • Wireless ≠ Mobile (not always) • M-learning is always mobile and wireless. • E-learning can be wireless but not mobile Scientific m-learning @ ICTP Italy Smart Phones • Combines PDA and Mobile Connectivity. • Supports Office Applications • WLAN, UMTS, High Resolution Camera • GPS, Accelerometer, Compass • Large Display, High End Processor, Memory and long lasting battery. Scientific m-learning @ ICTP Italy The Revolution .. • Psion Organizer II • 8 bit processor • 9V Battery • OPL – Language • Memory Extensions, plug-ins • Birth of Symbian 1984 2012 Scientific m-learning @ ICTP Italy History of Smartphone • 1994 : IBM Simon • First “Smartphone” • PIM, Data Communication Scientific m-learning @ ICTP Italy Scientific m-learning @ ICTP Italy The First Nokia Smartphones • 2001 : Nokia 7650 • GPRS : HSCSD • Light – Proximity Sensor • Symbian OS ! • Nokia N95 (March 07) • Having almost all features Scientific m-learning @ ICTP Italy S60 and UIQ Scientific m-learning @ ICTP Italy Scientific m-learning @ ICTP Italy Know your target-know your device -

Inphi Corporation (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K (Mark One) x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2010 Or ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 001-34942 Inphi Corporation (Exact Name of Registrant as Specified in Its Charter) Delaware 77-0557980 (State or Other Jurisdiction of (I.R.S. Employer Incorporation or Organization) Identification No.) 3945 Freedom Circle, Suite 1100, Santa Clara, California 95054 (Address of Principal Executive Offices) (Zip Code) Registrant’s telephone number, including area code: (408) 217-7300 Securities registered pursuant to Section 12(b) of the Act: Title of Class Name of Exchange on Which Registered Common Stock, $0.001 par value New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

The Internet of Things – Opportunities and Challenges for Semiconductor Companies May 2015

The Internet of Things – opportunities and challenges for semiconductor companies May 2015 January 2015 This final report is the result of a collaboration between McKinsey and the Global Semiconductor Alliance (GSA) For semiconductors, the IoT is GSA/McKinsey collaboration A key growth opportunity Unpaid collaboration between GSA and ▪ The number of connected IoT devices is McKinsey & Company to develop a expected to reach 20 – 30 bn by 2020 perspective on the implications of IoT for the semiconductor industry ▪ A semiconductor growth opportunity exists for servers/network equipment (“Internet”) and 11 GSA member executives overseeing the components for deployed “things” effort as the Steering Committee A new strategic challenge Interviews with 30 C-level executives from ▪ The highly vertical character of the IoT (many semiconductor companies and the broader IoT small niches) requires a new approach on how ecosystem (including semiconductor to address the market customers) ▪ The IoT is starting to happen but is still early Survey of 229 semiconductor executives in its development (e.g., unclear standards, no from GSA member companies “killer application” yet) ▪ IoT devices often have specific technical Supporting rigorous (quantitative) analyses requirements regarding low power consumption, integration, cost points, Final report summarizing findings (ex- connectivity, and sensors clusively available for GSA members) SOURCE: Gartner; IDC; ABI Research; GSA and McKinsey & Company “IoT collaboration” 1 The joint GSA/McKinsey report on IoT -

Case 1:10-Cv-00433-JB-SCY Document 357 Filed 08/30/16 Page 1 of 140

Case 1:10-cv-00433-JB-SCY Document 357 Filed 08/30/16 Page 1 of 140 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF NEW MEXICO FRONT ROW TECHNOLOGIES, LLC, Plaintiff, vs. No. CIV 10-0433 JB/SCY NBA MEDIA VENTURES, LLC, MLB ADVANCED MEDIA, L.P., MERCURY RADIO ARTS, INC., GBTV, LLC, MAJOR LEAGUE BASEBALL PROPERTIES, INC ., & PREMIERE RADIO NETWORKS, INC., Defendants. consolidated with FRONT ROW TECHNOLOGIES, LLC, Plaintiff, vs. No. CIV 12-1309 JB/SCY MLB ADVANCED MEDIA, L.P., MERCURY RADIO ARTS, INC., d/b/a ‘THE GLEN BECK PROGRAM, INC.’, & GBTV, LLC, Defendants. consolidated with FRONT ROW TECHNOLOGIES, LLC, Plaintiff, vs. No. CIV 13-1153 JB/SCY NBA MEDIA VENTURES, TURNER SPORTS INTERACTIVE, INC. & TURNER DIGITAL BASKETBALL Case 1:10-cv-00433-JB-SCY Document 357 Filed 08/30/16 Page 2 of 140 SERVICES, INC., Defendants. consolidated with FRONT ROW TECHNOLOGIES, LLC, Plaintiff, vs. No. CIV 13-0636 JB/SCY TURNER SPORTS INTERACTIVE, INC., AND TURNER DIGITAL BASKETBALL SERVICES, INC., Defendants. MEMORANDUM OPINION AND ORDER THIS MATTER comes before the Court on the Defendants’ Motion for Judgment on the Pleadings Pursuant to Fed. R. Civ. P. 12(c), filed October 21, 2015 (Doc. 229)(“Motion”). The Court held a hearing on January 5, 2016. The primary issues are: (i) what evidentiary standard applies to patent eligibility disputes under 35 U.S.C. § 101; (ii) whether the Court must wait until a later stage to examine the subject-matter eligibility of Plaintiff Front Row Technologies, LLC’s patents; (iii) whether the Court may select representative claims, and what those claims should be; (iv) whether Front Row’s patents are directed to patent-ineligible abstract ideas; and (v) if Front Row’s patents are directed to patent-ineligible abstract ideas, whether the claims’ elements, as a whole, contain an inventive concept sufficient to transform the claimed abstract idea into a patent-eligible invention. -

ERICSSON, INC. V. D-LINK SYSTEMS, INC

United States Court of Appeals for the Federal Circuit ______________________ ERICSSON, INC., TELEFONAKTIEBOLAGET LM ERICSSON, AND WI-FI ONE, LLC, Plaintiffs-Appellees, v. D-LINK SYSTEMS, INC., NETGEAR, INC., ACER, INC., ACER AMERICA CORPORATION, AND GATEWAY, INC., Defendants-Appellants, AND DELL, INC., Defendant-Appellant, AND TOSHIBA AMERICA INFORMATION SYSTEMS, INC. AND TOSHIBA CORPORATION, Defendants-Appellants, AND INTEL CORPORATION, Intervenor-Appellant, AND BELKIN INTERNATIONAL, INC., Defendant. ______________________ 2 ERICSSON, INC. v. D-LINK SYSTEMS, INC. 2013-1625, -1631, -1632, -1633 ______________________ Appeals from the United States District Court for the Eastern District of Texas in No. 10-CV-0473, Judge Leonard Davis. ______________________ Decided: December 4, 2014 ______________________ DOUGLAS A. CAWLEY, McKool Smith, P.C., of Dallas, Texas, argued for plaintiffs-appellees Ericsson Inc., et al. With him on the brief were THEODORE STEVENSON, III and WARREN LIPSCHITZ, and JOHN B. CAMPBELL and KATHY H. LI, of Austin, Texas. Of counsel on the brief was JOHN M. WHEALAN, of Chevy Chase, Maryland. WILLIAM F. LEE, Wilmer Cutler Pickering Hale and Dorr LLP, of Boston, Massachusetts, argued for defend- ants-appellants and intervenor-appellant. With him on the brief for intervenor-appellant Intel Corporation were JOSEPH J. MUELLER, MARK C. FLEMING, and LAUREN B. FLETCHER, of Boston, Massachusetts; and JAMES L. QUARLES, III, of Washington, DC. Of counsel on the brief were GREG AROVAS, Kirkland & Ellis LLP, of New York, New York, ADAM R. ALPER, of San Francisco, California, and JOHN C. O’QUINN, of Washington, DC. On the brief for defendants-appellants D-Link Systems, Inc., et al., were ROBERT A. -

The Tech Sector Rocks

Written by Published by Nick Tredennick DynamicSilicon Gilder Publishing, LLC The Investor's Guide to Breakthrough Micro Devices The Tech Sector Rocks echnology is the best sector in the market. Moore’s law predicts sustained improvements in integrated circuits (ICs). ICs get cheaper and they get more capable. As they get cheaper, they invade new areas. T As they get more capable, they invade new areas. Carpets, automobiles, fabrics, tires, soft drinks, and entertainment don’t do this. Markets for these things grow with improvements in productivity and they grow with the invention of new materials. But, tires aren’t going to invade the carpet business or the soft drink business. Marketing can drive soft drinks into more refrigerators or into more countries, but there’s no Moore’s law equivalent that’s going to drive them into automobile engines or into light bulbs. Some investors shun the tech sector for its boom and bust cycles (May 2001, Dynamic Silicon). This year may be one of the worst ever in the semiconductor industry. Following on two years of better than 30% growth, the industry may shrink by 20%. There’s nothing new about this cycle; it’s old hat for indus- try veterans. The cycle is a function of the way the semiconductor industry does business. In spite of these cycles, the semiconductor industry has sustained a cumulative growth rate of 17% for forty years. Farm equipment can’t do that; building materials can’t do that. Moore’s law works for integrated circuits; it does not work for tractors. -

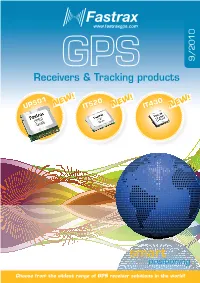

Fastrax IT03

www.fastraxgps.com 9/2010 Receivers & Tracking products UP501 NEW! IT520 NEW! IT430 NEW! Choose from the widest range of GPS receiver solutions in the world! FASTRAX PRODUCT MATRIX Sensivity Power Product Description TTFF acq./navig. consumption Dimensions(mm) Protocols Programmable Chipset Channels Photo Note FASTRAX 500-SERIES FOR ULTIMATE SENSITIVITY Ultra-sensitive, pin-compatible <33s -148 dBm [email protected] 16.2 x 18.8x 2.3 NMEA No MTK3329 66+22 IT MP compatible, 10 Hz fix with MP family GPS receivers /-165 dBm rate, extended power supply IT500 range , predicted 14 days A-GPS Ultra small, low-power and <33s -148 dBm [email protected] 10.4 x 14.0 x 2.3 NMEA No MTK3329 66+22 Up to 10 Hz fix rate, IT520 highly sensitive GPS module /-165 dBm predicted 14 days A-GPS FASTRAX 400-SERIES FOR MINIATURE SIZE AND LOW POWER Smallest available complete <35s -147 dBm [email protected] 9.6 x 9.6 x 1.85 NMEA No SiRFstar IV 48 Client Generated Extended GPS receiver with low power /-163 dBm or (default) GSD4e Ephemeris™ and IT430 consumption and 1.8V single (tracking) [email protected] OSP SiRFAware™ for always hot power supply (binary) start feature, advanced power saving modes FASTRAX 300-SERIES FOR HIGH PERFORMANCE Small and highly sensitive GPS <32s -146 dBm [email protected] 13.1 x 15.9x 2.3 NMEA & Limited with Sirf SiRFstarIII 20 Adaptive Trickle-Power™. receiver module /-159 dBm SiRF SDK GSC3f/LPx Push-to-Fix™. IT310 Highly sensitive, pin-compatible <32s -146 dBm 75mW@ 3.0V 16.2 x 18.8x 2.3 NMEA & Limited with Sirf SiRFstarIII 20 Fastrax IT MP compatible with MP family GPS receivers /-159 dBm SiRF SDK GSC3e/LPx Adaptive Trickle-Power™ IT300 Push-to-Fix™. -

Procmotive: Bringing Programmability and Connectivity Into Isolated Vehicles

ProCMotive: Bringing Programmability and Connectivity into Isolated Vehicles ARSALAN MOSENIA and JAD F. BECHARA, Princeton University, USA TAO ZHANG, Cisco Systems, USA PRATEEK MITTAL, Princeton University, USA MUNG CHIANG, Purdue University, USA In recent years, numerous vehicular technologies, e.g., cruise control and steering assistant, have been proposed and deployed to improve the driving experience, passenger safety, and vehicle performance. Despite the existence of several novel vehicular applications in the literature, there still exists a significant gap between resources needed for a variety of vehicular (in particular, data-dominant, latency-sensitive, and computationally-heavy) applications and the capabilities of already-in- market vehicles. To address this gap, different smartphone-/Cloud-based approaches have been proposed that utilize the external computational/storage resources to enable new applications. However, their acceptance and application domain are still very limited due to programmability, wireless connectivity, and performance limitations, along with several security/privacy concerns. In this paper, we present a novel reference architecture that can potentially enable rapid development of various vehicular applications while addressing shortcomings of smartphone-/Cloud-based approaches. The architecture is formed around a core component, called SmartCore, a privacy/security-friendly programmable dongle that brings general-purpose computational and storage resources to the vehicle and hosts in-vehicle applications. Based on the proposed architecture, we develop an application development framework for vehicles, that we call ProCMotive. ProCMotive enables developers to build customized vehicular applications along the Cloud-to-edge continuum, i.e., different functions of an application can be distributed across SmartCore, the user’s personal devices, and the Cloud. -

NMEA Reference Guide

NMEA Reference Guide Issue 2 CSR Churchill House Cambridge Business Park Cowley Road Cambridge CB4 0WZ United Kingdom Registered in England 3665875 Tel.: +44 (0)1223 692000 Fax.: +44 (0)1223 692001 www.csr.com © SiRF Technology, Inc., a CSR plc company 2009-2011 CS-129435-UGP2 This material is subject to SiRF's non-disclosure agreement. Document History Document History Revision Date Change Reason 1 30 JUN 10 Original publication of this document 2 22 DEC 10 Editorial Updates Updated content for the following message: ■ MID 120 Added name in Table 3.29 3 21 JAN11 Editorial Updates NMEA Reference Guide © SiRF Technology, Inc., a CSR plc company 2009-2011 CS-129435-UGP2 Page 2 of 50 This material is subject to SiRF's non-disclosure agreement. Trademarks, Patents and Licenses Trademarks, Patents and Licenses Unless otherwise stated, words and logos marked with ™ or ® are trademarks registered or owned by CSR plc or its affiliates. Other products, services and names used in this document may have been trademarked by their respective owners. This document contains proprietary and confidential information regarding SiRF products and is provided only under a non-disclosure agreement. SiRF reserves the right to make changes to its products and specifications at any time and without notice. SiRF makes no warranty, either express or implied, as to the accuracy of the information in this document. Performance characteristics listed in this document do not constitute a warranty or guarantee of product performance. All terms and conditions of sale are governed by separate terms and conditions, a copy of which may be obtained from your authorized SiRF sales representative. -

Location-Based Services (LBS)

Location-Based Services (LBS) WITH AN ANALYsis OF GNSS UseR TeCHNOLOGY ISSUE 4 Excerpt from the GNSS MARKET REPORT, ISSUE 4 (2015) 16 Location-Based Services (LBS) GNSS applications GNSS applications are supported by several categories of devices, mainly smartphones and tablets, but also specific equipment such as tracking devices, digital cameras, portable computers and fitness gear. These devices support a multitude of applications tailor-made to satisfy different usage conditions and needs, including: n Navigation: Route planning and turn-by-turn instructions based on GNSS positioning support both pedestrian and road navigation. Sensor fusion is enabling the uptake of indoor navigation. In this chapter n Mapping & GIS: Smartphones enable users to become map creators.* n Key trends: Almost 3 bln mobile applications currently in use rely on positioning infor- n Geo marketing and advertising: Consumer preferences are combined with positioning mation. data to provide personalised offers to potential customers and create market opportuni- n Industry: List of main players by value chain segment. ties for retailers. n Recent developments: More than 1 bln smartphones were shipped in 2013, with the n Safety and emergency: GNSS, in combination with network based methods, provides Asia-Pacific region taking a leading role. accurate emergency caller location. n Future market evolution: The market for smartphones will further grow by 6.2% per year n Enterprise applications: Mobile workforce management and tracking solutions are until 2023. implemented by companies to improve productivity. n User technology: Integration of handset and network based technologies provides the n Sports: GNSS enables monitoring of users’ performance through a variety of fitness appli- best performance for consumer applications. -

See Our Entire GPS Product Range

GPS Locosys is a longstanding and recognised leader in the Precision GNSS TIMING module with T-RAIM GPS and GNSS market. With highly experienced technical The ST-1612-T GNSS module can simultaneously acquire and R&D teams, Locosys offers some of the smallest, and track multiple satellite constellations including GPS innovative and feature rich GPS and GNSS products in the and GLONASS. Supporting conventional USB and UART market. With modules and smart antennas spanning all interfaces as well as a CAN interface the module is as major chipset brands and with ROM and Flash variants at home in a timing application as in an Automotive one. every application scenario has a solution. All products are When used as a timing module the 1PPS is even available of exceptional quality and are designed and manufactured when only one satellite is visible, and using position hold in-house to ISO/TS 16949 2009. and Auto survey PPS accuracies of 25nS [1 G] are achieved. S4-0606 KEY PRODUCTS The S4-0606 is a 6 x 6 x 1.35 mm fully featured GPS receiver based on the latest SiRF iV chipset. Supporting 48 GPS channels, and with the ability to filter out up to 8 active CW jammers users will be impressed with its performance and low power consumption in the most GNSS modules GNSS smart antennas GNSS mouse demanding of applications. Furthermore, by adding serial EEPROM, or using the host CPU’s memory, users In the product tables on the coming pages, please may enable SiRF CGEE (Client Generated Extended note the following colour codes: Ephemeris) a function that predicts satellite positions for GPS GALILEO BEIDOU up to 3 days and delivers CGEE-start time of less than QZSS GLONASS 15 seconds without the need for any network assistance.