07 NWD (AR) Property

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Buildings with Confirmed / Probable Cases of COVID-19

List of Buildings With Confirmed / Probable Cases of COVID-19 List of Residential Buildings in Which Confirmed / Probable Cases Have Resided (Note: The buildings will remain on the list for 14 days since the reported date.) Related Confirmed / District Building Name Probable Case(s) Islands Hong Kong Skycity Marriott Hotel 5482 Islands Hong Kong Skycity Marriott Hotel 5483 Yau Tsim Mong Block 2, The Long Beach 5484 Kwun Tong Dorsett Kwun Tong, Hong Kong 5486 Wan Chai Victoria Heights, 43A Stubbs Road 5487 Islands Tower 3, The Visionary 5488 Sha Tin Yue Chak House, Yue Tin Court 5492 Islands Hong Kong Skycity Marriott Hotel 5496 Tuen Mun King On House, Shan King Estate 5497 Tuen Mun King On House, Shan King Estate 5498 Kowloon City Sik Man House, Ho Man Tin Estate 5499 Wan Chai 168 Tung Lo Wan Road 5500 Sha Tin Block F, Garden Rivera 5501 Sai Kung Clear Water Bay Apartments 5502 Southern Red Hill Park 5503 Sai Kung Po Lam Estate, Po Tai House 5504 Sha Tin Block F, Garden Rivera 5505 Islands Ying Yat House, Yat Tung Estate 5506 Kwun Tong Block 17, Laguna City 5507 Crowne Plaza Hong Kong Kowloon East Sai Kung 5509 Hotel Eastern Tower 2, Pacific Palisades 5510 Kowloon City Billion Court 5511 Yau Tsim Mong Lee Man Building 5512 Central & Western Tai Fat Building 5513 Wan Chai Malibu Garden 5514 Sai Kung Alto Residences 5515 Wan Chai Chee On Building 5516 Sai Kung Block 2, Hillview Court 5517 Tsuen Wan Hoi Pa San Tsuen 5518 Central & Western Flourish Court 5520 1 Related Confirmed / District Building Name Probable Case(s) Wong Tai Sin Fu Tung House, Tung Tau Estate 5521 Yau Tsim Mong Tai Chuen Building, Cosmopolitan Estates 5523 Yau Tsim Mong Yan Hong Building 5524 Sha Tin Block 5, Royal Ascot 5525 Sha Tin Yiu Ping House, Yiu On Estate 5526 Sha Tin Block 5, Royal Ascot 5529 Wan Chai Block E, Beverly Hill 5530 Yau Tsim Mong Tower 1, The Harbourside 5531 Yuen Long Wah Choi House, Tin Wah Estate 5532 Yau Tsim Mong Lee Man Building 5533 Yau Tsim Mong Paradise Square 5534 Kowloon City Tower 3, K. -

Name of Buildings Awarded the Quality Water Supply Scheme for Buildings – Fresh Water (Plus) Certificate (As at 8 February 2018)

Name of Buildings awarded the Quality Water Supply Scheme for Buildings – Fresh Water (Plus) Certificate (as at 8 February 2018) Name of Building Type of Building District @Convoy Commercial/Industrial/Public Utilities Eastern 1 & 3 Ede Road Private/HOS Residential Kowloon City 1 Duddell Street Commercial/Industrial/Public Utilities Central & Western 100 QRC Commercial/Industrial/Public Utilities Central & Western 102 Austin Road Commercial/Industrial/Public Utilities Yau Tsim Mong 1063 King's Road Private/HOS Residential Eastern 11 MacDonnell Road Private/HOS Residential Central & Western 111 Lee Nam Road Commercial/Industrial/Public Utilities Southern 12 Shouson Hill Road Private/HOS Residential Central & Western 127 Repulse Bay Road Private/HOS Residential Southern 12W Commercial/Industrial/Public Utilities Tai Po 15 Homantin Hill Private/HOS Residential Yau Tsim Mong 15W Commercial/Industrial/Public Utilities Tai Po 168 Queen's Road Central Commercial/Industrial/Public Utilities Central & Western 16W Commercial/Industrial/Public Utilities Tai Po 17-19 Ashley Road Commercial/Industrial/Public Utilities Yau Tsim Mong 18 Farm Road (Shopping Arcade) Commercial/Industrial/Public Utilities Kowloon City 18 Upper East Private/HOS Residential Eastern 1881 Heritage Commercial/Industrial/Public Utilities Yau Tsim Mong 211 Johnston Road Commercial/Industrial/Public Utilities Wan Chai 225 Nathan Road Commercial/Industrial/Public Utilities Yau Tsim Mong Name of Buildings awarded the Quality Water Supply Scheme for Buildings – Fresh Water (Plus) -

Official Record of Proceedings

LEGISLATIVE COUNCIL ─ 9 April 2008 5545 OFFICIAL RECORD OF PROCEEDINGS Wednesday, 9 April 2008 The Council met at Eleven o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE MRS RITA FAN HSU LAI-TAI, G.B.M., G.B.S., J.P. THE HONOURABLE JAMES TIEN PEI-CHUN, G.B.S., J.P. THE HONOURABLE ALBERT HO CHUN-YAN IR DR THE HONOURABLE RAYMOND HO CHUNG-TAI, S.B.S., S.B.ST.J., J.P. THE HONOURABLE LEE CHEUK-YAN THE HONOURABLE MARTIN LEE CHU-MING, S.C., J.P. DR THE HONOURABLE DAVID LI KWOK-PO, G.B.M., G.B.S., J.P. THE HONOURABLE FRED LI WAH-MING, J.P. DR THE HONOURABLE LUI MING-WAH, S.B.S., J.P. THE HONOURABLE MARGARET NG THE HONOURABLE MRS SELINA CHOW LIANG SHUK-YEE, G.B.S., J.P. THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE CHEUNG MAN-KWONG THE HONOURABLE CHAN YUEN-HAN, S.B.S., J.P. 5546 LEGISLATIVE COUNCIL ─ 9 April 2008 THE HONOURABLE BERNARD CHAN, G.B.S., J.P. THE HONOURABLE CHAN KAM-LAM, S.B.S., J.P. THE HONOURABLE MRS SOPHIE LEUNG LAU YAU-FUN, G.B.S., J.P. THE HONOURABLE LEUNG YIU-CHUNG THE HONOURABLE SIN CHUNG-KAI, S.B.S., J.P. DR THE HONOURABLE PHILIP WONG YU-HONG, G.B.S. THE HONOURABLE WONG YUNG-KAN, S.B.S., J.P. THE HONOURABLE JASPER TSANG YOK-SING, G.B.S., J.P. THE HONOURABLE HOWARD YOUNG, S.B.S., J.P. DR THE HONOURABLE YEUNG SUM, J.P. -

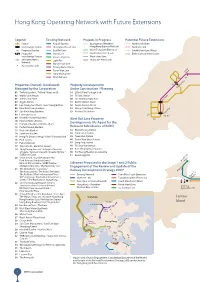

Hong Kong Operating Network with Future Extensions

Shenzhen Lo Wu Hong Kong Operating Network with Future Extensions Intercity Through Beijing Train Route Map Lok Ma Chau Sheung Shui Legend Existing Network Projects in Progress Potential Future Extensions Shanghai Station Airport Express Guangzhou-Shenzhen- North Island Line Kwu Tung Fanling Beijing Line Interchange Station Disneyland Resort Line Hong Kong Express Rail Link Northern Link Zhaoqing Guangzhou Proposed Station East Rail Line Kwun Tong Line Extension South Island Line (West) Shanghai Line Proposed Island Line South Island Line (East) Extension to Central South Guangdong Line Foshan HONG KONG SAR Interchange Station Kwun Tong Line West Island Line Dongguan Shenzhen Metro Light Rail Shatin to Central Link Network Ma On Shan Line Tai Wo * Racing days only Tseung Kwan O Line Yuen Long Tsuen Wan Line Long Tung Chung Line Ping 44 West Rail Line 40 47 33 Kam Tai Po Market Sheung 48 Road Properties Owned / Developed / Property Developments 49 Managed by the Corporation Under Construction / Planning Tin Shui Wai Ma On Shan 36 50 01 Telford Gardens / Telford Plaza I and II 34 LOHAS Park Package 3-10 Wu Kai Sha 02 World-wide House 39 Tai Wai Station New Territories Heng On 03 Admiralty Centre 40 Tin Shui Wai Light Rail University Siu Hong Tai 04 Argyle Centre 41 Austin Station Site C Shui 05 Luk Yeung Sun Chuen / Luk Yeung Galleria 42 Austin Station Site D Hang 06 New Kwai Fong Gardens 52 Wong Chuk Hang Station 27 07 Sun Kwai Hing Gardens 53 Ho Man Tin Station 35 08 Fairmont House 29 Tuen Mun Racecourse* 30 45 Shek Mun Fo Tan 09 Kornhill -

Annual Report 2020 Stock Code: 66

Keep Cities Moving Annual Report 2020 Stock code: 66 SUSTAINABLE CARING INNOVATIVE CONTENTS For over four decades, MTR has evolved to become one of the leaders in rail transit, connecting communities in Hong Kong, the Mainland of China and around the world with unsurpassed levels of service reliability, comfort and safety. In our Annual Report 2020, we look back at one of the most challenging years in our history, a time when our Company worked diligently in the midst of an unprecedented global pandemic to continue delivering high operational standards while safeguarding the well-being of our customers and colleagues – striving, as always, to keep cities moving. Despite the adverse circumstances, we were still able to achieve our objective of planning an exciting strategic direction. This report also introduces our Corporate Strategy, “Transforming the Future”, which outlines how innovation, technology and, most importantly, sustainability and robust environmental, social and governance practices will shape the future for MTR. In addition, we invite you Keep Cities to read our Sustainability Report 2020, which covers how relevant Moving and material sustainability issues are managed and integrated into our business strategies. We hope that together, these reports offer valuable insights into the events of the past year and the steps we plan on taking toward helping Hong Kong and other cities we serve realise a promising long-term future. Annual Report Sustainability 2020 Report 2020 Overview Business Review and Analysis 2 Corporate Strategy -

List of Buildings with Confirmed / Probable Cases of COVID-19

List of Buildings With Confirmed / Probable Cases of COVID-19 List of Residential Buildings in Which Confirmed / Probable Cases Have Resided (Note: The buildings will remain on the list for 14 days since the reported date.) Related Confirmed / District Building Name Probable Case(s) Kwun Tong Block 5, Laguna City 10011 Kwai Tsing Block 2, Serene Garden 10012 Yau Tsim Mong Block 2, Charming Garden 10016 Yau Tsim Mong 678 Shanghai Street 10017 Yau Tsim Mong 678 Shanghai Street 10018 Yau Tsim Mong Yen Yin Building 10019 Yau Tsim Mong David Mansion 10020 Yau Tsim Mong 45A Reclamation Street 10021 Sham Shui Po Hoi Tung House, Hoi Lok Court 10022 Yau Tsim Mong Yen Yin Building 10023 Tsuen Wan On Hong Building 10024 Eastern Block N, Kornhill 10025 Sai Kung Block 3, The Grandiose 10026 Yau Tsim Mong Block 2, Charming Garden 10027 Yuen Long Lin Won Building 10028 Yau Tsim Mong Block A, Shun Lee Building 10029 Tsuen Wan On Hong Building 10030 Yuen Long Yiu Wah House, Tin Yiu Estate 10031 Sai Kung Block 3, The Grandiose 10032 Yuen Long Yan Fu House , Tin Fu Court 10033 Tuen Mun Block 13, Lung Mun Oasis 10034 Wong Tai Sin Choi Fung Court 10035 Yau Tsim Mong Tai Wah Mansion 10036 Sai Kung Sheung Chun House, Sheung Tak Estate 10038 Tai Po Tai Om Village 10039 Yau Tsim Mong Kensington Plaza 10040 Sai Kung Block 3, The Grandiose 10041 Kwai Tsing Hong Mei House, Cheung Hong Estate 10042 Kwun Tong Chi Tat House, On Tat Estate 10043 Kwun Tong Choi Kiu House, Choi Hing Court 10044 Tsuen Wan On Hong Building 10045 1 Related Confirmed / District Building Name -

Homeasy Services Limited – CT Catalyst Air Purification Service Job

Homeasy Services Limited – CT Catalyst Air Purification Service Job Reference of Residence Apartments & Houses – New Territories (in alphabetical order) ** Different Phases with no other specific names will not be stated separately in the list. New Territories East Tseung Kwan O / Tiu Keng Leng / Hang Hau / Po Lam / Lohas Park Bauhinia Garden Kwong Ming Court Ocean Shores The Parkside Beverly Garden La Cite Noble On Ning Garden The Pinnacle Choi Ming Court Lohas Park (The Capital) Oscar By The Sea The Wings Chung Ming Court Lohas Park (Le Prestige) Park Central Tseung Kwan O Plaza Corinthia By The Sea Lohas Park (Le Prime) Radiant Towers Tsui Lam Estate East Point City Lohas Park Residence Oasis Twin Peaks (La Splendeur) Finery Park Lohas Park (Hemera) Serenity Place Verbena Heights Fu Ning Garden Ma Yau Tong Village Sheung Tak Estate Well On Garden Hau Tak Estate Maritime Bay The Beaumount Yee Ming Estate Hong Sing Gardens Metro Town The Grandiose Ying Ming Court Kin Ming Estate Metro Town (Le Point The Metro City Metro Town) King Lam Estate Nan Fung Plaza The Metro City (The Metropolis) Sai Kung / Clear Water Bay Bougainvillea Gardens Habitat (House) Pan Long Wan Silver View Lodge Dynasty Lodge Ho Chung New Village Pik Uk Prison Married The Giverny (House) Quarters Greenview Garden Pak Shek Terrace Pik Uk Village Sha Tin Belair Gardens Green Leaves Garden Pictorial Garden Shui Chuen O Estate Castello Hong Lam Court Prima Villa Springfield Garden Chek Nai Ping Tsuen Kwong Lam Court Ravana Garden Sunshine Grove City One Shatin Kwong Yuen -

CRM Advisors and Consultants, Or the National Park Service

CULTURAL RESOURCE MANAGEMENT Information for Parks, Federal Agencies, Indian Tribes, States, Local Governments, |Ul and the Private Sector VOLUME 19 NO. 3 1996 Preservation in the Pacific Basin U.S. DEPARTMENT OFTHE INTERIOR National Park Service Cultural Resources PUBLISHED BY THE VOLUME 19 NO. 3 1996 NATIONAL PARK SERVICE Contents ISSN 1068-4999 To promote and maintain high standards for preserving and managing cultural resources Preservation in the Pacific Basin DIRECTOR Roger G. Kennedy ASSOCIATE DIRECTOR Asia and the Pacific Honolulu's Chinatown 30 Katherine H. Stevenson A Big Area to Cover! 3 Gregory Yee Mark William Chapman EDITOR Japanese-American Cultural Resources Ronald M. Greenberg "The Future of Asia's Past"—An in Western Washington 33 International Conference on the Gail Lee Dubrow PRODUCTION MANAGER Preservation of Asia's Architectural Karlota M. Koester Heritage 6 Research, Education, and Cultural GUEST EDITOR Jennifer Malin Resource Management at William Chapman Angkor Borei, Cambodia 37 Jennifer Malin, Assistant Historic Preservation Programs and P. Bion Griffin the Community Miriam T. Stark ADVISORS The Example of HawaEi 7 David Andrews Judy Ledgerwood Editor, NPS Lowell Angell Joan Bacharach Rose Mary Ruhr Angkor Borei 38 Museum Registrar. NPS Randall I. Biallas Michael Dega Historical Architect, NPS Historic Preservation Training in Susan Buggey Micronesia The World Monuments Fund and Director, Historical Services Branch An Assessment of Needs 11 Parks Cartada Training at Angkor/University of John A. Bums William Chapman Phnom Penh 42 Architect NPS Delta Lightner John H. Stubbs Harry A. Butowsky Historian, NPS Pratt Cassity Learning from Levuka, Fiji— Valuing the Ordinary— Executive Director, Preservation in the First an Australian Perspective 45 National Alliance of Preservation Commissions Colonial Capital 15 Ken Taylor Muriel Crespi Cultural Anthropologist, NPS Gerald T. -

List of Integrated Home Care Services Teams

Catchment Areas of Integrated Home Care Services (Frail Cases) (w.e.f 1.10.2020) (as at 10 September 2020) Operators of s/n District Zone IHCST serving Service Boundary Remarks Note in the Zone Hollywood Terrace, Pine Court, Robinson Heights, The Grand Panorama, Tycoon Court, 39 Conduit Road, Blessings A01 CHUNG WAN Garden, Realty Gardens, Robinson Place, 77/79 Peak Road, Chateau De Peak, Dynasty Court, Grenville House, Kellett A02 MID LEVELS EAST View Town Houses, Mount Austin Estate, Strawberry Hill, Tregunter, Villa Verde, Wing On Villa, Emerald Gardens, A03 CASTLE ROAD Euston Court, Greenview Gardens, Scenic Garden, Wisdom Court, Connaught Garden, Kwan Yick Building Phase II, A04 PEAK Kwan Yick Building Phase III, Hongway Garden, Midland Centre, Queen's Terrace, Soho 189, Centre Point, A05 UNIVERSITY (except Hong Kong University Centrestage, Grandview Garden, Parkway Court, Tung Fai Gardens, Island Crest, Western Garden, Yue Sun Mansion, and Pok Fu Lam Road) Central and A11 SAI YING PUN Central and St. James' 1 Western Admiralty, Central, Sheung Wan, Connaught Road West from number 1 to 179, Des Voeux Road West (odd numbers - A12 SHEUNG WAN Western Settlement (East) 343, even numbers - 308), Centre Street, Queen’s Road West (odd numbers from 1 to 383 even numbers from 2 to 356), A13 TUNG WAH Western Street (all even numbers), Water Street 2, First Street (odd numbers from 1 to 131, even numbers from 2 to 84), A14 CENTRE STREET Second Street (odd numbers from 1 to 83, even numbers from 2 to 88), Third Street (odd numbers from 1 to -

Homeasy Services Limited – CT Catalyst Air Purification Service Job Reference of Residence Apartments & Houses –

Homeasy Services Limited – CT Catalyst Air Purification Service Job Reference of Residence Apartments & Houses – New Territories (in alphabetical order) New Territories East Tseung Kwan O / Tiu Keng Leng / Hang Hau / Po Lam / Lohas Park Alto Residences Kwong Ming Court On Ning Garden The Parkside Bauhinia Garden La Cite Noble Oscar By The Sea The Pinnacle Beverly Garden Lohas Park (The Capital) Park Central The Wings Capri Lohas Park (Le Prestige) Po Lam Estate The Wings (Ocean Wings) Choi Ming Court Lohas Park (Le Prime) Radiant Towers Tseung Kwan O Plaza Chung Ming Court Lohas Park Residence Oasis Tseung Kwan O Village (La Splendeur) Corinthia By The Sea Lohas Park (Hemera) Savannah Tsui Lam Estate East Point City Ma Yau Tong Village Serenity Place Twin Peaks Finery Park Maritime Bay Sheung Tak Estate Verbena Heights Fu Ning Garden Metro Town The Beaumount Well On Garden Hau Tak Estate Metro Town (Le Point The Grandiose Yan Ming Court Metro Town) Hong Sing Gardens Monterey The Metro City Yee Ming Estate Kin Ming Estate Nan Fung Plaza The Metro City Ying Ming Court (The Metropolis) King Lam Estate Ocean Shores The Papillons Yuk Ming Court Sai Kung / Clear Water Bay Bougainvillea Gardens Ho Chung New Village Pak Shek Terrace Royal Castle Dynasty Lodge Jade Villa Pan Long Wan Silver View Lodge Greenview Garden Lakeside Garden Pik Uk Prison Married The Giverny (House) Quarters Habitat (House) Mount Pavilia Pik Uk Village Wai Sum Village Sha Tin Belair Gardens Hong Lam Court Pristine Villa Sunshine Grove Castello Kwong Lam Court Ravana Garden -

Company Name Address Telephone No

Company Name Address Telephone No. 7-Eleven Portion of Shop 1, G/F, Chuang's ENew 2299 1110 Territorieserprises Building, 382 Lockhart Road, Wan Chai, Hong Kong 7-Eleven G/F, 166 Wellington Street, Sheung Wan, Hong 2299 1110 Kong 7-Eleven Shop 1C, 1D & 1E, G/F, Queen's Terrace, 1 Queen 2299 1110 Street, Sheung Wan, Hong Kong 7-Eleven Shops F & G, G/F, Hollywood Garden, 222 2299 1110 Hollywood Road, Sheung Wan, Hong Kong 7-Eleven G/F & the Cockloft, 298 Des Voeux Road CeNew 2299 1110 Territoriesral, Sheung Wan, Hong Kong 7-Eleven Portion of Shop C, G/F, Man Kwong Court, 12 2299 1110 Smithfield, Hong Kong 7-Eleven G/F & Cockloft, 68 Tung Lo Wan Road, Tai Hang, 2299 1110 Hong Kong 7-Eleven Shop 26, G/F & Living Quarter 1/F in Block 6, Lai 2299 1110 Tak Tsuen, Tai Hang, Hong Kong 7-Eleven Shop 60 UG/F, Island Resort Mall, 28 Siu Sai Wan 2299 1110 Road, Chai Wan 7-Eleven Shop 5, G/F, The Peak Galleria, 118 Peak Road, 2299 1110 Hong Kong 7-Eleven Shop 289 on 2nd Floor, Shun Tak Centre, 200 2299 1110 Connaught Road CeNew Territoriesral, Hong Kong 7-Eleven Shop B Lower Deck Level, Central Pier, Star Ferry, 2299 1110 Hong Kong 7-Eleven G/F., 40 Elgin Street, Central, Hong Kong 2299 1110 7-Eleven G/F, 76 Wellington Street, Central, Kong Kong 2299 1110 7-Eleven Shop 1, G/F, 9 Chiu Lung Street, Central, Hong 2299 1110 Kong 7-Eleven G/F, Teng Fuh Commercial Building, 331-333 2299 1110 Queen's Road Central, Central, Hong Kong 7-Eleven Shop C, G/F., Haleson Building, 1 Jubilee St., 2299 1110 Central, Hong Kong Company Name Address Telephone No. -

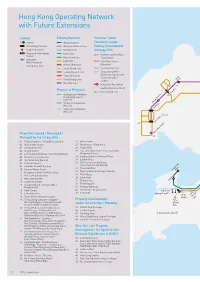

Hong Kong Operating Network with Future Extensions

Shenzhen Lo Wu Hong Kong Operating Network Beijing Intercity Through with Future Extensions Train Route Map Shanghai u g* in zho q Legend Existing Network Potential Future o Lok Ma Chau a ang Beijing Line h Z Station Airport Express Extensions under Gu Sheung Shui Shanghai Line n n a Interchange Station Disneyland Resort Line Railway Development sha u o Guangdong Line F gg Proposed Station on East Rail Line Strategy 2014 D HONG KONG SAR Proposed Interchange Kwu Tung Fanling * Due to the redevelopment of railway control point at Zhaoqing, Island Line Northern Link and Kwu Station services to/from Zhaoqing will be suspended from 16 April 2017 until further notice. Kwun Tong Line Tung Station Shenzhen Light Rail Metro Network Tuen Mun South Ma On Shan Line Extension * Racing days only South Island Line East Kowloon Line Tseung Kwan O Line Tung Chung West Tai Wo Tsuen Wan Line Extension and Possible Tung Chung East Tung Chung Line Long Yuen Long Station Ping 48 West Rail Line Hung Shui Kiu Station 41 47 South Island Line (West) Kam Projects in Progress Sheung Tai Po Market North Island Line Road 33 Guangzhou-Shenzhen- 49 Hong Kong Express Tin Shui Wai 36 50 Ma On Shan Rail Link Wu Kai Sha Hung Shui Kiu New Territories Shatin to Central Link Heng On (Phase I) University Tai Siu Hong Shatin to Central Link Shui (Phase II) Hang 30 39 27 35 29 Tuen Mun Racecourse* Shek Mun Fo Tan 31 City One Properties Owned / Developed / Tuen Mun South 28 Sha Tin Managed by the Corporation Tsuen Wan Tai Wo Hau Sha 05 Tin 01 Telford Gardens / Telford Plaza I