Comment Letter on Independent Contractor Status (Final)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Key Committees 2021

Key Committees 2021 Senate Committee on Appropriations Visit: appropriations.senate.gov Majority Members Minority Members Patrick J. Leahy, VT, Chairman Richard C. Shelby, AL, Ranking Member* Patty Murray, WA* Mitch McConnell, KY Dianne Feinstein, CA Susan M. Collins, ME Richard J. Durbin, IL* Lisa Murkowski, AK Jack Reed, RI* Lindsey Graham, SC* Jon Tester, MT Roy Blunt, MO* Jeanne Shaheen, NH* Jerry Moran, KS* Jeff Merkley, OR* John Hoeven, ND Christopher Coons, DE John Boozman, AR Brian Schatz, HI* Shelley Moore Capito, WV* Tammy Baldwin, WI* John Kennedy, LA* Christopher Murphy, CT* Cindy Hyde-Smith, MS* Joe Manchin, WV* Mike Braun, IN Chris Van Hollen, MD Bill Hagerty, TN Martin Heinrich, NM Marco Rubio, FL* * Indicates member of Labor, Health and Human Services, Education, and Related Agencies Subcommittee, which funds IMLS - Final committee membership rosters may still be being set “Key Committees 2021” - continued: Senate Committee on Health, Education, Labor, and Pensions Visit: help.senate.gov Majority Members Minority Members Patty Murray, WA, Chairman Richard Burr, NC, Ranking Member Bernie Sanders, VT Rand Paul, KY Robert P. Casey, Jr PA Susan Collins, ME Tammy Baldwin, WI Bill Cassidy, M.D. LA Christopher Murphy, CT Lisa Murkowski, AK Tim Kaine, VA Mike Braun, IN Margaret Wood Hassan, NH Roger Marshall, KS Tina Smith, MN Tim Scott, SC Jacky Rosen, NV Mitt Romney, UT Ben Ray Lujan, NM Tommy Tuberville, AL John Hickenlooper, CO Jerry Moran, KS “Key Committees 2021” - continued: Senate Committee on Finance Visit: finance.senate.gov Majority Members Minority Members Ron Wyden, OR, Chairman Mike Crapo, ID, Ranking Member Debbie Stabenow, MI Chuck Grassley, IA Maria Cantwell, WA John Cornyn, TX Robert Menendez, NJ John Thune, SD Thomas R. -

GUIDE to the 116Th CONGRESS

th GUIDE TO THE 116 CONGRESS - SECOND SESSION Table of Contents Click on the below links to jump directly to the page • Health Professionals in the 116th Congress……….1 • 2020 Congressional Calendar.……………………..……2 • 2020 OPM Federal Holidays………………………..……3 • U.S. Senate.……….…….…….…………………………..…...3 o Leadership…...……..…………………….………..4 o Committee Leadership….…..……….………..5 o Committee Rosters……….………………..……6 • U.S. House..……….…….…….…………………………...…...8 o Leadership…...……………………….……………..9 o Committee Leadership……………..….…….10 o Committee Rosters…………..…..……..…….11 • Freshman Member Biographies……….…………..…16 o Senate………………………………..…………..….16 o House……………………………..………..………..18 Prepared by Hart Health Strategies Inc. www.hhs.com, updated 7/17/20 Health Professionals Serving in the 116th Congress The number of healthcare professionals serving in Congress increased for the 116th Congress. Below is a list of Members of Congress and their area of health care. Member of Congress Profession UNITED STATES SENATE Sen. John Barrasso, MD (R-WY) Orthopaedic Surgeon Sen. John Boozman, OD (R-AR) Optometrist Sen. Bill Cassidy, MD (R-LA) Gastroenterologist/Heptalogist Sen. Rand Paul, MD (R-KY) Ophthalmologist HOUSE OF REPRESENTATIVES Rep. Ralph Abraham, MD (R-LA-05)† Family Physician/Veterinarian Rep. Brian Babin, DDS (R-TX-36) Dentist Rep. Karen Bass, PA, MSW (D-CA-37) Nurse/Physician Assistant Rep. Ami Bera, MD (D-CA-07) Internal Medicine Physician Rep. Larry Bucshon, MD (R-IN-08) Cardiothoracic Surgeon Rep. Michael Burgess, MD (R-TX-26) Obstetrician Rep. Buddy Carter, BSPharm (R-GA-01) Pharmacist Rep. Scott DesJarlais, MD (R-TN-04) General Medicine Rep. Neal Dunn, MD (R-FL-02) Urologist Rep. Drew Ferguson, IV, DMD, PC (R-GA-03) Dentist Rep. Paul Gosar, DDS (R-AZ-04) Dentist Rep. -

An Advocacy Statement by the Commission on Religion and Race, Eastern Pennsylvania Conference of the United Methodist Church Co-Chairpersons: the Rev

An Advocacy Statement by the Commission on Religion and Race, Eastern Pennsylvania Conference of The United Methodist Church Co-chairpersons: the Rev. Susan Worrell and the Rev. Alicia Julia-Stanley “We must not be enemies. Though passion may have strained, it must not break our bonds of affection. The mystic chords of memory will swell when again touched, as surely they will be, by the better angels of our nature.” ~ Abraham Lincoln, First Inaugural Address February 10, 2021 An open letter to select members of the United States Congress from Pennsylvania: Rep. John Joyce Rep. Mike Kelly Rep. Glenn Thompson Rep. Guy Reschenthaler Rep. Scott Perry Rep. Lloyd Smucker Rep. Dan Meuser Rep. Fred Keller As a nation, we stand at a dangerous precipice. We are witnessing a moment in history when an impeached former U.S. President is being tried by the U.S. Senate for inciting a violent, insurrectionist mob to attack the U.S. Capitol and threaten the lives of his Vice-President and members of the U.S. Congress. The former President urged and effectively unleashed the mob’s vengeance and fury against our elected public officials for standing up for our U.S. Constitution, the equal rights of all American voters, and the rights of states to have free and fair elections. The events of January 6, 2021, would not have happened without the echoes of assent you and others gave to Donald Trump’s incendiary words, the credibility you gave to his lies, and the supportive wall you built around him that continues to undermine dedicated leaders and departments of the Federal government. -

Rural Hospital Bonus Payment

November 13, 2020 The Honorable Alex M. Azar II Secretary U.S. Department of Health and Human Services 200 Independence Avenue, SW Washington, DC 20201 Dear Secretary Azar: As you continue to address the provision of health care during the COVID-19 public health emergency, we ask that the Department of Health and Human Services (HHS) resolve rural physician training issues that have been exacerbated by COVID-19. While HHS has taken important steps to shore up the health care system, rural physician training remains at risk. Rural hospitals have been significantly impacted by revenue losses due to lower patient volumes as a result of the public health emergency, and without Federal action, we are concerned that some may be forced to discontinue their physician training programs. In an effort to address this concern, we ask that you support these important programs by releasing targeted support from the Provider Relief Fund established in the CARES Act to fund rural hospitals that train physicians and commit to maintaining these training programs for at least three years. The Government Accountability Office (GAO) has reported that “rural training sites may incur higher costs because their training may have to utilize multiple training sites—such as community hospitals or rural health clinics—in order to meet accreditation requirements for resident rotations and patient case-mix. The added administrative work of coordinating with other sites to provide these resources can be a challenge.” Additionally, the data shows that training in rural areas increases the likelihood of practice in rural areas and is associated with a two- to three-fold increased likelihood of rural practice. -

December 4,2020 the Honorable Mitch

December 4,2020 The Honorable Mitch McConnell The Honorable Charles Schumer Majority Leader Minority Leader U.S. Senate U.S. Senate Washington, DC 20510 Washington, DC 20510 The Honorable Nancy Pelosi The Honorable Kevin McCarthy Speaker Minority Leader U.S. House of Representatives U.S. House of Representatives Washington, DC 2051 5 Washington, DC 20515 Dear Majority Leader McConnell, Minority Leader Schumer, Speaker Pelosi, and Minority Leader McCarthy, In March of this year economic shutdowns hit communities across the country. By passing the CARES Act, Congress acted quickly to respond to the health threat we were yet to fully understand and a shutdown with an unknown end date. At the time, December 31, 2020 was believed to be an appropriate expiration date for numerous emergency measures, including Section 4013, the suspension of Troubled Debt Restructuring (TDR) classification of loans. However, with the end of the year quickly approaching and millions of businesses still in need of relief an extension of Section 4013 along with further forbearance for lenders is critical to our recovery and the survival of businesses in every state of the country. The suspension of TDR classifications has alleviated institutions from an onerous process that in this unique environment would unnecessarily drain their capital accounts and ultimately decrease access to credit for consumers and small businesses in the midst of this exceptional economic downturn. The provision has allowed all financial institutions, particularly those holding commercial mortgages, to modify COVID-19 impacted loans, giving businesses the ability to stay afloat, and substantially increasing the capability of financial institutions to work with their customers so they may recover from the shutdowns. -

May 11, 2020 the Honorable Nancy Pelosi the Honorable Kevin

May 11, 2020 The Honorable Nancy Pelosi The Honorable Kevin McCarthy Speaker Minority Leader U.S. House of Representatives U.S. House of Representatives Washington, D.C. 20515 Washington, D.C. 20515 Dear Speaker Pelosi and Leader McCarthy, We are writing in support of the calls for a $49.95 billion infusion of federal funding to state departments of Transportation (DOTs) in the next COVID-19 response legislation. Our transportation system is essential to America’s economic recovery, but it is facing an immediate need as the COVID-19 pandemic significantly impacts states’ transportation revenues. With negotiations for the next COVID-19 relief package underway, we write to convey our strong support that future legislation includes a provision to address the needs of highway and bridge projects. With millions of Americans following “stay-at-home” orders, many state governments are facing losses in revenues across the board. These State DOTs are not exempt from these losses but operate with unique funding circumstances by having their own revenue shortfalls. Projections are showing decreases in state motor fuel tax and toll receipts as vehicle traffic declines by 50 percent in most parts of the country due to work and travel restrictions. An estimated 30 percent average decline in state DOTs’ revenue is forecasted over the next 18 months. Some state DOTs could experience losses as high as 45 percent. Due to these grim realities, some states are unable to make contract commitments for basic operations such as salt and sand purchases for winter operations. Both short-term and long-term transportation projects that were previously set to move forward are being delayed, putting construction jobs at risk. -

July 21, 2021 Dear Leaders of Democratic States

July 21, 2021 Dear Leaders of Democratic States: In the streets of Cuba, the people are bravely marching for a new day of freedom and demanding an end to the illegitimate, brutal Cuban dictatorship. After more than six decades of brutally oppressive rule, the Cuban people are risking their lives to loudly denounce the disastrous communist regime that has time and time again failed to promote and protect the general welfare of its citizens. The people are shouting “libertad,” and demanding freedom, democracy and human rights. As the Cuban people risk their lives for freedom, the world must stand with them in this critically important moment. As the democratically-elected leaders of the world’s free countries, we write to you today to fervently implore you to take action in support of the Cuban people and their democratic aspirations. It is time to finally end the evil and murderous reign of the communist, illegitimate Cuban regime that has murdered, tortured and oppressed for far too long. In concerted solidarity with the Cuban people, we believe there are four essential actions that we all must take immediately to promote freedom for the Cuban people and place further pressure on the corrupt and murderous Cuban regime to end its reign of terror. First, we urge you to emphatically denounce the illegitimate Cuban regime, hold it accountable for its human rights abuses and immediately end diplomatic relations. Freedom-loving nations must make clear our full and unwavering support for Cuba's pro-democracy movement, and for free and fair elections, with international supervision. -

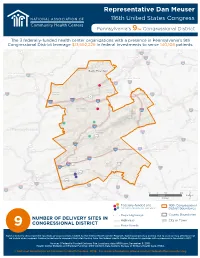

Representative Dan Meuser 220

15 6 81 84 380 84 11 220 180 Representative Dan Meuser 220 476 116th81 United States Congress 15 80 Pennsylvania's 9TH Congressional80 District 11 80 80 80 The 3 federally-funded health center organizations with a presence in Pennsylvania's 9th 11 209 Congressional District leverage $13,992,229 in federal investments476 to serve 140,108 patients.80 209 Scranton 46 81 522 476 Back Mountain Williamsport 209 78 Wilkes-Barre 81 11 22 22 78 78 209 Luzerne Montour County County 78 78 22 222 81 476 Columbia422 County 22 Carbon County 322 11 83 76 422 76 176 81 Pennsylvania Schuylkill 222County 76 15 322 276 Bethlehem Allentown Berks County Lebanon County Reading Harrisburg Warminster Southampton 0 5 10 20 Norristown Abington Miles Federally-funded site 116th Congressional (each color represents one organization) District Boundaries Major Highways County Boundaries NUMBER OF DELIVERY SITES IN Highways City or Town CONGRESSIONAL DISTRICT 9 Major Roads Notes | Delivery sites represent locations of organizations funded by the federal Health Center Program. Some locations may overlap due to scale or may otherwise not be visible when mapped. Federal investments represent the total funding from the federal Health Center Program to grantees with a presence in the state in 2017. Sources | Federally-Funded Delivery Site Locations: data.HRSA.gov, December 3, 2018. Health Center Patients and Federal Funding | 2017 Uniform Data System, Bureau of Primary Health Care, HRSA. © National Association of Community Health Centers, 2019. For more information, please contact [email protected]. Representative Dan Meuser 116th United States Congress Pennsylvania's 9TH Congressional District NUMBER OF DELIVERY SITES IN 9 CONGRESSIONAL DISTRICT (main organization in bold) PRIMARY HEALTH NETWORK Schuylkill Community Health Center - 210 Sunbury St Minersville, PA 17954-1346 Shamokin Community Health Center - 4203 Hospital Rd Coal Township, PA 17866-9668 Shenandoah Health Center - 624 W Centre St Shenandoah, PA 17976-1403 RURAL HEALTH CORP. -

COVID-19 Legislative Update February 22, 2021

Subscribe Past Issues Translate View this email in your browser COVID-19 Legislative Update February 22, 2021 COVID-19 Legislative Updates are published every Monday evening. For past updates, click here. For updates before May 8, 2020 click here. If you believe you have been accidentally unsubscribed, you can re-subscribe here. 2.22.2021. COVID-19 Legislative Update Legislation Supplemental V Timeline/Process: Today, the House Budget Committee approved the bill by a vote of 19- 16 and will go through Rules Committee before going to the floor later this week. There is a possibility of votes bleeding into the weekend. The plan remains for the House to pass the package this week, it to move through the Senate next week, and then further House action the following week if there are changes in the Senate. Politics: After some uncertainty about discretionary funding being passed through reconciliation process, the Senate Parliamentarian has tentatively indicated that discretionary funding should be able to be passed through reconciliation if converted into mandatory funding. However, where minimum wage stands remains unclear. In a call to governors last week, President Biden seemed to prepare for the reality that raising the minimum wage would not make it into the final bill. Policy: The Budget Committee approved the bill earlier today. Text here. Press release here. Last week, the Congressional Budget Office released scores for nine of the sections of the bill. CBO scores below: Ways and Means Committee: $927.3 billion Oversight and Reform -

March 17, 2021 the Honorable Janet Yellen U.S. Department of The

March 17, 2021 The Honorable Janet Yellen U.S. Department of the Treasury 1500 Pennsylvania Avenue, NW Washington, DC 20220 Dear Secretary Yellen: Congratulations on your recent confirmation to lead the U.S. Department of Treasury. We write today to request your assistance in implementing the Coronavirus Economic Relief for Transportation Services (CERTS) Act provisions included in the recently-enacted Coronavirus Response and Relief Supplemental Appropriations Act. We supported the CERTS Act because America’s motorcoach, school bus, and passenger vessel industries have been greatly affected by the COVID-19 pandemic. These industries play an essential role in national and community transportation networks, providing vital services for large and small as well as urban and rural communities. For example, the motorcoach industry recently provided more than 700 buses to transport National Guard troops to Washington D.C. to protect our nation’s capital. This past year has been incredibly challenging for these vital transportation providers as almost all major sources of business and revenue has been severely restricted or eliminated by state mandated closures – including school and sports-related travel, tourism, and mass public events. Unfortunately, indicators forecast that we will not be returning to normal operations for months. To ensure that these transportation service providers are ready and available for Americans once the economy reopens, emergency funding for these industries is necessary. That is why the U.S. Department of Treasury must move as quickly as possible to provide financial assistance, as authorized by Congress, to these companies that desperately need to keep their employees on payroll and cover increased operating costs. -

Key Committees for the 116Th Congress

TH KEY COMMITTEES FOR THE 116 CONGRESS APPROPRIATIONS COMMITTEES The Senate and House Appropriations Committees determine how federal funding for discretionary programs, such as the Older Americans Act (OAA) Nutrition Program, is allocated each fiscal year. The Subcommittees overseeing funding for OAA programs in both the Senate and the House are called the Labor, Health and Human Services, Education and Related Agencies Subcommittees. Listed below, by rank, are the Members of Congress who sit on these Committees and Subcommittees. Senate Labor, Health & Human Services, Education, and Related Agencies Appropriations Subcommittee Republicans (10) Democrats (9) Member State Member State Roy Blunt, Chairman Missouri Patty Murray, Ranking Member Washington Richard Shelby Alabama Dick Durbin Illinois Lamar Alexander Tennessee Jack Reed Rhode Island Lindsey Graham South Carolina Jeanne Shaheen New Hampshire Jerry Moran Kansas Jeff Merkley Oregon Shelley Moore Capito West Virginia Brian Schatz Hawaii John Kennedy Louisiana Tammy Baldwin Wisconsin Cindy Hyde-Smith Mississippi Chris Murphy Connecticut Marco Rubio Florida Joe Manchin West Virginia James Lankford Oklahoma Senate Appropriations Committee Republicans (16) Democrats (15) Member State Member State Richard Shelby, Chairman Alabama Patrick Leahy, Ranking Member Vermont Mitch McConnell Kentucky Patty Murray Washington Lamar Alexander Tennessee Dianne Feinstein California Susan Collins Maine Dick Durbin Illinois Lisa Murkowski Alaska Jack Reed Rhode Island Lindsey Graham South Carolina -

The Majority of Congress Is Standing up for Local Radio!

The majority of Congress is standing up for local radio! Rep. Ralph Abraham • Rep. Alma Adams • Rep. Rick Allen • Rep. Mark Amodei • Rep. Jodey Arrington • Rep. Brian Babin • Rep. Don Bacon • Rep. Jim Baird • Rep. Troy Balderson • Rep. Jim Banks Rep. Andy Barr • Sen. John Barrasso • Rep. Joyce Beatty • Rep. Gus Bilirakis • Rep. Dan Bishop • Rep. Rob Bishop • Rep. Sanford D. Bishop, Jr. • Sen. John Boozman • Rep. Mike Bost Rep. Brendan Boyle • Rep. Kevin Brady • Sen. Mike Braun • Rep. Mo Brooks • Rep. Susan Brooks • Rep. Anthony Brown • Rep. Vern Buchanan • Rep. Larry Bucschon • Rep. Ted Budd Rep. Michael Burgess • Sen. Richard Burr • Rep. Cheri Bustos • Rep. G.K. Butterfield • Rep. Bradley Byrne • Rep. Ken Calvert • Rep. André Carson • Rep. Buddy Carter • Rep. John Carter Rep. Kathy Castor • Rep. Steve Chabot • Rep. Liz Cheney • Rep. Lacy Clay • Rep. Tom Cole • Sen. Susan Collins • Rep. James Comer • Rep. Mike Conaway • Rep. Paul Cook • Rep. Jim Costa Sen. Tom Cotton • Rep. Joe Courtney • Sen. Kevin Cramer • Sen. Mike Crapo • Rep. Rick Crawford • Rep. Dan Crenshaw • Rep. Henry Cuellar • Rep. John Curtis • Sen. Steve Daines • Rep. Sharice Davids Rep. Warren Davidson • Rep. Danny Davis • Rep. Rodney Davis • Rep. Madeleine Dean • Rep. Peter DeFazio • Rep. Debbie Dingell • Rep. Jeff Duncan • Rep. Neal Dunn • Rep. Tom Emmer Sen. Mike Enzi • Sen. Joni Ernst • Rep. Dwight Evans • Rep. Drew Ferguson • Sen. Deb Fischer • Rep. Brian Fitzpatrick • Rep. Bill Flores • Rep. Jeff Fortenberry • Rep. Virginia Foxx • Rep. Mike Gallagher Rep. Mike Garcia • Sen. Cory Gardner • Rep. Greg Gianforte • Rep. Bob Gibbs • Rep. Jared Golden • Rep. Anthony Gonzalez • Rep.