Asian Meat Market Trends: a U.S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Guide to Identifying Meat Cuts

THE GUIDE TO IDENTIFYING MEAT CUTS Beef Eye of Round Roast Boneless* Cut from the eye of round muscle, which is separated from the bottom round. Beef Eye of Round Roast Boneless* URMIS # Select Choice Cut from the eye of round muscle, which is Bonelessseparated from 1the480 bottom round. 2295 SometimesURMIS referred # to Selectas: RoundChoic Eyee Pot Roast Boneless 1480 2295 Sometimes referred to as: Round Eye Pot Roast Roast, Braise,Roast, Braise, Cook in LiquidCook in Liquid BEEF Beef Eye of Round Steak Boneless* Beef EyeSame of muscle Round structure Steak as the EyeBoneless* of Round Roast. Same muscleUsually structure cut less than1 as inch the thic Eyek. of Round Roast. URMIS # Select Choice Usually cutBoneless less than1 1inch481 thic 2296k. URMIS #**Marinate before cooking Select Choice Boneless 1481 2296 **Marinate before cooking Grill,** Pan-broil,** Pan-fry,** Braise, Cook in Liquid Beef Round Tip Roast Cap-Off Boneless* Grill,** Pan-broil,** Wedge-shaped cut from the thin side of the round with “cap” muscle removed. Pan-fry,** Braise, VEAL Cook in Liquid URMIS # Select Choice Boneless 1526 2341 Sometimes referred to as: Ball Tip Roast, Beef RoundCap Off Roast, Tip RoastBeef Sirloin Cap-Off Tip Roast, Boneless* Wedge-shapedKnuckle Pcuteeled from the thin side of the round with “cap” muscle removed. Roast, Grill (indirect heat), Braise, Cook in Liquid URMIS # Select Choice Boneless Beef Round T1ip526 Steak Cap-Off 234 Boneless*1 Same muscle structure as Tip Roast (cap off), Sometimesbut cutreferred into 1-inch to thicas:k steaks.Ball Tip Roast, Cap Off Roast,URMIS # Beef Sirloin Select Tip ChoicRoast,e Knuckle PBonelesseeled 1535 2350 Sometimes referred to as: Ball Tip Steak, PORK Trimmed Tip Steak, Knuckle Steak, Peeled Roast, Grill (indirect heat), **Marinate before cooking Braise, Cook in Liquid Grill,** Broil,** Pan-broil,** Pan-fry,** Stir-fry** Beef Round Tip Steak Cap-Off Boneless* Beef Cubed Steak Same muscleSquare structureor rectangula asr-shaped. -

Cutting and Packaging Guidelines What’S in a Box

Cutting and packaging guidelines What’s in a box Detailed cutting specifications for each Braise/ Cut Code Fry/Grill Roast Stew Mince of the cuts begin on the next page Pot Roast and a carcase will make up 20 packs. Contents and weights will vary but, as Topsides B004 12 joints a guideline, each pack should weigh Silversides B002 16 joints approximately 10-12kg and contain: Thick Flanks B003 12 joints • 3 roasting/pot roasting joints – derived Rumps B006 40 steaks from topside, silverside, thick flank, Sirloins B006 60 steaks LMC or brisket Fillets B005 40 steaks • 3-4 packs of grilling/frying steak – Fore Ribs B008 20 steaks derived from rump, sirloin, fillet and Chucks B005/B009/B012 25 kg rib eye LMCs B008 6 joints • 3 packs of braising steaks – derived Briskets B002 14 joints from the chuck eye, feather and blade Thin Flanks B001 10 kg • 1 pack of stewing steak – derived Shin/Heels B004/B001 10 kg from the leg and the shin Dice B001 16 kg • 2 packs of diced beef – derived from Mince B004 22 kg lean trimmings • 3 packs of mince – derived from trimmings The cuts/pack information in this You can print off sheets and indicate what brochure is based on a 300 kg carcase, products are in the box, when you deliver MLC Classification R4H. Therefore, the number/weight of cuts in the packs are it to your customers. intended to act as a guideline only as butchery techniques may vary from one business to another. Code: Topside Joints (traditional) Topside B004 1. -

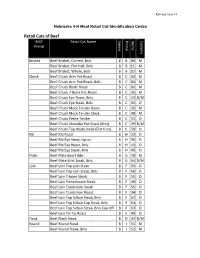

Retail Cuts of Beef BEEF Retail Cut Name Specie Primal Name Cookery Primal

Revised June 14 Nebraska 4-H Meat Retail Cut Identification Codes Retail Cuts of Beef BEEF Retail Cut Name Specie Primal Name Cookery Primal Brisket Beef Brisket, Corned, Bnls B B 89 M Beef Brisket, Flat Half, Bnls B B 15 M Beef Brisket, Whole, Bnls B B 10 M Chuck Beef Chuck Arm Pot-Roast B C 03 M Beef Chuck Arm Pot-Roast, Bnls B C 04 M Beef Chuck Blade Roast B C 06 M Beef Chuck 7-Bone Pot-Roast B C 26 M Beef Chuck Eye Roast, Bnls B C 13 D/M Beef Chuck Eye Steak, Bnls B C 45 D Beef Chuck Mock Tender Roast B C 20 M Beef Chuck Mock Tender Steak B C 48 M Beef Chuck Petite Tender B C 21 D Beef Chuck Shoulder Pot Roast (Bnls) B C 29 D/M Beef Chuck Top Blade Steak (Flat Iron) B C 58 D Rib Beef Rib Roast B H 22 D Beef Rib Eye Steak, Lip-on B H 50 D Beef Rib Eye Roast, Bnls B H 13 D Beef Rib Eye Steak, Bnls B H 45 D Plate Beef Plate Short Ribs B G 28 M Beef Plate Skirt Steak, Bnls B G 54 D/M Loin Beef Loin Top Loin Steak B F 59 D Beef Loin Top Loin Steak, Bnls B F 60 D Beef Loin T-bone Steak B F 55 D Beef Loin Porterhouse Steak B F 49 D Beef Loin Tenderloin Steak B F 56 D Beef Loin Tenderloin Roast B F 34 D Beef Loin Top Sirloin Steak, Bnls B F 62 D Beef Loin Top Sirloin Cap Steak, Bnls B F 64 D Beef Loin Top Sirloin Steak, Bnls Cap Off B F 63 D Beef Loin Tri-Tip Roast B F 40 D Flank Beef Flank Steak B D 47 D/M Round Beef Round Steak B I 51 M Beef Round Steak, Bnls B I 52 M BEEF Retail Cut Name Specie Primal Name Cookery Primal Beef Bottom Round Rump Roast B I 09 D/M Beef Round Top Round Steak B I 61 D Beef Round Top Round Roast B I 39 D Beef -

Cut Sheet Beef

Date: CUT SHEET PLEASE BE VERY GENTLE WHEN HANDLING YOUR VACCUM PACKED BEEF BAGS AS THE BONES CAN PIERCE THE PLASTIC. Farmer to fill out: Name: Phone: Email: Farm Address: Number of Animals to be butchered: # Breed Type: Special Instructions: Below for the butcher use only: Butcher to fill out: Animal Hanging Weight: Extra Notes: SAUSAGE FLAVOURING LIST PAYMENT - BANK TRANSFER FLAVOURS Please Tick Tranfer Details Direct Deposit SAUSAGE MIXES Total Amount Due: $ 1. Tomato & Onion 2. Worchestire & Cracked Pepper Account Name: Farm Direct 3. Sun Dried Tomato & Basil BSB #: 034 037 4. Herb & Garlic Account Number #: 349 076 5. Plain Beef BEEF CUTS Please CUTS Please Tick Tick 1. CHUCK x2 5. LEG X 2 Rolled Roast Corned Silverside Chuck Steak Silverside Steak Diced (suitable for diced, won’t be cut into diced) Rump Steak Thin 2. BRISKET x2 Rump Steak Thick Brisket Rump Roast Y-Bone Topside Roast Blade Roast Topside Steak Blade Steak Mince Oyster Blade Steak Knuckle Steak 3. RACK x2 Knuckle Roast Rib Eye Steak Thin 6. SKIRT / FLANK Rib Eye Steak Thick Ribs Rib Eye Bone In Skirt 4. LOIN X2 Mince Sirloin Steak Soup Bones T-Bone Marrow Bones Sirloin Roast Fillet Steak 7. SHANK / SHIN Diced / Gravy Beef (suitable for diced, won’t be cut into diced) Osso Bucco LEFT OVER MEAT AND TRIM WILL BE MADE INTO MINCE AND SAUSAGES. Notes: 1 3 4 5 1 - Chuck 2 2 - Brisket 6 3 - Rack 4 - Loin 5 - Leg 7 6 - Skirt / Flank 7 7 - Shank. -

Ostello Ostello Ostello Ostello Ostello Ostello

UNIVERSITY OF AUCKLAND WAIPARURU HALLS OF RESIDENCE MENU Click on the weekday’s below to view full menus Monday Tuesday Wednesday Thursday Friday Saturday Sunday O stello 10:30am - 2pm 10:30am - 2pm 10:30am - 2pm 10:30am - 2pm 10:30am - 2pm 10:30am - 2pm 10:30am - 2pm 4pm - 7pm 4pm - 7pm 4pm - 7pm 4pm - 7pm 4pm - 7pm 4pm - 7pm 4pm - 7pm 10:30am - 4pm 10:30am - 4pm 10:30am - 4pm 10:30am - 4pm 10:30am - 4pm 10:30am - 4pm 10:30am - 4pm 4pm - 9pm 4pm - 9pm 4pm - 9pm 4pm - 9pm 4pm - 9pm 4pm - 9pm 4pm - 9pm O stello O stello 11am - 2:30pm 11am - 2:30pm 11am - 2:30pm 11am - 2:30pm 11am - 2:30pm 11am - 2:30pm 11am - 2:30pm 4:30pm - 7:30pm 4:30pm - 7:30pm 4:30pm - 7:30pm 4:30pm - 7:30pm 4:30pm - 7:30pm 4:30pm - 7:30pm 4:30pm - 7:30pm O stello O stello 11:30am - 3pm 11:30am - 3pm 11:30am - 3pm 11:30am - 3pm 11:30am - 3pm 11:30am - 3pm 11:30am - 3pm 5pm - 8pm 5pm - 8pm 5pm - 8pm 5pm - 8pm 5pm - 8pm 5pm - 8pm 5pm - 8pm O stello O stello 12pm - 4pm 12pm - 4pm 12pm - 4pm 12pm - 4pm 12pm - 4pm 12pm - 4pm 12pm - 4pm 5:30pm - 9pm 5:30pm - 9pm 5:30pm - 9pm 5:30pm - 9pm 5:30pm - 9pm 5:30pm - 9pm 5:30pm - 9pm MONDAY BREAKFAST 7am - 10:30am Vegetarian CONTINENTAL Made to Order Bread and spreads | Cereals | Season and poached fruit | Natural yoghurt w/ assorted topping (Inc. Gluten free bread, various nut/soy/dairy free milks) HOT Freshly made porridge | Congee with shitake mushrooms served with soy sauce and crispy shallots O stello 10:30am - 2pm 10:30pm - 4pm 11am - 2:30pm 11:30am - 3pm 12pm - 4pm Chicken fettucine w Crispy fried crab and corn empanada Chilli -

Top Blade (Flat Iron), Chuck Roll, Mock Tender

GET THE A Everything beef at your ngertips. Anytime. Anywhere. Top Blade (FlatDownload it today. SearchIron), The Roundup Chuck Roll, Mock Tender BRAISING, STEWING, GRILLING SAUTÉ / PAN FRY OVEN ROASTING SIMMERING OR POT ROASTING TOP BLADE (FLAT IRON) CHARACTERISTICS HANDLING COMMON NAMES: Top Blade, Oyster Blade • The majority of the flat iron comes from the top • Needs to be split lengthwise to access and MUSCLE COMPOSITION: Consists of the Infraspinatus of the shoulder blade; a small portion will be remove a strand of connective tissue running muscle. May have the internal connective tissue part of the long cut shoulder clod through the length of the cut, thereby allowing removed (central tendon). • Highly tender, comparable to tenderloin for easy portioning into steaks or cubes • Aging is important to maximize tenderness • Coarse grain makes it ideal for marinating POINTS REQUIRING SPECIFICATION: • A band of connective tissue runs the length • Perfect as flat iron steaks, stir-fries and kebobs • Can be purchased split (central tendon removed) of the cut in the centre of the muscle and must • Can be purchased in pre-portioned format be removed to obtain the maximum usage • Tail length at scapular end from this cut • Removal or retention of bone skin • Strong beef flavour due to the location in the chuck • Packaging requirements • Recommended that this cut be purchased from WEIGHT RANGE: 6 – 7 lb / 2.7 – 3.2 kg the purveyor in a portioned format • Makes an excellent steak for casual menus and operations looking for a steak that can meet aggressive price points 114D CLASSIC CUTS (FLAT IRON) CUTTING 1. -

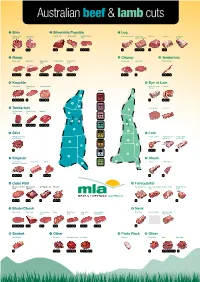

Australian Beef and Lamb Cuts Chart

Australian beef & lamb cuts ➊ Shin ➋ Silverside/Topside ➊ Leg Boneless shin/ Shin bone-in/ Topside roast Topside steak Silverside minute Easy carve leg roast Lamb steaks Mini roast Leg bone in Leg (tunnel gravy beef osso bucco steak (round or topside) boned) ➌ Rump ➋ Chump ➌ Tenderloin Rump steak Rump roast Rump minute Rump medallion Rump centre Chump chop Lamb rump Fillet/tenderloin steak steak ➍ Knuckle ➍ Eye of Loin Round steak Round/minute Knuckle medallion Boned and rolled Loin chop steak loin roast Legend ➊ ➐ OVEN ROAST ➋ ➌ ➎ PAN-FRY Butterfly steak Eye of loin Tenderloin ➊ Fillet/tenderloin Eye fillet centre Butt fillet steak cut ➍ SHALLOW/ CRUMB-FRY ➎ ➏ ➋ ➌ STIR-FRY ➐ ➍ ➏ Skirt ➎ Loin GRILL & Skirt (diced or rolled CHAR-GRILL Frenched cutlet Frenched rack of Frenched lamb and seasoned) lamb (8 rib) rack (13 rib) ➑ ➎ BRAISE & ➒ ➓ CASSEROLE SIMMER ➏ ➒ ➐ Striploin ➐ Shank Sirloin steak/ Sirloin roast T-bone ➑ Shank Lamb drumstick porterhouse/ New York ➊ BARBECUE ➐ ➑ Cube Roll ➏ Forequarter Rib eye/scotch fillet Rib eye/scotch Standing rib roast Rib cutlet Forequarter chop Easy carve shoulder Rolled shoulder Forequarter rack steak fillet roast roast (4 rib) ➒ Blade/Chuck ➑ Neck Blade steak Blade roast Boneless blade Chuck Oyster blade Blade minute Boneless blade Neck chop Best neck shop Neck fillet roast/ steak steak steak steak bone in rib eye roast ➓ Brisket Other ➒ Party Rack ➓ Other Rolled Brisket Diced beef Beef stirfry strips Beef mince Party ribs Diced lamb Mince Lamb strips. -

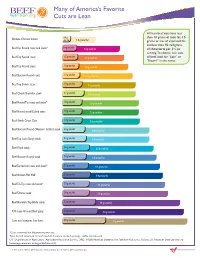

Many of America's Favorite Cuts Are Lean

Many of America’s Favorite BEEF Cuts are Lean All lean beef cuts have less than 10 grams of total fat, 4.5 Skinless Chicken breast 0.9 g sat. fat 3.0 g total fat grams or less of saturated fat and less than 95 milligrams 1.4 g sat. fat Beef Eye Round roast and steak* 4.0 g total fat of cholesterol per 3½-oz serving. To choose lean cuts 1.5 g sat. fat Beef To p Round roast 4.3 g total fat of beef, look for “Loin” or “Round” in the name. 1.6 g sat. fat Beef To p Round steak 4.6 g total fat 1.7 g sat. fat Beef Bottom Round roast 4.9 g total fat 1.9 g sat. fat Beef To p Sirloin steak 5.0 g total fat 2.1 g sat. fat Beef Chuck Shoulder steak 5.0 g total fat 1.9 g sat. fat Beef Round Tip roast and steak* 5.3 g total fat 1.9 g sat. fat Beef Round steak/Cubed steak 5.3 g total fat 1.9 g sat. fat Beef Shank Cross Cuts 5.4 g total fat 2.2 g sat. fat Beef Bottom Round (Western Griller) steak 6.0 g total fat Beef To p Loin (Strip) steak 2.3 g sat. fat 6.0 g total fat 2.6 g sat. fat Beef Flank steak 6.3 g total fat 2.3 g sat. fat Beef Bottom Round steak 6.6 g total fat 2.5 g sat. -

Our Handbook

Table of Contents 4-5 Welcome to ButcherBox! 30-31 Stew Beef 6-7 Grass-Fed & Grass-Finished Cheat Sheet 32-33 Ground Beef 8-9 Defrost + Storage 34-35 Ribeye Steak 10-11 5 Basics of Seasoning 36-37 Shaved Steak 12-13 Rubs & Marinades 38-39 NY Strip Steak 14-15 The Home Chef’s Toolbox 40-41 Filet Mignon 16-17 Cooking Temperatures 42-43 Premium Steak Tips 18-19 Cooking Icons Explained 44-45 Coulotte Roast 20-21 Beef Introduction 46-47 Tri-Tip Roast 22-23 Chuck Roast 48-49 Top Sirloin Steak 24-25 Denver Steak 50-51 Eye Round Roast 26-27 Flat Iron Steak 52-53 Beef Brisket 28-29 Ranch Steak 2 54-55 Pork Introduction 56-57 Pork Butt 58-59 Pork Tenderloin 60-61 Baby Back Ribs Don’t see one of your cuts in this handbook? Hop onto 62-63 Boneless Pork Chops butcherbox.com/recipes 64-65 Breakfast Sausage to discover: 66-67 Chicken Introduction • Detailed cooking instructions for every cut (up to 70, and more 68-69 Whole Chicken coming all the time!) 70-71 Chicken Thighs • Step-by-step recipes and videos from the ButcherBox test kitchen 72-73 Chicken Drumsticks and our favorite bloggers 74 Glossary • Tips and tricks for cooking quality meat in your kitchen 75 Thank You from ButcherBox! 3 3 4 Welcome to ButcherBox! I’m Yankel, Head Chef of ButcherBox, and I want to personally welcome you to the ButcherBox family. Your experience means so much to us — which is why we’ve created this handbook for you. -

Stock Yards Portion Cut Guide

VE T-A-GLANCE UT ABO THE RE TS A GUI A C ST CU DE BRING THE STEA A portion cut is a portion of the sub-primal cut and the portion most likely to end up on your plate. Each cut is identified with a Use this at-a-glance guide to help operators identify the best beef cuts to use WE K numbering system maintained by the USDA's Institutional Meat Purchase Specifications (IMPS) and the North American Meat for the most common foodservice applications. Processors Association (NAMP). The numbers refer to portion (1,000 series numbers) primal cuts from the five broad areas that represent different sections of the cattle: the Chuck, the Rib, the Loin, the Round and the Brisket/Plate/Flank. ● Indicates cuts that are highly Beef) recommended for certain types of menu ournedos Fingers T / / items, these cuts will produce optimal Recommended) Recommended) Sauce Barbecued results. Sandwiches Beef / Fried GRADING/MARBLING Steak SALES-DIALOGUE TIPS BBQ ❋ rnovers Indicates alternative cuts that produce / Beef Satay Tu Strip Heat) Quality) (Marinating / Porterhouse acceptable results. / • Who is the current COP provider? Chicken Grilled / Grilled Chateaubriand (Mexican / Gravy / Steak Italian / Quality) Spit-Roasted Pies in (Economy) (High Indicates uses for leftovers of these cuts / x (Moist Strip Steak Fondue / • What COP items are on the menu? Specials? (Can befound on their menu) Beef Pot -Bone (Marinated) Broil / Dip Swiss T NY Cubed Breakfast oppings, oppings, Beef (High (Economy-Marinating Rib T Beef Beef T y Cheese / Sandwiches Ribs Mignon Fr Roast -

Buckhead Beef RHODE ISLAND CUSTOM CUT / DEMAND OVERVIEW Buckhead Beef Is Sysco’S Own Custom Cut, Portion Control, Cut Shop

2017 Buckhead Beef RHODE ISLAND CUSTOM CUT / DEMAND OVERVIEW Buckhead Beef is Sysco’s own custom cut, portion control, cut shop. The plant operates Monday thru Friday under USDA inspection. Each day the skilled team at Buckhead Beef RI portion cuts steaks and chops to individual specifications. Sysco Connecticut stocks approximately 50 fresh portion control steak and chop items. These are the core items customers use the most frequently. In addition to these stock items we have the ability to custom cut to order. We refer to CUSTOM CUT / DEMAND SCHEDULE: this as custom cut/demand items. Orders Monday by 11:45 need to be entered and transmitted by for Tuesday delivery noon for the next day delivery. Tuesday by 11:45 for Wednesday Orders are transmitted to Buckhead Beef RI from early morning up to noon. delivery Wednesday by 11:45 The plant cuts the orders throughout the day, each evening Sysco Connecticut for Thursday delivery picks up all items on our refrigerated trucks. To cover all our customers geographically, the Sysco truck needs to leave Buckhead Beef RI by 6:00 PM. Thursday by 11:45 The product arrives at Sysco by 7:30 PM, is unloaded and staged for each for Friday delivery delivery for the next delivery. Friday by 11:45 for Large orders for events or parties, we ask for an extra day lead Monday delivery time so we can process each order with the proper care. Bulk cryovac packed codes are set up for our customers convenience. Custom cut / demand items are cut to order, increasing shelf life to customers. -

Beef Cuts Chart

CHUCK RIB LOIN SIRLOIN ROUND BEEF CUTS AND RECOMMENDED COOKING METHODS BRISKET PLATE FLANK CHUCK RIB LOIN SIRLOIN ROUND INGREDIENT CUTS | LEAN | LEAN Arm Chuck Roast Cross Rib Chuck Roast Ribeye Roast, Bone-In Porterhouse Steak Top Sirloin Steak Top Round Kabobs* Roast* | LEAN | LEAN | LEAN Arm Chuck Steak Shoulder Roast Ribeye Steak, Bone-In T-Bone Steak Top Sirloin Petite Top Round Stew Meat Roast Steak* | LEAN | LEAN | LEAN | LEAN Blade Chuck Roast Shoulder Steak* Back Ribs Strip Steak, Bone-In Top Sirloin Filet Bottom Round Strips Roast | LEAN | LEAN | LEAN Blade Chuck Steak* Ranch Steak Ribeye Roast, Boneless Strip Steak, Coulotte Roast Bottom Round Cubed Steak Boneless Steak* | LEAN | LEAN | LEAN 7-Bone Chuck Roast Flat Iron Steak Ribeye Steak, Boneless Strip Petite Roast Coulotte Steak Bottom Round Ground Beef and Rump Roast Ground Beef Patties | LEAN | LEAN | LEAN | LEAN Chuck Center Roast Top Blade Steak Ribeye Cap Steak Strip Filet Tri-Tip Roast Eye of Round Roast Shank Cross-Cut | LEAN | LEAN | LEAN | LEAN | LEAN Denver Steak Shoulder Ribeye Petite Roast Tenderloin Roast Tri-Tip Steak Eye of Round Tenderloin Tips Petite Tender Steak* BRISKET PLATE & FLANK | LEAN | LEAN | LEAN | LEAN | LEAN Chuck Eye Roast Shoulder Petite Ribeye Filet Tenderloin Steak Petite Sirloin Steak Brisket Flat Skirt Steak* Tender Medallions (Filet Mignon) | LEAN Chuck Eye Steak Short Ribs, Bone-In Sirloin Bavette Steak Brisket Point Flank Steak* KEY TO RECOMMENDED COOKING METHODS Country-Style Ribs Short Ribs, Bone-In* | LEAN These cuts meet A cut of cooked fresh meat is considered “lean” the government when it contains less than 10 grams of total fat, 4.5 guidelines for lean, grams or less of saturated fat and less than 95 based on cooked mg of cholesterol per 100 grams (3½ oz) and per servings, visible fat RACC (Reference Amount Customarily Consumed), © 2021 Cattlemen’s Beef Board and trimmed.