Artifi Cial Lift Techbook 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1981-04-15 EA Plan of Development Production

United States Department of the Interior Office of the Secretary Minerals Management Service 1340 West Sixth Street Los Angeles, California 90017 OCS ENVIRONMENTAL ASSESSMENT July 8, 1982 Operator Chevron U.S.A. Inc. Plan Type Development/Production Lease OCS-P 0296 Block 34 N., 37 W. Pl atfonn Edith Date Submitted April 15, 1981 Prepared by the Office of the Deputy Minerals Manager, Field Operations, Pacific OCS Region Related Environmental Documents U. S. DEPARTMENT OF THE INTERIOR GEOLOGICAL SURVEY Environmental Impact Report - Environmental Assessment, Shell OCS Beta Unit Development (prepared jointly with agencies of the State of California, 1978) 3 Volumes Environmental Assessment, Exploration, for Lease OCS-P 0296 BUREAU OF LAND MANAGEMENT Proposed 1975 OCS Oil and Gas General Lease Sale Offshore Southern California (OCS Sale No. 35), 5 Volumes Proposed 1979 OCS Oil and Gas Lease Sale Offshore Southern California (OCS Sale No. 48), 5 Volumes Proposed 1982 OCS Oil and Gas General Lease Sale Offshore Southern California (OCS Sale No. 68), 2 Volumes u.c. Santa Cruz - BLM, Study of Marine Mammals and Seabirds of the Southern California Bight ENVIRONMENTAL ASSESSMENT CHEVRON U.S.A. INC. OPERATOR PLAN OF DEVELOPMENT/PRODUCTION, PROPOSED PLATFORM EDITH, LEASE OCS-P 0296, BETA AREA, SAN PEDRO BAY, OFFSHORE SOUTHERN CALIFORNIA Table of Contents Page I. DESCRIPTION OF THE PROPOSED ACTION ••••••••••••••••••••• 1 II. DESCRIPTION OF AFFECTED ENVIRONMENT •••••••••••••••••••• 12 III. ENVIRONMENTAL CONSEQUENCES ••••••••••••••••••••••••••••• 29 IV. ALTERNATIVES TO THE PROPOSED ACTION •••••••••••••••••••• 46 v. UNAVOIDABLE ADVERSE ENVIRONMENTAL EFFECTS •••••••••••••• 48 VI. CONTROVERSIAL ISSUES ••••••••••••••••••••••••••••••••••• 48 VII. FINDING OF NO SIGNIFICANT IMPACT (FONS!) ••••••••••••••• 51 VIII. ENVIRONMENTAL ASSESSMENT DETERMINATION ••••••••••••••••• 55 IX. -

View Annual Report

ANNUAL 2017 REPORT Financial Highlights (Millions of dollars and shares, except per share data) 20171 20161 20151 Revenue Dividends to in billions Shareholders Revenue $ 20,620 $ 15,887 $ 23,633 in millions Operating Income (Loss) $ 1,362 $ (6,778) $ (165) Amounts Attributable to Company Shareholders: Loss from Continuing Operations $ (444) $ (5,761) $ (666) $614 $626 $620 $15.9 Net Loss $ (463) $ (5,763) $ (671) $20.6 $23.6 Diluted Income per Share Attributable to Company Shareholders: Loss from Continuing Operations $ (0.51) $ (6.69) $ (0.78) Net Loss $ (0.53) $ (6.69) $ (0.79) Cash Dividends per Share $ 0.72 $ 0.72 $ 0.72 Diluted Common Shares Outstanding 870 861 853 Working Capital2 $ 5,915 $ 7,654 $ 14,733 Capital Expenditures $ 1,373 $ 798 $ 2,184 Total Debt $ 10,942 $ 12,384 $ 15,355 17 16 15 17 16 15 Debt to Total Capitalization3 57% 57% 50% Depreciation, Depletion and Amortization $ 1,556 $ 1,503 $ 1,835 4 Total Capitalization $ 19,291 $ 21,832 $ 30,850 Capital Expenditures in billions 1 Reported results during these periods include impairments and other charges of $647 million for the year ended December 31, 2017, merger-related costs and termination fee of $4.1 billion and impairments and other charges of $3.4 billion for the year ended December 31, 2016, and impairments and other charges of $2.2 billion for the year ended December 31, 2015. 2 Working Capital is defined as total current assets less total current liabilities. $1.4 $0.8 $2.2 3 Debt to Total Capitalization is defined as total debt divided by the sum of total debt plus total shareholders’ equity. -

JX Report for a Sustainable Future 2010 JX Report for a Sustainable Future 2010 the JX Group Was Formed in April 2010 in Quest of a Sustainable Future

2010 Report for a Sustainable Future JX JX Holdings, Inc. JX Report for a Sustainable Future 2010 The JX Group was formed in April 2010 in quest of a sustainable future. Under our new mission statement, the JX Group aims to make major advances in the fields of energy, resources and materials. Guided by the slogan of “The Future of Energy, Resources and Materials,” the JX Group is determined to shape the future. JX Group Mission Statement JX Group Slogan JX Group Mission Statement JX Group will contribute to the development of a sustainable economy and society through innovation in the areas of energy, resources and materials. JX Group Values Our actions will respect the EARTH. Ethics Advanced ideas Relationship with society Trustworthy products/services Harmony with the environment About JX The name “JX” symbolizes the JX Group’s mission statement. The letter “J” represents our position as one of the world’s largest integrated energy, resources and materials business groups from Japan, while the letter “X” represents our willingness to pioneer new frontiers, our future growth and development potential and innovation. About the JX Corporate Brand Mark The JX corporate brand mark symbolizes the continuity of the global environment and the JX Group based on the JX Group’s mission statement. The design, in which the “JX” logo overlaps with a sphere, represents the JX Group’s commitment to a green earth—i.e., our contribution to the development of a sustainable economy and society, through innovation in the areas of energy, resources and materials. * The JX corporate brand mark is common to JX Holdings, Inc., JX Nippon Oil & Energy Corporation, JX Nippon Oil & Gas Exploration Corporation and JX Nippon Mining & Metals Corporation. -

Appendix 3: Projection Factors for Point and Area Sources (Adopted

APPENDIX 3 PROJECTION FACTORS FOR POINT AND AREA SOURCES Eastern Research Group, Inc. PROJECTION FACTORS FOR POINT AND AREA SOURCES Final Prepared for: Texas Commission on Environmental Quality Air Quality Division MC-164, P.O. Box 13087 Austin, TX 78711-3087 August 16, 2010 ERG No. 0227.03.027.006 TCEQ Contract No. 582-07-84003 Work Order No. 582-07-84003-FY10-27 PROJECTION FACTORS FOR POINT AND AREA SOURCES Final Prepared for: Texas Commission on Environmental Quality Air Quality Division MC-164, P.O. Box 13087 Austin, TX 78711-3087 Attn: Mr. Greg Lauderdale Prepared by: Eastern Research Group, Inc. 10860 Gold Center Drive, Suite 275 Rancho Cordova, CA 95670 August 16, 2010 TABLE OF CONTENTS Section Page ES.0 EXECUTIVE SUMMARY .....................................................................................................1 1.0 INTRODUCTION ...................................................................................................................1 2.0 DATA COLLECTION............................................................................................................2 2.1 Economy.com Economic Data and Projections............................................................ 3 2.2 Texas Industrial Production Index................................................................................ 3 2.3 Annual Energy Outlook ................................................................................................ 4 2.4 EGAS Model................................................................................................................ -

Advancing Artificial Lift

Advancing artificial lift Sven Olson, Leistritz Advanced Technologies Corp., USA, explains how artificial lift and gathering systems can be optimised through the use of multiphase pumps. he application of artificial lift in oil and gas exposure for well service and interventions. Today’s trend production continues to grow as operators strive to for optimising production and total recovery is to further Tmaximise recovery and the use of existing facilities extend the outreach from a single pad, which results in the and processes, as well as accessing tight formations and low application of more deviated and horizontal drilling. This permeability shale assets. Drill centres and pad production leads to complex well architecture with long horizontal are becoming very common as producers work to reduce sections, which makes lifting with conventional downhole facility footprints and minimise the environmental impact. products challenging, and in turn creates a whole new set However, along with the benefits of growing numbers of of problems facing the operator. Depending on the specific artificial lift installations also comes added complexity in production scenario of a formation, different artificial lift producing an asset, which leads to increased operator cost technologies are used. Figure 1 provides a depiction of a typical split of lifting alternatives for an operator producing 8000 onshore wells. Over 5 million wells are on artificial lift worldwide; in North America alone, it is estimated that 85% of all wells use artificial lift. In onshore applications the SRPs (sucker rod pumps) dominate, however ESPs (electrical submersible pumps) or PCPs (progressing cavity pumps) are increasingly gaining ground. Other commonly used technologies include velocity strings, plungers, jet pumps and gas lift systems. -

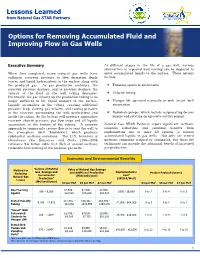

Options for Removing Accumulated Fluid and Improving Flow in Gas Wells

Lessons Learned from Natural Gas STAR Partners Options for Removing Accumulated Fluid and Improving Flow in Gas Wells Executive Summary At different stages in the life of a gas well, various alternatives to repeated well venting can be deployed to When first completed, many natural gas wells have move accumulated liquids to the surface. These options sufficient reservoir pressure to flow formation fluids include: (water and liquid hydrocarbon) to the surface along with the produced gas. As gas production continues, the Foaming agents or surfactants reservoir pressure declines, and as pressure declines, the velocity of the fluid in the well tubing decreases. Velocity tubing Eventually, the gas velocity up the production tubing is no longer sufficient to lift liquid droplets to the surface. Plunger lift, operated manually or with ‘smart’ well Liquids accumulate in the tubing, creating additional automation pressure drop, slowing gas velocity, and raising pressure in the reservoir surrounding the well perforations and Downhole pumps, which include reciprocating (beam) inside the casing. As the bottom well pressure approaches pumps and rotating (progressive cavity) pumps. reservoir shut-in pressure, gas flow stops and all liquids accumulate at the bottom of the tubing. A common Natural Gas STAR Partners report significant methane approach to temporarily restore flow is to vent the well to emission reductions and economic benefits from the atmosphere (well “blowdown”), which produces implementing one or more lift options to remove substantial methane emissions. The U.S. Inventory of accumulated liquids in gas wells. Not only are vented Greenhouse Gas Emissions and Sinks 1990—2008 methane emissions reduced or eliminated, but these lift estimates 9.6 billion cubic feet (Bcf) of annual methane techniques can provide the additional benefit of increased emissions from venting of low pressure gas wells. -

UKCS Technology Insights

UKCS Technology Insights April 2019 Unless identified elsewhere, all data is from the OGA UKSS 2017 and 2018 Cover photos: High frequency FWI image – courtesy of DownUnder Geosolutions using Capreolus 3D data from TGS Ocean bottom nodes – courtesy of Magseis Fairfield Riserless mud recovery – courtesy of Enhanced Drilling Carbon composite pipe – courtesy of Magma Global Contents Foreword 5 1. Seismic and exploration 22 Executive summary 6 2. Well drilling and completions 28 Operators’ technology plans 8 3. Subsea systems 34 Existing technologies for MER UK 12 4. Installations and topsides 40 Emerging technologies – MER UK priorities 14 5. Reservoir and well management 46 OGA’s technology stewardship 16 6. Facilities management 52 The Oil & Gas Technology Centre (OGTC) 18 7. Well plugging and abandonment 58 Technology plan feedback 21 8. Facilities decommissioning 64 Conclusions 70 Appendix - Technology spend 72 Image courtesy of Airbourne Oil & Gas Foreword I am pleased to see constant progress in the way our industry is OGTC, MER UK Taskforces and industry sponsors. A small maturing and deploying new technologies for the UK Continental technical team will be established to measure progress on all key Shelf (UKCS). This important effort is being supported by the objectives. Ultimately, these objectives will be followed up and coordinated work of the Oil and Gas Authority (OGA), the monitored through the OGA stewardship to further encourage Technology Leadership Board (TLB) and the Oil & Gas Technology uptake and share best practice. Centre (OGTC). There are huge prizes in reserves growth, production value and, This year’s Technology Insights summarises the rich content of most importantly, safe asset operation and life extension from the UKCS operators’ technology plans, submitted through the OGA use of current and new technologies. -

Trends in U.S. Oil and Natural Gas Upstream Costs

Trends in U.S. Oil and Natural Gas Upstream Costs March 2016 Independent Statistics & Analysis U.S. Department of Energy www.eia.gov Washington, DC 20585 This report was prepared by the U.S. Energy Information Administration (EIA), the statistical and analytical agency within the U.S. Department of Energy. By law, EIA’s data, analyses, and forecasts are independent of approval by any other officer or employee of the United States Government. The views in this report therefore should not be construed as representing those of the Department of Energy or other federal agencies. U.S. Energy Information Administration | Trends in U.S. Oil and Natural Gas Upstream Costs i March 2016 Contents Summary .................................................................................................................................................. 1 Onshore costs .......................................................................................................................................... 2 Offshore costs .......................................................................................................................................... 5 Approach .................................................................................................................................................. 6 Appendix ‐ IHS Oil and Gas Upstream Cost Study (Commission by EIA) ................................................. 7 I. Introduction……………..………………….……………………….…………………..……………………….. IHS‐3 II. Summary of Results and Conclusions – Onshore Basins/Plays…..………………..…….… -

Study of Development Alternatives for Remote Offshore, Low Energy Reservoirs: the Wisting Field Case

Study of development alternatives for remote offshore, low energy reservoirs: the Wisting field case Elshad Yadigarov Petroleum Engineering Submission date: July 2017 Supervisor: Milan Stanko, IGP Norwegian University of Science and Technology Department of Geoscience and Petroleum Abstract This work summarizes a series of analysis conducted to determine an optimized field development plan for Wisting oil field. The field presents several unique challenges, such as low reservoir pressure, very shallow reservoir depth and remoteness from the available infrastructure. The study used a homogeneous reservoir simulation model built during the Specialization Project. Some of the crucial data, such as porosity, permeability and horizontal-to-vertical permeability ratio had a huge uncertainty involved in it. In order to account for this, 27 reservoir models with a combination of those uncertain properties were constructed and integrated with the 3 production network models. As a result, 81 integrated models were run and the oil production data was then used to evaluate the NPV (Net Present Value) of each of the considered cases. 3 production network models have been used for the analysis – wells with no artificial lift, wells with gas lift and subsea multiphase boosting. Gas lift rate optimization study was conducted to maximize the production and the economics of this development option. Multiphase booster pump power requirements, which would meet the field operational conditions were also determined. NPV was set as an objective to decide on the most preferable development alternative. The capital expenditures for each of the development options were estimated with a commercial software, which was available for a limited period. -

New Era of Oil Well Drilling and Completions.Indd

Rod Pumping White Paper D352548X012 June 2020 New Era of Oil Well Drilling and Completions — Does It Require An Innovation In Rod Pumping? Abstract A new era of oil well drilling and completions is changing the face of rod pumping forever. Horizontal drilling with multistage hydraulic fracturing often results in very challenging production conditions. Pump placement below the kick-off (i.e., in non-vertical dogleg section), frequent gas slugs, large volumes of fl owback frac sand, signifi cant fl uctuations in fl uid fl ow rates, and steep decline curves are examples of the common challenges affecting the production of horizontal wells. Even the most sophisticated conventional pumpjack with an AC motor and variable frequency drive/variable speed drive (VFD/VSD) does not have the precise rod string control required to help mitigate and resolve many of these complex rod pumping issues that are frequently associated with horizontal multistage, hydraulically fractured wells. Linear pumping units, and more specifi cally linear hydraulic pumpjacks, have fundamental differences in geometry and control capabilities. Coupled with the fact that both natural gas and AC drive units support the same functionality, linear hydraulic pumpjacks provide the sophisticated rod string control required by today’s demanding wells. This paper will compare and contrast the different rod pumping methods and their abilities to address these production challenges. The paper will also discuss the additional benefi ts of combining the unique capabilities of a linear hydraulic pumpjack with sophisticated optimization control and remote access. The combination of these three key features provides an unprecedented solution that has the potential to become the next-generation rod pumping technology for cost effectively producing today’s challenging wells. -

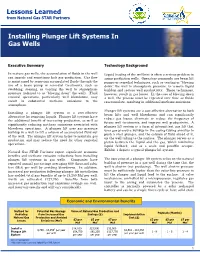

Installing Plunger Lift Systems in Gas Wells (Pdf)

Lessons Learned from Natural Gas STAR Partners Installing Plunger Lift Systems In Gas Wells Executive Summary Technology Background In mature gas wells, the accumulation of fluids in the well Liquid loading of the wellbore is often a serious problem in can impede and sometimes halt gas production. Gas flow aging production wells. Operators commonly use beam lift is maintained by removing accumulated fluids through the pumps or remedial techniques, such as venting or “blowing use of a beam pump or remedial treatments, such as down” the well to atmospheric pressure, to remove liquid swabbing, soaping, or venting the well to atmospheric buildup and restore well productivity. These techniques, pressure (referred to as “blowing down” the well). Fluid however, result in gas losses. In the case of blowing down removal operations, particularly well blowdowns, may a well, the process must be repeated over time as fluids result in substantial methane emissions to the reaccumulate, resulting in additional methane emissions. atmosphere. Plunger lift systems are a cost-effective alternative to both Installing a plunger lift system is a cost-effective beam lifts and well blowdowns and can significantly alternative for removing liquids. Plunger lift systems have reduce gas losses, eliminate or reduce the frequency of the additional benefit of increasing production, as well as future well treatments, and improve well productivity. A significantly reducing methane emissions associated with plunger lift system is a form of intermittent gas lift that blowdown operations. A plunger lift uses gas pressure uses gas pressure buildup in the casing-tubing annulus to buildup in a well to lift a column of accumulated fluid out push a steel plunger, and the column of fluid ahead of it, of the well. -

Artificial Lift for High-Volume Production

Artificial Lift for High-Volume Production Rod pumps bring oil to surface in many fields, but for better flow rates more than 100,000 wells use subsurface electric pumps or inject external gas to lighten the fluid column. Specialized approaches are needed to optimize existing gas-lift or submersible systems and to design new installations for more complex applications. Roy Fleshman Less than a fourth of producing oil wells flow nat- but there is overlap between systems depending Bartlesville, Oklahoma, USA urally. When a reservoir lacks sufficient energy on subsurface conditions, fluid types, required for oil, gas and water to flow from wells at rates, well inclination angles, depths, comple- Harryson desired rates, supplemental production methods tion configurations, lift-system hardware and Obren Lekic can help. Gas and water injection for pressure surface facilities. Houston, Texas, USA support or secondary recovery maintain well pro- Lift optimization to get the most fluid from a ductivity, but artificial lift is needed when reser- well or field at the lowest cost offers opportuni- voir drives do not sustain acceptable rates or ties for substantial production gains in new wells cause fluids to flow at all in some cases. Lift pro- or mature fields. When selecting and designing cesses transfer energy downhole or decrease lift systems, engineers must consider reservoir fluid density in wellbores to reduce the hydro- and well parameters, but field development static load on formations, so that available reser- strategies should be factored in as well. voir energy causes inflow, and commercial Artificial-lift selection is specialized and often For help in preparation of this article, thanks to Rick Bailey hydrocarbon volumes can be boosted or displaced tedious, but guidelines provide the relative appli- and Duane Russell, Reda, Bartlesville, Oklahoma, USA; to surface.