ETF Factsheet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Exchange Traded Products 1

EXCHANGE TRADED PRODUCTS 1 Product Type Region Listing ETF ETN Future Option Europe Eurozone Americas APAC Global Americas APAC/Africa Europe ISIN BLUE-CHIP INDICES EURO STOXX 50® Index ETFS EURO STOXX 50 ETF x x AU00000ESTX4 iShares EURO STOXX 50 (DE) x x DE0005933956 ComStage 1 EURO STOXX 50 UCITS ETF x x DE000ETF9504 Deka EURO STOXX 50® UCITS ETF x x DE000ETFL029 Deka EURO STOXX 50 (thesaurierend) UCITS ETF x x DE000ETFL466 Accion Eurostoxx 50 ETF, FI Cotizado Armonizado x x ES0105321030 Lyxor EURO STOXX 50 (DR) UCITS ETF - Dist x x FR0007054358 BNP Paribas Easy EURO STOXX 50 UCITS ETF EUR C x x FR0012739431 BNP Paribas Easy EURO STOXX 50 UCITS ETF EUR C/D x x FR0012740983 iSharesCoreEUR STOXX50 UCITS ETF EUR(Dist) x x IE0008471009 HSBC EURO STOXX 50 UCITS ETF x x IE00B4K6B022 iShares Core EURO STOXX 50 UCITS ETF x x IE00B53L3W79 Invesco EURO STOXX 50 UCITS ETF x x IE00B60SWX25 Invesco EURO STOXX 50 UCITS ETF B Dis x x IE00B5B5TG76 UBS ETF - EURO STOXX 50 UCITS ETF (EUR) A-dis x x LU0136234068 db x-trackers Euro Stoxx 50 UCITS ETF (DR) 1D x x LU0274211217 Lyxor Core Euro Stoxx 50 (DR) - UCITS ETF Dist x x LU0908501488 db x-trackers Euro Stoxx 50 UCITS ETF (DR) 1C x x LU0380865021 Lyxor Core EURO STOXX 50 (DR) - UCITS ETF Acc x x LU0908501215 Amundi Euro Stoxx 50 - UCITS ETF DR - EUR (C) x x LU1681047236 Amundi Euro Stoxx 50 - UCITS ETF DR - EUR (D) x x LU1681047319 Amundi Euro Stoxx 50 - UCITS ETF DR - USD (C) x x LU1681047400 Yuanta EURO STOXX 50 ETF x x TW0000066000 SPDR EURO STOXX 50 ETF x x US78463X2027 Sygnia Itrix Eurostoxx50 -

Stoxx® Global 1800 Index

STOXX ® GLOBAL 1800 INDEX A broad yet liquid representation of the world’s developed markets The STOXX Global 1800 Index consists of the 600 largest and most liquid companies in each of the developed Europe, North America and Asia/Pacific regions, currently stemming from 18 countries. It provides a broad representation of the world’s developed markets with a fixed number of 1,800 components. The index contains 600 European, 600 North American and 600 Asian/Pacific stocks represented, respectively, by the STOXX® Europe 600 Index, STOXX® North America 600 Index and STOXX® Asia/Pacific 600 Index. Global 1800 Index Family—Developed Market Benchmark Indices Aggregate of regional 600’s: STOXX Global 1800 Starting point: STOXX STOXX STOXX Europe 600 Asia/Pacific 600 North America 600 Subsets EURO STOXX STOXX Asia/Pacific 600 derived from regional 600’s: EURO STOXX ex STOXX Asia/Pacific • Financials 600 ex • Banks • Japan Subsets of Global 1800 • France • Australia • Germany STOXX Global 1800 ex STOXX Europe 600 • Europe Equal Wt. • North America STOXX Europe 600 ex • Asia/Pacific • Australia • Financials • Canada • Banks • France • UK • Germany • Eurozone • Japan • France • UK • Germany • USA • Health Care STOXX Eastern Europe 300 STOXX Nordic Key Benefits EFFICIENT Gain objective and transparent exposure to a liquid representation REPRESENTATION of the world’s developed markets COUNTRY AND Obtain similar country and industry allocation to underlying markets, SECTORS resulting in a diversified profile GRANULAR Employ derived sub-indices representing -

Stoxx® Europe 600 Ex Germany Index

BROAD INDICES 1 STOXX® EUROPE 600 EX GERMANY INDEX Stated objective Key facts STOXX calculates several ex region, ex country and ex sector indices. » Transparent and rules-based methodology This means that from the main index a specific region, country or sector is excluded. The sector classification is based on ICB » Buffer rule aims to reduce turnover Classification (www.icbenchmark.com.) Some examples: a) Blue-chip ex sector: the EURO STOXX 50 ex Financial Index » Weighted by free-float market cap excludes all companies assigned to the ICB code 8000 b) Benchmark ex region: the STOXX Global 1800 ex Europe Index excludes all companies from Europe c) Benchmark ex country: the STOXX Europe 600 ex UK Index excludes companies from the United Kingdom d) Size ex sector: the STOXX Europe Large 200 ex Banks Index excludes all companies assigned to the ICB code 8300 Descriptive statistics Index Market cap (EUR bn.) Components (EUR bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months STOXX Europe 600 ex Germany Index 8,555.4 6,874.9 13.0 5.7 237.8 1.3 3.5 0.0 2.5 STOXX Europe 600 Index 10,007.1 8,059.4 13.4 5.8 237.8 1.3 3.0 0.0 2.5 Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y STOXX Europe 600 ex Germany Index -2.5 7.6 17.7 21.9 76.1 -24.9 15.3 17.1 6.6 11.7 STOXX Europe 600 Index -2.5 7.6 18.9 22.6 78.6 -24.9 15.3 18.2 6.8 12.0 Index volatility and risk Annualized volatility (%) Annualized Sharpe ratio2 STOXX Europe 600 ex Germany Index 8.2 8.0 9.9 17.4 15.5 -3.5 1.9 1.7 0.4 0.7 STOXX Europe 600 Index 8.5 8.2 10.1 17.5 15.6 -3.3 1.8 1.8 0.4 0.7 Index to benchmark Correlation Tracking error (%) STOXX Europe 600 ex Germany Index 1.0 1.0 1.0 1.0 1.0 0.9 0.8 0.8 1.0 0.9 Index to benchmark Beta Annualized information ratio STOXX Europe 600 ex Germany Index 1.0 1.0 1.0 1.0 1.0 0.1 -0.0 -1.2 -0.2 -0.3 1 For information on data calculation, please refer to STOXX calculation reference guide. -

Ishares STOXX Europe 600 UCITS

iShares STOXX Europe 600 UCITS ETF EXSA (DE) August Factsheet Performance, Portfolio Breakdowns and Net Assets information as at: 31/08/ 2021 All other data as at 07/09/2021 For Investors in Luxembourg. Investors should read the Key Investor Information Document and Capital at risk. All financial investments Prospectus prior to investing. involve an element of risk. Therefore, the value of your investment and the income from it will The Fund seeks to track the performance of an index composed of the 600 largest companies from vary and your initial investment amount cannot European developed countries. be guaranteed. KEY FACTS KEY BENEFITS Asset Class Equity Fund Base Currency EUR Exposure to a broad range of companies from developed countries in Europe 1 Share Class Currency EUR 2 Direct investment to large, mid and small capitalisation companies Fund Launch Date 13/02/2004 Share Class Launch Date 13/02/2004 3 Regional exposure Benchmark STOXX® Europe 600 ISIN DE0002635307 Key Risks: The value of equities and equity-related securities can be affected by daily stock Total Expense Ratio 0,20% Distribution Type Up to 4x per year market movements. Other influential factors include political, economic news, company earnings Domicile Germany and significant corporate events. Counterparty Risk: The insolvency of any institutions providing Methodology Replicated services such as safekeeping of assets or acting as counterparty to derivatives or other Product Structure Physical instruments, may expose the Fund to financial loss. Rebalance Frequency -

Stoxx® Europe 600 Optimised Financial Services Index

OPTIMISED INDICES 1 STOXX® EUROPE 600 OPTIMISED FINANCIAL SERVICES INDEX Index description Key facts The STOXX Europe 600 Optimised Supersector Indices are derived from the » Indices which use liquidity and stock borrowing as explicit factors in STOXX Europe 600 Index, which comprises 600 of the largest European constituent selection to ensure tradability for long and short positions. stocks by free-float market cap. Index components are selected by equity Filters based on liquidity and availability to borrow are applied at the turnover value (three-month average daily turnover value - 3-month ADTV) supersector level. and availability to borrow (based on the average data over seven trading days, as provided by data explorers in EUR). The EURO STOXX Optimised » A sector-dependent liquidity factor reduces the weighting of those components whose average daily turnover, as a fraction of the free-float Banks is derived from the STOXX Europe 600 Optimised Banks Index and market cap, is above the supersector average. This liquidity weighting covers Eurozone companies. methodology enhances the tradability of each index while retaining the free- float market cap weighting across the larger, more liquid stocks. » Single stock weighting caps produce hedging tools that reduce idiosyncratic single-stock exposures, decrease volatility and improve diversification. These percentage weighting caps are defined based on the number of index components to ensure relevance across a heterogeneous group of supersectors. Descriptive statistics Index Market cap -

Gender Diversity Index 2020

European Women on Boards Gender Diversity Index 2020 This project is co-funded by the Rights, Equality and Citizenship Programme of the European Union 668 COMPANIES STUDIED GDI GENDER DIVERSITY INDEX 34% women on boards Perfect gender equality 28% 1 women in general leadership functions Only 62 companies with a GDI of 0.8 or more 0.8 138 companies 17% 0.7 with a GDI of women in executive level of 0.7 or more company decision-makers 0.56 Average Only 42 companies have a female CEO 0.3 50 companies with a GDI of 0.2 0.3 or less 129 companies have at least one female 22 member of the C-suite companies with a GDI of 0.2 or less Only 9% 0 Chairs of Boards are women This project is co-funded by the Rights, Equality and Citizenship Programme of the European Union Content 04 Executive summary 06 Foreword 08 Introduction 11 Terminology 12 Overall findings 25 Commitment to fostering inclusion and diversity 28 Sectoral findings 31 Country findings 97 Annex – Methodology WOMEN ON BOARDS AND IN CORPORATE LEADERSHIP GENDER DIVERSITY INDEX 2020 3 Executive summary The year 2020 saw many disruptions that shook up not only individual businesses but also our entire economies and societies. Besides the direct health consequences This report analyses women’s participation in of COVID-19, the pandemic damaged the corporate governance in the largest European well-being and work-life balance of many companies that are listed in the STOXX 600 employees while also exposing many to Europe index or, in some countries, national redundancies or temporary unemployment stock exchange indexes. -

Key Investor Information Invesco STOXX Europe Small 200 UCITS

Key Investor Information This document provides you with key investor information about this Fund. It is not marketing material. The information is required by law to help you understand the nature and the risks of investing in this Fund. You are advised to read it so you can make an informed decision about whether to invest. Invesco STOXX Europe Small 200 UCITS ETF (the “Fund”) A sub-fund of Invesco Markets plc (the “Umbrella Fund”) Acc (ISIN : IE00B60SWZ49 ) (the “Share Class”) The Fund is managed by Invesco Investment Management Limited, part of the Invesco Group. Objectives and Investment Policy - The Fund is a passively managed Exchange-Traded Fund (ETF), which aims to track the Net Total Return performance of the STOXX Europe Small 200 Index (the “Index”) 1, less fees, expenses and transaction costs. The Index gives a representation of small capitalisation companies in Europe. - The Fund does this through the use of unfunded swaps (“Swaps”).These Swaps are an agreement between the Fund and an approved counterparty to exchange one stream of cash flows against another stream but do not require the Fund to provide collateral, on the basis that the Fund has already invested in a basket of equities and equity related securities (namely shares). The performance of the Index is swapped from the counterparty to the Fund in exchange for the performance of equities and equity related securities. - The Fund shares are listed on one or more Stock Exchange(s).Only Authorised Participants may subscribe or redeem shares directly with the Fund. Other investors can buy or sell shares daily through an intermediary directly or on Stock Exchange(s) on which shares are traded. -

EURO STOXX 50 Index

EURO STOXX 50® Europe’s Leading Blue-Chip Index June 2020 1 | Confidential – Not for Redistribution – Copyright © 2020 Qontigo GmbH. Qontigo is part of Deutsche Börse Group. Content 02 Introduction Drivers of Strategic and Tactical 12 Allocations to the Eurozone 17 Appendix STOXX is now Part of Qontigo… A new financial intelligence driver, modernizing investment management Index Analytics STOXX & DAX AXIOMA World-class indices that are licensed to more Best of breed portfolio construction and risk than 500 companies, including the world’s analytics tools. largest financial product issuers, capital owners and asset managers. 3 | Confidential – Not for Redistribution – Copyright © 2020 Qontigo GmbH. Qontigo is part of Deutsche Börse Group. EURO STOXX 50® - A Unique Offering for Liquid, Diversified Access to the Eurozone Features Regional Coverage1) ▪ Comprehensive and transparent: completely rules-based coverage of the Eurozone1) ▪ Balanced: selection mechanism ensures balanced representation of supersectors using Industry Classification Benchmark (ICB) ▪ Representative and liquid: coverage of about 60% of total free-float through liquid supersector leaders. Components ranked and weighted by free-float subject to 10% cap ▪ Continuous pulse on market changes: quarterly rebalancing, annual review ▪ Established: launched on Feb. 26, 1998 1) Country composition as of March 2020: Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands and Spain 4 | Confidential – Not for Redistribution – Copyright © 2020 Qontigo GmbH. Qontigo is part of Deutsche Börse Group. Methodology Leads to Balanced Representation of Eurozone Supersector Leaders Sub- Universe universes Pre-selection Selection Weighting ... rank stocks by free- EURO STOXX® Select 50 largest float and select largest (covers approximately Within each of the 19 stocks as measured Weight by free-float stocks jointly by free-float from all subject to 10% cap 95% of Eurozone free- supersectors .. -

Stoxx® Europe 600 Index

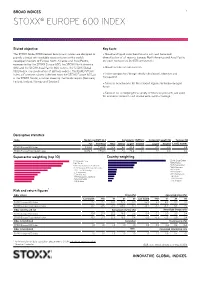

BROAD INDICES 1 STOXX® EUROPE 600 INDEX Stated objective Key facts The STOXX Global 1800 derived benchmark indices are designed to » Broad and liquid index benchmarks with well-balanced provide a broad yet investable representation of the world's diversification of all regions: Europe, North America and Asia/Pacific developed markets of Europe, North America and Asia/Pacific, are each represented by 600 components represented by the STOXX Europe 600, the STOXX North America 600 and the STOXX Asia/Pacific 600 indices.The STOXX Global » Broad number of components 1800 Index is a combination of all three indices. The EURO STOXX Index, a Eurozone subset, is derived from the STOXX Europe 600, as » Index composition/design strictly rules based, objective and is the STOXX Nordic, a subset covering the Nordic region (Denmark, transparent Finland, Iceland, Norway and Sweden). » Serve as benchmarks for the relevant regions/actively managed funds » Serve as an underlying for a variety of financial products, are used for academic research and receive wide media coverage Descriptive statistics Index Market cap (EUR bn.) Components (EUR bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months STOXX Europe 600 Index 9,100.2 7,368.8 12.3 5.3 211.4 1.0 2.9 0.0 2.8 STOXX Europe Total Market Index 10,074.9 7,936.3 7.5 2.3 211.4 0.1 2.7 0.0 3.0 Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month -

“COVID-19 and Investor Sentiment Influence on the US and European Countries Sector Returns”

“COVID-19 and investor sentiment influence on the US and European countries sector returns” Pedro Manuel Nogueira Reis https://orcid.org/0000-0003-1301-6645 https://publons.com/researcher/1887144/pedro-m-nogueira-reis/ AUTHORS Carlos Pinho https://orcid.org/0000-0002-7422-4555 https://publons.com/researcher/C-2033-2015 Pedro Manuel Nogueira Reis and Carlos Pinho (2020). COVID-19 and investor ARTICLE INFO sentiment influence on the US and European countries sector returns. Investment Management and Financial Innovations, 17(3), 373-386. doi:10.21511/imfi.17(3).2020.28 DOI http://dx.doi.org/10.21511/imfi.17(3).2020.28 RELEASED ON Thursday, 08 October 2020 RECEIVED ON Thursday, 09 July 2020 ACCEPTED ON Tuesday, 29 September 2020 LICENSE This work is licensed under a Creative Commons Attribution 4.0 International License JOURNAL "Investment Management and Financial Innovations" ISSN PRINT 1810-4967 ISSN ONLINE 1812-9358 PUBLISHER LLC “Consulting Publishing Company “Business Perspectives” FOUNDER LLC “Consulting Publishing Company “Business Perspectives” NUMBER OF REFERENCES NUMBER OF FIGURES NUMBER OF TABLES 33 2 7 © The author(s) 2021. This publication is an open access article. businessperspectives.org Investment Management and Financial Innovations, Volume 17, Issue 3, 2020 Pedro Manuel Nogueira Reis (Portugal), Carlos Pinho (Portugal) COVID-19 and investor BUSINESS PERSPECTIVES sentiment influence LLC “СPС “Business Perspectives” Hryhorii Skovoroda lane, 10, on the US and European Sumy, 40022, Ukraine www.businessperspectives.org countries sector returns Abstract Although some studies recently address the association between COVID-19 sentiment and returns, volatility, or stock trading volume, no one conducts an analysis to measure the impact of investor rationality or irrationality on the influence on countries and sectors’ returns. -

An Introduction to the STOXX® Europe 600 ESG-X Index 2 Figure 2 STOXX Europe 600 STOXX Europe 600 ESG-X Characteristics Number of Stocks 600 581

Insights ESG An Introduction to the STOXX® September 2019 Europe 600 ESG-X Index The STOXX Europe 600 ESG-X index employs a straightforward exclusion methodology that allows investors to eliminate certain types of exposure, without significant performance deviation from the parent benchmark. The STOXX Europe 600 ESG-X index, with its straightforward approach to index construction, includes product involvement screening for controversial weapons, tobacco and thermal coal as well as norms-based screening that follows the Ten Principles of the UN Global Compact, which cover human and labour rights, the environment, business ethics and anti-corruption. The STOXX Europe 600 ESG-X index delivers a risk-return performance profile that is, statistically, not significantly different to the STOXX Europe 600 index, but at the same time achieves compliance with the typical exclusion-based SRI approaches. The STOXX Europe 600 ESG-X shares the same rules, sector composition and methodology (including the same transparent free-float market-cap weighting scheme) as the STOXX Europe 600 index, which is a broad pan-European equity index containing the largest and most frequently traded equity securities. A ‘Fast Exit’ rule in the new index secures a swift response to any severe ESG controversy by quickly removing offenders, thus limiting investors’ risks. Key Points • Compliant with typical exclusion-based SRI approaches1 • Tier-1 ESG data provider, Sustainalytics • Risk-return profile similar to STOXX Europe 600 • No strong unintended biases or exposures resulting from exclusions, enabling investors to easily implement and adopt index as ESG-screened benchmark • Simplicity of methodology makes index suitable as underlying for derivatives and structured products • Innovative ‘Fast Exit’ feature allows index to adapt quickly to major controversies • Liquid futures traded, with appx. -

Stoxx® Europe 600 Technology Index

SUPERSECTOR INDICES 1 STOXX® EUROPE 600 TECHNOLOGY INDEX Index description Key facts The STOXX Supersector indices track supersectors of the relevant »Categorization according to their primary source of revenue guarantees an benchmark index. There are 20 supersectors according to the Industry accurate classification of companies in their respective business Classification Benchmark (ICB). Companies are categorized according to environments their primary source of revenue. The following supersectors are available: Technology, Telecommunications, Health Care, Banks, Financial Services, »Component capping ensures that no component can dominate the index Insurance, Real Estate, Automobiles and Parts, Consumer Products and Services, Media, Retail, Travel and Leisure, Food, Beverage and Tobacco, Personal Care, Drug and Grocery Stores, Construction and Materials, Industrial Goods and Services, Basic Resources, Chemicals, Energy, Utilities. Descriptive statistics Index Market cap (EUR bn.) Components (EUR bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months STOXX Europe 600 Technology Index 982.5 789.4 21.9 5.8 249.6 2.8 31.6 0.3 35.8 STOXX Europe 600 Index 13,124.6 10,434.8 17.4 7.4 308.4 1.6 3.0 0.0 3.1 Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y STOXX Europe 600 Technology Index 6.2 34.2 39.0 73.5 138.3 N/A N/A 39.6 20.5 19.3 STOXX Europe 600 Index 2.2 20.6