Combining Private 5G & Edge Computing: the Revenue Opportunity

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

State of Mobile Networks: Australia (November 2018)

State of Mobile Networks: Australia (November 2018) Australia's level of 4G access and its mobile broadband speeds continue to climb steadily upwards. In our fourth examination of the country's mobile market, we found a new leader in both our 4G speed and availability metrics. Analyzing more than 425 million measurements, OpenSignal parsed the 3G and 4G metrics of Australia's three biggest operators Optus, Telstra and Vodafone. Report Facts 425,811,023 31,735 Jul 1 - Sep Australia Measurements Test Devices 28, 2018 Report Sample Period Location Highlights Telstra swings into the lead in our download Optus's 4G availability tops 90% speed metrics Optus's 4G availability score increased by 2 percentage points in the A sizable bump in Telstra's 4G download speed results propelled last six months, which allowed it to reach two milestones. It became the the operator to the top of our 4G download speed and overall first Australian operator in our measurements to pass the 90% threshold download speed rankings. Telstra also became the first in LTE availability, and it pulled ahead of Vodafone to become the sole Australian operator to cross the 40 Mbps barrier in our 4G winner of our 4G availability award. download analysis. Vodafone wins our 4G latency award, but Telstra maintains its commanding lead in 4G Optus is hot on its heels upload Vodafone maintained its impressive 4G latency score at 30 While the 4G download speed race is close among the three operators milliseconds for the second report in row, holding onto its award in Australia, there's not much of a contest in 4G upload speed. -

Separation of Telstra: Economic Considerations, International Experience

WIK-Consult Report Study for the Competitive Carriers‟ Coalition Separation of Telstra: Economic considerations, international experience Authors: J. Scott Marcus Dr. Christian Wernick Kenneth R. Carter WIK-Consult GmbH Rhöndorfer Str. 68 53604 Bad Honnef Germany Bad Honnef, 2 June 2009 Functional Separation of Telstra I Contents 1 Introduction 1 2 Economic and policy background on various forms of separation 4 3 Case studies on different separation regimes 8 3.1 The Establishment of Openreach in the UK 8 3.2 Functional separation in the context of the European Framework for Electronic Communication 12 3.3 Experiences in the U.S. 15 3.3.1 The Computer Inquiries 15 3.3.2 Separate affiliate requirements under Section 272 17 3.3.3 Cellular separation 18 3.3.4 Observations 20 4 Concentration and cross-ownership in the Australian marketplace 21 4.1 Characteristics of the Australian telecommunications market 22 4.2 Cross-ownership of fixed, mobile, and cable television networks 27 4.3 The dominant position of Telstra on the Australian market 28 5 An assessment of Australian market and regulatory characteristics based on Three Criteria Test 32 5.1 High barriers to entry 33 5.2 Likely persistence of those barriers 35 5.3 Inability of other procompetitive instruments to address the likely harm 38 5.4 Conclusion 38 6 The way forward 39 6.1 Regulation or separation? 40 6.2 Structural separation, or functional separation? 42 6.3 What kind of functional separation? 44 6.3.1 Overview of the functional separation 44 6.3.2 What services and assets should be assigned to the separated entity? 47 6.3.3 How should the separation be implemented? 49 Bibliography 52 II Functional Separation of Telstra Recommendations Recommendation 1. -

PUBLIC NOTICE FEDERAL COMMUNICATIONS COMMISSION 445 12Th STREET S.W

PUBLIC NOTICE FEDERAL COMMUNICATIONS COMMISSION 445 12th STREET S.W. WASHINGTON D.C. 20554 News media information 202-418-0500 Internet: http://www.fcc.gov (or ftp.fcc.gov) TTY (202) 418-2555 DA No. 09-2218 Report No. TEL-01391 Thursday October 15, 2009 INTERNATIONAL AUTHORIZATIONS GRANTED Section 214 Applications (47 C.F.R. § 63.18); Section 310(b)(4) Requests The following applications have been granted pursuant to the Commission’s streamlined processing procedures set forth in Section 63.12 of the Commission’s rules, 47 C.F.R. § 63.12, other provisions of the Commission’s rules, or procedures set forth in an earlier public notice listing applications accepted for filing. Unless otherwise noted, these grants authorize the applicants (1) to become a facilities-based international common carrier subject to 47 C.F.R. § 63.22; and/or (2) to become a resale-based international common carrier subject to 47 C.F.R. § 63.23; or (3) to exceed the 25 percent foreign ownership benchmark applicable to common carrier radio licensees under 47 U.S.C. § 310(b)(4). THIS PUBLIC NOTICE SERVES AS EACH NEWLY AUTHORIZED CARRIER'S SECTION 214 CERTIFICATE. It contains general and specific conditions, which are set forth below. Newly authorized carriers should carefully review the terms and conditions of their authorizations. Failure to comply with general or specific conditions of an authorization, or with other relevant Commission rules and policies, could result in fines and forfeitures. Petitions for reconsideration under Section 1.106 or applications for review under Section 1.115 of the Commission's rules in regard to the grant of any of these applications may be filed within thirty days of this public notice (see Section 1.4(b)(2)). -

Telstra Corporation Limited (‘Telstra’) Welcomes the Opportunity to Make a Submission to the USPTO on Prior User Rights

Introduction Telstra Corporation Limited (‘Telstra’) welcomes the opportunity to make a submission to the USPTO on prior user rights. As Australia’s leading telecommunications and information services company, Telstra provides customers with a truly integrated experience across fixed line, mobiles, broadband, information, transaction, search and pay TV. Telstra BigPond is Australia’s leading Internet Service Provider offering retail internet access nationally, along with a range of online and mobile content and value added services One of our major strengths in providing integrated telecommunications services is our vast geographical coverage through both our fixed and mobile network infrastructure. This network and systems infrastructure underpins the carriage and termination of the majority of Australia's domestic and international voice and data telephony traffic. Telstra has an extensive intellectual property portfolio, including trade mark and patent rights in Australian and overseas. Telstra is also a licensor and a licensee of intellectual property, including a licensee of online and digital content. The prior user exemptions to infringement under Australian and other countries’ (such as Japanese, EU and Canadian) law are important mechanisms that allow companies or individuals to continue activities legitimately undertaken prior to the grant of a third party patent. It’s Telstra’s submission that harmonisation of US laws to recognise and adopt similar prior user provisions would be welcomed to similarly provide certainty for commercial practices and investment. Our response below focuses on those aspects of the study into prior user rights that are of particular interest or concern to Telstra. 1a. Please share your experiences relating to the use of prior user rights in foreign jurisdictions including, but not limited to, members of the European Union and Japan, Canada, and Australia. -

Getting to Know Your Telstra Pre-Paid 3G Wi-Fi Let’S Get This Show on the Road

GETTING TO KNOW YOUR TELSTRA PRE-PAID 3G WI-FI LET’S GET THIS SHOW ON THE ROAD You must be excited about your brand new Telstra Pre-Paid 3G Wi-Fi. This guide will help you get connected as quickly and as easily as possible. It’ll guide you through installation and run through all the handy extra features that are included. If all goes to plan you’ll be up and running in no time, so you can get connected while you’re on the move. 2 WHAT’S INSIDE 03 Safety first 06 Let’s get started 13 Getting connected 25 Wi-Fi home page 20 Extra features 22 Problem solving 25 Extra bits you should know 2 SAFETY FIRST Please read all the safety notices before using this device. This device is designed to be used at least 20cm from your body. Do not use the device near fuel or chemicals or in any prescribed area such as service stations, refineries, hospitals and aircraft. Obey all warning signs where posted. RADIO FREQUENCY SAFETY INFORMATION The device has an internal antenna. For optimum performance with minimum power consumption do not shield the device or cover with any object. Covering the antenna affects signal quality, may cause the router to operate at a higher power level than needed, and may shorten battery life. RADIO FREQUENCY ENERGY Your wireless device is a low-power radio transmitter and receiver. When switched on it intermittently transmits radio frequency (RF) energy (radio waves). The transmit power level is optimised for best performance and automatically 3 4 reduces when there is good quality reception. -

The State of 5G Trials

The State of Trials Courtesy of 5G Data Speeds Shows the highest claimed data speeds reached during 5G trials, where disclosed 36 Gb/s Etisalat 35.46 Gb/s Ooredoo 35 Gb/s M1 35 Gb/s StarHub 35 Gb/s Optus 20 Gb/s Telstra 20 Gb/s Vodafone UK 15 Gb/s Telia 14 Gb/s AT&T 12 Gb/s T-Mobile USA 11.29 Gb/s NTT DoCoMo 10 Gb/s Vodafone Turkey 10 Gb/s Verizon 10 Gb/s Orange France 9 Gb/s US Cellular 7 Gb/s SK Telecom 5.7 Gb/s SmartTone 5 Gb/s Vodafone Australia 4.5 Gb/s Sonera 4 Gb/s Sprint 2.3 Gb/s Korea Telecom 2.2 Gb/s C Spire 5G Trial Spectrum Shows the spectrum used by operators during 5G trials, where disclosed Telstra Optus NTTDoCoMo AT&T AT&T AT&T AT&T Verizon Vodafone Korea Vodafone Bell Vodafone StarHub UK Telecom Turkey Canada Turkey Sonera China SmarTone C Spire Verizon Mobile M1 Vodafone Sprint Korea Australia Telecom Optus Telia NTT DoCoMo Sprint Turkcell SK Telecom US Cellular T-Mobile USA Verizon US Cellular Verizon SUB 3 3.5 4.5 SUB 6 15 28 39 64 70 70-80 71-76 73 81-86 60-90 GHTZ Operator 5G Trials Shows the current state of 5G progress attained by operators Announced 5G trials Lab testing 5G Field testing 5G Operators that have announced timings of Operators that have announced Operators that have announced that they trials or publicly disclosed MoUs for trials that they have lab tested 5G have conducted 5G testing in the field Equipment Providers in 5G Trials Shows which equipment providers are involved in 5G trials with operators MTS T-Mobile USA SK Telekom Verizon Batelco Turkcell AT&T Bell Canada Sonera SmarTone Vodafone Orange BT Taiwan Germany Telia Mobile Telstra C Spire Vodafone US Cellular Vodafone Turkey M1 Australia MTS Ooredoo M1 NTT Docomo Optus Orange China StarHub Mobile Korea Telecom 5G trials with all five equipment providers Telefonica Deutsche Telekom Etisalat Telus Vodafone UK Viavi (NASDAQ: VIAV) is a global provider of network test, monitoring and assurance solutions to communications service providers, enterprises and their ecosystems. -

LTE-M & NB-Iot Measurements in Australia

Audit Report. LTE-M & NB-IoT measurements in Australia umlaut report umlaut report Foreword umlaut has tested the quality of the Mobile Networks in the Australian The company is headquartered in market and took a detailed look into Aachen, Germany and is a world the LTE-M & NB-IoT scanner mea- leader in mobile network testing and surements of the operators offering benchmarking. these services. 2 3 umlaut report umlaut report Report facts Testing Area 48,000 km States measured driven km Australian Capital Territory Victoria Northern Territory W43 2019 Western Australia to W48 2019 South Australia Data collection Queensland time period Tasmania The map shows the total driving area for Australia. The routes were independently selected by umlaut. 4 5 umlaut report umlaut report Overall coverage comparison per region NB-IoT and LTE-M technologies overall NB-IoT coverage comparison LTE-M coverage comparison coverage comparison per region per region per region Telstra Vodafone Telstra Vodafone Telstra Vodafone 100 100 100 The observation period was between CW43 2019 and CW48 2019. Telstra shows a higher NB-IoT coverage than Vodafone in [%] [%] [%] all eight Australian regions. Telstra is the only operator to deploy LTE-M technology in Australia showing high signal network coverage country wide. 0 0 0 South South South Overall Overall Overall Victoria Victoria Victoria Western Western Western Territory Territory Territory Australia Australia Australia Australia Australia Australia Northern Northern Northern Tasmania Tasmania Tasmania New South New South New South Queensland Queensland Queensland Wales & ACT Wales & ACT Wales & ACT 6 7 umlaut report umlaut report Signal coverage level and quality comparison per region (total) Telstra shows higher average values for NB-IoT signal Telstra shows an average of -10,4 dB for NB-IoT signal Telstra shows an average of -15,5 dB for LTE-M signal net- network coverage (NRSRP) than Vodafone in 6 out of 8 network quality (NRSRQ) and is slightly worse (~1dB) than work quality (RSRQ) in all Australian regions. -

21143 5G in China Report V2.Indd

5G in China: the enterprise story More than another G of speed? Copyright © 2018 GSM Association 5G IN CHINA: THE ENTERPRISE STORY GSMA Intelligence The GSMA represents the interests of mobile GSMA Intelligence is the definitive source of global operators worldwide, uniting nearly 800 operators mobile operator data, analysis and forecasts, and with more than 300 companies in the broader publisher of authoritative industry reports and mobile ecosystem, including handset and device research. makers, software companies, equipment providers Our data covers every operator group, network and internet companies, as well as organisations in and MVNO in every country worldwide – from adjacent industry sectors. The GSMA also produces Afghanistan to Zimbabwe. It is the most accurate industry-leading events such as Mobile World and complete set of industry metrics available, Congress, Mobile World Congress Shanghai, Mobile comprising tens of millions of individual data points, World Congress Americas and the Mobile 360 Series updated daily. of conferences. GSMA Intelligence is relied on by leading operators, For more information, please visit the GSMA vendors, regulators, financial institutions and corporate website at www.gsma.com third-party industry players, to support strategic Follow the GSMA on Twitter: @GSMA decision-making and long-term investment planning. The data is used as an industry reference point and is frequently cited by the media and by the industry itself. Our team of analysts and experts produce regular thought-leading research reports across a range of industry topics. GTI (Global TD-LTE Initiative), founded in 2011, has been dedicated to constructing a robust ecosystem www.gsmaintelligence.com of TD-LTE and promoting the convergence of [email protected] LTE TDD and FDD. -

Connect the World to Innovate and Share a Good Smart Living 2 CHINA UNICOM (HONG KONG) LIMITED CONTENTS

CHINA UNICOM (HONG KONG) LIMITED KONG) (HONG UNICOM CHINA CHINA UNICOM (HONG KONG) LIMITED HKEx : 0762 NYSE : CHU CORPORATE SOCIAL RESPONSIBILITY REPORT 2016 CHINA UNICOM (HONG KONG) LIMITED CORPORATE SOCIAL RESPONSIBILITY REPORT 2016 75th Floor, The Center, 99 Queen’s Road Central, Hong Kong www.chinaunicom.com.hk Connect the World to Innovate and Share a Good Smart Living 2 CHINA UNICOM (HONG KONG) LIMITED CONTENTS Message from Chairman 4 INTRODUCTION About us 6 FOCUS DEVELOPMENT Concerns of stakeholders Stable and Orderly Business Operation Uninterrupted, secure and quality in compliance with Laws and Regulations 8 network Favorable, applicable and user- Anti-corruption and integrity advocacy 11 friendly product Laws and regulation enforcement 11 Effective protection of client rights Risk management and control 11 Convenient and highly effective service channels Focus Development to INNOVATIVE DEVELOPMENT Improve Quality and Efficiency 12 Concerns of stakeholders Deploy quality network 14 Market-oriented innovation system Develop quality products 18 Rich and diversified innovation Commit to quality services 21 services Enrich supply of terminals 25 Focused technical innovation In-depth reform promoting development Drive Reform by Innovative Development 26 Build innovation system 28 COOPERATIVE DEVELOPMENT Pave way in key business areas 29 Concerns of stakeholders Carry out proprietary research and development 36 Open and synergistic cooperative Deepen corporate reform 37 platform Diversified and mutually-benefited partners Cooperative -

The Carrier Wi-Fi Summit

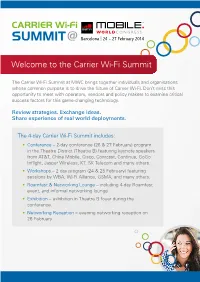

Welcome to the Carrier Wi-Fi Summit The Carrier Wi-Fi Summit at MWC brings together individuals and organisations whose common purpose is to drive the future of Carrier Wi-Fi. Don’t miss this opportunity to meet with operators, vendors and policy makers to examine critical success factors for this game-changing technology. Review strategies. Exchange ideas. Share experience of real world deployments. The 4-day Carrier Wi-Fi Summit includes: • Conference – 2-day conference (26 & 27 February) program in the Theatre District (Theatre B) featuring keynote speakers from AT&T, China Mobile, Cisco, Comcast, Continua, GoGo Inflight, Jasper Wireless, KT, SK Telecom and many others. • Workshops – 2 day program (24 & 25 February) featuring sessions by WBA, Wi-Fi Alliance, GSMA, and many others. • Roamfest & Networking Lounge – including 4-day Roamfest event, and informal networking lounge. • Exhibition – exhibition in Theatre B foyer during the conference. • Networking Reception – evening networking reception on 26 February. Industry partners Principal sponsor Premier sponsor Associate sponsor Roamfest sponsors Conference sponsors Notes: Red: C15 M100 Y80 K0 wireless Exhibitors Register now Conference program | 26 February 26 February JR Wilson, Chairman, WBA and VP, AT&T – Opening address – Transforming Connected World with Next 9:30 Generation Wi-Fi Dr. Reza Jafari, Chairman & CEO, e-Development International – Evolving role of Wi-Fi for operators and driving 9:45 societal benefit Panel Discussion: Global Role of Wi-Fi in ICT Moderator: Dr Reza Jafari, Chairman and CEO of e-Development International 10.00 Diego Molano Vega, Colombian ICT Minister Selina Lo, CEO, Ruckus Wireless JR Wilson, Chairman, WBA and VP, AT&T 10:45 Refreshment break Panel Discussion: Connected lifestyle – Vision 2020 Moderator: Mohan Gyani, Independent Telecommunications Professional 11:00 Kris Rinne, Senior vice president, architecture and planning, AT&T Bill Huang, General Manager, China Mobile Research Institute Dr. -

Ocde Oecd Organisation De Coop?Ation Et Organisation for Economic De D?Eloppement ?Onomiques Co-Operation and Development

OCDE OECD ORGANISATION DE COOP?ATION ET ORGANISATION FOR ECONOMIC DE D?ELOPPEMENT ?ONOMIQUES CO-OPERATION AND DEVELOPMENT COMMUNICATIONS OUTLOOK 1999 TELECOMMUNICATIONS: Regulatory Issues Country: KOREA Date completed: 6 August 1998 The attached questionnaire was undertaken in preparation for the biennial OECD Communications Outlook. The responses provided by countries on telecommunication regulation were used to provide information supporting the analytical sections published in association with data. A similar questionnaire with responses on broadcasting regulation is also available. In some cases, data for individual firms, used to compile OECD totals, have not been published at the request of the respondent. For further information, including data, see OECD Communications Outlook 1999 and http://www.oecd.org/dsti/sti/it/index.htm TELECOMMUNICATIONS Market Structure and Regulatory Status (Questions 1 -13) 1. Please provide details of the regulation of communication infrastructure, including the public switched telecommunication network (PSTN), provision in your country. Infrastructure provision for following service Regulatory Status (e.g. Number of licensed monopoly, duopoly, limited operators (1998) number, fully open to any applicant) Local PSTN Monopoly 1 (the second licensed operator is scheduled to operate from 1999) National PSTN Limited Competition 3 International PSTN Limited Competition 3 Analogue Cellular Mobile (e.g. NMT etc.) Monopoly 1 Digital Cellular Mobile (e.g. GSM etc.) Duopoly 2 Other Mobile PCS Limited Competition 3 Communication CT-2 Monopoly 1 Wireless Data Limited Competition 3 TRS Limited Competition 11 (two national operators and nine regional operators) Paging Limited Competition 13 (one national operator and twelve regional operators) Payphones Monopoly 1 2. Please provide details for the major public telecommunication operator (PTO) of public switched telecommunication services in your country. -

Share Swap Between Telefónica and China Unicom

La Dirección Estratégica de la Empresa. Teoría y Aplicaciones L.A. Guerras y J.E. Navas Thomson-Civitas, 2007, 4th edition www.guerrasynavas.com SHARE SWAP BETWEEN TELEFÓNICA AND CHINA UNICOM Miriam Delgado Verde Universidad Complutense de Madrid In 2005, Telefónica and China Unicom entered into a strategic alliance with the aim to operate jointly in the telecommunications industry. Initially, it took the form of a minority holding by the Spanish company in its Far Eastern counterpart when Telefónica purchased 5.38% of the Chinese operator’s capital. This initial operation was reinforced in September 2009 with a share swap between both companies, whereby Telefónica’s investment rose to 8.06% of China Unicom’s capital, whereas the latter acquired 0.9% of the Spanish telephone company. Through this new operation, Telefónica acquired a further 694 million shares, up to the aforementioned percentage, whilst China Unicom undertook to acquire 40.7 million shares in the Spanish company, which meant an investment by each party of one billion dollars (around 700 million euros at the prevailing rate of exchange). The partners agreed to keep possession of the shares for at least a year, although the agreement included joint operations over the following three years, unless either one of the parties should discharge the contract with six months’ prior notice. These joint operations included shared procurement, the development of common platforms for mobile phone services and the provision of services to multinational customers. One of the agreement’s clauses laid down a restriction on any investment in the share capital of each other’s rival companies.