Adopted 12-12-18 MINUTES TAX REFORM and RELIEF

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2019-2020 PAC Contributions

2019-2020 Election Cycle Contributions State Candidate or Committee Name Party -District Total Amount ALABAMA Sen. Candidate Thomas Tuberville R $5,000 Rep. Candidate Jerry Carl R-01 $2,500 Rep. Michael Rogers R-03 $1,500 Rep. Gary Palmer R-06 $1,500 Rep. Terri Sewell D-07 $10,000 ALASKA Sen. Dan Sullivan R $3,800 Rep. Donald Young R-At-Large $7,500 ARIZONA Sen. Martha McSally R $10,000 Rep. Andy Biggs R-05 $5,000 Rep. David Schweikert R-06 $6,500 ARKANSAS Sen. Thomas Cotton R $7,500 Rep. Rick Crawford R-01 $2,500 Rep. French Hill R-02 $9,000 Rep. Steve Womack R-03 $2,500 Rep. Bruce Westerman R-04 $7,500 St. Sen. Ben Hester R-01 $750 St. Sen. Jim Hendren R-02 $750 St. Sen. Lance Eads R-07 $750 St. Sen. Milton Hickey R-11 $1,500 St. Sen. Bruce Maloch D-12 $750 St. Sen. Alan Clark R-13 $750 St. Sen. Breanne Davis R-16 $500 St. Sen. John Cooper R-21 $750 St. Sen. David Wallace R-22 $500 St. Sen. Ronald Caldwell R-23 $750 St. Sen. Stephanie Flowers D-25 $750 St. Sen. Eddie Cheatham D-26 $750 St. Sen. Trent Garner R-27 $750 St. Sen. Ricky Hill R-29 $500 St. Sen. Jane English R-34 $1,500 St. Rep. Lane Jean R-02 $500 St. Rep. Danny Watson R-03 $500 St. Rep. DeAnn Vaught R-04 $500 St. Rep. David Fielding D-05 $500 St. Rep. Matthew Shepherd R-06 $1,000 St. -

THE LIST from Talk Business & Politics Managed by Trey Baldwin (@Baldwinar) & Jason Tolbert (@Tolbertobu) Send Inquiries by Email to [email protected]

THE LIST From Talk Business & Politics Managed by Trey Baldwin (@BaldwinAR) & Jason Tolbert (@TolbertOBU) Send inquiries by email to [email protected] R-Republican; D-Democrat; L-Libertarian; G-Green; I-Independent FEDERAL OFFICES – 4 SEATS ON THE BALLOT U.S. Congress – District 1 Rep. Rick Crawford – R (incumbent) Robert Butler – D U.S. Congress – District 2 Rep. French Hill – R (incumbent) Paul Spencer – D Gwen Combs – D Natashia Burch Hulsey - I U.S. Congress – District 3 Rep. Steve Womack – R (incumbent) Robb Ryerse – R Joshua Mahony – D U.S. Congress – District 4 Rep. Bruce Westerman – R (incumbent) Michael Barrett – I Lee McQueen - I Tom Canada - L CONSTITUTIONAL OFFICES – 7 SEATS ON THE BALLOT Governor Gov. Asa Hutchinson – R (incumbent) Jan Morgan – R (has formed exploratory committee) Mark West – L Lt. Governor Lt. Gov. Tim Griffin - R (incumbent) Attorney General Attorney General Leslie Rutledge - R (incumbent) Secretary of State Commissioner of State Lands John Thurston – R State Rep. Trevor Drown – R Anthony Bland – D Susan Inman - D Auditor of State Auditor Andrea Lea - R (incumbent) Treasurer of State Treasurer Dennis Milligan - R (incumbent) Commissioner of State Lands Tommy Land – R Alex Ray – R (Incumbent Land Commissioner John Thurston term-limited; running for Secretary of State post) ARKANSAS STATE SENATE – 18 SEATS ON THE BALLOT District 3 State Sen. Cecile Bledsoe – R (incumbent) District 4 State Rep. Greg Leding – D (Incumbent State Sen. Uvalde Lindsey not seeking re-election) District 5 State Sen. Bryan King – R (incumbent) State Rep. Bob Ballinger – R District 6 State Sen. Gary Stubblefield District 8 State Rep. -

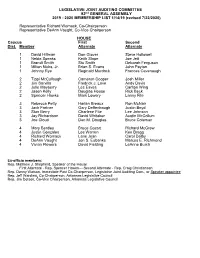

LEGISLATIVE JOINT AUDITING COMMITTEE 92Nd GENERAL ASSEMBLY 2019 - 2020 MEMBERSHIP LIST 1/14/19 (Revised 7/22/2020)

LEGISLATIVE JOINT AUDITING COMMITTEE 92nd GENERAL ASSEMBLY 2019 - 2020 MEMBERSHIP LIST 1/14/19 (revised 7/22/2020) Representative Richard Womack, Co-Chairperson Representative DeAnn Vaught, Co-Vice Chairperson HOUSE Caucus First Second Dist. Member Alternate Alternate 1 David Hillman Don Glover Steve Hollowell 1 Nelda Speaks Keith Slape Joe Jett 1 Brandt Smith Stu Smith Deborah Ferguson 1 Milton Nicks, Jr. Brian S. Evans John Payton 1 Johnny Rye Reginald Murdock Frances Cavenaugh 2 Tippi McCullough Cameron Cooper Josh Miller 2 Jim Sorvillo Fredrick J. Love Andy Davis 2 Julie Mayberry Les Eaves Carlton Wing 2 Jasen Kelly Douglas House Rick Beck 2 Spencer Hawks Mark Lowery Lanny Fite 3 Rebecca Petty Harlan Breaux Ron McNair 3 Jack Fortner Gary Deffenbaugh Justin Boyd 3 Stan Berry Charlene Fite Lee Johnson 3 Jay Richardson David Whitaker Austin McCollum 3 Joe Cloud Dan M. Douglas Bruce Coleman 4 Mary Bentley Bruce Cozart Richard McGrew 4 Justin Gonzales Les Warren Ken Bragg 4 Richard Womack Lane Jean Carol Dalby 4 DeAnn Vaught Jon S. Eubanks Marcus E. Richmond 4 Vivian Flowers David Fielding LeAnne Burch Ex-officio members: Rep. Matthew J. Shepherd, Speaker of the House First Alternate - Rep. Spencer Hawks----Second Alternate - Rep. Craig Christiansen Rep. Danny Watson, Immediate Past Co-Chairperson, Legislative Joint Auditing Com., or Speaker appointee Rep. Jeff Wardlaw, Co-Chairperson, Arkansas Legislative Council Rep. Jim Dotson, Co-Vice Chairperson, Arkansas Legislative Council ARKANSAS LEGISLATIVE COUNCIL 92nd GENERAL ASSEMBLY 2019 - 2020 MEMBERSHIP LIST 1/14/19 (revised 7/22/2020) Representative Jeff Wardlaw, Co-Chairperson Representative Jim Dotson, Co-Vice Chairperson HOUSE Caucus First Second Dist. -

2020 Game and Fish Wildlife Conservation Education Grant

Wildlife Conservation Education Grant Program Funding Recommendations Report Fiscal Year 2020 Cycle 1 County Organization Narrative Requested Senator Representative Recommendation Arkansas DeWitt High School DeWitt High School received $2,500.00 to purchase $5,399.00 Jonathan Dismang David Hillman $2,500.00 equipment for ANASP. DeWitt High School DeWitt High School received $4,000.00 to purchase $8,596.16 Jonathan Dismang David Hillman $4,000.00 clays and targets for AYSSP. Stuttgart High School Stuttgart High School received $2,503.60 to purchase $15,791.33 Jonathan Dismang David Hillman $2,503.60 ammo, shooting vests, barrel rests, clays and hearing protection for AYSSP. Stuttgart High School Stuttgart High School received $2,000.00 to purchase $8,387.57 Jonathan Dismang David Hillman $2,000.00 duck boxes, education books, signs, game cameras, bat houses, and seeds for Project WILD. Dock and drone items were not approved for purchase. Arkansas County Arkansas County Conservation District received $12,000.00 Jonathan Dismang David Hillman $5,500.00 Conservation District $5,500.00 to purchase plants and materials to create school yard habitats for Holy Rosary Catholic School and St. John's Lutheran School and the rennovation of the DeWitt High School school yard habitat. County Account $16,503.60 5 record(s) totaling $16,503.60 Ashley Crossett School District Crossett School received $1,811.49 to purchase ammo, $5,360.00 Eddie Cheatham LeAnne Burch $1,811.49 clays, and battery for thrower for AYSSP. Portland Elementary Portland Elementary received $330.00 to purchase 2 $330.00 Eddie Cheatham LeAnne Burch $330.00 sets of Easton-Truflite arrows. -

Citizen Initiatives Teacher Training Gas Taxes

DEFENDING AGAINST SECURITY BREACHES PAGE 5 March 2015 Citizen Initiatives Teacher Training Gas Taxes AmericA’s innovAtors believe in nuclear energy’s future. DR. LESLIE DEWAN technology innovAtor Forbes 30 under 30 I’m developing innovative technology that takes used nuclear fuel and generates electricity to power our future and protect the environment. America’s innovators are discovering advanced nuclear energy supplies nearly one-fifth nuclear energy technologies to smartly and of our electricity. in a recent poll, 85% of safely meet our growing electricity needs Americans believe nuclear energy should play while preventing greenhouse gases. the same or greater future role. bill gates and Jose reyes are also advancing nuclear energy options that are scalable and incorporate new safety approaches. these designs will power future generations and solve global challenges, such as water desalination. Get the facts at nei.org/future #futureofenergy CLIENT: NEI (Nuclear Energy Institute) PUB: State Legislatures Magazine RUN DATE: February SIZE: 7.5” x 9.875” Full Page VER.: Future/Leslie - Full Page Ad 4CP: Executive Director MARCH 2015 VOL. 41 NO. 3 | CONTENTS William T. Pound Director of Communications Karen Hansen Editor Julie Lays STATE LEGISLATURES Contributing Editors Jane Carroll Andrade Mary Winter NCSL’s national magazine of policy and politics Web Editors Edward P. Smith Mark Wolf Copy Editor Leann Stelzer Advertising Sales FEATURES DEPARTMENTS Manager LeAnn Hoff (303) 364-7700 Contributors 14 A LACK OF INITIATIVE 4 SHORT TAKES ON -

Creating the Schools Our Students Deserve

EDUCATOR’S GUIDE TO THE 92ND GENERAL ASSEMBLY: CREATING THE SCHOOLS OUR STUDENTS DESERVE The Arkansas Education Association is a professional organization for teachers, ed- ucation support professionals, students and advocates. Our fundamental objective is to work for quality and equitable public education for all of Arkansas students, the betterment of the Arkansas state education system and quality working condi- tions for educators. WHY DOES POLITICAL ACTION MATTER? Almost every aspect of a school employee’s job is determined by appointed or elected officials. • School funding/resources for students • Class sizes • How student test scores are used • Privatizing services • Due process rights • Retirement and health benefits • Wages If we want to exert some control over the issues that are important to us, our family, our profession, and our community, we need to know: Who are the appointed and elected decision makers? What information do they have BEFORE they make their decisions? As AEA members, our job is to be sure that the policymakers at the local, state and federal levels hear directly from us on education issues. We know what students need to succeed. If we are absent from the process, we will allow import- ant decisions about education to be determined by people who may have never set foot into a classroom or worked with a student. This guide will provide you with information about Arkansas legislators, how to contact them, how the state legislative process works and how to help them make the right decisions for your students and your profession. It will also serve as a guide for educators to find your way around the Capitol. -

2016 Legislative Packet.Pub

W L J 2016 L S Speakers Lieutenant Governor Tim Griffin Representa ve Jon Eubanks Arkansas House of Representa ves Speaker Pro-Tem Kelley Linck Arkansas Department of Human Services Chief Legisla ve and Intergovernmental Affairs Officer Roby Brock CEO Talk Business & Poli cs Dr. Jay Barth Hendrix College Poli cs and Interna onal Rela ons Hosted by Jus n T. Allen Government Rela ons Prac ce Group Leader 1 About Our Government Rela ons Prac ce Clients with legal and business issues involving government regulation need the assistance of attorneys with experience and relationships in this specialized area. Wright Lindsey Jennings’ Government Relations attorneys have substantial professional backgrounds in the public sector and the experience crafting practical government relations solutions for our clients. Both Justin T. Allen and Erika Ross Gee served as Chief Deputy Attorneys General for Attorney General Dustin McDaniel before rejoining the firm, and they have broad experience and contacts in all types of state government issues. Prior to joining the firm’s Government Relations practice group, Jay Shue served as the state’s first Medicaid Inspector General, overseeing the detection and investigation of fraud, waste and abuse in the Arkansas Medicaid system. Because our attorneys are not only government relations professionals but also experienced litigators, we are uniquely situated to represent any type of client interest involving federal, state or local government at any stage of the process. Likewise, our Government Relations attorneys are skilled in representing entities and individuals in regulatory and licensure matters before government agencies and the legislative branch. We further assist our clients by analyzing and monitoring legislation, drafting new legislation and proposed amendments, and preparing and presenting testimony on behalf of our clients before legislative committees. -

93Rd General Assembly Thursday, March 4, 2021 – Session Day 53

Visit our Website 93rd General Assembly Thursday, March 4, 2021 – Session Day 53 TODAY AT THE CAPITOL The House and Senate will convene at 1 p.m. COMMITTEE MEETINGS 7:30 a.m. – Joint Budget Special Language 8:30 a.m. – Joint Budget 9:30 a.m. – House Education | Senate City/County/Local 11:00 a.m. – Senate Transportation 11:30 a.m. – House Communications 2:00 p.m. – House Health, Judiciary and Tax | Senate Insurance/Commerce To view the full schedule of committee meetings, floor calendars, their agendas and video access, click here. TODAY’S BILLS *FEDERAL INCOME TAX SAVINGS FOR PASSTHROUGH ENTITIES HB 1209 by Rep. Joe Jett will help about 40,000 Arkansas businesses reduce their federal taxes by an estimated $50 million or more while generating $4 million in state revenue. The businesses impacted are those set up as passthrough entities—the owners pay tax at the individual level on their business income. Most businesses are set up this way. Under federal law, businesses can deduct state and local taxes (“SALT”) they have paid without a cap, but the individual SALT deduction is limited to $10,000 for individuals—this is the “SALT cap.” HB 1209 would let passthrough businesses choose (elect) to instead pay Arkansas tax at the entity level, as a flat tax at the top rate of 5.9%, such that the Arkansas tax should be 100% deductible for federal purposes. The IRS recently blessed the validity of this approach in Notice 2020-75. Several states have already adopted such options, including Oklahoma and Louisiana, and more are expected to adopt them in the coming year. -

2021 Arkansas Legislature

directory of the 2021 Arkansas Legislature Arkansas Citizens First Congress www.citizensfirst.org | [email protected] 1308 West Second Street. Little Rock, Arkansas 72201 PLEASE HELP! We need your support to ensure that our legislators are held accountable for the votes they take on Arkansas’s future. Your donations help guarantee that the voices of local, grassroots Arkansans are heard by our lawmakers. Your donations help pay for educating Arkansas on how they can impact the process with resources like this legislative directory. It’s generally downloaded and printed thousands of times per session. Your donations help us engage more Arkansans in the political process. Your support helps us watchdog the legislature and sift through the thousands of bills that will be filed throughout the session. We educate the public about what will impact them and how they can make a difference, and we expose the attempts to undermine our rights and values when our backs are turned. You have a whole team of experienced staff and volunteers behind you when you are part of the Citizens First Congress. Your donations allow us to mobilize thousands of Arkansans to contact their legislators, hold press conferences and rallies that expose bad legislation and build coalitions that protect our values. We simply cannot do it without you. Please give today, so we can continue to push our elected officials to prioritize the needs of Arkansas’s families. Donate online at www.arpanel.org. The Arkansas Citizens First Congress is a multi-issue and non-partisan coalition of organizations who work together for progressive change in state policy. -

93Rd Arkansas General Assembly Arkansas Municipal League Physical Address Mailing Address 301 W

Communicating With Your Legislator 93rd Arkansas General Assembly Arkansas Municipal League Physical Address Mailing Address 301 W. Second St. P.O. Box 38 North Little Rock, AR 72114 North Little Rock, AR 72115 501-374-3484 Important Online Resources The Arkansas Municipal League website at www.arml.org is the online home for information about the League and its many programs and services. To stay informed on legislative priorities and developments during the 93rd General Assembly of the Arkansas Legislature, click on the Legislative Action Center. Here you will find the online version of the Legislative Bulletin, contact information for all Arkansas legislators, and the League’s Policies and Goals. You can also search for bills by number, sponsor and keyword. The League also offers a new legislative directory app, ARML Leg, for your smartphone. Also, visit the “eCommunications” section on the front page of www.arml.org to sign up for the text messaging service and ListServ. Currently, the League offers five ListServs in order to exchange information. The Arkansas General Assembly’s website is www.arkleg.state.ar.us. At this site, you have the ability to track legislation from the first introduction of a bill in committee to its passage into law. You can download bills, research the current status of a bill and discover other useful legislature-related information. 2 Table of Contents Introduction ............................................................ 4 Key Municipal Principles ................................................. 5 Arkansas General Assembly 101 ........................................... 6 How a Bill Becomes an Arkansas Law ...................................... 7 Effective Ways to Influence Your Legislator ................................. 7 Graph—How a Bill Becomes a Law ....................................... -

Legislative Summary 2019 (PDF)

Legislative 2019 Summary 92ND General Assembly 1 Arkansas State Chamber/AIA Advocacy Efforts Historic Session for Business Gov. Hutchinson and Randy Zook visit after Hutchinson’s signing of Act 576 Legislation adopted by the 92nd General Assembly will enhance the vitality of the Arkansas business community for years to come. Governor Asa Hutchinson said this about the session, “I think I would make the claim that this last legislative session was the GOAT ... the greatest of all time.” We’ll leave it to historians to rank the sessions, but multiple issues we’ve worked on for more than a decade were adopted. For employers, the most significant changes will be a reduction in corporate, individual and unemployment insurance taxes, which will provide at least $100 million per year in savings! Arkansas Advantage 2030 In 2015, the Arkansas State Chamber/AIA commissioned a study to identify the critical areas that needed to be improved to make Arkansas more competitive. “Arkansas Advantage 2030” identified four areas that Arkansas must improve to increase its competitiveness with other states: Improve Worker Readiness Goal: Give Arkansas Businesses a Competitive Advantage by Having the Best Trained and Educated Workforce for the Jobs of the Future 2019 Legislative Agenda Improve the Arkansas Business Climate Our 2019 Legislative Agenda addressed issues from the Arkansas Goal: Move Arkansas into the Best (Top 15) ranked States for Advantage 2030 study. Each of our issue-based committees met Business Climate in the fall of 2018 to discuss and identify issues that would move Arkansas forward. The Agenda was then reviewed and approved Improve the Arkansas Legal Climate by our Boards of Directors. -

THE LIST from Talk Business & Politics Managed by Trey Baldwin (@Baldwinar) & Jason Tolbert (@Tolbertarpx) Send Inquiries by Email to [email protected]

THE LIST From Talk Business & Politics Managed by Trey Baldwin (@BaldwinAR) & Jason Tolbert (@TolbertARPX) Send inquiries by email to [email protected] R-Republican; D-Democrat; L-Libertarian; G-Green; I-Independent FEDERAL OFFICES – 4 SEATS ON THE BALLOT U.S. Congress – District 1 Rep. Rick Crawford – R (incumbent) Robert Butler – D Chintan Desai - D U.S. Congress – District 2 Rep. French Hill – R (incumbent) Paul Spencer – D Gwen Combs – D Natashia Burch Hulsey - I U.S. Congress – District 3 Rep. Steve Womack – R (incumbent) Robb Ryerse – R Joshua Mahony – D Michael Kalagias - L U.S. Congress – District 4 Rep. Bruce Westerman – R (incumbent) Hayden Shamel - D Michael Barrett – I Lee McQueen - I Tom Canada - L CONSTITUTIONAL OFFICES – 7 SEATS ON THE BALLOT Governor Gov. Asa Hutchinson – R (incumbent) Jan Morgan – R Mark West – L Jared Henderson - D Lt. Governor Lt. Gov. Tim Griffin - R (incumbent) Attorney General Attorney General Leslie Rutledge - R (incumbent) Secretary of State Commissioner of State Lands John Thurston – R State Rep. Trevor Drown – R Anthony Bland – D Susan Inman - D Auditor of State Auditor Andrea Lea - R (incumbent) Treasurer of State Treasurer Dennis Milligan - R (incumbent) Commissioner of State Lands Tommy Land – R Alex Ray – R Larry Williams – D (Incumbent Land Commissioner John Thurston term-limited; running for Secretary of State post) ARKANSAS STATE SENATE – 20 SEATS ON THE BALLOT District 3 State Sen. Cecile Bledsoe – R (incumbent) Jon Comstock - D District 4 State Rep. Greg Leding – D (Incumbent State Sen. Uvalde Lindsey not seeking re-election) District 5 State Rep. Bob Ballinger – R (Incumbent State Sen.