Financial Results for the Three Months Ended March 31, 2021 [Japanese GAAP]

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

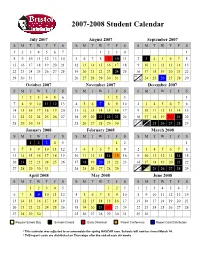

Approved Student Calendar

2007-2008 Student Calendar July 2007 August 2007 September 2007 SMTWT F S SMTWT F S SMTWT F S 1234567 1234 1 8910111213145678910 11 2 3 45678 15 16 17 18 19 20 21 12 13 14 15 16 17 18 9 10 11 12 13 14 15 22 23 24 25 26 27 28 19 20 21 22 23 24 25 16 17 18 19 20 21 22 23 29 30 31 26 27 28 29 30 31 30 24 25 26 27 28 29 October 2007 November 2007 December 2007 SMTWT F S SMTWT F S SMTWT F S 123456 123 1 7891011 12 134567 89102345678 14 15 16 17 18 19 20 11 12 13 14 15 16 17 9 10 11 12 13 14 15 21 22 23 24 25 26 27 18 19 20 21 22 23 24 16 17 18 19 20 21 22 23 24 28 29 30 31 25 26 27 28 29 30 30 31 25 26 27 28 29 January 2008 February 2008 March 2008 SMTWT F S SMTWT F S SMTWT F S 12345 12 1 67891011123456789 2345678 13 14 15 16 17 18 19 10 11 12 13 14 1516 9 1011121314 15 20 21 22 23 24 25 26 17 18 19 20 21 22 23 16 17 18 19 20 21 22 23 24 27 28 29 30 31 24 25 26 27 28 29 30 31 25 26 27 28 29 April 2008 May 2008 June 2008 SMTWT F S SMTWT F S SMTWT F S 12345 123 1234567 6789 10111245678910891011121314 13 14 15 16 17 18 19 11 12 13 14 15 16 17 15 16 17 18 19 20 21 20 21 22 23 24 25 26 18 19 20 21 22 23 24 22 23 24 25 26 27 28 27 28 29 30 25 26 27 28 29 30 31 29 30 Regular School Day Schools Closed Early Dismissal Parent Conference Report Card Distribution * This calendar was adjusted to accommodate the spring NASCAR race. -

Summary of Consolidated Financial Statements for the First Quarter of Fiscal Year Ending December 31, 2021 (IFRS)

Summary of Financial Statements for the First Quarter of Fiscal Year Ending December 31, 2021 Summary of Consolidated Financial Statements for the First Quarter of Fiscal Year Ending December 31, 2021 (IFRS) April 30, 2021 Name of listed company: Nabtesco Corporation Stock listed on: First Section of the Tokyo Stock Exchange Code number: 6268 URL: https://www.nabtesco.com Representative: Title: President and CEO Name: Katsuhiro Teramoto Inquiries: Title: General Manager, Corporate Communication Div. Name: Yasushi Minegishi TEL: +81-3-5213-1134 Scheduled date for filing of quarterly report: May 14, 2021 Scheduled dividend payment date: - Quarterly material to supplement the financial results: Yes Quarterly financial results conference: Yes (Teleconference for institutional investors and financial analysts) (Amounts rounded to the nearest million) 1. Consolidated Results for the First Three-month Period of FY2021 (January 1, 2021 to March 31, 2021) (1) Consolidated Operating Results (Percentages indicate year-on-year change) Net income Income Total comprehensive Net sales Operating income Net income attributable to owners before tax income of the parent Million yen % Million yen % Million yen % Million yen % Million yen % Million yen % First Three-month - - - - Period, FY 2021 72,028 5.0 6,655 (18.7) 124,494 81,115 80,058 84,268 First Three-month Period, FY2020 68,616 (2.4) 8,184 33.0 8,162 10.5 5,575 18.5 5,100 24.9 3,551 (33.9) Basic earnings per share Diluted earnings per share Yen Yen First three-month period, FY2021 647.79 647.75 First three-month period, FY2020 41.09 41.08 (2) Consolidated Financial Position Ratio of equity Equity attributable to Total assets Total equity attributable to owners of owners of the parent the parent Million yen Million yen Million yen % As of March 31, 2021 533,840 280,149 267,740 50.2 As of December 31, 2020 351,723 211,641 198,031 56.3 2. -

Pricing*, Pool and Payment** Due Dates January - December 2021 Mideast Marketing Area Federal Order No

Pricing*, Pool and Payment** Due Dates January - December 2021 Mideast Marketing Area Federal Order No. 33 Class & Market Administrator Payment Dates for Producer Milk Component Final Pool Producer Advance Prices Payment Dates Final Payment Due Partial Payment Due Pool Month Prices Release Date Payrolls Due & Pricing Factors PSF, Admin., MS Cooperative Nonmember Cooperative Nonmember January February 3 * February 13 February 22 December 23, 2020 February 16 ** February 16 February 17 Janaury 25 January 26 February March 3 * March 13 March 22 January 21 * March 15 March 16 March 17 February 25 February 26 March March 31 * April 13 April 22 February 18 * April 15 April 16 April 19 ** March 25 March 26 April May 5 May 13 May 22 March 17 * May 17 ** May 17 ** May 17 April 26 ** April 26 May June 3 * June 13 June 22 April 21 * June 15 June 16 June 17 May 25 May 26 June June 30 * July 13 July 22 May 19 * July 15 July 16 July 19 ** June 25 June 28 ** July August 4 * August 13 August 22 June 23 August 16 ** August 16 August 17 July 26 ** July 26 August September 1 * September 13 September 22 July 21 * September 15 September 16 September 17 August 25 August 26 September September 29 * October 13 October 22 August 18 * October 15 October 18 ** October 18 ** September 27 ** September 27 ** October November 3 * November 13 November 22 September 22 * November 15 November 16 November 17 October 25 October 26 November December 1 * December 13 December 22 October 20 * December 15 December 16 December 17 November 26 ** November 26 December January 5, 2022 January 13, 2022 January 22, 2022 November 17 * January 18, 2022 ** January 18, 2022 ** January 18, 2022 ** December 27 ** December 27 ** * If the release date does not fall on the 5th (Class & Component Prices) or 23rd (Advance Prices & Pricing Factors), the most current release preceding will be used in the price calculation. -

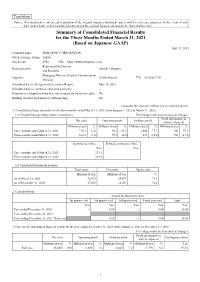

Summary of Consolidated Financial Results for the Three Months Ended

Translation Notice: This document is an excerpt translation of the original Japanese document and is only for reference purposes. In the event of any discrepancy between this translated document and the original Japanese document, the latter shall prevail. Summary of Consolidated Financial Results for the Three Months Ended March 31, 2021 (Based on Japanese GAAP) May 13, 2021 Company name: SEIKO PMC CORPORATION Stock exchange listing: Tokyo Stock code: 4963 URL https://www.seikopmc.co.jp/ Representative Director Representative: Satoshi Takizawa and President Managing Director, Head of Administration Inquiries: Hideki Inouchi TEL 03-6202-7331 Division Scheduled date to file Quarterly Securities Report: May 14, 2021 Scheduled date to commence dividend payments: – Preparation of supplementary material on quarterly financial results: No Holding of quarterly financial results meeting: No (Amounts less than one million yen are rounded down) 1. Consolidated financial results for the three months ended March 31, 2021 (from January 1, 2021 to March 31, 2021) (1) Consolidated operating results (cumulative) Percentages indicate year-on-year changes Profit attributable to Net sales Operating profit Ordinary profit owners of parent Millions of yen % Millions of yen % Millions of yen % Millions of yen % Three months ended March 31, 2021 7,511 13.6 963 62.5 1,054 77.7 700 79.3 Three months ended March 31, 2020 6,613 (1.6) 593 (4.8) 593 (10.6) 390 (21.9) Earnings per share Diluted earnings per share Yen Yen Three months ended March 31, 2021 23.11 – Three months ended March 31, 2020 12.89 – (2) Consolidated financial position Total assets Net assets Equity ratio Millions of yen Millions of yen % As of March 31, 2021 38,972 29,477 71.1 As of December 31, 2020 37,069 28,451 72.4 2. -

Interim Report January 1-March 31, 2021

INTERIM REPORT JANUARY 1-MARCH 31, 2021 “In the first quarter of 2021, net sales declined 22 percent due to lower license sales. Recurring support revenue rose 7 percent and accounts for 38 percent (28) of net sales. Operating profit totaled SEK 12 M (52) and cash flow was SEK 33 M (-4).” Johan Löf, CEO of RaySearch. FIRST QUARTER (JANUARY-MARCH 2021) • Order intake SEK 145.1 M (300.0) • Net sales SEK 162.1 M (208.9) • Operating profit SEK 12.3 M (51.6) • Profit after tax SEK 7.1 M (40.5) • Earnings per share before/after dilution SEK 0.21 (1.18) • Cash flow SEK 32.8 M (-4.2) • Order backlog SEK 1,207.1 M (1,281.5) at the end of the period SIGNIFICANT EVENTS DURING THE FIRST QUARTER • The RayStation® treatment planning system was sold to more leading cancer centers, including Legacy Cancer Institute in the US, the University Hospital in Krakow, Poland, Osaka City University Hospital and Kumamoto University Hospital in Japan. In addition, Inova Schar Cancer Institute in the US and Radiumhospitalet at Oslo University Hospital in Norway expanded their existing RayStation installations. • In March, the Parent Company issued a short-term loan of SEK 200,000 to Vinstandelsstiftelsen RayFoundation on commercial terms. • A wholly owned subsidiary has been established in Australia. THE COVID-19 PANDEMIC • The COVID-19 pandemic with temporary reprioritisations in healthcare had a negative impact on sales in the first quarter. The market situation is gradually improving in line with the vaccine rollout and the recovery is expected to continue. -

2021-2022 Custom & Standard Information Due Dates

2021-2022 CUSTOM & STANDARD INFORMATION DUE DATES Desired Cover All Desired Cover All Delivery Date Info. Due Text Due Delivery Date Info. Due Text Due May 31 No Deliveries No Deliveries July 19 April 12 May 10 June 1 February 23 March 23 July 20 April 13 May 11 June 2 February 24 March 24 July 21 April 14 May 12 June 3 February 25 March 25 July 22 April 15 May 13 June 4 February 26 March 26 July 23 April 16 May 14 June 7 March 1 March 29 July 26 April 19 May 17 June 8 March 2 March 30 July 27 April 20 May 18 June 9 March 3 March 31 July 28 April 21 May 19 June 10 March 4 April 1 July 29 April 22 May 20 June 11 March 5 April 2 July 30 April 23 May 21 June 14 March 8 April 5 August 2 April 26 May 24 June 15 March 9 April 6 August 3 April 27 May 25 June 16 March 10 April 7 August 4 April 28 May 26 June 17 March 11 April 8 August 5 April 29 May 27 June 18 March 12 April 9 August 6 April 30 May 28 June 21 March 15 April 12 August 9 May 3 May 28 June 22 March 16 April 13 August 10 May 4 June 1 June 23 March 17 April 14 August 11 May 5 June 2 June 24 March 18 April 15 August 12 May 6 June 3 June 25 March 19 April 16 August 13 May 7 June 4 June 28 March 22 April 19 August 16 May 10 June 7 June 29 March 23 April 20 August 17 May 11 June 8 June 30 March 24 April 21 August 18 May 12 June 9 July 1 March 25 April 22 August 19 May 13 June 10 July 2 March 26 April 23 August 20 May 14 June 11 July 5 March 29 April 26 August 23 May 17 June 14 July 6 March 30 April 27 August 24 May 18 June 15 July 7 March 31 April 28 August 25 May 19 June 16 July 8 April 1 April 29 August 26 May 20 June 17 July 9 April 2 April 30 August 27 May 21 June 18 July 12 April 5 May 3 August 30 May 24 June 21 July 13 April 6 May 4 August 31 May 25 June 22 July 14 April 7 May 5 September 1 May 26 June 23 July 15 April 8 May 6 September 2 May 27 June 24 July 16 April 9 May 7 September 3 May 28 June 25. -

2021 7 Day Working Days Calendar

2021 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 133 Saturday, January 2, 2021 134 Sunday, January 3, 2021 135 Monday, January 4, 2021 136 Tuesday, January 5, 2021 137 Wednesday, January 6, 2021 138 Thursday, January 7, 2021 139 Friday, January 8, 2021 140 Saturday, January 9, 2021 141 Sunday, January 10, 2021 142 Monday, January 11, 2021 143 Tuesday, January 12, 2021 144 Wednesday, January 13, 2021 145 Thursday, January 14, 2021 146 Friday, January 15, 2021 147 Saturday, January 16, 2021 148 Sunday, January 17, 2021 149 Monday, January 18, 2021 150 Tuesday, January 19, 2021 151 Wednesday, January 20, 2021 152 Thursday, January 21, 2021 153 Friday, January 22, 2021 154 Saturday, January 23, 2021 155 Sunday, January 24, 2021 156 Monday, January 25, 2021 157 Tuesday, January 26, 2021 158 Wednesday, January 27, 2021 159 Thursday, January 28, 2021 160 Friday, January 29, 2021 161 Saturday, January 30, 2021 162 Sunday, January 31, 2021 163 Monday, February 1, 2021 164 Tuesday, February 2, 2021 165 Wednesday, February 3, 2021 166 Thursday, February 4, 2021 167 Date Number of the Calendar Date Friday, February 5, 2021 168 Saturday, February 6, 2021 169 Sunday, February -

![Consolidated Financial Results for the Three Months Ended March 31, 2021 [IFRS] May 12, 2021](https://docslib.b-cdn.net/cover/7027/consolidated-financial-results-for-the-three-months-ended-march-31-2021-ifrs-may-12-2021-1017027.webp)

Consolidated Financial Results for the Three Months Ended March 31, 2021 [IFRS] May 12, 2021

Consolidated Financial Results for the Three Months Ended March 31, 2021 [IFRS] May 12, 2021 Company name : Sumitomo Rubber Industries, Ltd. Stock exchange listing : Tokyo Stock Exchange Code number : 5110 URL : https://www.srigroup.co.jp/ Representative : Satoru Yamamoto, President and CEO, Representative Director : Naoki Okawa, Senior Executive Officer and General Manager, Accounting & Contact Finance Department Phone : +81-78-265-3000 Scheduled date of filing quarterly securities report : May 13, 2021 Scheduled date of commencing dividend payments : - Supplementary documents for quarterly financial results : Yes Quarterly financial results briefing session : Yes (for institutional investors and analysts) (Amounts of less than one million yen are rounded to the nearest unit.) 1. Consolidated Financial Results for the Three Months Ended March 31, 2021 (January 1, 2021 to March 31, 2021) (1) Consolidated Operating Results (% indicates changes from the previous corresponding period.) Profit attributable Comprehensive Sales revenue Business profit Operating profit to owners income of parent Three months ended Million yen % Million yen % Million yen % Million yen % Million yen % March 31, 2021 213,688 12.0 16,202 468.8 15,584 466.1 10,669 - 29,374 - March 31, 2020 190,794 (9.7) 2,848 (51.3) 2,753 (54.0) (3,403) - (32,050) - (Note) “Business profit” is “Sales revenue” subtracted by “Cost of sales” and “Selling, general and administrative expenses.” Business profit Basic profit per Diluted profit to sales revenue share per share ratio Three -

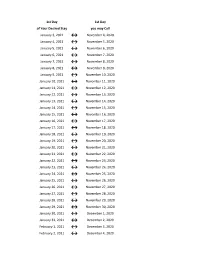

Flex Dates.Xlsx

1st Day 1st Day of Your Desired Stay you may Call January 3, 2021 ↔ November 4, 2020 January 4, 2021 ↔ November 5, 2020 January 5, 2021 ↔ November 6, 2020 January 6, 2021 ↔ November 7, 2020 January 7, 2021 ↔ November 8, 2020 January 8, 2021 ↔ November 9, 2020 January 9, 2021 ↔ November 10, 2020 January 10, 2021 ↔ November 11, 2020 January 11, 2021 ↔ November 12, 2020 January 12, 2021 ↔ November 13, 2020 January 13, 2021 ↔ November 14, 2020 January 14, 2021 ↔ November 15, 2020 January 15, 2021 ↔ November 16, 2020 January 16, 2021 ↔ November 17, 2020 January 17, 2021 ↔ November 18, 2020 January 18, 2021 ↔ November 19, 2020 January 19, 2021 ↔ November 20, 2020 January 20, 2021 ↔ November 21, 2020 January 21, 2021 ↔ November 22, 2020 January 22, 2021 ↔ November 23, 2020 January 23, 2021 ↔ November 24, 2020 January 24, 2021 ↔ November 25, 2020 January 25, 2021 ↔ November 26, 2020 January 26, 2021 ↔ November 27, 2020 January 27, 2021 ↔ November 28, 2020 January 28, 2021 ↔ November 29, 2020 January 29, 2021 ↔ November 30, 2020 January 30, 2021 ↔ December 1, 2020 January 31, 2021 ↔ December 2, 2020 February 1, 2021 ↔ December 3, 2020 February 2, 2021 ↔ December 4, 2020 1st Day 1st Day of Your Desired Stay you may Call February 3, 2021 ↔ December 5, 2020 February 4, 2021 ↔ December 6, 2020 February 5, 2021 ↔ December 7, 2020 February 6, 2021 ↔ December 8, 2020 February 7, 2021 ↔ December 9, 2020 February 8, 2021 ↔ December 10, 2020 February 9, 2021 ↔ December 11, 2020 February 10, 2021 ↔ December 12, 2020 February 11, 2021 ↔ December 13, 2020 -

1. Consolidated Business Results of the First Quarter Ended March 31, 2021 (January 1, 2021 to March 31, 2021)

Date: May 12, 2021 Summary of Consolidated Financial Statements for the first quarter of Fiscal Year 2021 ended March 31, 2021 (IFRS basis) (All financial information has been prepared based on the original Japanese-language document, Summary of Consolidated Financial Statements for the first quarter announced on May 12, 2021) Listed company name: DMG MORI CO., LTD. Stock exchange listing: First Section of Tokyo Stock Exchange Code Number: 6141 URL https://www.dmgmori.co.jp Company Representative: Masahiko Mori, President Contact Person Hirotake Kobayashi, Vice President, Accounting / Finance HQ, Executive Officer Phone: +81-(0)3-6758-5900 Filing date of quarterly financial statements: May 17, 2021 Estimated starting date of dividend payment: - Preparation of supplementary explanatory materials: Yes Holding of quarterly earnings release conference: Yes 1. Consolidated business results of the first quarter ended March 31, 2021 (January 1, 2021 to March 31, 2021) (Note: All amounts less than one million are disregarded) (1) Consolidated business results (% of change from same period in the previous year) Earnings before Income attributable to Total comprehensive Sales revenues Operating income Quarterly Profit income taxes owners of the parent income million yen % million yen % million yen % million yen % million yen % million yen % First quarter ended 81,122 △7.0 3,986 21.8 3,134 148.5 1,819 1,972.9 1,812 1,306.4 5,392 - March 31, 2021 First quarter ended 87,255 △27.6 3,272 △68.6 1,261 △85.7 87 △98.6 128 △97.9 △9,840 - March 31, 2020 Basic earnings (△loss) Diluted earnings (△loss) per share per share Yen Yen First quarter ended 10.38 10.36 March 31, 2021 First quarter ended △1.13 △1.13 March 31, 2020 (Note) Basic earnings (△loss) per share is based on the earning amount which excludes earnings attributed to owners of hybrid capital. -

Guidance for Troubled Debt Restructurings for March 31-June 30 Statutory Financial Statements and Related Interim Risk-Based Capital Filings (Where Required)

-- To: All Insurers From: Financial Condition (E) Committee Date: March 27, 2020 RE: Guidance for Troubled Debt Restructurings for March 31-June 30 Statutory Financial Statements and Related Interim Risk-Based Capital Filings (where required) Background Information This guidance is being issued by the Financial Condition (E) Committee to all U.S. insurers filing with the NAIC in an effort to encourage insurers to work with borrowers who are unable to, or may become unable to meet their contractual payment obligations because of the effects of COVID-19. The Committee, which is the NAIC parent committee of all the solvency policy making task forces and working groups of the NAIC, supports the use of prudent loan modifications that can mitigate the impact of COVID-19. Parameters of Guidance This guidance applies to a troubled debt restructuring issued as a result of COVID-19 and is applicable to the term of the loan modification, but solely with respect to a modification, including a forbearance arrangement, an interest rate modification, a repayment plan, and any other similar arrangement that defers or delays the payment of principal or interest, which occurs during the applicable reporting period for a loan that was not more than 30 days past due as of December 31, 2019. Nothing in this guidance supersedes the requirement or authority of any state, particularly any state that has separately issued COVID-19 orders, directives or other guidance the impact of which may lead to debt becoming troubled and/or needing to be restructured. Direct Mortgage Loans & Schedule BA Mortgages For purposes of any risk-based capital calculations prepared by insurers for March 31 and June 30, all direct mortgages and Schedule BA mortgages for which the insurer chooses, or is government mandated, to allow delays in any required principal and interest payments in accordance with the above parameters are not required to be reclassified to a different RBC category (e.g. -

MEMORANDUM Tel

Office of Financial Services MEMORANDUM Tel. (807) 343-8010 ext8730 Fax (807) 343-8967 [email protected] Date: March 16, 2021 To: Researchers Subject: Reminder RESEARCH YEAR END DEADLINES Research Grants funded from the Federal and Provincial Governments and their Agencies have a financial reporting period ending March 31, 2021. This includes NSERC, SSHRC, CIHR, CRC, MOHLTC, OPIC, OCI and many others. If you are uncertain if this applies to your grant, please contact Margot Ross (807)343-8010 ext. 8730 or by email at [email protected]. All 2020/21 transactions must be dated March 31, 2021 or earlier to be included in the 2020/21 financial reporting period. It is the responsibility of each researcher to submit their paperwork before the deadlines listed below. The transactions received before these deadlines will be included in the 2020/21 research financial reporting period. CASH RECEIPTS All cheques and cash dated prior to March 31, 2021 must be received by Accounts on or before Friday April 23, 2021 in order to be processed with a March date. All such deposits made after April 24th will be April dated. ACCOUNTS RECEIVABLE INVOICES All March dated invoices for external customers must be requested and processed by OFS by Friday April 16, 2021. PURCHASING CARD STATEMENTS All purchasing card statements for the period ending March 31st must be in the Office of Financial Services on or before Thursday April 8, 2021. The March 2021 statement will include all activity up to March 29th. Activity after March 29th will be recorded as an April 2021 transaction.