A Revealing Carbon Assessment of Brew Dr. Kombucha's Supply Chain

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TEATIPSBRIEF100 100 Pieces of Info to Use in Tea Stories Issue 1

Olga Nikandrova. Denis Shumakov TEATIPSBRIEF100 100 pieces of info to use in tea stories Issue 1. 2017 www.facebook.com/teatipsbrief/ www.teatips.ru Table of content Tea micro-trends .............................................................................................................................................. 5 Micro-trend. Tea and wine experiments ................................................................................................................... 5 One more time on tea machines. Teforia Leaf ........................................................................................................ 5 Micro-trend. Nitro Tea ..................................................................................................................................................... 6 Nano-trend. Teafe in Raipur and Bangalore ............................................................................................................ 7 Micro-Trend. Cheese tea. 40 degrees and 15 minutes ......................................................................................... 7 Micro-trend: kombuchading kombucha at topical bars ........................................................................................ 8 Ambient Brew: Tea and Food Pairing ......................................................................................................................... 9 Micro-trend: Albino tea cultivars .............................................................................................................................. -

Assessment of Kombucha Tea Recipe and Food Safety Plan

Environmental Health Services FFoooodd IIssssuuee Notes from the Field Food Safety Assessment of Kombucha Tea Recipe and Food Safety Plan Request received from: Regional Health Authority Date of request: January 27, 2015. Updated March 9, 2020. Issue (brief description): Assessment of kombucha tea recipe and food safety plan Disclaimer: The information provided in this document is based on the judgement of BCCDC’s Environmental Health Services Food Safety Specialists and represents our knowledge at the time of the request. It has not been peer-reviewed and is not comprehensive. Summary of search information: 1. Internet sources: general search for “kombucha” 2. OVID and PubMed search “kombucha” AND “illness” 3. Personal communication with federal and provincial agencies Background information: Kombucha Tea (KT, sometimes called Manchurian tea or Kargasok tea) is a slightly sweet, mildy acidic tea beverage consumed worldwide, which has seen significant sales growth in North American markets from recent years.1 KT is prepared by fermenting sweetened black or green tea preparations with a symbiotic culture of bacteria and yeast (SCOBY), often referred to as the “mushroom” (misnamed because of its appearance) or as a “mother” (for its ability to reproduce). The floating mat is a biofilm layer made up of bacteria and cellulose that is more correctly referred to as a pellicle. The culture comes in different varieties, but is generally made up of a variable amount of Gluconacetobacter, Lactobacillus, and Acetobacter (genera of acetic acid bacteria) -

Trendscape Report, Highlighting What Campbell’S Global Team of Chefs and Bakers See As the Most Dynamic Food Trends to Watch

Insights for Innovation and Inspiration from Thomas W. Griffiths, CMC Vice President, Campbell’s Culinary & Baking Institute (CCBI) Last year we published our first-ever Culinary TrendScape report, highlighting what Campbell’s global team of chefs and bakers see as the most dynamic food trends to watch. The response has been exceptional. The conversations that have taken place over the past year amongst our food industry friends and colleagues have been extremely rewarding. It has also been quite a thrill to see this trend-monitoring program take on a life of its own here at Campbell. Staying on the pulse of evolving tastes is inspiring our culinary team’s day-to- day work, driving us to lead innovation across company-wide business platforms. Most importantly, it is helping us translate trends into mealtime solutions that are meaningful for life’s real PICS moments. It’s livening up our lunch break conversations, too! TO OT H These themes are This 2015 Culinary TrendScape report offers a look at the year’s ten most exciting North 15 the driving force 0 American trends we’ve identified, from Filipino Flavors to Chile Peppers. Once again, 2 behind this year’s top trends we’ve developed a report that reflects our unique point of view, drawing on the expertise of our team, engaging culinary influencers and learning from trusted Authenticity industry partners. Changing Marketplace Just like last year, we took a look at overarching themes—hot topics—that are shaping Conscious Connections the ever-changing culinary landscape. The continued cultural transformation of retail Distinctive Flavors markets and restaurants catering to changing consumer tastes is clearly evident Elevated Simplicity throughout this year’s report. -

An Exploratory Value Chain Analysis for Burmese Pickled Tea (LAPHET)

Copyright is owned by the Author of the thesis. Permission is given for a copy to be downloaded by an individual for the purpose of research and private study only. The thesis may not be reproduced elsewhere without the permission of the Author. An Exploratory Value Chain Analysis for Burmese Pickled Tea (LAPHET) A thesis presented in partial fulfilment of the requirements for the degree of Masters of AgriCommerce in Agribusiness Institute of Agriculture and Environment MASSEY UNIVERSITY Palmerston North, NEW ZEALAND SO PYAY THAR 2016 i ABSTRACT Laphet (pickled tea) is a well-known traditional cuisine of Myanmar consisting of tea leaves fermented into a pickle. It has a unique taste different from tea used for drinking and has health benefits. Despite the fact that pickled tea is a popular food in Myanmar, no research has been done to analyse its value chain and evaluate its potential in the global market. This study is an exploratory research and aims to examine the value chain of pickled tea from production to the final consumer and to evaluate how to improve the quality in the value chain. In addition, the improvements to the integrity to the pickled tea value chain are addressed. The value chain analysis revealed the maJor actors in the pickled tea value chain and described the process as tea leaves pass through several intermediaries with value being added at each stage before reaching the end consumer. The chain is governed by wholesalers and manufacturers who have capital advantage over the other chain actors. Therefore, farmers get the lower share of the price margin. -

STUDY of BIODEGRADABLE PACKAGING MATERIAL PRODUCED from SCOBY Priyanka Aduri*, Kokolu Ankita Rao, Areeba Fatima, Priyanka Kaul, A

Aduri et al RJLBPCS 2019 www.rjlbpcs.com Life Science Informatics Publications Original Research Article DOI: 10.26479/2019.0503.32 STUDY OF BIODEGRADABLE PACKAGING MATERIAL PRODUCED FROM SCOBY Priyanka Aduri*, Kokolu Ankita Rao, Areeba Fatima, Priyanka Kaul, A. Shalini Department of Biotechnology, Chaitanya Bharathi Institute of Technology, Hyderabad, Telangana, India. ABSTRACT: To overcome the various deleterious effects of plastic food packaging, the objective is to find out if in reality a material produced from biological sources could act as an alternative to plastic and could be put to use on a large scale. Micro-organisms have been found to be a better solution for production of high quality products with minimum complexity. Production of a food packaging material from a particular species of microorganisms might just be a solution to the problem of wide usage of plastic. SCOBY (symbiotic culture of bacteria and yeast) obtained on fermentation of Kombucha can serve as an edible packaging material. It is the gelatinous mat, a bacterial cellulose (BC) formed by Kombucha tea fermentation.Kombucha is a beverage that is produced by tea (Black tea/ Green tea) and sugar fermentation using SCOBY as starter culture. It is a conglomerate of yeasts and Acetic acid bacteria.Since SCOBY is a biologically consumable and a fully recyclable packaging option, it can be used to store food products with no waste thus giving a biodegradable, eco-friendly and a zero waste packaging if proved to be one. However, more research on the properties of SCOBY and its limitations if any are necessary for further conclusions. KEYWORDS: Plastic, Food packaging, biodegradable, SCOBY, Bacterial cellulose, Kombucha fermentation. -

Columbia Heights

Columbia Heights www.tynancoffeeandtea.com Pour Over Coffee LOOSE LEAF TEA FRUIT AND GREEN TEA 16oz SMOOTHIES 16oz Seasonal Full immersion drip 12oz Black Malawi Pamwamba – caramel English Breakfast Wild Berry and citrus Dark Orange Strawberries, blueberries, raspberries, Earl grey and blackberries with green tea and Anniversario XX – chocolate, Darjeeling Estate pure cane simple syrup dense, buttery Green Mango Organic Green Mangos with green tea and pure COFFEE 12oz/16oz China Jasmine cane simple syrup Enchanted Green House Coffee Moroccan mint available until 12pm Mon-Fri. Available all day Herbal on weekends Honeymilk Ginger* WARM FAVORITES Café con Leche Roasted Almonds* 12oz/16oz Pure Red* House coffee + textured milk Tuscany Lavender* Red Eye Drinking chocolate House coffee + espresso *Teas are caffeine free Dominican cocoa + Belizean vanilla + Americano textured milk Espresso + water Spiced apple cider ICED TEA 12oz/16oz All natural spiced apple cider The Tiny Cup Black Forest Tea Latte Black Tea + vanilla pieces + 12oz/16oz Seasonal Espresso Assam tea flowers + blue Anniversario XX mallow blossoms Masala chai Macchiato Lemon Green Scratch made Indian Chai. Espresso + dollop of foam Green tea + lemon peel + Black tea + pure cane sugar + Cortado lemon grass whole spices + textured milk Espresso + equal parts textured milk Forest Berries Dirty chai Con Pana Elderberries + hibiscus Masala Chai + espresso Espresso + homemade whipped cream blossoms + apple pieces + Green Tea Latte (12oz) black currant + blackberries Japanese Izu green -

KOMBUCHA MASTER RECIPE 24 Cups Water 2 Cups Organic Sugar 5

KOMBUCHA MASTER RECIPE 24 cups water 2 cups organic sugar 5 black tea bags 5 green tea bags 4 cups starter tea 1 Make the tea base: Bring the water to a boil. Remove from heat and stir in the sugar to dissolve. Drop in the tea and allow it to steep until the water has cooled. Depending on the size of your pot, this will take a few hours. You can speed up the cooling process by placing the pot in an ice bath. 2 Add the starter tea: Once the tea is cool, remove the tea bags or strain out the loose tea. Stir in the starter tea. (The starter tea makes the liquid acidic, which prevents unfriendly bacteria from taking up residence in the first few days of fermentation.) 3 Transfer to jars and add the SCOBY: Pour the mixture into a 1-gallon glass jar (or divide between two 2-quart jars, in which case you'll need 2 scobys) and gently slide the scoby into the jar with clean hands. Cover the mouth of the jar with a few layers tightly-woven cloth, coffee filters, or paper towels secured with a rubber band. (If you develop problems with gnats or fruit flies, use a tightly woven cloth or paper towels, which will do a better job keeping the insects out of your brew.) 4 Ferment for 7 to 10 days: Keep the jar at room temperature, out of direct sunlight, and where it won't get jostled. Ferment for 7 to 10 days, checking the kombucha and the scoby periodically. -

2018-08-26 Portland Tea Tour

F6 EZ EE THE WASHINGTON POST . SUNDAY, AUGUST 26, 2018 t sounds weird — and it ia” watchers; the series featured it sounds weird — but if in its second through fourth sea- you slurp it, you’ll get Teatime in a coffee town sons. In keeping with its hipster better flavor,” the server cred, Tea Chai Té offers kombucha “Isaid as he arranged a flight of four on tap. Mason jar chandeliers, teas before me. I glanced around mismatched rustic wood tables the busy tasting room of Steven In Oregon, Portland has plenty of room for hot-beverage competition and a cozy outdoor seating area Smith Teamaker. Everyone else reinforce the aesthetic. was delicately sipping their brews, BY ERIN E. WILLIAMS I was overwhelmed by the so I slurped surreptitiously. menu’s 120 scratch-made tea I was in Oregon, at the end of a blends, including fair trade and whistle-stop tour of some of Port- organic (75) options, so the wom- land’s best-known teahouses. Al- an behind the counter recom- though Stumptown seems to re- mended a light-tasting white volve around coffee, it is also a city peach tea. I settled into a table of tea — from quiet cafes to larger next to a miniature library, sipped retail operations. Its local busi- my drink and tucked a similarly nesses have cast a leafy influence peachy kombucha bottle into my on American tea culture, ushering bag for later. in a new era of specialized quaff- The next morning, I was ready ing. My informal tally counts for two final heavy hitters. -

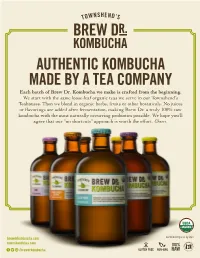

AUTHENTIC KOMBUCHA MADE by a TEA COMPANY Each Batch of Brew Dr

AUTHENTIC KOMBUCHA MADE BY A TEA COMPANY Each batch of Brew Dr. Kombucha we make is crafted from the beginning. We start with the same loose-leaf organic teas we serve in our Townshend’s Teahouses. Then we blend in organic herbs, fruits or other botanicals. No juices or flavorings are added after fermentation, making Brew Dr. a truly 100% raw kombucha with the most naturally occurring probiotics possible. We hope you’ll agree that our “no shortcuts” approach is worth the effort. Cheers. brewdrkombucha.com Certified Organic by QCS townshendstea.com /brewdrkombucha CITRUS HOPS CLEAR MIND GINGER TURMERIC This unique recipe employs white tea A brilliant botanical flavor with notes Both the ginger and turmeric roots are leaves and two types of NW hops. of rosemary and sage. Each herb in known for their invigorating flavors The resulting brew is deliciously light, the recipe is noted for its ability to and effects. Cheers to your health! crisp and refreshing. assist in mental clarity and focus. CITRUS HOPS – 14oz BOTTLE CLEAR MIND – 14oz BOTTLE GINGER TURMERIC – 14oz BOTTLE HAPPINESS HERBAL UPLIFT LEMON GINGER CAYENNE Subtle and refreshing white tea, This brew is loaded with organic Potent organic ginger combines with simply paired with dried rose petals. herbs from Townshend’s Apothecary the heat of cayenne pepper in this The soft, floral finish is like a ray of line of herbal blends. An ideal drink spicy yet refreshing brew, crafted with smiling sunshine. for maintaining health and wellness. green tea and lemongrass. HAPPINESS – 14oz BOTTLE HERBAL UPLIFT – 14oz BOTTLE LEMON GINGER CAYENNE – 14oz BOTTLE LOVE MINT LEMONADE SPICED APPLE A refreshing brew featuring jasmine A light and refreshing kombucha As close as kombucha can get to and lavender. -

ANN and RSM Modelling of Antioxidant Characteristics of Kombucha Fermented Milk Beverages with Peppermint

116 J. VITAS et al.: Antioxidant characteristics of kombucha fermented milk beverages, Mljekarstvo 68 (2), 116-125 (2018) Original scientific paper - Izvorni znanstveni rad UDK: 637.146 ANN and RSM modelling of antioxidant characteristics of kombucha fermented milk beverages with peppermint doi: 10.15567/mljekarstvo.2018.0205 Jasmina Vitas*, Radomir Malbaša, Aleksandar Jokić, Eva Lončar, Spasenija Milanović University of Novi Sad, Faculty of Technology Novi Sad, Bulevar cara Lazara 1, 21000 Novi Sad, Republic of Serbia Received - Prispjelo: 07.09.2017. Accepted - Prihvaćeno: 20.02.2018. Abstract Antioxidant activity to stable DPPH radical (AADPPH) and unstable hydroxyl radicals (AA.OH) and nutraceuticals (monounsaturated fatty acids (MUFAs), polyunsaturated fatty acids (PUFAs) and ascorbic acid) content of kombucha fermented milks with peppermint (KFM-P) were modelled and optimised. Beverages were produced by the addition of 10 % of kombucha peppermint inoculum to the milk containing 0.8, 1.6 and 2.8 % milk fat at 37, 40 and 43 °C. Response surface methodol- ogy (RSM) indicated opposite response surfaces for AADPPH and AA.OH PUFAs and ascorbic acid, as most significant and influential factors, were included in graphical optimization and gave the working region for obtaining products of highest antioxidant quality: lower temperatures and milk fat up to 1.8 %; higher temperatures and milk fat of maximum 1.6 %. ANN modelling of antioxidant charac- teristics of kombucha fermented milk beverages with peppermint was, as expected, more accurate than RSM. Key words: kombucha, antioxidants, peppermint, fermented milk, RSM and ANNs Introduction Milk fermentation process leads to a variety of use- Kombucha is a popular traditional fermented ful compounds released from metabolic activity, beverage which is usually prepared at home and is such as organic acids, bioactive peptides or folic associated to various health promoting characteris- acid, that cause the increase of nutritional and health tics, which are mainly reported by the users. -

Assessing Polyphenol Components and Antioxidant Activity During Fermented Assam Tea Ball Processing

sustainability Article Assessing Polyphenol Components and Antioxidant Activity during Fermented Assam Tea Ball Processing Pimpinan Somsong 1,2, Chalat Santivarangkna 3, Pimsiri Tiyayon 1, Chi-Ming Hsieh 4,* and Warangkana Srichamnong 3,* 1 School of Agricultural Resources, Chulalongkorn University, Bangkok 10330, Thailand; [email protected] (P.S.); [email protected] (P.T.) 2 Emerging Process for Food Functionality Design Research Unit, Chulalongkorn University, Bangkok 10330, Thailand 3 Institute of Nutrition, Mahidol University, Salaya, Nakhon Pathom 73170, Thailand; [email protected] 4 International Bachelor Program of Agribusiness, National Chung Hsing University, Taichung 402, Taiwan * Correspondence: [email protected] (C.-M.H.); [email protected] (W.S.); Tel.: +886-42284-0849 (ext. 622) (C.-M.H.); +66-2800-2380 (ext. 316) (W.S.) Received: 9 June 2020; Accepted: 13 July 2020; Published: 21 July 2020 Abstract: Fermented tea is traditionally consumed in many Asian countries. In Thailand, the product is made by anaerobic submerged fermentation of semi-mature tea leaves before being made into a ball form. This study aims to investigate the composition of health-associated bioactive compounds in fermented tea balls made from Camellia sinensis var. assamica, which is naturally grown in the forests of northern Thailand. The processing involves steaming semi-mature tea leaves followed by anaerobic fermentation in 2% NaCl solution (1:5 w/v of tea leaves solution). Levels of catechin (C), epicatechin (EC), epicatechin gallate (ECG), epigallocatechin gallate (EGCG), gallocatechin (GC), flavonols (myricetin, quercetin, and kaempferol), phenolic acids (caffeic acid, chlorogenic acid, coumaric acid, and sinapic acid), total phenolic content, and in vitro antioxidant activity were evaluated in fresh tea leaves, steamed tea leaves, and fermented tea leaves over a period of 60 days’ monitoring. -

The Kombucha Tea Recall

The Kombucha Tea Recall By Christine S. LeBlanc, J.D., LL.M. candidate (Health Law) [email protected] Daily health drink turned nighttime libation? It sounds crazy, but it looks like it might be the future for Kombucha tea, a drink which has made a major splash with health food enthusiasts around the nation. Recently however, suppliers of Kombucha voluntarily pulled the product from supermarket shelves due to regulatory concerns related to alcohol content in the drink. Background Originating in East Asia in the 1800’s, Kombucha tea is also known as a “mushroom”, because the yeast and bacteria contained therein take on a similar shape during fermentation.1 It is prepared by combining yeast and bacteria with sugar and black or green tea.2 Thereafter, the mixture is allowed to ferment, creating what is known as Kombucha.3 This brewing process usually begins with a starter Kombucha, commonly known as the “daughter”, which is taken from another Kombucha, typically referred to as “big momma.”4 The alcohol content of the “big momma” is directly correlated with its age and acidity.5 The finished product is a drink composed of B vitamins, vinegar, and certain other compounds.6 Kombucha has been associated with a number of health benefits, including, but not limited to, increased immunity, cancer prevention, and improved digestion and liver function.7 Ardent drinkers of Kombucha also attribute weight loss, improved complexion, and reduction in hair loss to consumption of the product.8 The most notable of these assertions comes from G.T. Dave,