SEC News Digest, 06-18-1963

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Full-Depth Asphalt Pavements for Parking Lots and Driveways. It Is Based on the Asphalt Institute's Thickness Design Manual, Manual Series No

E D C ,!1 T R F (I ED 023 277 EF 002 075 Full-Depth Asphalt Pavements for Parking Lots andDriveways. Asphalt Inst.,College Park, Md. Report No -IS -91 Pub Date Oct 67 Note-16p. Available from-The Asphalt Institute, AsphaltInstitute Building,College Park, Maryland. EDRS Price MF 4025 HC -$090 Descriptors -*Asphalts, *Driveways, *ParkingFacilities The latest information for designingfull-depth asphalt pavementsfor parking lots invehicle and drivewaysiscoveredinreiationshiptothe continued increase registration. It is based on TheAsphalt Institute's ThicknessDesign Manual, Series No. all aspects of asphalt pavementthickness 1 (MS-1), Seventh Edition, which covers design in detail, utilizing the latest,computer-derived information from pavementtests here and abroad. The pavementcross-sectiOns given arefor typical conditions. Tables, drawings, and photographs areincluded. (IRK) Is-DEPTH U.S. DEPARTMENT Of HEALTH, EDUCATION & WELFARE PAVEMERTS OFFICE Of EDUCATION THIS DOCUMENT HAS BEEN REPRODUCED EXACTLYAS RECEIVED FROM THE PERSON OR ORGANIZATION ORIGINATING IT.POINTS Of VIEW OR OPINIONS STATED DO NOT NECESSARILY REPRESENT OFFICIALOFFICE OF EDUCATION Inc NTS POSITION OR POLICY. OCTOBER 1967 THE ASPHALT INSTITUTE ins INFORMATION SERIES NO. 91( IS-91 ) ijairif:JJaadiora Alia#4111:aai jel. #11 1:1111111. 44;1 o . A IF la Passenger Cars In most areas of concentrated population around theworld, parking space for motor vehicles is at a premium. In 1966, over 94 millionvehicles were registered in the United With similar growth being .1 States, with no sign of any let-up in registration growth. .4* 4,1 tr. experienced throughout the world, it is likely that theneed for more parking space will continue indefinitely. -

SEC News Digest, 01-16-1961

SECURITIES AND EXCHANGE COMMISSION Jl$~~~ IDil@rn~fijf ~ A brief summary of financial proposals filed with and actions by the S.E.C. Q)~@ Washington 25, D.C. (In ordering full text of Relea.e. from Publication. Unit, cite number) FOR RELEASE January 16, 1961 Statistical Release No. 1728. The SEC Index of Stock Prices. based on the closing price of 300 common stocks for the week ended January 13, 1961, for the composite and by major industry groups compared with the preced- ing week and with the highs and lows for 1960 - 1961 is as follows: 1957-59 :tl 100 Percent 1960 1961 1/13/«;1 1/6/61 Change High ~ Composite 120.5 118.3 11.9 121.4 107.7 Manufacturing 115.1 113,0 11.9 122.0 103.6 Durable Goods 118.5 117.0 11.3 129.5 107.7 Non-Durable Goods 112.1 109.2 12.7 115.1 99.5 Transportation 100.5 97.8 12.8 108.3 87.1 Utility 147.1* 144.2 11.9 147.1 118.4 Trade. Finance & Service 134.5* 132.5 11.5 134.5 120,5 Mining 83.8 83.3 10.6 86.7 67,0 *New High SECURITIES ACT REGISTRATION STATEMENTS. During the week ended January 12. 1961. 21 registration state- ments were filed. 23 became effective. 3 were withdrawn, and 303 were pending at the week end. ORDER SUSPENDS MARKWELL-WEST STAR MINING REGISTRATION. In a "stop order" decision announced today (Release 33-4317), the SEC suspended the effectiveness of a Securities Act registration statement filed in January 1957 by J. -

SEC News Digest, 11-25-1977

Issue 77-227 u.s. SECURITIES AND ADMINISTRATIVE PROCEEDINGS EXCHANGE COMMISSION NASD SANCTION AGAINST WILLIAM E. BRANDOW REDUCED TO CENSURE The Commission has modified the sanction imposed by the NASD on William E. Brandow, a Minneapolis insurance broker. The NASD had suspended Brandow from association with any member for one year. The Commission reduced his sanction to censure. Brandow was the administrator of a Minnesota school district's tax-sheltered annuity program (TSA). Among the insurance companies he represented was one which sold variable, as well as fixed, annuities. Variable annuities are securities, and the company which sold them is an NASD member. In his capacity as TSA administrator, Brandow sent letters annually to school district employees about the various annuity plans offered in that program. The Commission sustained the NASD's finding that the letter Brandow sent out in 1975 was sales liter- ature required to be filed with the NASD. It also affirmed the NASD's finding that Brandow failed to file that letter, and a similar one mailed in 1974. The Commission reversed the NASD's finding that the content of Brandow's 1975 letter was misleading. The Commission found that Brandow erroneously concluded that his letters were not sales literature covered by the filing requirement. It noted that Brandow's "failure to file was not prompted by contempt for the rule," nor did it suggest a lack of integrity. The Commission also noted that the pendency of this case has precluded Brandow from working for an NASD member. In effect, he had already served a lengthy suspension. -

57 Part 210—General Allocation and Price Rules

Department of Energy § 210.1 with section 552 of title 5, United 212.93(b)(4)(iii)(B)(I); 212.93(i)(4); States Code and part 202 of this title. 212.94(b)(2)(iii); 212.128; 212.132; 212.172; (b) Matter may be withheld from dis- and § 212.187 of part 212. closure under section 552(b) of title 5 (b) Effective February 5, 1985, para- only on the grounds specified in: graph (a) of this section shall apply, to (1) Section 552(b)(1), applicable to the extent indicated, only to firms in matter specifically required by Execu- the following categories. A firm may be tive Order to be kept secret in the in- included in more than one category, terest of the national defense or for- and a firm may move from one cat- eign policy. This section shall be inter- egory to another. The fact that a firm preted to include matter protected becomes no longer subject to the rec- under Executive Order No. 11652 of ordkeeping requirements of one cat- March 8, 1972, establishing categories egory shall not relieve that firm of and criteria for classification, as well compliance with the recordkeeping re- as any other such orders dealing spe- quirements of any other category in cifically with disclosure of IEP related which the firm is still included. materials; (1) Those firms which are or become (2) Section 552(b)(3), applicable to parties in litigation with DOE, as de- matter specifically exempted from dis- fined in paragraph (c)(1) of this section. -

SEC News Digest, 07-09-1968

· SECURITIES AND EXCHANGE COMMISSION ~m~~ !p)u@m~~ A brief summary of finoncial proposals filed with and actions by the S.E.C. (In ordertng lull text of Releases from Publications Unit. e i T e number) SEC (Iasue No. 68-133) FOR RELEASE Ju_l~y_9~,~1_96_B _ PENNsYLVANIA ELECTRIC SEEKS ORDER. The SEC has issued an order under the Holding Coapany Act (Release 35-16109) giving intereated persons until August 1 to request a hearing upon a proposal of Pennsylvania Electric COlipany ("Penelec"), a Johnstown, Pa., subsidiary of General Public Utilities Corporation ("GPU") to issue and aell $38,000,000 principal amount of first mortgage bonds, due 1998, at coapetitive bidding. Net proceeds of its bond aale will be used to finance its business as a public utility, including the re- i~ura ...nt of its treasury for expenditure therefrom prior to January I, 1968 for construction purposes and the pa~nt of $30,000,000 of its short-term bank loans outstanding at the time of the sale of bonds. GULP POWER RECEIVES SUPPLEMENTAL ORDER. The SEC has issued an order under the Holding Co.pany Act (Releaae 35-16110) authorizing Gulf Power Company, Pensacola, Fla., to issue and sell to banka an additional $1,000.000 of unaecured proaiasory notes. This supplements Com.ission order of April 9, 1968 (Holding eo.pany Act Releaae No. 16030) which authorized Gulf to issue and sell to banks from ti.. to tLme prior to Dece.ber 31, 1969, some $13,000,000 of unsecured promissory notes. Net proceeds of the coapany's note sale will be used to finance, in part, its 1968 and 1969 construction program, esti . -

United States Department of the Interior Minerals Management Service

CODETAIL UNITED STATES DEPARTMENT OF THE INTERIOR COMPANY MINERALS MANAGEMENT SERVICE 01-OCT-2021 PACIFIC OCS REGION PAGE: 1 Company Details Orders : COMPANY Companies: ALL Bonds : ALL 10th OCS Oil and Gas Lease Sale 00087 DEC/QUAL : 09-OCT-1962 Term Date : 09-OCT-1962 Regns : G 11th OCS Oil and Gas Lease Sale Zone 3 00100 DEC/QUAL : 28-APR-1964 Term Date : 28-APR-1964 Regns : G 12th OCS Oil and Gas Sale Zone 2 00118 DEC/QUAL : 01-JAN-1947 Term Date : 14-OCT-1968 Regns : G 1400 CORP. 00622 DEC/QUAL : 10-DEC-1980 Term Date : 22-APR-1982 Regns : P 145 OG HOLDINGS, LLC 03267 4514 Cole Ave. DEC/QUAL : 07-NOV-2012 Suite 600 Term Date : Dallas, TX 75205 Regns : PAYG * * * * * * UNCLASSIFIED * * * * * * CODETAIL UNITED STATES DEPARTMENT OF THE INTERIOR COMPANY MINERALS MANAGEMENT SERVICE 01-OCT-2021 PACIFIC OCS REGION PAGE: 2 Company Details Orders : COMPANY Companies: ALL Bonds : ALL 157 OG Holdings, LLC 03271 4514 Cole Avenue DEC/QUAL : 21-DEC-2012 Suite 600 Term Date : Dallas, TX 75205 Regns : PAYG 1982 Drilling Program 00830 Box 6629 DEC/QUAL : 14-NOV-1983 San Antonio, TX 78209 Term Date : 19-JUL-1988 Regns : P 1986 STEA Limited Partnership I 01145 1221 Lamar, Suite 1600 DEC/QUAL : 19-JUN-1987 Houston, TX 77010 Term Date : 19-SEP-1997 Regns : G 1987-I STEA Limited Partnership 01253 1221 Lamar, Suite 1600 DEC/QUAL : 24-MAR-1988 Houston, TX 77010 Term Date : 19-SEP-1997 Regns : G 1987-VI STEA Limited Partnership 01252 1221 Lamar, Suite 1600 DEC/QUAL : 24-MAR-1988 Houston, TX 77010 Term Date : 19-SEP-1997 Regns : G * * * * * * UNCLASSIFIED * * * * * * CODETAIL UNITED STATES DEPARTMENT OF THE INTERIOR COMPANY MINERALS MANAGEMENT SERVICE 01-OCT-2021 PACIFIC OCS REGION PAGE: 3 Company Details Orders : COMPANY Companies: ALL Bonds : ALL 1988-I TEAI Limited Partnership 01470 c/o Torch Energy Assoc. -

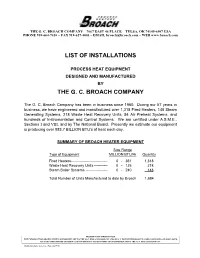

List of Installations the G. C. Broach Company

THE G. C. BROACH COMPANY – 7667 EAST 46 PLACE – TULSA, OK 74145-6307 USA PHONE 918-664-7420 – FAX 918-627-4083 – EMAIL [email protected] – WEB www.broach.com LIST OF INSTALLATIONS PROCESS HEAT EQUIPMENT DESIGNED AND MANUFACTURED BY THE G. C. BROACH COMPANY The G. C. Broach Company has been in business since 1960. During our 57 years in business, we have engineered and manufactured over 1,318 Fired Heaters, 148 Steam Generating Systems, 218 Waste Heat Recovery Units, 54 Air Preheat Systems, and hundreds of Instrumentation and Control Systems. We are certified under A.S.M.E., Sections I and VIII, and by The National Board. Presently we estimate our equipment is producing over 883.7 BILLION BTU's of heat each day. SUMMARY OF BROACH HEATER EQUIPMENT Size Range Type of Equipment MILLION BTU/Hr Quantity Fired Heaters ------------------------------ 0 - 361 1,318 Waste Heat Recovery Units ----------- 0 - 125 218 Steam Boiler Systems ------------------ 0 - 240 148 Total Number of Units Manufactured to date by Broach 1,684 PROPRIETARY INFORMATION THE INFORMATION SHOWN HEREIN IS PROPRIETARY TO THE G. C. BROACH COMPANY AND SHALL NOT BE REPRODUCED, USED, DISCUSSED, OR DISCLOSED TO OUR COMPETITORS OR THEIR AGENTS WITHOUT EXPRESS WRITTEN PERMISSION FROM THE G. C. BROACH COMPANY. (MLO\LI\001-Master List –Cover Page)-20171356 THE G. C. BROACH COMPANY PHONE 918-664-7420 7667 EAST 46 PLACE FAX 918-627-4083 TULSA, OK 74145-6307 EMAIL [email protected] USA WEB www.broach.com LIST OF INSTALLATIONS DIRECT FIRED PROCESS HEATERS AND RELATED EQUIPMENT DESIGNED AND MANUFACTURED BY THE G. -

Thesis-1971D-F981e.Pdf (1.948Mb)

ECONOMIC AND LEGAL IMPLICATIONS OF LIQUID ASPHALT PRICING IN OKLAHOMA, 1961-1965 By DALE RODNEY FUNDERBURK :l' Bachelor of Arts East Texas State University Commerce, Texas 1964 Master of Science Oklahoma State University Stillwater, Oklahoma 1968 Submitted to the Faculty of the Graduate College of the Oklahoma State University in partial fulfillment of the requirements for the Degree of DOCTOR OF PHILOSOPHY May, 1971 • I ECONOMIC AND LEGAL IMPLICATIONS OF LIQUID ASPHALT PRICING ~ IN OKLAHOMA, 1961-1965 Thesis Approved: Thesis Adviser ';.Z:41 ')f. ¥,J. Dean o~e Graduate College "788273 ii ACKNOWLEDGMENTS The writer wishes to express his deep appreciation to his dissertation co111Tiittee, Ors. Larkin B. Warner, Chairman, Richard H. Leftwich, Joseph M. Jadlow, and Wayne A. Meinhart. Special apprecia tion is due Dr. Warner for his tireless assistance and guidance. Also, Dr. Leftwich's specialized knowledge of the case around which this study is centered proved invaluable. Sincere appreciation is also extended to Mr. Burck Bailey of the Oklahoma City law firm Fellers, Snider, Baggett, Blankenship and Bailey. His cooperation in providing office space to the writer, as well as making available the trial transcript and exhibits, and his willingness to give freely of his time greatly facilitated the completion of this dissertation. The constructive and unselfish way in which these individuals made available their services helped to make a long and difficult task a pleasant experience. iii TABLE OF CONTENTS Chapter Page I. PROBLEM, BACKGROUND AND PROCEDURE 1 II. MARKET STRUCTURE . 8 The Product . • • . • . • . 8 Su pp l y . Q • Iii " • • e • • • • Iii e • • • 10 Technology, Cost~ and the Supply of Asphalt . -

United States Department of the Interior Minerals Management Service Codetail Company 02-Mar-2009 Page

CODETAIL UNITED STATES DEPARTMENT OF THE INTERIOR COMPANY MINERALS MANAGEMENT SERVICE 02-MAR-2009 GULF OF MEXICO REGION PAGE: 1 Company Details Orders : CODE Companies: ALL Bonds : ALL 00001 Conoco Inc. 550 Westlake Park Boulevard DEC/QUAL : 14-OCT-1981 3 Westlake Park - Suite 9000 Term Date : 14-FEB-2003 Houston, TX 77079 Regns : YG BONDS: EFFECTIVE PI/LE/AR TP AMOUNT SURTY BOND NUMBER CAN/REP 05-JUN-1978 AREA A 300000 20011 8076-34-91 01-JAN-1994 02-NOV-1979 PIPE P 300000 20005 8081-43-17 14-FEB-2003 01-JAN-1994 ADEV D 3000000 20005 8076-34-91 08-MAY-1998 08-MAY-1998 ADEV D 3000000 20017 19-41-77 14-FEB-2003 00001 Continental Oil Company . DEC/QUAL : 01-JAN-1947 Term Date : 23-JUL-1979 Regns : G BONDS: EFFECTIVE PI/LE/AR TP AMOUNT SURTY BOND NUMBER CAN/REP 05-JUN-1978 AREA A 300000 20011 8076-34-91 23-JUL-1979 00001 Conoco Inc. DEC/QUAL : 23-JUL-1979 Term Date : 14-OCT-1981 Regns : G BONDS: EFFECTIVE PI/LE/AR TP AMOUNT SURTY BOND NUMBER CAN/REP 02-NOV-1979 PIPE P 300000 20005 8081-43-17 14-OCT-1981 05-JUN-1978 AREA A 300000 20011 8076-34-91 14-OCT-1981 00002 Atlantic Richfield Company Post Office Box 1346 DEC/QUAL : 12-JUL-1966 Houston, TX 77251 Term Date : 23-AUG-1985 Regns : YG BONDS: EFFECTIVE PI/LE/AR TP AMOUNT SURTY BOND NUMBER CAN/REP 05-AUG-1982 PIPE P 300000 20005 8094-54-86 23-AUG-1985 25-JUN-1954 AREA A 300000 20005 7933154 23-AUG-1985 * * * * * * UNCLASSIFIED * * * * * * CODETAIL UNITED STATES DEPARTMENT OF THE INTERIOR COMPANY MINERALS MANAGEMENT SERVICE 02-MAR-2009 GULF OF MEXICO REGION PAGE: 2 Company Details Orders : CODE -

Lease Owner by Owner

LSTOWNLD UNITED STATES DEPARTMENT OF THE INTERIOR LEASE ADMINISTRATION BUREAU OF OCEAN ENERGY MANAGEMENT 20-SEP-2021 GULF OF MEXICO REGION PAGE: 1 Active Leases by Lessee - Detail LEASES HELD BY: 00087 10th OCS Oil and Gas Lease Sale NO RECORDS FOUND LEASES HELD BY: 00100 11th OCS Oil and Gas Lease Sale Zone 3 NO RECORDS FOUND LEASES HELD BY: 00118 12th OCS Oil and Gas Sale Zone 2 NO RECORDS FOUND LEASES HELD BY: 03267 145 OG HOLDINGS, LLC NO RECORDS FOUND LEASES HELD BY: 03271 157 OG Holdings, LLC NO RECORDS FOUND LEASES HELD BY: 00830 1982 Drilling Program NO RECORDS FOUND LEASES HELD BY: 01145 1986 STEA Limited Partnership I NO RECORDS FOUND LEASES HELD BY: 01253 1987-I STEA Limited Partnership NO RECORDS FOUND LEASES HELD BY: 01252 1987-VI STEA Limited Partnership NO RECORDS FOUND LEASES HELD BY: 01470 1988-I TEAI Limited Partnership NO RECORDS FOUND LEASES HELD BY: 01471 1988-II TEAI Limited Partnership NO RECORDS FOUND LEASES HELD BY: 01472 1988-VI TEAI Limited Partnership NO RECORDS FOUND LEASES HELD BY: 01566 1989-I TEAI Limited Partnership NO RECORDS FOUND LEASES HELD BY: 01802 1993 Offshore Limited Partnership NO RECORDS FOUND LEASES HELD BY: 01965 1995 Income Program Limited Liability Company Lease Measure Lease Area Aliquot Aliquot Portion Percent Lessee Net Portion G02939 A 4999.960000 0.000 2.02703 101.350689 TOTAL ACRES 4999.960000 TOTAL NET PORTION (ACRES) 101.350689 TOTAL HECTARES 2023.415147 TOTAL NET PORTION (HECTARES) 41.015232 LEASES HELD BY: 03266 207 OG HOLDINGS, LLC NO RECORDS FOUND LEASES HELD BY: 03272 233 OG Holdings, LLC NO RECORDS FOUND LEASES HELD BY: 02687 300 Energy, Ltd. -

Jenkins V. Kansas City Missouri School District

460 F.Supp. 421 United States District Court, W.D. Missouri, Western Division. SCHOOL DISTRICT OF KANSAS CITY, MISSOURI, et al. v. The STATE OF MISSOURI et al. No. 77-0420-CV-W-1-3. | Oct. 6, 1978. Synopsis Kansas City Missouri School District and its students through their parents brought school desegregation action against the State of Missouri, its state Board of Education, certain Missouri school districts and certain Missouri officials, state of Kansas, its state Board of Education, certain Kansas school districts, the United States Department of Housing and Urban Development, the Department of Transportation and the Department of Health, Education and Welfare seeking metropolitan- wide desegregation plan in greater Kansas City area. On various pretrial motions, the District Court, Russell G. Clark, J., held that: (1) complaint which alleged segregative condition throughout entire metropolitan area as result of intentional acts and omissions of Kansas and Missouri school districts stated claim for interdistrict relief; (2) Missouri long-arm statute did not authorize exercise of personal jurisdiction over Kansas defendants where alleged segregative acts and omissions of Kansas defendants occurred entirely within Kansas even though such acts allegedly had effect of causing Kansas City Missouri School District to be racially identifiable; (3) Kansas City Missouri School District did not have standing to maintain action asserting violation of students’ constitutional rights and would be realigned as party defendant; (4) students had standing to maintain action; (5) complaint was not so vague as to make impossible a responsive pleading by federal agencies and (6) denial of motion to dismiss, dismissal of Kansas school officials and school districts for lack of jurisdiction, denial of standing to Kansas City School District and realignment of that district would be certified. -

United States Department of The

CODETAIL UNITED STATES DEPARTMENT OF THE INTERIOR COMPANY MINERALS MANAGEMENT SERVICE 20-SEP-2021 ALASKA OCS REGION PAGE: 1 Company Details Orders : COMPANY Companies: ALL Bonds : ALL ; 00995 DEC/QUAL : 01-JAN-1947 Term Date : Regns : G ; 00999 DEC/QUAL : 01-JAN-1947 Term Date : Regns : G 10th OCS Oil and Gas Lease Sale 00087 DEC/QUAL : 09-OCT-1962 Term Date : 09-OCT-1962 Regns : G 11th OCS Oil and Gas Lease Sale Zone 3 00100 DEC/QUAL : 28-APR-1964 Term Date : 28-APR-1964 Regns : G 12th OCS Oil and Gas Sale Zone 2 00118 DEC/QUAL : 01-JAN-1947 Term Date : 14-OCT-1968 Regns : G * * * * * * UNCLASSIFIED * * * * * * CODETAIL UNITED STATES DEPARTMENT OF THE INTERIOR COMPANY MINERALS MANAGEMENT SERVICE 20-SEP-2021 ALASKA OCS REGION PAGE: 2 Company Details Orders : COMPANY Companies: ALL Bonds : ALL 1400 CORP. 00622 DEC/QUAL : 01-JAN-1947 Term Date : Regns : P 145 OG HOLDINGS, LLC 03267 4514 Cole Ave. DEC/QUAL : 07-NOV-2012 Suite 600 Term Date : Dallas, TX 75205 Regns : PAYG 157 OG Holdings, LLC 03271 4514 Cole Avenue DEC/QUAL : 21-DEC-2012 Suite 600 Term Date : Dallas, TX 75205 Regns : PAYG 1982 Drilling Program 00830 Box 6629 DEC/QUAL : 14-NOV-1983 San Antonio, TX 78209 Term Date : Regns : G 1986 STEA Limited Partnership I 01145 1221 Lamar, Suite 1600 DEC/QUAL : 19-JUN-1987 Houston, TX 77010 Term Date : 19-SEP-1997 Regns : G * * * * * * UNCLASSIFIED * * * * * * CODETAIL UNITED STATES DEPARTMENT OF THE INTERIOR COMPANY MINERALS MANAGEMENT SERVICE 20-SEP-2021 ALASKA OCS REGION PAGE: 3 Company Details Orders : COMPANY Companies: ALL Bonds : ALL 1987-I STEA Limited Partnership 01253 1221 Lamar, Suite 1600 DEC/QUAL : 24-MAR-1988 Houston, TX 77010 Term Date : 19-SEP-1997 Regns : G 1987-VI STEA Limited Partnership 01252 1221 Lamar, Suite 1600 DEC/QUAL : 24-MAR-1988 Houston, TX 77010 Term Date : 19-SEP-1997 Regns : G 1988-I TEAI Limited Partnership 01470 c/o Torch Energy Assoc.