New York University Revenue Bonds, Series 2015A

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

New York University Revenue Bonds, Series 2019A,B1 and B2

Moody’s: “Aa2” S&P: “AA-” NEW ISSUE – BOOK–ENTRY ONLY (See “Ratings” herein) $862,755,000 DORMITORY AUTHORITY OF THE STATE OF NEW YORK NEW YORK UNIVERSITY REVENUE BONDS ® $603,460,000 $176,125,000 $83,170,000 Series 2019A Subseries 2019B-1 Subseries 2019B-2 (Tax-Exempt) (Taxable) (Taxable) (Green Bonds) Dated: Date of Delivery Due: July 1, as shown on the inside cover Payment and Security: The New York University Revenue Bonds, Series 2019A (Tax-Exempt) (the “Series 2019A Bonds”), the New York University Revenue Bonds, Subseries 2019B-1 (Taxable) (the “Subseries 2019B-1 Bonds”) and the New York University Revenue Bonds, Subseries 2019B-2 (Taxable) (Green Bonds) (the “Subseries 2019B-2 Bonds” and, together with the Subseries 2019B-1 Bonds, the “Series 2019B Bonds”, and the Series 2019B Bonds together with the Series 2019A Bonds, the “Series 2019 Bonds”) are special obligations of the Dormitory Authority of the State of New York (“DASNY”) payable solely from and secured by a pledge of (i) certain payments to be made under the Loan Agreement (the “Loan Agreement”), dated as of May 28, 2008, between New York University (the “University”) and DASNY, and (ii) all funds and accounts (except the Arbitrage Rebate Fund or any fund or account established for the payment of the Purchase Price or Redemption Price of Bonds tendered for purchase or redemption) established under DASNY’s New York University Revenue Bond Resolution, adopted May 28, 2008 (the “Resolution”), a Series Resolution authorizing the issuance of the Series 2019A Bonds adopted on February 6, 2019 (the “Series 2019A Resolution”) and a Series Resolution authorizing the issuance of the Series 2019B Bonds adopted on February 6, 2019 (the “Series 2019B Resolution” and, together with the Series 2019A Resolution, the “Series 2019 Resolutions”). -

People with Disabilities

Application for MTA Reduced-Fare MetroCard for People with Disabilities Information Type or print in ink. Last Name First Name M.I. Street Address Apt. No. 2" City State Zip Code Home Telephone Birth Date Male Female 1 1/2" Social Security Number Code ALL INFORMATION WILL BE KEPT STRICTLY CONFIDENTIAL Return Metropolitan Transportation Authority Completed Reduced-Fare Program Application to: 370 Jay Street, Room 934 Brooklyn, New York 11201 For further information or additional copies of this Application or the Application for Senior Citizens, call: (212) METROCARD (212-638-7622) (718) 596-8273 TTY/TDD (for people with hearing impairments) Monday to Friday, 7 a.m. to 11 p.m., weekends 9 a.m. to 5 p.m. Or visit www.mta.info For Office Disk # Use Only Image # Examiner’s Signature Information The Metropolitan Transportation Authority’s (MTA) Reduced-Fare MetroCard For All Program for People with Disabilities provides reduced-fare transportation for Applicants persons with the following disabilities: • receiving Medicare benefits for any reason other than age* • serious mental illness (SMI) and receiving Supplemental Security Income (SSI) benefits •blindness • hearing impairment •ambulatory disability •loss of both hands •mental retardation and/or other organic mental capacity impairment If you do not have one of these disabilities, you are not eligible for the Reduced-Fare MetroCard Program. Read the entire form carefully before you apply. All applicants must sign the affirmation in Section 1 and have the statement and signature confirmed by a notary public. All applicants must supply at their own expense one 2" x 1 " photograph (passport type) with this application. -

370 Jay Street & the M

Contact: February 9, 2016 Chelsea Newburg (718) 694-4915 [email protected] REVENUE REVIEW: 370 JAY STREET & THE MONEY ROOM Wednesday, February 17 from 6:30 – 8:30pm Less than four blocks from the Transit Museum, above the Jay Street – MetroTech Station, stands 370 Jay Street, a 13-story white limestone building that for more than 50 years housed the headquarters of New York’s evolving transit agencies. From 1951 to 2006 subway and bus fares were processed there, in the Department of Revenue’s once-secret Money Room. The Money Room evolved as technology advanced: tokens were introduced in 1953, an innovative vacuum system helped speed up money processing at bus depots, and in the 1990s the MetroCard and Automated Fare Collection system brought revenue collection into the digital age. On Wednesday, February 17th, join long-time MTA employee and COO of Revenue Control Alan Putre and transit blogger Ben Kabak of Second Avenue Sagas for a look back at the fascinating history of this once-secret room. Tickets are available at http://bit.ly/RevenueReview for $10 (free for Museum members). Visit www.mta.info/museum/programs for more information on Transit Museum programs and to purchase tickets. New York Transit Museum programs explore the history, ingenuity, and inner workings of the transit system that is the lifeblood of our region. AfterHours at the Transit Museum provides an extended opportunity to explore the museum and features panels and programs with experts from the MTA, and the design, urban planning, and engineering fields – all set against the backdrop of the Museum’s 1936 decommissioned subway station. -

Letter to the Responsible Parties

THE PRACTICAL NOMAD EDWARD HASBROUCK 1130 Treat Avenue, San Francisco, CA 94110, USA phone +1-415-824-0214 [email protected] http://hasbrouck.org The Practical Nomad: How to Travel Around the World (3rd edition, 2004) The Practical Nomad Guide to the Online Travel Marketplace (2001) http://www.practicalnomad.com 26 April 2004 Hugh McCann, General Manager of Rail Operations JFK Airtrain, JFK International Airport Pan Am Road - Building 402 Jamaica (New York), NY 11430 Joseph J. Seymour, Executive Director Port Authority of New York and New Jersey 225 Park Avenue South New York, NY 10003 Office of the Inspector General Port Authority of New York and New Jersey Post Office Box 2018 Hoboken, NJ 07030 New York City Transit Department MetroCard Customer Service 370 Jay Street Brooklyn (New York), NY 11201-9876 Complaints Department New York City Department of Consumer Affairs 42 Broadway, 9th floor New York, NY 10004 Complaint Unit New York State Consumer Protection Board 5 Empire State Plaza, Suite 2101 Albany, NY 12223-1556 Dear Mr. McCann, Mr. Seymour, et al: On my most recent visit to New York, I looked forward to the opportunity to ride the new Airtrain from and to JFK. While I enjoyed the ride, I found the payment system, specifically the manner of labeling and advertising MetroCards used for payment of Airtrain fares, to be false, deceptive, and fraudulent. So far as I can tell, the only acceptable form of payment for Airtrain fares is the "MetroCard". MetroCards are sold at vending machines in Airtrain stations, in MTA subway stations (and perhaps in other locations). -

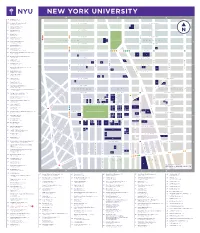

Nyu-Downloadable-Campus-Map.Pdf

NEW YORK UNIVERSITY 64 404 Fitness (B-2) 404 Lafayette Street 55 Academic Resource Center (B-2) W. 18TH STREET E. 18TH STREET 18 Washington Place 83 Admissions Office (C-3) 1 383 Lafayette Street 27 Africa House (B-2) W. 17TH STREET E. 17TH STREET 44 Washington Mews 18 Alumni Hall (C-2) 33 3rd Avenue PLACE IRVING W. 16TH STREET E. 16TH STREET 62 Alumni Relations (B-2) 2 M 25 West 4th Street 3 CHELSEA 2 UNION SQUARE GRAMERCY 59 Arthur L Carter Hall (B-2) 10 Washington Place W. 15TH STREET E. 15TH STREET 19 Barney Building (C-2) 34 Stuyvesant Street 3 75 Bobst Library (B-3) M 70 Washington Square South W. 14TH STREET E. 14TH STREET 62 Bonomi Family NYU Admissions Center (B-2) PATH 27 West 4th Street 5 6 4 50 Bookstore and Computer Store (B-2) 726 Broadway W. 13TH STREET E. 13TH STREET THIRD AVENUE FIRST AVENUE FIRST 16 Brittany Hall (B-2) SIXTH AVENUE FIFTH AVENUE UNIVERSITY PLACE AVENUE SECOND 55 East 10th Street 9 7 8 15 Bronfman Center (B-2) 7 East 10th Street W. 12TH STREET E. 12TH STREET BROADWAY Broome Street Residence (not on map) 10 FOURTH AVE 12 400 Broome Street 13 11 40 Brown Building (B-2) W. 11TH STREET E. 11TH STREET 29 Washington Place 32 Cantor Film Center (B-2) 36 East 8th Street 14 15 16 46 Card Center (B-2) W. 10TH STREET E. 10TH STREET 7 Washington Place 17 2 Carlyle Court (B-1) 18 25 Union Square West 19 10 Casa Italiana Zerilli-Marimò (A-1) W. -

The Chronicle

THIS PAGE HAS BEEN APPROVED BY: Section Editor:_____ Copy Editor:_____ Jasmine:_____ Jeff Selingo:_____ Scott Smallwood:_____ Display _____ Photo credit _____ Page fit by: ___________________ Editorial: ___________ THE CHRONICLE of Higher Education ® February 11, 2011 • $3.75 chronicle.com Volume LVII, Number 23 College Giving HUNTSVILLE: One Year Later Has Yet to Recover From Recession Wealthy donors pledge lowest total in a decade By Kathryn Masterson lthough the recession of- ficially ended more than A a year ago, private giving to colleges and other charities re- mained depressed in 2010, two sur- veys have found. After a steep drop-off in 2009, donations to higher education dur- ing the 2010 Top Money fiscal year rose Raisers, just 0.5 percent, 2009-10 the annual Vol- untary Support of Education 1 Stanford U. $598,890,327 Survey found. The report was released last CHRISTINE PRICHARD FOR THE CHRONICLE 2 Harvard U. week by the Joseph Leahy of the U. of Alabama at Huntsville is struggling to recover his teaching and research skills, with the help of his wife, Virginia. $596,963,000 Council for Aid to Educa- The Johns tion. Adjusted 3 Hopkins U. for inflation, $427,593,283 total giving ac- A Professor’s Long Road Back Source: Council for tually declined Aid to Education slightly, a clear Shot in the head at a department meeting, Joseph Leahy is relearning his job signal that the economic recovery that colleges have been hoping for has not yet By Robin Wilson ciate professor of microbiology. member the events at all.” arrived. -

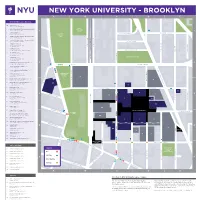

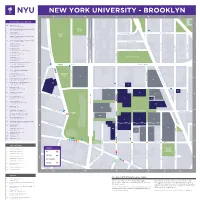

A B 1 1 2 2 4 4 5 5 3 3 a C D B C E

<3EG=@9C<7D3@A7BG0@==9:G< A B C D NASSAU STREET E CADMAN PLAZA E. NYU Buildings & Destinations 16 Admissions (D-3) Wunsch Hall • 311 Bridge St. 5 Bern Dibner Library of Science & Technology WALT (D-3) • 5 MetroTech Ctr. WHITMAN 1 PARK BROOKLYN QUEEN1 6 Café & Servery (C-3) CONCORD STREET Rogers Hall • 6 MetroTech Ctr. CADMAN CONCORD STREET PLAZA 1 Center for Urban Science + Progress (CUSP) PARK (C-4) • 1 MetroTech Ctr. S 20 Center for Urban Science + Progress (CUSP) E (A-3) • 1 Pierrepont Plaza CHAPEL STREET 6 Computer Lab (C-3) Jacobs Academic Building C A D 6 MetroTech Ctr. ADAMS STREET ADAMS STREET M DUMBO Incubator A N 20 Jay Street • (Not located on map) CATHEDRAL PLACE P L GOLD STREET A 6 Greenhouse (C-3) PRINCE STREET Z DUFFIELD STREET Jacobs Academic Building A 6 MetroTech Ctr. W . MCLAUGHLIN PARK 6 Gymnasium (C-3) Jacobs Academic Building BROOKLYN BRIDGE PROMENADE 6 MetroTech Ctr. JAY STREET 6 Information Technology Help Desks (C-3) 2 2 Rogers Hall • 6 MetroTech Ctr. 25 38 103 TILLARY STREET TILLARY STREET 6 Jacobs Academic Building (C-3) 6 MetroTech Ctr. FLATBUSH AVENUE EXTENSION 26 6 Jacobs Administration Building (C-3) 41 6 MetroTech Ctr. 52 5 LC400 Event Space (D-3) KOREAN WAR Bern Dibner Library Building VETERANS 5 MetroTech Ctr. PLAZA 19 6 Mail Room/Main Receiving Dock (C-3) 11 Rogers Hall • 6 MetroTech Ctr. CADMAN PLAZA E. BRIDGE STREET 6 NYU Public Safety Badging Station (C-3) 20 Jacobs Academic Building CLINTON STREET 6 MetroTech Ctr. -

New York City Department of Transportation Willoughby Street Pedestrian Priority Existing Conditions Report

New York City Department of Transportation Willoughby Street Pedestrian Priority Existing Conditions Report Final Issue | October 2, 2014 This report takes into account the particular instructions and requirements of our client. It is not intended for and should not be relied upon by any third party and no responsibility is undertaken to any third party. Job number 227520-12 Ove Arup & Partners P.C. 77 Water Street New York NY 10005 United States of America www.arup.com New York City Department of Transportation Willoughby Street Pedestrian Priority Existing Conditions Report Contents Page 1 Introduction 1 1.1 Project Background 1 1.2 Goals and Objectives 2 1.3 Project Site and Adjacent Uses 3 2 Existing Conditions: Mobility 11 2.1 Transit 11 2.2 Pedestrians 14 2.3 Vehicles 20 2.4 Cycling 31 3 Existing Conditions: Character and Environment 33 3.1 General Character 33 3.2 Architecture 34 3.3 Pedestrian Gathering Areas and Public Open Space 35 3.4 Landscape/Hardscape 38 3.5 Views and View Corridors 39 3.6 Availability of Sunlight 40 3.7 Source of Noise Pollution 40 3.8 Perception of Safety 41 4 Key Issues and Opportunities 43 5 Pedestrian Priority Streets 45 5.1 What is a pedestrian priority street? 45 5.2 Pedestrian Priority /Shared Street Precedents 47 Final Issue | October 2, 2014 | | | Ove Arup & Partners P.C. New York City Department of Transportation Willoughby Street Pedestrian Priority Existing Conditions Report 1 Introduction 1.1 Project Background Over the past 20 years Downtown Brooklyn in New York City has become an increasingly successful and vibrant area that supports a broad mix of uses and attracts world-class businesses and institutions. -

Directions to NYU Washington Square Campus Directions to NYU Washington Square Campus 5 ATM - Chase Bank (D-3) 5 Metrotech Ctr

. E A Z A L P NEW YORKAN UNIVERSITY - BROOKLYN M D A B C D NASSAU STREET E CA NYU Buildings & Destinations 16 Admissions (D-3) Wunsch Hall • 311 Bridge St. WALT 5 Bern Dibner Library of Science & Technology WHITMAN (D-3) • 5 MetroTech Ctr. B 1 PARK ROOK 1 6 Café & Servery (C-3) CONCORD STREET CADMAN CONCORD STREET L Rogers Hall • 6 MetroTech Ctr. Y PLAZA N Q 1 Center for Urban Science + Progress (CUSP) PARK U EEN T T (C-4) • 1 MetroTech Ctr. E E E S E E E 20 Center for Urban Science + Progress (CUSP) X P (A-3) • 1 Pierrepont Plaza ENAD CHAPEL STREET Y T M E T MS STR MS STR (C-3) T 6 Computer Lab E RO C E A A E Jacobs Academic Building P A D D D 6 MetroTech Ctr. A A M GE STR A E DUMBO Incubator D N C 20 Jay Street • (Not located on map) CATHEDRAL PLACE N P OLD STRE L BRI RI G A P 6 Greenhouse (C-3) N Z DUFFIELD STRE T Jacobs Academic Building A E 6 MetroTech Ctr. W . MCLAUGHLIN PARK 6 Gymnasium (C-3) Jacobs Academic Building BROOKLY AY STRE 6 MetroTech Ctr. J 6 Information Technology Help Desks (C-3) 2 2 Rogers Hall • 6 MetroTech Ctr. 25 38 103 TILLARY STREET TILLARY STREET 6 Jacobs Academic Building (C-3) 6 MetroTech Ctr. FLATBUSH 26 . 6 Jacobs Administration Building (C-3) 41 A E 6 MetroTech Ctr. T Z 52 E E (D-3) KOREAN WAR LA 5 LC400 Event Space A P Bern Dibner Library Building VETERANS V N PLAZA STR E 5 MetroTech Ctr. -

C040171ZMK -- Downtown Brooklyn Development; Amendment to the Zoning Map Sections 12D And

CITY PLANNING COMMISSION May 10, 2004/Calendar No. 5 C 040171 ZMK IN THE MATTER OF an application submitted by the Department of City Planning pursuant to Sections 197-c and 201 of the New York City Charter for an amendment of the Zoning Map, Section Nos. 12d and 16c: 1. eliminating from an existing R6 District a C1-3 District bounded by a line 200 feet northerly of Myrtle Avenue, Prince Street, Myrtle Avenue, a line 100 feet easterly of Prince Street, Fair Street, Fleet Place, a line 85 feet southerly of Fair Street, Prince Street, the westerly centerline prolongation of Fair Street, Flatbush Avenue Extension, and Gold Street; 2. changing from an R6 District to an R7-1 District property bounded by Myrtle Avenue, Ashland Place, the easterly centerline prolongation of former Fair Street, and Fleet Place; 3. changing from an R6 District to a C6-4 District property bounded by a line 200 feet northerly of Myrtle Avenue, Prince Street, Myrtle Avenue, Fleet Place, Willoughby Street, a line midway between Fleet Street and the former Prince Street and its southerly prolongation, a line 85 feet southerly of the former Fair Street, the former Prince Street and its southerly centerline prolongation, the westerly centerline prolongation of the former Fair Street, and Flatbush Avenue Extension; 4. changing from a C5-4 District to a C6-4.5 District property bounded by Willoughby Street, Jay Street, a line 200 feet northeasterly of Fulton Street, Duffield Street, Fulton Street, Smith Street, Livingston Street, and Boerum Place; 5. changing from a C6-1 District to a C6-2 District property bounded by: a. -

Employment • Education • Volunteership • STEM

NYU in Brooklyn As Brooklyn evolves into a powerful driver of New York’s innovation economy, NYU is helping cement its position as a global leader in academics and technology. That’s good for everyone—from greentech companies in Gowanus to college hope- fuls in Canarsie. Academic Programs with an Economic Impact Situated together in Downtown Brooklyn, NYU’s technological initiatives will train stu- dents to develop their potential and help new businesses set down strong local roots. • The NYU Polytechnic School of Engineering, ranked among the nation’s foremost en- gineering programs for salary potential and ROI, named the #2 non-HBCU school for minorities by Diverse Issues in Higher Education, and designated a Best Northeastern College by the Princeton Review. • CUSP, the Center for Urban Science & Progress, a world leader in the burgeoning field of urban informatics. • NYU’s business incubators, a lightning rod for the best ideas and brightest individuals in The Economics of Research: the tech world. NYU will strengthen Downtown • NYU’s Media & Games Network (MAGNET) Brooklyn’s position as the epicenter bridges the gap between technology and of the city’s science and tech eco- culture with research and teaching in both system. Brooklyn’s Tech Triangle game design and digital media design. will become a focal point for STEM training, wireless research, game development, clean technology, and Co-locating these programs sets the stage more. Research funding will allow for powerful collaboration between innova- the best ideas for urban progress tors. That means better resources for stu- to find their footing in Brooklyn, the dents, more diverse community programs, laboratory for – and beneficiary of – stronger incentives to attract investors, and our data-driven achievements. -

Finance Committee Meeting

Finance Committee Meeting November 2014 Committee Members A. Saul, Chair F. Ferrer, Vice Chair A. Albert* J. Ballan J. Banks, III R. Bickford N. Brown A. Cappelli J. Kay C. Moerdler M. Pally J. Sedore, Jr. V. Tessitore, Jr* P. Trottenberg I. Weinshall C. Wortendyke Finance Committee Meeting 347 Madison Avenue, 5th Floor Board Room New York, NY 10017 Monday, 11/17/2014 12:30 - 1:45 PM ET 1. PUBLIC COMMENTS PERIOD 2. APPROVAL OF MINUTES – OCTOBER 27, 2014 Finance Committee Minutes - Page 4 3. 2014 COMMITTEE WORK PLAN Committee Work Plan - Page 16 4. BUDGETS/CAPITAL CYCLE Finance Watch Finance Watch - Page 24 5. MTA HEADQUARTERS & ALL-AGENCY ITEMS Report and Information Items Station Maintenance Billing Update - Page 36 Review and Assessment of the Finance Committee Charter - Page 39 MTA Wide Customer Satisfaction Presentation - Page 42 Procurements MTAHQ Procurement Report - Page 62 MTAHQ Non-Competitive Procurements - Page 64 MTAHQ Competitive Procurements - Page 66 6. METRO -NORTH RAILROAD & LONG ISLAND RAIL ROAD MNR Action Item - Page 68 MNR/LIRR Procurements - Page 86 7. NEW YORK CITY TRANSIT, and MTA BUS OPERATIONS NYCT Procurements - Page 94 8. BRIDGES AND TUNNELS B & T Procurement - Page 100 9. FIRST MUTUAL TRANSPORTATION ASSURANCE COMPANY (No Items) 10. MTA CONSOLIDATED REPORTS Statement of Operations - Page 104 Overtime Report - Page 112 Report on Subsidies - Page 116 Positions - Page 123 Subsidy, Interagency Loans and Stabilization Fund Transactions - Page 126 Farebox Recovery Ratios - Page 129 MTA Ridership - Page 130 Fuel Hedge Program - Page 154 11. REAL ESTATE AGENDA Action Items Approve Real Estate Action Items - Page 158 Report and Information Items Real Estate Info Items - Page 174 Date of the next meeting, Monday, December 15th at 12:30 PM Minutes of the MTA Finance Committee Meeting October 27, 2014 347 Madison Avenue New York, NY 12:30 PM The following Finance Committee members attended: Hon.