Fact Sheet International Trade: Asian Markets

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Product List March 2019 - Page 1 of 53

Wessex has been sourcing and supplying active substances to medicine manufacturers since its incorporation in 1994. We supply from known, trusted partners working to full cGMP and with full regulatory support. Please contact us for details of the following products. Product CAS No. ( R)-2-Methyl-CBS-oxazaborolidine 112022-83-0 (-) (1R) Menthyl Chloroformate 14602-86-9 (+)-Sotalol Hydrochloride 959-24-0 (2R)-2-[(4-Ethyl-2, 3-dioxopiperazinyl) carbonylamino]-2-phenylacetic 63422-71-9 acid (2R)-2-[(4-Ethyl-2-3-dioxopiperazinyl) carbonylamino]-2-(4- 62893-24-7 hydroxyphenyl) acetic acid (r)-(+)-α-Lipoic Acid 1200-22-2 (S)-1-(2-Chloroacetyl) pyrrolidine-2-carbonitrile 207557-35-5 1,1'-Carbonyl diimidazole 530-62-1 1,3-Cyclohexanedione 504-02-9 1-[2-amino-1-(4-methoxyphenyl) ethyl] cyclohexanol acetate 839705-03-2 1-[2-Amino-1-(4-methoxyphenyl) ethyl] cyclohexanol Hydrochloride 130198-05-9 1-[Cyano-(4-methoxyphenyl) methyl] cyclohexanol 93413-76-4 1-Chloroethyl-4-nitrophenyl carbonate 101623-69-2 2-(2-Aminothiazol-4-yl) acetic acid Hydrochloride 66659-20-9 2-(4-Nitrophenyl)ethanamine Hydrochloride 29968-78-3 2,4 Dichlorobenzyl Alcohol (2,4 DCBA) 1777-82-8 2,6-Dichlorophenol 87-65-0 2.6 Diamino Pyridine 136-40-3 2-Aminoheptane Sulfate 6411-75-2 2-Ethylhexanoyl Chloride 760-67-8 2-Ethylhexyl Chloroformate 24468-13-1 2-Isopropyl-4-(N-methylaminomethyl) thiazole Hydrochloride 908591-25-3 4,4,4-Trifluoro-1-(4-methylphenyl)-1,3-butane dione 720-94-5 4,5,6,7-Tetrahydrothieno[3,2,c] pyridine Hydrochloride 28783-41-7 4-Chloro-N-methyl-piperidine 5570-77-4 -

ADHD Parents Medication Guide Revised July 2013

ADHD Parents Medication Guide Revised July 2013 Attention-Deficit/Hyperactivity Disorder Prepared by: American Academy of Child & Adolescent Psychiatry and American Psychiatric Association Supported by the Elaine Schlosser Lewis Fund Physician: ___________________________________________________ Address: ___________________________________________________ ___________________________________________________ ___________________________________________________ Phone: ___________________________________________________ Email: ___________________________________________________ ADHD Parents Medication Guide – July 2013 2 Introduction Attention-Deficit/Hyperactivity Disorder (ADHD) is a neurodevelopmental disorder characterized by difficulty paying attention, excessive activity, and impulsivity (acting before you think). ADHD is usually identified when children are in grade school but can be diagnosed at any time from preschool to adulthood. Recent studies indicate that almost 10 percent of children between the ages of 4 to 17 are reported by their parents as being diagnosed with ADHD. So in a classroom of 30 children, two to three children may have ADHD.1,2,3,4,5 Short attention spans and high levels of activity are a normal part of childhood. For children with ADHD, these behaviors are excessive, inappropriate for their age, and interfere with daily functioning at home, school, and with peers. Some children with ADHD only have problems with attention; other children only have issues with hyperactivity and impulsivity; most children with ADHD have problems with all three. As they grow into adolescence and young adulthood, children with ADHD may become less hyperactive yet continue to have significant problems with distraction, disorganization, and poor impulse control. ADHD can interfere with a child’s ability to perform in school, do homework, follow rules, and develop and maintain peer relationships. When children become adolescents, ADHD can increase their risk of dropping out of school or having disciplinary problems. -

August 2014 Medical Marijuana and Your Workforce - Part III Drug Tests, Zero Tolerance Policies and Unemployment Compensation

LAW OFFICE OF LORI A. GOLDSTEIN, LLC CLIENT BULLETIN August 2014 Medical Marijuana and Your Workforce - Part III Drug Tests, Zero Tolerance Policies and Unemployment Compensation This is the final in a three-part series covering the new Illinois Compassionate Use of Medical Cannabis Pilot Program Act and what it means for employers. Drug Testing Until the Illinois courts provide more guidance, employers should proceed with caution when a registered patient tests positive for marijuana on a pre-employment or employee drug screening. Since cannabis can remain in the body for several weeks, a positive drug test does not necessarily mean that an applicant or employee is impaired at the time of the test. Employers must be careful not to reject a registered patient’s application based solely based on a positive drug test, unless hiring the applicant presents a public safety risk (e.g., security guard or driver positions). Evaluate drug test results for registered patient employees on a case-by-case basis, permitting the employee to explain or contest the basis of a positive test result. Zero Tolerance Policies and Privacy Laws Can employers in states legalizing marijuana include marijuana in zero tolerance drug policies? How are privacy rights affected? Many states, including Illinois, forbid employers from terminating employees for lawful activities conducted during nonworking hours (Illinois Right to Privacy in the Workplace Act.) But if the Illinois courts follow the courts of other states, employers will have more freedom to discipline a registered patient who tests positive for marijuana. The Colorado Supreme Court will soon be considering this issue. -

Sample Drug-Free Workplace Policy Acknowledgement Statement for Your Employees to Sign

DRUG-FREE WORKPLACE POLICY 2 DISCLAIMER DISCLAIMER: Pinnacol Assurance is providing this resource for informational purposes only. It is not designed for use by any reader, business or enterprise, nor is this intended to be legal advice on what a drug policy should or should not contain. This sample policy is designed to be illustrative of the types of policies used and is written in general terms, without specific consideration given to individual needs or circumstances. Provisions included may not be applicable to the specific reader or business situation, and specific provisions that are applicable may have been omitted from this sample. These materials are not to be used as a substitute for legal or management advice on what is necessary for a valid, binding drug policy. Pinnacol will not be held responsible for any consequences arising out of the use of this sample document, and recommends that before implementing a drug policy advice be obtained from a learned professional knowledgeable in this area. INTRODUCTION 3 At Pinnacol Assurance, we are committed to helping you protect the safety and health of your employees. One way to protect your employees and mitigate risk is by establishing a drug-free workplace policy. This resource was designed to help you design, implement and enforce a drug-free workplace policy. When creating a drug-free workplace policy, consider the following: n What is the purpose of this program and policy? n Who is responsible for enforcing the policy? n Is this a zero-tolerance policy? n How is the policy communicated to your employees? n Who is covered by this policy? n What are the consequences for violating the policy? n What are your employees required to tell you? n Do you offer any type of employee assistance to n Does the policy include drug testing? employees who need help? n Does the policy include searches? Portions of the sample policy contained in this book have been pulled from the elaws section of the U.S. -

Should Per Se Limits Be Imposed for Cannabis? Equating Cannabinoid Blood Concentrations with Actual Driver Impairment: Practical Limitations and Concerns

HUMBOLDT JOURNAL OF SOCIAL RELATIONS—ISSUE 35, 2013 Should Per Se Limits Be Imposed For Cannabis? Equating Cannabinoid Blood Concentrations with Actual Driver Impairment: Practical Limitations and Concerns Paul Armentano National Organization for the Reform of Marijuana Laws [email protected] ________________________________________________________________________ Abstract Fourteen US states have amended their longstanding, effect-based DUI drug laws to per se or zero tolerant per se statutes in regard to cannabis. Other states are considering enacting similar legislation. Under these amended traffic safety laws, it is a criminal violation for one to operate a motor vehicle with trace levels of cannabinoids or their metabolites in his or her blood or urine. Opponents of per se cannabinoid limits argue that neither the presence of cannabinoids nor their metabolites are appropriate or consistent predictors of behavioral or psychomotor impairment. They further argue that the imposition of such per se limits may result in the criminal conviction of individuals who may have previously consumed cannabis at some unspecified point in time, but were no longer under its influence. As more states enact statutory changes allowing for the legal use of cannabis under certain circumstances, there is a growing need to re-examine the appropriateness of these proposed per se standards for cannabinoids and their metabolites because the imposition of such limits may, in some instances, inadvertently criminalize behavior that poses no threat to traffic safety, -

Adhd Labeling and Treatment of Children in Japan 1

CCHR REPORT: ADHD LABELING AND TREATMENT OF CHILDREN IN JAPAN 1 2018 ADHD labeling and treatment of children in Japan CITIZENS COMMISSION ON HUMAN RIGHTS JAPAN CITIZENS COMMISSION ON HUMAN RIGHTS EUROPE January 2018 CCHR REPORT: ADHD LABELING AND TREATMENT OF CHILDREN IN JAPAN 2 CCHR REPORT: ADHD LABELING AND TREATMENT OF CHILDREN IN JAPAN 3 Introduction Children in Japan are being labeled with the psychiatric diagnosis attention- deficit/hyperactivity disorder (ADHD) and given psychiatric drugs in order to control the symptoms labeled as ADHD, just as in many European and American countries. The rate of the drugs used are different than those in Europe and the USA which is caused mainly by earlier abuses of psychostimulant drugs causing some of these to be banned and secondly a zero tolerance to drugs use in general (the psychostimulants used in the control of ADHD labeled children are actual drugs with a high abuse potential). Large international pharmaceuticals are increasingly focusing on releasing new types of drugs on the Japanese market that can be prescribed to children labelled with ADHD such as lisdexamfetamine and guanfacine (sold under the name Intuniv). The Japanese market is being described as “the world’s third-biggest market for ADHD treatments” and is growing at more than 20 percent annually.1 Japanese children in early studies were found to be among those less considered fulfilling the diagnostic criteria for attention-deficit/hyperactivity disorder (ADHD). Yet, marketing efforts and American psychiatrists have promoted the American concept of various behavioural symptoms clustered together and called ADHD, to a degree, that a large number of parents have taken on the concept. -

NPPC GSP Oral Comments on the Kingdom of Thailand Maria Zieba

NPPC GSP Oral Comments on The Kingdom of Thailand Maria Zieba I appreciate the opportunity to represent the National Pork Producers Council at today’s hearing. NPPC is a national association representing 42 state producer organizations. It represents the federal policy and global interests of 60,000 U.S. pork producers. The United States is the top global exporter of pork, shipping nearly 2.5 million metric tons (MT), valued at over $6.4 billion to more than 100 nations in 2018. While Thailand consumes more than one million metric tons of pork annually, it imported no U.S. pork in 2018. That’s because Thailand effectively maintains a ban on U.S. pork. It defends its unwarranted ban on uncooked pork and other pork products by pointing to the use of ractopamine by some U.S. pork producers. Ractopamine hydrochloride (or ractopamine) is a feed ingredient approved for use in the United States for swine and beef cattle. In swine, it is used for increased weight gain, feed efficiency, and carcass leanness in finishing swine. Thailand maintains a ban on imports of pork produced with ractopamine, despite the approval by its own Ministry of Health for domestic use. After an extensive risk assessment, the U.S. Food and Drug Administration approved ractopamine for use in hogs in 1999, and no adverse human health problems have been reported since approval. In 2012, the Codex Alimentarius recognized the safety of ractopamine, establishing a recommended maximum residue level (MRL) for the product. At least 25 other countries have also approved the use of ractopamine in pork production, and an additional 75 countries permit imports of pork produced using ractopamine. -

Ractopamine and Clenbuterol Urinary Residues in Pigs As Food-Producing Animals

J. PLEADIN et al.: RTC and CLB Urinary Residues in Pigs, Food Technol. Biotechnol. 49 (4) 517–522 (2011) 517 ISSN 1330-9862 scientific note (FTB-2714) Ractopamine and Clenbuterol Urinary Residues in Pigs as Food-Producing Animals Jelka Pleadin1*, Ana Vuli}1, Nina Per{i1, Dinka Mili}2 and Nada Vah~i}3 1Laboratory for Analytical Chemistry, Croatian Veterinary Institute, Savska 143, HR-10000 Zagreb, Croatia 2Dubravica Swine Farm, Ltd., Pavla [toosa 109, HR-10293 Dubravica, Croatia 3Faculty of Food Technology and Biotechnology, University of Zagreb, Pierottijeva 6, HR-10000 Zagreb, Croatia Received: January 17, 2011 Accepted: April 21, 2011 Summary The aim of the study is to determine residual ractopamine (RCT) and clenbuterol (CLB) concentrations in urine during and after their administration in anabolic dose to male pigs. RCT and CLB residues were determined using previously validated enzyme-linked immunosorbent assay (ELISA) as a quantitative screening method. Hydrolysis of urine samples with b-glucuronidase showed significantly higher (p<0.05) RCT residues. Study results showed RCT and CLB urine concentrations to vary greatly during oral treatment for 28 days, with maximal RCT and CLB concentration recorded on day 25 ((327.4±161.0) ng/mL) and day 20 ((68.4±32.2) ng/mL), respectively. RCT concentration of (57.1±10.6) ng/mL and CLB concentration of (38.8±20.1) ng/mL were measured on day 0 of treatment withdrawal; on day 7 of treatment withdrawal, the measured concentration of RCT ((5.0±0.9) ng/mL) was 20-fold of CLB concentration ((0.3±0.2) ng/mL). -

Teenage Drinking and Driving

State of Illinois For more information, Illinois State Police or to request a safety ZERO TOLERANCE LAW presentation, you for Underage Drinking may send an email to the Teenage and Driving ISP Safety Zero Tolerance is a state law that went into effect on Education Unit at: Drinking and January 1, 1995, and provides for the suspension of driving privileges of any person under the age of 21 Safety_Education@isp. who drives after consuming alcohol. As the name Driving Zero Tolerance suggests, any trace of alcohol in a state.il.us young person’s system can result in a suspended or call 217/782-6637 driver’s license. Possession or Consumption You can also visit us on of Alcoholic Beverages the web at: It is illegal for any person under the age of 21 to www.state.il.us/safety/ consume or possess, whether opened or unopened, alcoholic beverages. Penalties include: eduprogs.cfm • Driving privileges suspended for 6 months for a first conviction. • Driving privileges suspended for 12 months for a second conviction. • A maximum $2,500 fine and up to one year in jail. Improper Use of Illinois Driver’s License or ID Card You could spend up to three years in prison, face fines of up to $25,000, and have your driver’s license suspended if you: • Allow another to use your driver’s license or ID Card. • Use someone else’s driver’s license or ID Card to represent yourself. Printed by the Authority of the State of Illinois ISP Central Printing Section • Knowingly possess a fictitious or unlawfully altered Illinois State Police driver’s license or ID Card. -

Meat and Meat Products Market Summary

Food Outlook Meat and meat products market summary Struggling with high feed prices and stagnating World meat market at a glance consumption, global meat production in 2012 is forecast to grow by less than 2 percent to 302 million Change: 2012 tonnes. As falling industry profitability has translated 2010 2011 2012 over 2011 estim. f'cast into modest output gains in the developed countries, million tonnes % most of the world expansion is likely to take place in WORLD BALANCE the developing countries, which now account for 60 Production 294.2 297.1 301.8 1.6 percent of world output. Virtually all of the sector Bovine meat 66.7 66.6 66.8 0.4 growth in 2012 is forecast to stem from the feed- Poultry meat 98.9 102.3 104.5 2.2 dependent poultry and pigmeat sectors, as gains in Pigmeat 109.3 108.8 110.8 1.9 Ovine meat 13.7 13.8 13.9 0.9 both bovine and sheep meat outputs are anticipated Trade 26.7 28.8 29.4 2.2 to be modest. Bovine meat 7.7 8.0 8.0 1.0 Concerns about the profitability of the meat Poultry meat 11.7 12.7 13.0 2.4 sector have been compounded by a weakening of Pigmeat 6.2 7.1 7.4 3.0 the growth of export markets, with trade expansion Ovine meat 0.8 0.7 0.8 1.9 anticipated to slow down to 2 percent from 8 percent SUPPLY AND DEMAND INDICATORS in 2011. -

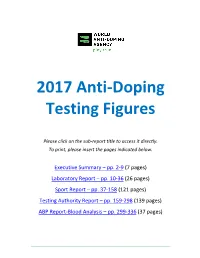

2017 Anti-Doping Testing Figures Report

2017 Anti‐Doping Testing Figures Please click on the sub‐report title to access it directly. To print, please insert the pages indicated below. Executive Summary – pp. 2‐9 (7 pages) Laboratory Report – pp. 10‐36 (26 pages) Sport Report – pp. 37‐158 (121 pages) Testing Authority Report – pp. 159‐298 (139 pages) ABP Report‐Blood Analysis – pp. 299‐336 (37 pages) ____________________________________________________________________________________ 2017 Anti‐Doping Testing Figures Executive Summary ____________________________________________________________________________________ 2017 Anti-Doping Testing Figures Samples Analyzed and Reported by Accredited Laboratories in ADAMS EXECUTIVE SUMMARY This Executive Summary is intended to assist stakeholders in navigating the data outlined within the 2017 Anti -Doping Testing Figures Report (2017 Report) and to highlight overall trends. The 2017 Report summarizes the results of all the samples WADA-accredited laboratories analyzed and reported into WADA’s Anti-Doping Administration and Management System (ADAMS) in 2017. This is the third set of global testing results since the revised World Anti-Doping Code (Code) came into effect in January 2015. The 2017 Report – which includes this Executive Summary and sub-reports by Laboratory , Sport, Testing Authority (TA) and Athlete Biological Passport (ABP) Blood Analysis – includes in- and out-of-competition urine samples; blood and ABP blood data; and, the resulting Adverse Analytical Findings (AAFs) and Atypical Findings (ATFs). REPORT HIGHLIGHTS • A analyzed: 300,565 in 2016 to 322,050 in 2017. 7.1 % increase in the overall number of samples • A de crease in the number of AAFs: 1.60% in 2016 (4,822 AAFs from 300,565 samples) to 1.43% in 2017 (4,596 AAFs from 322,050 samples). -

Japan 2020 Crime & Safety Report

Japan 2020 Crime & Safety Report This is an annual report produced in conjunction with the Regional Security Office at the U.S. Embassy in Tokyo. OSAC encourages travelers to use this report to gain baseline knowledge of security conditions in Japan. For more in-depth information, review OSAC’s Japan country page for original OSAC reporting, consular messages, and contact information, some of which may be available only to private-sector representatives with an OSAC password. Travel Advisory The current U.S. Department of State Travel Advisory at the date of this report’s publication assesses Japan at Level 2, indicating travelers should exercise increased caution due to due to an outbreak of COVID-19. Prior to the COVID-19 pandemic, Japan’s Travel Advisory was assessed as a Level 1. Review OSAC’s report, Understanding the Consular Travel Advisory System. Overall Crime and Safety Situation Crime Threats The U.S. Department of State has assessed all cities with U.S. diplomatic posts in Japan as being LOW- threat locations for crime directed at or affecting official U.S. government interests. The crime rate in Japan is generally well below the U.S. national average. Crimes targeting foreigners are seldom, especially as Tokyo has touted itself as “the world’s safest big city” in preparation for the now-postponed 2020 Olympic Games. The Economist Intelligence Unit ranked Tokyo and Osaka as the world’s number one and number three safest cities for 2019. Pickpocketing and other petty crimes do sometimes take place in crowded shopping areas, bars and nightclubs, and public transportation hubs.