Equity Fund May 2012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Is the Vice Chairman and Managing

Mr Jayadev Galla Vice-Chairman Amara Raja Group Mr Jayadev Galla (Jay) is the Vice Chairman and Managing Director of Amara Raja Batteries Limited (ARBL), a leading manufacturer of Advanced Lead Acid batteries for Industrial and Automotive applications. ARBL is a joint venture between Amara Raja group and US based Johnson Controls Inc. (JCI). JCI is a USD 35 billion conglomerate and the global leader in building efficiency, automotive interior experience and automotive power solutions. The company owns the brand name “Amaron” which is the second largest selling automotive battery brand in India today. ARBL is a widely held public limited company listed on the National Stock Exchange of India Limited and the Bombay Stock Exchange Limited. The gross revenue for the year ending March 31, 2012 is more than USD 450 mn. Achievements Spearheading ARBL’s automotive batteries (Amaron) venture Striking a partnership with JCI, U.S.A. for the automotive battery business Winning the prestigious Ford World Excellence Award in 2004 achieved by meeting global delivery standards. ARBL is the 3rd supplier from India to be given this award. Posts and Responsibilities Confederation of Indian Industry Young Indians National Branding Chair Young Indian’s National Immediate Past Chairman Young Indians Immediate Past Chairman - District Chapter Initiatives Amara Raja Group of Companies Vice Chairman, Amara Raja Power Systems Limited Vice Chairman and Managing Director, Amara Raja Electronics Limited Vice Chairman, Mangal Industries Limited Director, Amara Raja Infra Private Limited Director, Amaron Batteries (P) Ltd. Director, Amara Raja Industrial Services (P) Ltd. Permanent Trustee of the Rajanna Trust The Trust was established in 1999 and is dedicated to rural development and to improve the economic conditions of the farmers in Chittoor District, Andhra Pradesh. -

NIFTY Midcap

February 28, 2018 The NIFTY Free Float Midcap 100 Index is designed to capture the movement of the midcap segment of the market. The NIFTY Free Float Midcap 100 Index comprises 100 tradable stocks listed on the National Stock Exchange (NSE). NIFTY Free Float Midcap 100 Index is computed using free float market capitalization method, wherein the level of the index reflects the total free float market value of all the stocks in the index relative to particular base market capitalization value. NIFTY Free Float Midcap 100 can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds, ETFs and structured products. Index Variant: NIFTY Free Float Midcap 100 Total Returns Index. Portfolio Characteristics Statistics Since Methodology Free Float Market Capitalization QTD YTD 1 Year 5 Years Inception No. of Constituents 100 Returns (%) # -6.95 -6.95 19.32 21.13 21.70 Launch Date July 18, 2005 Since Base Date January 01, 2003 1 Year 5 Years Inception Base Value 1000 Std. Deviation * 14.40 17.13 22.66 Calculation Frequency Online Daily Beta (NIFTY 50) 1.16 0.96 0.84 Index Rebalancing Semi-Annually Correlation (NIFTY 50) 0.76 0.82 0.85 Sector Representation Fundamentals Sector Weight(%) P/E P/B Dividend Yield 47.29 2.79 0.91 FINANCIAL SERVICES 19.97 CONSUMER GOODS 13.14 Top constituents by weightage PHARMA 9.80 INDUSTRIAL MANUFACTURING 6.73 Company’s Name Weight(%) SERVICES 6.68 RBL Bank Ltd. 2.19 ENERGY 6.56 Container Corporation of India Ltd. 1.91 AUTOMOBILE 6.55 IT 6.23 Voltas Ltd. -

Popular Employer Names Number of Data Profiles Blackrock, Inc. 43

S.No Popular Employer Names Number of Data Profiles 1. Blackrock, Inc. 43 2. BMC Software, Inc. 55 3. BNP Paribas Inc. 113 4. BRISTLECONE India Ltd 57 5. British Telecom 131 6. Broadcom Corporation 59 7. Broadridge Financial Solutions, Inc. 44 8. Bureau Veritas 47 9. CA Technologies 65 10. CA, Inc. 39 11. Cairn India 45 12. Calsoft Pvt Ltd 44 13. Capgemini 1,309 14. Capgemini Consulting 578 15. Capita india 82 16. Capital Iq, Inc. 41 17. Caterpillar, Inc. 75 18. CBRE Group 60 19. CenturyLink 47 20. Cerner Corporation 65 21. CGI Group Inc. 300 22. Cipla Medpro Manufacturing 43 23. Cisco Systems (India) Private Limited 57 24. Cisco Systems Inc 396 25. Citibank 235 26. Citigroup, Inc. 53 27. CitiusTech 59 28. Citrix Systems Inc 40 29. CMC Group 102 30. Cognizant 1,374 31. Cognizant Technology Solutions Corp 1,715 32. Collabera Inc. 74 33. Computer Sciences Corporation (CSC) 653 34. Concentrix Corporation 159 35. Convergys Corporation 113 36. Credit Suisse 90 37. Crisil 117 38. CTS Corporation 109 39. Cummins India Ltd 70 40. Cvent, Inc. 46 41. Cybage 201 42. Daimler India Commercial Vehicles Pvt Ltd 61 43. Dell, Inc. 516 44. Deloitte 414 45. Deloitte & Touche LLP 107 46. Deloitte Consulting LLP 282 47. Deloitte Support Services India Private Ltd 94 48. Deloitte Touche Tohmatsu (DTT) 79 49. Deutsche Bank 235 50. Dimension Data 63 51. Directi 44 52. Dr Reddy's Laboratories Ltd 85 53. Dun & Bradstreet Corp 50 54. E.I. Du Pont De Nemours & Co (DuPont) 47 55. -

Loan Against Securities – Approved Single Scrips

Loan against securities – Approved Single Scrips SR no ISIN Scrip Name Margin 1 INE216A01030 BRITANNIA INDUSTRIES LIMITED 50 2 INE854D01024 UNITED SPIRITS LIMITED 50 3 INE437A01024 APOLLO HOSPITALS ENTERPRISE LTD 50 4 INE208A01029 ASHOK LEYLAND LTD 50 5 INE021A01026 ASIAN PAINTS LTD 50 6 INE406A01037 AUROBINDO PHARMA LTD 50 7 INE917I01010 BAJAJ AUTO LTD 50 8 INE028A01039 BANK OF BARODA 50 9 INE084A01016 BANK OF INDIA 50 10 INE463A01038 BERGER PAINTS INDIA LTD 50 11 INE029A01011 BHARAT PETROLEUM CORPORATION LTD 50 12 INE323A01026 BOSCH LTD 50 13 INE010B01027 CADILA HEALTHCARE LTD 50 14 INE059A01026 CIPLA LTD 50 15 INE522F01014 COAL INDIA LTD 50 16 INE259A01022 COLGATE-PALMOLIVE (INDIA) LTD 50 17 INE361B01024 DIVIS LABORATORIES LTD 50 18 INE089A01023 DRREDDYS LABORATORIES LTD 50 19 INE129A01019 GAIL (INDIA) LTD 50 20 INE860A01027 HCL TECHNOLOGIES LTD 50 21 INE158A01026 HERO MOTOCORP LTD 50 22 INE038A01020 HINDALCO INDUSTRIES LTD 50 23 INE094A01015 HINDUSTAN PETROLEUM CORPORATION LTD 50 24 INE030A01027 HINDUSTAN UNILEVER LTD 50 25 INE079A01024 AMBUJA CEMENTS LTD 50 26 INE001A01036 HOUSING DEVELOPMENT FINANCE CORPLTD 50 27 INE090A01021 ICICI BANK LTD 50 28 INE242A01010 INDIAN OIL CORPORATION LTD 50 29 INE009A01021 INFOSYS LTD 50 30 INE154A01025 ITC LTD 50 31 INE237A01028 KOTAK MAHINDRA BANK LTD 50 32 INE498L01015 LT FINANCE HOLDINGS LTD 50 33 INE018A01030 LARSEN TOUBRO LTD 50 34 INE326A01037 LUPIN LTD 50 35 INE101A01026 MAHINDRA MAHINDRA LTD 50 36 INE585B01010 MARUTI SUZUKI INDIA LTD 50 37 INE775A01035 MOTHERSON SUMI SYSTEMS LTD 50 38 INE883A01011 -

TVS MOTOR COMPANY LIMITED Twentieth Annual Report 2011- 2012

TVS MOTOR COMPANY LIMITED Twentieth Annual Report 2011- 2012 TVS MOTOR COMPANY LIMITED Board of Directors VENU SRINIVASAN Registered office Chairman & Managing Director "Jayalakshmi Estates", 29 (Old No.8), Haddows Road, Chennai - 600 006, Tamil Nadu, India. H. LAKSHMANAN Tel : 044 - 2827 2233 T. KANNAN Fax : 044 - 2825 7121 C. R. DUA Factories K. S. BAJPAI Post Box No. 4, Harita, Hosur - 635 109, Tamil Nadu, India. Tel : 04344 - 276780 R. RAMAKRISHNAN Fax : 04344 - 276016 PRINCE ASIRVATHAM Post Box No. 1, Byathahalli Village, Audit Committee T. KANNAN Kadakola Post, Mysore - 571 311, Karnataka, India. Chairman Tel : 0821 - 2596560 C.R. DUA Fax : 0821 - 2596530 / 2596533 R. RAMAKRISHNAN Bhatian Village, Nalagarh Post & Taluk PRINCE ASIRVATHAM Solan District - 174 101, Himachal Pradesh, India. Investors' Grievance T. KANNAN Tel : 01795 - 220494 Committee Chairman Fax : 01795 - 220496 VENU SRINIVASAN Website : www.tvsmotor.in R. RAMAKRISHNAN Subsidiary Companies President & CEO K.N. RADHAKRISHNAN Sundaram Auto Components Limited, Chennai Executive Vice S.G. MURALI TVS Energy Limited, Chennai President - Finance TVS Housing Limited, Chennai TVS Wind Energy Limited, Chennai Company Secretary K.S. SRINIVASAN TVS Wind Power Limited, Chennai Auditors SUNDARAM & SRINIVASAN Sundaram Engineering Products Services Limited, Chennai Chartered Accountants, TVS Motor Company (Europe) B.V., Amsterdam New No.4, (Old No.23) TVS Motor (Singapore) Pte. Limited, Singapore Sir C.P. Ramaswamy Road, PT. TVS Motor Company Indonesia, Jakarta Alwarpet, Chennai - 600 018. Sundaram Business Development Consulting (Shanghai) Co. Cost Auditor A.N. RAMAN Ltd., China Cost Accountant No. 10 P, Muthukumaraswami Salai, Off. Baby Nagar 1st Main Road, CONTENTS Page No. Velachery, Chennai - 600 042 Financial Highlights 2 Shares listed with Madras Stock Exchange Ltd., Chennai. -

February 2018

Sl. No. Name of Authorization Holder Auth. No. Status 1 BIG BAGS ( INDIA ) PRIVATE LIMITED 730003826 Redemption 2 SRI BALAJI EMBROIDERY AND EXPORTS, 730004159 Duty Paid Regularization 3 SUNITA IMPEX PVT LTD 730004173 Redemption 4 GOWRISHANKAR ENGINEERING INDUSTRIES, 730004575 Redemption 5 SUNITA IMPEX PVT LTD 730004169 Redemption 6 QUAD TOOLING TECHNOLOGIES PRIVATE LIMITED 730006149 Redemption 7 MICROTEX ENERGY PVT LTD 730006172 Duty Paid Regularization 8 TEXPORT OVERSEAS 730006778 Redemption 9 TEXPORT OVERSEAS 730006784 Redemption 10 AUTHENTICITY, 730006873 Redemption 11 SIDDHARTA RESORTS & FOODS (P) LTD 730007425 Redemption 12 REPROMEN OFFSET PRINTERS PVT. LTD., 730008006 Duty Paid Regularization 13 SRI MARUTI INDUSTRIES, 730007982 Redemption 14 MSR HOTEL (BANGALORE) PVT LTD 730008277 Redemption 15 MSR HOTEL (BANGALORE) PVT LTD 730008498 Redemption 16 MSR HOTEL (BANGALORE) PVT LTD 730008605 Redemption 17 N.RANGARAO AND SONS, 730008629 Redemption 18 MSR HOTEL (BANGALORE) PVT LTD 730008675 Redemption 19 MSR HOTEL (BANGALORE) PVT LTD 730009009 Redemption 20 ECL PUYVAST INDIA PVT LTD 730009143 Redemption 21 MSR HOTEL (BANGALORE) PVT LTD 730009890 Redemption 22 MSR HOTEL (BANGALORE) PVT LTD 730009986 Redemption 23 BREMELS RUBBER INDUSTRIES PRIVATE LIMITED, 730010184 Redemption 24 GRASIM INDUSTRIES LTD., 730010524 Redemption 25 GRASIM INDUSTRIES LTD., 730010584 Redemption 26 ORIENTAL GRANITES 730010993 Redemption 27 UMBEL PROPERTIES PVT LTD 730010597 Redemption 28 UMBEL PROPERTIES PVT LTD 730011122 Redemption 29 MULTI TECK ENGINEERING SOLIUTIONS, -

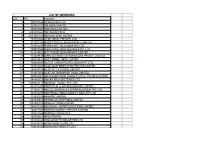

List of Importers S.N

LIST OF IMPORTERS S.N. IEC Importer 1 888015356 20 MICRONS LTD. 2 793012112 3M INDIA LIMITED 3 388038047 ABB INDIA LIMITED. 4 3892000662 ABI SNOWATECH 5 2503001335 ABIRAMI SOAP WORKS 6 799008966 ACER INDIA (PRIVATE) LTD 7 713020253 ADVICS SOUTH INDIA PRIVATE LIMITED 8 711002207 AGRIPLAST TECH INDIA PVT LTD 9 799008966 AGRITRADE INDIA SERVICES PVT LTD 10 312019882 AGT FOODS INDIA PRIVATE LIMITED 11 712023836 AISIN AUTOMOTIVE KARNATAKA PRIVATE LIMITED 12 288002822 AKZO NOBEL INDIA LIMITED 13 799009091 ALCON LABORATORIES (INDIA) PVT LTD., 14 503082058 ALOK MASTERBATCHES PRIVATE LIMITED 15 288007735 ALSTOM T & D INDIA LIMITED 16 711017956 ALSTOM TRANSPORT INDIA LIMITED 17 497016061 AMALGAMATIONS VALEO CLUTCH PRIVATE LIMITED 18 988006723 AMARA RAJA BATTERIES LTD 19 3306001414 AMAZON WOOD PVT. LTD. 20 488016207 AMBATTUR CLOTHING PRIVATE LIMITED 21 311009174 AMCOL MINERALS & MATERIALS INDIA PVT LTD 22 407034293 AMPHENOL OMNICONNECT INDIA PVT LTD 23 415900018 ANANDA VIKATAN 24 907000657 APARNA ENTERPRISES LIMITED 25 1088000720 APOLLO TYRES LIMITED 26 988001292 AQUAMALL WATER SOLUTIONS LIMITED 27 402017986 ARISTON AGENCY PRIVATE LIMITED 28 300022964 ARKEMA CHEMICALS 29 300062401 ARMSTRONG 30 588169340 ARO GRANITE INDUSTRIES LTD 31 588130311 ASAHI INDIA GLASS LTD 32 798014911 ASHIRVAD PIPES PVT LTD 33 488014336 ASHOK LEYLAND LIMITED 34 388010789 ASIAN PAINTS LTD 35 412001951 ASIAN TRADING COMPANY 36 796005532 AT & S INDIA PRIVATE LIMITED 37 707010462 ATS ELGI LIMITED 38 2588000011 AUROBINDO PHARMA LIMITED 39 507039807 AUTOLIV INDIA PVT. LTD. 40 903006499 AVANTI FEEDS LTD. 41 497016753 BASF CATALYSTS INDIA PVT LTD., 42 388007257 BASF INDIA LIMITED 43 288012101 BATA INDIA LIMITED 44 596004729 BECTON DICKINSON INDIA PRIVATE LIMITED 45 788013441 BEML LIMITED, 46 388167084 BENNETT COLEMAN & CO LTD 47 288019539 BERGER PAINTS INDIA LIMITED 48 788001027 BHARAT ELECTRONICS LTD. -

PLM EDS Technologies Pvt. Ltd. I

Name of the Guests Designation Name of the Company Topic Technical Support Mr. Nivas S EDS Technologies Pvt. Ltd. Introduction to ABAQUS Manager -PLM Associate Director- Mr. Srikanth P Virtusa Corporation Digital Marketing Marketing Grant Thorton Shared Services Industry Expectations from Management Mr. Sanjay Thirumalai Managing Director India (P) Ltd graduates. Mr. Rajiv Srinivas Head-India Staffing ANZ Campus to Corporate Mr. Preetham Senior Director, FP&A Changing Scope and Span of Finance Honeywell Shanbhag Ops & Transformation Function in the New Era of Growth Indian Economy- Challenges & Opportunities Dr. Vivek Murthy Professor IIM Bangalore ahead Mr. Sathya Financial Innovation & financial fragility: A Director-Finance Bally Technologies India Pvt. Ltd Kalyanasundaram CFOs/Corporate perspective CA. Raghavendra G. The Challenging role of CFOs in creating and CFO and COO India at ThoughtWorks S sustaining value during turbulent times Mr. Hemant Changing paradigms of BFSI sector in India: Founder Dharni Group Dharnidharka Challenges and Opportunities Financial markets innovations – Challenges Mr. Alok Chhajer Chief Catalyst Katalist Consulting and opportunities for emerging markets. Mr. Ram Logfire Technology Solutions Managing Director Supply Chain Management with ERP Swaminathan Private Limited Career Opportunities in Sales & Marketing in Mr. Srinivas K S Associate Director Biocon Pharma Industry. Mr. Tony V Francis Dy. General Manager Red FM The story of Brand Red FM in India Mr. Sujeet Mishra Co-Founder Glia Services Pvt. Ltd Internet of Things Corporate Global HR - The Era Of Digital Engagement & its Impact Mr. Amith Prakash HCL Technologies Limited Employee Engagement On HR Practices. Ms. Preeth Cauvery CEO Symbioconsults Lean Operations TT Electronics Engineering Solving the Equation of Un- Employability - Mr. -

General Disclosure Kotak Securities Limited Is a Corporate Trading and Clearing Member of Bombay Stock Exchange Limited (BSE), N

General Disclosure Kotak Securities Limited is a corporate trading and clearing member of Bombay Stock Exchange Limited (BSE), National Stock Exchange of India Limited (NSE), Metropolitan Stock Exchange of India Limited (MSEI). Kotak Securities Limited is also a depository participant with National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited (CDSL). Kotak Securities Limited is also registered with Insurance Regulatory and Development Authority as Corporate Agent for Kotak Mahindra Old Mutual Life Insurance Limited and is also a Mutual Fund Advisor registered with Association of Mutual Funds in India (AMFI). We are registered as a Research Analyst under SEBI (Research Analyst) Regulations, 2014. We or our associates may have received compensation from the subject company(ies) in the past 12 months. Subject company(ies) may have been client during twelve months preceding the date of distribution of the research report. We or our associates may have received compensation for investment banking or merchant banking or brokerage services from the subject company(ies) in the past 12 months. We or our associates may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company(ies) in the past 12 months. We or our associates may have received any compensation or other benefits from the subject company(ies) or third party in connection with the research report. Research Analyst or his/her relative's financial interest in the subject company(ies): Yes – Infosys Ltd KSL has financial interest in the subject company(ies): Yes (Cash Market positions) – ABB India Ltd, ACC Ltd, Adani Port and Special Economic Zone Ltd, Asian Paints Ltd, Bajaj Auto Ltd, Bajaj Electricals Ltd, Blue Dart Express Ltd, Carborundum Universal Ltd, Cipla Ltd, Crompton Greaves Ltd, Dr. -

Weekly Newsletter 27 FEB 2021

Weekly Newsletter 27 FEB 2021 The Index was launched on July 18, 2005 and the Index rebalancing Weekly is done Semi-annually. Nifty Midcap 100 can be used for purposes INDEX 26-Feb-21 Change such as benchmarking fund portfolios, launching of index funds, (%) ETFs, and structured products. Broad Market Indexes Sector Representation NIFTY 50 14,529.15 -3.0% Sector Weight(%) NIFTY 500 12,181.40 -2.1% FINANCIAL SERVICES 19.97 NIFTY MIDCAP 100 23,268.50 0.6% CONSUMER GOODS 13.14 NIFTY SMALLCAP 100 8,049.70 0.9% PHARMA 9.80 Volatility Index INDUSTRIAL MANUFACTURING 6.73 INDIA VIX 28.14 26.5% SERVICES 6.68 ENERGY 6.56 Sectoral Indexes AUTOMOBILE 6.55 NIFTY BANK 34,803.60 -2.9% IT 6.23 NIFTY AUTO 10,169.90 -3.5% CONSTRUCTION 5.84 NIFTY FINANCIAL SERVICES 16,085.25 -4.0% METALS 4.98 CHEMICALS 3.51 NIFTY FMCG 32,443.15 -2.7% TEXTILES 3.20 NIFTY IT 24,301.45 -4.7% CEMENT & CEMENT PRODUCTS 2.73 NIFTY MEDIA 1,625.15 -3.1% MEDIA & ENTERTAINMENT 1.60 NIFTY METAL 3,822.65 7.6% HEALTHCARE SERVICES 1.48 NIFTY PHARMA 11,927.90 -3.4% TELECOM 1.00 NIFTY REALTY 349.8 0.5% Sector-wise, Financial Services, Consumer goods, Pharma, Industrial Manufacturing, and Services occupies top five weights (%) in the ind- Nifty 50, the benchmark index of National Stock Exc- ex. Financial Services has the highest weight (%) of 19.97 per cent. hange (NSE), declined -3% during the week. Nifty Top constituents by weightage 500, too, declined for the week. -

Dashboard the Monthly Auto Update

August 2010 Dashboard The Monthly Auto Update Speedometer Data Track: August volume update of auto majors August 2010 relative performance Sector overview and outlook ......................................................... 2 Hero Honda ................................................................................. 3 M OSL Auto Index Sensex 110 Bajaj Auto ................................................................................... 4 Maruti Suzuki .............................................................................. 6 10 6 Mahindra & Mahindra ................................................................... 8 Tata Motors ................................................................................ 10 TVS Motor .................................................................................12 10 2 Special Report: Maruti Suzuki: Annual report update ........... 13 98 2-Aug-10 9-Aug-10 16-Aug-10 23-Aug-10 30-Aug-10 Sector Gauge: July update 12-month relative performance Two-wheelers ............................................................................15 Three-wheelers ..........................................................................16 M OSL Auto Index Sensex Cars and UVs ............................................................................. 18 18 0 Commercial vehicles .................................................................... 20 14 0 News and Events .................................................................... 23 Yamaha’s three launches: the SZ, SZ-X and YBR 125 -

Corporate Social Responsibility Isthe Function of the CEO: a Portrait of the President of the Confederation of Indian Industry Shashank Shah Sri Sathya Sai University

The Journal of Values-Based Leadership Volume 3 Article 4 Issue 2 Summer/Fall 2010 July 2010 Corporate Social Responsibility isthe Function of the CEO: A Portrait of the President of the Confederation of Indian Industry Shashank Shah Sri Sathya Sai University A. Sudhir Bhaskar Sri Sathya Sai University Follow this and additional works at: https://scholar.valpo.edu/jvbl Part of the Business Commons Recommended Citation Shah, Shashank and Bhaskar, A. Sudhir (2010) "Corporate Social Responsibility isthe Function of the CEO: A Portrait of the President of the Confederation of Indian Industry," The Journal of Values-Based Leadership: Vol. 3 : Iss. 2 , Article 4. Available at: https://scholar.valpo.edu/jvbl/vol3/iss2/4 This Article is brought to you for free and open access by the College of Business at ValpoScholar. It has been accepted for inclusion in The ourJ nal of Values-Based Leadership by an authorized administrator of ValpoScholar. For more information, please contact a ValpoScholar staff member at [email protected]. Corporate Social Responsibility IS the Function of the CEO A Portrait of the President of the Confederation of Indian Industry SHASHANK SHAH, SRI SATHYA SAI UNIVERSITY (INTERVIEWER /AUTHOR), DOCTORAL RESEARCH SCHOLAR, SCHOOL OF BUSINESS MANAGEMENT, ANANTAPUR DISTRICT, ANDHRA PRADESH, INDIA A. SUDHIR BHASKAR, SRI SATHYA SAI UNIVERSITY (INTERVIEWER/AUTHOR) DEAN, SCHOOL OF BUSINESS MANAGEMENT ANANTAPUR DISTRICT, ANDHRA PRADESH, INDIA Background In March, 2009, Dr. Venu Srinivasan assumed the position of the President of the Confederation of Indian Industry and remitted the office in April, 2010. An accomplished industrialist from the century-old TVS1 family, Srinivasan was conferred with the prestigious Padma Shri Award by 1 TVS Motor Company is the third largest two-wheeler manufacturer in India and one among the top ten in the world, with annual turnover of more than USD 1 billion in 2008-2009, and is the flagship company of the USD 4 billion TVS Group.