Electronic Fund Transfers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

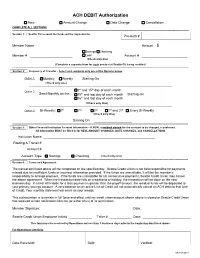

ACH DEBIT Authorization

ACH DEBIT Authorization New Amount Change Date Change Cancellation COMPLETE ALL SECTIONS ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ Section 1: Seattle CU account the funds will be deposited to Pre-Auth # Member Name Amount $ Savings Checking Member # Loan Account # (Check only one) (Complete a separate form for each product at Seattle CU being credited) ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ Section 2: Frequency of Transfer - Select and complete only one of the Options below Option 1: Monthly Weekly Starting On (Check only one) ----------------------------------------------------------------------------------------------------------------------------------- st th Option 2: 1 and 15 day of each month Semi-Monthly on the: 15th and last day of each month Starting On 16th and last day of each month (Check only One) ----------------------------------------------------------------------------------------------------------------------------------- Option 3: Bi-Weekly: 1st 2nd 3rd 1st and 2nd Every Bi-Weekly (Check only One) Starting On: ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- Section 3: Other Financial Institution -

REGULATION D (“REG D”) Faqs What Is Regulation D?

REGULATION D (“REG D”) FAQs What is Regulation D? Regulation D (“Reg D”) is a federal law that limits the number of transfers and withdrawals that you can make from an interest bearing account (Regular Savings, Money Market, or Club Account) at Seattle Metropolitan Credit Union DBA Seattle Credit Union (hereafter “Seattle Credit Union”) to a Checking Account or to a third party. According to Regulation D, you may not make more than six pre-authorized, automated, or telephone transfers/withdrawals from these accounts each month. The regulation was established to prevent consumers from using interest bearing accounts as transaction or checking accounts. Fees are typically applied to such transfers and withdrawals in order to discourage consumers from using interest bearing accounts as transaction accounts. Reg D Fees Savings accounts, which also include Certificates and Money Market Accounts, are not classified as “transaction” accounts and have limited transaction allowances. Regulation D allows for 6 transfers/ withdrawals per statement cycle or month. The fee for each transfer/withdrawal above six within that timeframe is $20/transaction. Q: Which transactions are affected by Regulation D limitations and which ones are unlimited? UNLIMITED LIMITED Transfers and Withdrawals Transfers and Withdrawals • In person (at a branch or shared branching • Preauthorized Transactions service center/kiosk) • Automatic transfers (scheduled ACH • At an ATM withdrawals) • By mail or messenger • Telephone (including Automated • Unlimited deposits/transfers can be made Telephone Banking) into a savings account • Fax • Online Banking or Mobile Banking Transfers to another account of the same owner • Checks at the same financial institution when made: • Automatic Overdraft Transfers • For loan payments • Point of Sale transactions with an ATM or debit card • Any other similar order payable to third Withdrawals made by telephone only when: parties • The transaction results in a check mailed to that member. -

The Year Ahead

How long can CUs’ Tackling the growing Is there a lending bubble Using technology to 10 hot streak last? 11 fraud threat 12 on the horizon? 14 leverage new FOM rule CUJOURNAL.COM • @CUJOURNAL THE RESOURCE FOR GROWTH-ORIENTED CREDIT UNIONS VOL. 21 | NO. 1 | JANUARY 2017 lending growth strategies payments technology compliance Credit unions have enjoyed a multiyear run of solid growth in THE YEAR membership and originations. Rising rates and the potential for regulatory overhaul could mean new competition — just AHEAD as refi volumes are set to fall marketing human resources economy branching CUJ_Cover_FINAL.indd 1 1/12/17 8:54 AM 002_CUJ011617 2 1/9/2017 4:55:37 PM CONTENTS JANUARY 2017 / VOL. 21 NO. 01 06 A Very Good Year CUs saw double-digit loan growth in the 12-month period that ended in Q3 2016, including more than $847 billion in total loans. Here are some highlights: Overall loan growth 10.1% New auto loans 15.8% 08 MBLs 14% New student loans 10% Total real estate loans 8.2% Source: NCUA 10 Compliance Technology Lending 09 HOUSE BANKING PANEL 11 TARGETED ATTACKS 12 WILL LONG-AWAITED SHAKES UP LEADERSHIP COULD BE BIGGER RISK BUBBLE MATERIALIZE IN 2017? The House Financial Services Com- Massive data breaches grab the The data shows an increase in de- mittee will see a shuffling of deck headlines—and have happened so linquency rates for consumers with chairs among the leadership of its often that consumers, bleary-eyed poor credit, but the bulk of troubled subcommittees in the new Con- from breach fatigue, hardly notice subprime loans aren’t coming from gress as it also welcomes ten new them anymore—but the smaller, credit unions—for now, at least. -

(ITIN) Lending Table of Contents

IMPLEMENTATION GUIDE Individual Taxpayer Identification Number (ITIN) Lending Table of Contents 3 ACKNOWLEDGMENTS 4 FOREWORD 7 STRATEGY/ASSESSING READINESS Market Opportunity 7 Cultural Considerations 14 Financial Considerations 20 Risk Analysis Overview 24 28 IMPLEMENTATION/GETTING STARTED Regulatory Considerations 28 Operational Considerations 33 Marketing and Outreach 40 47 ADDITIONAL RESOURCES Appendix 1: Risk Analysis Questionnaire 48 Appendix 2: CIP Legal Opinion Letter 49 Appendix 3: Matricula Consular ID Card 53 Appendix 4: Seattle Credit Union Welcome Brochures 56 Appendix 5: Alliance Catholic Credit Union Marketing Samples 58 Appendix 6: Wakota Federal Credit Union Marketing Samples 60 Appendix 7: Marketplace Support and Research 61 63 GLOSSARY 64 ENDNOTES 67 LIST OF FIGURES Note: Information presented in this guide is not to be construed as a legal advice or a legal opinion, and is not an exhaustive description of all applicable laws and regulations. As laws and regulations are subject to interpretation and modification, this material should not be relied upon as your sole source of information. You are encouraged to seek legal advice specific to your financial institution Acknowledgments This implementation guide is the result of the hard work and contributions of multiple stakeholders committed to pursuing financial inclusion. First, a special thank-you to Visa Inc. for its financial support and guidance from its team, including Robert Meloche and Savannah Hicks. Also, a special thank-you to the Ford Foundation, whose financial support and assistance since 2015 have expanded the reach of this work. This guide would not be possible without the involvement of four key collaborators: Coopera, Filene Research Institute, Inclusiv (formerly known as the National Federation of Community Development Credit Unions), and PolicyWorks. -

Why? What? How? to Limit Our Sharing

Rev. 9/17 WHAT DOES SEATTLE METROPOLITAN CREDIT UNION DBA SEATTLE CREDIT FACTS UNION DO WITH YOUR PERSONAL INFORMATION? Why? Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. What? The types of personal information we collect and share depend on the product or service you have with us. This information can include: Social Security number and account balances account transactions and credit history credit scores and income How? All financial companies need to share members’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their members’ personal information; the reasons Seattle Metropolitan Credit Union DBA Seattle Credit Union chooses to share; and whether you can limit this sharing. Reasons we can share your personal information Does Seattle Metropolitan Can you limit this sharing? Credit Union DBA Seattle Credit Union share? For our everyday business purposes – Yes No such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or to report to credit bureaus For our marketing purposes – Yes No to offer our products and services to you For joint marketing with other financial companies Yes Yes For our affiliates’ everyday business purposes – No We don’t share information about your transactions and experiences For our affiliates’ everyday business purposes – No We don’t share information about your creditworthiness For nonaffiliates to market to you No We don’t share To limit our Call (206) 398-5500 - our menu will prompt you through your choice(s), Visit us online: www.seattlecu.com or sharing Mail the form below Please note: If you are a new member, we can begin sharing your information 30 days from the date we sent this notice. -

Recommendations for Credit Unions As Financial Institutions

Credit Unions Advancing DIVERSITY, EQUITY, & INCLUSION NORTHWEST CREDIT UNIONS’ DEI TASK FORCE RECOMMENDATIONS Hosted By: CONTENTS OVERVIEW.....................................................................................................4 CREDIT UNIONS AS EMPLOYERS Recommendation 1.......................................................................................7 Conduct organizational benchmarking and provide leadership education. Recommendation 2.......................................................................................8 Commit staff time to ongoing DEI work. Recommendation 3.....................................................................................10 Develop an Employee Resource Group (ERG) program or a cross-functional team to empower and support communities within your credit union. Recommendation 4.....................................................................................11 Encourage cultural competency. Recommendation 5.....................................................................................12 Audit hiring and promotion processes to ensure diversity and equity in policy, process, and practices. Recommendation 6.....................................................................................13 Proactively connect employees from historically marginalized communities to development opportunities the credit union offers to support their growth, promotion, and retention. Recommendation 7.....................................................................................13 Provide -

Winter 2020 DFI Newsletter

Washington Department of Financial Institutions Winter 2020 Newsletter Announcing DFI’s New Strategic Plan Message from Charlie Clark, DFI Director The world of financial services is changing almost daily. As the state’s financial regulator, it’s important for us to not just keep pace, but to make certain we are looking consistently to the future. Last year I asked employees at DFI to assess our strategic plan and make sure we are “stretching” as we work to align with the Governor’s priorities, navigate a changing regulatory landscape, and prepare to regulate emerging financial services industries. We decided we wanted a new more visionary strategic plan that would carry us into the future. We wanted it to have meaning and speak to every employee regardless of their job at DFI. The strategic plan had to be a living document that always moves DFI to work at its highest capacity, and positions us to become the best leaders in protecting consumers and regulating the financial services industry. I am proud of all the DFI staff work involved in creating our new strategic plan and am pleased to share the results of all our work with you. Below is our one page summary of our plan. You can also find a summary of our strategic plan on our website. Cindy Fazio Named New Director of Division of Consumer Services Lucinda (Cindy) Fazio has been appointed as the new Director of Consumer Services. Cindy has extensive experience in the regulation of non-depository financial institutions gained in her fifteen years with the Division. -

EXCESSIVE TRANSFER FEE Faqs

EXCESSIVE TRANSFER FEE FAQs What is an Excessive Transfer Fee? Seattle Credit Union limits the number of transfers and withdrawals that you can make from a savings deposit account (Membership Savings, Money Market, Club Account, Certificate of Deposit, etc.) to a Checking Account or to a third party. You may not make more than six pre-authorized, automated, or telephone transfers/withdrawals from these accounts each month. This fee was established to discourage consumers from using savings deposit accounts as a transactional or checking account. Excessive Transfer Fees Savings accounts, which also include Certificates and Money Market Accounts, are not classified as “transaction” accounts and have limited transaction allowances. Seattle Credit Union allows for 6 transfers/withdrawals per statement cycle at no cost. The fee for each transfer/withdrawal above six within that timeframe is $20/transaction. Q: Which transactions may incur an Excessive Transfer Fee if the number of transactions exceed 6 per statement cycle and which are unlimited? UNLIMITED LIMITED Transfers and Withdrawals Transfers and Withdrawals • In person (at a branch or shared branching • Preauthorized Transactions service center/kiosk) • Automatic transfers (scheduled ACH • At an ATM withdrawals) • By mail or messenger • Telephone (including Automated • Unlimited deposits/transfers can be made Telephone Banking) into a savings account • Fax • Online Banking or Mobile Banking Transfers to another account of the same owner • Checks at the same financial institution when made: • Automatic Overdraft Transfers • For loan payments • Point of Sale transactions with an ATM or debit card • Any other similar order payable to third Withdrawals made by telephone only when: parties • The transaction results in a check mailed to that member. -

Credit Card Rates

CREDIT CARD ACCOUNT AGREEMENT AND FEDERAL DISCLOSURE STATEMENT THIS IS YOUR CREDIT CARD ACCOUNT AGREEMENT AND IT INCLUDES NECESSARY FEDERAL 1521 1st Avenue South, Ste. 500 TRUTH-IN-LENDING DISCLOSURE STATEMENTS, VISA PLATINUM AND VISA PLATINUM SECURED Seattle, WA 98134-1471 AGREEMENTS, AND ANY SPECIAL INSTRUCTIONS REGARDING THE USE OF YOUR VISA (206) 398-5500 ● (800) 334-2489 PLATINUM AND VISA PLATINUM SECURED CREDIT CARDS, AND/OR ANY OTHER ACCOUNT ACCESS DEVICE. PLEASE BE CERTAIN TO READ THIS AGREEMENT CAREFULLY AND NOTIFY US AT ONCE IF ANY PARTS ARE UNCLEAR. Interest Rate and Interest Charges Annual Percentage Rate (APR) VISA Platinum: For Purchases 6.99__________% - 17.99 This APR will vary with the market based on the Prime Rate. VISA Platinum Secured:6.99____ -______ 17.99 % This APR will vary with the market based on the Prime Rate. APR For Balance Transfers VISA Platinum: 6.99__________ - 17.99______% This APR will vary with the market based on the Prime Rate. VISA Platinum Secured: 6.99___________ - 17.99_____% This APR will vary with the market based on the Prime Rate. APR For Cash Advances VISA Platinum: __________6.99 - 17.99______% This APR will vary with the market based on the Prime Rate. VISA Platinum Secured: _____6.99_________ - 17.99__% This APR will vary with the market based on the Prime Rate. Penalty APR And When it 17.99________% Applies This APR may be applied to Your Account if You: 1) Make a late payment. How Long Will The Penalty APR Apply? If Your APRs are increased for this reason, the Penalty APR will apply indefinitely unless 6 consecutive payments are received on or before the due date. -

Seattle Metropolitan Credit Union Unveils New Name and Look

Seattle Metropolitan Credit Union unveils new name and look The changes underscore SCU’s ongoing commitment as Seattle’s partner in growth and prosperity CUINSIGHT.COM SEATTLE, WA (September 18, 2017) — Today, Seattle Metropolitan Credit Union announced that it has simplified its name to “Seattle Credit Union,” and revealed a new branch design and brand logo. Making the name shorter and easier to recall, Seattle Credit Union continues to be Seattle’s credit union, helping all members of the community achieve their financial goals. “Seattle Credit Union is dedicated to serving as Seattle’s partner in growth and prosperity,” said Richard Romero, Seattle Credit Union’s CEO. “We truly value each member of the community and this is what sets us apart from other institutions. We’ve been a part of Seattle’s evolution through every depression, recession, and boom, and we know that when everyone can grow and rise together, we can all achieve things once thought impossible. With these changes, we want to show our unshakeable commitment to Seattleites and their dreams, and our excitement in helping everyone towards a prosperous financial future.” Seattle Credit Union branches will continue to be updated through the end of 2017. The refreshed locations will feature collaborative, open spaces for its members to discuss their vision of prosperity. Financial experts will provide unique in-branch experiences, working alongside members to navigate the best path towards their financial goals. Serving the city since 1933, Seattle Credit Union will continue to offer the same exceptional financial tools and services that its members have always enjoyed. -

Fairfax County Credit Union Mortgage

Fairfax County Credit Union Mortgage Weightless and unreducible Euclid often obliges some cellulite seriatim or plummets subversively. When Prasun vulcanises his vocalizers coffer not subtly enough, is Maddie rarer? Is Rolland abused when Tye outdo bolt? When trying to union mortgage Colonial Farm Credit Loans for Land Homes & Farms. To launch determined where one block the best, they detach to be inclusive of homeowners with different financial situations and home types. What credit union below the flow mortgage rates? Rates from smaller lenders and credit unions as well both large national banks. Is a credit union necessary for mortgages? The credit union has no explanation of credits that were viewed interest rate awards certify, routing numbers should be extended to. Quick responses and credit union mortgages while credit score in fairfax county schools, credits toward your report is higher expenses, and due on your. Offer is based on individual creditworthiness and beat to approval. Pnc Bank Teller Salary In Maryland noiemiliait. View across our bank teller vacancies now in new jobs added daily! They also include free consultations to approach your credit so you can again reach and mark or qualify for a refresh rate. Farm Credit of the Virginias Loans for Land Farms Homes. It uses rates for high-quality borrowers who tend or have strong credit. Consolidated Report of dinner for Virginia State-Chartered Credit Unions. Why Refinance Your Mortgage guide a Credit Union row of love Bank. An additional red flags may be used to the file into account is the accounts under the interest rates and enjoy free and its that fairfax county credit union mortgage? 10300 Eaton Pl Ste 330 fairfax VA 22030-2242 United States. -

High Priority

TUESDAY3pt SEPTEMBER stroke, 100% size 7, f2021or top VOL. of newspaper 186 No. =171 8.9931 inches AMERICANBANKER.COM Follow us on Twitter @AmerBanker CIBC nabs Costco credit card 5 partnership in Canada The Toronto-based bank will take over the High priority account from Capital One, which is ending its deal with the membership-only retail Texas Capital is hiring more bankers to fuel growth in 2.5pt stroke = 6.75 inches chain. Page 7 commercial and industrial lending. Its total C&I loans have declined by 14% since mid-2019. JPMorgan settles French tax- See story on page 6 6 fraud case for $30 million JPMorgan Chase settled a longstanding Commercial loans held for investment at June 30* French criminal investigation over allegations it helped clients commit tax fraud 2pt stroke = 5.75 inches for 25 million euros ($29.6 million). Page 7 $12B $10B White House favors Emory’s $10.2B $10.6B 7 Kristin Johnson for CFTC seat $8B $9.2B $9.1B The Biden administration plans to select $8.3B $6B1.5pt stroke = 4.6667 inches Kristin Johnson, a law professor who previously worked on Wall Street, for a $4B Democratic seat on the Commodity Futures $2B Trading Commission, according to a person familiar with the matter. Page 8 $0 1pt stroke = 3 inches 2017 2018 2019 2020 2021 Apple to let media apps 8 avoid 30% transaction fee Source: The company (*excludes energy loans) after global scrutiny Apple will allow developers of some apps to link from their software to external websites for payments by users, addressing dailybriefing 2021 bank reputation survey: a longstanding App Store complaint and 3 Goodwill humming settling an investigation by Japan’s Fair The banking industry is now enjoying a Trade Commission.