Q3 2017 – Interim Management Statement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AXIA Research

Greece Outlook 2019: The year of the elections AXIA Research Table of Contents Start of a new era ......................................................................................................... 3 Early elections or at the end of the government’s term? ....................................................................... 3 Unexciting economic performance, while fiscal space shrinks without pro-growth ........................................... 4 Elections is the key catalyst for the markets .................................................................................... 5 Top picks ......................................................................................................................... 5 2019, the year of the elections ......................................................................................... 6 The day after the Prespa Agreement ......................................................................................................................................... 6 Timing of elections: May vs. September/October ...................................................................................................................... 7 Looking at recent polls ............................................................................................................................................................... 9 Strategies by Syriza and ND ahead and after the elections ...................................................... 13 Syriza to try to close the gap with ND as is already regrouping -

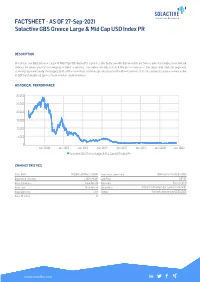

FACTSHEET - AS of 27-Sep-2021 Solactive GBS Greece Large & Mid Cap USD Index PR

FACTSHEET - AS OF 27-Sep-2021 Solactive GBS Greece Large & Mid Cap USD Index PR DESCRIPTION The Solactive GBS Greece Large & Mid Cap USD Index PR is part of the Solactive Global Benchmark Series which includes benchmark indices for developed and emerging market countries. The index intends to track the performance of the large and mid cap segment covering approximately the largest 85% of the free-float market capitalization in the Greek market. It is calculated as a price returnindex in USD and weighted by free-float market capitalization. HISTORICAL PERFORMANCE 30,000 25,000 20,000 15,000 10,000 5,000 0 Jan-2008 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive GBS Greece Large & Mid Cap USD Index PR CHARACTERISTICS ISIN / WKN DE000SLA88M4 / SLA88M Base Value / Base Date 20567.58 Points / 08.05.2006 Bloomberg / Reuters / .SGRLMCUP Last Price 1007.83 Index Calculator Solactive AG Dividends Not included Index Type Price Return Calculation 8:00 am to 10:30 pm (CET), every 15 seconds Index Currency USD History Available daily back to 08.05.2006 Index Members 11 FACTSHEET - AS OF 27-Sep-2021 Solactive GBS Greece Large & Mid Cap USD Index PR STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -3.79% -1.94% 3.19% 42.80% 9.25% -95.10% Performance (p.a.) - - - - - -17.80% Volatility (p.a.) 14.64% 18.14% 18.18% 24.49% 19.34% 39.78% High 1061.99 1061.99 1090.57 1090.57 1090.57 29018.58 Low 1005.59 934.88 934.88 615.28 842.27 523.70 Sharpe Ratio -2.57 -0.43 0.35 1.77 0.65 -0.45 Max. -

Winter in Prague 144 Companies Representing 15 Countries Can Be Selected for Meetings Online

emerging europe conference Winter in Prague 144 companies representing 15 countries can be selected for meetings online Atrium / X5 / Banca Transilvania / Torunlar REIC have recently signed up click here Registration closes on Friday Tuesday to Friday 4 November For more information please contact your WOOD sales representative: 29 November to 2 December 2016 Warsaw +48 222 22 1530 Prague +420 222 096 452 Radisson Blu Alcron Hotel London +44 20 3530 0611 [email protected] Companies by country Bolded confirmed Companies by sector Bolded confirmed Austria Hungary Romania Turkey Consumer Financials Healthcare TMT Atrium ANY Biztonsagi Nyomda Nyrt. Banca Transilvania Anadolu Efes Aegean Airlines Alior Bank Georgia Healthcare Group Agora AT&S Magyar Telekom Bucharest Stock Exchange Arcelik AmRest Alpha Bank Krka Asseco Poland CA Immobilien MOL Group Conpet Bizim Toptan Anadolu Efes Athex Group (Hellenic Exchanges) Lokman Hekim AT&S Conwert OTP Bank Electrica Cimsa Arcelik Banca Transilvania CME Erste Bank Wizz Air Fondul Proprietatea Coca-Cola Icecek Astarta Bank Millennium Industrials Cyfrowy Polsat S.A. Immofinanz Hidroelectrica Dogan Holding Atlantic Grupa BGEO Ciech LiveChat Software PORR Poland Nuclearelectrica Dogus Otomotiv Bizim Toptan Bank Pekao Cimsa Luxoft Raiffeisen Bank Agora OMV Petrom Ford Otosan CCC Bank Zachodni WBK Dogus Otomotiv Magyar Telekom RHI Alior Bank Romgaz Garanti Coca-Cola Icecek Bucharest Stock Exchange Ford Otosan O2 Czech Republic Uniqa AmRest SIF-2 Moldova Halkbank DIXY CSOB Grupa Azoty Orange Polska Vienna Insurance Group Asseco Poland Transelectrica Lokman Hekim Eurocash Erste Bank Grupa Kęty OTE Warimpex Bank Millennium Transgaz Migros Ticaret Folli Follie Eurobank HMS Group Turk Telekom Wienerberger Bank Pekao Pegasus Airlines Fortuna Garanti Industrial Milk Company Wirtualna Polska Holding Bank Zachodni WBK Russia Sabanci Holding Gorenje Getin Noble Bank Intercars Croatia CCC DIXY Teknosa Hellenic Petroleum Halkbank Mytilineos Atlantic Grupa Ciech Gazprom Tofas Kernel Hellenic Bank Pegas Nonwovens Podravka Cyfrowy Polsat S.A. -

Winter in Prague Tuesday 5 December to Friday 8 December 2017

emerging europe conference Winter in Prague Tuesday 5 December to Friday 8 December 2017 Our 2017 event held over 4 informative and jam-packed days, will continue the success of the previous five years and host almost 3,000 investor meetings, with over 160 companies representing 17 countries, covering multiple sectors. For more information please contact your WOOD sales representative: WOOD & Company Save Warsaw +48 222 22 1530 the Date! Prague +420 222 096 452 conferences 2017 London +44 20 3530 0611 [email protected] Participating companies in 2016 - by country Participating companies in 2016 - by sector Austria Hungary Romania Turkey Consumer Financials Healthcare TMT Atrium ANY Banca Transilvania Anadolu Efes Aegean Airlines Alior Bank Georgia Healthcare Group Asseco Poland AT&S Budapest Stock Exchange Bucharest Stock Exchange Arcelik AmRest Alpha Bank Krka AT&S CA Immobilien Magyar Telekom Conpet Bizim Toptan Anadolu Efes Athex Group (Hellenic Exchanges) Lokman Hekim CME Conwert MOL Group Electrica Cimsa Arcelik Banca Transilvania Cyfrowy Polsat S.A. Erste Bank OTP Bank Fondul Proprietatea Coca-Cola Icecek Astarta Bank Millennium Industrials Luxoft Immofinanz Wizz Air Hidroelectrica Dogan Holding Atlantic Grupa BGEO Aeroflot Magyar Telekom PORR Nuclearelectrica Dogus Otomotiv Bizim Toptan Bank Zachodni WBK Cimsa O2 Czech Republic RHI Kazakhstan OMV Petrom Ford Otosan CCC Bucharest Stock Exchange Ciech Orange Polska Uniqa Insurance Group Steppe Cement Romgaz Garanti Coca-Cola Icecek Budapest Stock Exchange Dogus Otomotiv OTE Vienna -

Company Update Strategy to Penetrate New Markets Pays Off

Metka Greece/ Basic Resources Company update Investment Research Reason: Estimates Revision 3 June 2013 Buy Strategy to penetrate new markets pays off Recommendation unchanged Share price: EUR 10.70 Despite the uncertain global economic environment, Metka’s strategy to closing price as of 31/05/2013 penetrate new markets in Africa and Middle East bears fruits, securing Target price: EUR 13.80 new EPC contracts that help replenish backlog. Metka’s attractive from Target Price: EUR 12.70 investment case remains intact due to: a) solid position in a broad region Reuters/Bloomberg MTKr.AT/METTK GA (SE Europe, Middle East, Africa) which is characterized by substantial Daily avg. no. trad. sh. 12 mth 46,695,000 opportunities due to rising demand and high infrastructure needs, b) Daily avg. trad. vol. 12 mth (m) 488,890.88 increasing importance of natural gas as the fuel of choice for thermal Price high 12 mth (EUR) 12.70 power plants, c) strong balance sheet estimating a net cash position of Price low 12 mth (EUR) 5.55 c.EUR 190m by the end of 2013 and c.EUR 260m by the end of 2014. In Abs. perf. 1 mth -7.2% this framework, we raise our target price to EUR 13.80 from EUR 12.70 Abs. perf. 3 mth -12.3% Abs. perf. 12 mth 82.9% previously, reiterating our Buy recommendation. Market capitalisation (EURm) 556 Metka’s backlog currently stands at around EUR 1.0bn, conservatively Current N° of shares (m) 52 excluding from our estimates the second awarded project in Syria with a budget of EUR 678m as opposed to the first project which is in an Free float 43% advanced phase. -

EUROBANK ERGASIAS S.A. €5 Billion Global Covered Bond

BASE PROSPECTUS EUROBANK ERGASIAS S.A. (incorporated with limited liability in the Hellenic Republic with registration number 000223001000) €5 billion Global Covered Bond Programme Under this €5 billion global covered bond programme (the Programme), Eurobank Ergasias S.A. (the Issuer) (formerly known as EFG Eurobank Ergasias S.A., which changed its name to Eurobank Ergasias S.A. on 2 August 2012) may from time to time issue bonds (the Covered Bonds) denominated in any currency agreed between the Issuer and the relevant Dealer(s) (as defined below). Application has been made to the Commission de Surveillance du Secteur Financier (the CSSF) in its capacity as competent authority under the Luxembourg Act dated 10 July 2005 on prospectuses for securities (as amended) (the Prospectus Act 2005) to approve this document as a base prospectus (the Base Prospectus). By approving this base prospectus, the CSSF does not give any undertaking as to the economic and financial soundness of the operation or the quality or solvency of the Issuer in accordance with Article 7(7) of the Prospectus Act 2005. Application has also been made to the Luxembourg Stock Exchange for Covered Bonds issued under the Programme to be admitted to trading on the Luxembourg Stock Exchange’s regulated market and to be listed on the official list of the Luxembourg Stock Exchange (the Official List). This document comprises a base prospectus for the purposes of Article 5.4 of Directive 2003/71/EC as amended (which includes amendments made by Directive 2010/73/EU to the extent that such amendments have been implemented in a relevant Member State of the European Economic Area) (the Prospectus Directive) but is not a base prospectus for the purposes of Section 12(a)(2) or any other provision of or rule under the United States Securities Act of 1933 (as amended) (the Securities Act). -

OPAP Recommendation BUY

GREECE | EQUITY RESEARCH | GAMING November 18, 2015 COMPANY UPDATE OPAP Recommendation BUY Regulatory pushback Target Price €9.10 Prior Target Price €10.00 Player tax on OTC games – The govt has decided to proceed with the player tax on Closing Price (17/11) €6.79 OPAP’s games as a measure alternative to the VAT on private education. The Market Cap (mn) €2,166.0 proposed tax amounts to EUR0.05 per column. The resulting price increase varies from 10% on Kino to 20% on Stihima. It is worth noting that this tax will be payable by Expected Return 34.0% punters, not OPAP, but is a clear negative as it will adversely affect OPAP revenues. Expected Dividend 9.4% We understand it relates only to OTC games (i.e. excludes lotteries/Scratch). Expected Total Return 43.4% Keep calm and game on; reality can be different from theory – Applying the “play to extinction theory” would point to c24% drop in Kino GGR, namely c13-14% impact on OPAP Share Price group EBITDA. Our view is that the impact of the player tax on Kino GGR can be SD contained at 10-15%. This is based on: 1) the historic experience of Q1'13 when the 12.00 abolition of the tax-free threshold on player winnings had a less pronounced impact than the -16% implied by the mathematical application of the theory, with the actual 11.00 Kino GGR decline (-13%) being in sync with the decline in disposable income (-11%); 2) the fact that we were already using conservative estimates assuming an 18% 10.00 decline in Kino wagers in 2016 due to the VLT deployment. -

Annual Report & Annual Bulletin

Annual Report & Annual Bulletin 13 2012 ANNUAL REPORT 2012 3 CONTENTS COMPANY PROFILE ...............................................................................................................................................p. 5 • Background - Incorporation • Object - Operations • Outlook • EYDAP NISON S.A. • Area of Service • Board of Directors CORPORAtE GOvERNANCE .............................................................................................p. 15 • Board of Directors: Composition and Functions • Internal Audit and Audit Committee • Investor Relations and Communication with Shareholders • Code of Corporate Governance CORPORAtE RESPONSIBILItY ...................................................................................... p. 21 • Environment • Human Resources • Society • Responsible Business Practice KEY FINANCIALS FOR thE GrouP .........................................................p. 27 • Key financials for the group • Consumption Evolution & Breakdown • Stock Information FINANCIAL REPORt OF thE YEAR ............................................................... p. 39 • Statements of the management board members • Board of directors’ consolidated report • Financial statements for the annual period 1st january to 31st december 2012 • Independent Auditor’s Report • Published Financial Data and Information • Law 3401/2005 art. 10 Information COMPANY PROFILE I. ANNUAL REPORT 2012 Ι. COMPANY PROFILE 6 7 Α. Background - Incorporation The Athens Water Supply and Sewerage Company In January 2000, EYDAP S.A. was -

Annual Financial Report for the Period from 1 of January

Annual Financial Report For the Period from 1st of January to 31 st of December 2014 In accordance with Law 3556/2007 SIDENOR HOLDINGS S.A. Societe Anonyme Reg. No.: 2310/06/B/86/20 2-4 Mesogeion Ave. Athens These financial statements have been translated from the original statutory financial statements that have been prepared in the Greek language. In the event that differences exist between this translation and the original Greek language financial statements, the Greek language financial statements will prevail over this document. Annual Financial Report 31 December 2014 Table of contents Σελίδα Α. Board of Directors Statements 2 Β. Board of Directors’ Annual Report 3 C. Independent Auditor’s Report 20 D. Annual Financial Statements 23 E. Information as per article 10 of Law no. 3401/2005 91 F. Figures and Information 92 1 Annual Financial Report 31 December 2014 Α. Board of Directors Statements (According to article 4, par 2, of Law no. 3556/2007) The Members of the Board of Directors of the Societe Anonyme with the trade name SIDENOR HOLD- INGS S.A. and the distinctive title SIDENOR S.A., based in Athens, 2-4, Mesogeion Avenue: 1. George Kalfarentzos, son of Christos, Chairman of the Board of Directors, 2. Nikolaos Mariou, General Manager and BoD member, 3. Stavros Theodoropoulos, BoD member in our above capacity, hereby state and confirm that according to our knowledge: The company and consolidated financial statements of SIDENOR S.A., for the fiscal year 01.01.2014- 31.12.2014, which have been compiled according to the International Financial Reporting Standards, pro- vide a true and fair view of the assets and the liabilities, the own capital and the financial results of SIDENOR S.A., as well as the entities included in the consolidated financial statements, taken as a whole. -

Gek Terna Societe Anonyme Holdings Real Estate Constructions

GEK TERNA SOCIETE ANONYME HOLDINGS REAL ESTATE CONSTRUCTIONS 85 Mesogeion Ave., 115 26 Athens Greece General Commercial Registry No. 253001000 (former S.A. Reg. No. 6044/06/Β/86/142) ANNUAL FINANCIAL REPORT for the period 1 January to 31 December 2014 In accordance with article 4 of L. 3556/2007 and the relevant executive Decisions by the Board of Directors of the Hellenic Capital Market Commission GEK TERNA GROUP Annual Financial Statements of the financial year 1 January 2014 ‐ 31 December 2014 (Amounts in thousands Euro, unless otherwise stated) CONTENTS I. STATEMENTS BY MEMBERS OF THE BOARD OF DIRECTORS ............................................... 4 II. INDEPENDENT AUDITOR’S REPORΤ ................................................................................... 5 III. ANNUAL REPORT OF THE BOARD OF DIRECTORS FOR THE FINANCIAL YEAR 2014 .............. 7 IV. ANNUAL FINANCIAL STATEMENTS SEPARATE AND CONSOLIDATED OF 31 DECEMBER 2014 (1 JANUARY ‐ 31 DECEMBER 2014) ......................................................................................... 32 STATEMENT OF FINANCIAL POSITION ................................................................................................... 33 STATEMENT OF COMPREHENSIVE INCOME ........................................................................................... 35 STATEMENT OF CASH FLOWS ................................................................................................................ 37 STATEMENT OF CHANGES IN EQUITY OF THE COMPANY ...................................................................... -

OPAP SA Annual Financial Report 2016 OPAP SA

OPAP S.A. Annual Financial Report 2016 1 OPAP S.A. | 112 Athinon Ave, 104 42 Athens, Greece, Tel: +30 (210) 5798800 OPAP S.A. Annual Financial Report 2016 2 TABLE OF CONTENTS I. Representation of the Members of the Board of Directors ........................................................................ 5 II. Board of Directors’ Report for the period 1.1.2016 -31.12.2016 ............................................................... 6 1. Financial progress and performances of year 2016 .................................................................................... 6 2. Significant events during the year 2016 and their effect on the financial statements ................................... 7 3. Main risks and uncertainties..................................................................................................................... 9 4. Company’s strategy and Group’s prospects for the year 2017 .................................................................. 13 5. Non-financial report – Sustainable development ...................................................................................... 16 6. Related Parties significant transactions ................................................................................................... 22 7. Corporate Governance Statement .......................................................................................................... 23 8. Dividend policy – Distribution of net profit ............................................................................................. -

Interim Financial Statements

GEK TERNA SOCIETE ANONYME HOLDINGS REAL ESTATE CONSTRUCTIONS 85 Mesogeion Ave., 115 26 Athens, Greece General Commercial Registry No. 253001000 (former S.A. Reg. No. 6044/06/Β/86/142) SIX‐MONTH FINANCIAL REPORT For the period 1 January to June 30, 2020 In accordance with article 5 of L. 3556/2007 and the relevant executive Decisions by the Board of Directors of the Hellenic Capital Market Commission [The current page has been deliberately left blank] CONTENTS I. STATEMENTS BY MEMBERS OF THE BOARD OF DIRECTORS ........................................................ 5 II. SIX‐MONTH MANAGEMENT REPORT OF THE BOARD OF DIRECTORS .......................................... 7 Α. Financial Developments & Performance for the Reporting Period ................................................ 7 Β. Significant events for the period 01.01 – 30.06.2020 .................................................................... 8 C. Significant Events after the end of the reporting period 01.01 – 30.06.2020 ............................. 15 D. Risk Factors and Uncertainties ..................................................................................................... 17 Ε. Outlook and Prospects ................................................................................................................. 25 F. Alternative Performance Measures (“APMs”) ............................................................................. 29 G. Non‐Financial Information Report...............................................................................................