2018 Annual Report 1 Overview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kaufland Australia Proposed Store Mornington, Melbourne Economic Impact Assessment

Kaufland Australia Proposed store Mornington, Melbourne Economic Impact Assessment November 2018 Prepared by: Anthony Dimasi, Managing Director – Dimasi & Co [email protected] Prepared for Kaufland Australia Table of contents Executive summary 1 Introduction 5 Section 1: The supermarket sector – Australia and Victoria 6 Section 2: Kaufland Australia – store format and offer 13 Section 3: Economic Impact Assessment 20 3.1 Site location and context 21 3.2 Trade area analysis 23 3.3 Competition analysis 27 3.4 Estimated sales potential 28 3.5 Economic impacts 30 3.6 Net community benefit assessment 43 Executive summary The Supermarkets & Grocery Stores category is by far the most important retail category in Australia. Total sales recorded by Supermarkets & Grocery Stores as measured by the Australian Bureau of Statistics have increased from $64.5 billion at 2007 to $103.7 billion at 2017, recording average annual growth of 4.9% per annum – despite the impacts of the global financial crisis (GFC). Over this past decade the category has also increased its share of total Australian retail sales from 31.3% to 33.7%. For Victoria, similar trends are evident. Supermarkets and grocery stores’ sales have increased over the past decade at a similar rate to the national average – 4.5% versus 4.9%. The share of total retail sales directed to supermarkets and grocery stores by Victorians has also increased over this period, from 31.6% at 2007 to 32.8% at 2017. Given the importance of the Supermarkets & Grocery Stores category to both the Victorian retail sector and Victorian consumers, the entry of Kaufland into the supermarket sector brings with it enormous potential for significant consumer benefits, as well as broader economic benefits. -

Supermarket Refrigeration Going Natural

cover story >>> SEAN McGOWAN REPORTS Supermarket refrigeration going natural In 2005, Coles Supermarkets opened its first ‘environmental concept’ supermarket featuring a cascade carbon dioxide refrigeration system. Two years on the technology has undergone significant improvement to better serve the local market, while internationally it promises to receive widespread adoption by the world’s retail heavyweights, as Sean McGowan reports. Supermarket refrigeration accounts for a significant 1% of Australia’s total electricity consumption, and this figure is reported to be higher in Europe and the United States. Therefore, its not surprising to find supermarket chains worldwide clamoring to adopt new technology which promises to cut their energy costs, while at the same time, address their corporate responsibilities to the environment and the communities who shop with them. The knight in shining armour looks set to be carbon dioxide (CO2) refrigeration systems, which are often used in a cascade design with fluorocarbon refrigerants such as R507 or R134a. A cascade system using ammonia is also on the agenda according to one of Australia’s leading supermarket refrigeration specialists, Frigrite Refrigeration. “We have traveled the world investigating system design and have developed solutions that best suit the Australian market. We installed the first CO2 systems in Australia, with another four systems installed in new supermarkets since,” says Andrew Reid, national account manager for Frigrite. “Due to economic constraints, the cascade CO2 systems installed in Australia best suit the energy and environmental expectations, however, further development is underway in finding improvements to the current concepts, which may involve a fundamental system design change and alternate refrigerants to those currently being used.” Reid says supermarket chains have acknowledged the importance of meeting environmental and community expectations as the general awareness of these two aspects increases. -

2017 Annual Report

19 September 2017 The Manager Market Announcements Office Australian Securities Exchange Dear Manager, 2017 ANNUAL REPORT Attached is the Wesfarmers Limited 2017 Annual Report. A copy of the report will be sent by mid-October 2017 to those shareholders who have elected to receive a copy. The report is also available on the company’s website www.wesfarmers.com.au. Yours faithfully, LJ KENYON COMPANY SECRETARY For personal use only Wesfarmers Annual 2017 Report 2017 Annual Report Delivering value today and tomorrow For personal use only The primary objective of Wesfarmers is to provide a satisfactory return to its shareholders. About Wesfarmers About this report From its origins in 1914 as a Western This annual report is a summary Wesfarmers is committed to reducing Australian farmers’ cooperative, of Wesfarmers and its subsidiary the environmental footprint associated Wesfarmers has grown into one of companies’ operations, activities and with the production of the annual Australia’s largest listed companies. financial position as at 30 June 2017. In report and printed copies are only With headquarters in Western Australia, this report references to ‘Wesfarmers’, posted to shareholders who have its diverse business operations ‘the company’, ‘the Group’, ‘we’, ‘us’ and elected to receive a printed copy. This cover: supermarkets, liquor, hotels ‘our’ refer to Wesfarmers Limited (ABN report is printed on environmentally and convenience stores; home 28 008 984 049) unless otherwise stated. responsible paper manufactured under improvement; department stores; ISO 14001 environmental standards. References in this report to a ‘year’ office supplies; and an Industrials are to the financial year ended division with businesses in chemicals, 30 June 2017 unless otherwise stated. -

Hypermarket Lessons for New Zealand a Report to the Commerce Commission of New Zealand

Hypermarket lessons for New Zealand A report to the Commerce Commission of New Zealand September 2007 Coriolis Research Ltd. is a strategic market research firm founded in 1997 and based in Auckland, New Zealand. Coriolis primarily works with clients in the food and fast moving consumer goods supply chain, from primary producers to retailers. In addition to working with clients, Coriolis regularly produces reports on current industry topics. The coriolis force, named for French physicist Gaspard Coriolis (1792-1843), may be seen on a large scale in the movement of winds and ocean currents on the rotating earth. It dominates weather patterns, producing the counterclockwise flow observed around low-pressure zones in the Northern Hemisphere and the clockwise flow around such zones in the Southern Hemisphere. It is the result of a centripetal force on a mass moving with a velocity radially outward in a rotating plane. In market research it means understanding the big picture before you get into the details. PO BOX 10 202, Mt. Eden, Auckland 1030, New Zealand Tel: +64 9 623 1848; Fax: +64 9 353 1515; email: [email protected] www.coriolisresearch.com PROJECT BACKGROUND This project has the following background − In June of 2006, Coriolis research published a company newsletter (Chart Watch Q2 2006): − see http://www.coriolisresearch.com/newsletter/coriolis_chartwatch_2006Q2.html − This discussed the planned opening of the first The Warehouse Extra hypermarket in New Zealand; a follow up Part 2 was published following the opening of the store. This newsletter was targeted at our client base (FMCG manufacturers and retailers in New Zealand). -

Supply-Change.Org Company Launch List

Supply-Change.Org Company Launch List Is your company on this list? Contact Supply Change to request a profile preview, now through March 25, 2015. Adani Wilmar Burberry Emami Biotech Adidas Campbell's Etablissements Fr. Colruyt AEON Cargill Eurostar Agropalma Carrefour Farm Frites Ahlstrom Casino Fazer Group Ajinomoto Catalyst Paper Ferrero Trading Aldi Nord Cefetra Findus Group Aldi Sud Cémoi Florin Almacenes Exito Cencosud General Mills Amcor Cérélia Ginsters Arla Foods Coca-Cola Godrej Industries Arnott's Biscuits Coles Supermarkets Golden Agri-Resources ASDA Colgate-Palmolive Goodman Fielder Asia Pacific Resources Compass Group Greenergy International International Limited ConAgra Foods Grupo André Maggi Asia Pulp and Paper Co-op Clean Co. Grupo JD Associated British Foods Coop Norway Gucci Auchan Coop Sweden H & M August Storck Coop Switzerland Hain Celestial Aviko Co-operative Group Haribo Avon CostCo HarperCollins Axfood Cranswick Harry's Barilla CSM Bakery Supplies Hasbro Barry Callebaut Food Dai Nippon Printing Co. Heineken International Manufacturers Europe Dairy Farm International Heinz BASF Danone Henkel Bayer Dansk Supermarked Hershey Company Beijing Hualian Danzer Hewlett-Packard Best Buy Delhaize Hillshire Brands BillerudKorsnäs Doctor's Associates Holmen Bimbo Dohle Handelsgruppe Holding ICA Bongrain Dow IGA Boots UK Drax Group Iglo Foods Group Brambles Dunkin' Brands Igor Novara Brioche Pasquier Cerqueux Dupont Ikea British Airways Ecover Inditex British Sky Broadcasting Elanco International Flavors & Fragrances Bunge -

COL ASX Release

18 August 2020 The Manager Company Announcements Office Australian Securities Exchange Dear Sir or Madam Coles Group Limited – 2020 Full Year Results Release Please find attached for immediate release to the market the 2020 Full Year Results Release for Coles Group Limited. This announcement is authorised by the Board. Yours faithfully, Daniella Pereira Company Secretary For personal use only Coles Group Limited ABN 11 004 089 936 800 Toorak Road Hawthorn East Victoria 3123 Australia PO Box 2000 Glen Iris Victoria 3146 Australia Telephone +61 3 9829 5111 www.colesgroup.com.au 18 August 2020 2020 Full Year Results Release First year strategy delivered whilst supporting team members, suppliers and community through droughts, bushfires and COVID-19 Performance summary (retail non-IFRS basis)1 ▪ Full year sales revenue increased by 6.9% to $37.4 billion with sales revenue growth across all segments ▪ 51st consecutive quarter of Supermarkets comparable sales growth, increasing by 7.1% in Q4 ▪ Liquor comparable sales growth of 20.2% in Q4 ▪ Express convenience (c-store) comparable sales growth of 8.3% in Q4 ▪ Achieved Smarter Selling cost savings in excess of $250 million ▪ Group EBIT growth achieved for the first time in four years, increasing by 4.7% ▪ Strong earnings per share growth of 7.1% ▪ Cash realisation of 111% and net debt of $0.4 billion, providing significant capacity for future growth ▪ Fully-franked final dividend of 27.5 cents per share declared, a 14.6% uplift on the prior year final dividend ▪ Delivered a total shareholder -

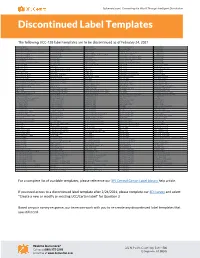

Discontinued Label Templates

3plcentral.com | Connecting the World Through Intelligent Distribution Discontinued Label Templates The following UCC-128 label templates are to be discontinued as of February 24, 2021. AC Moore 10913 Department of Defense 13318 Jet.com 14230 Office Max Retail 6912 Sears RIM 3016 Ace Hardware 1805 Department of Defense 13319 Joann Stores 13117 Officeworks 13521 Sears RIM 3017 Adorama Camera 14525 Designer Eyes 14126 Journeys 11812 Olly Shoes 4515 Sears RIM 3018 Advance Stores Company Incorporated 15231 Dick Smith 13624 Journeys 11813 New York and Company 13114 Sears RIM 3019 Amazon Europe 15225 Dick Smith 13625 Kids R Us 13518 Harris Teeter 13519 Olympia Sports 3305 Sears RIM 3020 Amazon Europe 15226 Disney Parks 2806 Kids R Us 6412 Orchard Brands All Divisions 13651 Sears RIM 3105 Amazon Warehouse 13648 Do It Best 1905 Kmart 5713 Orchard Brands All Divisions 13652 Sears RIM 3206 Anaconda 13626 Do It Best 1906 Kmart Australia 15627 Orchard Supply 1705 Sears RIM 3306 Associated Hygienic Products 12812 Dot Foods 15125 Lamps Plus 13650 Orchard Supply Hardware 13115 Sears RIM 3308 ATTMobility 10012 Dress Barn 13215 Leslies Poolmart 3205 Orgill 12214 Shoe Sensation 13316 ATTMobility 10212 DSW 12912 Lids 12612 Orgill 12215 ShopKo 9916 ATTMobility 10213 Eastern Mountain Sports 13219 Lids 12614 Orgill 12216 Shoppers Drug Mart 4912 Auto Zone 1703 Eastern Mountain Sports 13220 LL Bean 1702 Orgill 12217 Spencers 6513 B and H Photo 5812 eBags 9612 Loblaw 4511 Overwaitea Foods Group 6712 Spencers 7112 Backcountry.com 10712 ELLETT BROTHERS 13514 Loblaw -

2019 Annual Report 1 2019 the YEAR in REVIEW

Wesfarmers Annual Report Annual Wesfarmers 2019 2019 WESFARMERS ANNUAL REPORT ABOUT WESFARMERS ABOUT THIS REPORT All references to ‘Indigenous’ people are intended to include Aboriginal and/or From its origins in 1914 as a Western This annual report is a summary Torres Strait Islander people. Australian farmers’ cooperative, Wesfarmers of Wesfarmers and its subsidiary Wesfarmers is committed to reducing the has grown into one of Australia’s largest companies’ operations, activities and environmental footprint associated with listed companies. With headquarters in financial performance and position as at the production of this annual report and Perth, Wesfarmers’ diverse businesses in this 30 June 2019. In this report references to printed copies are only posted to year’s review cover: home improvement; ‘Wesfarmers’, ‘the company’, ‘the Group’, shareholders who have elected to receive apparel, general merchandise and office ‘we’, ‘us’ and ‘our’ refer to Wesfarmers a printed copy. This report is printed on supplies; an Industrials division with Limited (ABN 28 008 984 049), unless environmentally responsible paper businesses in chemicals, energy and otherwise stated. manufactured under ISO 14001 fertilisers and industrial safety products. Prior References in this report to a ‘year’ are to environmental standards. to demerger and divestment, the Group’s the financial year ended 30 June 2019 businesses also included supermarkets, unless otherwise stated. All dollar figures liquor, hotels and convenience retail; and are expressed in Australian -

Your Rights to Return Goods Bought Online—A Scan of the Return Policies of Online Retailers in Australia

Your rights to return goods bought online—a scan of the return policies of online retailers in Australia December 2011 Overview In December 2011, Consumer Action Law Centre looked at the refund and return policies of 12 leading online businesses operating in Australia.i The purpose of this research was to investigate whether online retailers understood their obligations under the Consumer Guarantees provisions of the Australian Consumer Law (which protect consumers if they are sold goods or services that are faulty) and whether they reflect that understanding in the information they provide to consumers. We sorted the policies into three categories: . Good practice: policy does not mislead consumers and sets out consumer rights clearly and comprehensively; . Pass: policy is ok, but has minor problems or could be clearer; and . Fail: policy seriously departs from good practice, risks misleading consumers regarding their rights or places unreasonable barriers to returning faulty goods. What we found was pretty disappointing. In our assessment: . only two of the retailers we looked at, Deals Direct and Crazy Sales, met the good practice standard, with refund and return policies that were both compliant with the Consumer Guarantees and demonstrate good practice; . Target and Big W had passable policies, but still need improvement; and . the remaining eight businesses, including some big names like Apple, Coles Online and Officeworks, had policies with many serious deficiencies. Since reviewing the policies in December 2011, some of these companies have said that they will review or change their policies. Be aware that the problems we identify below may have been addressed. What this document contains . -

FY20 Results Presentation

18 August 2020 The Manager Company Announcements Office Australian Securities Exchange Dear Sir or Madam Coles Group Limited – 2020 Full Year Results Presentation Please find attached for immediate release to the market the 2020 Full Year Results Presentation for Coles Group Limited. This announcement is authorised by the Board. Yours faithfully, Daniella Pereira Company Secretary Coles Group Limited ABN 11 004 089 936 800 Toorak Road Hawthorn East Victoria 3123 Australia PO Box 2000 Glen Iris Victoria 3146 Australia Telephone +61 3 9829 5111 www.colesgroup.com.au SecondBite CEO Jim Mullan accepts donations from Coles during the COVID-19 pandemic. By the end of FY20, Coles had donated the equivalent of 116 million meals to SecondBite since 2011 and the equivalent of 32 million meals to Foodbank since 2003. This is the equivalent of 148 million meals to people in need since 2003. 2020 Full Year Results Presentation 18 August 2020 Disclaimer This presentation contains summary information about Coles Group Limited (ACN 004 089 936) and its related bodies corporate (together, Coles) and Coles’ activities as at the date of this presentation. It is information given in summary form only and does not purport to be complete. It should be read in conjunction with Coles’ other periodic corporate reports and continuous disclosure announcements filed with the Australian Securities Exchange (ASX), available at www.asx.com.au This presentation is for information purposes only and is not a prospectus or product disclosure statement, financial product or investment advice or a recommendation to acquire Coles shares or other securities. It has been prepared without taking into account the investment objectives, financial situation or needs of individuals. -

The Australian Grocery Sector: Structurally Irredeemable?

THE AUSTRALIAN GROCERY SECTOR: structurally irredeemable? Alexandra Merrett and Rhonda L Smith1 By all appearances, the grocery sector in Australia is less than ideally competitive and indeed less competitive than most other advanced economies. It may be that the size of the Australian economy imposes a natural limit on the market structure whereby the available economies of scale and scope mean that there is only room for two large players. The evidence suggests that, while Coles and Woolworths may have substantial market power, they do not take advantage of such market power by systematic monopoly pricing. Rather, any uses of market power are episodic and appear largely related to non-price conduct. Indeed, it seems the biggest impact for Australian consumers of our present market structure is reduced choice and innovation as sources of supply are rationalised. Australians may therefore need to consider the extent to which they prefer increased choice over lower prices and the convenience of one-stop shops. In considering these issues, this paper attempts to assess anecdotal claims – particularly in relation to ‘must have’ brands and private labels – by reference to available data. In doing so, we highlight several potential uses of publicly available information which may go some way to proving or disproving market power problems in the Australian grocery sector. 1 Alexandra Merrett is a competition lawyer and Senior Fellow at the Melbourne Law School, and may be contacted on [email protected]. Rhonda Smith is an economist and Senior Lecturer at the University of Melbourne. She may be contacted on [email protected]. -

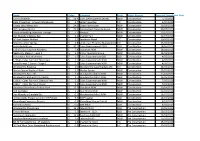

Name Value Company State Status Reason Forecast Completion Date Coles Schofields 34.9 $ Coles Developments (NSW) NSW Constr

Name Value Company State Status Reason Forecast Completion Date Coles Schofields $ 34.9 Coles Developments (NSW) NSW Construction 1/10/2021 Salta Properties - Citiwest Warehouse $ 5.7 Salta Properties VIC Construction 6/09/2021 Costco Lake Macquarie $ 24.6 Costco Wholesale NSW Construction 23/08/2021 262 Liverpool Street $ 25.6 Cornerstone Property Group NSW Construction 30/07/2021 Westrac Building Extension Tomago $ 5.7 Westrac NSW Construction 22/07/2021 Dan Murphy's Bateau Bay $ 2.1 Charter Hall NSW Construction 12/07/2021 BP Fuel Station Wollert $ 2.5 Sandhurst Retail VIC Construction 30/06/2021 Kmart Caroline Springs $ 2.8 Lend Lease Property Management (Australia)VIC Construction P/L 25/06/2021 Coles Andergrove $ 20.2 Coles Developments QLD QLD Construction 18/06/2021 115-151 Dunning Ave Rosebery $ 7.8 Goodman NSW NSW Construction 16/06/2021 Neeta City Stage 2 - Level 1 $ 5.2 Elanor Investors Group NSW Construction 15/06/2021 Coles Ascot Refurbishment $ 1.6 Coles Supermarkets QLD QLD Construction 4/06/2021 1236.8 - Coles Format C Moss Vale $ 2.2 Coles Supermarkets NSW NSW Construction 4/06/2021 Coles Format C Stores - Stage 2 $ 2.3 Coles Supermarkets NSW NSW Construction 4/06/2021 Woolworths Belgrave $ 1.0 Woolworths Supermarkets VIC VIC Construction 28/05/2021 Marley Spoon Wetherill Park $ 1.5 Marley Spoon NSW Construction 25/05/2021 Woolworths Bass Hill $ 2.4 Woolworths (Misc) NSW NSW Construction 21/05/2021 Woolworths Bathurst City Centre $ 1.7 Woolworths (Misc) NSW NSW Construction 13/05/2021 1236.6 - Coles Format C Edensor Park