Introduction to Cloud Computing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Google Is a Strong Performer in Enterprise Public Cloud Platforms Excerpted from the Forrester Wave™: Enterprise Public Cloud Platforms, Q4 2014 by John R

FOR CIOS DECEMBER 29, 2014 Google Is A Strong Performer In Enterprise Public Cloud Platforms Excerpted From The Forrester Wave™: Enterprise Public Cloud Platforms, Q4 2014 by John R. Rymer and James Staten with Peter Burris, Christopher Mines, and Dominique Whittaker GOOGLE, NOW A FULL-SERVICE PLATFORM, IS RUNNING TO CATCH THE LEADERS Since our last analysis, Google has made significant improvements to its cloud platform — adding an IaaS service, innovated with new big data solutions (based on its homegrown dremel architecture), and added partners. Google is popular among web developers — we estimate that it has between 10,000 and 99,000 customers. But Google Cloud Platform lacks several key certifications, monitoring and security controls, and application services important to CIOs and provided by AWS and Microsoft.1 Google has also been slow to position its cloud platform as the home for applications that want to leverage the broad set of Google services such as Android, AdSense, Search, Maps, and so many other technologies. Look for that to be a key focus in 2015, and for a faster cadence of new features. Forrester Wave™: Enterprise Public Cloud Forrester Wave™: Enterprise Public Cloud Platforms For CIOs, Q4 ‘14 Platforms For Rapid Developers, Q4 ‘14 Risky Strong Risky Strong Bets Contenders Performers Leaders Bets Contenders Performers Leaders Strong Strong Amazon Web Services MIOsoft Microsoft Salesforce Cordys* Mendix MIOsoft Salesforce (Q2 2013) OutSystems OutSystems Google Mendix Acquia Current Rackspace* IBM Current offering (Q2 2013) offering Cordys* (Q2 2013) Engine Yard Acquia CenturyLink Google, with a Forrester score of 2.35, is a Strong Performer in this Dimension Data GoGrid Forrester Wave. -

Potential Competition, Nascent Competitors, and Killer Acquisitions John M

Potential Competition, Nascent Competitors, and Killer Acquisitions John M. Yun* INTRODUCTION Assessing the competitive impact of acquisitions is an integral part of antitrust enforcement. In fact, there is probably no other area of antitrust enforcement that is as well-developed and formalized as the review of mergers and acquisitions.1 Recently, however, there has been a great deal of attention given to a certain category of acquisitions—namely, the acquisition of potential competitors and nascent competitive threats.2 Relatedly, there is a concern that, post-acquisition, the acquiring firm will * This chapter is based, in part, on written testimony provided on September 24, 2019, before the Subcommittee on Antitrust, Competition Policy, and Consumer Rights of the U.S. Senate Committee on the Judiciary for a hearing entitled, Competition in Digital Technology Markets: Examining Acquisitions of Nascent or Potential Competitors by Digital Platforms. The testimony was reprinted as Potential Competition and Nascent Competitors, 4 CRITERION J. ON INNOVATION 625 (2019). I thank Joshua Wright for providing valuable comments and Scalia Law student Rachel Burke for excellent research assistance. 1 See, for example, U.S. DEP’T OF JUSTICE & FED. TRADE COMM’N, HORIZONTAL MERGER GUIDELINES (2010), https://www.justice.gov/atr/horizontal-merger-guidelines-08192010 [hereinafter Horizontal Merger Guidelines], which is based on a strong legacy of prior merger guidelines including major revisions in 1982 and 1992. 2 See, e.g., AUSTL. COMPETITION & CONSUMER COMM’N, DIGITAL PLATFORMS INQUIRY FINAL REPORT 10 (2019), https://www.accc.gov.au/system/files/Digital%20platforms%20inquiry%20-%20final%20report.pdf [hereinafter ACCC Report] (“. a range of factors contributed to each of Google’s and Facebook’s dominant positions in their respective markets. -

Data Sheet Netsuite Integration Tools Achieve Cloud Business Efficiency and Preserve Existing Investments by Integrating with Third-Party Applications

Data Sheet NetSuite Integration Tools Achieve Cloud Business Efficiency and Preserve Existing Investments by Integrating with Third-Party Applications NetSuite provides a complete cloud business management platform to power an entire business— but the reality is many companies may already be running other third-party on-premise or cloud applications for specific business processes, or they may have invested significant resources in an on-premise ERP solution like Oracle or SAP. The SuiteCloud development platform and SuiteCloud Connect integration solutions let you seamlessly integrate NetSuite with your existing systems, preserving your investments and enabling new business efficiency. In particular, a two-tier ERP model is fast emerging as the solution of choice for multinational companies expanding into new lines of business or geographic subsidiaries, or seeking standardization across a distributed environment. With a two-tier ERP model, enterprises are deploying cloud business management across their subsidiaries and synching it to on-premise ERP at headquarters at a fraction of the time and cost required for an in-house ERP deployment. With SuiteCloud integration solutions, NetSuite customers and partners can rapidly extend and integrate NetSuite capabilities for ERP/financials, CRM, ecommerce with other business systems, streamlining processes and speeding business value. SuiteCloud Connect Enterprises deploying NetSuite can use NetSuite’s SuiteCloud Connect solutions for best practices- based integration with Oracle or SAP, as well as Salesforce.com and Google. SuiteCloud Connect is based on the SuiteCloud platform, providing standards-based technology to enable the free flow of financial, supply chain and customer information between NetSuite and other business applications or cloud platforms, or between divisions running NetSuite and on-premise ERP systems at headquarters in a two-tier ERP model. -

Professional Heroku® Programming

ffirs.indd i 1/10/2013 1:46:29 PM PROFESSIONAL HEROKU® PROGRAMMING INTRODUCTION . xxv PART I AN OVERVIEW OF HEROKU CHAPTER 1 How Heroku Works . 3 CHAPTER 2 Architectural Considerations . .17 CHAPTER 3 Porting Your Applications to Heroku . 45 PART II CREATING AND MANAGING HEROKU APPLICATIONS CHAPTER 4 Deploying Your Applications to Heroku . 73 CHAPTER 5 Managing Releases with Heroku . 89 CHAPTER 6 Working with Add-Ons . 115 CHAPTER 7 Managing, Monitoring, and Scaling Your Heroku Applications . 133 PART III USING A DATA STORE WITH YOUR HEROKU APPLICATIONS CHAPTER 8 Using Heroku Postgres as a Data Store for Your Heroku Applications . 157 CHAPTER 9 Using Database.com as a Data Store for Your Heroku Applications . .181 CHAPTER 10 Using Third-Party Data Stores for Your Heroku Applications . .207 PART IV PROGRAMMING ON HEROKU’S POLYGLOT PLATFORM CHAPTER 11 Developing with Ruby . .233 CHAPTER 12 Developing with Java . 267 CHAPTER 13 Developing with Other Supported Languages . 301 CHAPTER 14 Understanding Buildpacks . 351 PART V CREATING A NEW GENERATION OF HEROKU APPLICATIONS CHAPTER 15 Building Mobile Applications with Heroku . 383 CHAPTER 16 Building Social Applications with Heroku . 411 APPENDIX Additional Resources . 445 INDEX . 469 ffirs.indd i 1/10/2013 1:46:29 PM ffirs.indd ii 1/10/2013 1:46:30 PM PROFESSIONAL Heroku® Programming ffirs.indd iii 1/10/2013 1:46:30 PM ffirs.indd iv 1/10/2013 1:46:30 PM PROFESSIONAL Heroku® Programming Chris Kemp Brad Gyger John Wiley & Sons, Ltd. ffirs.indd v 1/10/2013 1:46:30 PM © 2013 John Wiley & Sons, Ltd. -

Informatica Intelligent Cloud Services

Informatica® Intelligent Cloud Services Summer 2019 July Data Integration Connections Informatica Intelligent Cloud Services Data Integration Connections Summer 2019 July July 2019 © Copyright Informatica LLC 2006, 2019 This software and documentation are provided only under a separate license agreement containing restrictions on use and disclosure. No part of this document may be reproduced or transmitted in any form, by any means (electronic, photocopying, recording or otherwise) without prior consent of Informatica LLC. U.S. GOVERNMENT RIGHTS Programs, software, databases, and related documentation and technical data delivered to U.S. Government customers are "commercial computer software" or "commercial technical data" pursuant to the applicable Federal Acquisition Regulation and agency-specific supplemental regulations. As such, the use, duplication, disclosure, modification, and adaptation is subject to the restrictions and license terms set forth in the applicable Government contract, and, to the extent applicable by the terms of the Government contract, the additional rights set forth in FAR 52.227-19, Commercial Computer Software License. Informatica, Informatica Cloud, Informatica Intelligent Cloud Services, PowerCenter, PowerExchange, and the Informatica logo are trademarks or registered trademarks of Informatica LLC in the United States and many jurisdictions throughout the world. A current list of Informatica trademarks is available on the web at https:// www.informatica.com/trademarks.html. Other company and product names may be trade names or trademarks of their respective owners. Portions of this software and/or documentation are subject to copyright held by third parties. Required third party notices are included with the product. The information in this documentation is subject to change without notice. -

Cloud Computing: a Taxonomy of Platform and Infrastructure-Level Offerings David Hilley College of Computing Georgia Institute of Technology

Cloud Computing: A Taxonomy of Platform and Infrastructure-level Offerings David Hilley College of Computing Georgia Institute of Technology April 2009 Cloud Computing: A Taxonomy of Platform and Infrastructure-level Offerings David Hilley 1 Introduction Cloud computing is a buzzword and umbrella term applied to several nascent trends in the turbulent landscape of information technology. Computing in the “cloud” alludes to ubiquitous and inexhaustible on-demand IT resources accessible through the Internet. Practically every new Internet-based service from Gmail [1] to Amazon Web Services [2] to Microsoft Online Services [3] to even Facebook [4] have been labeled “cloud” offerings, either officially or externally. Although cloud computing has garnered significant interest, factors such as unclear terminology, non-existent product “paper launches”, and opportunistic marketing have led to a significant lack of clarity surrounding discussions of cloud computing technology and products. The need for clarity is well-recognized within the industry [5] and by industry observers [6]. Perhaps more importantly, due to the relative infancy of the industry, currently-available product offerings are not standardized. Neither providers nor potential consumers really know what a “good” cloud computing product offering should look like and what classes of products are appropriate. Consequently, products are not easily comparable. The scope of various product offerings differ and overlap in complicated ways – for example, Ama- zon’s EC2 service [7] and Google’s App Engine [8] partially overlap in scope and applicability. EC2 is more flexible but also lower-level, while App Engine subsumes some functionality in Amazon Web Services suite of offerings [2] external to EC2. -

My Detailed Resume

William B. Davis, Jr. Windsor Heights, IA (515) 360-0445 linkedin.com/in/billdavisjr [email protected] SOFTWARE & WEB DEVELOPER Accomplished IT professional with extensive experience in all facets of software development lifecycle, user training, and support. Skilled at documentation and user interface design. Always interested in examining new technologies while keeping focus on long-term system planning and maintainability. TECHNICAL SKILLS ● Computers: PCs (Windows, Mac, other), minicomputers (DEC/HP VAX and Alpha), and mainframe (IBM 3090). ● Web technologies: HTML, CSS, Java Server Pages, ASP, and ASP.NET. ● Languages: Java & JSP, JavaScript, Visual BASIC 6 & VBA, VMS BASIC, Microsoft BASIC, Microsoft C, Lattice C, Perl, SQL, COBOL, Pascal, Ruby / Rails, various Assembly languages. ● Scripting: VMS DCL, IBM JCL, Microsoft VBA and VBScript, Unix bash, Windows/DOS batch scripting. ● Operating Systems: Windows, Mac OS & OS X, DEC/HP OpenVMS, Unix, AIX, Linux, other. ● Integrated Development Environments (IDEs): Eclipse, IBM RAD 6, ISPF & Panvalet, Visual -

Cloud Computing

Cloud Computing By Dennis Schmidt, Director, Office of Information Systems, UNC School of Medicine, and the GIR Information Security Working Group Cloud computing provides computing resources as an online service, not as a physical product. The user typically has little knowledge of the physical makeup or location of the supporting infrastructure. (Analogy: You buy electrical service instead of generating it yourself.) An entire spectrum of potentially lower cost, easy-to-use services with high reliability and rapid startup times is now available. Researchers and users are demanding access to the capabilities that these services provide, but security officers are reluctant to give them access and academic IT organizations are not typically resourced to provide them locally. This document provides some basic high level information and recommendations that institutions should consider before venturing into the public cloud. Types of Clouds: Security Concerns: Institutional Policies Should: Public cloud: available to the general public or a large industry group and is Access controls (Who has access to your data?) Address processing or storing owned by an organization providing cloud services. Lower cost, higher risk. Data Location (Is it being stored in a foreign country, not sensitive information in the cloud Private cloud: operated solely for one organization. It may be managed by subject to US laws?) Require that proper technical the organization or a third party and may exist on premise or off premise. Encryption (Is the data encrypted? -

Service Description IBM Kenexa Talent Acquisition This Service Description Describes the Cloud Service IBM Provides to Client

Service Description IBM Kenexa Talent Acquisition This Service Description describes the Cloud Service IBM provides to Client. Client means the company and its authorized users and recipients of the Cloud Service. The applicable Quotation and Proof of Entitlement (PoE) are provided as separate Transaction Documents 1. IBM Kenexa BrassRing on Cloud The IBM Kenexa Talent BrassRing on Cloud SaaS offering is made up of the following components: a. IBM Kenexa BrassRing on Cloud b. IBM Kenexa BrassRing on Cloud is a scalable, online tool that helps employers and recruiters centralize and manage the Talent Acquisition process across multiple company divisions or locations. Base offering features include: ● Creating and posting job requisitions ● Sourcing ● Talent Gateways for candidates to search jobs and submit interest ● Tracking applications and work flow ● Screening candidates ● Approval levels to facilitate the selection processes ● Standard and ad-hoc reporting capabilities ● Social media interfaces and mobile technology c. The IBM Kenexa BrassRing on Cloud will be provided in both a staging and production environments. The staging environment will be provided through the life of the contract for testing purposes. d. The IBM Kenexa BrassRing on Cloud Onboard can be branded to Client’s company logo and colors. 2. IBM Kenexa Talent Acquisition BrassRing Onboard The IBM Kenexa Talent Acquisition BrassRing Onboard SaaS offering is made up of the following components: a. IBM Kenexa BrassRing on Cloud IBM Kenexa BrassRing on Cloud is a scalable, online tool that helps employers and recruiters centralize and manage the Talent Acquisition process across multiple company divisions or locations. Base offering features include: ● Creating and posting job requisitions ● Sourcing ● Talent Gateways for candidates to search jobs and submit interest ● Tracking applications and work flow ● Screening candidates ● Approval levels to facilitate the selection processes ● Standard and ad-hoc reporting capabilities ● Social media interfaces and mobile technology b. -

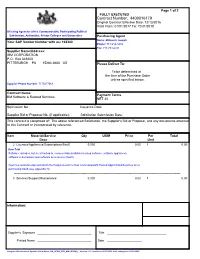

Contract Number: 4400016179

Page 1 of 2 FULLY EXECUTED Contract Number: 4400016179 Original Contract Effective Date: 12/13/2016 Valid From: 01/01/2017 To: 12/31/2018 All using Agencies of the Commonwealth, Participating Political Subdivision, Authorities, Private Colleges and Universities Purchasing Agent Name: Millovich Joseph Your SAP Vendor Number with us: 102380 Phone: 717-214-3434 Fax: 717-783-6241 Supplier Name/Address: IBM CORPORATION P.O. Box 643600 PITTSBURGH PA 15264-3600 US Please Deliver To: To be determined at the time of the Purchase Order unless specified below. Supplier Phone Number: 7175477069 Contract Name: Payment Terms IBM Software & Related Services NET 30 Solicitation No.: Issuance Date: Supplier Bid or Proposal No. (if applicable): Solicitation Submission Date: This contract is comprised of: The above referenced Solicitation, the Supplier's Bid or Proposal, and any documents attached to this Contract or incorporated by reference. Item Material/Service Qty UOM Price Per Total Desc Unit 2 Licenses/Appliances/Subscriptions/SaaS 0.000 0.00 1 0.00 Item Text Software: includes, but is not limited to, commercially available licensed software, software appliances, software subscriptions and software as a service (SaaS). Agencies must develop and attach the Requirements for Non-Commonwealth Hosted Applications/Services when purchasing SaaS (see Appendix H). -------------------------------------------------------------------------------------------------------------------------------------------------------- 3 Services/Support/Maintenance 0.000 0.00 -

Larry Page Developing the Largest Corporate Foundation in Every Successful Company Must Face: As Google Word.” the United States

LOWE —continued from front flap— Praise for $19.95 USA/$23.95 CAN In addition to examining Google’s breakthrough business strategies and new business models— In many ways, Google is the prototype of a which have transformed online advertising G and changed the way we look at corporate successful twenty-fi rst-century company. It uses responsibility and employee relations——Lowe Google technology in new ways to make information universally accessible; promotes a corporate explains why Google may be a harbinger of o 5]]UZS SPEAKS culture that encourages creativity among its where corporate America is headed. She also A>3/9A addresses controversies surrounding Google, such o employees; and takes its role as a corporate citizen as copyright infringement, antitrust concerns, and “It’s not hard to see that Google is a phenomenal company....At Secrets of the World’s Greatest Billionaire Entrepreneurs, very seriously, investing in green initiatives and personal privacy and poses the question almost Geico, we pay these guys a whole lot of money for this and that key g Sergey Brin and Larry Page developing the largest corporate foundation in every successful company must face: as Google word.” the United States. grows, can it hold on to its entrepreneurial spirit as —Warren Buffett l well as its informal motto, “Don’t do evil”? e Following in the footsteps of Warren Buffett “Google rocks. It raised my perceived IQ by about 20 points.” Speaks and Jack Welch Speaks——which contain a SPEAKS What started out as a university research project —Wes Boyd conversational style that successfully captures the conducted by Sergey Brin and Larry Page has President of Moveon.Org essence of these business leaders—Google Speaks ended up revolutionizing the world we live in. -

Clarion Alumni July 2001

Volume 48 No. 2 July 2001 Clarion University of Pennsylvania Alumni News Surrogate Parenting... Animal Refuge Style -See Page 15- Clarion Grads Lighting a Fire at Scholarship Auction Raises $55,000 Zippo -See Page 8- -See Page 9- Alumni Association Announces Recipients of ‘Distinguished Awards’ See Pages 6 & 7 www.clarion.edu/news 2-CLARION ALUMNI NEWS A L U M N I A S S O C I A T I O N CLARION ALUMNI NEWS Clarion Alumni News is published Stay in Touch three times a year by the Clarion University Alumni Association and remember the day I earned my undergraduate the Office of University Relations. degrees. It was in December of 1997 and even then Tippin Send comments to: University Iwas hot. The speakers were inspirational, my Relations Department, Clarion friends and family were there to cheer and I had an University, 974 E. Wood St., Clarion, PA 16214-1232; 814-393-2334; FAX overwhelming feeling of accomplishment. I 814-393-2082; or e-mail remember sitting in the gym next to my good [email protected]. friend Jen Founds and other communication majors, the people I had been in classes with for ALUMNI ASSOCIATION Alumni Events Calendar four years. It was an incredible day, the day that BOARD OF DIRECTORS you think about from the time you’re in junior Larry W. Jamison ’87,President Saturday, July 28 - Saturday, September 2001 high school. This was the payoff for all my hard John R. Mumford ’73 &’75, Pres.-elect August 4 Saturday, September 8 Wendy A. Clayton, ’85, secretary State System of Higher Alpha Sigma Alpha Gamma work.