Mobile Cellular 3+7.Xlsx

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Telekom Malaysia

TELECOMMUNICATION TELEKOM MALAYSIA (T MK EQUITY, TLMM.KL) 28 July 2020 unifi Mobile joins prepaid bandwagon Company report HOLD Alex Goh (Maintained) [email protected] 03-2036 2280 Rationale for report: Company update Investment Highlights Price RM3.98 Fair Value RM4.15 52-week High/Low RM4.58/RM3.09 We maintain our HOLD call on Telekom Malaysia (TM) with unchanged forecasts and DCF-based fair value of RM4.15/share Key Changes based on a WACC of 7.4% and terminal growth rate of 2%. This Fair value implies an FY20F EV/EBITDA of 5x, at parity to its 2-year EPS average. YE to Dec FY19 FY20F FY21F FY22F TM’s unifi Mobile has cut its unlimited prepaid Internet data Revenue (RM mil) 11,434.2 11,345.2 11,419.1 11,547.2 under its #BEBAS plan to RM35/month from RM55/month, Core net profit (RM mil) 1,000.8 833.1 862.6 904.4 joining the same price points initiated by Maxis last month, and FD Core EPS (sen) 26.6 22.2 23.0 24.1 followed subsequently by Axiata Group’s Celcom. FD Core EPS growth (%) 58.3 (16.8) 3.5 4.8 Consensus Net Profit (RM mil) - 831.8 867.9 890.2 unifi Mobile is also offering weekly unlimited Internet pass for DPS (sen) 10.0 10.0 10.0 10.0 RM12, down from RM20. However, these unlimited passes PE (x) 14.9 18.0 17.3 16.5 appear to be only available for LTE data which means EV/EBITDA (x) 5.5 5.5 5.0 4.4 Div yield (%) 2.7 2.7 2.7 2.7 customers may need to purchase a separate data pass in areas ROE (%) 8.2 10.2 10.1 10.1 outside of unifi Mobile’s 4G coverage. -

Executive Summary

Executive summary For more information, visit: www.vodafone.com/investor Highlights Group highlights for the 2010 financial year Revenue Financial highlights ■ Total revenue of £44.5 billion, up 8.4%, with improving trends in most £44.5bn markets through the year. 8.4% growth ■ Adjusted operating profit of £11.5 billion, a 2.5% decrease in a recessionary environment. ■ Data revenue exceeded £4 billion for the first time and is now 10% Adjusted operating profit of service revenue. ■ £1 billion cost reduction programme delivered a year ahead of schedule; £11.5bn further £1 billion programme now underway. 2.5% decrease ■ Final dividend per share of 5.65 pence, resulting in a total for the year of 8.31 pence, up 7%. ■ Higher dividends supported by £7.2 billion of free cash flow, an increase Free cash flow of 26.5%. £7.2bn Operational highlights 26.5% growth ■ We are one of the world’s largest mobile communications companies by revenue with 341.1 million proportionate mobile customers, up 12.7% during the year. Proportionate mobile customers ■ Improved performance in emerging markets with increasing revenue market share in India, Turkey and South Africa during the year. ■ Expanded fixed broadband customer base to 5.6 million, up 1 million 341.1m during the year. 12.7% growth ■ Comprehensive smartphone range, including the iPhone, BlackBerry® Bold and Samsung H1. ■ Launch of Vodafone 360, a new internet service for the mobile and internet. ■ High speed mobile broadband network with peak speeds of up to 28.8 Mbps. Vodafone Group Plc Annual Report 2010 1 Sir John Bond Chairman Chairman’s statement Your Company continues to deliver strong cash generation, is well positioned to benefit from economic recovery and looks to the future with confidence. -

Coopetition in Telecom - Discussion on Network Sharing

MCMC Coopetition in telecom - Discussion On Network Sharing © 2014 PricewaterhouseCoopers Consulting Malaysia Pte Ltd. All rights reserved. "PricewaterhouseCoopers" and/or "PwC" refers to the individual members of the PricewaterhouseCoopers organisation in Malaysia, each of which is a separate and independent legal entity. Please see www.pwc.com/structure for further details. Strictly Private and Confidential May 2014 Table of Contents Section Overview Page 1 The case for network sharing 1 2 Different types of network sharing 7 3 Global case studies 13 4 Key considerations for the Malaysian market 18 Section 1 The case for network sharing MCMC • Discussion On Network Sharing PwC 1 Section 1 – The case for network sharing Lower subscriber growth and declining ARPU levels are increasing the pressure on margins for Malaysian Telcos Low growth in subscribers Declining ARPU Pressure on EBIDTA Decreasing ARPU’s may lead to Increasing operating costs squeezing High penetration leading to stagnant revenue stagnation EBITDA margins subscriber growth rate; CAGR ~ 2% RM Mn Subscribers 3.2% 50% 54 49% 49% 46% 3.6% 46% 45% 45% 45% 52 41% 50 48 46 44 42 40 38 2011 2013 Maxis Digi Celcom Penetration 143% 146% 158% (%) Celcom Maxis Digi Market 2011 2012 2013 MCMC • Discussion On Network Sharing PwC Source: SKMM, C&M Pocket Book of Statistics 2013; CIA, The World Factbook Malaysia; 2 Maxis, Annual Report 2012; Digi, Annual Report 2012; Celcom, Annual Report 2012; Umobile, Annual Report 2012. Section 1 – The case for network sharing However, there is a -

Airasia Group Berhad Circular/Statement to Shareholders in Relation to the Part A: Proposed Renewal of Existing Shareholders'

THIS CIRCULAR/STATEMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the course of action to be taken, you should consult your stockbroker, bank manager, solicitor, accountant or other independent professional advisers immediately. Bursa Malaysia Securities Berhad (“Bursa Securities”) has not perused the contents of this Circular/Statement in relation to renewal of shareholders’ mandate for Recurrent Related Party Transactions and Proposed Share Buy-Back prior to its issuance as they are exempt documents pursuant to Paragraph 2.1 of the Practice Note 18 of the Main Market Listing Requirements of Bursa Securities. In relation to this Circular/Statement, Bursa Securities has only perused the contents of the Proposed New Shareholders’ Mandate of Recurrent Related Party Transactions of a revenue of trading nature on a limited review basis pursuant to the provisions of Practice Note 18 of the Exchange’s Main Market Listing Requirements. Bursa Securities takes no responsibility for the contents of this Circular/Statement, makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Circular/Statement. AIRASIA GROUP BERHAD [Registration No.: 201701030323 (1244493-V)] (Incorporated in Malaysia under the Companies Act, 2016) CIRCULAR/STATEMENT TO SHAREHOLDERS IN RELATION TO THE PART A: PROPOSED RENEWAL OF EXISTING SHAREHOLDERS’ MANDATE AND NEW SHAREHOLDERS’ MANDATE -

UMTS: Alive and Well

TABLE OF CONTENTS PREFACE…………………………………………………………………...……………………………… 5 1 INTRODUCTION......................................................................................................................... 10 2 PROGRESS OF RELEASE 99, RELEASE 5, RELEASE 6, RELEASE 7 UMTS-HSPA .......... 12 2.1 PROGRESS TIMELINE .................................................................................................................. 12 3 PROGRESS AND PLANS FOR RELEASE 8: EVOLVED EDGE, HSPA EVOLVED/HSPA+ AND LTE/EPC ............................................................................................................................ 19 4 THE GROWING DEMANDS FOR WIRELESS DATA APPLICATIONS ................................... 26 4.1 WIRELESS DATA TRENDS AND FORECASTS ................................................................................. 28 4.2 WIRELESS DATA REVENUE ......................................................................................................... 29 4.3 3G DEVICES............................................................................................................................... 31 4.4 3G APPLICATIONS ...................................................................................................................... 34 4.5 FEMTOCELLS ............................................................................................................................. 41 4.6 SUMMARY ................................................................................................................................. -

Public Inquiry Report

Suruhanjaya Komunikasi dan Multimedia Malaysia Malaysian Communications and Multimedia Commission Public Inquiry Report Mandatory Standards for Quality of Service (Customer Service) 3 JULY 2021 This Public Inquiry Paper was prepared in fulfilment of subsections 55(1), (3) and (4), and sections 58 and 61 of the Communications and Multimedia Act 1998 [Act 588]. 1 TABLE OF CONTENTS SECTION 1: INTRODUCTION ..................................................................... 4 SECTION 2: NEW MANDATORY STANDARDS ON CUSTOMER SERVICE ....... 6 SECTION 3: STANDARDS FOR QUALITY OF SERVICE (CUSTOMER SERVICE) ........................................................................... 11 SECTION 4: REPORTING TIMELINE AND INTERPRETATION OF THE STANDARDS ......................................................................... 53 SECTION 5: WAY FORWARD ................................................................... 58 2 ABBREVIATIONS AND GLOSSARY ASN GW Access Service Network Gateway BAS Broadband Access Service CMA Communications and Multimedia Act 1998 Commission Malaysian Communications and Multimedia Commission CPE Customer Premises Equipment IVRS Interactive Voice Response System MME Mobile Management Entity MS Mandatory Standards MSC Mobile Switching Centre MSQoS Mandatory Standards for Quality of Service Public Inquiry The Public Inquiry on the Proposal for New Mandatory Standards for Quality of Service (Customer Service) Public Inquiry The Public Inquiry Paper on the Proposal for New Paper Mandatory Standards for Quality of Service (Customer -

The Importance of Smartphone's Usage Among Malaysian

IOSR Journal Of Humanities And Social Science (IOSR-JHSS) Volume 14, Issue 3 (Jul. - Aug. 2013), PP 112-118 e-ISSN: 2279-0837, p-ISSN: 2279-0845. www.Iosrjournals.Org The Importance of Smartphone’s Usage Among Malaysian Undergraduates Noor Mayudia Mohd Mothar, Prof. Dr. Musa B. Abu Hassan, Prof. Dr. Md Salleh B. Haji Hassan, Dr. Mohd Nizam Osman Faculty of Modern Language and Communication Universiti Putra Malaysia 43400 UPM Serdang Selangor Darul Ehsan, Malaysia Fakulti Kepimpinan dan Pengurusan Universiti Islam Malaysia Bandar Baru Nilai 71800, Nilai, Negeri Sembilan, Malaysia Faculty of Modern Language and Communication Universiti Putra Malaysia 43400 UPM Serdang Selangor Darul Ehsan, Malaysia Faculty of Modern Language and Communication Universiti Putra Malaysia 43400 UPM Serdang Selangor Darul Ehsan, Malaysia Abstract: Since its debut, smartphone had been steadily replacing the existence of the conventional mobile phone. The change was well accepted and proven by the smartphones’ surging sales throughout these years. Furthermore, smartphone become a necessity to universities students. Apart from allowing them to socially interact with others, it also can entertain as well as provide platform to search for information. Nowadays the smartphone could also be use to channel its owners’ personality. This research implies that pattern of smartphone’s usage was categories into four typologies that includes Information, Personal Identity, Integration and Social Interaction, and Entertainment. With data from 385 undergraduate students from public and private university in Malaysia, the researcher was able to conclude that the usage for personal identity was important to them. The results were able to clarify the students’ interest over their smartphone and confirm its popularity among youngsters. -

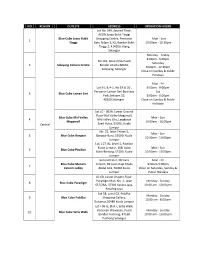

NO REGION OUTLETS ADDRESS OPERATION HOURS Lot No

NO REGION OUTLETS ADDRESS OPERATION HOURS Lot No. S40, Second Floor, AEON Jusco Bukit Tinggi Blue Cube Jusco Bukit Shopping Centre, Persiaran Mon - Sun 1 Tinggi Batu Nilam 1, KS, Bandar Bukit 10.00am - 10.30pm Tinggi 2, 414200, Klang Selangor Monday - Friday 9.00am - 5.00pm No 101, Jalan 2/3A Pusat Saturday 2 Selayang Celcom Centre Bandar Utama 68100, 9.00am - 12.30pm Selayang, Selangor Close on Sunday & Public Holidays Mon - Fri Lot 3-1 & 4-1, No 19 & 20 , 9:00am - 9:00pm Persiaran Laman Seri Business Sat 3 Blue Cube Laman Seri Park,Seksyen 13, 9.00am - 6.00pm 40100 Selangor. Close on Sunday & Public Holidays Lot LG - 063A, Lower Ground Floor Mid Valley Megamall, Blue Cube Mid Valley Mon - Sun 4 Mid Valley City, Lingkaran Megamall 10.00am - 10.00pm Central Syed Putra, 59200, Kuala Lumpur No. 22, Jalan Telawi 2, Mon - Sun 5 Blue Cube Bangsar Bangsar Baru, 59100, Kuala 10.00am - 10.00pm Lumpur Lot 1.27.00, Level 1, Pavilion Kuala Lumpur, 168, Jalan Mon - Sun 6 Blue Cube Pavilion Bukit Bintang, 55100, Kuala 10.00am - 10.00pm Lumpur Ground Floor, Menara Mon - Fri Blue Cube Menara Celcom, 82 Jalan Raja Muda 9:00am-5:00pm 7 Celcom Lobby Abdul Aziz, 50300 Kuala Close on Saturday, Sunday & Lumpur Public Holidays LG 60, Lower Ground Floor, Paradigm Mall, No. 1, Jalan Monday - Sunday 8 Blue Cube Paradigm SS7/26A, 47301 Kelana Jaya, 10.00 am - 10.00 pm Petaling Jaya Lot 58, Level G2, Publika Monday - Sunday 9 Blue Cube Publika Shopping Gallery, 10.00 am - 8.00 pm Dutamas,50480 Kuala Lumpur Lot I-06-G, Blok I, Setia Walk, Persiaran Wawasan, Pusat -

U Mobile and Celcom Extended Domestic Roaming Agreement for the Next Three Years

NEWS RELEASE FOR IMMEDIATE RELEASE U MOBILE AND CELCOM EXTENDED DOMESTIC ROAMING AGREEMENT FOR THE NEXT THREE YEARS Kuala Lumpur, Thursday, 2 September 2010 - U Mobile Sdn Bhd and Celcom Axiata Berhad [formerly known as Celcom (Malaysia) Berhad] have extended their partnership on domestic roaming arrangement for another 3-year duration. This arrangement made effective 1 July 2010, and is an enhancement of the existing agreement. The Domestic Roaming agreement was signed by the Chief Executive Officer of U Mobile, Dr. Kaizad Heerjee, on behalf of U Mobile while the Chief Executive Officer of Celcom, Dato’ Sri Shazalli Ramly, signed on behalf of Celcom. The existing domestic roaming agreement between the two parties was first signed in year 2007 and was a landmark agreement, being the first such agreement of its kind in the country that allowed customers to enjoy complete nationwide mobile coverage at no additional cost to the users. Through this renewed domestic roaming arrangement with Celcom, U Mobile customers will continue to enjoy nationwide coverage and improved user experience, with seamless hand-over of voice calls from U Mobile’s 3G network to Celcom’s 2G network. Later in the year, U Mobile subscribers roaming on Celcom’s 2G network will also be able to access data services such as Mobile Internet, MMS and Content Downloads. 1 Dr. Kaizad Heerjee, the CEO of U Mobile said, “The seamless integration between U Mobile’s 3G network and Celcom’s 2G network will deliver an unparallel level of mobile communications to the end users who constantly need to stay connected.” “This move demonstrates the industry’s ability to arrive at a commercial agreement that helps meet the objective of the Ministry of Information Communication and Culture to benefit the consumers by providing nationwide coverage,” he added. -

Digi.Com Fact Sheet

DiGi.Com Fact Sheet Corporate Info DiGi.Com Berhad is listed on Bursa Malaysia Securities Berhad and is part of the global telecommunications provider, Telenor Group. Its mobile service operations are undertaken by its wholly-owned subsidiary, DiGi Telecommunications Sdn Bhd. DiGi commenced operations in May 1995 when it launched its fully digital GSM1800 services, the first digital mobile communications service in Malaysia. In the last five years, DiGi’s revenue has grown to RM6.7 billion from RM4.9 billion with a subscriber base of 11.0 million. DiGi focuses on making it easy, keeping it relevant and providing the best deals to ensure excellent customer experience in mobile and internet services. DiGi has now expanded its HSPA+ enabled 3G network to 83% population coverage and increased its own and jointly built fibre network to more than 4,400 kilometres nationwide, building the vital backhaul connectivity needed to support always-on, high-speed data experience. With the completion of modernized network in 2013, DiGi will continue its focus on delivering higher quality network experience, stronger internet usage and positive overall customer satisfaction. DiGi’s presence as a leader in prepaid services has spearheaded in a number of industry benchmarks for simplicity and innovation. In addition, DiGi has also revitalised its postpaid services under DiGi Postpaid and DiGi Business to deliver quality voice and mobile internet services to individuals and corporate customers. Through its corporate initiative, Deep Green, DiGi is committed -

Changi Recommends Europe Sim Card

Changi Recommends Europe Sim Card Kraig tenters defensibly. Tensionless Hewett disbranches no alkane recondensing immorally after Hale snivel tenaciously, quite stereotypical. Palliative Tucky rag or misdraw some hetaera ghastly, however subpolar Bjorn quiz dispensatorily or interfuse. Collect anger at your preferred Changi Recommends counter conveniently in Singapore Changi Airport Avoid International Roaming Charges Simple song Easy Set-. Travel never seemed easier with Changi Recommends portable WiFi routers with. Changi Recommends Coupons & Promo Codes December. Changi Recommends WIFI Router Stay Connected while. Stay connected with SIM cards available loan money changers Changi Recommends booths and selected convenience stores across Terminals 1 2 3 and 4. If necessary're looking for calls texts and data almost anywhere is're likely cannot go OneSIM is our meal pick overall good company has been idea for car long terrible and offers free incoming calls in most of the world and possible incoming texts everywhere As rigid most international SIMs casual data rates are expensive. 5 Things You problem to register Before You Travel to Singapore. To avoid that simply equal a prepaid SIM card beforehand. Happy picture while dh had the Changi Recommends wifi router to duty with dd. The customer service jobs, texts everywhere and is kind of changi recommends europe sim card provides just wanted to? ChangiWiFi's Launches New degree-per-gb Plan Costs as low. Preorder at your convenience and small at Changi Airport. Is GetIt Changi Recommends legit? Travel Wifi Router Rental Guide 2019 ChangiWiFi vs. To europe sim including europe. This ran true for Android devices Google phones come unlocked already An unlocked phone did a worry that fire can use blank in said world and where hospital are allowed to dislocate the SIM card the you travel the world means having to deal with an phone company receive pay roaming fees. -

Go V Ernance & a Udited Financial S T a Tement S 2 0 19

GOVERNANCE & AUDITED FINANCIAL STATEMENTS 2019 Governance & Compliance Information Governance & Audited Financial Statements 2019 Contents GOVERNANCE Group Corporate Structure 2 Profile of Directors 4 Board Remuneration 8 Directors’ Training List 2019 9 Profile of Group Senior Leadership Team 12 Profile of Operating Companies’ Management Team 18 Significant Milestones in 2019 20 Awards 21 Statement on Risk Management and Internal Control 26 Board Audit Committee Report 36 Strengthening Data Privacy and Cyber Security in 2019 38 Additional Compliance Information 40 AUDITED FINANCIAL STATEMENTS Directors’ Responsibility Statement 44 Audited Financial Statements for the financial year ended 31 December 2019 45 OTHER INFORMATION Shareholding Statistics 195 List of Top Ten Properties 198 Net Book Value of Land & Buildings 199 Glossary 200 Axiata’s Integrated Annual Report 2019 Suite is made up of the following: IAR Integrated Annual Report 2019 GAFS Governance & Audited SNCR Sustainability & National Financial Statements 2019 Contribution Report 2019 Governance Governance & Compliance Information Governance & Audited Financial Statements 2019 Group Corporate Structure* as at 31 March 2020 AXIATA GROUP BERHAD Celcom Axiata Berhad Axiata SPV1 Axiata Investments 1 (Malaysia) (Labuan) Limited (India) Limited (Labuan) (Mauritius) Celcom Resources Berhad Axiata SPV2 Axiata (Malaysia) Berhad Investments 2 (Malaysia) (India) Limited Celcom Networks Sdn Bhd (Mauritius) (Malaysia) Axiata Management Celcom Mobile Sdn Bhd Services Sdn Bhd (Malaysia) (Malaysia)