Todd E. Freed

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Marginable OTC Stocks

List of Marginable OTC Stocks @ENTERTAINMENT, INC. ABACAN RESOURCE CORPORATION ACE CASH EXPRESS, INC. $.01 par common No par common $.01 par common 1ST BANCORP (Indiana) ABACUS DIRECT CORPORATION ACE*COMM CORPORATION $1.00 par common $.001 par common $.01 par common 1ST BERGEN BANCORP ABAXIS, INC. ACETO CORPORATION No par common No par common $.01 par common 1ST SOURCE CORPORATION ABC BANCORP (Georgia) ACMAT CORPORATION $1.00 par common $1.00 par common Class A, no par common Fixed rate cumulative trust preferred securities of 1st Source Capital ABC DISPENSING TECHNOLOGIES, INC. ACORN PRODUCTS, INC. Floating rate cumulative trust preferred $.01 par common $.001 par common securities of 1st Source ABC RAIL PRODUCTS CORPORATION ACRES GAMING INCORPORATED 3-D GEOPHYSICAL, INC. $.01 par common $.01 par common $.01 par common ABER RESOURCES LTD. ACRODYNE COMMUNICATIONS, INC. 3-D SYSTEMS CORPORATION No par common $.01 par common $.001 par common ABIGAIL ADAMS NATIONAL BANCORP, INC. †ACSYS, INC. 3COM CORPORATION $.01 par common No par common No par common ABINGTON BANCORP, INC. (Massachusetts) ACT MANUFACTURING, INC. 3D LABS INC. LIMITED $.10 par common $.01 par common $.01 par common ABIOMED, INC. ACT NETWORKS, INC. 3DFX INTERACTIVE, INC. $.01 par common $.01 par common No par common ABLE TELCOM HOLDING CORPORATION ACT TELECONFERENCING, INC. 3DO COMPANY, THE $.001 par common No par common $.01 par common ABR INFORMATION SERVICES INC. ACTEL CORPORATION 3DX TECHNOLOGIES, INC. $.01 par common $.001 par common $.01 par common ABRAMS INDUSTRIES, INC. ACTION PERFORMANCE COMPANIES, INC. 4 KIDS ENTERTAINMENT, INC. $1.00 par common $.01 par common $.01 par common 4FRONT TECHNOLOGIES, INC. -

Time Warner Cable Inc. and 10-Q, Quarterly Report of Time Warner Cable Inc

FILED 7-02-15 04:59 PM EXHIBITA1507009 E: Form 10-K, Annual Report of Time Warner Cable Inc. and 10-Q, Quarterly Report of Time Warner Cable Inc. TIME WARNER CABLE INC. FORM 10-K (Annual Report) Filed 02/13/15 for the Period Ending 12/31/14 Address 60 COLUMBUS CIRCLE, 17TH FLOOR NEW YORK, NY 10023 Telephone 212-364-8200 CIK 0001377013 Symbol TWC SIC Code 4841 - Cable and Other Pay Television Services Industry Broadcasting & Cable TV Sector Services Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2015, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2014 Commission file number 001-33335 TIME WARNER CABLE INC. (Exact name of registrant as specified in its charter) Delaware 84-1496755 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 60 Columbus Circle New York, New York 10023 (Address of principal executive offices) (Zip Code) (212) 364-8200 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Name of each exchange on which Title of each class registered Common Stock, par value $0.01 New York Stock Exchange 5.750% Notes due 2031 New York Stock Exchange 5.250% Notes due 2042 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

FORM 10-K the Travelers Companies, Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 __________________________________________________________________________ FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __________to__________ ________________________________________________ Commission file number 001-10898 ________________________________________________ The Travelers Companies, Inc. (Exact name of registrant as specified in its charter) _________________________________________________________________ Minnesota 41-0518860 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) ______________________________________________________________________________ 485 Lexington Avenue New York, NY 10017 (Address of principal executive offices) (Zip code) (917) 778-6000 (Registrant’s telephone number, including area code) ______________________________________________________________________________ Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common stock, without par value TRV New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). Yes x No ¨ Indicate -

Chicago Board Options Exchange Annual Report 2001

01 Chicago Board Options Exchange Annual Report 2001 cv2 CBOE ‘01 01010101010101010 01010101010101010 01010101010101010 01010101010101010 01010101010101010 CBOE is the largest and 01010101010101010most successful options 01010101010101010marketplace in the world. 01010101010101010 01010101010101010 01010101010101010 01010101010101010 01010101010101010 01010101010101010ifc1 CBOE ‘01 ONE HAS OPPORTUNITIES The NUMBER ONE Options Exchange provides customers with a wide selection of products to achieve their unique investment goals. ONE HAS RESPONSIBILITIES The NUMBER ONE Options Exchange is responsible for representing the interests of its members and customers. Whether testifying before Congress, commenting on proposed legislation or working with the Securities and Exchange Commission on finalizing regulations, the CBOE weighs in on behalf of options users everywhere. As an advocate for informed investing, CBOE offers a wide array of educational vehicles, all targeted at educating investors about the use of options as an effective risk management tool. ONE HAS RESOURCES The NUMBER ONE Options Exchange offers a wide variety of resources beginning with a large community of traders who are the most experienced, highly-skilled, well-capitalized liquidity providers in the options arena. In addition, CBOE has a unique, sophisticated hybrid trading floor that facilitates efficient trading. 01 CBOE ‘01 2 CBOE ‘01 “ TO BE THE LEADING MARKETPLACE FOR FINANCIAL DERIVATIVE PRODUCTS, WITH FAIR AND EFFICIENT MARKETS CHARACTERIZED BY DEPTH, LIQUIDITY AND BEST EXECUTION OF PARTICIPANT ORDERS.” CBOE MISSION LETTER FROM THE OFFICE OF THE CHAIRMAN Unprecedented challenges and a need for strategic agility characterized a positive but demanding year in the overall options marketplace. The Chicago Board Options Exchange ® (CBOE®) enjoyed a record-breaking fiscal year, with a 2.2% growth in contracts traded when compared to Fiscal Year 2000, also a record-breaker. -

Capital Power Corporation 12Th Floor, EPCOR Tower 1200 – 10423 101 Street Edmonton, AB T5H 0E9

Capital Power Corporation 12th Floor, EPCOR Tower 1200 – 10423 101 Street Edmonton, AB T5H 0E9 For release: February 21, 2017 Capital Power reports fourth quarter and year-end 2016 results EDMONTON, Alberta – Capital Power Corporation (Capital Power, or the Company) (TSX: CPX) today released financial results for the fourth quarter and year ended December 31, 2016. Net income attributable to shareholders in the fourth quarter of 2016 was $28 million and basic earnings per share attributable to common shareholders was $0.21 per share, compared with $35 million, or $0.29 per share, in the comparable period of 2015. Normalized earnings attributable to common shareholders in the fourth quarter of 2016, after adjusting for one-time items and fair value adjustments, were $26 million or $0.27 per share compared with $41 million or $0.42 per share in the fourth quarter of 2015. Net cash flows from operating activities were $69 million in the fourth quarter of 2016 compared with $114 million in the fourth quarter of 2015. Funds from operations (FFO) were $75 million in the fourth quarter of 2016, compared to $125 million in the fourth quarter of 2015. For the year ended December 31, 2016, net income attributable to shareholders was $111 million and basic earnings per share attributable to common shareholders was $0.91 per share compared with $90 million and $0.70 for the year ended December 31, 2015. For the year ended December 31, 2016, normalized earnings attributable to common shareholders were $117 million, or $1.22 per share, compared with $111 million, or $1.15 per share in 2015. -

Investor Presentation Q1 2021 Quarterly Results

Investor Presentation Q1 2021 Quarterly Results May 14th, 2021 Forward looking statements and COVID-19 Forward Looking Statements In the course of today’s meeting, representatives of the Corporation may make, in their remarks or in response to questions, and the accompanying materials may include, statements containing forward-looking information. Certain statements, other than statements of historical fact, are forward-looking statements based on certain assumptions and reflect the Corporation’s current expectations, or with respect to disclosure regarding the Corporation’s public subsidiaries, reflect such subsidiaries’ disclosed current expectations. Forward-looking statements are provided for the purposes of assisting the reader in understanding the Corporation’s financial performance, financial position and cash flows as at and for the periods ended on certain dates and to present information about management’s current expectations and plans relating to the future and the reader is cautioned that such statements may not be appropriate for other purposes. These statements may include, without limitation, statements regarding the operations, business, financial condition, expected financial results, performance, prospects, opportunities, priorities, targets, goals, ongoing objectives, strategies and outlook of the Corporation and its subsidiaries including the fintech strategy, the expected impact of the COVID-19 pandemic on the Corporation and its subsidiaries’ operations, results and dividends, as well as the outlook for North American -

Sun Life Guaranteed Investment Funds (Gifs)

Sun Life Guaranteed Investment Funds (GIFs) ANNUAL FINANCIAL STATEMENTS SUN LIFE ASSURANCE COMPANY OF CANADA December 31, 2015 Life’s brighter under the sun Sun Life Assurance Company of Canada is a member of the Sun Life Financial group of companies. © Sun Life Assurance Company of Canada, 2016. 36D-0092-02-16 Table of Contents Independent Auditors' Report 3 Sun MFS Dividend Income 196 Sun Beutel Goodman Canadian Bond 5 Sun MFS Global Growth 200 Sun BlackRock Canadian Balanced 10 Sun MFS Global Total Return 204 Sun BlackRock Canadian Composite Equity 15 Sun MFS Global Value 209 Sun BlackRock Canadian Equity 20 Sun MFS Global Value Bundle 214 Sun BlackRock Canadian Equity Bundle 25 Sun MFS International Growth 218 Sun BlackRock Cdn Composite Eq Bundle 29 Sun MFS International Growth Bundle 222 Sun BlackRock Cdn Universe Bond 33 Sun MFS International Value 226 Sun Canadian Balanced Bundle 38 Sun MFS International Value Bundle 230 Sun CI Cambridge Canadian Equity 42 Sun MFS Monthly Income 234 Sun CI Cambridge Cdn Asset Allocation 46 Sun MFS US Equity 238 Sun CI Cambridge Global Equity 50 Sun MFS US Equity Bundle 242 Sun CI Cambridge/MFS Canadian Bundle 54 Sun MFS US Growth 246 Sun CI Cambridge/MFS Global Bundle 58 Sun MFS US Value 250 Sun CI Signature Diversified Yield II 62 Sun MFS US Value Bundle 255 Sun CI Signature High Income 66 Sun Money Market 259 Sun CI Signature Income & Growth 70 Sun NWQ Flexible Income 264 Sun Daily Interest 74 Sun PH&N Short Term Bond and Mortgage 268 Sun Dollar Cost Average Daily Interest 78 Sun RBC Global High -

Information for California Residents

Information for California residents THE FOLLOWING IS A LIST OF THE TRAVELERS COMPANIES WHICH ARE LICENSED AS INSURERS IN THE STATE OF CALIFORNIA: COMPANY CA ID # STATE OF DOMICILE American Equity Specialty Insurance Company 4452-9 Connecticut One Tower Square, Hartford, CT 06183 Discover Property & Casualty Insurance Company 2421-6 Connecticut One Tower Square, Hartford, CT 06183 Farmington Casualty Company 3044-5 Connecticut One Tower Square, Hartford, CT 06183 Fidelity and Guaranty Insurance Company 2333-3 Iowa 1089 Jordan Creek, Ste. 300, West Des Moines IA 50266 Fidelity and Guaranty Insurance Underwriters, Inc. Pinnacle II 1596-6 Wisconsin at Bishops Woods, 13935 Bishops Drive,Suite 200, Brookfield, WI 53005 Northland Casualty Company 1590-9 Connecticut One Tower Square, Hartford, CT 06183 Northland Insurance Company 1643-6 Connecticut One Tower Square, Hartford, CT 06183 St. Paul Fire and Marine Insurance Company 0825-0 Connecticut One Tower Square, Hartford, CT 06183 St. Paul Guardian Insurance Company 2049-5 Connecticut One Tower Square, Hartford, CT 06183 St. Paul Mercury Insurance Company 1891-1 Connecticut One Tower Square, Hartford, CT 06183 St. Paul Protective Insurance Company 1194-0 Connecticut One Tower Square, Hartford, CT 06183 Select Insurance Company 1651-9 Texas 1301 East Collins Boulevard, Richardson, TX 75081 Standard Fire Insurance Company (The) 0335-0 Connecticut One Tower Square, Hartford, CT 06183 Travelers Casualty and Surety Company 1790-5 Connecticut One Tower Square, Hartford, CT 06183 Travelers Casualty -

2020 Annual Information Form

2020 Annual Information Form March 23, 2021 POWER CORPORATION OF CANADA > 2020 ANNUAL INFORMATION FORM 2 TABLE OF CONTENTS Item 1 General Information 3 Item 1.1 Defined terms 3 Item 1.2 Information regarding Power Financial 4 Item 2 Documents Incorporated by Reference 5 Item 3 Forward-Looking Information 6 Item 4 Corporate Structure 8 Item 4.1 Incorporation 8 Item 4.2 Intercorporate relationships 9 Item 5 General Development of the Business 11 Item 5.1 Business of Power 11 Item 5.2 Development of the business over the last three years 11 Item 6 Narrative Description of the Business 16 Item 6.1 Publicly traded operating companies 16 Item 6.2 Alternative asset investment platforms 20 Item 6.3 China AMC 22 Item 7 Risk Factors 23 Item 8 Description of the Share Capital 25 Item 8.1 Power 25 Item 8.2 Power Financial 27 Item 9 Ratings 32 Item 10 Dividends 35 Item 10.1 Power 35 Item 10.2 Power Financial 35 Item 11 Market for Securities 37 Item 11.1 Power 37 Item 11.2 Power Financial 38 Item 12 Directors and Officers 41 Item 12.1 Directors 41 Item 12.2 Executive and other officers 42 Item 13 Voting Securities 44 Item 14 Committees 45 Item 14.1 Audit Committee 45 Item 15 Interest of Management and Others in Material Transactions 48 Item 16 Transfer Agent 49 Item 17 Experts 49 Item 18 Environmental, Social and Governance Factors 50 Item 19 Additional Information 51 Appendix A Power Corporation of Canada Audit Committee Charter 52 POWER CORPORATION OF CANADA > 2020 ANNUAL INFORMATION FORM 3 ITEM 1 GENERAL INFORMATION Item 1 Item 1.1 Defined terms – General Information General The following abbreviations have been used throughout this Annual Information Form: Name in full Abbreviation adidas AG adidas Annual Information Form of Great-West Lifeco Inc., Lifeco’s Annual Information Form dated February 10, 2021 Annual Information Form of IGM Financial Inc., IGM Financial’s Annual Information Form dated March 18, 2021 The Canada Life Assurance Company Canada Life China Asset Management Co., Ltd. -

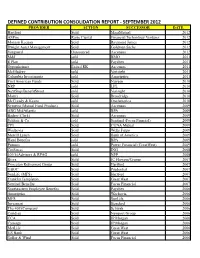

Defined Contribution Consolidation Report

DEFINED CONTRIBUTION CONSOLIDATION REPORT - SEPTEMBER 2012 PROVIDER ACTION SUCCESSOR DATE Hartford Sold MassMutual 2012 ASPire Raise Capital Financial Technology Ventures 2012 Morgan Keegan Sold Raymond James 2012 Dwight Asset Management Sold Goldman Sachs 2012 Vanguard Outsourced Ascensus 2012 M&I sold BMO 2011 E Plan sold Paychex 2011 Oppenheimer Exited RK Ascensus 2011 McGladrey sold Verisight 2011 Columbia Investments sold Ameriprise 2011 First American Funds Sold Nuveen 2010 NRP sold LPL 2010 NextStep/BenefitStreet sold Verisight 2010 Matrix Sold Broadridge 2010 McCready & Keene sold OneAmerica 2010 Symetra (Mutual Fund Product) Sold Ascensus 2009 ABG MidAtlantic sold BPA 2009 Baden (Clark) Sold Ascensus 2009 Schloss & Co. sold Sentinal (Focus Finncial) 2009 CPI Sold CUNA Mutual 2009 Wachovia Sold Wells Fargo 2009 Merrill Lynch Sold Bank of America 2009 Hand Benefits sold BPA 2009 Putnam sold Power Financial (GreatWest) 2009 CitiStreet Sold ING 2008 401(k)Advisors & RPAG sold NFP 2008 Bisys Sold JC Flowers/Crump 2007 Princeton Retirement Group Sold Hartford 2007 UBOC Sold Prudential 2007 SunLife (MFS) Sold Hartford 2007 Franklin Templeton Sold Great West 2007 Sentinel Benefits Sold Focus Financial 2007 Southeastern Employee Benefits Sold Paychex 2006 Ameriprise Sold Wachovia 2006 MFS Sold SunLife 2006 Invesmart Sold Standard 2006 The 401kCompany Sold Schwab 2006 Ceridian Sold Newport Group 2006 CCA Sold JP Morgan 2006 Cynergy Sold JP Morgan 2006 MetLife Sold Great West 2006 US Bank Sold Great West 2006 Geller & Wind Sold Focus Financial -

PCC Q2 2021 Investor Presentation

Investor Presentation Q2 2021 Quarterly Results August 9th, 2021 Forward looking statements and COVID-19 Forward Looking Statements In the course of today’s meeting, representatives of the Corporation may make, in their remarks or in response to questions, and the accompanying materials may include, statements containing forward-looking information. Certain statements, other than statements of historical fact, are forward-looking statements based on certain assumptions and reflect the Corporation’s current expectations, or with respect to disclosure regarding the Corporation’s public subsidiaries, reflect such subsidiaries’ current expectations as disclosed in their respective Management’s Discussion and Analysis (“MD&A”). Forward-looking statements are provided for the purposes of assisting the listener/reader in understanding the Corporation’s financial performance, financial position and cash flows as at and for the periods ended on certain dates and to present information about management’s current expectations and plans relating to the future and the listener/reader is cautioned that such statements may not be appropriate for other purposes. These statements may include, without limitation, statements regarding the operations, business, financial condition, expected financial results, performance, prospects, opportunities, priorities, targets, goals, ongoing objectives, strategies and outlook of the Corporation and its subsidiaries including the fintech strategy, the expected impact of the COVID-19 pandemic on the Corporation and -

2019 Insurance Fact Book

2019 Insurance Fact Book TO THE READER Imagine a world without insurance. Some might say, “So what?” or “Yes to that!” when reading the sentence above. And that’s understandable, given that often the best experience one can have with insurance is not to receive the benefits of the product at all, after a disaster or other loss. And others—who already have some understanding or even appreciation for insurance—might say it provides protection against financial aspects of a premature death, injury, loss of property, loss of earning power, legal liability or other unexpected expenses. All that is true. We are the financial first responders. But there is so much more. Insurance drives economic growth. It provides stability against risks. It encourages resilience. Recent disasters have demonstrated the vital role the industry plays in recovery—and that without insurance, the impact on individuals, businesses and communities can be devastating. As insurers, we know that even with all that we protect now, the coverage gap is still too big. We want to close that gap. That desire is reflected in changes to this year’s Insurance Information Institute (I.I.I.)Insurance Fact Book. We have added new information on coastal storm surge risk and hail as well as reinsurance and the growing problem of marijuana and impaired driving. We have updated the section on litigiousness to include tort costs and compensation by state, and assignment of benefits litigation, a growing problem in Florida. As always, the book provides valuable information on: • World and U.S. catastrophes • Property/casualty and life/health insurance results and investments • Personal expenditures on auto and homeowners insurance • Major types of insurance losses, including vehicle accidents, homeowners claims, crime and workplace accidents • State auto insurance laws The I.I.I.