(The “Notes”) Issued by Eurasia Capital S.A

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Russia: Investment Banking Review Full Year 2019 Refinitiv Deals Intelligence

Russia: Investment Banking Review Full Year 2019 Refinitiv Deals Intelligence 1 QUARTERLY HIGHLIGHTS HIGHLIGHTS M&A FEES UP 151% M&A TOP FINANCIAL ADVISOR ECM FEES UP 808% VTB Capital DCM FEES UP 13% ECM TOP BOOK RUNNER Goldman Sachs & Co LOAN FEES DOWN -2% DCM TOP BOOK RUNNER ANY INV. M&A DOWN -5% VTB Capital TARGET M&A DOWN -5% M&A TOP TARGETED INDUSTRY ECM PROCEEDS UP 499% Industrials DCM PROCEEDS UP 12% DCM TOP ISSUING ECM TOP ISSUING Click on any of the above arrows to INDUSTRY INDUSTRY go straight to the analysis. Financials Materials CLICK BELOW TO SIGN UP FOR OUR NEWSLETTERS, PURCHASE CUSTOMIZED DATA OR FOLLOW US ON SOCIAL MEDIA: 2 REPORT SUMMARY INVESTMENT BANKING FEES Investment banking fees in Russia reached an estimated US$347.7 million during 2019, 80% more than the value recorded during 2018 when fees sunk to the lowest level since 2002. The 2019 Russian investment banking fee total is 31% less than the decade average of US$501.2 million annually. Fees generated from completed M&A transactions increased 151% year-on-year to US$87.4 million. Equity capital markets fees totalled US$103.4 million, more than nine-times the value earned during 2018, while debt capital markets underwriting fees increased 13% to US$103.3 million. Syndicated lending fees declined 2% to a seventeen-year low of US$53.9 million. Both equity and debt capital markets underwriting fees each accounted for 30% of the overall Russian investment banking fee pool. Syndicated lending fees accounted for a 15% cut, while M&A advisory fees accounted for 25%, the highest share since 2015. -

Announcing: Finalists Circle for the Prestigious M&A

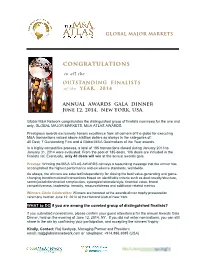

GLOBAL MAJOR MARKETS CONGRATULATIONS to all the OUTSTANDING FINALISTS of the YEAR, 2014 ANNUAL AWARDS GALA DINNER June 12, 2014, New YORK, USA. Global M&A Network congratulates the distinguished group of finalists nominees for the one and only, GLOBAL MAJOR MARKETS, M&A ATLAS AWARDS. Prestigious awards exclusively honors excellence from all corners of the globe for executing M&A transactions valued above a billion dollars as always in the categories of: 40 Deal, 7 Outstanding Firm and 4 Global M&A Dealmakers of the Year awards. In a highly competitive process, a total of 185 transactions closed during January 2013 to January 31, 2014 were evaluated. From the pool of 185 deals, 106 deals are included in the finalists list. Eventually, only 40 deals will win at the annual awards gala. Prestige: Winning the M&A ATLAS AWARDS conveys a resounding message that the winner has accomplished the highest performance and excellence standards, worldwide. As always, the winners are selected independently for closing the best value-generating and game- changing transformational transactions based on identifiable criteria such as deal novelty/structure, sector/jurisdiction/market complexities, synergies/rationale/style, financial value, brand competitiveness, leadership, tenacity, resourcefulness and additional related metrics. Winners Circle Celebration: Winners are honored at the awards dinner trophy presentation ceremony held on June 12, 2014 at the Harvard Club of New York. WHAT to DO if you are among the coveted group of distinguished finalists? If you submitted nominations, please confirm your guest attendance for the annual Awards Gala Dinner, held on the evening of June 12, 2014, NY. -

$20,000,000,000 Programme No. 2 for the Issuance of Loan Participation Notes to Be Issued By, but with Limited Recourse To, VTB Capital S.A

BASE PROSPECTUS SUPPLEMENT $20,000,000,000 Programme No. 2 for the Issuance of Loan Participation Notes to be issued by, but with limited recourse to, VTB Capital S.A. for the purpose of financing loans to JSC VTB Bank This base prospectus supplement (the “Base Prospectus Supplement”) is prepared in connection with the Programme No. 2 for the Issuance of Loan Participation Notes by VTB Capital S.A. (the “Issuer”) (the “Programme”) and is supplemental to, and should be read in conjunction with, the base prospectus dated February 10, 2011 (the “Base Prospectus”). Capitalised terms used, but not otherwise defined in this Base Prospectus Supplement shall have the meanings ascribed thereto in the Base Prospectus. This Base Prospectus Supplement has been approved by the Central Bank of Ireland (the “Central Bank”), as competent authority under the Prospectus Directive 2003/71/EC (the “Prospectus Directive”). The Central Bank only approves this Base Prospectus Supplement as meeting the requirements imposed under Irish and EU law pursuant to the Prospectus Directive. This Base Prospectus Supplement constitutes a Base Prospectus Supplement for the purposes of the Prospectus Directive. This Base Prospectus Supplement constitutes neither an offer to sell nor a solicitation of an offer to buy any Notes by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation. THE SECURITIES TO BE ISSUED UNDER THE PROGRAMME HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE US SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, SUBJECT TO CERTAIN EXCEPTIONS, MAY NOT BE OFFERED OR SOLD WITHIN THE UNITED STATES OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, U.S. -

Global Finance Names the World's Best Investment Banks 2021

Global Finance Names The World’s Best Investment Banks 2021 NEW YORK, February 18, 2021– Global Finance magazine has named the 22nd annual World’s Best Investment Banks in an exclusive survey to be published in the April 2021 print and digital editions and online at GFMag.com. J.P. Morgan was honored as the Best Investment Bank in the World for 2021. “With widespread expectations of consolidation in multiple sectors and all around the About Global Finance world, investment banks will play a leading role in reshaping the world economy post- Global Finance, founded in pandemic,” said Joseph D. Giarraputo, publisher and editorial director of Global Finance. 1987, has a circulation of “Companies need more than ever to understand the specialties and skills that investment 50,000 and readers in 191 bank brings to the table. Global Finance awards are a valuable guide.” countries. Global Finance’s audience includes senior Global Finance editors, with input from industry experts, used a series of criteria— corporate and financial including entries from banks, market share, number and size of deals, service and officers responsible for making advice, structuring capabilities, distribution network, efforts to address market conditions, investment and strategic innovation, pricing, after-market performance of underwritings and market reputation— decisions at multinational companies and financial to score and select winners, based on a proprietary algorithm. Deals announced or institutions. Its website — completed in 2020 were considered. GFMag.com — offers analysis and articles that are the legacy For editorial information please contact Andrea Fiano, editor: [email protected] of 34 years of experience in international financial GLOBAL WINNERS markets. -

Invesco Approved Broker List Name of Entity Legal Entity Identifier (LEI) ABG SUNDAL COLLIER ASA 2138005DRCU66B8BNY04 ABN AMRO

Invesco Approved Broker List This document is for informational purposes only on the brokers approved by Invesco for its regulated investment management activities in Europe. This does not constitute a recommendation of any broker for the trading activity of the reader of this document. Please note that the entities listed in this document are only approved to trade certain instruments. Information is shown as at 30th June 2021. Invesco Fund Managers Limited reserves the right to make changes at any time to this document without notice. This document is issued by Invesco Fund Managers Limited, which is authorised and regulated by the Financial Conduct Authority. Name Of Entity Legal Entity Identifier (LEI) ABG SUNDAL COLLIER ASA 2138005DRCU66B8BNY04 ABN AMRO BANK N.V. BFXS5XCH7N0Y05NIXW11 AHORRO CORPORACION FINANCIERA SV SA 95980020140005375141 ARCTIC SECURITIES AS 5967007LIEEXZX4RVS72 ARDEN PARTNERS PLC 213800KRNTZFOY1DA806 AUERBACH GRAYSON & COMPANY LLC 254900THN5ANAH8X1V30 AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED JHE42UYNWWTJB8YTTU19 AUTONOMOUS RESEARCH LLP 213800LBM6PT85IGM996 BAADER HELVEA LIMITED 529900DXD7EPV64JOG51 BANCO BILBAO VIZCAYA ARGENTARIA SOCIEDAD ANONIMA K8MS7FD7N5Z2WQ51AZ71 BANCO J.P. MORGAN S.A BMSV765KS3ZUWB7LXV33 BANCO SANTANDER S.A. 5493006QMFDDMYWIAM13 BANCO SANTANDER (BRASIL) S.A 549300D1H731B30TSI43 BANK DEGROOF PETERCAM SA 549300NBLHT5Z7ZV1241 BANK GPB (JSC) 253400WSS48YWMBUA688 BANK GUTMANN AKTIENGESELLSCHAFT 549300KFLI6V2PUY8522 BANK OF AMERICA NATIONAL ASSOCIATION B4TYDEB6GKMZO031MB27 BANK OF AMERICA, -

Financial Rankings 2015 2015

GLOBAL M&A MARKET REVIEW FINANCIAL RANKINGS 2015 2015 GLOBAL M&A FINANCIAL ADVISORY RANKINGS The Bloomberg M&A Advisory League Tables are the definitive publication of M&A advisory rankings. The CONTENTS tables represent the top financial and legal advisors across a broad array of deal types, regions, and industry sectors. The rankings data is comprised of mergers, acquisitions, divestitures, spin-offs, debt-for-equity- 1. Introduction swaps, joint ventures, private placements of common equity and convertible securities, and the cash 2. Global M&A Year in Review injection component of recapitalization according to Bloomberg standards. 3. Global M&A Heat Map 4. Global M&A Regional Review Bloomberg M&A delivers real-time coverage of the M&A market from nine countries around the world. We 5. Global M&A League Tables provide a global perspective and local insight into unique deal structures in various markets through a 6. Americas M&A Regional Review network of over 800 financial and legal advisory firms, ensuring an accurate reflection of key market trends. 7. Americas M&A League Tables Our quarterly league table rankings are a leading benchmark for legal and financial advisory performance, and our Bloomberg Brief newsletter provides summary highlights of weekly M&A activity and top deal 9. EMEA M&A Regional Review trends. 10. EMEA M&A League Tables 13. APAC M&A Regional Review Visit {NI LEAG CRL <GO>} to download copies of the final release and a full range of market specific league 14. APAC M&A League Tables table results. On the web, visit: http://www.bloomberg.com/professional/solutions/investment-banking/. -

REDCO PROPERTIES GROUP LIMITED 力高地產集團有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 1622)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. This announcement does not constitute an offer to sell or the solicitation of an offer to buy any securities in the United States or any other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The securities referred to herein will not be registered under the Securities Act, and may not be offered or sold in the United States except pursuant to an exemption from, or a transaction not subject to, the registration requirements of the Securities Act. Any public offering of securities to be made in the United States will be made by means of a prospectus. Such prospectus will contain detailed information about the company making the offer and its management and financial statements. The Company does not intend to make any public offering of securities in the United States. REDCO PROPERTIES GROUP LIMITED 力高地產集團有限公司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 1622) ISSUANCE OF US$250 MILLION 7% SENIOR NOTES DUE 2018 Reference is made to the announcement of the Company dated 8 November 2017 in respect of the proposed Notes Issue. On 8 November 2017, the Company, together with the Subsidiary Guarantors, entered into the Purchase Agreement with Credit Suisse, Morgan Stanley, China Everbright Bank Hong Kong Branch, Orient Securities (Hong Kong) and VTB Capital in connection with the Notes Issue. -

HSBC Hong Kong

RESTRICTED HSBC Hong Kong Presentation by Mark McCombe, CEO Hong Kong March 2011 www.hsbc.com Forward-looking statements •This presentation and subsequent discussion may contain certain forward-looking statements with respect to the financial condition, results of operations and business of the Group. These forward-looking statements represent the Group’s expectations or beliefs concerning future events and involve known and unknown risks and uncertainty that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Additional detailed information concerning important factors that could cause actual results to differ materially is available in our Annual Report and Accounts 2010. Past performance cannot be relied on as a guide to future performance. •This presentation contains non-GAAP financial information. Reconciliation of non-GAAP financial information to the most directly comparable measures under GAAP are provided in the ‘Reconciliation of reported and underlying profit before tax’ supplement available at www.hsbc.com. 2 2010 highlights Improved financial performance All regions and customer groups profitable Strong capital generation enabled an increased dividend HSBC well placed for evolving regulatory environment 3 2010 financial highlights Better / 2009 2010 (worse) Reported PBT 7.1 19.0 +169% (US$bn) Continued recovery in underlying profits Underlying PBT1 13.5 18.4 +36% (US$bn) Significantly improved EPS (US$) 0.34 0.73 +115% credit quality ROE (%) 5.1 9.5 +440bps -

League Tables Q1 2020

GLOBAL FIXED INCOME LEAGUE TABLES Q1 2020 Q1 2020 MANAGER RANKINGS GLOBAL FIXED INCOME CONTENTS Bloomberg’s corporate bond database consists of more than 1.9 million active securities-- including convertible bonds and preferred securities--along with more than 4.1 million 1. Global market review matured, called or retired bonds, covering over 24,000 unique issuers across more than 130 countries and 100 different currencies. 2. US market review LEAG<GO> for a full range of league tables 3. Canada market review 4. Latin America market NIM<GO> for Bloomberg’s new issue monitor review 5. EMEA market review Due to the dynamic nature of the Professional Service product, league table rankings may vary between this release and data found on the Bloomberg Professional Service. 6. Asia market review 7. Table criteria DATA SUBMISSIONS AND QUERIES Contact Phone Email North America Andrea Niper +1 609 279 3880 [email protected] EMEA Pietro Stimamiglio +44 20 3525 2785 [email protected] Asia-Pacific Dave Lin +852 2977 4617 [email protected] © 2020 Bloomberg Finance L.P. All rights reserved. Bloomberg Global Fixed Income | Q1 2020 Global Corporate Leveraged Finance: Quarterly Volume Corporate High Yield Bonds Global Fixed Income Review Global Sponsor-Led Loans 500 Q1 2020 credited Corporate & Financial Bonds volume increased 18.76% to USD 1.5 Trln while deal count increased 1.42% to 4,633 offerings year-on-year. Corporate Bonds volume increased 24.17% year-on-year to USD 718.5 Bln while the deal 400 n n count increased 17.43% to 2,089. Financial Bonds volume increased 14.15% year-on-year to USD 764.0 Bln over 2,508 l l B B deals. -

Concluded by Mechel Open-Joint St

Full text of resolution 9 To approve the following interested party transaction (transactions) concluded by Mechel Open-Joint Stock Company (the “Company”) on the following conditions: Parties to Transaction(s): ABN AMRO Bank N.V.; Amsterdam Trade Bank N.V., Banque Cantonale Vaudoise Banque de Commerce et de Placements S.A.; BNP PARIBAS (Suisse) S.A.; BNP PARIBAS S.A. (incl. London branch); BNP PARIBAS UK HOLDINGS LIMITED; BANCA COMERCIALA ROMANA S.A.; Barclays Bank PLC; Barclays Capital Inc.; Bayerische Landesbank AG; Calyon S.A.; Credit Agricole S.A.; Credit Agricole (Suisse) S.A.; CITIGROUP Inc. Citibank N.A., COMMERZBANK Aktiengesellschaft (incl. London branch), Credit Suisse (UK) Limited, Credit Suisse AG, CREDIT EUROPE BANK N.V. (incl. Malta branch), DEUTSCHE BANK AG, KBC Bank N.V., KFW, DZ BANK AG, DEMIR HALK BANK (NEDERLAND) NV, DEUTSCHE ZENTRAL-GENOSSENSCHAFTSBANK, Frankfurt am main, ERSTE BANK DER OESTERREICHISCHEN SPARKASSEN AG, ERSTE GROUP BANK AG, European Bank for Reconstruction and Development, Federated Project and Trade Finance Core Fund, Galena Asset Management B.V., Garanti Bank International NV,ICBC (London) plc, ICICI Bank UK Plc, ICICI Bank Eurasia LLC, ING Bank N.V., ING Bank Deutschland AG, ING Bank Slaski S.A., ING Belgium S.A., ING Belgium N.V., Joint Stock Commercial Bank “Rosbank”, London Forfaiting Company Limited, Morgan Stanley Bank International Limited, NATIXIS (incl. London branch), Natixis Bank ZAO, Nordea Bank AB, VTB Bank (Deutschland) AG, VTB Bank Europe Plc, Raiffeisen Zentralbank Osterreich AG, -

Annual Report 2009 Contents

Annual report 2009 Contents Mission and values 3 Statement of the Chairman of the Supervisory Council 4 Statement of the President and Chairman 6 1. Financial highlights 8 2. VTB’s market position 10 3. The economy and financial sector 12 4. Management report 15 4.1. Key events in 2009 15 4.2. VTB Group strategy 16 4.3. Review of operating performance 17 4.3.1. Corporate banking 17 4.3.2. Retail banking 21 4.3.3. Investment banking 28 4.3.4. Other businesses 32 4.4. Review of financial performance 34 4.5. Risk management 40 5. Corporate governance 50 5.1. Overview of the corporate governance system 50 5.2. The General Shareholders Meeting of JSC VTB Bank 51 5.3. The Supervisory Council of JSC VTB Bank 52 5.4. The Management Board of JSC VTB Bank 59 5.5. The President and Chairman of JSC VTB Bank 64 5.6. Remuneration of the members of the Supervisory Council and the Management Board 64 5.7. Internal control and audit 64 5.8. Shareholder and investor relations 67 5.9. Management of VTB Group 68 6. Corporate social responsibility 72 6.1. Personnel 72 6.2. Social programmes 74 7. Management responsibility statement 77 8. Сonsolidated financial statements in accordance with IFRS 78 9. Transactions of JSC VTB Bank 176 10. Other Group information 177 10.1. Details and correspondent accounts of JSC VTB Bank 177 10.2. Licences 178 10.3. Contact information 179 11. Shareholders’ information 184 The Annual Report is based on the data as at 31 March 2010, available for JSC VTB Bank and its subsidiaries at the time the report was written. -

Global Equity Capital Markets Review

Global Equity Capital Markets Review FULL YEAR 2020 | MANAGING UNDERWRITERS Global Equity Capital Markets Review Full Year 2020 | Managing Underwriters Global Deals Intelligence Global Initial Public Offerings GLOBAL EQUITY CAPITAL MARKETS ACTIVITY TOPS US$1 TRILLION $300 1,800 Equity capital markets activity totaled US$1.1 trillion during full year 2020, a 56% increase compared to a year ago and the strongest annual period for global equity capital markets activity since records began in 1,600 Thousands 1980. By number of issues, over 6,100 ECM offerings were brought to market during 2020, a 33% $250 increase compared to a year ago and an all-time record. Global capital raising totaled US$309.5 billion 1,400 during the fourth quarter, a 1% increase compared to the third quarter of the year and was the third consecutive quarter to surpass US$300 billion. Over 1,900 ECM deals priced during the fourth quarter, $200 1,200 breaking the previous record set during the third quarter of this year. 1,000 GLOBAL IPOs UP 25% DURING 2020 TO SIX-YEAR HIGH Global initial public offering activity, excluding SPACs, totaled US$222.3 billion during full year 2020, a $150 25% increase compared to last year and the strongest annual period for global IPOs since 2014. IPOs 800 on US exchanges increased 71% during the 2020, while China-domiciled IPOs totaled US$93.9 billion during the year, more than double 2019 levels and a ten-year high. During the fourth quarter of 2020, $100 600 global IPO activity totaled US$82.9 billion, the largest three-month period for global IPOs since the fourth quarter of 2010.