U.S. SBA Office of Advocacy--Small and Micro Business Lending For

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

H.2 Actions of the Board, Its Staff, and The

ANNOUNCEMENT H.2, 1995, No. 17 Actions of the Board, its Staff, and BOARD OF GOVERNORS the Federal Reserve Banks; OF THE Applications and Reports Received FEDERAL RESERVE SYSTEM During the Week Ending April 29, 1995 ACTIONS TAKEN BY THE BOARD OF GOVERNORS TESTIMONY AND STATEMENTS One-dollar coin for the current one-dollar banknote - - statement by Governor Kelley to the Subcommittee on Domestic and International Monetary Policy of the House Committee on Banking and Financial Services, May 3, 1995. Authorised, April 28, 1995. BANK HOLDING COMPANIES Illinois Financial Services, Inc., Chicago, Illinois -- request for reconsideration of Board’s approval of application to acquire Archer Financial Corporation, Archer National Bank, and Chicago National Bank. Denied, April 24, 1995. BANK MERGERS Premier Bank, Inc., Wytheville, Virginia -- to acquire certain assets and assume certain liabilities of four branches of NationsBank of Virginia, N.A., Richmond, Virginia, and to establish branches. Approved, April 24, 1995. BANKS. FOREIGN Banco Frances del Rio de la Plata S.A., Buenos Aires, Argentina -- to establish a representative office in New York, New York. Approved, April 24, 1995. Farmers Bank of China, Taipei, Taiwan -- to establish a state'licensed, limited branch in Los Angeles, California. Approved, April 24, 1995. INTERNATIONAL OPERATIONS Chemical Bank, New York, New York -- to make an investment in Chemical Investment Bank Limited, London, England. Permitted, April 28, 1995. Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis H 2 APRIL 24, 1995 TO APRIL 28, 1995 PAGE 2 ACTIONS TAKEN BY THE BOARD OF GOVERNORS REGULATIONS AND POLICIES Public welfare investments by state member banks delegation of authority to Federal Reserve Banks to approve certain public welfare investments (Docket R-0877). -

Former Westernbank Chiefs Seek to Toss $176M FDIC Suit - Law360

Former Westernbank Chiefs Seek To Toss $176M FDIC Suit - Law360 http://www.law360.com/banking/articles/329418/former-westernbank-chi... Advanced Search (/advanced_search) News, cases, companies, firms Search (#) (/subscribe) News Sections (#AllSections) Alerting Tools (#Tools) Jobs (/jobs/seeker) [email protected] Former Westernbank Chiefs Seek To Toss $176M FDIC Suit Got an idea for a story? Email [email protected] By Jamie Santo Share us on: (mailto:[email protected]). (/articles/329418 Got the inside scoop but Law360, New York (April 12, 2012, 8:06 PM ET) -- prefer to stay out of the spotlight? /print?section=banking) Executives and directors of the now-defunct Westernbank (/articles/329418 Email [email protected] Puerto Rico asked a federal judge Wednesday to dismiss (mailto:[email protected]). /share?section=banking) a $176 million Federal Deposit Insurance Corp (/agencies (/about /rights_and_reprints?article_id=329418) /federal-deposit-insurance-corp). suit accusing the group Banking of gross negligence in its handling of loans prior to the (/about/editorial_contacts) CFPB Tells 3rd Circ. Home Loan Rescission Documents bank's closure in 2010. Suits Valid (/banking/articles/330539/cfpb- tells-3rd-circ-home-loan-rescission-suits- Dismiss valid) (http://articles.law360.s3.amazonaws.com In a motion filed in the U.S.district court in Puerto Rico, the Case Information The Consumer Financial Protection Bureau on Friday six former Westernbank executives and directors argue urged the Third Circuit to allow more flexibility for loan Case Title recipients who have allegedly legally rescinded home loans to pursue legal action against lenders who fail to that the FDIC (/agencies/federal-deposit-insurance- W Holding Company, Inc. -

Federal Register / Vol. 62, No. 217 / Monday, November 10, 1997 / Notices 60513

Federal Register / Vol. 62, No. 217 / Monday, November 10, 1997 / Notices 60513 Vice President) 100 North 6th Street, Company, Wilmington, Delaware; to sale to (or purchase from) a customer, Philadelphia, Pennsylvania 19105-1521: merge with Harrisburg Bancshares, Inc., subject to the limitations and 1. PSB Bancorp, Inc., Philadelphia, Houston, Texas, and thereby indirectly conditions, pursuant to § 225.28(b)(7)(ii) Pennsylvania; to become a bank holding acquire Harrisburg Bancshares, Inc., of the Board's Regulation Y, and acting company by acquiring 100 percent of Reno, Nevada, and Harrisburg Bank, as agent for the private placement of the voting shares of Pennsylvania Houston, Texas. securities, pursuant to § 225.28(b)(7)(iii) Savings Bank, Philadelphia, Board of Governors of the Federal Reserve of the Board's Regulation Y. Pennsylvania. System, November 5, 1997. 2. The Bank of Nova Scotia, Toronto, B. Federal Reserve Bank of Jennifer J. Johnson, Ontario, Canada; to acquire Iron Richmond (A. Linwood Gill III, Deputy Secretary of the Board. Mountain Depository Corporation, New Assistant Vice President) 701 East Byrd York, New York, and thereby engage in [FR Doc. 97±29643 Filed 11±7±97; 8:45 am] Street, Richmond, Virginia 23261-4528: buying, selling and storing bars, rounds, 1. Eastern Virginia Bankshares, Inc., BILLING CODE 6210±01±F bullion, and coins of gold, silver Tappahannock, Virginia; to become a platinum, palladium, copper, and any bank holding company by acquiring 100 FEDERAL RESERVE SYSTEM other metal approved by the Board, for percent of the voting shares of company's own account and the Southside Bank, Tappahannock, Notice of Proposals To Engage in account of others, and providing Virginia, and Bank of Northumberland, Permissible Nonbanking Activities or incidential services such as arranging Incorporated, Heathsville, Virginia. -

Actions of the Board, Its Staff, and the Federal Reserve Banks; Applications and Reports Received

Federal Reserve Release H.2 Actions of the Board, Its Staff, and the Federal Reserve Banks; Applications and Reports Received No. 35 Week Ending August 31, 2002 Board of Governors of the Federal Reserve System, Washington, DC 20551 H.2 Board Actions August 25, 2002 to August 31, 2002 Regulations And Policies Financial System Resilience -- request for comment on a Draft Interagency White Paper on Sound Practices to Strengthen the Resilience of the U.S. Financial System (Docket No. R-1128). - Approved, August 22, 2002 (AC) (AC) = Addition or Correction Board - Page 1 of 1 H.2 Actions under delegated authority August 25, 2002 to August 31, 2002 BS&R Banking Supervision and Regulation RBOPS Reserve Bank Operations and Payment Systems C&CA Consumer and Community Affairs IF International Finance FOMC Federal Open Market Committee OSDM Office of Staff Director for Management Bank Branches, Domestic Secretary AmSouth Bank, Birmingham, Alabama -- to establish a branch at 1415 West 5th Street, Laurel, Mississippi. - Approved, August 27, 2002 Secretary AmSouth Bank, Birmingham, Alabama -- to establish branches at 2531 John Hawkins Parkway, Hoover; 8455 Tuttle Avenue, Sarasota, Florida; 2320 South U.S. Highway 77, Lynn Haven; and 200 Grand Boulevard, Destin. - Approved, August 30, 2002 Dallas Community Bank, Granbury, Texas -- to establish a branch at 6224 Colleyville Boulevard, Suite B, Colleyville. - Approved, August 28, 2002 Cleveland Fifth Third Bank, Cincinnati, Ohio -- to establish a branch at 2211 Hayes Avenue, Sandusky. - Approved, August 27, 2002 Chicago First Banking Center, Burlington, Wisconsin -- to establish a branch at the intersection of State Highways 81 and 23, Darlington. -

451 NYSE-Listed Non-US Issuers from 47 Countries

451 NYSE-listed non-U.S. Issuers from 47 Countries (as of December 29, 2006) Share Country Issuer (based on jurisdiction of incorporation) † Symbol Industry Listed Type IPO ARGENTINA (11 DR Issuers ) Banco Macro S.A. BMA Banking 3/24/06 A IPO BBVA Banco Francés S.A. BFR Banking 11/24/93 A IPO IRSA-Inversiones y Representaciones, S.A. IRS Real Estate Development 12/20/94 G IPO MetroGas, S.A. MGS Gas Distribution 11/17/94 A IPO Nortel Inversora S.A. NTL Telecommunications 6/17/97 A IPO Petrobras Energía Participaciones S.A. PZE Holding Co./Oil/Gas Refining 1/26/00 A Quilmes Industrial (QUINSA) S.A. LQU Holding Co./Beer Production 3/28/96 A IPO Telecom Argentina S.A. TEO Telecommunications 12/9/94 A Telefónica de Argentina, S.A. TAR Telecommunications 3/8/94 A Transportadora de Gas del Sur, S.A. TGS Gas Transportation 11/17/94 A YPF Sociedad Anónima YPF Oil/Gas Exploration 6/29/93 A IPO AUSTRALIA (8 ADR Issuers ) Alumina Limited AWC Diversified Minerals 1/2/90 A Australia and New Zealand Banking Group Limited ANZ Banking/Financial Services 12/6/94 A BHP Billiton Limited BHP Mining/Exploration/Production 5/28/87 A IPO James Hardie Industries N.V. JHX International Bldg. Materials 10/22/01 A National Australia Bank Limited NAB Banking 6/24/88 A Rinker Group Limited (Rinker) RIN Heavy Building Materials Mfg. 10/28/03 A Telstra Corporation Limited TLS Telecommunications 11/17/97 A IPO Westpac Banking Corporation WBK Banking 3/17/89 A IPO AUSTRIA (1 ADR Issuer ) Telekom Austria AG TKA Telecommunications 11/21/00 A IPO BAHAMAS (3 non-ADR Issuers ) Teekay LNG Partners L.P. -

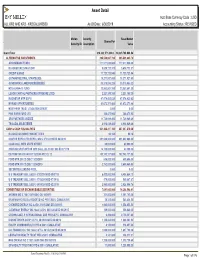

Asset Detail Acct Base Currency Code : USD ALL KR2 and KR3 - KR2GALLKRS00 As of Date : 6/30/2019 Accounting Status : REVISED

Asset Detail Acct Base Currency Code : USD ALL KR2 AND KR3 - KR2GALLKRS00 As Of Date : 6/30/2019 Accounting Status : REVISED Mellon Security Base Market . Shares/Par Security ID Description Value Grand Total 214,322,571,803.0.. 18,225,768,088.54 ALTERNATIVE INVESTMENTS 395,539,667.780 395,539,665.78 ARROWMARK FUND I 177,577,920.000 177,577,920.00 BLACKSTONE STRAT OPP 5,629,722.370 5,629,722.37 CREDIT SUISSE 11,723,723.940 11,723,723.94 GOTHAM NEUTRAL STRATEGIES 18,271,927.600 18,271,927.60 GOVERNORS LANE FUNDÉÉÉÉÉÉÉÉ 30,370,085.220 30,370,085.22 H2O ALPHA-10 FUND 23,983,801.350 23,983,801.35 LUXOR CAPITAL PARTNERS OFFSHORE LTDD 2,221,195.350 2,221,195.35 MAGNETAR MTP EOF II 47,074,425.620 47,074,425.62 MYRIAD OPPORTUNITIES 61,672,371.480 61,672,371.48 NORTHERN TRUST LITIGATION CREDIT 2.000 0.00 PINE RIVER FUND LTD 366,473.900 366,473.90 SRS PARTNERS USÉÉÉÉ 11,729,989.490 11,729,989.49 TRICADIA SELECTÉÉÉÉ 4,918,029.460 4,918,029.46 CASH & CASH EQUIVALENTS 901,268,217.160 887,047,810.08 BLACKROCK MONEY MARKET FD B 90.160 90.16 CANTOR REPO A TRI REPO 2.450% 07/01/2019 DD 06/28/19 691,600,000.000 691,600,000.00 CASH COLL WITH STATE STREET 60,000.000 60,000.00 CNH/USD SPOT OPTION 2019 CALL JUL 19 007.000 ED 071119 14,130,000.000 42,390.00 EB TEMP IVN FD VAR RT 12/31/49 FEE CL 12 182,143,127.000 182,143,127.00 FORD MTR CR CO DISC 11/25/2019 636,000.000 609,606.00 FORD MTR CR CO DISC 12/04/2019 2,762,000.000 2,685,469.58 SECURITIES LENDING POOL 0.000 0.00 U S TREASURY BILL 0.000% 07/02/2019 DD 05/07/19 6,422,000.000 6,408,684.73 U S TREASURY -

Small and Micro Business Lending For

SBA Office of Advocacy SBA Office Small Business and Micro Business Lending in the United States for Data Years 2005-2006 Business Lending in the United States for Data Years Small Business and Micro Small Business and Micro Business Lending in the United States, for Data Years 2006-2007 June 2008 Created by Congress in 1976, the Office of Advocacy of the U.S. Small Business Administration (SBA) is an independent voice for small business within the federal govern- ment. Appointed by the President and confirmed by the U.S. Senate, the Chief Counsel for Advocacy directs the office. The Chief Counsel advances the views, concerns, and interests of small business before Congress, the White House, federal agencies, federal courts, and state policy makers. Economic research, policy analyses, and small business outreach help identify issues of concern. Regional Advocates and an office in Washington, DC, support the Chief Counsel’s efforts. For more information on the Office of Advocacy, visit http://www.sba.gov/advo or call (202) 205-6533. Receive email notices of new Office of Advocacy information by signing up on Advocacy’s Listservs at http://web.sba.gov/list ; ADVOCACY NEWSLETTER ; ADVOCACY PRESS ; ADVOCACY REGULATORY NEWS ; ADVOCACY RESEARCH June 2008 No. 327 Small Business and Micro Business Lending in the United States for Data Years 2006-2007 by Victoria Williams and Charles Ou, U.S. Small Business Administration, Office of Advocacy, Office of Economic Research, 2008. 124 pages. Introduction Overall Findings Annually, the Office of Advocacy prepares a The pace of borrowing and lending in the small study on institutional lending to small firms. -

460 NYSE Non-U.S. Listed Issuers from 47 Countries (December 28, 2004)

460 NYSE Non-U.S. Listed Issuers from 47 Countries (December 28, 2004) Share Country Issuer (based on jurisdiction of incorporation) † Symbol Industry Listed Type IPO ARGENTINA (10 DR Issuers ) BBVA Banco Francés S.A. BFR Banking 11/24/93 A IPO IRSA-Inversiones y Representaciones, S.A. IRS Real Estate Development 12/20/94 G IPO MetroGas, S.A. MGS Gas Distribution 11/17/94 A IPO Nortel Inversora S.A. NTL Telecommunications 6/17/97 A IPO Petrobras Energía Participaciones S.A. PZE Holding Co./Oil/Gas Refining 1/26/00 A Quilmes Industrial (QUINSA) S.A. LQU Holding Co./Beer Production 3/28/96 A IPO Telecom Argentina S.A. TEO Telecommunications 12/9/94 A Telefónica de Argentina, S.A. TAR Telecommunications 3/8/94 A Transportadora de Gas del Sur, S.A. TGS Gas Transportation 11/17/94 A YPF Sociedad Anónima YPF Oil/Gas Exploration 6/29/93 A IPO AUSTRALIA (10 ADR Issuers ) Alumina Limited AWC Diversified Minerals 1/2/90 A Australia and New Zealand Banking Group Limited ANZ Banking/Financial Services 12/6/94 A BHP Billiton Limited BHP Mining/Exploration/Production 5/28/87 A IPO Coles Myer Ltd. CM Retail Operations 10/31/88 A James Hardie Industries N.V. JHX International Bldg. Materials 10/22/01 A National Australia Bank Limited NAB Banking 6/24/88 A Rinker Group Limited (Rinker) RIN Heavy Building Materials Mfg. 10/28/03 A Telstra Corporation Limited TLS Telecommunications 11/17/97 A IPO Westpac Banking Corporation WBK Banking 3/17/89 A IPO WMC Resources Ltd WMC Minerals Development/Prod. -

FBOP Corporation–Written Agreement

UNITED STATES OF AMERICA BEFORE THE BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM WASHINGTON, D.C. Written Agreement by and between Docket No. 09-110-WA/RB-HC FBOP CORPORATION Oak Park, Illinois and FEDERAL RESERVE BANK OF CHICAGO Chicago, Illinois WHEREAS, FBOP Corporation, Oak Park, Illinois (“FBOP”), a registered multi-bank holding company, owns and controls: Park National Bank, Chicago, Illinois; California National Bank, Los Angeles, California; San Diego National Bank, San Diego, California; Pacific National Bank, San Francisco, California; North Houston Bank, Houston, Texas; Madisonville State Bank, Madisonville, Texas; Bank USA National Association, Phoenix, Arizona; Citizens National Bank, Teague, Texas; and Community Bank of Lemont, Lemont, Illinois, (each a “Bank”, collectively, the “Banks”); and various nonbank subsidiaries (collectively, the “Consolidated Organization”); WHEREAS, in recognition of their common goal to maintain the financial soundness of FBOP and the Consolidated Organization, FBOP and the Federal Reserve Bank of Chicago (the “Reserve Bank”) have mutually agreed to enter into this Written Agreement (the “Agreement”); and [Page Break] WHEREAS, on August 28, 2009, the board of directors of FBOP, at a duly constituted meeting, adopted a resolution authorizing and directing Michael Kelly to enter into this Agreement on behalf of FBOP, and consenting to compliance with each and every provision of this Agreement by FBOP and its institution-affiliated parties, as defined in sections 3(u) and 8(b)(3) of the Federal Deposit Insurance Act, as amended (the “FDI Act”) (12 U.S.C. §§ 1813(u) and 1818(b)(3)). NOW, THEREFORE, FBOP and the Reserve Bank agree as follows: Risk Management 1. -

Fundamentals Content Monthly Coverage Packet April 2009 - Worldscope

FUNDAMENTALS CONTENT MONTHLY COVERAGE PACKET APRIL 2009 - WORLDSCOPE A SERIES OF RESOURCE DOCUMENTS HIGHLIGHTING THE BREADTH AND DEPTH OF THOMSON REUTERS WORLDSCOPE FUNDAMENTALS CONTENT For further information or assistance, please contact your local Thomson Reuters customer service or account team. North America: +1 888.888.1082 [email protected] [email protected] Europe: +44 (0) 870 458.1052 [email protected] Asia: +63 2 878.5772 [email protected] 1 NOTICE This document contains confidential and proprietary information of Thomson Reuters and may be used only by a recipient designated by and for purposes specified by Thomson Reuters. Reproduction of, dissemination of, modifications to, or creation of derivative works from this document, by any means and in any form or manner, is expressly prohibited, except with the prior written permission of Thomson Reuters. Permitted copies of this document must retain all proprietary notices contained in the original. The information in this document is subject to change without prior notice. Always confirm with Thomson Reuters that you are using the most current version of this document. Thomson Reuters is free to modify any of its products and services, in any manner and at any time, notwithstanding the information contained in this document. Certain information, including images, graphics, numerical or textual data pertaining to assets or securities may be included in this document to illustrate different types of products and services of Thomson Reuters. Such information may be fictitious or incomplete and should not be relied upon or considered investment advice. THE CONTENTS OF THIS DOCUMENT SHALL NOT CONSTITUTE ANY WARRANTY OF ANY KIND, EITHER EXPRESSED OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE IMPLIED WARRANTIES OF MERCHANTABILITY AND/OR FITNESS FOR A PARTICULAR PURPOSE OR GIVE RISE TO ANY LIABILITY OF THOMSON REUTERS, ITS AFFILIATES OR ITS SUPPLIERS. -

Actions Ofthe Board, Its Staff, and the Federal Reserve Banks: Applications and Reports Received

----~=~ ~ --- -~====== Federal Reserve Release H.2 Actions ofthe Board, Its Staff, and the Federal Reserve Banks: Applications and Reports Received No. 41 Week Ending October 11, 1997 1" ; Board o/Governors o/the Federal Reserve System, Washington, DC 20551 No. 41 ACTIONS TAKEN BY THE BOARD OF GOVERNORS TESTIMONY AND STATEMENTS to Bank: examination and supervision systems -- statement by Governor Phillips before the House Subcommittee on Financial Institutions and Consumer Credit of the House Banking and Financial Services Committee, October 8, 1997. - Authorized, October 6, 1997 Economic developments affecting the fiscal position ofthe United States. - statement by Chairman Greenspan before the House Committee on the Budget, October 8, 1997. - Published, October 8, 1997 BANK HOLDING COMPANIES Barnett Banks, Inc., Jacksonville, Florida; BB&T Corporation, Winston-Salem, North Carolina; Central Fidelity Banks, Inc., Richmond, Virginia; Crestar Financial Corporation, Richmond; First American Corporation, Nashville, Tennessee; First Citizens BancShares, Inc., Raleigh, North Carolina; First Union Corporation, Charlotte, North Carolina; First Virginia Banks, Inc., Falls Church, Virginia; Jefferson Bankshares, Inc., Charlottesville, Virginia; NationsBank Corporation, Charlotte, North Carolina; Riggs National Corporation, Washington, D.C.; Signet Banking Corporation, Richmond, Virginia; SunTrust Banks, Inc., Atlanta, Georgia; SynoVlls Financial Corporation, Columbus, Georgia; and Wachovia Corporation, Winston-Salem, North Carolina -- to acquire Monetary Transfer System, L.L.C., St. Louis, Missouri, and engage in data processing services through Honor Technologies, Inc., Maitland, Florida. - Approved, October 6, 1997 BANKS, STATE MEMBER Centura Bank, Rocky Mount, North Carolina -- to acquire five branches of NationsBank, N.A., Charlotte, North Carolina, and to establish branches at those locations. - Approved, October 6, 1997 BOARD OPERATIONS Budget objective for 1998 and 1999. -

Circular 11492: Circularlist

RELATIONSHI RELATIONSHI RELATIONS RELATIONSHIP INSTITUTION RSDD # P SPECIALIST P SPECIALIST HIP MANAGER MANAGER PHONE 1ST CONSTITUTION BANCORP 2784920 YOGESH DALAL 212-720-2253 JOHN ANELLO 212-720-2878 473 BROADWAY HOLDING CORPORATION 1035157 ROLAND GERRARD 212-720-2450 JOHN ANELLO 212-720-2878 AAREAL BANK AG 3123432 STEPHANIE MARTIN 212-720-1418 BERNARD JACOBS 212-720-5890 ABBEY NATIONAL TREASURY SERVICES PLC 3041385 LARRY ROSTOKER 212-720-2513 RALPH SANTASIERO 212-720-2557 ABN AMRO BANK N.V. 25012 LARRY ROSTOKER 212-720-2513 RALPH SANTASIERO 212-720-2557 ABN AMRO BANK N.V. - JERSEY CITY REP OFFICE 3158603 LARRY ROSTOKER 212-720-2513 RALPH SANTASIERO 212-720-2557 ABSA BANK LTD. 2291996 COSMO DEBARI 212-720-2405 JANET DUNLOP 212-720-2227 ADIRONDACK BANCORP, INC. 2467474 YOGESH DALAL 212-720-2253 JOHN ANELLO 212-720-2878 ADIRONDACK TRUST COMPANY 645317 ROLAND GERRARD 212-720-2450 JOHN ANELLO 212-720-2878 AGRICULTURAL BANK OF CHINA 2625126 FRANK PAINE 212-720-2650 DENNIS HERBST 212-720-2258 ALDEN STATE BANK 414102 FRED FINKELBERG 212-720-2157 JOHN ANELLO 212-720-2878 ALLGEMEINE HYPOTHEKENBANK RHEINBODEN AG 3128624 RAY CASTRO 212-720-2301 BERNARD JACOBS 212-720-5890 ALLIANCE FINANCIAL CORPORATION 1140510 YOGESH DALAL 212-720-2253 JOHN ANELLO 212-720-2878 ALLIED IRISH BANKS, LTD. 3403 PETER SCHNEIDER 212-720-2215 RALPH SANTASIERO 212-720-2557 AMBOY BANCORPORATION 2611718 JEROME KOTCH 212-720-2236 JOHN ANELLO 212-720-2878 AMERICAN EXPRESS BANK INTERNATIONAL 727576 SCHUYLER MACGUIRE 212-720-2544 WILLIAM BRODOWS 212-720-2508 AMERICAN EXPRESS